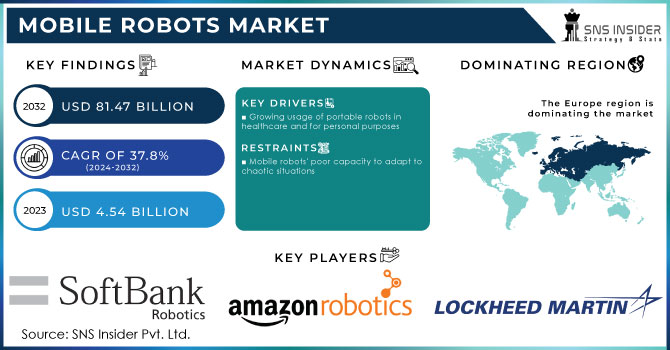

The Mobile Robots Market Size was USD 19.55 billion in 2023 and is expected to reach USD 90.92 billion by 2032, growing at a CAGR of 18.62 % over the forecast period of 2024-2032. Advancements in AI, machine learning, and sensor technology are driving this explosive growth — allowing robots to better navigate and interact with their environments. Main contributors include the increasing need for automation across multiple sectors (e.g., logistics, healthcare, and manufacturing) with the e-commerce sector being an enormous component. Other growing trends are collaborative robots (cobots), robotics-as-a-service (RaaS) models and integration of 5G to allow for real-time processing. Mobile robots are also branching out into areas like agriculture and defense.

Get More Information on Mobile Robots Market - Request Sample Report

Drivers:

Revolutionizing Mobile Robots Operations with 5G Integration

The integration of 5G technology is transforming the mobile robots market by enabling real-time data processing, faster speeds, and enhanced connectivity. Ultra-low latency allows mobile robots to efficiently traverse dynamic landscapes by processing a high volume of data at the edge and deciding better. In fields such as defense, 5G enables coordination of up to 10,000 robots in complex terrain for autonomous reconnaissance and rescue missions, among other applications. It will enable the development of innovative autonomous delivery systems, agriculture, industrial automation, and robotics-as-a-service (RaaS).Advanced countermeasure techniques guarantee coverage for 5G in combat settings, making it possible for mobile robots to function correctly even amidst electromagnetic interference.

Restraints:

Mobile robots face difficulties navigating complex, unstructured environments with unpredictable obstacles and sudden changes.

Despite advancements, mobile robots still face significant challenges that limit their widespread adoption A continuing challenge is navigating complex, unstructured environments, particularly in dynamic environments where sudden disturbances or obstacles can hinder performance. Furthermore, managing fragile objects carefully and working in extreme situations such as sub-optimal light or unfavorable weather remains a challenge. Another hurdle is that mobile robots are difficult to combine with existing infrastructure. For example, 91% of shippers and 75% of logistics providers use warehouse management systems, while fewer than 8% of warehouses in the U.S. use autonomous mobile robots (AMRs).Larger companies often lead adoption, with smaller firms following later, creating a gap in technology usage between different-sized operations.

Opportunities:

The increasing demand in e-commerce offers a chance for mobile robots to optimize warehouse operations, improving inventory management, order fulfillment, and reducing labor costs.

The rapid growth of e-commerce has significantly increased the demand for autonomous mobile robots (AMRs) in warehouses and fulfillment centers. Robots, such as BrightPick’s Giraffe, are revolutionizing tasks like inventory management, order fulfillment, and navigating high shelves up to 20 feet tall. AMRs streamline operations, improve accuracy, and enhance efficiency, helping meet the rising demands of online shopping. The use of AMRs addresses challenges like labor shortages, scalability, and cost efficiency. As companies invest in warehouse automation, including AMRs, this trend is expected to expand further, with robots handling everything from sorting and picking to last-mile delivery, creating a major opportunity in modernizing logistics operations.

Challenges:

Integrating mobile robots into existing systems involves challenges in ensuring compatibility, adjusting infrastructure, and achieving seamless operational integration.

Integrating mobile robots into existing infrastructure and supply chain systems remains a significant challenge, as it requires overcoming technical complexity and substantial costs. Many organizations struggle to ensure seamless communication and compatibility between mobile robots and legacy systems. This process requires comprehensive data acquisition, adjustments in systems, and upgrades in existing workflows, that can incur a cost and operational downtime to get integrated. More importantly, as organizations increasingly turn to automation, the demand for competent workers to oversee and sustain these programs grows. If they are not properly integrated, they can be seriously limited in their potential to optimize operations, which can slow adoption and reduce return on investment.

By Professional Robots

In 2023, professional robots dominated the mobile robots market, accounting for approximately 69% of the market share. These robots are prevalent in various sectors such as healthcare, logistics, and manufacturing as they are known for their high accuracy, capabilities and flexibility. Professional robots are usually built for specialized roles for specific applications like medical surgeries, automation in warehouses and inspection, thus it is very important to have robots to help improve operations efficiency and safety. They excel in performing complex and repetitive tasks, as well as hazardous activities, which is one reason why they dominate.

The Personal & Domestic Robots segment is expected to experience the fastest growth from 2024 to 2032, Increase to the rising demand for home automation and convenience. Factors spurring this segment’s growth include an increase in dual-income households, an aging population and rising consumer interest in smart home technologies. Moreover, with the entrance of AI, robotics, and IoT combination into the customer portion, development is advancing the functionality of individual and domestic robots, making them less demanding and less expensive. As these robots become more intelligent, affordable, and reliable, their adoption in everyday homes is expected to surge, further driving market expansion.

By Application

The Healthcare segment is the dominant application in the mobile robots market, holding around 25% of the market share in 2023. The increasing adoption of mobile robots in healthcare is driven by the need for improved efficiency, patient care, and operational productivity. Mobile robots are being increasingly used in hospitals and healthcare facilities for tasks such as disinfection, delivery of medical supplies, and assisting healthcare staff in non-critical tasks. This allows medical personnel to focus on patient care while enhancing the overall quality of service. The growing aging population and rising healthcare demands are fueling the need for automation in healthcare facilities, which is expected to further boost the market for mobile robots in this sector over the coming years.

The agriculture sector is expected to be the fastest-growing segment in the mobile robots market from 2024 to 2032, as labor shortages, environmental concerns, and the need for high productivity increase, mobile robots can perform a wide range of agricultural tasks more efficiently. Planting, harvesting, monitoring crops, spraying pesticides, and studying soil types are among these tasks. Mobile robots equipped with advanced sensors and AI technologies allow for precise, data-driven farming, reducing waste and increasing crop yields. The growth of precision agriculture, coupled with the push for sustainable farming practices, is significantly driving the adoption of mobile robots in agriculture.

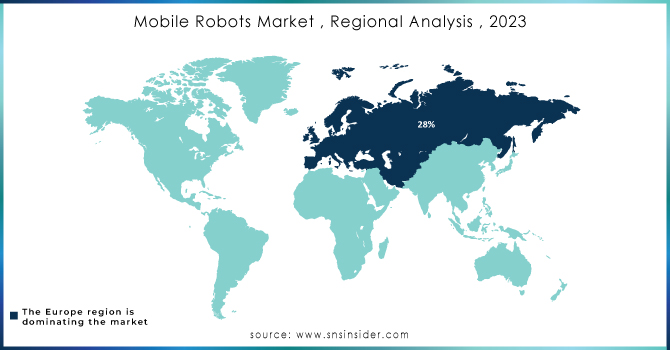

Asia-Pacific is the dominant region in the mobile robots market, holding around 50% of the market share in 2023. This dominance is largely driven by the rapid technological advancements, increasing adoption of automation, and the presence of key manufacturing hubs in countries like China, Japan, and South Korea. These countries have been early adopters of robotics and automation in industries such as manufacturing, logistics, and healthcare. China's significant investments in AI and robotics technology, along with its expanding smart manufacturing industry, contribute heavily to the region’s growth. Japan, a leader in robotics innovation, continues to advance in both industrial and service robots, with applications in sectors like healthcare, retail, and agriculture. South Korea also stands out with its robust robotics infrastructure, particularly in the automotive and electronics industries. Additionally, countries in Southeast Asia, such as Singapore and India, are rapidly catching up with growing investments in robotics as they look to modernize their industries and tackle labor shortages. The region’s dominance is further bolstered by favorable government policies, the availability of skilled labor, and increasing interest in robotics in emerging industries.

North America is the fastest-growing region in the mobile robots market from 2024-2032, driven by advancements in automation, AI, and robotics. The U.S. is at the forefront of technological innovations and industries, such as logistics, healthcare and manufacturing, that are increasingly employing mobile robots to enhance efficiency, and cost go down and offset labor shortages. E-commerce and wholesale/retail automation led by Amazon and Walmart & Co. are robust growth drivers. In Canada too, we have growth, most notably in healthcare and agriculture as mobile robots are being utilized for precision farming and patient care. Favorable government policies and funding further support the region's growth, positioning North America as a leader in mobile robot deployment.

Need any customization research on Mobile Robots Market - Enquiry Now

Some of the major players in Mobile Robots Market along with their product:

KUKA (Germany) - (Industrial Robots, Automation Solutions)

ABB (Switzerland) - (Industrial Robots, Collaborative Robots, Automation Solutions)

Honda Motor (Japan) - (ASIMO Robot, Autonomous Delivery Robots)

Mobile Industrial Robots (Denmark) - (Autonomous Mobile Robots, AMRs)

Omron Automation (US) - (Autonomous Mobile Robots, Robotics Automation Solutions)

Honda Motor Co. Ltd (Japan) - (ASIMO Robot, Autonomous Robots for Various Applications)

Northrop Grumman Corporation (US) - (Autonomous Robotics, Military Robots, Drones)

iRobot Corporation (US) - (Home Cleaning Robots, Roomba, Robotic Vacuum Cleaners)

SoftBank Robotics Group (Japan) - (Pepper Robot, Social Robots, Humanoid Robots)

Kongsberg Maritime (Norway) - (Autonomous Underwater Vehicles, Robotics for Maritime Applications)

GeckoSystems Intl. Corp. (US) - (Mobile Robots, Care Robots, Autonomous Robots for Elderly Assistance)

ECA GROUP (France) - (Autonomous Underwater Vehicles, Drones, Robotics for Defense and Security)

LG Electronics (South Korea) - (Service Robots, Home Robots, Automated Cleaning Robots)

Lockheed Martin Corporation (US) - (Military Robots, Autonomous Systems, Robotic Technology for Aerospace and Defense)

List of Suppliers who provide raw material and component in Mobile Robots Market:

Raw Material Suppliers:

BASF (Germany)

Dow Chemical Company (US)

ArcelorMittal (Luxembourg)

Alcoa (US)

ThyssenKrupp (Germany)

Component Suppliers:

Nidec Corporation (Japan)

Mitsubishi Electric (Japan)

STMicroelectronics (Switzerland)

Bosch Rexroth (Germany)

Omron Corporation (Japan)

Recent Development

August 05, 2024, KUKA Robotics will present state-of-the-art solutions, including AMRs and advanced robotic palletizing systems, at PACK EXPO International 2024. Featured will be its KMP 1500P AMR, which is equipped with cutting-edge SLAM navigation, and its KR IONTEC robot designed for high-efficiency depalletizing. These innovations help KUKA address the demands for greater flexibility, speed and precision in packaging and processing applications.

June 6, 2024, ABB’s new T702 tug-style AMR introduces a 360-degree point cloud data through Visual SLAM for more accurate navigation in dynamic environments, 6 June 2024 When combined with AMR Studio software, it commissions faster and performs better than unstructured installations.

| Report Attributes | Details |

| Market Size in 2023 | USD 19.55 Billion |

| Market Size by 2032 | USD 90.92 Billion |

| CAGR | CAGR of 18.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Professional Robots, Personal & Domestic Robots) • By Application (Agricultural, Cleaning, Educational, Healthcare, Manufacturing, Warehousing & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KUKA (Germany), ABB (Switzerland), Honda Motor (Japan), Mobile Industrial Robots (Denmark), Omron Automation (US), Northrop Grumman Corporation (US), iRobot Corporation (US), SoftBank Robotics Group .(Japan), Kongsberg Maritime (Norway), GeckoSystems Intl. Corp. (US), ECA Group (France), LG Electronics (South Korea), and Lockheed Martin Corporation (US). |

Ans: Mobile Robots Market is anticipated to expand by 18.62% from 2024 to 2032.

Ans: Mobile Robots Market size was valued at USD 19.55 billion in 2023

Ans: Asia-Pacific Region is dominating the Mobile Robots Market.

Ans: Key drivers of the mobile robots market are advancements in automation, AI, operational efficiency, labor shortages, and growing adoption in industries like logistics, healthcare, and manufacturing.

Ans: Adoption of industry 4.0 technology in industrial automation and warehousing.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rate, by Region

5.2 Operational Efficiency Metrics, by Region

5.3 Robot Maintenance Data, by Region

5.4 Supply Chain and Manufacturing Data, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Mobile Robots Market Segmentation, by Type

7.1 Chapter Overview

7.2 Professional Robots

7.2.1 Professional Robots Market Trends Analysis (2020-2032)

7.2.2 Professional Robots Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Personal & Domestic Robots

7.3.1 Personal & Domestic Robots Market Trends Analysis (2020-2032)

7.3.2 Personal & Domestic Robots Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Mobile Robots Market Segmentation, by Application

8.1 Chapter Overview

8.2 Agricultural

8.2.1 Agricultural Market Trends Analysis (2020-2032)

8.2.2 Agricultural Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cleaning

8.3.1 Cleaning Market Trends Analysis (2020-2032)

8.3.2 Cleaning Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Educational

8.4.1 Educational Market Trends Analysis (2020-2032)

8.4.2 Educational Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Healthcare

8.5.1 Healthcare Market Trends Analysis (2020-2032)

8.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Manufacturing

8.6.1 Manufacturing Market Trends Analysis (2020-2032)

8.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Warehousing & Logistics

8.7.1 Warehousing & Logistics Market Trends Analysis (2020-2032)

8.7.2 Warehousing & Logistics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Mobile Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Mobile Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Mobile Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Mobile Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Mobile Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Mobile Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Mobile Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Mobile Robots Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Mobile Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 KUKA

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 ABB

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Honda Motor

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Mobile Industrial Robots

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Omron Automation

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Northrop Grumman Corporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 iRobot Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 SoftBank Robotics Group

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Kongsberg Maritime

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 GeckoSystems Intl. Corp.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Professional Robots

Personal & Domestic Robots

By Application

Agricultural

Cleaning

Educational

Healthcare

Manufacturing

Warehousing & Logistics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The RF Power Amplifier Market size was valued at USD 8.5 Billion in 2023. It is estimated to reach USD 25.3 Billion by 2032, growing at a CAGR of 12.9% during 2024-2032.

The Smart Retail Market Size was valued at USD 39.92 billion in 2023 and is expected to grow at a CAGR of 26.45% to reach USD 329.03 billion by 2032.

The Switch Mode Power Supply Market Size was valued at USD 2.71 billion in 2023 and is expected to grow at 4.83% CAGR to reach USD 4.12 billion by 2032.

The Volatile Organic Compound Gas Sensor Market Size was valued at USD 163.81 million in 2023, and is expected to reach USD 278.19 million by 2032, and grow at a CAGR of 6.07% over the forecast period 2024-2032.

The Household Robots Market Size was valued at USD 10.15 Billion in 2023 and is expected to reach USD 48.85 Billion by 2032 and grow at a CAGR of 19.10% over the forecast period 2024-2032.

The Infrared Imaging Market Size was USD 7.03 Billion in 2023 and is expected to reach USD 12.36 Billion by 2032 and grow at a CAGR of 6.5% by 2024-2032.

Hi! Click one of our member below to chat on Phone