Nano-Enabled Packaging Market Report Size & Overview:

Get More Information on Nano-Enabled Packaging Market - Request Sample Report

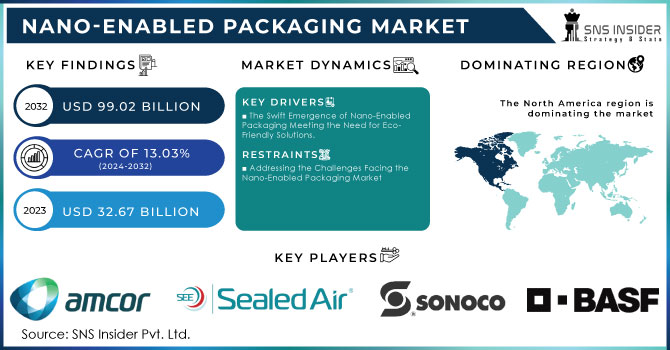

The Nano-Enabled Packaging Market Size was valued at USD 32.67 billion in 2023 and is expected to reach USD 99.02 billion by 2032 and grow at a CAGR of 13.03 % over the forecast period 2024-2032.

The Nano-enabled packaging market is experiencing significant growth, driven by the increasing demand for enhanced food preservation, safety, and sustainability. This innovative packaging leverages nanotechnology to improve barrier properties, which protects products from moisture, oxygen, and light, thereby extending shelf life and maintaining freshness. The food and beverage sector is a primary contributor to this market, with rising consumer awareness about food safety and quality spurring the adoption of advanced packaging solutions. Additionally, the trend toward sustainable practices is propelling the development of eco-friendly nano-packaging materials that reduce environmental impact. Growth in urbanization and changing lifestyles, particularly among busy consumers seeking convenience foods and ready-to-eat meals, further stimulate demand. Beyond food applications, the pharmaceutical industry is increasingly integrating Nano-enabled packaging to enhance drug stability and efficacy by providing superior protection against external factors. Furthermore, regulatory support and funding for nanotechnology research are expected to bolster market advancements. As a result, the global nano-enabled packaging market is anticipated to witness robust expansion, reflecting broader trends in consumer preferences for safety, convenience, and sustainability across various sectors, including food, beverages, and pharmaceuticals.

Companies are now more dedicated to improving product freshness and quality, leading them to adopt advanced packaging solutions that enhance protection and reduce food waste. The food and beverage sector is leading the way in this shift, creating strong demand for packaging with Nano-technology. This innovative technology, also known as active or intelligent packaging, is crucial for maintaining food safety, prolonging shelf life, and improving convenience. Consumer preferences shifting, urbanization speeding up, and more women in the workforce are all factors driving the increasing popularity of convenience foods, pre-made meals, and packaged drinks. The USDA approximates that around 30-40% of food in the U.S. is wasted, equaling about 133 billion pounds and worth $161 billion in 2010. This remarkable amount of waste underscores the urgent requirement for efficient packaging solutions to reduce losses, with Nano-enabled packaging being an important factor in this advancement. The consequences of wasting food are significant; not only does it result in throwing away nutritious food that could have fed families, but it also shows the considerable resources like land, water, labor, and energy used in creating, preparing, and moving that food. This fact highlights how crucial it is to practice sustainability in packaging and come up with new solutions that meet current needs for food safety, quality, and environmental impact reduction, thereby improving the efficiency of the food supply chain.

Nano-Enabled Packaging Market Dynamics

Drivers

-

The Swift Emergence of Nano-Enabled Packaging Meeting the Need for Eco-Friendly Solutions.

The Nano-enabled packaging market is experiencing remarkable growth, fueled by a surging demand for sustainable packaging solutions. As environmental concerns continue to escalate, consumers and businesses alike are seeking packaging alternatives that minimize ecological impact. Nano-enabled materials, including biodegradable polymers and recyclable nanocomposites, are emerging as highly sought-after options that align with this shift toward sustainability. These innovative materials not only offer enhanced barrier properties and improved shelf life but also contribute to reducing waste and promoting a circular economy. The versatility of Nano-enabled packaging allows for tailored solutions that meet the specific needs of various industries, including food and beverage, pharmaceuticals, and consumer goods. In the food sector, for instance, the use of biodegradable films made from nanomaterials can significantly decrease the amount of plastic waste, addressing critical concerns over food safety and environmental degradation. Moreover, the rising trend of eco-conscious consumerism is prompting companies to invest in research and development of advanced Nano-enabled packaging technologies, further propelling market growth. Regulatory support and incentives aimed at reducing plastic usage are also enhancing market opportunities, allowing companies to innovate while adhering to environmental standards. As consumers increasingly prioritize sustainability in their purchasing decisions, the demand for Nano-enabled packaging solutions is set to soar, making it a pivotal player in the global packaging landscape and a significant contributor to the broader movement towards a sustainable future.

-

Improving Protection and Traceability with Nanotechnology in Innovative Smart Packaging Solutions

Smart packaging innovations, driven by advancements in nanotechnology, are fundamentally transforming how products are protected and traced in the market. By integrating Nano-enabled sensors and RFID (Radio Frequency Identification) tags into packaging, companies can monitor the freshness, quality, and authenticity of products in real-time. This capability not only enhances product protection but also significantly boosts consumer trust and safety, particularly in combating fraud associated with packaged goods. The U.S. Food and Drug Administration (FDA) recognizes the potential of smart packaging technologies to improve food safety and supply chain efficiency, stating that innovations in packaging could address issues related to product recalls and counterfeiting. By providing transparent data about a product’s journey—from production to consumption—smart packaging fosters greater accountability in the supply chain. This level of traceability not only protects consumers but also allows manufacturers to respond swiftly to safety concerns, thus enhancing overall market confidence. As the demand for safer and more reliable packaging continues to rise, the integration of smart packaging solutions will play a crucial role in shaping the future of product protection and traceability.

Restraints

-

Addressing the Challenges Facing the Nano-Enabled Packaging Market

Despite the strong potential for growth in the Nano-enabled packaging market, there are various obstacles that could impede its further development. One of the main difficulties is the expensive nature of developing and producing Nano-materials. The advanced technology and specialized production methods needed for Nano-enabled packaging solutions can lead to higher costs, which may discourage smaller companies from using these advancements. Moreover, manufacturers are faced with substantial challenges due to regulatory obstacles, as the absence of uniform guidelines and strict regulations concerning the utilization of nanomaterials can lead to uncertainty. Businesses need to maneuver through intricate compliance regulations that could potentially hold up the release of products and raise operating expenses. Consumer awareness and approval are also vital factors in influencing the market. Many individuals are still doubtful about the safety of nanotechnology in food packaging due to worries about possible health hazards and environmental effects. This fear has the potential to restrict the extensive use of Nano-enhanced solutions. Moreover, the nano-enabled packaging market growth could be hindered by competition from traditional packaging materials that are typically cheaper and more commonly used. Traditional materials may remain prevalent in the market as businesses strive to find the right mix of sustainability and cost-efficiency. In order to address these limitations, stakeholders in the nano-enabled packaging industry must commit resources to education, research, and advocacy efforts in order to showcase the safety, effectiveness, and long-term advantages of these innovative solutions.

Nano-Enabled Packaging Market Segmentation Analysis

By Type

In 2023, the Intelligent and Smart Packaging segment captured the largest share of the Nano-enabled packaging market, accounting for an impressive 85.78% of total revenue. This dominance can be attributed to the growing demand for enhanced product protection, safety, and consumer engagement. Intelligent and smart packaging technologies, which utilize nanotechnology for features like real-time monitoring and interactive capabilities, are increasingly favored across various industries, particularly food and beverage, pharmaceuticals, and cosmetics. Recent advancements highlight the innovative strides being made within this segment. For instance, Amcor, a global leader in packaging solutions, has launched its latest range of intelligent packaging solutions that incorporate embedded sensors to monitor freshness and track supply chain integrity. Their innovative approach not only prolongs shelf life but also enhances consumer safety by providing real-time updates on product conditions.

Similarly, Tetra Pak introduced its new Tetra Prisma Aseptic packaging, which integrates smart technology for traceability and product authentication. This development leverages Nano-sensors to ensure that products remain fresh during transport and storage, catering to the increasing consumer demand for transparency regarding product safety. Another notable player, Sealed Air, has developed the Cryovac® brand of intelligent packaging materials, which feature active ingredients that respond to environmental changes, enhancing the preservation of food products. Their ongoing commitment to innovation in smart packaging illustrates the industry's trend towards integrating sustainability with advanced technology. As companies continue to focus on sustainability, smart packaging solutions are expected to evolve further. The integration of Internet of Things (IoT) technology with Nano-enabled packaging allows for seamless communication between products and consumers, fostering greater engagement and trust. This synergy not only enhances user experience but also positions businesses to better meet regulatory demands for transparency and safety in packaging. The rapid growth and significant market share of intelligent and smart packaging in the Nano-enabled packaging sector underscore its pivotal role in shaping the future of packaging solutions across various industries.

By Application

In 2023, the Food and Beverages segment emerged as the dominant application in the Nano-enabled packaging market, capturing a substantial 37.56% share of total revenue. This growth is significantly driven by the rising consumption of packaged food products, coupled with an increasing preference among retailers and manufacturers for shelf-stable and sustainable packaging solutions. As urbanization accelerates and lifestyles shift toward convenience, the demand for ready-to-eat meals and packaged beverages continues to grow, prompting manufacturers to seek innovative packaging solutions that enhance product longevity and safety. The food and beverage industry is also experiencing heightened consumer expectations for healthy, fresh, and safely preserved products. According to a report by the U.S. Department of Agriculture (USDA), food waste in the U.S. is estimated to account for nearly 30-40% of the total food supply, which underscores the urgent need for packaging innovations that improve shelf life and reduce spoilage. This scenario presents a significant opportunity for Nano-enabled packaging technologies that can actively monitor and extend the freshness of food products. Several leading companies are making notable strides in this space. Tetra Pak recently launched its Tetra Edge packaging solution, which incorporates nanotechnology to improve barrier properties and ensure longer shelf life for liquid food products. This advancement aligns with their commitment to sustainability and reducing food waste. Amcor has also introduced new Nano-enabled flexible packaging solutions designed specifically for food applications. Their Amcor Ultra line utilizes advanced nanomaterials to enhance barrier protection against moisture, oxygen, and light, thereby prolonging the freshness and quality of packaged food items.

Moreover, Nestlé has been investing in sustainable packaging innovations, focusing on reducing plastic waste. The company's initiatives include exploring biodegradable and recyclable materials enhanced with nanotechnology to improve performance while meeting environmental standards. As the food and beverage sector continues to prioritize safety and sustainability, the demand for Nano-enabled packaging solutions is set to grow robustly. With increasing investments in research and development, coupled with government initiatives promoting sustainable practices, the Nano-enabled packaging market within the food and beverage application is poised for significant expansion, providing essential solutions that align with modern consumer demands and regulatory frameworks.

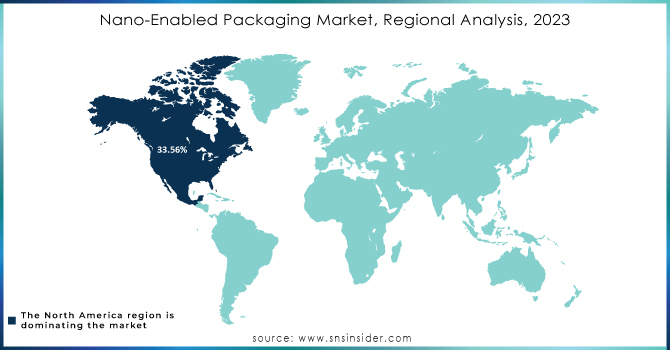

Nano-Enabled Packaging Market Regional Analysis

In 2023, North America emerged as the dominant region in the Nano-enabled packaging market, capturing a significant 33.56% share of the total revenue. This strong market presence can be attributed to several factors, including the region's advanced technological infrastructure, high consumer awareness regarding food safety and sustainability, and robust investments in research and development. The growing demand for innovative packaging solutions, particularly in the food and beverage, pharmaceutical, and cosmetics sectors, has further fueled market growth.Key players in the North American market are making substantial strides in product development and technological advancements. Amcor, a global leader in packaging solutions, has recently launched a new line of AmLite Ultra packaging, which utilizes nanotechnology to create thinner, lighter, and more sustainable packaging that still provides excellent barrier properties. This innovation not only addresses consumer demand for sustainable packaging but also aligns with Amcor’s commitment to reducing plastic waste. Sealed Air, known for its Cryovac® brand, has developed SmartGuard, a Nano-enabled packaging solution that features integrated sensors for monitoring product freshness in real-time. This product is particularly advantageous for perishable goods, providing retailers and consumers with assurance regarding the quality and safety of food items. Tetra Pak has also been active in North America, introducing its Tetra Prisma Aseptic packaging, which leverages Nano-coatings to enhance the preservation of beverages and liquid foods. This development caters to the increasing consumer preference for shelf-stable products without compromising quality. Overall, North America’s dominance in the Nano-enabled packaging market underscores its pivotal role in shaping industry standards and driving innovation, paving the way for a sustainable future in packaging solutions. As companies continue to launch new products and develop advanced technologies, the region is well-positioned to maintain its leadership in the global market.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for Nano-enabled packaging, driven by rapid industrialization, increasing urbanization, and rising consumer demand for innovative and sustainable packaging solutions. This dynamic growth can be attributed to several key factors, including the region's burgeoning middle class, heightened awareness of food safety, and significant advancements in nanotechnology.

Countries such as China, India, and Japan are at the forefront of this growth. In China, the food and beverage sector is rapidly evolving, with consumers increasingly favoring packaged and convenience foods. The Chinese government is actively supporting research and development in nanotechnology, promoting sustainable practices in packaging to reduce food waste and enhance product safety. This regulatory support encourages local companies to invest in Nano-enabled solutions that can meet the growing demand. In Japan, Mitsubishi Gas Chemical Company has launched its Nanoshield™ technology, which integrates nanomaterials into packaging to provide superior barrier properties against moisture and oxygen, thereby extending the shelf life of food products. This innovation aligns with the country’s emphasis on food safety and sustainability. Furthermore, Toppan Printing Co., Ltd. has developed Eco-Leaf, a Nano-enabled packaging solution designed for the food industry that incorporates intelligent features to monitor freshness and quality. This product exemplifies the growing trend of integrating smart packaging technologies that respond to consumer needs for convenience and safety. The increasing focus on sustainability is also reflected in the region’s consumer preferences, with a significant shift towards eco-friendly packaging options. Reports indicate that the Asia-Pacific Nano-enabled packaging market is projected to expand rapidly, driven by the region's strong demand for active and intelligent packaging solutions.

Need any customization research on Nano-enabled Packaging Market - Enquiry Now

Key Players

Some of the key Players in Nano-enabled Packaging Market with product and offerings:

-

Amcor (AmLite Ultra Packaging)

-

Sealed Air (SmartGuard)

-

Klöckner Pentaplast (KP Cormark)

-

Tetra Pak International S.A. (Tetra Prisma Aseptic)

-

CCL Industries Inc. (CCL Secure)

-

Sonoco Products Company (Sonoco® SmartSeal)

-

BASF SE (Ecovio®)

-

Avery Dennison (Avery Dennison® Intelligent Labels)

-

DuPont (Tyvek®)

-

Teijin Films (Teonex®)

-

Checkpoint Systems, Inc. (Checkpoint RFID Solutions)

-

Mondi Group (BarrierPack Recyclable)

-

Berry Global, Inc. (Berry SuperClear®)

-

Innovia Films (Rovipak®)

-

Schur Flexibles (Schur®Star)

-

Uflex Ltd. (Uflex Nano Coating Technology)

-

Hindalco Industries (Aluminium Foil Packaging)

-

Pactiv Evergreen Inc. (Pactiv® BioPreferred®)

-

Crown Holdings, Inc. (Crown's Eco-Can)

-

Constantia Flexibles (Constantia Fresh)

-

Greiner Packaging International (Greiner Bio-One)

-

Kraft Heinz Company (Kraft Packaging Solutions)

-

Rexam PLC (Rexam Beverage Can)

-

Mitsubishi Gas Chemical Company (Nanoshield™)

-

Fujifilm (Fujifilm Prescale®)

-

LyondellBasell Industries (LyondellBasell's Circular Economy Solutions)

-

Graham Packaging Company (Graham's Sustainable Packaging Solutions)

-

National Starch and Chemical Company (Natrosol®)

-

Ahlstrom-Munksjö (Ahlstrom-Munksjö Fiber-based Packaging)

-

Sappi Lanaken Mill (Sappi's Barrier Coated Paper)

-

Others

Recent Development

-

In June 2024, Sonoco announced that it entered into a contract to acquire Evisoys, from KPS Capital Partners, LP for USD 3.9 billion. The transaction is expected to enhance its core business and invest in high-return opportunities.

-

In March 2023, Amcor and Nfinite Nanotechnology Inc. announced that they entered into a joint research project agreement to validate Nfinite’s nanocoating technology to enhance compostable and recyclable packaging.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 32.67 Billion |

| Market Size by 2032 | USD 99.02 Billion |

| CAGR | CAGR of 13.03 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Intelligent & Smart Packaging, Active Packaging) • By Application(Food & Beverages ,Pharmaceuticals ,Personal Care & Cosmetics, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amcor, Sealed Air, Klöckner Pentaplast, Tetra Pak International S.A., CCL Industries Inc., Sonoco Products Company, BASF SE, Avery Dennison, DuPont, Teijin Films, Checkpoint Systems, Inc., Mondi Group, Berry Global, Inc., Innovia Films, Schur Flexibles, Uflex Ltd., Hindalco Industries, Pactiv Evergreen Inc., Crown Holdings, Inc., Constantia Flexibles, Greiner Packaging International, Kraft Heinz Company, Rexam PLC, Mitsubishi Gas Chemical Company, Fujifilm, LyondellBasell Industries, Graham Packaging Company, National Starch and Chemical Company, Ahlstrom-Munksjö, Sappi Lanaken Mill, and others. |

| Key Drivers | • The Swift Emergence of Nano-Enabled Packaging Meeting the Need for Eco-Friendly Solutions. • Improving Protection and Traceability with Nanotechnology in Innovative Smart Packaging Solutions |

| RESTRAINTS | • Addressing the Challenges Facing the Nano-Enabled Packaging Market |