To Get More Information on Micro Mobile Data Center Market - Request Sample Report

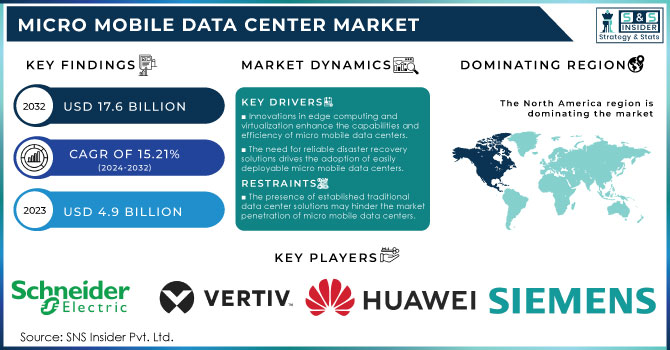

Micro Mobile Data Center Market was valued at USD 4.9 billion in 2023 and is expected to reach USD 17.6 Billion by 2032, growing at a CAGR of 15.21% from 2024-2032.

As more businesses seek flexible and efficient solutions for data storage and processing, the micro mobile data center market is experiencing remarkable growth. Functioning as miniature versions of traditional data centers, these self-contained portable units are perfect for disaster recovery scenarios, edge computing solutions, and time constrained situations. Increased demand for scalable IT infrastructure that can quickly adapt to changing business needs is one of the primary drivers boosting this market growth. Micro mobile data centers provided rapid deployment technology, allowing companies to continue with their operations. Demand for this market is also driven by its technological advancements. By enabling businesses to process data nearer the source of acquisition, edge computing capabilities facilitate both lower latency and faster response time. It is a very important feature for industries like manufacturing, healthcare, and transportation where real-time analysis of data are required. According to a new report, the health care industry is increasingly helping micro mobile data centers for telemedicine so that providers can get fast access and analysis of patient data in remote areas.

The growing focus on energy efficiency also drives the need for these solutions. With their reduced rack space, micro mobile data centers often consume lower power than traditional setups as well — complementing corporate environmental sustainability efforts. The micro mobile data center Market is expected to witness continuous expansion in the future due to the growing need for flexible IT deployments, development of new technology at a rapid rate, and energy efficiency. Deployment of this technology across different sectors provides real-world use cases highlighting its benefits, in turn driving the adoption of this technology in an array of other industries. For Instance, According to Reports, micro mobile data centers can reduce energy consumption by 20% to 40% compared to traditional data centers. This significant reduction supports organizations in achieving their sustainability goals.

Drivers

Innovations in edge computing and virtualization enhance the capabilities and efficiency of micro mobile data centers.

The need for reliable disaster recovery solutions drives the adoption of easily deployable micro mobile data centers.

The exponential growth of data from IoT devices and remote applications necessitates scalable data management solutions.

Some of the key drivers behind scalable data management solutions, and thus creating demand for micro mobile data center, is rapid growth of data generated from Internet of Things (IoT) devices and remote applications. As a larger number of devices get connected and they continuously stream massive amounts of data for processing, analysis, or storage to central servers, traditional systems used for managing this data often struggle to handle this influx. The answer to this concern lies in micro mobile data centers, which are able to deploy portable and modular units closer to where the data is generated. Such proximity will significantly reduce delays and response times-critical for real-time data analysis applications, which is needed in smart cities, industrial automation, and healthcare monitoring.

Moreover, micro mobile data centers are highly scalable which means that organizations can adjust their data management infrastructure in case of an increase in the amount of generated or gathered data without costly investments on permanent constructions. These solutions are flexible to adapt to cyclical workloads and seasonal changes allowing companies to scale their operations rapidly up or down in accordance with current needs. With increasing reliance on IoT, the industries need to store and process this volume of data as efficiently as possible. They not only provide solutions for these data management problems, but also enhance the operational efficiency of an organization by ensuring that they can rightly use data-driven insights. Therefore, they are very important in the transformation of data management solutions.

As data integrity and availability have become the need of the hour; increasing number of reliable disaster recovery solutions is one of the key factors responsible for accelerating growth in adoption of micro mobile data centers. Natural disasters, cyberattacks, and system malfunctions can significantly impact business processes and cause considerable data loss. To counteract these threats, organizations are increasingly aware of the necessity for a fully-fledged disaster recovery plan. Micro mobile data centers are especially efficient with disaster recovery because they can be moved and set up quickly. These units come in compact packages and can be deployed immediately to temporarily set up office, allowing businesses to get back on their feet shortly after a disaster. Micro mobile data centers can be quickly deployed to back up critical data and applications which – unlike traditional data center, are costly and take longer to set up — helps you avoid an outage.

In addition, the modular construction makes it easy to customize disaster recovery solutions for any organization. The companies can station micro mobile data centers in many places, which also helps to create a distributing network that strengthens the resilience and redundancy. This allows us even if one site faces any issues, we can easily take everything from other locations as it is running on different servers. Furthermore, the adoption of cutting-edge technology like real-time data replication and edge computing improves their utilization for disaster recovery. This ensures that data is synchronized and available which makes micro mobile data centers a valuable solution for enterprises wanting to safeguard their backbone assets with business continuity.

Restraints

The upfront investment for purchasing and setting up micro mobile data centers can be significant, deterring smaller businesses from adopting the technology.

Integrating micro mobile data centers with existing IT infrastructure can be technically challenging, requiring specialized knowledge and skills.

The presence of established traditional data center solutions may hinder the market penetration of micro mobile data centers.

Traditional data center solution are already well established which hinders the penetration of market for micro mobile data centers. For years, traditional data centers have formed the backbone of IT infrastructure for several organizations, providing stability, security and a large zoom to store data. The amalgam of these systems is often so tightly interwoven into the business architecture that it becomes extremely difficult to replace with latest alternatives such as micro mobile data centers. Micro mobile data centers are perceived as less stable and reliable than traditional data centers, so organizations may find it difficult to justify the investment. Furthermore, traditional infrastructure typically requires legacy investments and running costs, meaning that companies may resist due to a concern that implementation of micro mobile data centers will disrupt existing processes or undermine data security. Additionally, technically it can be hard to incorporate micro mobile data centers into already established setups. The subtle ambiguity surrounding differing protocols between existing systems drives uncertainty in their adoption, while the amount of re-training associated with litigation-oriented technology will simply act as a barrier against new technology adoption altogether.

However, the established position of conventional data centers may resist the acceptance of micro mobile data centers despite its many benefits including portability, fleetness and low latency. While addressing these challenges, communicating how micro mobile data centers can increase operational flexibility and adapt to evolving business requirements along with real-life successful examples of applied practices will help prepare the ground.

By Type

The 40-60 RU segment dominated the market in 2023, capturing over 43.2% share due to its substantial capacity to support larger facilities. Major players like Schneider Electric, Vertiv Group Corp., and IBM provide micro mobile data centers that accommodate more than 40 RU. In June 2022, Huawei unveiled its FusionCube micro data center solution, which integrates computing, storage, and networking capabilities. This solution includes advanced cooling technology and is designed for easy deployment in edge environments, optimizing energy consumption and reducing overall operational costs

On the other hand, the 20-40 RU segment is projected to grow at fastest CAGR during the forecast period. This growth is driven by the rising demand for compact micro mobile data centers that feature advanced capabilities such as board cooling, continuous UPS, and integrated storage systems. To meet this demand, various companies are introducing 20-40 RU micro mobile data centers. For example, In March 2024, Huawei introduced the FusionEdge Mini Data Center, designed to provide robust computing and storage capabilities in a compact form factor. This mini data center complies with NEMA and IP standards, ensuring high protection against dust and moisture, making it suitable for deployment in challenging environments.

By Industry Vertical

The government and defense sector dominated the market, accounting for over 28.3% of revenue in 2023, and is expected to sustain this lead throughout the forecast period. This segment's expansion is fueled by the increasing adoption of advanced technologies, such as 5G and AI, in government operations, along with a growing demand for mobile data centers in the defense sector. Numerous companies are now launching mobile micro data centers tailored specifically for government and defense applications. A notable example is Zella DC's introduction of the Zella Fort, a ready-to-use, self-contained data storage solution designed to cater to the specific requirements of the military.

In addition, the IT and telecom segment is forecasted to achieve the highest CAGR during the forecast period. This growth is largely attributed to the rising demand for micro mobile data centers in this sector, driven by improved data security and lower latency, which are expected to play a crucial role in market expansion in the years ahead.

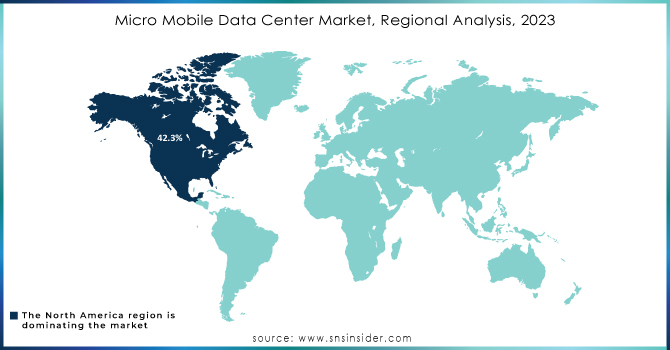

In 2023, North America dominated the market and accounting for a revenue share of more than 42.3%. This expansion can be ascribed to the widespread usage of complex technical systems and data centers across many industries, as well as to the early acceptance of cutting-edge technology. The main drivers of market expansion in this area are the early adoption of mini mobile data centers and significant expenditures in technological advances. Additionally, the growing use of mini mobile data centers in industries like BFSI, healthcare, and education helps to the expansion of the regional market.

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. The rise of the retail industry, which is expected to have a beneficial effect on the uptake of mini mobile data centers, can be ascribed to the market growth throughout the region. Additionally, it is anticipated that government initiatives like Digital India, which aims to make the country a digitally enabled nation, will encourage the growth of micro data centers in India.

Do You Need any Customization Research on Micro Mobile Data Center Market - Enquire Now

The major key players are

Schneider Electric - APC by Schneider Electric

Vertiv Group Corp. - Vertiv Power Systems

IBM Corporation - IBM Power Systems

Huawei Technologies Co., Ltd. - Huawei Smart Power

Dell Technologies - Dell Power Manager

Cisco Systems, Inc. - Cisco EnergyWise

EdgeConneX - EdgeConneX Power Management Solutions

Zella DC - Zella DC Power Management Systems

Micro Focus International - Micro Focus Power Management Solutions

NetApp, Inc. - NetApp Power Management Software

Fujitsu Limited - Fujitsu Power Management Solutions

Hewlett Packard Enterprise (HPE) - HPE Power Management Solutions

Rittal GmbH & Co. KG - Rittal Power Distribution Systems

Nlyte Software - Nlyte Power Management

Siemens AG - Siemens Power Management Solutions

Mproof - Mproof Energy Management Solutions

Supermicro Computer, Inc. - Supermicro Power Solutions

Acer Group - Acer Power Management Solutions

ScaleMatrix - ScaleMatrix Power Optimization Solutions

Centrica Business Solutions - Centrica Power Management Solutions

Power management solutions Supplier

APC by Schneider Electric

Vertiv Power Systems

IBM Power Systems

Huawei Smart Power

Dell Power Manager

Cisco EnergyWise

EdgeConneX Power Management Solutions

Zella DC Power Management Systems

Micro Focus Power Management Solutions

NetApp Power Management Software

Fujitsu Power Management Solutions

HPE Power Management Solutions

Rittal Power Distribution Systems

Nlyte Power Management

Siemens Power Management Solutions

Mproof Energy Management Solutions

Supermicro Power Solutions

Acer Power Management Solutions

ScaleMatrix Power Optimization Solutions

Centrica Power Management Solutions

Digital Realty launched Data Hub, integrating HPE GreenLake Colocation with PlatformDIGITAL. This combination on Digital Realty's global platform provides enterprises with an ideal setting to unify their data and utilize infrastructure on demand, enabling the extraction of trapped value and promoting innovation.

Schneider Electric enhanced its EcoStruxure IT data center infrastructure management software with automated sustainability reporting features powered by machine learning, enabling users to easily measure and report sustainability metrics and comply with regulations like the European Energy Efficiency Directive. This new reporting engine streamlines data analysis and empowers organizations to minimize their environmental impact.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.9 billion |

| Market Size by 2032 | US$ 17.6 billion |

| CAGR | CAGR of 15.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Up to 20 RU, 20-40 RU, 40-60 RU) • By Industrial Vertical (BFSI, IT & Telecom, Government & Defense, Oil & Gas, Manufacturing, Others) • By Organization Size (Small & Medium Enterprise, Large Enterprise) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric, Vertiv Group Corp.,IBM Corporation, Huawei Technologies Co., Ltd., Dell Technologies, Cisco Systems, Inc., EdgeConneX, Zella DC, Micro Focus International, NetApp, Inc. |

| Key Drivers | • Innovations in edge computing and virtualization enhance the capabilities and efficiency of micro mobile data centers. • The need for reliable disaster recovery solutions drives the adoption of easily deployable micro mobile data centers. • The exponential growth of data from IoT devices and remote applications necessitates scalable data management solutions. |

| Market Restraints | • The upfront investment for purchasing and setting up micro mobile data centers can be significant, deterring smaller businesses from adopting the technology. • Integrating micro mobile data centers with existing IT infrastructure can be technically challenging, requiring specialized knowledge and skills. • The presence of established traditional data center solutions may hinder the market penetration of micro mobile data centers. |

Ans- The Micro Mobile Data Center Market was valued at USD 4.9 billion in 2023 and is expected to reach USD 17.6 billion by 2032, growing at a CAGR of 15.21% from 2024-2032.

Ans- The Micro Mobile Data Center Market is expected to grow at a CAGR of 15.21% over the forecast period of 2024-2032.

Ans- In 2023, North America led the Micro Mobile Data Center Market, capturing a significant revenue share of 42.3%.

Ans- Innovations in edge computing and virtualization enhance the capabilities and efficiency, driving the growth of the Micro Mobile Data Center Market.

Ans- Some of the challenges facing the Micro Mobile Data Center Market are:

1) The upfront investment for purchasing and setting up micro mobile data centers can be significant, deterring smaller businesses from adopting the technology.

2) Integrating micro mobile data centers with existing IT infrastructure can be technically challenging, requiring specialized knowledge and skills.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Micro Mobile Data Center Market Segmentation, By Type

7.1 Chapter Overview

7.2 Up to 20 RU

7.2.1 Up to 20 RU Market Trends Analysis (2020-2032)

7.2.2 Up to 20 RU Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 20-40 RU

7.3.1 20-40 RU Market Trends Analysis (2020-2032)

7.3.2 20-40 RU Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 40-60 RU

7.4.1 40-60 RU Market Trends Analysis (2020-2032)

7.4.2 40-60 RU Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Micro Mobile Data Center Market Segmentation, by Industry Vertical

8.1 Chapter Overview

8.2 BFSI

8.2.1 BFSI Market Trends Analysis (2020-2032)

8.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 IT & Telecom

8.3.1 IT & Telecom Market Trends Analysis (2020-2032)

8.3.2 IT & Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Government & Defense

8.4.1 Government & Defense Market Trends Analysis (2020-2032)

8.4.2 Government & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Oil & Gas

8.5.1 Oil & Gas Market Trends Analysis (2020-2032)

8.5.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Manufacturing

8.6.1 Manufacturing Market Trends Analysis (2020-2032)

8.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Micro Mobile Data Center Market Segmentation, by Organization Size

9.1 Chapter Overview

9.2 Small and Medium-sized Enterprises

9.2.1 Small and Medium-sized Enterprises Market Trends Analysis (2020-2032)

9.2.2 Small and Medium-sized Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Large Enterprises

9.3.1 Large Enterprises Market Trends Analysis (2020-2032)

9.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Micro Mobile Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.2.4 North America Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.5 North America Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.2.6.2 USA Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.6.3 USA Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.2.7.2 Canada Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.7.3 Canada Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.8.3 Mexico Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Micro Mobile Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.6.3 Poland Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.7.3 Romania Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Micro Mobile Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.5 Western Europe Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.6.3 Germany Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.7.2 France Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.7.3 France Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.8.3 UK Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.9.3 Italy Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.10.3 Spain Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.13.3 Austria Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Micro Mobile Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.5 Asia Pacific Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.6.2 China Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.6.3 China Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.7.2 India Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.7.3 India Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.8.2 Japan Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.8.3 Japan Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.9.3 South Korea Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.10.3 Vietnam Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.11.3 Singapore Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.12.2 Australia Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.12.3 Australia Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Micro Mobile Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.5 Middle East Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.6.3 UAE Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Micro Mobile Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.2.4 Africa Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.2.5 Africa Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Micro Mobile Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.6.4 Latin America Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.5 Latin America Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.6.3 Brazil Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.7.3 Argentina Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.8.3 Colombia Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Micro Mobile Data Center Market Estimates and Forecasts, Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Micro Mobile Data Center Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Micro Mobile Data Center Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11. Company Profiles

11.1 Schneider Electric

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Vertiv Group Corp.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 IBM Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Huawei Technologies Co., Ltd

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Dell Technologies

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 NVIDIA Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Cisco Systems, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 EdgeConneX

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Zella DC

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Micro Focus International

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusio

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Up to 20 RU

20-40 RU

40-60 RU

By Industrial Vertical

BFSI

IT & Telecom

Government & Defense

Oil & Gas

Manufacturing

Others

By Organization size

Small & Medium Enterprise (SME)

Large Enterprise

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Multi-Access Edge Computing Market was valued at USD 3.40 billion in 2023 and is expected to reach USD 121.86 billion by 2032, growing at a CAGR of 48.95% from 2024-2032.

The Customer Relationship Management (CRM) Market was valued at USD 80.01 billion in 2023, will reach USD 248.48 billion and CAGR of 13.45% by 2032.

The Prescriptive & Predictive Analytics Market was valued at USD 20.80 billion in 2023 and is expected to reach USD 156.14 billion by 2032, growing at a CAGR of 25.13% over the forecast period 2024-2032.

Customer Intelligence Platform Market was valued at USD 2.5 billion and is expected to reach USD 22.1 billion by 2032, growing at a CAGR of 27.4% over 2024-2032

The Video Analytics Market size was valued at USD 8.12 billion in 2023 and is expected to reach USD 50.31 billion by 2032, growing at a CAGR of 22.51% over the forecast period of 2024-2032.

IT Professional Services Market was valued at USD 870.55 billion in 2023 and will reach USD 1983.82 billion by 2032, growing at a CAGR of 9.62% by 2032.

Hi! Click one of our member below to chat on Phone