Get More Information on Molded Fiber Packaging Market- Request Sample Report

The Molded Fiber Packaging Market Size was valued at USD 10.20 Billion in 2023 and is expected to reach USD 15.69 Billion by 2032 and grow at a CAGR of 5% over the forecast period 2024-2032.

The molded fiber packaging market is experiencing significant growth, driven by rising environmental concerns and the global shift towards sustainable packaging solutions. As industries move away from traditional petroleum-based products, molded fiber packaging offers an eco-friendly alternative due to its biodegradable and compostable nature. However, to ensure product quality and functionality, certain molded fiber products require additional processes like lamination. This overview explores the factors driving the molded fiber packaging market, the role of lamination, recent innovations, and ongoing efforts to reduce plastic usage in packaging.

According to a survey by the United Nations Environment Programme (UNEP), over 380 million tons of plastic are produced globally each year, with almost 50% of that plastic used for single-use purposes. Additionally, around one-third of global plastic production is non-recyclable, posing a significant challenge to waste management systems and environmental sustainability.

As a result, molded fiber packaging has emerged as a preferred solution for businesses seeking to reduce their environmental impact. Made from recycled paper and natural fibers, molded fiber products are biodegradable, compostable, and more sustainable compared to conventional plastic packaging. This shift is a crucial step towards reducing plastic waste and embracing eco-friendly packaging alternatives, driving the growth of the molded fiber packaging market.

The Role of Lamination in Molded Fiber Packaging

Despite the clear advantages of molded fiber packaging, certain products need additional treatments to maintain durability and meet specific industry standards. Lamination is particularly important in the food packaging and medical packaging sectors, where product integrity and safety are paramount.

Companies like Omnipac Group, a key player in the molded fiber packaging market, stress the necessity of lamination to enhance the durability and functionality of their products. For example, in the food service industry, packaging must be grease-resistant and sturdy enough to handle various food types without compromising hygiene. In the medical field, single-use medical packaging requires a protective barrier to prevent contamination and maintain sterility, making lamination an essential process.

Innovations in Reducing Plastic in Lamination

With the rising focus on sustainable packaging, manufacturers are exploring ways to minimize or eliminate the use of plastic in lamination processes. Genera, a leading provider of compostable food service packaging, is making significant strides in creating molded fiber products that naturally break down without leaving harmful residues. By using compostable materials, Genera is helping reduce the environmental impact of single-use packaging while maintaining product quality.

Similarly, Imerys Minerals has developed innovative barrier coatings that serve as alternatives to traditional plastic-based lamination, such as polyethylene (PE) coatings. These coatings provide the necessary protection and performance without relying on plastic, improving the recyclability and compostability of molded fiber products. Such innovations are key to reducing the reliance on plastic in the molded fiber packaging market, making it a more sustainable and environmentally friendly solution.

Fiber Sourcing and Market Dynamics

In North America, the demand for pulp-quality fiber remains robust, despite challenges faced by the pulp and paper industry. Pulp markets offer landowners in North America an important outlet for managing forest resources and utilizing a mixture of timber qualities. Although the demand for pulp-quality fiber has declined since the late 1990s, other industries such as oriented strand board (OSB) and wood pellets have emerged as significant consumers of low-value fiber.

According to the Forisk U.S. Pulp Fiber Index, the total cost of fiber in the U.S. increased by 15% from 2000 to 2021, driven by inflation and rising raw material costs. During the same period, consumer inflation rose by 50%, and wood pulp prices climbed by 33%, indicating that the cost of materials for molded fiber packaging continues to rise, albeit at a slower pace than other sectors of the economy.

KEY DRIVERS:

Growing Demand in the Food and Beverage Industry

The rapid expansion of the food and beverage industry is expected to significantly fuel market growth, particularly for molded fiber packaging. Recent studies indicate that around 70% of consumers are now more likely to purchase products with sustainable packaging, reflecting a significant shift towards eco-friendly options. Additionally, the molded fiber packaging segment is expected to account for nearly 25% of the total sustainable packaging market by 2025. With approximately 50% of manufacturers in the food and beverage sector actively seeking sustainable packaging solutions, the demand for molded fiber packaging is poised to rise, positively impacting market performance.

Regulatory environment encourages manufacturers to adopt molded fiber packaging to comply with sustainability standards.

The regulatory environment is increasingly pushing manufacturers to adopt molded fiber packaging to comply with sustainability standards. According to a report by the European Commission, approximately 70% of European consumers are now aware of the harmful effects of single-use plastics, prompting governments to take action. The EU aims to ensure that all packaging is reusable or recyclable by 2030, significantly impacting manufacturers’ packaging choices. In the U.S., states like California and New York have implemented bans on single-use plastics, further accelerating the shift toward sustainable alternatives. A survey conducted by the Packaging Association found that 55% of companies are adopting sustainable packaging solutions in response to legislative pressures.

RESTRAIN:

Molded fiber packaging often requires specialized machinery and high-quality raw materials, which can lead to increased production costs compared to conventional plastic packaging.

Molded fiber packaging, while eco-friendly, often incurs higher production costs compared to conventional plastic packaging. This is primarily due to the specialized machinery and high-quality raw materials required for its production. According to industry estimates, the initial setup costs for molded fiber packaging machinery can be 20% to 30% higher than traditional plastic manufacturing equipment. Additionally, the raw materials used in molded fiber, such as recycled paper or natural fibers, can be more expensive due to their limited supply and higher processing requirements. For instance, the cost of sourcing and processing recycled paper for molded fiber packaging can be up to 15% higher than that of producing plastic packaging.

Moreover, the energy consumption involved in manufacturing molded fiber products is generally higher. Studies indicate that the production of molded fiber packaging can require up to 10% more energy compared to plastic packaging production, further adding to the operational costs. This is a significant factor, especially for small and medium-sized businesses looking to switch to sustainable packaging alternatives but struggling with tight budgets.

Despite these cost challenges, the rising demand for sustainable packaging solutions, driven by environmental regulations and consumer preferences, continues to push manufacturers towards molded fiber packaging. However, unless production technologies become more cost-efficient or raw material prices stabilize, these higher production costs may remain a key barrier to wider adoption.

BY FIBER PACKAGING TYPE

The transfer molded pulp segment holds the largest share in the molded fiber packaging market. This type of pulp is thinner compared to other varieties, with both sides polished to offer a smooth and refined finish. Its widespread use in applications such as fruit and vegetable trays, egg trays, wine shippers, slipper pans, and end caps is driving its growing demand globally. In fact, transfer molded pulp accounts for approximately 40% of the total molded fiber packaging market, primarily due to its cost-effectiveness and versatile applications. As the demand for eco-friendly and sustainable packaging solutions rises, this segment continues to expand at a steady rate.

The thermoformed pulp segment ranks second in market dominance. This type of pulp is processed to be denser and used to create more precisely shaped products. Its superior finish makes it ideal for premium applications such as molded tableware, including dinner plates, trays, cups, and soup bowls.

BY APPLICATION

The food and beverage segment dominates the molded fiber packaging market, driven by the rising demand for eggs, fruits, and vegetables. Molded fiber’s porous material provides excellent ventilation and shock absorption, reducing the risk of eggs breaking during transportation. Additionally, it helps prevent contamination, keeping products free from infections. The porous structure also absorbs moisture from fruits and vegetables, helping to maintain their freshness for longer periods and reducing food waste. With supermarkets placing emphasis on attractive packaging, colored and printed molded pulp trays have gained popularity, boosting the growth of this segment. Recent data shows that the food and beverage sector accounts for over 45% of the total molded fiber packaging demand globally.

The electrical and electronics segment ranks second, with increasing digitalization driving the demand for molded fiber packaging. These products are ideal for protecting sensitive electronics during transit, ensuring safe delivery.

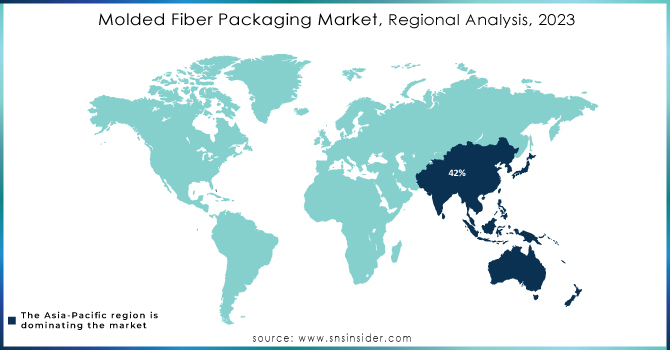

In the Asia Pacific, the region led the global market with a revenue share of 42% in 2023, with China accounting for the largest portion. China's strong food and beverage industry, coupled with the booming electronics market, is fueling the demand for molded fiber packaging. The country's high population and rising disposable incomes are driving increased consumption of packaged goods. Furthermore, China is home to major electronics companies like Huawei, Lenovo, and Xiaomi, which boosts the need for protective packaging for delicate electronic products. The government’s push for biodegradable packaging and the ban on single-use plastics are also playing a pivotal role in market growth.

The North American molded fiber packaging market is expected to experience the fastest growth during the forecast period, driven by increasing digitization and efforts to reduce plastic usage, particularly in the packaged food and food service industries. The growing emphasis on environmental regulations and the need for easy disposal of packaging materials are accelerating the demand for bio-based molded fiber packaging. This shift toward sustainability is expected to boost market growth in the region.

In the U.S., the molded fiber packaging market is projected to grow at a significant CAGR, largely due to strategic acquisitions and partnerships. For example, ProAmpac Intermediate, Inc., a leader in flexible packaging, acquired Irish Flexible Packaging and Fispak. This acquisition bolsters ProAmpac’s sustainability-focused packaging offerings in Europe and the U.K., demonstrating how such collaborations are driving market demand in the U.S.

In Europe, the molded fiber packaging market is driven by its widespread use in the food service and packaging industries. In 2022, the EU had close to one million restaurants and mobile food services, a number expected to grow, driving up demand for sustainable packaging solutions. Additionally, stringent environmental regulations across EU member countries continue to promote the use of eco-friendly materials in packaging, contributing to market expansion.

Need Any Customization Research On Molded Fiber Packaging Market - Inquiry Now

Some of the major players in the Molded Fiber Packaging Market are:

Brodrene Hartmann A/S

Genpak, LLC

Huhtamako Oyj

Eco-Products, Inc.

Fabri-Kal

Thermoform Engineered Quality LLC

Cullen Packaging

Pulpac AB

Pactive LLC

International Paper Company

ProAmpac

Dongguan City Luheng Papers Company Ltd.

Hartmann

Suzano has commenced operations at its new paper mill in Ribas do Rio Pardo, Brazil, with an annual production capacity of 2.55 million tonnes of eucalyptus pulp. This USD 4.3 billion project increases Suzano's total production capacity by over 20%, reaching 13.5 million tonnes annually, including packaging products.

In February 2024, Sanofi Consumer Healthcare will join PA Consulting and PulPac’s Blister Pack Collective to develop fiber-based blister packs that are recyclable in the paper waste stream, aiming to eliminate 'problem plastics' in pharmaceutical packaging.

Tanbark Molded Fiber Products, a Saco-based packaging manufacturer, is set to receive over USD 2 million in financing to create nine jobs and retain 23 in Maine. On February 15, the Finance Authority of Maine (FAME) approved USD 1.59 million in loans, alongside USD 500,000 from the Maine Technology Institute, to support equipment purchases for Tanbark's micro-fiber manufacturing expansion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.20 Billion |

| Market Size by 2032 | US$ 15.69 Billion |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fiber Packaging Type (Thick Wall, Processed Pulp, Transfer Molded, Thermoformed Fiber) • By Product Type (Boxes & Cartons, Inserts & Dividers, Trays, Cups & Bowls, Clamshells, Others) • By Application (Electrical & Electronics, Healthcare, Industrial, Food & Beverage, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Brodrene Hartmann A/S, CKF Inc, Pro-Pac Packaging Limited, Hentry Molded Products, Inc., Genpak, LLC, Huhtamako Oyj, Eco-Products, Inc., Fabri-Kal, Sabert Corporation, Thermoform Engineered Quality LLC, Cullen Packaging, Pulpac AB, Pactive LLC, International Paper Company, ProAmpac, Dongguan City Luheng Papers Company Ltd., Hartmann |

| Key Drivers | • Growing Demand in the Food and Beverage Industry • Regulatory environment encourages manufacturers to adopt molded fiber packaging to comply with sustainability standards. |

| Restraints | • Molded fiber packaging often requires specialized machinery and high-quality raw materials, which can lead to increased production costs compared to conventional plastic packaging. |

Ans: The Molded Fiber Packaging Market is expected to grow at a CAGR of 5% during 2024-2032.

Ans: The Molded Fiber Packaging Market size was USD 10.20 billion in 2023 and is expected to Reach USD 15.69 billion by 2032.

Ans: Regulatory environment encourages manufacturers to adopt molded fiber packaging to comply with sustainability standards.

Ans: The Food & Beverage dominated the Molded Fiber Packaging market.

Ans: Asia Pacific dominated the Molded Fiber Packaging market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Molded Fiber Packaging Market Segmentation, by Fiber Packaging Type

7.1 Chapter Overview

7.2 Thick Wall

7.2.1 Thick Wall Market Trends Analysis (2020-2032)

7.2.2 Thick Wall Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Processed Pulp

7.3.1 Processed Pulp Market Trends Analysis (2020-2032)

7.3.2 Processed Pulp Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Transfer Molded

7.4.1 Transfer Molded Market Trends Analysis (2020-2032)

7.4.2 Transfer Molded Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Thermoformed Fiber

7.5.1 Thermoformed Fiber Market Trends Analysis (2020-2032)

7.5.2 Thermoformed Fiber Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Molded Fiber Packaging Market Segmentation, by Product Type

8.1 Chapter Overview

8.2 Boxes & Cartons

8.2.1 Boxes & Cartons Market Trends Analysis (2020-2032)

8.2.2 Boxes & Cartons Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Inserts & Dividers

8.3.1 Inserts & Dividers Market Trends Analysis (2020-2032)

8.3.2 Inserts & Dividers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Trays

8.4.1 Trays Market Trends Analysis (2020-2032)

8.4.2 Trays Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Cups & Bowls

8.5.1 Cups & Bowls Market Trends Analysis (2020-2032)

8.5.2 Cups & Bowls Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Clamshells

8.6.1 Clamshells Market Trends Analysis (2020-2032)

8.6.2 Clamshells Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Molded Fiber Packaging Market Segmentation, by Application

9.1 Chapter Overview

9.2 Electrical & Electronics

9.2.1 Electrical & Electronics Market Trends Analysis (2020-2032)

9.2.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Food & Beverages

9.3.1 Food & Beverages Market Trends Analysis (2020-2032)

9.3.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Healthcare

9.4.1 Healthcare Market Trends Analysis (2020-2032)

9.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Industrial

9.5.1 Industrial Market Trends Analysis (2020-2032)

9.5.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Food & Beverage

9.6.1 Food & Beverage Market Trends Analysis (2020-2032)

9.6.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Automotive

9.7.1 Automotive Market Trends Analysis (2020-2032)

9.7.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.11 Others

9.11.1 Others Market Trends Analysis (2020-2032)

9.11.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Molded Fiber Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.2.4 North America Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.5 North America Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.2.6.2 USA Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.6.3 USA Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.2.7.2 Canada Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.7.3 Canada Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Molded Fiber Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Molded Fiber Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.7.2 France Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.7.3 France Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Molded Fiber Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.6.2 China Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.6.3 China Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.7.2 India Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.7.3 India Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.8.2 Japan Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.8.3 Japan Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.12.2 Australia Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.12.3 Australia Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Molded Fiber Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Molded Fiber Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.2.4 Africa Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.5 Africa Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Molded Fiber Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.6.4 Latin America Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.5 Latin America Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Molded Fiber Packaging Market Estimates and Forecasts, by Fiber Packaging Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Molded Fiber Packaging Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Molded Fiber Packaging Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Brodrene Hartmann A/S

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 CKF Inc

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Pro-Pac Packaging Limited

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Hentry Molded Products, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Genpak, LLC

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Huhtamako Oyj

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Eco-Products, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Fabri-Kal

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Sabert Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Thermoform Engineered Quality LLC

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

KEY MARKET SEGMENTATION

BY FIBER PACKAGING TYPE

Thick Wall

Processed Pulp

Transfer Molded

Thermoformed Fiber

BY PRODUCT TYPE

Boxes & Cartons

Inserts & Dividers

Trays

Cups & Bowls

Clamshells

Others

BY APPLICATION

Electrical & Electronics

Healthcare

Industrial

Food & Beverage

Automotive

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Building and Construction Tapes Market size was valued at USD 4.8 billion in 2023 and is expected to Reach USD 7.36 billion by 2031 and grow at a CAGR of 5.5 % over the forecast period of 2024-2031.

The Shoe Packaging Market size was USD 6.44 billion in 2023 and is expected to Reach USD 8.49 billion by 2031 and grow at a CAGR of 3.51 % over the forecast period of 2024-2031.

The Food Packaging Films Market size was valued at USD 54.65 billion in 2023 and is expected to Reach USD 97.14 billion by 2032 and grow at a CAGR of 6.6 % over the forecast period of 2024-2032.

The Sterile Medical Packaging Market size was USD 47.70 billion in 2023 and will reach USD 107.95 billion by 2032 and grow at a CAGR of 9.5% by 2024-2032.

The Container Liner Market Size was valued at USD 892 million in 2023 and is expected to reach USD 1360.24 million by 2032 and grow at a CAGR of 4.8 % over the forecast period 2024-2032.

The Disposable Straw Market size was USD 19.5 billion in 2023 and is expected to Reach USD 28.59 billion by 2031 and grow at a CAGR of 4.9% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone