To get more information on Military and Aerospace Sensors Market - Request Free Sample Report

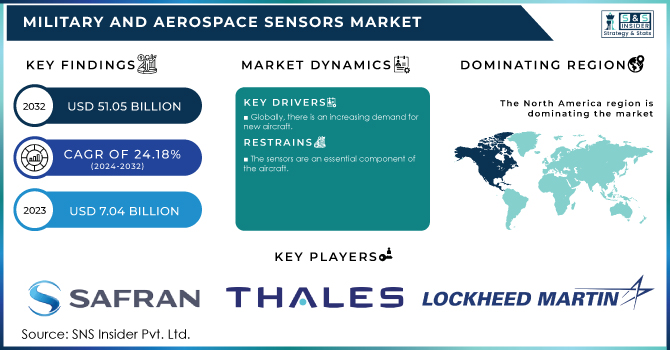

The Military and Aerospace Sensors Market size was USD 7.04 billion in 2023 and is expected to reach USD 51.05 billion by 2032 and grow at a CAGR of 24.18% over the forecast period of 2024-2032.

Many military and aeronautical systems rely heavily on sensors. Defense intelligence, surveillance, and reconnaissance equipment stationed on national borders or in remote places are linked via wireless networks that give real-time data from several sensors. Furthermore, for effective aircraft operation, new and advanced aircraft use sensors such as pressure sensors, temperature sensors, speed sensors, accelerometer, level sensors, flow sensors, gyroscopes, and radar sensors.

MARKET DYNAMICS

KEY DRIVERS

Sensor Technology Advances Continue

Globally, there is an increasing demand for new aircraft.

RESTRAINTS

The sensors are an essential component of the aircraft.

OPPORTUNITIES

The Internet of Things is becoming more popular in the aviation industry.

Military vessels are in high demand.

CHALLENGES

The number of passengers flying has increased.

IMPACT OF COVID-19

Components and raw materials needed to construct military sensors were not readily available. Due to travel restrictions and a labour scarcity, the supply chain is experiencing transportation-related delays. Production/assembly lines are also operating at reduced capacity or are totally shut down. Long-term market drivers for military sensors remain robust, and the industry has begun to show indications of recovery from the big market price reset before to the pandemic. The COVID-19 pandemic has ravaged the planet, leaving many sectors struggling to survive. Governments and companies interested in sensor technology are reacting differently to the new circumstances. Some product launches are taking place, while others are not; some testing are being conducted, while others have been postponed; and some businesses are still functioning, while others have closed.

The COVID-19 epidemic has caused supply chain and logistical difficulties throughout North America.

Airborne During the projection period, the airborne segment is expected to have the greatest CAGR. Sensors for unmanned aerial vehicles, Aero stats, and helicopters are used in airborne systems. Sensors attached on these platforms detect, record, and analyse events on the ground in real time. Land The segment dominated the market for military and aerospace sensors. For military organizations and surveillance agencies to obtain tactical intelligence, land-based systems employ radar, unmanned ground vehicles, unattended ground sensors, and target detection.

The naval segment is predicted to develop the most during the forecast period, owing to the rising use of marine communication, command, control, intelligence, and reconnaissance systems by military agencies around the world. Space During the projection period, the segment is predicted to increase steadily. Space-based systems include satellites that carry payloads and provide voice or data transmission as well as optical images. They are capable of communication, monitoring, and reconnaissance.

Intelligence and Reconnaissance: This sector led the military and aerospace sensors market. Intelligence and reconnaissance systems collect data from numerous sensors and analyse it to provide guidance and direction to commanders and aircraft operators.

Communication and navigation: This area is predicted to expand faster during the forecast period. Sensors are used by communication and navigation systems to provide proper communication, networking, and collaborative tools for effective communication and navigation.

Warfare Using Electronic Means During the projection period, this segment is expected to increase the most. Electronic warfare is a military activity in which electromagnetic energy is used to determine, exploit, reduce, or prevent the enemy's hostile usage of the electromagnetic spectrum. Furthermore, electronic warfare systems can detect difficult-to-detect naval vessels and stealth aircraft.

Control and command During the projection period, the segment is expected to increase steadily. Command and control systems use information from multiple sensors to plan, coordinate, and control military forces and assets.

By End-Use

OEM

Aftermarket

By Platform

Airborne

Land

Naval

Space

By Application

Intelligence & Reconnaissance

Communication & Navigation

Combat Operations

Electronic Warfare

Target Recognition

Command and Control

Surveillance & Monitoring

By Type

Pressure Sensors

Torque Sensors

Accelerometer

Level Sensors

Flow Sensors

Proximity Sensors

Gyroscopes

Radar Sensors

Magnetic Sensors

Others

REGIONAL ANALYSIS

North America controls the market for military and aerospace sensors. This trend is expected to continue during the forecast period due to the presence of prominent players such as Honeywell International Inc., Ametek, Inc., and Raytheon Company, as well as their significant investments in the development of military and aerospace sensors.

Europe The increased use of modern combat vehicles and aircraft by armed forces for tactical operations is likely to drive expansion in the European market over the study period.

Asia-Pacific During the forecast period, the market in this area is expected to expand at a rapid pace. Increasing defence spending in nations such as India and China, as well as increased demand for new aircraft, are driving regional market expansion.

Africa and the Middle East Defense spending increases in nations such as Saudi Arabia, the United Arab Emirates, and Israel are driving market expansion in the Middle East and Africa area.

South America The employment of combat vehicles and planes for information collection on drug trafficking and rebel groups, monitoring deforestation, and controlling illegal migration has increased in Latin America, which is projected to boost market expansion.

Need any customization research on Military and Aerospace Sensors Market - Enquiry Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

south Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The Major Players are Lockheed Martin Corporation, Safran Electronics & Defense, BAE Systems PLC, Ametek, Inc., Thales Group, Honeywell International Inc., TE Connectivity Ltd, Raytheon Company, General Electric Company, Ultra-Electronics, and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.04 Billion |

| Market Size by 2032 | US$ 51.05 Billion |

| CAGR | CAGR of 24.18% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Airborne, Land, Naval and Space) • By Application (Intelligence & Reconnaissance, Communication & Navigation, Combat Operations, Electronic Warfare, Target Recognition, Command and Control and Surveillance &Monitoring) • By End-Use (OEM and Aftermarket) • By Type (Pressure Sensors, Temperature Sensors, Torque Sensors, Speed Sensors, Accelerometer, Level Sensors, Flow Sensors, Proximity Sensors, Gyroscopes, Radar Sensors, Magnetic Sensors and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lockheed Martin Corporation, Safran Electronics & Defense, BAE Systems PLC, Ametek, Inc., Thales Group, Honeywell International Inc., TE Connectivity Ltd, Raytheon Company, General Electric Company, Ultra-Electronics, and other players. |

| Key Drivers | • Sensor Technology Advances Continue • Globally, there is an increasing demand for new aircraft. |

| Restraints | • The sensors are an essential component of the aircraft. |

Due to travel restrictions and a labour scarcity, the supply chain is experiencing transportation-related delays. Production/assembly lines are also operating at reduced capacity or are totally shut down.

North America, Europe, Asia-Pacific, The Middle East & Africa, Latin America are the major region cover.

The sample for the Military and Aerospace Sensors Market report is available on the website upon request. To obtain the sample report, you can also use the 24*7 chat support and direct call services.

Yes, this report cover top down , bottom up Quantitative Research.Qualitative Research, Fundamental Research, data triangulation, ID’s & FGD’s Analytical research, And other as per report requirement.

Manufacturers/Service provider, Consultant, Association, Research institute, private and universities libraries, Suppliers and Distributors of the product.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia War

4.3 Impact of Ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Military and Aerospace Sensors Market Segmentation, by End-Use

8.1 OEM

8.2 Aftermarket

9. Military and Aerospace Sensors Market Segmentation, by Platform

9.1 Airborne

9.2 Land

9.3 Naval

9.4 Space

10 .Military and Aerospace Sensors Market Segmentation, by Application

10.1 Intelligence & Reconnaissance

10.2 Communication & Navigation

10.3 Combat Operations

10.4 Electronic Warfare

10.5 Target Recognition

10.6 Command and Control

10.7 Surveillance & Monitoring

11. Military and Aerospace Sensors Market Segmentation, by Type

11.1 Pressure Sensors

11.2 Temperature Sensors

11.3 Torque Sensors

11.4 Speed Sensors

11.5 Accelerometer

11.6 Level Sensors

11.7 Flow Sensors

11.8 Proximity Sensors

11.9 Gyroscopes

11.10 Radar Sensors

11.11 Magnetic Sensors

11.12 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 USA

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 UK

12.3.3 France

12.3.4 Italy

12.3.5 Spain

12.3.6 The Netherlands

12.3.7 Rest of Europe

12.4 Asia-Pacific

12.4.1 Japan

12.4.2 South Korea

12.4.3 China

12.4.4 India

12.4.5 Australia

12.4.6 Rest of Asia-Pacific

12.5 The Middle East & Africa

12.5.1 Israel

12.5.2 UAE

12.5.3 South Africa

12.5.4 Rest

12.6 Latin America

12.6.1 Brazil

12.6.2 Argentina

12.6.3 Rest of Latin America

13. Company Profiles

13.1 Lockheed Martin Corporation

13.1.1 Financial

13.1.2 Products/ Services Offered

13.1.3 SWOT Analysis

13.1.4 The SNS view

13.2 Safran Electronics & Defense

13.3 BAE Systems PLC

13.4 Ametek, Inc.

13.5 Thales Group

13.6 TE Connectivity Ltd

13.7 Honeywell International Inc.

13.8 Raytheon Company

13.9 General Electric Company

13.10 Ultra-Electronics

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Aircraft Transparencies Market size was valued at USD 1.4 Billion in 2023 & is estimated to reach USD 2.3 Billion by 2030 with a growing CAGR of 5.77% Over the Forecast period of 2024-2032.

The Space Launch Services Market was valued at USD 20.4 billion in 2023 and is expected to reach USD 72.2 billion by 2032, growing at a CAGR of 15.04% over the forecast period of 2024-2032.

The Aviation Engine MRO Market Size was valued at USD 33.5 billion in 2023 and is expected to grow to USD 53.3 billion by 2032, achieving a compound annual growth rate (CAGR) of 5.32% over the forecast period of 2024 to 2032.

The Tactical Optics Market Size was valued at USD 11.34 billion in 2022 and is expected to reach USD 18.77 Billion by 2030 with a growing CAGR of 6.5% over the forecast period 2023-2030.

The Military and Aerospace Sensors Market size was USD 7.04 billion in 2023 and is expected to reach USD 51.05 billion by 2032 and grow at a CAGR of 24.18% over the forecast period of 2024-2032.

The Artificial Intelligence In Military Market Size was valued at US$ 9819.4 million in 2023, is expected to reach USD 39481.39 million by 2032, and grow at a CAGR of 16.72% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone