Get More Information on Mini Tractors Market - Request Sample Report

The Mini Tractors Market size was valued at USD 8.62 billion in 2023 and is expected to reach USD 12.57 billion by 2032, with a growing at CAGR of 4.33% over the forecast period 2024-2032.

The mini tractors market is witnessing substantial growth driven by the growing trend of agricultural mechanization and increasing uptake of compact equipment for many applications. In the developing regions, especially the Asia-Pacific, small and medium farmers are building the demand since cost-effective, efficient solutions are particularly important for boosting production in these regions. The expanding market is influenced by government initiatives corresponding to agricultural mechanization, like tractor financial subsidies and tractor loans implemented in countries like India and China. Additionally, urbanization and land fragmentation are driving the demand for tractors with compact designs that can perform multiple tasks on smaller lands. Government assistance for mini tractors in 2023-2024 is substantial, with India setting aside as much as INR 1,000 crore (roughly USD 120 million) for tractor loans and subsidies as part of the short-term rental systems within the National Mission on Agricultural Extension and Technology (NMAET). Tractor sales have been rising in China by 13% a year, fueled by government subsidies Mini tractors are also increasingly in demand as Asia is urbanizing at 4% per year, resulting in more compact tractors being required for the smaller, fragmented land parcels. The percentage of farms using mini tractors in India is around 23% and is on the rise aided by these initiatives.

The Growth Of Mini Tractors Is Their Increasing Use In Non-Farm Applications Such As Landscaping, Snow Clearing, And Mowing

The versatility and user-friendly operation of these machines make them appealing to homeowners, commercial landscapers, and municipalities alike. New technologies, such as hydrostatic transmissions, and the potential introduction of hybrid or electric mini tractors add a newer interest factor to the product category as well. This increase in sustainability and adoption of well-functioning equipment is even greater in regions such as North America and Europe where the demand for energy-efficient solutions is increasing. These mini tractors (like the John Deere 1025R) were selling over 40,000 units per year in North America in 2023 due to demand for snow clearing, landscaping, and mowing applications. At the same time, demand for snow clearing alone rose 9% every winter season in the northeastern U.S., and electric mini tractors like the Kubota L2501 and John Deere 2025R are rapidly becoming a viable option, with sales projected to increase by 17% per year for five years. Hybrid or electric models are forecasted to account for 20% of all new mini tractor purchases by 2024.

KEY DRIVERS:

Mini Tractors Gaining Popularity in Specialized Applications for Vineyards Orchards and Landscaping Growth

The growing diversity of different specialized applications besides traditional farming, is considered one of the major drivers for the growth of the mini tractors market. Mini tractors are used more and more for applications like orchards, vineyards, and turf maintenance. The small and agile nature of these tractors allows them to work in tight areas where standard tractors are too bulky to function. Such as where vineyard farming exists in Europe and North America, demand for small tractors increased for adequate pruning, spraying, and soil management to ensure small-sized plants can be managed more efficiently compared to traditional tractors. Likewise, the adoption of equipment designed to adapt to various kinds of terrain is being sustained by investments in aesthetic and functional outdoor spaces that are witnessing media attention, bringing revenue to the landscaping industry, thus further propelling demand for landscape equipment. These new use cases have essentially grown the market, with manufacturers now designing models specifically for these niche sectors. specialized sectors such as vineyards and orchards had a positive growth of 13% for mini tractors having a minimum working width of 51 inches, such as the John Deere 5075EN in 2023. North American landscaping and turf mini tractor sales increased 9% YOY with 10,000-15,000 units of annual sales for snow clearing applications from urban areas.

Advanced Technologies in Mini Tractors Boosting Efficiency Sustainability and Market Growth for Farmers

The adoption of advanced technologies on mini tractors also stands as a major factor, including precision farming tools, and autonomous operations. With GPS-enabled guidance systems, remote monitoring, and data analytics, farmers can make better use of their resources, maximizing productivity while minimizing costs. In addition to this, with the agricultural industry focusing on sustainable development and reduced emissions, electric and hybrid mini tractors are continuously being developed. For example, key players are offering battery-powered variants that offer noise-free operation and low environmental footprint, in response to consumer preferences for environment-friendly products and growing government regulations on emissions. These advancements make mini tractors more appealing to farmers and create a new space for their use as farmers adopt them for urban farming and controlled-environment farming, which thereby bolsters market growth.

New Holland unveiled the T4 Electric Power tractor operating on a 120-horsepower electric motor, capable of running for 4 to 8 hours and charging in 1 hour. The model will facilitate operational cost-cutting of no less than 90% against diesel tractors. Underpinned by surging demand for low-emission and quieter vehicles. Moreover, the efficiency of precision farming is being boosted by GPS guidance systems, with their productivity standing at up to 25%.

RESTRAIN:

Challenges Hindering Mini Tractors Growth in Large-Scale Farming and Remote Regions

The mini tractors market has a significant restraint, which is, that it hardly suits large-scale operations. Mini tractors have less use in commercial farming because they are designed primarily for small farms or special tasks, which is insufficient for heavy commercial-scale duty tractors. This limits their uptake in areas with a high prevalence of large farms, such as in large parts of North America and South America. Furthermore, in case of heavy soil or harsh weather conditions, their efficiency is quite low to general-purposed tractors, but mini tractors are unarguably more versatile for diverse agricultural landscapes. Another major problem is that of awareness and reach in the remote parts. Smallholder farmers from developed regions have little experience with advanced agricultural machinery, resulting in low machinery adoption. Compounding this problem are relatively smaller dealership networks and limited availability of service, maintenance, and repair facilities.

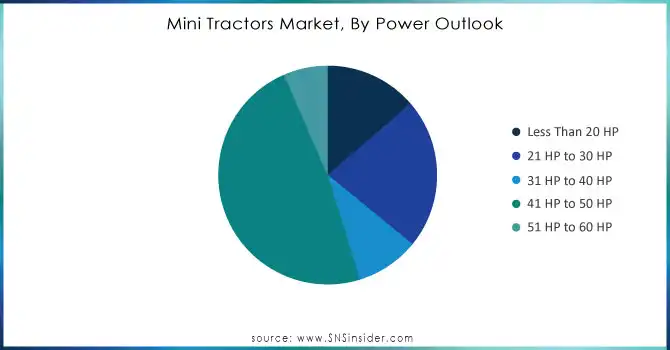

BY POWER OUTLOOK

41 HP to 50 HP segment witnessed the largest mini tractors market share of 48% in 2023 and the segment is expected to grow at the highest growth rate from 2024 to 2032. The dominance of this segment can be attributed to the versatile applications that small and mid-sized tractors cater to such as plowing, tilling, and transportation. Demand among farmers for this kind of balance between power and price is especially strong. The ability to perform well in various types of terrain and its versatility in planting different crops continue to strengthen its market position. The rapid growth of this segment is also supported by an increase in mechanization and technological developments. This power band finds a large section of farmers moving towards tractors as it is power that can run all types of implements efficiently due to its multi-tasking ability. Backed by favorable government policies and subsidies, rising adoption in emerging economies is likely to keep it on the growth path during the forecast period.

Need Any Customization Research On Mini-Tractors-Market - Inquiry Now

In 2023, the Mechanical transmission segment accounted for a share of 55% in the mini tractors market, primarily due to its relatively lower cost and ease of use. Farmers in developing economies and small-scale farming operations where economics is a critical factor prefer mechanical transmissions. They are also among the most durable machines and heavy-duty dependable tractors for primary agriculture such as plowing, tilling, and sowing. Farmers usually prefer this design of transmission because it does not require much maintenance and is reliable even in harsh environments, particularly in the countryside where precision repair shops are hard to find.

The Hydrostatic transmission segment is forecast to experience the highest CAGR between 2024 and 2032 owing to its sophistication and usability. Hydrostatic systems provide smoothness of operation, allow the operator to control the speed with better precision, and are best used in selected niches like landscaping, orchard farming, mowing, etc. Aggregated in these parameters it makes sense to users who want their operations to be efficient and comfortable. Hydrostatic transmissions are gaining traction in developed markets such as North America and Europe as customers are likely to invest in new technologies because of increased urbanization and high demand for multi-purpose tractors.

BY DRIVE TYPE

In 2023, Two-Wheel Drive (2WD) segment held the dominant market share of 58% higher than other types due to its price, simplicity, and appropriate use for smaller production Such tractors gain special market because developing economies and most importantly they are very cost-effective as well which is proved by the usage of small and marginal farmers. 2WD tractors are ideal for the job farm with light mechanization and on flat surfaces that only need basic jobs like plowing, sowing, moving, etc. Similarly, the cost-effective maintenance and better availability have made their foothold in price-sensitive regions such as Asia-Pacific and Africa.

The Four-Wheel Drive (4WD) segment is anticipated to register the highest CAGR over the forecast period ranging from 2024 to 2032 owing to the rising need for greater efficiency and more versatility. Because they are designed for heavy-duty use, 4WD tractors also feature superior grips and bodies, allowing for stability when working through difficult terrain, wet or heavy soils, and more difficult-to-bear weather conditions. The growth of this segment is attributed to the developed regions of North America and Europe, where farms are going for various sorts of machines for productivity. In addition to this, increasing orchard and vineyard farming, where 4WD ability is necessary for tight and uneven rows, is further stimulating the growth of the 4WD tractor market. The rapid growth of this segment is the result of the rapid transformation of layer farming due to the incorporation of precision farming tools.

BY VEHICLE TYPE

The agriculture segment accounted for the largest mini tractor market share of 58% in 2023, as mini tractors are extensively used for farming activities. Mini tractors are crucial for small-scale and medium-sized farms where tasks include plowing, planting, harvesting, and soil preparation require compact, cost-effective, and versatile equipment. The segment continues to be leading as mini tractors are capable of performing multiple operations which in turn increases productivity and decreases the manpower requirement. Furthermore, increasing mechanization and governmental initiatives for agricultural progress in developing countries (primarily in Asia-Pacific, and Latin America) add to the market share of the agriculture segment.

The snow-clearing segment is estimated to register the highest CAGR during the forecast period of 2024 to 2032, as it is widely utilized in cold climatic regions as an effective snow-boosting equipment, especially in North America and Europe. Mini tractors with snow clearing attachments (plows, blowers), which municipalities, property owners, and landscapers are also very interested in for driveway, road, and pathway clearing, are also finding markets. Climate change means these extreme winter weather events are occurring more often, and the need for snow-clearing mini tractors will continue to rise over the next few years. These machines combine a good tow-to-weight ratio, unbeatable usability, and low operational costs compared to bigger snow removal machines, making them perfect for these applications

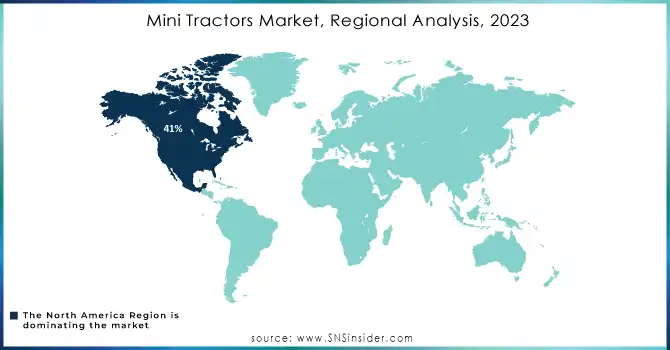

In 2023, North America accounted for 41% of the mini tractors market. Advanced agricultural equipment is very popular in this area, where mini tractors are now considered the best working option for farmers. As an example, one of the most famous manufacturers in North America John Deere lays out a group of mini tractors you will find for small farms and landscaping work. Apart from this, the U.S. government announces various subsidies and incentives, which in turn add to the number of mini tractors. Moreover, the growing adoption of mini tractors in urban areas by landscaping services for handling operations such as lawn care, snow clearing, and turf management is supplementing demand in the market. These, in turn, consolidate the largest market share of North America.

Asia Pacific is estimated to have the highest growing CAGR from 2024-2032, owing to the increase in agricultural mechanization in India, China, and Japan. Mini tractors are gaining traction in India with smallholder farmers increasingly choosing economical and versatile equipment suitable for plowing and tilling narrow fields. Ever heard of mini tractors? In case you might wonder, these are sold by firms like Mahindra & Mahindra and Sonalika Tractors, meant for small farms and equipped with highly powerful engines whilst easily maneuverable. Additionally, the demand for economical farming equipment in areas with smaller landholdings is expanding the size of the market. Likewise, in China, the government revamp of agriculture has led to higher investments in small-scale implementation, with the likes of Yanmar also establishing a presence across the region to meet the demand. Increasing urban farming and specialty crop production within the area is also driving the rapid growth of mini tractors

Some of the major players in the Mini Tractors Market are:

Mahindra & Mahindra Ltd. (Mahindra 265 DI, Mahindra 475 DI)

Deere & Company (John Deere) (John Deere 3025E, John Deere 5050E)

Kubota Corporation (Kubota L2501, Kubota B2301)

CNH Industrial N.V. (Case IH, New Holland) (New Holland Boomer 35, Case IH Farmall 50C)

AGCO Corporation (Massey Ferguson 1735M, Fendt 200 Vario)

Yanmar Co., Ltd. (Yanmar SA221, Yanmar YM1510)

Escorts Limited (Farmtrac 6060, Powertrac 445)

LS Mtron (LS XR3135, LS J202)

Branson Tractors (Branson 3520, Branson 2515)

Doosan Bobcat Inc. (Bobcat CT1025, Bobcat CT5558)

Tractors and Farm Equipment Limited (TAFE) (TAFE 45DI, TAFE 35DI)

Volvo Construction Equipment (Volvo L35G, Volvo EC950F Crawler Excavator)

Tong Yang Moolsan (TYM) (TYM T233, TYM T603)

Daedong Industrial Co., Ltd. (Kioti CS2220, Kioti RX7320)

Argo Tractors S.p.A. (Landini 4-080, McCormick X4)

Mahindra Tractors (USA) (Mahindra 2538, Mahindra 4540)

Kohler Co. (Kohler 7000 Series Engines, Kohler 6000 Series Engines)

Fendt (AGCO Corporation) (Fendt 200 Vario, Fendt 500 Vario)

HMT Limited (HMT 3522, HMT 5520)

SAME Deutz-Fahr (SDF Group) (SAME Solaris 45, Deutz-Fahr 5080 D)

In October 2024, Swaraj Tractors, part of the Mahindra Group, launched the new Target 625 model in two-wheel and four-wheel drive variants, aiming to boost its presence in India’s agricultural machinery market. This move is part of their strategy to strengthen market competition.

In August 2024, Kubota Tractor Corporation partnered with Kansas Speedway for the Kubota Tractor 200 race in the upcoming Truck Series. This collaboration aims to enhance Kubota's brand visibility and strengthen its connection with motorsports fans.

In October 2024, Yanmar America introduced a new range of tractors at Equip Expo 2024, including the debut of its most powerful U.S. model, the SM475, along with the SM240 and SM240H.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.62 Billion |

| Market Size by 2032 | USD 12.57 Billion |

| CAGR | CAGR of 4.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Outlook (Less Than 20 HP, 21 HP to 30 HP, 31 HP to 40 HP, 41 HP to 50 HP, 51 HP to 60 HP) • By Transmission (Hydrostatic, Mechanical) • By Drive Type (Two-Wheel Drive, Four-wheel Drive) • By Vehicle Type (Mowing, Agriculture, Snow, Clearing, Landscaping) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mahindra & Mahindra Ltd., Deere & Company, Kubota Corporation, CNH Industrial N.V., AGCO Corporation, Yanmar Co., Ltd., Escorts Limited, LS Mtron, Branson Tractors, Doosan Bobcat Inc., Tractors and Farm Equipment Limited (TAFE), Volvo Construction Equipment, Tong Yang Moolsan (TYM), Daedong Industrial Co., Ltd., Argo Tractors S.p.A., Mahindra Tractors (USA), Kohler Co., Fendt (AGCO Corporation), HMT Limited, SAME Deutz-Fahr (SDF Group). |

| Key Drivers | • Mini Tractors Gaining Popularity in Specialized Applications for Vineyards Orchards and Landscaping Growth • Advanced Technologies in Mini Tractors Boosting Efficiency Sustainability and Market Growth for Farmers |

| Restraints | • Challenges Hindering Mini Tractors Growth in Large-Scale Farming and Remote Regions |

Ans: The Mini Tractors Market is expected to grow at a CAGR of 4.33% during 2024-2032.

Ans: Mini Tractors Market size was USD 8.62 billion in 2023 and is expected to Reach USD 12.57 billion by 2032.

Ans: The major growth factor driving the Mini Tractors Market is the increasing demand for efficient, cost-effective farming equipment among small and medium-sized farms, supported by government initiatives promoting agricultural mechanization.

Ans: The Mechanical segment dominated the Mini Tractors Market in 2023.

Ans: North America dominated the Mini Tractors Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Mini Tractors Product Innovation and Adoption Rates (2023)

5.2 Mini Tractors Price Trends and Affordability Metrics (2023)

5.3 Mini Tractors Technological Adoption Rate

5.4 Mini Tractors Supply Chain and Raw Material Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Mini Tractors Market Segmentation, By Power Outlook

7.1 Chapter Overview

7.2 Less Than 20 HP

7.2.1 Less Than 20 HP Market Trends Analysis (2020-2032)

7.2.2 Less Than 20 HP Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 21 HP to 30 HP

7.3.1 21 HP to 30 HP Market Trends Analysis (2020-2032)

7.3.2 21 HP to 30 HP Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 31 HP to 40 HP

7.4.1 31 HP to 40 HP Market Trends Analysis (2020-2032)

7.4.2 31 HP to 40 HP Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 41 HP to 50 HP

7.5.1 41 HP to 50 HP Market Trends Analysis (2020-2032)

7.5.2 41 HP to 50 HP Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 51 HP to 60 HP

7.6.1 51 HP to 60 HP Market Trends Analysis (2020-2032)

7.6.2 51 HP to 60 HP Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Mini Tractors Market Segmentation, By Transmission

8.1 Chapter Overview

8.2 Hydrostatic

8.2.1 Hydrostatic Market Trends Analysis (2020-2032)

8.2.2 Hydrostatic Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Mechanical

8.3.1 Mechanical Market Trends Analysis (2020-2032)

8.3.2 Mechanical Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Mini Tractors Market Segmentation, By Drive Type

9.1 Chapter Overview

9.2 Two-Wheel Drive

9.2.1 Two-Wheel Drive Market Trends Analysis (2020-2032)

9.2.2 Two-Wheel Drive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Four-wheel Drive

9.3.1 Four-wheel Drive Market Trends Analysis (2020-2032)

9.3.2 Four-wheel Drive Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Mini Tractors Market Segmentation, By Vehicle Type

10.1 Chapter Overview

10.2 Mowing

10.2.1 Mowing Market Trends Analysis (2020-2032)

10.2.2 Mowing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Agriculture

10.3.1 Agriculture Market Trends Analysis (2020-2032)

10.3.2 Agriculture Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Snow Clearing

10.4.1 Snow Clearing Market Trends Analysis (2020-2032)

10.4.2 Snow Clearing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Landscaping

10.5.1 Landscaping Market Trends Analysis (2020-2032)

10.5.2 Landscaping Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Mini Tractors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.2.4 North America Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.2.5 North America Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.2.6 North America Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.2.7.2 USA Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.2.7.3 USA Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.2.7.4 USA Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.2.8.2 Canada Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.2.8.3 Canada Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.2.8.4 Canada Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.2.9.2 Mexico Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.2.9.3 Mexico Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.2.9.4 Mexico Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Mini Tractors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.1.7.2 Poland Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.1.7.3 Poland Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.1.7.4 Poland Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.1.8.2 Romania Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.1.8.3 Romania Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.1.8.4 Romania Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.10 turkey

11.3.1.10.1 Turkey Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Mini Tractors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.4 Western Europe Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.5 Western Europe Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.6 Western Europe Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.7.2 Germany Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.7.3 Germany Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.7.4 Germany Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.8.2 France Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.8.3 France Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.8.4 France Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.9.2 UK Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.9.3 UK Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.9.4 UK Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.10.2 Italy Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.10.3 Italy Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.10.4 Italy Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.11.2 Spain Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.11.3 Spain Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.11.4 Spain Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.14.2 Austria Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.14.3 Austria Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.14.4 Austria Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Mini Tractors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.4 Asia Pacific Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.5 Asia Pacific Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.6 Asia Pacific Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.7.2 China Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.7.3 China Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.7.4 China Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.8.2 India Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.8.3 India Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.8.4 India Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.9.2 Japan Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.9.3 Japan Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.9.4 Japan Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.10.2 South Korea Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.10.3 South Korea Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.10.4 South Korea Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.11.2 Vietnam Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.11.3 Vietnam Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.11.4 Vietnam Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.12.2 Singapore Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.12.3 Singapore Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.12.4 Singapore Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.13.2 Australia Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.13.3 Australia Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.13.4 Australia Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Mini Tractors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.1.4 Middle East Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.1.5 Middle East Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.1.6 Middle East Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.1.7.2 UAE Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.1.7.3 UAE Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.1.7.4 UAE Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Mini Tractors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.2.4 Africa Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.2.5 Africa Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.2.6 Africa Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Mini Tractors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.6.4 Latin America Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.6.5 Latin America Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.6.6 Latin America Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.6.7.2 Brazil Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.6.7.3 Brazil Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.6.7.4 Brazil Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.6.8.2 Argentina Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.6.8.3 Argentina Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.6.8.4 Argentina Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.6.9.2 Colombia Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.6.9.3 Colombia Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.6.9.4 Colombia Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Mini Tractors Market Estimates and Forecasts, By Power Outlook (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Mini Tractors Market Estimates and Forecasts, By Transmission (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Mini Tractors Market Estimates and Forecasts, By Drive Type (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Mini Tractors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12. Company Profiles

12.1 Mahindra & Mahindra Ltd

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Deere & Company (John Deere)

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Kubota Corporation

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 CNH Industrial N.V. (Case IH, New Holland)

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 AGCO Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Yanmar Co., Ltd.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Escorts Limited

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 LS Mtron

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Branson Tractors

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Doosan Bobcat Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Power Outlook

Less Than 20 HP

21 HP to 30 HP

31 HP to 40 HP

41 HP to 50 HP

51 HP to 60 HP

By Transmission

Hydrostatic

Mechanical

By Drive Type

Two-Wheel Drive

Four-wheel Drive

By Vehicle Type

Mowing

Agriculture

Snow Clearing

Landscaping

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automotive Intelligence Park Assist System Market size was valued at USD 10.93 billion in 2023 and is expected to reach USD 25.12 billion by 2031 and grow at a CAGR of 11.05% over the forecast period 2024-2031.

The Tire Pressure Monitoring System (TPMS) Market Size was valued at USD 7.3 Billion in 2023 and will reach USD 17.9 Bn by 2032, growing at a CAGR of 10.5% during the forecast period of 2024 -2032.

The Automotive Lightweight Material Market Size was valued at USD 82.68 Billion in 2023 and is expected to reach USD 128.02 Billion by 2032 and grow at a CAGR of 5.0% over the forecast period 2024-2032.

The Automotive Fender Market Size was USD 13.01 billion in 2023 and is expected to reach USD 28.07 Bn by 2032, growing at a CAGR of 8.94% by 2024-2032.

The LED Fog Lamp Market was valued at USD 1.3 Billion in 2023 and is expected to reach USD 4.7 Billion by 2032, growing at a CAGR of 15.24% from 2024-2032.

The Autonomous Trucks Market size is expected to reach USD 66.50 Bn by 2030, the market was valued at USD 29.80 Bn in 2022 and will grow at a CAGR of 10.6% over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone