To get more information on Motor Insurance Market - Request Free Sample Report

The Motor Insurance Market was valued at USD 858.26 billion in 2023 and is expected to reach USD 1470.72 billion by 2032, growing at a CAGR of 6.23% from 2024-2032.

The motor insurance market has seen substantial growth, fueled by factors like the increasing number of vehicles on the road, government regulations, and a greater awareness of the importance of financial protection. In the United States, for instance, at the end of 2022, more than 285 million vehicles were registered, symbolizing a greater insurance demand because of increased reliance on cars as daily vehicles. These gains in vehicle numbers have been further enhanced by technological advancements like telematics, enabling insurers to offer personalized, usage-based policies. Increased competition on price and customer service through online platforms for comparing and purchasing insurance has also boosted market participation. In fact, in 2022, the average American paid $1,759 for insurance, reflecting a 15% rise from the previous year, reflecting the growing costs tied to vehicle ownership and coverage.

The demand for motor insurance is because of the increasing need for comprehensive coverage with rising cases of road accidents, traffic cases, and increased cases of vehicle thefts. In 2022, there were 42,514 fatal car accidents on U.S. roadway surfaces, thus calling for more comprehensive coverage. As of 2023, the District of Columbia is declared to have had the largest rate of motor vehicle theft in the United States, with as many as 1,070.9 cases per 100,000 inhabitants, making theft protection even more necessary. As the number of cars also increases, the consumer's demand grows for more customized policies, like third-party liability, theft, and comprehensive coverage. With more and more cars on the road, insurance providers are now offering customized policies that mitigate certain specific risks drivers may encounter so they are better guarded against both accidents and thefts.

In terms of future opportunities, the motor insurance market is poised for further growth with the rise of autonomous vehicles and connected car technology. This particularly opens up opportunities for the innovation of various products by insurers, such as usage-based insurance and automated claims processing. Increasing consumer demand for flexible, on-demand insurance will also spur the industry into offering more customized coverage plans with dynamic pricing models. But all growth comes with challenges, including regulatory issues and the need for insurers to adjust to new technologies while maintaining customer trust and satisfaction.

MARKET DYNAMICS

DRIVERS

The Impact of Telematics and Usage-Based Insurance (UBI) on the Motor Insurance Market

Telematics and Usage-Based Insurance (UBI) is revolutionizing the motor insurance landscape, enabling insurers to offer far more personalized and dynamic pricing models. As this development in telematics technology has enabled the real-time tracking of driver behavior, insurers can further initiate premiums based on actual usage, leading to greater customer satisfaction and trust. These customized policies, where customers can receive value-driven, flexible solutions, also fall in alignment with growing consumer demand. Telematics-driven UBI also supports the effort to mitigate risks, hence reducing claims costs for insurers. As a result, this innovation not only boosts market competitiveness but also creates significant growth opportunities, especially in attracting tech-savvy and price-conscious customers.

The Role of Regulatory Requirements in Shaping the Motor Insurance Market

Regulatory requirements can effectively influence motor insurance demand because most areas of the world require coverage for car owners. Regulatory needs ensure that accident circumstances protect drivers in the financial aspects, leading to stability and predictability of the insurance market. As governments continue to enforce the needs, stricter standards are introduced, and the market enjoys constant demand with limited choice from the buyers' end. This mandatory nature of coverage also provides a solid ground for insurers, given that it guarantees some level of revenue. As a result, the regulatory environment not only facilitates market growth but also creates space for insurers to innovate with policies that converge with the changing legal framework.

RESTRAINTS

Impact of Rising Fraud and Increasing Claims Costs on the Motor Insurance Market

The increasing fraudulent claims problem and increasing cost of automobile accidents, repair, and medical treatment represent some of the main restrictions of the motor insurance market. Insurers have a major problem detecting fraud as these people have also improved their fraudulent methods. Inflation in claims has thus resulted. At the same time, repair and medical costs keep rising with inflation and new technologies in vehicles. These push insurers to raise their premiums; however, regulatory restrictions restrict their ability to do so. The two factors mentioned above will likely slow down the growth of the market, increase operational costs, and limit profitability for insurers.

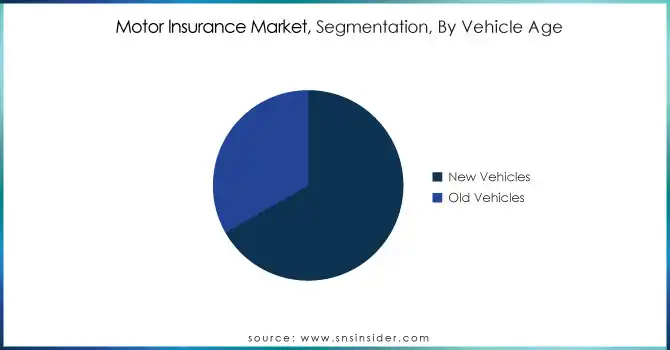

BY VEHICLE AGE

New Vehicles segment dominated the Motor Insurance Market with the highest revenue share of about 67% in 2023. This is because most consumers are highly demanding about the latest models, which are usually replete with advanced safety and technology features. These types of vehicles usually require high coverage options, thus more premium payouts and a high revenue yield for the insurance companies.

The old Vehicles segment is expected to grow at the fastest CAGR of about 7.36% from 2024-2032, mainly due to the growth in the number of aging cars on the road; consumers are holding onto them for longer periods because it makes economic sense. Because of this, insurers provide specific coverage for older vehicles, which increases the attraction and market size of that segment.

BY APPLICATION

The Personal Vehicle segment dominated the Motor Insurance Market with the highest revenue share of about 71% in 2023. This dominance is largely driven by the high volume of individual car ownership globally, with consumers seeking comprehensive coverage for personal use. Additionally, the increasing number of new drivers and vehicles entering the market contributes to sustained demand for personal vehicle insurance.

Commercial Vehicle segment is expected to grow at the highest CAGR of about 7.15% from 2024-2032. This growth is fueled by the expanding global logistics and e-commerce sectors, which rely heavily on commercial vehicles for transportation. As businesses continue to invest in fleets and delivery vehicles, the need for specialized commercial vehicle insurance coverage is expected to rise, driving the segment's rapid expansion.

BY COVERAGE

Liability Coverage segment dominated the Motor Insurance Market with the highest revenue share of about 43% in 2023. This dominance stems from its mandatory nature in most regions, ensuring that drivers meet legal requirements to cover damages or injuries caused by third parties. Its widespread adoption makes it an essential policy, consistently driving significant revenue for insurers.

The Comprehensive Insurance segment is expected to grow at the fastest CAGR of about 8.14% from 2024-2032. This growth is fueled by rising consumer demand for broader coverage, protecting against theft, natural disasters, and other non-collision incidents. As vehicle values increase, consumers prioritize comprehensive protection, driving its rapid adoption.

BY DISTRIBUTION CHANNEL

The Insurance Agents/Brokers segment dominated the Motor Insurance Market with the highest revenue share of about 46% in 2023. The long-established trust consumers drive this dominant place in agents and brokers for personalized service, expert advice, and tailored policy recommendations. Their ability to navigate complex insurance options and provide face-to-face interactions continues to be a key factor in retaining a significant market share.

The Direct Response segment is expected to grow at the highest CAGR of about 8.30% from 2024-2032. This growth is largely attributed to the increasing consumer preference for online and self-service insurance solutions, which offer convenience and competitive pricing. The rise of digital platforms and the ability to instantly compare and purchase policies without intermediaries is expected to drive this segment’s expansion, appealing to tech-savvy consumers seeking efficiency.

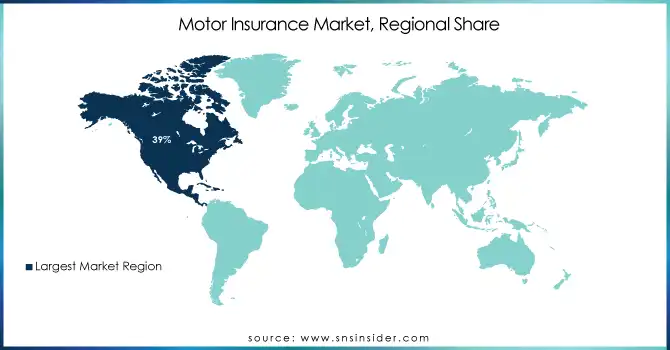

REGIONAL ANALYSIS

North America dominated the motor insurance market in 2023, holding a 39% revenue share. This dominance is attributed to the high vehicle ownership rate, robust regulatory environment, and a well-established insurance infrastructure. Additionally, the demand for comprehensive coverage and the region's relatively high premium rates contribute significantly to North America's leading position in the global market.

The Asia Pacific region is expected to grow at the fastest CAGR of 8.10% from 2024 to 2032. This growth is driven by rapid urbanization, increasing disposable income, and rising vehicle ownership in countries like China and India. As more consumers in this region seek insurance solutions, coupled with improvements in digital insurance platforms, Asia Pacific is poised to become a major driver of global motor insurance market expansion.

RECENT NEWS-

Berkshire Hathaway, Inc. (Auto Insurance, Liability Coverage)

Tokio Marine Holdings, Inc. (Personal Auto Insurance, Commercial Vehicle Insurance)

People’s Insurance Company of China (Vehicle Insurance, Third-Party Liability Insurance)

State Farm Mutual Automobile Insurance (Auto Insurance, Comprehensive Coverage)

Ping An Insurance (Group) Company of China, Ltd. (Car Insurance, Personal Liability Insurance)

Allstate Insurance Company (Auto Insurance, Collision Coverage)

Admiral (Car Insurance, Multicar Insurance)

China Pacific Insurance Co. (Motor Vehicle Insurance, Third-Party Liability)

GEICO (Auto Insurance, Liability Insurance)

Allianz (Car Insurance, Commercial Vehicle Insurance)

American International Group Inc. (Auto Insurance, Personal Liability Coverage)

Assicurazioni Generali S.p.A. (Car Insurance, Comprehensive Coverage)

AXA Cooperative Insurance Company (Gulf Insurance Company K.S.C.) (Auto Insurance, Liability Insurance)

Bajaj Allianz General Insurance Company Limited (Car Insurance, Personal Coverage)

Reliance General Insurance Company Limited (Reliance Capital Limited) (Car Insurance, Liability Coverage)

The Hanover Insurance Group Inc. (Opus Investment Management) (Auto Insurance, Commercial Vehicle Coverage)

The Progressive Corporation (Auto Insurance, Liability Insurance)

Universal Sompo General Insurance Company Limited (Car Insurance, Third-Party Liability)

Zurich Insurance Group Ltd. (Motor Insurance, Collision Coverage)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 858.26 Billion |

| Market Size by 2032 | USD 1470.72 Billion |

| CAGR | CAGR of 6.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Coverage (Liability Coverage, Collision Coverage, Comprehensive Insurance, Others) • By Distribution Channel (Insurance Agents/Brokers, Direct Response, Banks, Others) • By Vehicle Age (New Vehicles, Old Vehicles) • By Application (Commercial Vehicle, Personal Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Berkshire Hathaway, Inc., Tokio Marine Holdings, Inc., People’s Insurance Company of China, State Farm Mutual Automobile Insurance, Ping An Insurance (Group) Company of China, Ltd., Allstate Insurance Company, Admiral, China Pacific Insurance Co., GEICO, Allianz, American International Group Inc., Assicurazioni Generali S.p.A., AXA Cooperative Insurance Company (Gulf Insurance Company K.S.C.), Bajaj Allianz General Insurance Company Limited, Reliance General Insurance Company Limited (Reliance Capital Limited), The Hanover Insurance Group Inc. (Opus Investment Management), The Progressive Corporation, Universal Sompo General Insurance Company Limited, Zurich Insurance Group Ltd. |

| Key Drivers | • The Impact of Telematics and Usage-Based Insurance (UBI) on the Motor Insurance Market • The Role of Regulatory Requirements in Shaping the Motor Insurance Market |

| RESTRAINTS | • Impact of Rising Fraud and Increasing Claims Costs on the Motor Insurance Market |

ANS- Motor Insurance Market was valued at USD 858.26 billion in 2023 and is expected to reach USD 1470.72 billion by 2032, growing at a CAGR of 6.23% from 2024-2032.

ANS- Increasing vehicle numbers, government regulations, and awareness of financial protection are key drivers.

ANS- The New Vehicles segment led with a 67% revenue share due to high demand for advanced, safety-equipped models.

ANS- High car ownership and demand for comprehensive coverage contribute to the Personal Vehicle segment's 71% market share

ANS- Increasing accident rates and expanding global regulations are expected to push the segment's growth at 8.14% CAGR.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Consumer Behavior and Demand for Customization

5.2 Regulatory Developments and Compliance

5.3 Usage Statistics, by Region, 2023

5.4 Insurance Fraud and Rising Claims Costs

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Motor Insurance Market Segmentation, by Coverage

7.1 Chapter Overview

7.2 Liability Coverage

7.2.1 Liability Coverage Market Trends Analysis (2020-2032)

7.2.2 Liability Coverage Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Collision Coverage

7.3.1 Collision Coverage Market Trends Analysis (2020-2032)

7.3.2 Collision Coverage Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Comprehensive Insurance

7.4.1 Comprehensive Insurance Market Trends Analysis (2020-2032)

7.4.2 Comprehensive Insurance Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Motor Insurance Market Segmentation, by Application

8.1 Chapter Overview

8.2 Commercial Vehicle

8.2.1 Commercial Vehicle Market Trends Analysis (2020-2032)

8.2.2 Commercial Vehicle Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Personal Vehicle

8.3.1 Personal Vehicle Market Trends Analysis (2020-2032)

8.3.2 Personal Vehicle Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Motor Insurance Market Segmentation, by Distribution Channel

9.1 Chapter Overview

9.2 Insurance Agents/Brokers

9.2.1 Insurance Agents/Brokers Market Trends Analysis (2020-2032)

9.2.2 Insurance Agents/Brokers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Direct Response

9.3.1 Direct Response Market Trends Analysis (2020-2032)

9.3.2 Direct Response Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Banks

9.4.1 Banks Market Trends Analysis (2020-2032)

9.4.2 Banks Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Motor Insurance Market Segmentation, by Vehicle Age

10.1 Chapter Overview

10.2 New Vehicles

10.2.1 New Vehicles Market Trends Analysis (2020-2032)

10.2.2 New Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Old Vehicles

10.3.1 Old Vehicles Market Trends Analysis (2020-2032)

10.3.2 Old Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Motor Insurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.2.4 North America Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.6 North America Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.2.7.2 USA Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.7.4 USA Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.2.8.2 Canada Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.8.4 Canada Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.2.9.2 Mexico Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.9.4 Mexico Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Motor Insurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.1.7.2 Poland Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.7.4 Poland Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.1.8.2 Romania Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.8.4 Romania Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Motor Insurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.4 Western Europe Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.6 Western Europe Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.7.2 Germany Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.7.4 Germany Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.8.2 France Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.8.4 France Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.9.2 UK Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.9.4 UK Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.10.2 Italy Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.10.4 Italy Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.11.2 Spain Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.11.4 Spain Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.14.2 Austria Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.14.4 Austria Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Motor Insurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.4 Asia Pacific Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.6 Asia Pacific Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.7.2 China Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.7.4 China Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.8.2 India Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.8.4 India Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.9.2 Japan Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.9.4 Japan Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.10.2 South Korea Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.10.4 South Korea Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.11.2 Vietnam Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.11.4 Vietnam Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.12.2 Singapore Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.12.4 Singapore Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.13.2 Australia Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.13.4 Australia Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Motor Insurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.1.4 Middle East Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.6 Middle East Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.1.7.2 UAE Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.7.4 UAE Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Motor Insurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.2.4 Africa Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.6 Africa Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Motor Insurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.6.4 Latin America Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.6 Latin America Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.6.7.2 Brazil Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.7.4 Brazil Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.6.8.2 Argentina Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.8.4 Argentina Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.6.9.2 Colombia Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.9.4 Colombia Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Motor Insurance Market Estimates and Forecasts, by Coverage (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Motor Insurance Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Motor Insurance Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Motor Insurance Market Estimates and Forecasts, by Vehicle Age (2020-2032) (USD Billion)

12. Company Profiles

12.1 Berkshire Hathaway, Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Tokio Marine Holdings, Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 People’s Insurance Company of China

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 State Farm Mutual Automobile Insurance

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Ping An Insurance (Group) Company of China, Ltd.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Allstate Insurance Company

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Admiral

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 China Pacific Insurance Co.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 GEICO

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Allianz

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Coverage

Liability Coverage

Collision Coverage

Comprehensive Insurance

Others

By Distribution Channel

Insurance Agents/Brokers

Direct Response

Banks

Others

By Vehicle Age

New Vehicles

Old Vehicles

By Application

Commercial Vehicle

Personal Vehicle

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The New Energy Vehicle (NEV) Taxi Market Size was valued at USD 29.3 billion in 2023 and is expected to reach USD 203 billion by 2032 and grow at a CAGR of 24% over the forecast period 2024-2032.

The Off-Highway Brake Oil Aftermarket Market size was valued at USD 17.95 billion in 2023 and will reach $25.70 billion by 2032, growing at a CAGR of 4.08% over the forecast period of 2024-2032.

The Automotive Aftermarket Industry Size was valued at USD 425.25 billion in 2023 and is expected to reach USD 575.52 billion by 2031 and grow at a CAGR of 3.92% over the forecast period 2024-2031.

The Route Optimization Software Market Size was valued at USD 7.01 Billion in 2023 & will reach USD 23.50 Bn by 2032 & grow at a CAGR of 14.41% by 2024-2032

The E-bikes Market size was valued at USD 49 billion in 2023 and is expected to reach USD 72.39 billion by 2031 and grow at a CAGR of 5% by 2024-2031.

The Automotive Emission Test Equipment Market Size was valued at USD 772.33 Million in 2023 and is expected to reach USD 1185.07 Million by 2032 and grow at a CAGR of 4.89% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone