Mycoplasma Testing Market Size:

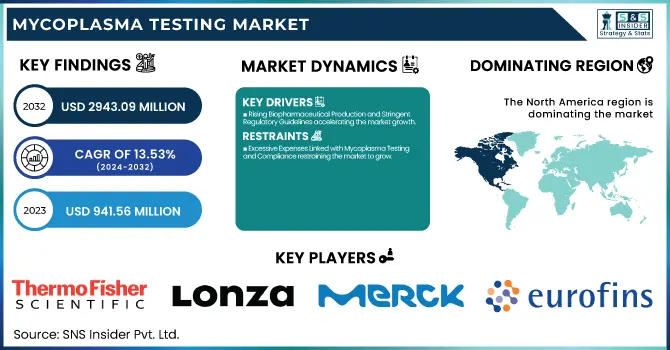

The Mycoplasma Testing Market size was valued at USD 941.56 million in 2023 and is expected to reach USD 2943.09 million by 2032, growing at a CAGR of 13.53% from 2024-2032.

To Get more information on Mycoplasma Testing Market - Request Free Sample Report

The Mycoplasma Testing Market report provides key insights by delivering in-depth statistical analysis on incidence and prevalence rates of contamination across various end-use industries and geographical locations. It provides regional mycoplasma testing trends, which describe the use of PCR, ELISA, and microbial culture methods in biopharmaceutical production, CROs, and research organizations. The report also provides a detailed volume overview of testing, highlighting the growing need for automated and fast detection technologies. It also includes an extensive regional expenditure analysis, including government, commercial, private, and out-of-pocket spending, providing a competitive advantage by outlining industry-specific financial investments in biosafety compliance.

Mycoplasma Testing Market Dynamics

Drivers

-

Rising Biopharmaceutical Production and Stringent Regulatory Guidelines accelerating the market growth.

The growing manufacture of biopharmaceuticals such as monoclonal antibodies, vaccines, and cell & gene therapies is fueling the need for mycoplasma testing. The FDA, EMA, and ICH require strict mycoplasma testing for biologics to guarantee product safety and efficacy. Failure to comply with regulations can incur expensive recalls and delay production, rendering mycoplasma testing a major quality control requirement. The increasing emphasis on Good Manufacturing Practices (GMP) also reinforces the use of sophisticated mycoplasma detection methods. A recent addition in February 2024 included Thermo Fisher Scientific broadening its biosafety testing capabilities, including mycoplasma testing, at its Wisconsin GMP laboratory, reflecting the increased industry interest. Merck also opened a USD 304.32 million biosafety testing facility in October 2024 to address the surging global biopharmaceutical quality assurance demand.

-

Technological Advancements in Mycoplasma Detection Methods Propelling Market Growth.

The development of high-speed and sensitive mycoplasma detection technologies, including PCR-based tests and real-time PCR kits, is transforming the industry. Weeks were needed for traditional culture-based methods, while today's molecular diagnostics provide precise detection within hours. Companies are continuously creating innovative products to improve efficiency. For instance, Roche's MycoTOOL Mycoplasma Real-Time PCR Kit and Lonza's MycoAlert PLUS Kit offer quicker and more efficient results. In 2024, Agilent Technologies launched improved real-time PCR-based mycoplasma detection assays to enable high-throughput testing within pharmaceutical and biotech companies. The use of automation and artificial intelligence-based analysis in mycoplasma test laboratories further expedites throughput and accuracy. With growing investments in R&D and increasing awareness among biopharmaceutical producers, sophisticated mycoplasma detection solutions are increasingly being used.

Restraint

-

Excessive Expenses Linked with Mycoplasma Testing and Compliance restraining the market to grow.

Conventional culture-based mycoplasma testing is time-consuming but cost-effective; however, contemporary PCR-based and real-time PCR assays, though sensitive and quick, are very costly in terms of reagents, specialized equipment, and trained staff. Moreover, biopharmaceutical firms have to comply with strict regulatory standards of agencies like the FDA, EMA, and ICH, necessitating ongoing investment in validated testing procedures, quality control processes, and compliance audits. Small and medium-sized biotech companies, contract research organizations (CROs), and academic research institutions find it difficult to bear the cost of setting up and maintaining high-end mycoplasma testing laboratories. This financial barrier constrains market growth, especially in developing economies where budgetary limitations affect mass adoption.

Opportunities

-

The rapid growth of cell and gene therapy presents a significant opportunity for the mycoplasma testing market.

Rapid expansion in the field of cell and gene therapy is an opportunity in disguise for the mycoplasma testing industry. With more FDA-approved cell and gene therapies and increasing numbers in the coming years, quality control measures such as rigorous testing, including mycoplasma testing, become ever more important to ensure product safety and regulatory compliance. As mycoplasma contamination can adulterate cell cultures and adversely affect therapeutic outcomes, regulatory bodies like the FDA and EMA require strict testing procedures for advanced therapies. The rising number of clinical trials for regenerative medicine and personalized treatments is also accelerating the demand for effective and dependable mycoplasma detection solutions. In reaction, leading players in the market are coming up with specialized mycoplasma testing products specific to cell and gene therapy, thus creating a highly rewarding growth area for the industry in the future years.

Challenges

-

A major challenge in the mycoplasma testing market is the limited awareness and lack of standardized testing protocols in emerging markets.

The markets like North America and Europe have strong regulatory systems for mycoplasma testing in biopharmaceutical production, and most developing nations have weak enforcement and biosafety testing infrastructure. Variable regulatory guidelines between regions pose challenges to manufacturers in adopting uniform mycoplasma testing approaches. Furthermore, small-scale biotechnology companies and emerging market research institutes have limited financial resources and lack technical expertise for accessing sophisticated PCR-based mycoplasma detection technologies. Bridging these barriers calls for higher regulatory harmonization, industry cooperation, and training programs to enhance awareness and accessibility to mycoplasma testing solutions in the developing world.

Mycoplasma Testing Market Segmentation Analysis

By Product

The Kits & Reagents segment dominated the market with a 52.33% market share in 2023 as a result of the growing use of quick, sensitive, and affordable detection products in biopharmaceutical production, contract research organizations (CROs), and academic research institutions. Mycoplasma contamination is a major threat in cell culture-based research and biologics manufacturing, and hence frequent and accurate testing is required. Kits and reagents, especially PCR-based and ELISA-based detection assays, yield rapid and precise results as opposed to conventional culture-based methods, which are time-consuming and labor-intensive. The increasing need for ready-to-use, standardized test solutions that guarantee regulatory compliance with organizations such as the FDA, EMA, and ICH also accelerated market growth. Besides, leading market players like Thermo Fisher Scientific, Lonza, and Merck KGaA continued to advance their mycoplasma detection product offerings during 2023, further solidifying the dominance of the segment. The growing number of biologics, cell and gene therapy research initiatives, and vaccine manufacturing continued to generate tremendous demand for mycoplasma testing kits and reagents. The market is augmented by ease of use, cost-effectiveness for frequent testing, and integration with automated lab workflows with ease.

By Technology

The PCR (Polymerase Chain Reaction) segment dominated the mycoplasma testing market with a 34.12% market share in 2023 because it is very sensitive, has a quick turnaround time, and is more accurate than conventional methods of detection. PCR-based mycoplasma testing is now the method of choice for pharmaceutical and biotech firms, contract research organizations (CROs), and research institutions because it can identify even trace levels of mycoplasma contamination in cell cultures, biopharmaceutical products, and gene therapy vectors. In contrast to culture-based tests, which may take weeks to yield results, PCR-based assays are highly sensitive and yield results within hours, facilitating quicker decision-making in bioproduction and research settings. Regulatory bodies like the FDA, EMA, and ICH highly recommend PCR-based mycoplasma testing, further propelling its use in Good Manufacturing Practices (GMP)-compliant laboratories. Improvements in real-time PCR (qPCR) and digital PCR (dPCR) have further consolidated the dominance of this segment by providing quantitative and highly specific detection of mycoplasma DNA.

By Application

The Cell Line Testing segment dominated the market with a 41.26% market share in 2023 because of the pivotal role played by cell lines in biopharmaceutical manufacturing, research, and regenerative medicine. Mycoplasma contamination of cell cultures is a grave risk to the integrity and replicability of research outcomes, affecting drug discovery, vaccine manufacture, and biologics manufacturing. Therefore, the pharmaceutical industry, biotechnology companies, and research institutions place special emphasis on regular mycoplasma testing of cell lines to meet Good Manufacturing Practices (GMP) as well as regulatory requirements specified by organizations like the FDA, EMA, and ICH. The growing application of cell-based assays, monoclonal antibodies, and gene therapies has also accelerated the need for sensitive and quick mycoplasma testing solutions to ensure cell lines are contaminant-free.

The growing interest in the adoption of sophisticated cell culture technologies in applications like stem cell therapy, regenerative medicine, and biologics manufacturing has heightened the need for strict quality control procedures. PCR-based mycoplasma testing, in addition to ELISA and microbial culture methods, has become the norm for maintaining cell line integrity in research and clinical use. Industry leaders such as Thermo Fisher Scientific, Lonza, and Charles River Laboratories have developed their cell line testing services and mycoplasma detection product lines, further solidifying the dominance of the segment. With the increasing demand for personalized medicine and biopharmaceutical innovation, cell line testing continues to be an integral part of maintaining biosafety and regulatory compliance in the life sciences industry.

By End-use

Pharmaceutical & Biotechnology Companies dominated the market with a 36.12% market share maintaining the leadership position in 2023 as a result of regulatory strictures and high stakes surrounding biopharmaceutical production. Mycoplasma contamination threatens seriously in the manufacture of biologics, vaccines, monoclonal antibodies, and cell & gene therapies since it will compromise product efficacy, safety, and regulatory licensure. In an attempt to curtail these risks, the pharmaceutical and biotech industry has heavily invested in regular mycoplasma testing regimes while adhering to international regulatory compliance as required by organizations such as the FDA, EMA, and ICH. Increased GMP adoption as well as the use of quality control methods further supported the role of speedy and highly sensitive mycoplasma detection technology within this industry.

Mycoplasma Testing Market Regional Insights

North America dominated the mycoplasma testing market with a 40.25% market share in 2023, Owing to its established biopharmaceutical and biotech sectors, rigorous regulatory requirements, and investments in R&D. The region also features key biopharmaceutical firms, CROs, and regulatory agencies like the U.S. FDA and thus adheres strictly to biosafety test protocols, and hence, there is steady demand for mycoplasma testing technology. Furthermore, the region also has high usage rates of advanced molecular diagnostics, for instance, real-time PCR-based detection of mycoplasma, which is more efficient and consistent than conventional culture-based technologies. Key industry players, Thermo Fisher Scientific, Charles River Laboratories, and Lonza, have strong bases in the region, thereby cementing North America's leading role. The growth in cell and gene therapy in the region and heightened clinical trial activities additionally drive demand for tight control against contamination.

The fastest-growing region of the mycoplasma testing market is the Asia Pacific region growing at 14.19% CAGR throughout the forecast period due to increasing expansion in the biopharmaceutical industry, surging government sponsorship for biotechnology research, and investment boosts in pharma manufacturing. Relevant countries like China, India, and South Korea are rapidly becoming world leaders in biologics production, creating an increased demand for effective mycoplasma testing solutions. The regulatory bodies in the region, like China's National Medical Products Administration (NMPA) and India's Central Drugs Standard Control Organization (CDSCO), are also tightening biosafety regulations to meet international standards, which will drive increased adoption of mycoplasma testing technologies. The rise in the number of contract research organizations (CROs) and biomanufacturing units, along with growing awareness among clients regarding risks associated with contamination of cell-based therapies, still boosts market growth. With improving investment in next-generation diagnostic technologies and biosafety infrastructure, the Asia Pacific is well positioned to record substantial growth over the forthcoming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Mycoplasma Testing Market

-

Thermo Fisher Scientific Inc. (MycoSEQ Mycoplasma Detection Kit, MycoAlert Mycoplasma Detection Kit)

-

Lonza Group Ltd. (MycoAlert PLUS Mycoplasma Detection Kit, Nucleofector Technology)

-

Merck KGaA (PlasmoTest Mycoplasma Detection Kit, Mycoplasma Removal Agent)

-

Charles River Laboratories International, Inc. (Endosafe-PTS System, Accugenix Mycoplasma Testing Services)

-

Roche Diagnostics (MycoTOOL Mycoplasma Real-Time PCR Kit, LightCycler 480 System)

-

bioMérieux SA (VIDAS Mycoplasma Assay, NucliSENS EasyQ Mycoplasma)

-

Agilent Technologies, Inc. (AriaMx Real-Time PCR System, Mycoplasma Detection Assays)

-

Becton, Dickinson and Company (BD MAX Mycoplasma Detection Kit, BD Phoenix M50)

-

InvivoGen (PlasmoTest Mycoplasma Detection Kit, Normocin Antimicrobial Reagent)

-

PromoCell GmbH (Mycoplasma Detection Kit, Antibiotic-Antimycotic Solution)

-

Sartorius AG (Microsart ATMP Mycoplasma Kit, Microsart RESEARCH Mycoplasma Kit)

-

Takara Bio Inc. (PCR Mycoplasma Detection Set, Mycoplasma Elimination Cocktail)

-

Minerva Biolabs GmbH (VenorGeM Mycoplasma Detection Kit, Mycoplasma Off Kit)

-

ATCC (American Type Culture Collection) (Universal Mycoplasma Detection Kit, Genuine Cultures for Mycoplasma Testing)

-

Biological Industries Israel Beit Haemek Ltd. (Mycoplasma Detection Kit, Mycoplasma Prevention Reagent)

-

MP Biomedicals, LLC (Mycoplasma PCR Detection Kit, Mycoplasma Removal Agent)

-

Clongen Laboratories, LLC (Mycoplasma Testing Services, PCR Detection Kits)

-

GenBio (ImmunoWELL Mycoplasma IgG/IgM Test, Mycoplasma Pneumoniae IgM ELISA)

-

ScienCell Research Laboratories, Inc. (Mycoplasma Detection Kit, Mycoplasma Removal Reagent)

-

Eurofins Scientific (Mycoplasma Testing Services, Mycoplasma Real-Time PCR Assay)

Suppliers (These suppliers provide essential mycoplasma detection kits, reagents, PCR solutions, and testing services to research laboratories, biopharmaceutical companies, and healthcare facilities worldwide.)

-

Thermo Fisher Scientific Inc.

-

Merck KGaA (MilliporeSigma)

-

Lonza Group Ltd.

-

Charles River Laboratories International, Inc.

-

Roche Diagnostics

-

bioMérieux SA

-

Sartorius AG

-

Takara Bio Inc.

-

Minerva Biolabs GmbH

-

Eurofins Scientific

Recent Development

-

In February 2024, Thermo Fisher Scientific Inc., the world leader in serving science, announced that it was expanding its PPD clinical research business by adding mycoplasma and other biosafety testing capacity at its Good Manufacturing Practices (GMP) lab in Middleton, Wisconsin. The expanded analytical testing services will help to keep biopharmaceutical products free of contaminants, further demonstrating the company's dedication to helping customers bring safe and effective medicines to patients.

-

In October 2024, Merck, a global science and technology leader, officially inaugurated its new USD 304.32 million biosafety testing laboratory in Rockville, Maryland, USA. The facility will be a key player in biosafety testing and analytical development—essential elements of drug development and commercialization for traditional and novel therapeutic modalities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 941.56 million |

| Market Size by 2032 | US$ 2943.09 million |

| CAGR | CAGR of 13.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Kits & Reagents, Services) • By Technology (PCR, ELISA, Direct Assay, Indirect Assay, Microbial Culture Techniques, Enzymatic Methods) • By Application (Cell Line Testing, Virus Testing, End of Production Cells Testing, Others) • By End-use (Academic Research Institutes, Cell Banks, Contract Research Organizations, Pharmaceutical & Biotechnology Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Lonza Group Ltd., Merck KGaA, Charles River Laboratories International, Inc., Roche Diagnostics, bioMérieux SA, Agilent Technologies, Inc., Becton, Dickinson and Company, InvivoGen, PromoCell GmbH, Sartorius AG, Takara Bio Inc., Minerva Biolabs GmbH, ATCC (American Type Culture Collection), Biological Industries Israel Beit Haemek Ltd., MP Biomedicals, LLC, Clongen Laboratories, LLC, GenBio, ScienCell Research Laboratories, Inc., Eurofins Scientific, and other players. |