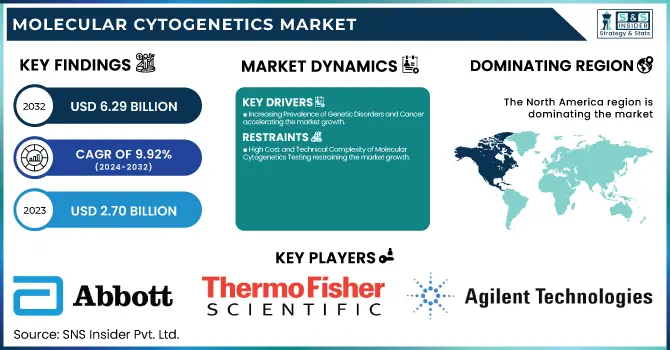

Molecular Cytogenetics Market Size Analysis

The Molecular Cytogenetics Market size was valued at USD 2.70 billion in 2023 and is expected to reach USD 6.29 billion by 2032, growing at a CAGR of 9.92% from 2024-2032. This report provides exclusive insights into the Molecular Cytogenetics Market by providing a comprehensive analysis of genetic disorders and cancer incidence (2023), broken down by region, for a better understanding of variations in disease burden across the world. It also discusses trends in the adoption of molecular cytogenetics methods, including regional differences in the use of FISH, CGH, and karyotyping. A thorough evaluation of molecular cytogenetics testing volume and growth (2020-2032) is presented to monitor long-term usage patterns. In addition, the report provides a thorough analysis of healthcare and research expenditure on molecular cytogenetics (2023), broken down by government, commercial, private, and out-of-pocket spending, providing unmatched insights into funding trends driving the market.

To Get more information on Molecular Cytogenetics Market - Request Free Sample Report

Molecular Cytogenetics Market Dynamics

Drivers

-

Increasing Prevalence of Genetic Disorders and Cancer accelerating the market growth.

The increasing incidence of cancer and genetic disorders is one of the key growth drivers of the molecular cytogenetics market. According to the World Health Organization (WHO), in 2023, more than 10 million deaths were reported due to cancer, with an increasing focus on early diagnosis and precision medicine. Moreover, rare genetic diseases impact about 350 million individuals worldwide, which generates tremendous demand for sophisticated diagnostic methods. Molecular cytogenetics technologies like fluorescence in situ hybridization (FISH) and comparative genomic hybridization (CGH) are important for detecting chromosomal abnormalities associated with these conditions. Emerging trends like the growth of next-generation sequencing (NGS)-based cytogenetic testing have further fueled market growth. Firms are investing in AI-based analysis platforms to enhance accuracy and turnaround time, and molecular cytogenetics has become an indispensable part of contemporary diagnostics.

-

Growing Adoption of Personalized Medicine and Targeted Therapies Propelling the growth of the Molecular Cytogenetics market

The movement towards personalized medicine is driving the implementation of molecular cytogenetics in clinical and research environments. As the comprehension of genetic alterations advances, medical professionals are applying cytogenetic methods to customize treatments under unique genomic profiles. For example, testing for amplification of the HER2 gene by FISH is a key process for identifying targeted treatment for breast cancer patients. Increased precision oncology demand has been fueled by a recent upsurge in companion diagnostics, as organizations like the FDA increasingly approve more cytogenetic-based diagnostics. New technologies that combine AI and automation to integrate into genetic testing have made analysis more efficient and accurate for detecting chromosomal anomalies. Increased attention on biomarker-based drug development continues to consolidate molecular cytogenetics' place in transforming patient-specific treatments.

Restraint

-

High Cost and Technical Complexity of Molecular Cytogenetics Testing restraining the market growth.

The technicality and high cost of molecular cytogenetics testing are major factors hindering the growth of the market. Methods like comparative genomic hybridization and fluorescence in situ hybridization necessitate costly apparatus, specialized chemicals, and trained professionals, precluding them from smaller research and diagnostic laboratories. Maintenance and the cost of consumables also weigh heavily on expenditures, preventing broader adoption, particularly in the developing world. Furthermore, the interpretation of data in molecular cytogenetics is intricate and demands bioinformatics knowledge, which poses a limitation for its widespread adoption. Although automation and AI-based solutions are being formulated to enhance efficiency, their high upfront cost is a cause of concern. Overcoming these cost and complexity challenges will be important for broadening market penetration and facilitating greater access to molecular cytogenetics-based diagnostics.

Opportunities

-

Expansion of Molecular Cytogenetics in Non-Oncology Applications is a growing opportunity for the market.

Though oncology is still a predominant domain for molecular cytogenetics, its use increasingly becomes feasible for non-oncology applications such as prenatal testing, neurological illnesses, and severe genetic disorders. Growing knowledge and the need for early diagnosis resulted in increased implementation of cytogenetic methods for reproductive medicine, especially in preimplantation and prenatal testing. Besides, studies on neurogenetic diseases such as autism spectrum disorders and Alzheimer's are fueling the demand for early risk assessment by cytogenetic tools. Further growth in integrating next-generation sequencing (NGS) with cytogenetics is increasing diagnostic options. With the recognition of the clinical value of molecular cytogenetics in non-oncology diseases by regulatory organizations and healthcare providers, market stakeholders have a good chance to formulate innovative solutions meeting a broader range of medical purposes.

Challenges

-

One of the key challenges in the molecular cytogenetics market is the lack of standardization and reproducibility in testing methods.

One of the major issues in the molecular cytogenetics industry is the absence of standardization and reproducibility in testing. Sample preparation, assay protocols, and data interpretation variability can cause inconsistent results between laboratories, impacting clinical decision-making and regulatory approval. FISH, CGH, and karyotyping techniques need to be executed with high precision and expertise, which makes it challenging to have uniformity across different environments. Furthermore, variations in reagent quality and image analysis software solutions also add to test differences. Regulatory agencies are promoting more uniform protocols, but the challenge is complex because of the varied assortment of technology applied to cytogenetic analysis. Standardization issues must be addressed to enable reliability, enhance clinical utility, and promote increased acceptance of molecular cytogenetics in routine diagnostics and research.

Molecular Cytogenetics Market Segmentation Analysis

By Application

The oncology segment dominated the molecular cytogenetics market with a 40.56% market share in 2023 because of the growing worldwide cancer burden and the expanding use of genetic testing for early diagnosis, prognosis, and treatment choice. Molecular cytogenetics methods like fluorescence in situ hybridization (FISH) and comparative genomic hybridization (CGH) have become valuable tools in detecting chromosomal aberrations linked with different cancers like leukemia, breast cancer, and lung cancer. The increasing use of targeted therapies and companion diagnostics has further driven the market for cytogenetic analysis in oncology. Moreover, programs such as the Cancer Moonshot program in the U.S. and rising investments in cancer genomics research have consolidated the strength of the segment's market leadership, with healthcare professionals and researchers making precision oncology their top priority for more effective treatment options.

The personalized medicine segment is expected to experience the fastest growth within the molecular cytogenetics market with the highest CAGR as there is greater emphasis moving toward individualized treatment strategies through genetic profiling. Next-generation sequencing (NGS) and molecular diagnostics advancements are facilitating targeted therapeutic strategies that better outcomes for patients and reduce adverse drug reactions. The increasing incorporation of molecular cytogenetics into personalized medicine is aided by efforts such as the Human Genome Project and national precision medicine initiatives globally. Moreover, the increasing interest of the pharmaceutical industry in biomarker-based drug development is fueling demand for cytogenetic methods to detect patient-specific genetic variations. As the healthcare industry further shifts towards precision medicine, molecular cytogenetics will be a driving force behind disease prediction, prevention, and treatment, propelling the segment's growing momentum in the forecast years.

By Technology

The Comparative Genomic Hybridization (CGH) segment dominated the molecular cytogenetics market with a 37.51% market share in 2023 because of its high-resolution ability to detect chromosomal imbalances and copy number variations (CNVs). CGH, especially array-based CGH (aCGH), is the gold standard for the identification of genetic abnormalities in oncology, genetic disorders, and prenatal diagnostics. Its benefits over traditional karyotyping, such as greater throughput, automation, and capacity to examine DNA from multiple sources, have encouraged extensive use in clinical and research settings. Moreover, additional investment in genomics research, along with developments in microarray technology, has reinforced the need for CGH within hospitals, diagnostic laboratories, and research centers. The technique's importance in the detection of cancer and inherited diseases' structural variation has turned it into a favored option, earning it market dominance in 2023.

The Others segment, encompassing upcoming molecular cytogenetics technologies like digital PCR, single-cell sequencing, and optical genome mapping, is anticipated to witness the fastest growth during the forecast period. The high-paced development of such sophisticated techniques is fueled by their capacity to yield greater resolution, real-time examination, and sensitivity than conventional cytogenetic analyses. The rising need for more accurate and scalable diagnostic technologies in rare genetic disorders, reproductive medicine, and individualized medicine is driving molecular cytogenetics innovation. Furthermore, the increased use of artificial intelligence (AI) and bioinformatics tools in genomic analysis is broadening the scope of next-generation cytogenetic technologies. As these state-of-the-art solutions keep rising in research and clinical usage, the other segment is set for substantial growth over the forecast period.

By Product

The Consumables segment dominated the molecular cytogenetics market with a 40.09% market share in 2023 as a result of the strong demand for reagents, probes, kits, and other laboratory materials needed for numerous cytogenetic methods, such as fluorescence in situ hybridization (FISH) and comparative genomic hybridization (CGH). These consumables are applied in all diagnostic and research processes, hence representing a recurring cost for laboratories and healthcare institutions. Further, the growing incidence of genetic disorders and cancer has fueled the demand for molecular cytogenetics-based testing, accelerating the use of reagents and probes. Ongoing improvements in probe design, fluorescence labeling, and hybridization technology have also made them universally used. As molecular diagnostics are increasingly incorporated into standard care and research, the consumables segment remains indispensable, maintaining its dominant position in the market.

The software & Services segment is anticipated to register the fastest growth with 10.55% CAGR during the forecast period based on the increasing adoption of computerized solutions and AI-supported data analysis in molecular cytogenetics. The complexity of genetic information drives the need for advanced bioinformatics tools to accurately analyze large-scale genomic variations. Software programs specifically developed for karyotyping, FISH image analysis, and next-generation sequencing (NGS) data interpretation are increasingly becoming necessary for clinical as well as research use. Moreover, the need for cloud-based solutions and AI-powered genomic diagnostics is also fueling investment in cytogenetic data management services. Also, the practice of outsourcing services like genetic counseling, diagnostic assistance, and genomic data interpretation is increasingly becoming popular among healthcare providers. With ongoing developments in computational genomics and precision medicine, the Software & Services segment is expected to grow substantially over the next few years.

By End-use

The Clinical & Research Laboratories segment dominated the molecular cytogenetics market with a 34.25% market share in 2023 because diagnostic and research activities are performed in huge numbers in these locations. Clinical labs are extensively involved in the diagnosis of genetic disorders, prenatal screening, and oncology testing, all of which involve the application of molecular cytogenetics methods such as fluorescence in situ hybridization (FISH) and comparative genomic hybridization (CGH). Research laboratories, however, concentrate on genomic research, biomarker identification, and precision medicine development, further fueling the need for cytogenetic analysis. Moreover, government and private investments in genetic research have grown substantially, favoring the growth of molecular cytogenetics applications. The demand for high-throughput screening, sophisticated imaging methods, and AI-based data interpretation further solidifies the market leadership of Clinical & Research Laboratories.

The Pharmaceutical & Biotech Companies segment is anticipated to experience the fastest growth in the forecast period because of the growing emphasis on drug development, precision medicine, and targeted therapies. Molecular cytogenetics is a critical component in oncology drug discovery, companion diagnostics, and biomarker identification, and hence, it is crucial for pharmaceutical and biotech companies. Increased use of personalized medicine and gene-targeted therapies further spurred the demand for cytogenetic analysis in drug development trials and regulatory approvals. Moreover, improvements in CRISPR gene editing, next-generation sequencing (NGS), and AI-based genomics are creating opportunities in the biotechnology industry, with subsequent investments in cytogenetic work. As pharmaceutical and biotech firms keep on expanding their genetic research capacity, this sector is likely to witness strong growth in the forecast period.

Molecular Cytogenetics Market Regional Insights

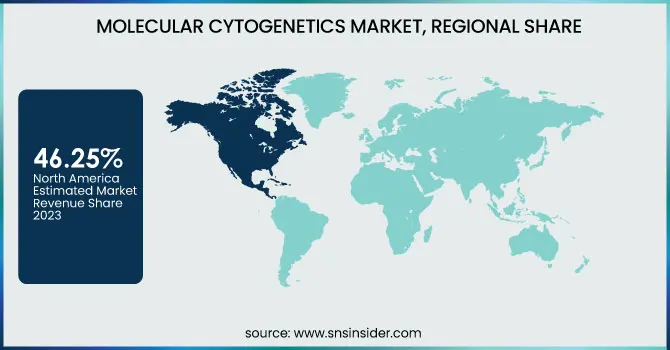

North America dominated the molecular cytogenetics market with a 46.25% market share owing to its established healthcare system, highest adoption rates of sophisticated genetic testing technologies, and high investments in precision medicine. The concentration of major market players, including Illumina, Thermo Fisher Scientific, and Agilent Technologies, also ensures that the region takes the lead. Government programs, including the All of Us Research Program of the National Institutes of Health (NIH), are propelling extensive genomic studies, increasing demand for molecular cytogenetics reagents. Also, the increased incidence of genetic disorders and cancer and growing funding for research and development have caused strong market penetration. The extensive application of molecular cytogenetics in personalized medicine, oncology, and prenatal screening further entrenches North America as the market leader in the region.

Asia Pacific is the fastest-growing region in the molecular cytogenetics market, with 11.09% CAGR throughout the forecast period because of growing healthcare investments, rising genetic testing awareness, and an expanding patient base with genetic diseases and cancer. China, India, and Japan are witnessing fast-paced growth in biotechnology and genomics research, backed by government programs like China's Precision Medicine Initiative. The increasing presence of international market players and partnerships with local biotech companies have further driven market growth. Moreover, the affordability and availability of molecular diagnostics are enhancing, which translates to increased use in hospitals and research centers. The high population base of the region, combined with an increasing demand for prenatal and oncological genetic testing, is fueling rapid market growth, and the Asia Pacific is a strong region for future growth in molecular cytogenetics.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in the Molecular Cytogenetics Market

- Abbott Laboratories (Vysis FISH Probes, PathVysion HER-2 DNA Probe Kit)

- Agilent Technologies, Inc. (SureFISH Probes, CGH+SNP Microarray Kits)

- Bio-Rad Laboratories, Inc. (QX200 Droplet Digital PCR System, NGC Chromatography Systems)

- Danaher Corporation (Leica Biosystems' FISH Probes, Cytovision Cytogenetics Software)

- F. Hoffmann-La Roche Ltd. (KAPA Library Preparation Kits, NimbleGen CGX Arrays)

- Illumina, Inc. (Verifi Prenatal Test, TruSight NIPT Solution)

- PerkinElmer, Inc. (CGX Onco Arrays, Volocity 3D Image Analysis Software)

- Thermo Fisher Scientific Inc. (Oncomine Solutions, CytoScan Dx Assay)

- Oxford Gene Technology (OGT) (CytoSure Constitutional v3 Arrays, SureSeq NGS Panels)

- MetaSystems (Metafer Slide Scanning Platform, Isis FISH Imaging System)

- BioView Ltd. (Duet Image Analysis System, Allegro Plus Scanner)

- Applied Spectral Imaging (GenASIs FISH Imaging, HiBand Karyotyping System)

- Molecular Devices, LLC (ImageXpress Micro Confocal System, SpectraMax iD5 Multi-Mode Microplate Reader)

- CytoTest Inc. (CT-P53/CEP 17 FISH Probe, CT-ALK/EML4 Fusion Probe)

- Genial Genetics (Genial Helix Software, CytoSNP Array Kits)

- SciGene (Little Dipper Processor for FISH, Hybex Microsample Incubation System)

- ASD Healthcare (Cytogenetic Media, FISH Hybridization Buffer)

- Biocare Medical, LLC (IQ Kinetic Slide Stainer, FISH Retrieval Solutions)

- Genomic Vision (FiberVision Molecular Combing System, FSHD Diagnostic Assay)

- Zeiss Group (Axio Imager 2 Microscope, MetaSystems Ikaros Karyotyping Software)

Suppliers (These suppliers provide essential raw materials, reagents, imaging systems, and analytical tools for molecular cytogenetics applications.)

-

Thermo Fisher Scientific

-

Agilent Technologies

-

Bio-Rad Laboratories

-

PerkinElmer

-

F. Hoffmann-La Roche Ltd.

-

Abbott Laboratories

-

Danaher Corporation (Leica Biosystems)

-

Oxford Gene Technology (OGT)

-

Applied Spectral Imaging

-

MetaSystems

Recent Development in the Molecular Cytogenetics Market

-

In February 2025, the California Institute of Technology or Caltech sued Bio-Rad Laboratories Inc. for unauthorized use of Caltech's proprietary DNA analysis technology in Bio-Rad's Droplet platform. The suit asserts that Bio-Rad used Caltech's multiplexing technology in its QX600 and QX ONE systems without authorization.

-

In April 2024, Agilent Technologies launched its new SureScan Microarray Scanner. The high-resolution imaging and analysis-capable scanner is intended for microarrays used in molecular cytogenetics to increase the accuracy and efficiency of genetic analysis.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.70 Billion |

| Market Size by 2032 | US$ 6.29 Billion |

| CAGR | CAGR of 9.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Genetic Disorders, Oncology, Personalized Medicine, Other Application) • By Technology (Comparative Genomic Hybridisation, FISH, Immunohistochemistry, Karyotyping, Others) • By Product (Instruments, Consumables, Software & Services) • By End-use (Clinical & Research Laboratories, Hospitals & Path Labs, Academic Research Institutes, Pharmaceutical & Biotech Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Illumina, Inc., PerkinElmer, Inc., Thermo Fisher Scientific Inc., Oxford Gene Technology (OGT), MetaSystems, BioView Ltd., Applied Spectral Imaging, Molecular Devices, LLC, CytoTest Inc., Genial Genetics, SciGene, ASD Healthcare, Biocare Medical, LLC, Genomic Vision, Zeiss Group, and other players. |