Get More Information on Mirror Coatings Market - Request Sample Report

The Mirror Coatings Market Size was valued at USD 764.3 million in 2023 and is expected to reach USD 1291.2 million by 2032 and grow at a CAGR of 6.0% over the forecast period 2024-2032.

The mirror coatings market is driven by advancements in material sciences and growing applications across industries such as automotive, aerospace, construction, and astronomy. Innovations in coating technologies are addressing the demand for enhanced durability, reflectivity, and functionality in mirrors used in these sectors. Recent developments underscore the importance of cutting-edge mirror coatings. For instance, in May 2024, a significant milestone was achieved with the Rubin Observatory applying its first reflective coating to its primary mirror. This effort underscores the advancements in large-scale optical coatings designed for precision in astronomical observations. Similarly, the Vera Rubin Observatory introduced a reflective coating to its primary mirror during the same month, highlighting the increasing investment in high-performance mirror coatings to support next-generation telescopes.

The aerospace and defense sectors are also benefiting from mirror coating innovations. In December 2023, an advanced mirror-like coating was unveiled for the F-35C fighter aircraft aboard the USS Abraham Lincoln. This development exemplifies how such coatings are being optimized for stealth and performance enhancements in military applications. Collectively, these initiatives demonstrate how companies are leveraging advanced technologies to meet diverse industry needs, driving the mirror coatings market forward with solutions tailored to precision, efficiency, and durability.

Drivers:

Rising Adoption of High-Performance Coatings in Astronomy and Scientific Applications Drives Innovation in the Mirror Coatings Market

The growing investments in scientific research and development are propelling the demand for high-performance mirror coatings, particularly in astronomy. Advanced coatings that enhance reflectivity and durability are critical for telescopes and observatories, ensuring precision in celestial observations. Projects like the Vera Rubin Observatory's primary mirror coating exemplify this trend. These innovations cater to the need for improved optical performance and longer service life, pushing manufacturers to innovate and expand their offerings. This demand aligns with increasing space exploration initiatives globally, establishing astronomy as a significant driver for the mirror coatings market.

Growing Use of Mirror Coatings in Automotive and Aerospace Sectors Enhances Market Potential Across Industrie0073

Increased Application of Energy-Efficient Mirror Coatings in Construction Industry Accelerates Market Growth

Technological Advancements in Deposition Techniques Boost Precision and Quality in Mirror Coatings

Rising Focus on Sustainable and Eco-Friendly Mirror Coating Solutions to Align with Environmental Norms

Restraint:

High Costs of Advanced Mirror Coatings and Equipment Restrict Adoption Among Small-Scale Industries and Emerging Markets

High costs associated with advanced mirror coatings and the specialized equipment required for their production act as a significant restraint for the mirror coatings market, particularly for small-scale industries and emerging markets. The development of high-performance coatings involves the use of premium raw materials, precision technologies such as chemical vapor deposition or sputtering, and advanced machinery, all of which increase production costs. Small-scale manufacturers and businesses in cost-sensitive regions often face challenges in affording these technologies, limiting their ability to compete with larger companies. Additionally, the need for skilled labor and adherence to stringent quality standards further adds to the operational expenses, making it difficult for smaller players to justify the investment. This cost barrier not only restricts the adoption of advanced mirror coatings but also slows market penetration in regions with constrained industrial budgets, impacting the overall market growth potential.

Opportunity:

Rising Investments in Space Exploration and Satellite Programs Open New Avenues for High-Performance Mirror Coatings

Emerging economies, particularly in Asia-Pacific, Latin America, and parts of Africa, represent untapped opportunities for the extruder market. As industrialization continues in these regions, the demand for extruded products in various sectors such as automotive, construction, and packaging is on the rise. With rapid urbanization and increased infrastructure development, emerging economies are poised to become key markets for extrusion technologies. Furthermore, the growing middle class in these regions is driving demand for consumer goods that require extruded materials, such as packaging for food, electronics, and personal care products. Companies looking to expand their market share can benefit from targeting these regions, where there is a growing need for both standard and customized extrusion solutions. The rise of manufacturing facilities in emerging markets, coupled with supportive government policies to boost local production, is expected to fuel the growth of the Mirror Coatings market in these regions.

Growing Adoption of Smart Mirrors in Commercial and Residential Sectors Expands Application Scope for Mirror Coatings

Development of Multifunctional Mirror Coatings for Healthcare and Biomedical Applications Creates Emerging Opportunities in Specialized Markets

Multifunctional mirror coatings are opening new horizons in healthcare and biomedical applications, where precision and hygiene are paramount. These coatings are used in medical devices, surgical instruments, and diagnostic equipment to enhance optical clarity and ensure sterility. Innovations in anti-reflective and antimicrobial coatings are particularly gaining traction, addressing the unique needs of medical environments. For example, high-performance coatings that reduce light scattering and glare improve the accuracy of imaging systems and diagnostic tools. As the healthcare industry continues to grow, fueled by advancements in medical technology and increased patient demand, the need for coatings that combine functionality with stringent hygiene standards is expected to expand, creating niche opportunities for manufacturers in this field.

Challenge:

Stringent Environmental Regulations and Sustainability Requirements Pose Challenges in Manufacturing Advanced Mirror Coatings

Environmental regulations and the rising focus on sustainability pose significant challenges for mirror coating manufacturers, impacting production processes and material choices. These regulations often require manufacturers to reduce volatile organic compound (VOC) emissions, use eco-friendly materials, and adopt energy-efficient production techniques, all of which can increase operational costs and complexity. Meeting these requirements demands substantial investment in research and development to create coatings that meet both performance and environmental standards. Moreover, transitioning existing production lines to comply with these norms often involves significant capital expenditure, making it particularly burdensome for small and mid-sized manufacturers. Balancing the high-performance requirements of industries such as aerospace, automotive, and construction with the need for sustainability is a complex task, and failure to comply with regulatory standards can lead to fines or loss of market access. This dual pressure of regulatory compliance and maintaining competitive pricing remains a critical challenge for the mirror coatings market.

| Technology Trend | Description | Example Applications | Impact on Market |

|---|---|---|---|

| Anti-Reflective Coatings | Coatings are designed to reduce glare and reflection, enhancing optical clarity and visibility. | Telescopes, cameras, optical instruments, automotive mirrors. | Increased adoption in industries requiring high-precision optics. Significant growth in demand from the optics and automotive sectors. |

| Self-Cleaning Coatings | Coatings that allow mirrors to remain clean by using hydrophobic and oleophobic properties to repel water and dirt. | Architectural mirrors, automotive side mirrors, outdoor signage. | Growth in demand is driven by convenience, especially in high-maintenance environments like buildings and vehicles. |

| Infrared Reflective Coatings | Coatings that improve energy efficiency by reflecting infrared light while maintaining optical clarity. | Solar panels, energy-efficient windows, automotive windshields. | Adoption of renewable energy and energy-efficient technologies, creating new opportunities in the construction and automotive sectors. |

| Durable Coatings for Harsh Environments | Advanced coatings are designed to withstand extreme conditions, including UV radiation, high temperatures, and corrosive environments. | Aerospace, defense, industrial applications, telescopes. | Strong demand from the aerospace and defense industries, as well as applications in high-temperature environments. |

| Multifunctional Coatings | Coatings that combine multiple properties, such as anti-reflective, scratch-resistant, and self-healing features, into one coating. | Smart mirrors, healthcare diagnostic tools, and consumer electronics. | Significant rise in demand due to increased use of smart technologies and consumer electronics. Provides added value in diverse applications. |

| Nanotechnology-based Coatings | Coatings incorporating nanomaterials to achieve enhanced optical properties, increased durability, and functionality at a microscopic scale. | High-precision mirrors for telescopes, high-performance optics. | Continuous innovation due to the demand for high-performance optical systems and growing interest in nano-based solutions. |

| Metallic Coatings | Metal-based coatings are often applied to mirrors to enhance reflectivity and provide durability against wear and corrosion. | Automotive mirrors, satellite components, and reflectors in optical telescopes. | Demand is driven by the need for high reflectivity in industries like automotive and aerospace. |

By Type

In 2023, the Polyurethane resin segment dominated the Mirror Coatings Market, accounting for approximately 40% of the market share. Polyurethane resin is favored for its durability, resistance to environmental factors, and ability to provide a high-quality finish that enhances the reflective properties of mirrors. This resin is particularly popular in automotive and architectural applications, where both aesthetic appeal and longevity are crucial. For example, polyurethane-based coatings are used extensively in car side mirrors, providing enhanced durability against wear and tear while maintaining excellent optical clarity.

By Technology

The Water-based technology segment dominated the Mirror Coatings Market in 2023, capturing 45% of the market share. Water-based coatings are environmentally friendly, with low levels of volatile organic compounds (VOCs), making them a preferred choice for eco-conscious consumers and industries. They offer a combination of ease of application and excellent performance in creating durable, reflective surfaces, particularly in the architectural sector. For example, water-based mirror coatings are commonly used in interior decor and home furnishings due to their sustainability benefits and high-quality finish.

By End-Use Industry

The Architectural segment dominated the Mirror Coatings Market in 2023, with a market share of 35%. Architectural applications, particularly in interior design and construction, require mirrors with superior reflectivity and resistance to degradation over time. These coatings are widely used in decorative mirrors, glass facades, and other architectural elements. The increasing demand for modern architectural aesthetics, such as mirrored facades and decorative wall mirrors in commercial buildings and residential properties, drove this growth.

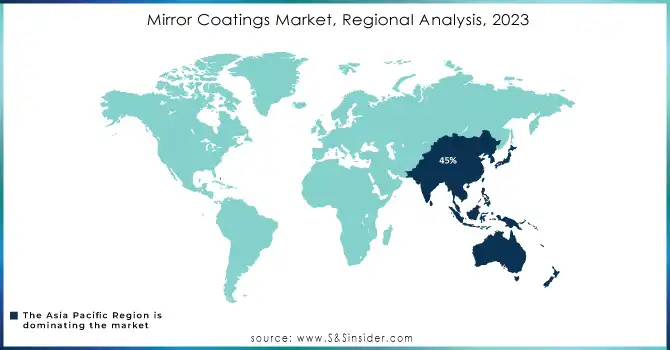

In 2023, Asia Pacific dominated the Mirror Coatings Market, accounting for 45% of the market share. The region's dominance is primarily driven by the rapid growth of end-use industries like automotive, architecture, and solar power in countries like China, Japan, and India. In China, the automotive industry is a major contributor, with the demand for high-quality mirror coatings in vehicles increasing due to the country's booming car manufacturing sector. The rise in urbanization and infrastructure development in India and China has also led to a surge in the demand for architectural mirrors. Japan, on the other hand, has a strong presence in high-end mirror coatings, particularly for decorative and electronic applications. For example, China’s automotive industry produced over 25 million vehicles in 2023, contributing significantly to the growth of mirror coatings used in automotive side and rearview mirrors. This is further supported by the growing popularity of solar power, where mirror coatings are essential for improving the reflectivity and efficiency of solar panels in countries like India. The region’s robust industrial base, along with increasing technological advancements, ensures its market leadership.

The North American region, emerged as the fastest-growing region and is expected to grow with a CAGR of 6.5% from 2024 to 2032. This growth can be attributed to the rising demand for mirror coatings in the automotive and architectural sectors, alongside increasing investments in renewable energy, particularly in solar power. In the United States, there is a significant push towards green building initiatives, with more construction projects incorporating reflective materials like mirror coatings in both residential and commercial buildings. Additionally, the automotive market in North America remains strong, with major players like General Motors and Ford investing in advanced mirror technologies to improve vehicle aesthetics and functionality. For instance, in 2023, North America accounted for about 14.5 million vehicle sales, where mirror coatings are increasingly used in car side mirrors and rearview mirrors. Canada’s growing focus on solar energy also contributes to the rise in demand for mirror coatings, with initiatives such as the “Green Energy Act” driving investments in solar power infrastructure. The combination of these factors ensures that North America remains the fastest-growing region, bolstered by increased technological advancements and rising consumer demand for high-quality, sustainable coatings.

Get Customized Report as per your Business Requirement - Request For Customized Report

Arkema Group (Rilsan, Kynar PVDF)

Casix, Inc. (Casix Coatings, Casix Mirror Coatings)

Cemex S.A.B. de C.V. (Cemex Reflective Coatings, Cemex Mirror Glass)

Diamon-Fusion International, Inc. (Diamon-Fusion Coating, DF-Xtra Coating)

FENZI S.p.A (Mirroflex, Fenzi Mirror Coatings)

Ferro Corporation (Mirror Silver, Ferro Mirror Coatings)

Glas Trosch Holding AG (Mirrorglass, Glass Reflective Coatings)

Guardian Glass (Guardian CrystalClear, SunGuard)

Mader Group (Mader Mirror Coating, Mader Clear Coatings)

Pearl Nano, LLC (Pearl Nano Mirror Coating, Nano Coating)

3M Company (3M Mirror Film, 3M Scotchgard Glass Coating)

AkzoNobel N.V. (Interpon Mirror Coating, AkzoNobel Mirror Coatings)

BASF SE (BASF Glass Coating, BASF Reflective Coating)

Bystronic Glass GmbH (Bystronic Glass Mirror Coating, Bystronic Coating Systems)

Chemours Company (Opteon Mirror Coating, Chemours Reflective Coatings)

Dupont de Nemours, Inc. (DuPont Tedlar, DuPont Reflective Coatings)

Eastman Chemical Company (Eastman Coatings, Eastman Mirror Coating Solutions)

Jotun A/S (Jotun Mirror Coatings, Jotun Reflective Coatings)

PPG Industries, Inc. (PPG Mirror Coatings, PPG Sun Control)

Sherwin-Williams Company (Sherwin-Williams Mirror Coatings, Sherwin-Williams Reflective Coatings)

Raw Material Suppliers:

Ferro Corporation

BASF SE

Chemours Company

Arkema Group

Eastman Chemical Company

Dow Chemical Company

Huntsman Corporation

Equipment Manufacturers:

Mader Group

Glas Trosch Holding AG

Bystronic Glass GmbH

SCHOTT AG

Applied Materials, Inc.

Bohle Group

End-users (OEMs):

VELUX Group (Roof windows)

Cemex S.A.B. de C.V. (Construction materials)

Saint-Gobain (Construction and building materials)

Toyota (Automotive)

Ford (Automotive)

General Motors (Automotive)

April 2024: Guardian Glass introduced Guardian CrystalClear, a reduced-iron glass that offered 67% greater color neutrality and 90% visible light transmission. This product improved clarity and color neutrality, making it suitable for various architectural applications. It was compatible with Guardian SunGuard low-E coatings and available in multiple thicknesses and jumbo sizes.

March 2024: Guardian Glass and the VELUX Group entered a joint development agreement to advance tempered vacuum-insulated glass (VIG) technology. The partnership combined their expertise, technical teams, and intellectual property to meet the growing demand for VIG and integrate it into VELUX's roof window products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 764.3 Million |

| Market Size by 2032 | US$ 1291.2 Million |

| CAGR | CAGR of 6.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Polyurethane resin, Epoxy resin, Acrylic resin, Others) •By Technology (Water-based, Solvent-based, Nanotechnology-based) •By End-use Industry (Architectural, Automotive & Transportation, Decorative, Solar power, Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Casix, Inc., Guardian Glass, Cemex S.A.B. de C.V., Mader Group, Diamon-Fusion International, Inc., FENZI S.p.A, Pearl Nano, LLC, Ferro Corporation,Arkema Group, Glas Trosch Holding AG and other key players |

| Key Drivers | • Increased Application of Energy-Efficient Mirror Coatings in Construction Industry Accelerates Market Growth • Technological Advancements in Deposition Techniques Boost Precision and Quality in Mirror Coatings |

| RESTRAINTS | • High Costs of Advanced Mirror Coatings and Equipment Restrict Adoption Among Small-Scale Industries and Emerging Markets |

Ans: Key stakeholders considered in the study:

Raw material vendors

distributors/traders/wholesalers/suppliers

regulatory authorities, including government agencies and NGO

commercial research & development (r&d) institutions

importers and exporters

government organizations, research organizations, and consulting firms

trade/industrial associations

end-use industries are the stake holder of this report

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Environmental problems and rules that are too strict and Water-based coatings can be a problem are the challenges faced by the Mirror Coatings Market.

Ans: Mirror coatings have been used more and more in the automotive, solar, and construction industries over the past decade and more.

Ans: Mirror Coatings Market Size was valued at USD 680.5 million in 2021, and expected to reach USD 1223.25 million by 2028, and grow at a CAGR of 6.0 % over the forecast period 2022-2028.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Raw Material Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Mirror Coatings Market Segmentation, by Type

7.1 Chapter Overview

7.2 Polyurethane resin

7.2.1 Polyurethane resin Market Trends Analysis (2020-2032)

7.2.2 Polyurethane resin Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Epoxy resin

7.3.1 Epoxy resin Market Trends Analysis (2020-2032)

7.3.2 Epoxy resin Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Acrylic resin

7.4.1 Acrylic resin Market Trends Analysis (2020-2032)

7.4.2 Acrylic resin Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Mirror Coatings Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Water-based

8.2.1 Water-based Market Trends Analysis (2020-2032)

8.2.2 Water-based Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Solvent-based

8.3.1 Solvent-based Market Trends Analysis (2020-2032)

8.3.2 Solvent-based Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Nanotechnology-based

8.4.1 Nanotechnology-based Market Trends Analysis (2020-2032)

8.4.2 Nanotechnology-based Market Size Estimates and Forecasts to 2032 (USD Million)

9. Mirror Coatings Market Segmentation, by End-use Industry

9.1 Chapter Overview

9.2 Architectural

9.2.1 Architectural Market Trends Analysis (2020-2032)

9.2.2 Architectural Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Automotive & Transportation

9.3.1 Automotive & Transportation Market Trends Analysis (2020-2032)

9.3.2 Automotive & Transportation Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Decorative

9.4.1 Decorative Market Trends Analysis (2020-2032)

9.4.2 Decorative Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Solar power

9.5.1 Solar power Market Trends Analysis (2020-2032)

9.5.2 Solar power Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Mirror Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.4 North America Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.5 North America Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.2 USA Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.6.3 USA Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.2 Canada Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.7.3 Canada Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.2 Mexico Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.8.3 Mexico Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Mirror Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.6.3 Poland Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.7.3 Romania Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.8.3 Hungary Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.9.3 Turkey Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Mirror Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.5 Western Europe Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.6.3 Germany Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.2 France Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.7.3 France Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.2 UK Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.8.3 UK Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.9.3 Italy Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.10.3 Spain Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.13.3 Austria Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Mirror Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.5 Asia Pacific Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.2 China Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.6.3 China Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.2 India Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.7.3 India Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.2 Japan Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.8.3 Japan Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.2 South Korea Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.9.3 South Korea Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.10.3 Vietnam Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.2 Singapore Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.11.3 Singapore Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.2 Australia Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.12.3 Australia Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Mirror Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.4 Middle East Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.5 Middle East Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.6.3 UAE Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.7.3 Egypt Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.9.3 Qatar Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Mirror Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.4 Africa Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.5 Africa Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.6.3 South Africa Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Mirror Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.4 Latin America Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.5 Latin America Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.2 Brazil Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.6.3 Brazil Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.2 Argentina Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.7.3 Argentina Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.2 Colombia Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.8.3 Colombia Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Mirror Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Mirror Coatings Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Mirror Coatings Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Million)

11. Company Profiles

11.1 Casix, Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Guardian Glass

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Cemex S.A.B. de C.V.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Mader Group

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Diamon-Fusion International, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 FENZI S.p.A

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Pearl Nano, LLC

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Ferro Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Arkema Group

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Glas Trosch Holding AG

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Polyurethane resin

Epoxy resin

Acrylic resin

Others

By Technology

Water-based

Solvent-based

Nanotechnology-based

By End-use Industry

Architectural

Automotive & Transportation

Decorative

Solar power

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Biodegradable Films Market size was USD 1.3 billion in 2023 and is expected to reach USD 2.3 billion by 2032, growing at a CAGR of 6.7% from 2024 to 2032.

The Waterborne Coatings Market Size was USD 72.3 billion in 2023 and will reach to USD 119.6 billion by 2032 and grow at a CAGR of 5.1% by 2024-2032.

Antimicrobial Preservatives Market size was USD 3.1 Billion in 2023 and is projected to reach USD 4.6 Billion by 2032, at a CAGR of 4.5% from 2024 to 2032.

The Self-Healing Materials Market Size was valued at USD 1.9 billion in 2023, and is expected to reach USD 13.7 Billion by 2032, and grow at a CAGR of 24.6% over the forecast period 2024-2032.

The Prepreg market size was valued at USD 10.62 billion in 2023 and is expected to reach USD 27 billion by 2032 and grow at a CAGR of 10.93% over the forecast period 2024-2032.

Potassium Soap Insecticides Market was valued at USD 9.06 Mn in 2023 and is expected to reach USD 19.35 Mn by 2032, growing at a CAGR of 8.80% from 2024-2032.

Hi! Click one of our member below to chat on Phone