To get more information on Military Software Market - Request Free Sample Report

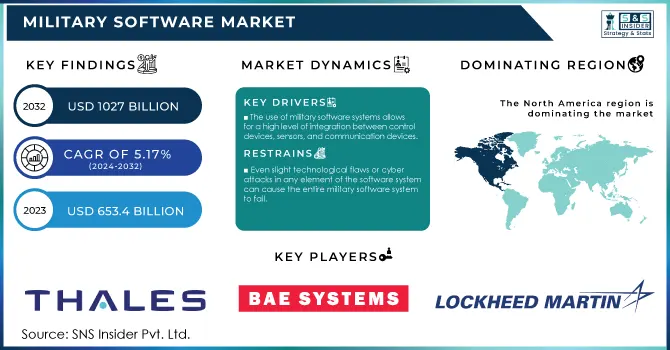

The Military Software Market Size was valued at USD 653.4 billion in 2023 and is projected to reach 1027 billion by the end of 2032, with a growing CAGR of 5.17% during the forecast period 2024-2032.

Defense forces from throughout the world use varied software into weapons and other systems used on land, marine, aerial, and space platforms. The use of software in systems based on these platforms has allowed for the development of more efficient military systems that are less susceptible to human error.

It has also resulted in higher synergy and improved battle system performance while requiring less maintenance. These military software applications include cybersecurity, logistics and transportation, target recognition, and battlefield healthcare.

The use of military software systems allows for a high level of integration between control devices, sensors, and communication devices. This is a primary driving force in the market for military software systems.

Furthermore, developing technologies such as the Internet of Things and artificial intelligence, as well as its incorporation into military software systems, have enabled battlefield communication considerably faster and clearer than ever before.

A slight technological glitch or a cyber-attack in any element of the software system might lead to the downfall of the entire Military software systems industry is the key constraint factor.

KEY DRIVERS

The use of military software systems allows for a high level of integration between control devices, sensors, and communication devices.

Emerging technologies such as the Internet of Things and artificial intelligence, as well as its incorporation into military software systems, have improved combat communication faster and clearer than ever before.

RESTRAINTS

Even slight technological flaws or cyber-attacks in any element of the software system can cause the entire military software system to fail.

OPPORTUNITIES

The market's constant need for novel items in all services creates a strong potential for profit.

The COVID-19 epidemic has had a significant impact on the global market for military software.

The COVID-19 epidemic delayed economic growth in practically all major countries, causing changes in consumer purchasing habits.

National and international travel have been hampered as a result of the lockdown applied in many nations, which has greatly disrupted the supply chain of numerous sectors around the world, consequently increasing the supply-demand gap.

As a result, a lack of raw material supply is likely to slow the manufacturing pace of military software, severely impacting market growth.

However, the situation is expected to improve as governments around the world begin to reduce regulations for resuming corporate operations.

Raytheon has created a virtual software factory to help speed up the creation of military software and aid in the development of counter-threat capabilities for the armed forces. The software factory is made up of actual coding areas, Cloud-based tools, and software professionals. It will strive to give new capabilities to the military as rapidly as possible.

The virtual software factory was created in response to military commanders' calls for a shift in how software is generated, similar to how the consumer technology industry does it. The factory will enable the corporation to use modern software development approaches such as Agile and DevOps across all of its applications.

Air force, army, and navy are the main segments for application. The sector army will drive the market's expansion at the fastest rate. The new battleground necessitates flawless and unambiguous communication. The army sector uses ground-based communications to relay vital information, allowing army units to stay informed about the state of the conflict.

The US army is already planning to deploy cutting-edge software to improve communication. As military equipment becomes more advanced, the nay segment is likely to contribute to market expansion during the forecast period. During the forecast period, the section air force will expand significantly. The US Air Force has also created a new GPS signal that army leaders would find extremely useful. Military Software Industry Trends tend to accelerate market expansion.

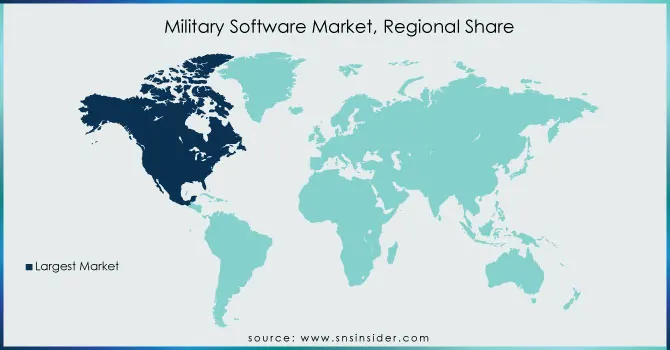

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa account for the majority of the military software market. North America has high-end main players, and technological innovation drives market expansion; as a result, it will control the military software market in 2023.

Because many military software suppliers are present in Europe, the military software market will rise. The continual terrorist attacks in China and India are driving market growth, which is expanding the Asia Pacific region's growth. It also increases military spending, which stimulates the expansion of the regional market.

Many significant firms are located in the Middle East and Asia, and as they invest in the military software business, the region's growth accelerates. The Brazilian army's requirement for increased border surveillance to defend the region will boost Latin American market growth. Military Software Market Forecast indicates that every region will have an impact on the market's growth.

Need any customization research on Military Software Market - Enquiry Now

KEY PLAYERS

The Key Players are Thales Group, IBM, Bae System, Soartech, Charles Corporation, Lockheed Martin, Raytheon Company, Northrop Grumman, General Dynamics, Nvidia & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 653.4 Billion |

| Market Size by 2032 | US$ 1027 Billion |

| CAGR | CAGR of 5.17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Learning & Intelligence, Advanced Computing, and AI Systems) • By Application (Information Processing and Cyber Security) • By Type (Command and Control, Military Messaging, Electronic Warfare) • By End Use (Army, Navy, Air Force) • By Platform (Land-based, air-based, naval) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thales Group, IBM, Bae System, Soartech, Charles Corporation, Lockheed Martin, Raytheon Company, Northrop Grumman, General Dynamics, Nvidia |

| DRIVERS | • The use of military software systems allows for a high level of integration between control devices, sensors, and communication devices. • Emerging technologies such as the Internet of Things and artificial intelligence, as well as its incorporation into military software systems, have improved combat communication faster and clearer than ever before. |

| RESTRAINTS | • Even slight technological flaws or cyber-attacks in any element of the software system can cause the entire military software system to fail. |

The sample for the Military Software Market report is available on the website upon request. To obtain the sample report, you can also use the 24*7 chat support and direct call services.

Market is projected to reach 1081 billion by the end of 2032, with a growing CAGR of 5.87% during the forecast period 2024-2032.

Thales Group, IBM, Bae System, Soartech, Charles Corporation, Lockheed Martin, Raytheon Company, Northrop Grumman, General Dynamics, Nvidia.

Manufacturers/Service provider, Consultant, Association, Research institute, private and universities libraries, Suppliers and Distributors of the product.

Yes, this report cover top down , bottom up Quantitative Research. Qualitative Research, Fundamental Research, data triangulation, ID’s & FGD’s Analytical research, And other as per report requirement.

The market's constant need for novel items in all services creates a strong potential for profit.

Even slight technological flaws or cyber-attacks in any element of the software system can cause the entire military software system to fail.

Emerging technologies such as the Internet of Things and artificial intelligence, as well as its incorporation into military software systems, have improved combat communication faster and clearer than ever before.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia war

4.3 Impact of ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Military Software Market, by Technology

8.1 Learning & Intelligence

8.2 Advanced Computing

8.3 AI Systems

9. Military Software Market, by Application

9.1 Information Processing

9.2 Cyber Security

10. Military Software Market, by Type

10.1 Command and Control

10.2 Military Messaging

10.3 Electronic Warfare

11. Military Software Market, by End Use

11.1 Army

11.2 Navy

11.3 Air Force

12. Military Software Market, by Platform

12.1 Land-based

12.2 air-based

12.3 naval

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 USA

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Germany

13.3.2 UK

13.3.3 France

13.3.4 Italy

13.3.5 Spain

13.3.6 The Netherlands

13.3.7 Rest of Europe

13.4 Asia-Pacific

13.4.1 Japan

13.4.2 South Korea

13.4.3 China

13.4.4 India

13.4.5 Australia

13.4.6 Rest of Asia-Pacific

13.5 The Middle East & Africa

13.5.1 Israel

13.5.2 UAE

13.5.3 South Africa

13.5.4 Rest

13.6 Latin America

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of Latin America

14. Company Profiles

14.1 Thales Group

14.1.1 Financial

14.1.2 Products/ Services Offered

14.1.3 SWOT Analysis

14.1.4 The SNS view

14.2 IBM

14.3 Bae System

14.4 Soartech

14. 5 Charles Corporation

14.6 Lockheed Martin

14.7 Raytheon Company

14.8 Northrop Grumman

14.9 General Dynamics

14.10 Nvidia

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technology

Learning & Intelligence

Advanced Computing

AI Systems

By Application

Information Processing

Cyber Security

By Type

Military Messaging

By End Use

Army

Navy

Air Force

By Platform

Land-based

air-based

naval

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Military Battery Market was valued at USD 1.14 billion in 2023 and is projected to reach USD 1.69 billion by 2032, growing at a CAGR of 4.4% over the forecast period of 2024-2032.

The Electric Ship Market size was valued at USD 3.90 billion in 2023 and is projected to reach USD 18.77 billion by 2032, growing at an impressive CAGR of 19.2% during the forecast period of 2024-2032.

The Hydrographic Survey Equipment Market Size was valued at USD 2.90 billion in 2022 and is expected to reach USD 4.35 billion by 2030 with a growing CAGR of 5.41% over the forecast period 2023-2030.

The Hypersonic Weapons Market size was valued at USD 6.7 Billion in 2023 & is estimated to reach USD 15.92 Billion by 2031 and increase at a compound annual growth rate (CAGR) of 11.2% between 2024 and 2031.

The Surveillance Radars Market Size was valued at USD 10.29 billion in 2023 and is expected to reach USD 20.40 billion by 2032 with a growing CAGR of 7.9% over the forecast period 2024-2032.

The Combat Management System Market Size was valued at US$ 378.6 million in 2023 and is expected to reach USD 520.9 million by 2032 with a growing CAGR of 3.61% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone