Mooring Inspection Market Report Scope & Overview:

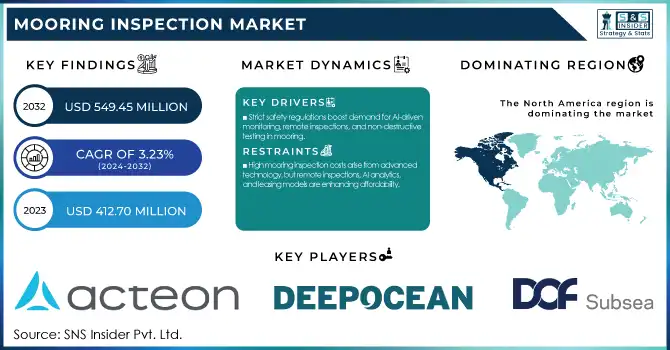

The Mooring Inspection Market Size was estimated at USD 412.70 Million in 2023 and is expected to arrive at USD 549.45 Million by 2032 with a growing CAGR of 3.23% over the forecast period 2024-2032. The Mooring Inspection Market report offers a unique analysis of inspection frequency, failure rates, and regulatory compliance trends across key regions. It highlights the adoption of advanced inspection technologies such as AI-driven predictive analytics, real-time digital twin monitoring, and automated ROV-based inspections. The report also examines mooring system integrity scores, offering insights into structural health trends. Additionally, it explores the increasing shift toward remote and autonomous inspection solutions, reducing human intervention and enhancing efficiency, emerging trends like electromagnetic-based integrity assessment and machine learning-driven anomaly detection further shape the market landscape.

To Get more information on Mooring Inspection Market - Request Free Sample Report

Mooring Inspection Market Dynamics

Drivers

-

Stringent safety regulations drive the demand for frequent mooring inspections, accelerating the adoption of AI-driven monitoring, remote inspection technologies, and non-destructive testing.

Stringent safety regulations are a key driver in the Mooring Inspection Market, as governments and industry bodies enforce stricter compliance measures to ensure offshore infrastructure integrity. Regulator bodies like the International Maritime Organization (IMO) and the American Bureau of Shipping (ABS) require regular checks to minimize the risk of structural failure and environmental accidents. The increasing focus on asset integrity management (AIM) has driven demand for real-time monitoring, digital twin technology, and predictive analytics during mooring inspections. In industries facing these challenges, companies are turning to remote and autonomous inspection solutions and in industries such as oil and gas, robotic-operated vehicles (ROVs) and AI-driven predictive maintenance to meet compliance while minimizing operational expenditures. Furthermore, as floating offshore wind farms and deepwater oil & gas exploration proliferate, the need for stringent safety protocols is becoming increasingly imperative. The NDT techniques are gaining ground in the market, with advancements in sensor-based monitoring improving the accuracy and efficiency of inspections and making it easier to comply with regulatory guidelines.

Restraint

-

High inspection costs in the Mooring Inspection Market stem from expensive advanced technologies, but trends like remote inspections, AI-driven analytics, and leasing models are improving affordability.

High inspection costs remain a key restraint in the Mooring Inspection Market, as advanced technologies such as ROVs, AUVs, and AI-driven monitoring systems require significant investment. This is costly for the operators and demands specialized equipment, trained personnel, and generally offshore deployment, which is prohibitive for a lot of operators, particularly small ones. Furthermore, the cost of implementing digital twin technology and predictive analytics for improved efficiency also drives up initial costs. In contrast, the market is realizing a transition towards more affordable remote and autonomous inspection technology solutions, lessening the need for human divers and manual methods. Rental and leasing models are also being tentatively developed to relieve financial pressures. The industry is witnessing significant growth despite being an expensive affair, underpinned by stringent safety regulations, expansion in offshore energy projects, and a burgeoning need for real-time monitoring. Now that we have a historical context regarding the IoT-based predictive maintenance trend and AI-based data analysis, they can confidently conclude that they will significantly impact cost-effectiveness in the long term, meaning that advanced inspections will soon be within reach of all stakeholders.

Opportunities

-

The integration of IoT and AI enables real-time monitoring and predictive maintenance, reducing operational risks, optimizing performance, and minimizing unplanned downtimes.

The integration of IoT and AI in mooring inspection is transforming the industry by enabling real-time monitoring and predictive maintenance. IoT-enabled sensors provide constantly updated information on mooring line tension, corrosion and structural integrity feeding actionable insights to centralized systems. Predictive analytics powered by AI processes this data to flag potential failures before they happen, minimising the chances of mooring failures and unplanned downtimes. This proactive approach improves operational efficiency, safety, and cost-effectiveness as it reduces manual inspections and emergency interventions. Using AI-powered digital twin technology, virtual replicas are made for mooring systems to simulate stress conditions and optimize maintenance schedules for operators. With infrastructure in the North Sea and elsewhere aging, and regulatory compliance becoming more stringent, companies are increasingly investing in automated inspection solutions to help them ensure compliance and to extend the lifespan of these assets. IoT and AI-guided predictive maintenance is transforming the mooring inspection domain, promoting intelligent, data-backed decision processes.

Challenges

-

The growing reliance on digital inspection tools in the mooring inspection market increases vulnerability to cyber threats, requiring robust security measures to prevent data breaches and system manipulation.

As the mooring inspection market increasingly integrates digital technologies, such as IoT-enabled sensors, AI-driven predictive maintenance, and cloud-based data management, cybersecurity risks have become a major concern. The dependence on real-time monitoring systems, remote inspection tools, and automated ROVs/AUVs creates vulnerabilities in essential infrastructure, making them susceptible to cyber threats such as data breaches, hacking, and system manipulation. An ineffectual inspection system is bound to result in false assessments, operational interruptions, and safety risks that expose offshore systems to danger. Moreover, regulators are elaborating the compliance mandates around cybersecurity, pushing organizations to allocate budget behind a comprehensive security framework. But many organizations have outdated systems with weak encryption and little to no cybersecurity training, making them easy targets for attacks. In response, the industry is turning to blockchain for

Mooring Inspection Market Segmentation Analysis

By Type

The Below Water Inspection segment dominated with a market share of over 62% in 2023, due to the critical need for frequent assessments of underwater mooring components. Chains, anchors, and connectors are all subject to corrosion, biofouling and mechanical stress, requiring in-depth inspections to ensure their safety and durability. From oil & gas to renewable energy to marine infrastructure, such offshore industries depend on these inspections to meet stringent regulatory compliance needs and avoid structural failures. These new developments offer significant advantages in terms of efficiency, accuracy, and safety for subsea inspections, with the most advanced technology including remotely operated vehicles (ROVs), sonar imaging, and automated underwater drones. As offshore activities increase around the world, the need to inspect mooring systems below the water line has also crept upwards, establishing itself as the largest source of the segment.

By Technology

The Close Visual Inspection (CVI) segment dominated with a market share of over 32% in 2023, due to its cost-effectiveness, ease of implementation, and widespread adoption across offshore and marine industries. This approach enables inspectors to inspect mooring lines, chains and connectors for visible defects, such as corrosion, cracks and wear, without the need for sophisticated equipment. CVI is mostly used for scheduled maintenance, which guarantees timely identification of structural problems and averts failures. It is also widely applicable in both shallow and deepwater environments, providing an effective remedy for a diverse range of operational scenarios. The need to meet the growing demand for offshore oil and gas exploration and the need for regular inspections at these locations to ensure safety and compliance with industry regulations remains the key driver behind the dominance of CVI in this market.

Mooring Inspection Market Regional Outlook

North America region dominated with a market share of over 42% in 2023, primarily Due to the significant number of offshore drilling rigs, FPSOs and production platforms in the region, regular maintenance of mooring systems is essential for safe and continuous operation. Government-imposed regulations BSEE (Bureau of Safety and Environmental Enforcement) impose strict inspection protocols to avoid both structural accidents and environmental catastrophes. With increasing investments in the deepwater and ultra-deepwater exploration, demand for mooring inspection services further increases. Additionally, continuous monitoring and maintenance of aging offshore infrastructure in the region, further strengthens North America to sustain its lead in the market. This dominance is maintained by advanced methods of inspection and security compliance.

Asia-Pacific is the fastest-growing region in the Mooring Inspection Market, driven by increasing offshore energy projects, expanding maritime trade, and rising investments in renewable energy. The surge in large-scale offshore oil & gas exploration in addition to the rapid development of offshore wind farms in China, India, and Australia has created a significant demand for reliable mooring inspection solutions. Increasing safety regulations and the need to avoid structural failure in marine operations also drive market growth. Moreover, growth in inspection technologies such as ultrasonic testing and electromagnetic detection are expected to gain traction in the region. With governments driving for sustainable energy and tightening compliance regulations, the need for efficient mooring inspection services grows in Asia-Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Mooring Inspection Market

-

Acteon Group (Mooring Integrity Management, Subsea Inspection Services)

-

DeepOcean (ROV-Based Mooring Inspection, Structural Integrity Monitoring)

-

Oceaneering International (Autonomous Inspection Systems, Digital Asset Integrity Solutions)

-

DOF Subsea (ROV and Diver-Based Mooring Inspections, Ultrasonic Testing)

-

Deep Sea Mooring (Mooring Line Inspection, Load Monitoring Systems)

-

Welaptega (3D Scanning, Chain Measurement and Inspection)

-

InterMoor (Mooring System Surveys, Fatigue Analysis)

-

Moffatt & Nichol (Engineering and Mooring Risk Assessment, Structural Health Monitoring)

-

Delmar (Mooring Integrity Services, Anchor Handling and Inspection)

-

Vryhof (Mooring System Inspection, Digital Monitoring Solutions)

-

Fugro (Subsea Asset Monitoring, Remote Mooring Inspection)

-

Bureau Veritas (Mooring Compliance Audits, Certification & Testing)

-

ABS Group (Mooring Integrity Management, Risk-Based Inspection)

-

Saipem (ROV-Based Inspection, Structural Fatigue Analysis)

-

Wood PLC (Digital Twin for Mooring, Structural Risk Assessment)

-

DNV (Regulatory Compliance, Mooring Component Certification)

-

Seatronics (Subsea Inspection Equipment, ROV Tooling)

-

JIFMAR Offshore Services (Mooring Maintenance, Inspection & Repair)

-

Ocean Installer (Mooring System Monitoring, Tension Analysis)

-

Bluewater (Floating System Integrity, Mooring Line Inspection)

Suppliers for (Provides advanced offshore inspection equipment and services, including ROV-based mooring inspections and subsea monitoring solutions) on Mooring Inspection Market

-

Acteon Group

-

Ashtead Technology

-

InterMoor Inc

-

Deepwater Corrosion Services

-

Welaptega Marine

-

Oceaneering International

-

Deep Sea Mooring

-

Vryhof Anchors

-

Fugro

-

Bluewater

Recent Development

In October 2024: Acteon and TAISEI Corporation have signed a memorandum of understanding to collaborate on floating offshore wind projects in Japan. Acteon will provide services throughout the project lifecycle, including foundation and mooring solutions, as well as inspection, maintenance, and repair services. This partnership aims to accelerate Japan's renewable energy initiatives by leveraging both companies' expertise.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 412.70 Million |

| Market Size by 2032 | USD 549.45 Million |

| CAGR | CAGR of 3.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Below Water Inspection, Above Water Inspection) • By Technology (Close Visual Inspection, Magnetic Particle Inspection, Ultrasonic Testing, Electromagnetic Detection, Mooring Line Dimension Measurement) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acteon Group, DeepOcean, Oceaneering International, DOF Subsea, Deep Sea Mooring, Welaptega, InterMoor, Moffatt & Nichol, Delmar, Vryhof, Fugro, Bureau Veritas, ABS Group, Saipem, Wood PLC, DNV, Seatronics, JIFMAR Offshore Services, Ocean Installer, Bluewater. |