Get More Information on Motorcycles Market - Request Sample Report

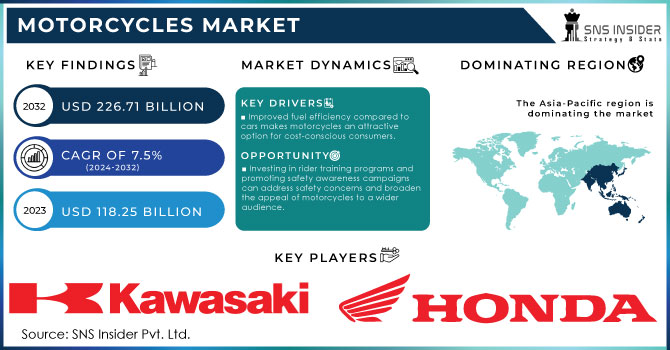

The Motorcycles Market Size was valued at USD 118.25 billion in 2023 and is expected to reach USD 226.71 billion by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

Rising disposable incomes, particularly in developing economies, are putting motorcycles within reach of a larger population. This affordability makes them a viable alternative to automobiles, especially in regions with limited public transport infrastructure. The motorcycles offer greater fuel efficiency compared to cars, which is a significant advantage in a world increasingly focused on environmental consciousness. The unit sales of Motorcycles market in the United States are expected to reach 641.90k motorcycles in 2029.

Manufacturers are continuously innovating to produce lighter, more powerful, and fuel-efficient engines. Improved braking systems, suspension, and safety features enhance rider confidence and control. For instance, the development of Anti-lock Braking Systems (ABS) has significantly reduced the risk of skidding during emergency braking. These advancements improves the overall riding experience and also address safety concerns, attracting a wider range of riders.

Stringent safety regulations implemented in developed countries can add to production costs and limit the affordability of some models. The lack of proper infrastructure, especially designated parking spaces and dedicated lanes, can be a deterrent for potential riders in congested urban areas.

KEY DRIVERS:

Improved fuel efficiency compared to cars makes motorcycles an attractive option for cost-conscious consumers.

Advancements in motorcycle technology like lighter engines and improved braking systems enhance rider experience and safety.

By utilizing advanced materials like aluminium and carbon fibre, manufacturers are crafting engines that are not only more powerful but also lighter. This reduction in weight translates to a more nimble and responsive motorcycle, making it easier to move and control, especially when navigating tight corners or navigating city streets. This improved handling fosters a more enjoyable and engaging riding experience, particularly for those who value agility and precision. Traditional braking systems can lock up the wheels during emergency situations, causing the rider to lose control. Modern motorcycles, however, are increasingly equipped with Anti-lock Braking Systems (ABS). This technology prevents the wheels from locking, ensuring the rider retains steering control even during hard braking. This not only minimizes the risk of skidding and accidents but also inspires greater confidence in riders, allowing them to push their limits with a sense of security.

RESTRAINTS:

The environmental impact of motorcycle emissions, although generally lower than cars, can still be a concern for eco-conscious consumers.

Stricter safety regulations in developed countries can increase production costs, making some motorcycles less affordable.

The significant restraint for the motorcycle industry is the implementation of stricter safety regulations in developed countries. While these regulations aim to create a safer riding environment, they can also lead to increased production costs for manufacturers. This is because complying with these regulations often necessitates incorporating more sophisticated safety features, such as Anti-lock Braking Systems (ABS) and airbags. While these features undoubtedly enhance rider safety, they can also add to the overall price tag of the motorcycle. This price hike can push some models out of reach for budget-conscious consumers, particularly in developing economies where affordability is a key consideration. The motorcycle market thrives on offering a cost-effective mode of transportation, and stricter regulations that inflate prices can inadvertently limit the accessibility of these vehicles for a segment of the population.

OPPORTUNITIES:

Investing in rider training programs and promoting safety awareness campaigns can address safety concerns and broaden the appeal of motorcycles to a wider audience.

Highlighting the fuel efficiency and cost-saving benefits of motorcycles can attract budget-conscious riders, especially in regions with rising fuel costs.

CHALLENGES:

Motorcycle emissions, though lower than cars, can still be a concern for environmentally conscious consumers.

By Motorcycles Type

Off-Road Motorcycles

On-Road Motorcycles

Scooters

The on-road motorcycle is the dominating sub-segment in the Motorcycles Market by motorcycle type holding around 60-70% of market share. On-road motorcycles offer greater versatility compared to off-road models. They can handle a wider range of terrains, including highways, city streets, and even some light off-road riding. Additionally, on-road motorcycles tend to be more comfortable for longer journeys due to their ergonomic design and touring capabilities. This makes them a compelling choice for commuters, long-distance riders, and touring enthusiasts. Scooters, while offering fuel efficiency and practicality for urban commutes, lack the power and versatility of on-road motorcycles, limiting their appeal to a smaller segment of riders.

By Propulsion Type

ICE

Electric

The Internal Combustion Engine (ICE) is the dominating sub-segment in the Motorcycles Market by propulsion type. This dominance is primarily due to the affordability and established infrastructure associated with ICE motorcycles. The vast network of gas stations makes refuelling convenient, while the lower upfront cost compared to electric motorcycles continues to be a significant deciding factor for many buyers. However, the electric motorcycle segment is poised for significant growth in the coming years, driven by rising environmental concerns, government incentives, and advancements in battery technology that are extending range and improving performance.

By Engine Capacity

Up to 200cc

200cc to 400cc

400cc to 800cc

More than 800cc

"Up to 200cc" and "200cc to 400cc” are the dominating sub-segment in the Motorcycles Market by engine capacity. These segments cater to a large portion of the market, particularly in developing economies, due to their affordability and fuel efficiency. Smaller engine motorcycles are ideal for navigating congested city streets and offer a practical and economical transportation solution. Additionally, these segments often have lower insurance premiums compared to larger motorcycles, making them even more attractive to budget-conscious riders and new riders seeking entry-level options. While larger engine motorcycles exceeding 400cc offer more power and performance, their higher price tag and fuel consumption limit their market share.

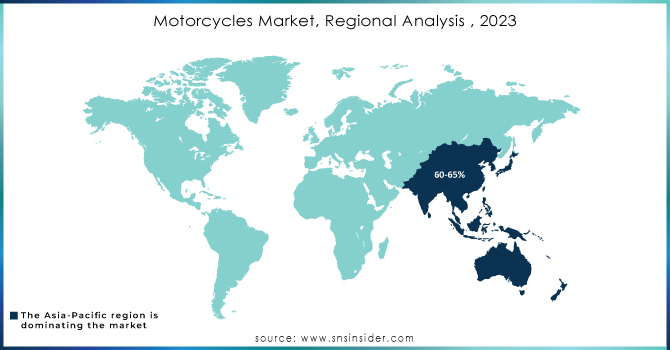

The Asia-Pacific is the dominating region in the Motorcycle Market holding around 60-65% of market share. Rapid urbanization creates a demand for affordable and motile transportation. The massive populations in countries like China and India translate to a vast customer base. The government support through production incentives and purchase subsidies fuels affordability. Motorcycles are simply cheaper to buy and maintain compared to cars in Asia, making them accessible to a wider demographic.

Europe is the second highest region in this market. A long-standing motorcycle culture fosters a passion for high-performance machines, and it boasts well-developed infrastructure with dedicated lanes and scenic routes that enhance the riding experience. This market also caters to a premium segment with renowned brands offering technologically advanced motorcycles.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Honda Motor Co., Ltd. (Japan), Kawasaki Heavy Industries, Suzuki Motor Corporation (Japan), Eicher Motors Limited (India), Yamaha Motor Co., Ltd. (Japan), Harley-Davidson, Inc. (the US), PIERER Mobility AG (Austria), BMW AG (Germany), Triumph Motorcycles (UK), Polaris Industries, Inc. (US) and other key players.

In Jan. 2024: EV startup Raptee Energy unveiled its high-powered electric motorcycle at the Tamil Nadu investor meet. Boasting a 150 km range and 135 km/hr top speed, the motorcycle is slated for an April 2024 launch.

In March 2023: Hero MotoCorp invested $60 million in California's Zero Motorcycles to co-develop electric motorcycle powertrains. Hero will leverage its manufacturing, sourcing, and marketing muscle to bring Zero's electric technology to market.

In Feb. 2023: Yamaha India upgraded all its two-wheelers to OBD-II systems from April 2023. This includes adding traction control for better grip and safer cornering to their 150cc motorbikes. They also plan to make all their bikes compatible with E20 fuel by year-end.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 118.25 Billion |

| Market Size by 2032 | US$ 226.71 Billion |

| CAGR | CAGR of 7.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Motorcycles Type (Off-Road Motorcycles, On-Road Motorcycles, Scooters) • by Propulsion Type (ICE, Electric) • by Engine Capacity (Up to 200cc, 200cc to 400cc, 400cc to 800cc, More than 800cc) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honda Motor Co., Ltd. (Japan), Kawasaki Heavy Industries, Suzuki Motor Corporation (Japan), Eicher Motors Limited (India), Yamaha Motor Co., Ltd. (Japan), Harley-Davidson, Inc. (the US), PIERER Mobility AG (Austria), BMW AG (Germany), Triumph Motorcycles (UK), Polaris Industries, Inc. (US) |

| Key Drivers | Due to an increase in demand for sleep management systems, warning systems, and alert systems to prevent motorcycle accidents. The addition of larger gasoline tanks and improved mileage. |

| RESTRAINTS | The related standards' absenteeism. The motorbike market is projected to be hampered by a lack of infrastructure in offering uniform platforms. |

The Motorcycles Market Size was valued at USD 118.25 billion in 2023.

Major players in the market Honda Motor Co., Ltd. (Japan), Kawasaki Heavy Industries, Suzuki Motor Corporation (Japan), Eicher Motors Limited (India), Yamaha Motor Co., Ltd. (Japan), Harley-Davidson, Inc. (the US), PIERER Mobility AG (Austria), BMW AG (Germany), Ltd. (Japan), Triumph Motorcycles (UK), Polaris Industries, Inc. (US), Hero MotoCorp Ltd. (India), Bajaj Auto Ltd. (India), TVS Motor Company (India), Ducati Motor Holding S.p.A. (Italy), and others in the final report.

The motorcycles Market is segmented into three segments by Engine Capacity, by Motorcycle Type, and by Application.

Asia Pacific region is dominating the Motorcycles Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Motorcycles Market Segmentation, By Motorcycles Type

7.1 Introduction

7.2 Off-Road Motorcycles

7.3 On-Road Motorcycles

7.4 Scooters

8. Motorcycles Market Segmentation, By Propulsion Type

8.1 Introduction

8.2 ICE

8.3 Electric

9. Motorcycles Market Segmentation, By Engine Capacity

9.1 Introduction

9.2 Up to 200cc

9.3 200cc to 400cc

9.4 400cc to 800cc

9.5 More than 800cc

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Motorcycles Market, By Country

10.2.3 North America Motorcycles Market Segmentation, By Motorcycles Type

10.2.4 North America Motorcycles Market Segmentation, By Propulsion Type

10.2.5 North America Motorcycles Market Segmentation, By Engine Capacity

10.2.6 USA

10.2.6.1 USA Motorcycles Market Segmentation, By Motorcycles Type

10.2.6.2 USA Motorcycles Market Segmentation, By Propulsion Type

10.2.6.3 USA Motorcycles Market Segmentation, By Engine Capacity

10.2.7 Canada

10.2.7.1 Canada Motorcycles Market Segmentation, By Motorcycles Type

10.2.7.2 Canada Motorcycles Market Segmentation, By Propulsion Type

10.2.7.3 Canada Motorcycles Market Segmentation, By Engine Capacity

10.2.8 Mexico

10.2.8.1 Mexico Motorcycles Market Segmentation, By Motorcycles Type

10.2.8.2 Mexico Motorcycles Market Segmentation, By Propulsion Type

10.2.8.3 Mexico Motorcycles Market Segmentation, By Engine Capacity

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Motorcycles Market, By Country

10.3.2.2 Eastern Europe Motorcycles Market Segmentation, By Motorcycles Type

10.3.2.3 Eastern Europe Motorcycles Market Segmentation, By Propulsion Type

10.3.2.4 Eastern Europe Motorcycles Market Segmentation, By Engine Capacity

10.3.2.5 Poland

10.3.2.5.1 Poland Motorcycles Market Segmentation, By Motorcycles Type

10.3.2.5.2 Poland Motorcycles Market Segmentation, By Propulsion Type

10.3.2.5.3 Poland Motorcycles Market Segmentation, By Engine Capacity

10.3.2.6 Romania

10.3.2.6.1 Romania Motorcycles Market Segmentation, By Motorcycles Type

10.3.2.6.2 Romania Motorcycles Market Segmentation, By Propulsion Type

10.3.2.6.4 Romania Motorcycles Market Segmentation, By Engine Capacity

10.3.2.7 Hungary

10.3.2.7.1 Hungary Motorcycles Market Segmentation, By Motorcycles Type

10.3.2.7.2 Hungary Motorcycles Market Segmentation, By Propulsion Type

10.3.2.7.3 Hungary Motorcycles Market Segmentation, By Engine Capacity

10.3.2.8 Turkey

10.3.2.8.1 Turkey Motorcycles Market Segmentation, By Motorcycles Type

10.3.2.8.2 Turkey Motorcycles Market Segmentation, By Propulsion Type

10.3.2.8.3 Turkey Motorcycles Market Segmentation, By Engine Capacity

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Motorcycles Market Segmentation, By Motorcycles Type

10.3.2.9.2 Rest of Eastern Europe Motorcycles Market Segmentation, By Propulsion Type

10.3.2.9.3 Rest of Eastern Europe Motorcycles Market Segmentation, By Engine Capacity

10.3.3 Western Europe

10.3.3.1 Western Europe Motorcycles Market, By Country

10.3.3.2 Western Europe Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.3 Western Europe Motorcycles Market Segmentation, By Propulsion Type

10.3.3.4 Western Europe Motorcycles Market Segmentation, By Engine Capacity

10.3.3.5 Germany

10.3.3.5.1 Germany Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.5.2 Germany Motorcycles Market Segmentation, By Propulsion Type

10.3.3.5.3 Germany Motorcycles Market Segmentation, By Engine Capacity

10.3.3.6 France

10.3.3.6.1 France Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.6.2 France Motorcycles Market Segmentation, By Propulsion Type

10.3.3.6.3 France Motorcycles Market Segmentation, By Engine Capacity

10.3.3.7 UK

10.3.3.7.1 UK Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.7.2 UK Motorcycles Market Segmentation, By Propulsion Type

10.3.3.7.3 UK Motorcycles Market Segmentation, By Engine Capacity

10.3.3.8 Italy

10.3.3.8.1 Italy Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.8.2 Italy Motorcycles Market Segmentation, By Propulsion Type

10.3.3.8.3 Italy Motorcycles Market Segmentation, By Engine Capacity

10.3.3.9 Spain

10.3.3.9.1 Spain Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.9.2 Spain Motorcycles Market Segmentation, By Propulsion Type

10.3.3.9.3 Spain Motorcycles Market Segmentation, By Engine Capacity

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.10.2 Netherlands Motorcycles Market Segmentation, By Propulsion Type

10.3.3.10.3 Netherlands Motorcycles Market Segmentation, By Engine Capacity

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.11.2 Switzerland Motorcycles Market Segmentation, By Propulsion Type

10.3.3.11.3 Switzerland Motorcycles Market Segmentation, By Engine Capacity

10.3.3.12 Austria

10.3.3.12.1 Austria Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.12.2 Austria Motorcycles Market Segmentation, By Propulsion Type

10.3.3.12.3 Austria Motorcycles Market Segmentation, By Engine Capacity

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Motorcycles Market Segmentation, By Motorcycles Type

10.3.3.13.2 Rest of Western Europe Motorcycles Market Segmentation, By Propulsion Type

10.3.3.13.3 Rest of Western Europe Motorcycles Market Segmentation, By Engine Capacity

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Motorcycles Market, By Country

10.4.3 Asia-Pacific Motorcycles Market Segmentation, By Motorcycles Type

10.4.4 Asia-Pacific Motorcycles Market Segmentation, By Propulsion Type

10.4.5 Asia-Pacific Motorcycles Market Segmentation, By Engine Capacity

10.4.6 China

10.4.6.1 China Motorcycles Market Segmentation, By Motorcycles Type

10.4.6.2 China Motorcycles Market Segmentation, By Propulsion Type

10.4.6.3 China Motorcycles Market Segmentation, By Engine Capacity

10.4.7 India

10.4.7.1 India Motorcycles Market Segmentation, By Motorcycles Type

10.4.7.2 India Motorcycles Market Segmentation, By Propulsion Type

10.4.7.3 India Motorcycles Market Segmentation, By Engine Capacity

10.4.8 Japan

10.4.8.1 Japan Motorcycles Market Segmentation, By Motorcycles Type

10.4.8.2 Japan Motorcycles Market Segmentation, By Propulsion Type

10.4.8.3 Japan Motorcycles Market Segmentation, By Engine Capacity

10.4.9 South Korea

10.4.9.1 South Korea Motorcycles Market Segmentation, By Motorcycles Type

10.4.9.2 South Korea Motorcycles Market Segmentation, By Propulsion Type

10.4.9.3 South Korea Motorcycles Market Segmentation, By Engine Capacity

10.4.10 Vietnam

10.4.10.1 Vietnam Motorcycles Market Segmentation, By Motorcycles Type

10.4.10.2 Vietnam Motorcycles Market Segmentation, By Propulsion Type

10.4.10.3 Vietnam Motorcycles Market Segmentation, By Engine Capacity

10.4.11 Singapore

10.4.11.1 Singapore Motorcycles Market Segmentation, By Motorcycles Type

10.4.11.2 Singapore Motorcycles Market Segmentation, By Propulsion Type

10.4.11.3 Singapore Motorcycles Market Segmentation, By Engine Capacity

10.4.12 Australia

10.4.12.1 Australia Motorcycles Market Segmentation, By Motorcycles Type

10.4.12.2 Australia Motorcycles Market Segmentation, By Propulsion Type

10.4.12.3 Australia Motorcycles Market Segmentation, By Engine Capacity

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Motorcycles Market Segmentation, By Motorcycles Type

10.4.13.2 Rest of Asia-Pacific Motorcycles Market Segmentation, By Propulsion Type

10.4.13.3 Rest of Asia-Pacific Motorcycles Market Segmentation, By Engine Capacity

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Motorcycles Market, By Country

10.5.2.2 Middle East Motorcycles Market Segmentation, By Motorcycles Type

10.5.2.3 Middle East Motorcycles Market Segmentation, By Propulsion Type

10.5.2.4 Middle East Motorcycles Market Segmentation, By Engine Capacity

10.5.2.5 UAE

10.5.2.5.1 UAE Motorcycles Market Segmentation, By Motorcycles Type

10.5.2.5.2 UAE Motorcycles Market Segmentation, By Propulsion Type

10.5.2.5.3 UAE Motorcycles Market Segmentation, By Engine Capacity

10.5.2.6 Egypt

10.5.2.6.1 Egypt Motorcycles Market Segmentation, By Motorcycles Type

10.5.2.6.2 Egypt Motorcycles Market Segmentation, By Propulsion Type

10.5.2.6.3 Egypt Motorcycles Market Segmentation, By Engine Capacity

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Motorcycles Market Segmentation, By Motorcycles Type

10.5.2.7.2 Saudi Arabia Motorcycles Market Segmentation, By Propulsion Type

10.5.2.7.3 Saudi Arabia Motorcycles Market Segmentation, By Engine Capacity

10.5.2.8 Qatar

10.5.2.8.1 Qatar Motorcycles Market Segmentation, By Motorcycles Type

10.5.2.8.2 Qatar Motorcycles Market Segmentation, By Propulsion Type

10.5.2.8.3 Qatar Motorcycles Market Segmentation, By Engine Capacity

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Motorcycles Market Segmentation, By Motorcycles Type

10.5.2.9.2 Rest of Middle East Motorcycles Market Segmentation, By Propulsion Type

10.5.2.9.3 Rest of Middle East Motorcycles Market Segmentation, By Engine Capacity

10.5.3 Africa

10.5.3.1 Africa Motorcycles Market, By Country

10.5.3.2 Africa Motorcycles Market Segmentation, By Motorcycles Type

10.5.3.3 Africa Motorcycles Market Segmentation, By Propulsion Type

10.5.3.4 Africa Motorcycles Market Segmentation, By Engine Capacity

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Motorcycles Market Segmentation, By Motorcycles Type

10.5.3.5.2 Nigeria Motorcycles Market Segmentation, By Propulsion Type

10.5.3.5.3 Nigeria Motorcycles Market Segmentation, By Engine Capacity

10.5.3.6 South Africa

10.5.3.6.1 South Africa Motorcycles Market Segmentation, By Motorcycles Type

10.5.3.6.2 South Africa Motorcycles Market Segmentation, By Propulsion Type

10.5.3.6.3 South Africa Motorcycles Market Segmentation, By Engine Capacity

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Motorcycles Market Segmentation, By Motorcycles Type

10.5.3.7.2 Rest of Africa Motorcycles Market Segmentation, By Propulsion Type

10.5.3.7.3 Rest of Africa Motorcycles Market Segmentation, By Engine Capacity

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Motorcycles Market, By Country

10.6.3 Latin America Motorcycles Market Segmentation, By Motorcycles Type

10.6.4 Latin America Motorcycles Market Segmentation, By Propulsion Type

10.6.5 Latin America Motorcycles Market Segmentation, By Engine Capacity

10.6.6 Brazil

10.6.6.1 Brazil Motorcycles Market Segmentation, By Motorcycles Type

10.6.6.2 Brazil Motorcycles Market Segmentation, By Propulsion Type

10.6.6.3 Brazil Motorcycles Market Segmentation, By Engine Capacity

10.6.7 Argentina

10.6.7.1 Argentina Motorcycles Market Segmentation, By Motorcycles Type

10.6.7.2 Argentina Motorcycles Market Segmentation, By Propulsion Type

10.6.7.3 Argentina Motorcycles Market Segmentation, By Engine Capacity

10.6.8 Colombia

10.6.8.1 Colombia Motorcycles Market Segmentation, By Motorcycles Type

10.6.8.2 Colombia Motorcycles Market Segmentation, By Propulsion Type

10.6.8.3 Colombia Motorcycles Market Segmentation, By Engine Capacity

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Motorcycles Market Segmentation, By Motorcycles Type

10.6.9.2 Rest of Latin America Motorcycles Market Segmentation, By Propulsion Type

10.6.9.3 Rest of Latin America Motorcycles Market Segmentation, By Engine Capacity

11. Company Profiles

11.1 Honda Motor Co., Ltd. (Japan)

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Kawasaki Heavy Industries

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Suzuki Motor Corporation (Japan)

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Eicher Motors Limited (India)

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Yamaha Motor Co., Ltd. (Japan)

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Harley-Davidson, Inc. (the US)

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 PIERER Mobility AG (Austria)

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 BMW AG (Germany)

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Triumph Motorcycles (UK)

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Polaris Industries, Inc. (US)

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Battery Swapping Market size was valued at USD 2.7 billion in 2023 and is expected to reach USD 70.7 Billion by 2032, growing at a CAGR of 43.96% from 2024-2032.

Automotive Sun Visor Market Size was USD 2.32 billion in 2023 & is expected to reach USD 3.50 billion by 2032 and grow at a CAGR of 4.73% by 2024-2032.

Automotive Regenerative Braking System Market was valued at $8.29 billion in 2023 & will reach $ 36 billion by 2032 & grow at a CAGR of 17.8% by 2024-2032

The Automotive Grille Market Size was $10.32 billion in 2023 and is expected to reach USD 16.02 billion by 2032 and grow at a CAGR of 5% by 2024-2032.

The Public Transportation Market Size was valued at $231.44 billion in 2023 and will reach $440 billion by 2032 and grow at a CAGR of 7.4% by 2024-2032

The Commercial Vehicle (CV) Active Power Steering Market Size was valued at USD 5.85 billion in 2023 and is expected to reach USD 14.29 billion by 2031 and grow at a CAGR of 11.8% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone