Get more information on Mining Automation Market - Request Sample Report

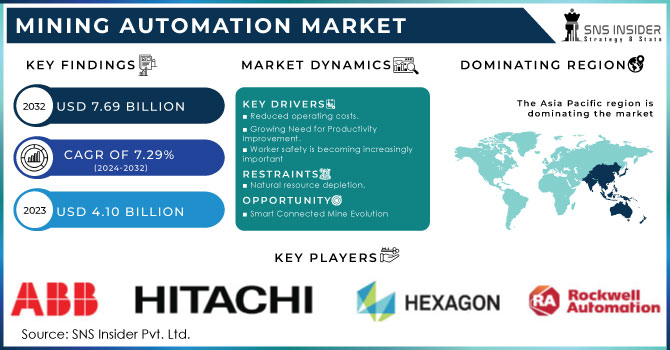

The Mining Automation Market Size was valued at USD 4.10 Billion in 2023 and is expected to reach USD 7.69 Billion by 2032 and grow at a CAGR of 7.29% over the forecast period 2024-2032.

Automated mining systems are revolutionizing the industry by significantly enhancing operational efficiency through continuous operations, reduction of downtime, and optimized resource extraction. For example, the combination of automated drilling rigs with driverless cars enables mining businesses to run around the clock without the disruptions caused by human labor, including shift changes and exhaustion. It has been demonstrated that this ongoing activity increases productivity by 5–10%, which is the same as a conventional mining business opening a new mine.

Furthermore, real-time equipment monitoring and preventative maintenance are made possible by predictive maintenance solutions, which are fueled by AI and IoT and reduce unplanned downtime. To reduce operating disruptions and increase the lifespan of mining equipment, data from equipment sensors, for instance, can be used to forecast possible failures and fine-tune maintenance schedules.

According to the data from the U.S. Bureau of Labor Statistics indicates that the use of these technologies has also decreased workplace accidents since they allow autonomous systems to take over risky duties, increasing overall safety.

Moreover, smart mining settings are now possible thanks to the integration of IoT devices, where sensors and networked systems continuously offer data on safety measures, environmental conditions, and equipment performance. By automating dangerous jobs, these developments not only increase worker safety but also operational efficiency. Companies like as BHP and Rio Tinto, for example, have decreased operational hazards and enhanced production by implementing autonomous drill systems and trucks. This pattern is indicative of a larger movement in the mining sector toward more automated and data-driven processes, which is being fueled by advances in AI, ML, and IoT technology.

Drivers

Rising need for productivity and safety in the mines are driving the market growth.

Metals and minerals are in demand all over the world. Mining corporations are under pressure to increase profits and reduce overhead costs. Technologies that minimize downtime and enhance output by offering continuous operations for which little human intervention is needed such as automated drilling and haulage systems are being used. Over the past ten years, the use of automatic systems has assisted in reducing mining-related deaths by roughly 30%, as per the U.S. Department of Labor’s Mine Safety and Health Administration. Moreover, these modern technologies can alleviate human exposure to hazardous situations, like as unstable rock formations and underground mining, and enhance safety while improving production rates.

Moreover, most governments in Canada and Australia, which are among the world’s top mining nations, seem to agree. Recently, the Australian government has invested in a variety of initiatives in order to promote the development and use of innovative mining systems. Increased productivity and a safer working environment have once again demonstrated the dual advantages of automation. The mining industry is increasingly adopting this technology as a result of the increased emphasis on both performance and safety.

Restrain

High costs and high capital investment hamper the market growth.

High costs and significant capital investment requirements are major restraints that hinder the growth of the mining automation market. Significant upfront costs are associated with the implementation of automated systems in mining operations. These costs include the acquisition of cultured equipment, the integration of complex software, and the installation of supporting infrastructure. These expenses may be unaffordable, particularly for smaller mining firms or those doing business in areas with constrained funding sources. The overall financial burden is further increased by the constant upkeep, upgrades, and training needed to guarantee the effective operation of automated systems.

By Solution

The software automation solution type held the largest market share around 43.45% in 2023. Because it plays a crucial part in improving decision-making, safety, and operational efficiency in mining operations. Predictive maintenance, fleet management systems, and real-time data analytics are just a few of the many uses of software automation that are crucial for maximizing mining equipment efficiency and minimizing downtime. Mining businesses can monitor and control operations remotely with the help of these solutions, which increases production and reduces costs. Additionally, the need for advanced software that can integrate different parts of mining operations from exploration to production and it has increased as the mining industry continues to pursue digital transformation methods.

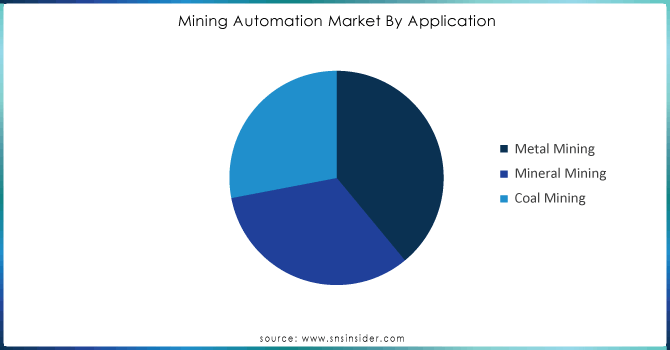

By Application

The mineral mining segment held the largest market share around 42.13% in 2023. It is anticipated that the application of metal mining will rise significantly during the projection period. The development in the use of autonomous technology in metal prospecting activities is the reason for the expansion. Furthermore, revenue growth is anticipated as a result of the application sectors' growing need for metals like copper, zinc, lead, and nickel. In addition, the need for automated solutions in the metal mining industry has surged in response to the growing demand for base metals.

Get Customized Report as per your Business Requirement - Request For Customized Report

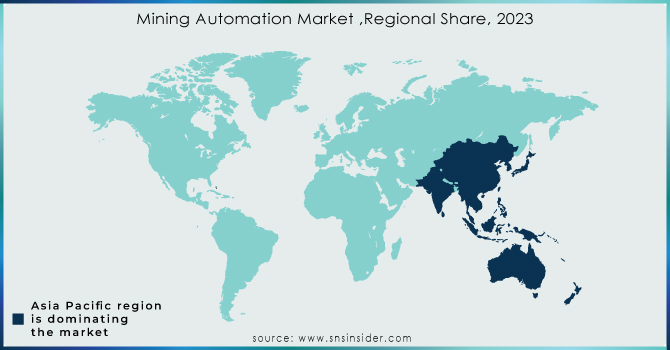

Asia Pacific held the largest market share in the mining automation market around 35.33% in 2023. The regional market is expected to be driven by Australia's increasing embrace of automation technology. Robots and remote-controlled machinery are used in Australia's economy to safely and effectively harvest minerals. Throughout the projection period, markets like China and India are likely to present significant growth prospects because of their unexplored drilling and exploration potential. For instance, Australian business Deswik, which provides a variety of software and consulting solutions connected with mining, was purchased by Sandvik AB in 2022.

Moreover, in China, the government's focus on enhancing safety and productivity within its extensive mining industry has resulted in the widespread implementation of advanced automation technologies. Australia, famous for its extensive mining activities, has adopted automation to improve operational efficiency and decrease labor expenses. India's mining sector is expanding rapidly and is turning to automation to handle increased demand as well as tackle issues like labor shortages and safety risks. Moreover, the quick growth of infrastructure and technological improvements in the area help facilitate the implementation of advanced mining automation systems. Together, these factors have positioned Asia-Pacific as the primary region in the worldwide mining automation market, indicating its significance and strong potential for growth.

The Key Players are Caterpillar, Hitachi, Ltd., Liebherr Group, Atlas Copco AB, Autonomous Solution Inc., Liebherr Group, Rio Tinto, Sandvik AB, Siemens, Komatsu Ltd. & Other Players.

Recent Developments:

In 2023, Caterpillar unveiled its Cat Command for Underground system, a cutting-edge automation system. To improve efficiency and safety in underground mining operations.

In 2023, Komatsu Ltd. unveiled its Autonomous Haulage System version 6, which improves its previous models by incorporating more advanced AI algorithms and better integration with other mining equipment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.10 Billion |

| Market Size by 2032 | USD 7.69 Billion |

| CAGR | CAGR of 7.29 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Software Automation, Services, Equipment Automation) • By Application (Metal Mining, Mineral Mining, Coal Mining) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Caterpillar, Hitachi, Ltd., Liebherr Group, Atlas Copco AB, Autonomous Solution Inc., Liebherr Group, Rio Tinto, Sandvik AB, Siemens, Komatsu Ltd. & Other Players. |

| Key Drivers | • Rising need for productivity and safety in the mines are driving the market growth. |

| RESTRAINTS | •High costs and high capital investment hamper the market growth. |

The market value is expected to reach USD 9.32 billion by 2032.

Natural resource depletion is limiting the Mining Automation Market's expansion.

The key players in the mining automation market are MST Global, ABB Ltd., Hexagon, Hitachi, Rockwell Automation, Emerson Electric, Mitsubishi Electric Corporation, Schneider Electric, Honeywell International, and Siemens.

Top-down research, bottom-up research, qualitative research, quantitative research, and Fundamental research.

Manufacturers, Consultants, Association, Research Institutes, private and university libraries, suppliers, and distributors of the product.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Solution launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Mining Automation Market Segmentation, by Solution

7.1 Chapter Overview

7.2 Software Automation

7.2.1 Software Automation Market Trends Analysis (2020-2032)

7.2.2 Software Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Implementation & Maintenance

7.3.3.1 Services Market Trends Analysis (2020-2032)

7.3.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Training

7.3.4.1 Training Market Trends Analysis (2020-2032)

7.3.4.2 Training Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Consulting

7.3.5.1 Consulting Market Trends Analysis (2020-2032)

7.3.5.2 Consulting Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Equipment Automation

7.4.1 Equipment Automation Market Trends Analysis (2020-2032)

7.4.2 Equipment Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.3 Autonomous Trucks

7.4.3.1 Autonomous Trucks Market Trends Analysis (2020-2032)

7.4.3.2 Autonomous Trucks Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.4 Remote Control Equipment

7.4.4.1 Remote Control Equipment Market Trends Analysis (2020-2032)

7.4.4.2 Remote Control Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.5 Teleoperated Mining Equipment

7.4.5.1 Teleoperated Mining Equipment Market Trends Analysis (2020-2032)

7.4.5.2 Teleoperated Mining Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Mining Automation Market Segmentation, by Application

8.1 Chapter Overview

8.2 Metal Mining

8.2.1 Metal Mining Market Trends Analysis (2020-2032)

8.2.2 Metal Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Mineral Mining

8.3.1 Mineral Mining Market Trends Analysis (2020-2032)

8.3.2 Mineral Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Coal Mining

8.4.1 Coal Mining Market Trends Analysis (2020-2032)

8.4.2 Coal Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Mining Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.4 North America Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.5.2 USA Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.6.2 Canada Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.7.2 Mexico Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Mining Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.5.2 Poland Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.6.2 Romania Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Mining Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.4 Western Europe Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.5.2 Germany Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.6.2 France Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.7.2 UK Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.8.2 Italy Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.9.2 Spain Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.12.2 Austria Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Mining Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.4 Asia Pacific Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.5.2 China Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.5.2 India Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.5.2 Japan Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.6.2 South Korea Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.7.2 Vietnam Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.8.2 Singapore Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.9.2 Australia Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Mining Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.4 Middle East Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.5.2 UAE Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Mining Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.2.4 Africa Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Mining Automation Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Mining Automation Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Mining Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.4 Latin America Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.5.2 Brazil Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.6.2 Argentina Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.7.2 Colombia Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Mining Automation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Mining Automation Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Caterpillar

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Hitachi, Ltd.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Liebherr Group

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 , Atlas Copco AB

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Autonomous Solution Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Liebherr Group

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Rio Tinto

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Sandvik AB

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Siemens

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Komatsu Ltd.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Solution

Software Automation

Services

Implementation & Maintenance

Training

Consulting

Equipment Automation

Autonomous Trucks

Remote Control Equipment

Teleoperated Mining Equipment

By Application

Metal Mining

Mineral Mining

Coal Mining

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Radar Sensors Market Size was valued at USD 11.95 Billion in 2023 and is expected to grow at a CAGR of 14.85% to Reach USD 41.54 Billion by 2032.

The Cable Blowing Equipment Market Size was valued at USD 106.3 Million in 2023 and is expected to Hit USD 176.92 Million at a CAGR of 5.83% from 2024-2032

The Drone Camera Market Size was valued at USD 14.20 billion in 2023 and is expected to reach USD 145.45 billion by 2032 and grow at a CAGR of 29.5% over the forecast period 2024-2032.

The GPS Tracking Device Market was valued at USD 3.17 billion in 2023 and is expected to reach USD 10.03 billion by 2032, growing at a CAGR of 13.69% over the forecast period 2024-2032.

The SiC Device Market size was valued at USD 2.35 billion in 2023 and is expected to reach USD 15.82 billion by 2032 and grow at a CAGR of 23.6% over the forecast period 2024-2032.

The Programmable Robots Market was valued at USD 3.44 billion in 2023 and is expected to reach USD 13.22 billion by 2032, growing at a CAGR of 16.16% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone