Get more information on Milking Robots Market - Request Free Sample Report

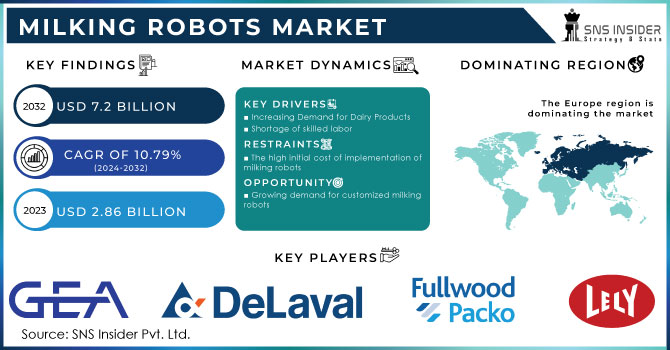

The Milking Robots Market Size was valued at USD 2.86 billion in 2023. It is estimated to grow to USD 7.2 billion by 2032 and grow at a CAGR of 10.79% over the forecast period of 2024-2032.

The milking robot market is set to experience significant growth, driven by the growing dairy sector according to the USDA’s Dairy Global Market Analysis report. The main reasons for this growth are rising milk output, expanding cheese needs, and lack of workforce. The report predicts that fluid milk production in Australia will rise by 1% in 2024, reaching 8.5 Billion tonnes, mostly because more workers are available and beef cattle prices are falling. Milk production in the United States is anticipated to grow by 1%, while cheese production is projected to rise by 2% to reach 466,000 tonnes, driven by an increase in demand. Processing capacity and higher milk output. The expected increase in cheese production is projected to raise exports by 8% to major markets such as Japan, China, Mexico, South Korea, and the Philippines. In addition, it is expected that the production of skim milk powder will increase by 11% to reach 1.30 Billion tonnes in 2024, while exports are projected to grow by 3% to 838,000 tonnes. These patterns together suggest a growing dairy sector, providing an ideal environment for the implementation of robotic milking devices. As dairy farms grow to keep up with increasing global demand, the importance of effective and automated milking solutions becomes more vital. Milking robots provide various benefits such as better milk quality, improved animal well-being, and reduced labor costs.

The growing worldwide dairy market offers a substantial chance for the milking robot market. The need for effective and automated milking solutions is increasing as annual milk production reached 881 Billion tonnes in 2019 and is expected to grow by just over 2% in 2021. The growing dairy industry, due to population increase, higher incomes, and shifting consumption habits, requires advanced technologies for improved productivity and animal well-being. With rising labor costs and shortages, milking robots are becoming a practical solution for the industry. Additionally, cow's milk production accounts for 81% of the global market with Asia emerging as the top region, indicating a significant potential market for milking robots in this industry. These factors together are responsible for the positive trajectory of growth in the milking robot market.

Drivers

Industry 4.0 serves as the main driver for the incorporation of milking robots into the market.

The rise of Dairy 4.0, a part of the larger Industry 4.0 movement, is a key factor in the growing use of milking robots. The dairy products industry is going through a significant change by incorporating technologies like robotics, artificial intelligence, and the Internet of Things. Milking robots, serving as a foundation for this transformation, provide numerous benefits. They boost operational efficiency by automation, enhance milk quality by minimizing human involvement, and facilitate real-time data collection for precision agriculture. In addition, the labor-intensive traditional milking methods, combined with rising labor expenses and deficiencies, create a strong appeal for milking robots. The significant roles played by countries such as China, Australia, the UK, India, and the USA in Industry 4.0 dairy research indicate that milking robots are poised for global adoption due to the advantages provided by Dairy 4.0 technologies.

Detecting subclinical mastitis early can accelerate the adoption of milking robots.

The urgent need for effective prevention strategies is emphasized by the estimated €100 opportunity cost per cow, showcasing the substantial economic losses caused by subclinical mastitis. Detecting and intervening early are essential in reducing the effects of this common condition. The research results show that machine learning models have the potential to forecast subclinical mastitis with reasonable accuracy up to 7 days in advance, even when data collection is less frequent, providing a hopeful solution to this issue. Robots that milk cows, which have high-tech sensors and data analysis abilities, are crucial for gathering and evaluating data needed for predictive models. Milking robots can offer beneficial information for early detection and intervention in cow health through continuous monitoring of parameters such as milk yield, composition, and somatic cell count, leading to improved herd health, higher productivity, and decreased antibiotic usage.

Restraints

Challenges in economy and policy are hindering the adoption of milking robots.

The dairy sector is encountering a combination of economic hurdles and regulatory demands that present substantial obstacles to implementing milking robots. Decreasing prices for milk at the farm, along with continuous inflation and increasing input expenses, are putting pressure on the profitability of dairy farmers. This decrease in the economy limits the funds for investing in state-of-the-art technologies such as milking robots. Moreover, the decreasing number of dairy cattle in areas such as New Zealand, along with the EU's initiatives to lower nitrogen emissions and promote the slaughter of dairy cows, cause an atmosphere of unpredictability and hinder investments in the long run. The suggested optional payment plan in Ireland may result in fewer herds and farm shutdowns, affecting the market for milking robots. Moreover, the change in product emphasis to premium items such as cheese, observed in areas like New Zealand and the EU, could lead to a preference for investing in equipment for cheese production rather than milking robots in the near future. The challenging landscape caused by these combined factors hinders milking robot manufacturers and the widespread adoption of this technology.

High levels of initial investment and challenges with technology serve as obstacles preventing the widespread implementation of automated machinery.

Even though there is a strong demand for automation in agriculture to combat labor shortages and increase efficiency, there are major obstacles preventing widespread implementation. The significant initial expenses of purchasing and installing sophisticated equipment pose a significant challenge for numerous companies, especially small and medium-sized businesses. In addition, incorporating these intricate systems into current processes necessitates specific skills that may be hard to find and costly. Challenges are also presented by technological limitations, including machines' capability to function efficiently in varied and uncertain surroundings. Furthermore, worries about losing jobs and the risk of accidents could cause opposition to automation from both employees and the general public. Conquering these challenges requires significant funding for research and development, along with specific support initiatives to help companies shift to automated processes.

Segment Analysis

By Robotic System Type

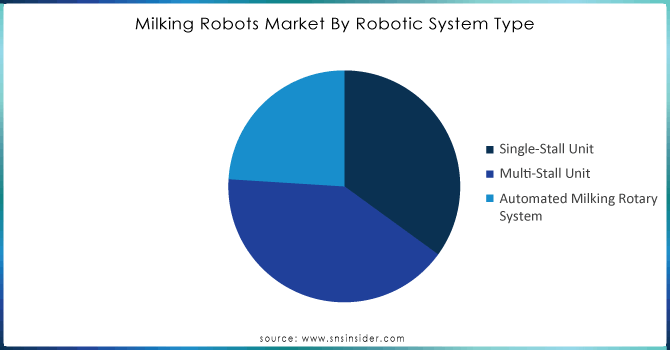

Based on Robotic System Type, Multi-Stall Unit dominated the Milking robots with 44% of share in 2023. This prevailing position is projected to persist in the upcoming years because of the increasing worldwide need for milk and dairy products. Multi-stall units are created to carry out the milking process at the same time for numerous cows, which speeds up operational processes and reduces expenses. Small and medium-sized enterprises (SMEs) prefer these units to quickly see a return on investment, lower capital expenses, and improve efficiency. For example, the Lely Astronaut A5 multi-stall system enables the simultaneous milking of several cows, resulting in higher efficiency and ensuring each cow is milked in line with its natural rhythm. This ability not only boosts milk output but also cuts labor expenses and enhances animal well-being. The multi-stall units' design, including automated teat cleaning, real-time milk quality analysis, and data-driven herd management systems, is appealing to dairy farmers seeking to update their operations. Farmers can meet the increasing consumer demand for dairy products and still be profitable by effectively handling more cows with less resources. The increasing capabilities of multi-stall units due to technological advancements are projected to lead to higher adoption rates, establishing them as a top choice in the milking robots market.

Need any customization research on Milking Robots Market - Enquiry Now

By Herd Size

Based on Herd Size, Above 1,000 dominated the milking robots with 40% of share in 2023. Robotic milking systems offer substantial benefits to large dairy farms, mainly by improving labor productivity and realizing cost reductions. Automating milking helps to minimize the necessity for a large workforce, which is advantageous due to the current shortage of labor on big farms. Using milking robots helps reduce the significant expenses related to recruiting, training, and keeping dependable workers by allowing for consistent milking without much human involvement. This process automation results in significant improvements in operational efficiency and cost savings. In the case of DeLaval, the Voluntary Milking System VMS™ V300 is created for effectively managing big herds, offering instant information and evaluation to enhance milk yield and herd well-being. Big farms gain advantages from these systems since they make the milking process more efficient, guarantee a consistent milk quality, and decrease the physical burden on farm employees. Another prominent illustration is the GEA Dairy Robot R9500, providing cutting-edge functions such as in-line milk analysis and automated teat preparation, meeting the requirements of extensive operations.

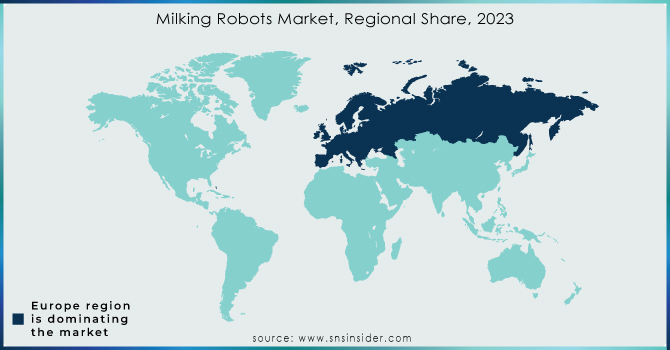

Europe hold the largest market for milking robots with 37% of share in 2023. The widespread use of automation in dairy farms throughout Western Europe has transformed the sector, greatly improving efficiency, productivity, and overall profitability for farmers. The use of milking robots comes with various advantages including higher milk production, better animal care, and lower labor expenses, making them a desirable option for dairy farmers. For example, the Lely Astronaut A5 and DeLaval VMS V300 are two automated milking systems that have gained popularity. The advantages of using milking robots are widely known. As per research conducted by the European Dairy Association, farms that utilize robotic milking systems have seen a rise in milk production of approximately 10-15% and a decrease in labor expenses of about 20-30%. For instance, the high labor costs in Germany have led dairy farmers to implement automated options in order to stay competitive and profitable within the EU. For instance, the Lely Astronaut A5 is created to offer farmers with insight based on data and improve operational efficiencies, resulting in significant labor savings and enhanced herd management.

Asia Pacific is fastest growing segment in milking robots with 29% of share in 2023. The significant expansion is mainly caused by the rising need for dairy items, driven by a growing population and changing dietary habits towards more dairy intake. To keep up with the growing need, dairy farms in the area are more and more using milking robots that make milking easier, cut labor expenses, and increase productivity. The trend towards updating agricultural practices is clear as automated systems are replacing traditional manual milking methods. Technologically advanced milking robots such as the GEA Dairy Robot R9500 and Lely Astronaut A5 improve productivity and ensure better hygiene and animal welfare, which are increasingly important to consumers. In countries such as China and India, the use of milking robots is increasing rapidly as dairy farms expand to keep up with rising consumer needs.

The major key players are GEA Group AG, DeLaval, Inc., Fullwood Ltd., Lely, BouMatic, Fullwood Packo, DAIRYMASTER, Hokofarm Group B.V., Milkwell Milking Systems, System Happel, and other key players mentioned in the final report.

In Feb 2023, DeLaval has planned to increase its production capacity of automatic milking machines by 50% in order to meet the growing customer demand.

In October 2023, Lely, the robot manufacturer, and Konrad Pumpe GmbH, the innovative specialist in plant engineering, united forces through an official partnership. Lely integrated Konrad Pumpe GmbH's dosing systems into their feed range, available via Lely Centers. This expanded Konrad Pumpe GmbH's reach and empowered Lely Centers to offer farmers enhanced capabilities with the Lely Vector feeding system.

In August 2023, GEA and Unilever teamed up to diminish greenhouse gas emissions (GHG) in dairy farming by deploying GEA's new manure enricher solution, ProManure E2950. In the initial phase, four units were installed on Dutch farms supplying Unilever with milk. Over a year, data from these systems was scrutinized to gauge their impact on Unilever's carbon footprint. This evaluation allowed Unilever and GEA to assess and expand the system's potential to substantially curb GHG emissions throughout the milk production process, thereby enhancing Unilever's sustainability along its value chain.

In June 2023, Fullwood JOZ extended its exclusive collaboration with Mueller, broadening its range to include cooling solutions for milking robots and traditional milking systems

| Report Attributes | Details |

| Market Size in 2023 | USD 2.86 Billion |

| Market Size by 2032 | USD 7.2 Billion |

| CAGR | CAGR of 10.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robotic System Type (Single-Stall Unit, Multi-Stall Unit, and Automated Milking Rotary System) • By Herd Size (Up to 100, Between 100-1,000, and Above 1,000) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | GEA Group AG, DeLaval, Inc., Fullwood Ltd., Lely, BouMatic, Fullwood Packo, DAIRYMASTER, Hokofarm Group B.V., Milkwell Milking Systems, System Happel |

| Key Drivers |

|

| Market Restraints |

|

Ans. The Milking Robots Market is to grow at a CAGR of 10.79 % Over the Forecast Period 2024-2032.

Ans. The Milking Robots Market size is valued at USD 2.86 Bn in 2023.

Ans: Milking robots are complex machines that require advanced technical knowledge for installation, operation, and maintenance. Farmers who lack the necessary expertise may find it challenging to adopt this technology. Moreover, the reliability of milking robots is crucial for uninterrupted milking operations. Any technical glitches or breakdowns can lead to significant losses for farmers.

Ans: The shortage of skilled labor in the dairy industry has led to increased adoption of milking robots. These machines eliminate the need for manual labor, allowing farmers to overcome labor shortages and maintain productivity.

Ans: Yes, you can ask for the customization as pas per your business requirement.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1Wafer Production Volumes, by Region (2023)

5.2Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Milking Robots Market Segmentation, by Robotic System Type

7.1 Chapter Overview

7.2 Single-Stall Unit

7.2.1 Single-Stall Unit Market Trends Analysis (2020-2032)

7.2.2 Single-Stall Unit Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Multi-Stall Unit

7.3.1 Multi-Stall Unit Market Trends Analysis (2020-2032)

7.3.2 Multi-Stall Unit Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Automated Milking Rotary System

7.4.1 Automated Milking Rotary System Market Trends Analysis (2020-2032)

7.4.2 Automated Milking Rotary System Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Milking Robots Market Segmentation, by Herd Size

8.1 Chapter Overview

8.2 Up to 100

8.2.1 Up to 100 Market Trends Analysis (2020-2032)

8.2.2 Up to 100 Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Between 100-1,000

8.3.1 Between 100-1,000 Market Trends Analysis (2020-2032)

8.3.2 Between 100-1,000 Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Above 1,000

8.4.1 Above 1,000 Market Trends Analysis (2020-2032)

8.4.2 Above 1,000 Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Milking Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.2.4 North America Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.2.5.2 USA Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.2.6.2 Canada Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Milking Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Milking Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.6.2 France Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain MILKING ROBOTS Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland MILKING ROBOTS Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria MILKING ROBOTS Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Milking Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.4.5.2 China Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.4.5.2 India Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.4.5.2 Japan Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.4.9.2 Australia Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Milking Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar MILKING ROBOTS Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Milking Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.2.4 Africa Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Milking Robots Market Estimates and Forecasts by Herd Size , (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Milking Robots Market Estimates and Forecasts, byRobotic System Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Milking Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.6.4 Latin America Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Milking Robots Market Estimates and Forecasts, by Robotic System Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Milking Robots Market Estimates and Forecasts, by Herd Size (2020-2032) (USD Billion)

10. Company Profiles

10.1 GEA Group AG

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 DeLaval, Inc.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Fullwood Ltd.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Lely

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 BouMatic

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Fullwood Packo

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 DAIRYMASTER

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Hokofarm Group B.V.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Milkwell Milking Systems

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 System Happel

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Robotic System Type

Single-Stall Unit

Multi-Stall Unit

Automated Milking Rotary System

By Herd Size

Up to 100

Between 100-1,000

Above 1,000

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Traction Transformer Market Size was valued at USD 1.42 Billion in 2023 and is expected to grow at a CAGR of 6.51% to reach USD 2.49 Billion by 2032.

The E-Paper Display Market Size was valued at USD 2.88 Billion in 2023 and is expected to reach USD 9.88 Billion by 2032 and grow at a CAGR of 14.72% over the forecast period 2024-2032.

The Crop Monitoring Market Size was valued at USD 3.05 billion in 2023 and is expected to grow at a CAGR of 15.04% to reach USD 10.71 billion by 2032.

The Intelligent Battery Sensor Market Size was valued at USD 7.31 Billion in 2023 and is expected to grow at 10.96% CAGR to reach USD 18.59 Billion by 2032.

The Cannabis Vape Market Size was valued at USD 5.06 Billion in 2023 and is expected to grow at a CAGR of 14.53% to reach USD 17.11 Billion by 2032.

The Robotic Vision Market Size was valued at USD 2.62 Billion in 2023 and is expected to grow at a CAGR of 9.13% to reach USD 5.73 Billion by 2032.

Hi! Click one of our member below to chat on Phone