To Get More Information on Mobile Wallet Market - Request Sample Report

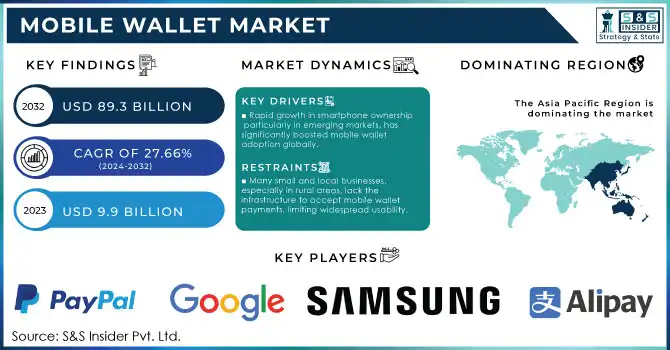

The Mobile Wallet Market was valued at USD 9.9 billion in 2023 and is expected to reach USD 89.3 Billion by 2032, growing at a CAGR of 27.66% over 2024-2032.

The mobile wallet market is witnessing remarkable expansion as digital payment systems increasingly integrate into commerce and daily transactions. Mobile wallets, enabling secure storage and swift payments via smartphones, are becoming indispensable due to their convenience, robust security, and adaptability to changing consumer demands. A key driver of this growth is the widespread adoption of smartphones and high-speed internet, especially in emerging markets. For instance, India recorded an extraordinary 13.4 billion mobile payment transactions in 2024, spearheaded by UPI platforms such as Google Pay and PhonePe. Likewise, in the U.S., apple pay reported a 25% surge in usage for in-store payments in 2024, emphasizing growing consumer trust. These trends align with global shifts towards cashless economies, as governments and enterprises promote digital transactions for enhanced efficiency and transparency.

Additionally, the integration of features like loyalty programs, bill payment options, ticketing, and financial management tools within wallet apps has further fueled adoption. PayPal, for instance, reported notable growth in its "Pay Later" feature in 2024, catering to users' demand for flexible payment options. Innovations in near-field communication (NFC) and biometric security, including fingerprint authentication, are also enhancing mobile wallet reliability and user experience. Collaborations between wallet providers and retailers are also reshaping consumer interactions. Starbucks, for example, facilitated 55% of its U.S. sales in 2024 through its mobile wallet app, which combines seamless payment processes with loyalty benefits. Such partnerships demonstrate how businesses use mobile wallets to enhance customer retention and satisfaction.

The growth of e-commerce has significantly bolstered mobile wallet usage, particularly in Asia-Pacific. In China, digital payment platforms like Alipay and WeChat Pay commanded over 90% of the country's digital transaction market share in 2024, reflecting regional dominance in mobile wallet adoption. In conclusion, the mobile wallet market is thriving due to rising smartphone penetration, changing user preferences, and multifunctional app integration. This trajectory suggests a future where mobile wallets are fundamental to global financial systems and consumer lifestyles.

Drivers

Rapid growth in smartphone ownership, particularly in emerging markets, has significantly boosted mobile wallet adoption globally.

The global shift towards cashless economies encourages mobile wallet usage as a secure, efficient alternative to cash and cards.

The surge in online shopping has amplified the need for seamless digital payment solutions, propelling mobile wallet growth.

The exponential growth of e-commerce has propelled mobile wallets into a central role in digital transactions, revolutionizing how payments are processed. With the steady expansion of online shopping platforms, consumers increasingly seek payment methods that are secure, efficient, and seamless. Mobile wallets fulfill these demands by offering frictionless checkouts, removing the need for manual card inputs, reducing transaction times, and strengthening security through advanced features like biometric authentication and tokenization.

In 2024, global e-commerce sales were estimated at USD 6.3 trillion, with a significant share attributed to mobile wallet-facilitated transactions. For instance, PayPal experienced a 19% year-on-year increase in mobile transactions during the first quarter of 2024. Likewise, leading platforms such as Amazon and Alibaba have implemented wallet features like one-click payments to align with the growing preference for effortless and efficient online shopping. Mobile wallets are versatile, accommodating multiple payment methods, loyalty programs, and promotional codes, making them attractive to both tech-savvy consumers and businesses. These capabilities not only streamline the payment process but also help businesses improve customer engagement and retention. For example, Amazon Pay and Google Pay offer seamless integration with online stores, ensuring quick transactions and enhancing customer satisfaction.

Furthermore, the rise of cross-border e-commerce has driven mobile wallet adoption due to its ability to support multi-currency transactions and diverse payment systems. In the Asia-Pacific region, platforms like Alipay and Paytm dominate the digital payment landscape, facilitating over 85% of retail transactions in countries like China, which leads the global e-commerce boom. As e-commerce continues to expand, especially in emerging markets with advancing internet infrastructure, mobile wallets are becoming an indispensable component of the digital economy. Enhanced user experiences, robust security measures, and growing consumer trust position mobile wallets as the preferred payment solution within the global e-commerce ecosystem.

| Metric | Data (2024) | Insights |

|---|---|---|

| Global e-commerce sales | USD 6.3 trillion | Mobile wallets contributed significantly to sales. |

| Increase in mobile wallet transactions | 23% YoY growth | Reflects growing reliance on wallets for online payments. |

| Mobile wallet adoption in APAC | >85% of e-commerce transactions | Dominated by platforms like Alipay and WeChat Pay. |

| Leading sector using wallets | Retail e-commerce | Fast and secure checkouts enhance consumer experience. |

Restraints

Many small and local businesses, especially in rural areas, lack the infrastructure to accept mobile wallet payments, limiting widespread usability.

Issues like app crashes, transaction delays, or network unavailability can lead to user dissatisfaction and reduced reliance on mobile wallets.

Users worry about the potential for cyberattacks, fraud, and unauthorized data access due to the sensitive financial information stored in mobile wallets.

Mobile wallets need to be reliable, any technical errors like app crashing, delays in transactions, or connectivity issues can majorly hamper the credibility of mobile wallets and take a toll on the user experience soon might lead to the fading away of the adoption of these wallets. Mobile wallet solutions rely on seamless, efficient operation to process secure transactions and any glitches can cause consumers to lose trust. If users face delays or crashes when making payments, they lose confidence in the reliability of the wallet and will be less inclined to use the service again.

In fast-paced industries like e-commerce and retail, even a brief delay in transaction processing can lead to frustrated users, increased transaction abandonment, and a negative impact on the reputation of mobile payment systems. According to J.D. Power, 44% of the total mobile wallet users have reported such issues which are directly related to user experience. These problems can keep consumers from using mobile wallets again because consumers expect the most seamless, efficient, and hassle-free payment experience possible. There are various issues also with connectivity that hampers the functionality of the mobile wallet. In an area with weak or unreliable internet, mobile wallets are subject to slow processing of transactions or even the failure of your transaction altogether. The issue is even more pronounced in developing markets where internet infrastructure is still maturing. According to the International Telecommunication Union (ITU), there are approximately 3.7 billion people across the globe who do not have reliable internet access, which has become a major hurdle for mobile wallet adoption in these regions.

Such technical disruptions not only erode consumer confidence but also hinder the growth trajectory of the mobile wallet market. The disruption to mobile wallets will impact transactions, sales, and customer loyalty for businesses that rely on them to process money. To avoid these potential risks, wallet providers are investing more in enterprise customer wallet infrastructure such as cloud-based and encryption technologies to offer better performance, reliability, and security. Yet, until these functionality problems are genuinely solved, they will continue to be a significant obstacle to the growth of the mobile wallet marketplace.

By Technology

The proximity technology segment dominated the market and represented a revenue share of 65.7% in 2023, due to its extensive application in in-store payments. NFC and other proximity-based technologies allow users to conduct instant in-store, contactless transactions via a simple tap of their smartphones over the POS. It has been popular in retail, transportation, and other consumer-facing sectors. This growth can be further attributed to the high penetration of NFC-enabled smart devices and consumers' ongoing need for speedy and secure payment methods. The growing integration of seamless proximity-based payment systems in mobile wallets is expected to drive the growth of mobile wallet deployment in brick-and-mortar stores, thereby dominating the segment in the market.

In the mobile wallet market, the remote technology segment is witnessing the highest compound annual growth rate (CAGR). This growth is a result of the increasing transition from traditional methods to transaction methods, where consumers can purchase goods and services remotely from their mobile devices without actually being near the merchant. With the continued growth of e-commerce and digital platforms across the world, especially as internet infrastructure improves in regions such as Africa, the appetite for remote payments only seems to increase. The emergence of new remote payment methods enables consumers to buy wherever and whenever they want — digital wallets, online payment systems, etc. Increasing convenience of remote payments and enhanced security measures like two-factor authentication are driving segment growth at an accelerating pace, and forecasts suggest that it will continue to grow in the coming years.

By Application

The retail and e-commerce segment held the largest revenue share of 35.2% in 2023 and is likely to retain its lead all through the forecast period. As retailers and online retailers start to see the possible benefits of accepting mobile wallet payments, the writing is on the wall. The intent of retail integration of cashless or contactless pay-tech with digital marketing is to gain consumer data, opportunities, and ultimately conversion and loyalty. Moreover, NFC technology is expected to improve operational efficiency by reducing processing costs and accelerating checkout. It helps e-commerce firms and brands deliver great offers and monitor loyalty points to serve mobile customers better.

The banking segment is anticipated to register the highest CAGR during the forecast period. In addition, many vending companies are switching to mobile payment systems for fast, convenient transactions at vending machines. Vending companies can accept mobile payments from QR code programs, electronic wallet applications, or vouchers.

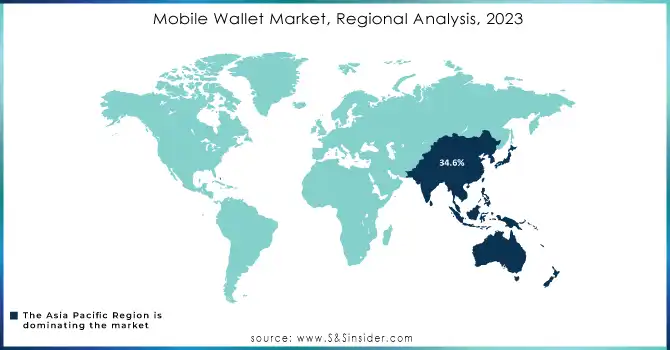

The market for mobile wallets was dominated by Asia-Pacific in 2023, accounting for 34.6% of the global share, and is expected to grow at the fastest CAGR over the forecast period. The main contributors to this growth are the young, smartphone-loving demographic and increasing number of internet users, particularly in markets like India and China. Besides, initiatives like Digital India and Make in India by the Government are to bolster smartphone penetration that drives mobile wallet demand in the region.

Latin America is expected to register the highest CAGR of 28.6% throughout the forecast period, on the back of burgeoning smartphone penetration, increasing e-commerce activity, and rising consumer need for convenience. The recent increase in the rate of adoption of mobile wallets across the region is also due to regional governments and financial institutions playing their parts through regulatory frameworks and support for infrastructure development.

Do You Need any Customization Research on Mobile Wallet Market - Enquire Now

The major key players along with their products are

PayPal - PayPal Mobile Wallet

Apple Inc. - Apple Pay

Google - Google Pay

Samsung Electronics - Samsung Pay

Alipay (Ant Group) - Alipay Mobile Wallet

WeChat (Tencent) - WeChat Pay

Amazon - Amazon Pay

Visa Inc. - Visa Checkout

Mastercard - Mastercard PayPass

Square Inc. - Square Wallet

Paytm - Paytm Wallet

Venmo (owned by PayPal) - Venmo Mobile Wallet

MobiKwik - MobiKwik Wallet

Cash App (Square Inc.) - Cash App Wallet

Lazada (Alibaba Group) - Lazada Wallet

TrueMoney (Ascend Money) - TrueMoney Wallet

Samsung Electronics - Samsung Pay

Revolut - Revolut Mobile Wallet

Zelle (Early Warning Services) - Zelle Payment App

Razer - Razer Pay

October 2024: Monzo introduced a new feature in its mobile wallet app, allowing users to store loyalty cards and make seamless contactless payments. This update enhances user convenience, offering greater control over financial management and fostering a more streamlined digital wallet experience.

September 2024: The Commonwealth Bank launched a digital wallet with cryptocurrency support and instant payment capabilities. This new offering enhances the customer experience by integrating various banking services, ensuring users can manage digital payments, including cryptocurrencies, in a unified platform.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.9 billion |

| Market Size by 2032 | US$ 89.3 billion |

| CAGR | CAGR of 27.66% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Remote, Proximity) • By Application (Retail & E-commerce, Hospitality & Transportation, Banking, Vending Machine, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PayPal, Apple Inc, Google, Samsung Electronics, Alipay, WeChat, Amazon, Visa Inc, Mastercard, Square Inc, Paytm, Venmo, MobiKwik, Cash App, Lazada, TrueMoney, Samsung Electronics, Revolut, Zelle, Razer |

| Key Drivers | • Rapid growth in smartphone ownership, particularly in emerging markets, has significantly boosted mobile wallet adoption globally. • The global shift towards cashless economies encourages mobile wallet usage as a secure, efficient alternative to cash and cards. • The surge in online shopping has amplified the need for seamless digital payment solutions, propelling mobile wallet growth. |

| Market Challenges | • Users worry about the potential for cyberattacks, fraud, and unauthorized data access due to the sensitive financial information stored in mobile wallets. • Many small and local businesses, especially in rural areas, lack the infrastructure to accept mobile wallet payments, limiting widespread usability. • Issues like app crashes, transaction delays, or network unavailability can lead to user dissatisfaction and reduced reliance on mobile wallets. |

Ans- The Mobile Wallet Market was valued at USD 9.9 billion in 2023 and is expected to reach USD 89.3 Billion by 2032, growing at a CAGR of 27.66% over 2024-2032.

Ans- The Mobile Wallet Market is expected to grow at a CAGR of 27.66% during the forecast period of 2024-2032.

Ans- The Asia-Pacific region dominated the Mobile Wallet Market and represented significant revenue share in 2023.

Ans- Some of the factors driving the Mobile Wallet Market are:

Rapid growth in smartphone ownership, particularly in emerging markets, has significantly boosted mobile wallet adoption globally.

The global shift towards cashless economies encourages mobile wallet usage as a secure, efficient alternative to cash and cards.

Ans- Some of the challenges restraining the Mobile Wallet Market are:

Users worry about the potential for cyberattacks, fraud, and unauthorized data access due to the sensitive financial information stored in mobile wallets.

Many small and local businesses, especially in rural areas, lack the infrastructure to accept mobile wallet payments, limiting widespread usability.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, 2023

5.2 User Demographics, 2023

5.3 Integration Capabilities, by Software, 2023

5.4 Impact on Decision-making

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Mobile Wallet Market Segmentation, by Technology

7.1 Chapter Overview

7.2 Remote

7.2.1 Remote Market Trends Analysis (2020-2032)

7.2.2 Remote Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Proximity

7.3.1 Proximity Market Trends Analysis (2020-2032)

7.3.2 Proximity Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Mobile Wallet Market Segmentation, by Application

8.1 Chapter Overview

8.2 Retail & E-commerce

8.2.1 Retail & E-commerce Market Trends Analysis (2020-2032)

8.2.2 Retail & E-commerce Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Hospitality & Transportation

8.3.1 Hospitality & Transportation Market Trends Analysis (2020-2032)

8.3.2 Hospitality & Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Banking

8.4.1 Banking Market Trends Analysis (2020-2032)

8.4.2 Banking Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Vending Machine

8.5.1 Vending Machine Market Trends Analysis (2020-2032)

8.5.2 Vending Machine Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Mobile Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.4 North America Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.5.2 USA Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.6.2 Canada Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.7.2 Mexico Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Mobile Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.5.2 Poland Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.6.2 Romania Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Mobile Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.4 Western Europe Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.5.2 Germany Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.6.2 France Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.7.2 UK Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.8.2 Italy Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.9.2 Spain Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.12.2 Austria Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Mobile Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.4 Asia Pacific Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.5.2 China Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.5.2 India Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.5.2 Japan Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.6.2 South Korea Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.7.2 Vietnam Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.8.2 Singapore Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.9.2 Australia Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Mobile Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.4 Middle East Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.5.2 UAE Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Mobile Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.4 Africa Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Mobile Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.4 Latin America Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.5.2 Brazil Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.6.2 Argentina Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.7.2 Colombia Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Mobile Wallet Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Mobile Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 PayPal

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Apple Inc

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Google

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Samsung Electronics

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Alipay (Ant Group)

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 WeChat (Tencent)

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Amazon

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Visa Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Mastercard

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Square Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Technology

Remote

Proximity

By Application

Retail & E-commerce

Hospitality & Transportation

Banking

Vending Machine

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Robotic Process Automation Market size was valued at USD 2.8 Billion in 2023 and is expected to grow to USD 38.4 Billion by 2032 and grow at a CAGR of 33.8% over the forecast period of 2024-2032.

The Quantum Computing Market Size was valued at USD 1.03 Billion in 2023 and is expected to reach USD 10.31 Billion by 2032 and grow at a CAGR of 29.1% over the forecast period 2024-2032.

Augmented Intelligence Market Size was valued at USD 25.7 Billion in 2023 and is expected to reach USD 193.3 Billion by 2032, growing at a CAGR of 25.17% over the forecast period 2024-2032.

The Immersive Content Creation Market Size was valued at USD 12.57 Billion in 2023 and is expected to reach USD 87.12 Billion by 2032 and grow at a CAGR of 24.0% over the forecast period 2024-2032.

The Smart Contracts Market Size was valued at USD 1.6 Billion in 2023 and will reach USD 11.7 Billion by 2032, growing at a CAGR of 24.7% by 2032.

Asset Performance Management Market was valued at USD 3.0 billion in 2023 and is expected to reach USD 8.4 billion by 2032 and grow at a CAGR of 12.2% from 2024-2032.

Hi! Click one of our member below to chat on Phone