Get more information on Microduct Market - Request Sample Report

The Microduct Market Size was valued at USD 5.21 Billion in 2023 and is expected to reach USD 13.63 Billion by 2032 and grow at a CAGR of 11.30% over the forecast period 2024-2032.

The microduct market is experiencing robust growth, driven by the escalating demand for high-speed data transmission and the need for advanced network infrastructure. A primary catalyst for this expansion is the global shift towards digital transformation, a trend that has become a top priority for 74% of organizations in 2024. Notably, 77% of companies have embarked on their digital transformation journey, although only 35% report success in achieving their goals. With over 5.35 billion internet users worldwide, the adoption of digital technologies by businesses, governments, and residential sectors is fueling the demand for fiber-optic networks, creating a steady growth for the microduct market.

The growing reliance on mobile devices, cloud computing, and video streaming services has significantly driven the demand for high-capacity, low-latency networks. Microducts play a pivotal role in supporting these advanced networks by facilitating the efficient deployment of dense fiber-optic cables in both urban and rural environments. Their flexible design enables optimal use of underground and aerial spaces, making them ideal for a wide range of applications. Moreover, microducts are becoming increasingly essential in supporting the Industrial Internet of Things (IIoT), enabling seamless connectivity for machines, sensors, and systems. This stable communication network enhances operational efficiency, particularly in manufacturing and other industrial sectors, fueling further growth in the microduct market.

Drivers

Microducts play a crucial role in housing and protecting fiber optic cables, enabling efficient installation and maintenance, driving the market growth.

Substantial investment in fiber optic deployment is driven by the increasing need for high-speed broadband services in urban, suburban, and rural areas. Countries and corporations globally are actively deploying fiber networks as a component of nationwide broadband initiatives. For instance, projects such as the European Commission's "Digital Decade" seek to achieve universal gigabit connectivity by 2030, generating the continuous need for microduct infrastructure. Furthermore, the rise of 5G and IoT ecosystems necessitates strong backhaul support, which also calls for the installation of fiber optics with microduct solutions. Microduct systems offer flexibility, scalability, and cost-effectiveness through gradual installations, which is crucial in heavily populated urban areas which drive the market growth. These systems are not heavy, simple to set up and work well with air-blown fiber deployment to allow for fast and effective network growth. To meet growing data traffic needs, telecommunication companies are set to experience strong growth in the microduct market as they work on enhancing their current infrastructure.

The cost-effectiveness and reduced installation time that microduct systems offer are key factors driving the market.

The increasing need for fiber optic networks has led to the use of microduct technology, offering a more efficient and cost-friendly alternative to traditional fiber optic installation methods. Conventional methods frequently involve a lot of excavation, leading to expensive expenses and time setbacks. On the other hand, microducts are tiny, pliable tubes that can be put in place with little disturbance, leading to notable labor cost savings and quicker deployment. This is particularly advantageous for telecom operators and service providers who require rapid network expansion without incurring high costs. Furthermore, microduct systems provide excellent adaptability, enabling simple modifications to accommodate current capacity requirements and expand as demand grows. This flexibility guarantees that infrastructure investments are used efficiently, avoiding unnecessary construction, and reducing initial installation expenses. The capacity to expand fiber optic networks slowly to meet changing technological demands is a crucial benefit in the rapid digital landscape of today.

Restraints

The microduct market is subject to a variety of regulatory challenges that can hinder growth.

Various regions have distinct codes, standards, and regulations for telecommunications infrastructure installation, and microducts may not align with all market requirements. At times, government regulations may support conventional installation methods or place limitations on the use of specific materials, potentially hindering the widespread use of microducts. Furthermore, obtaining regulatory approvals for fiber optic network installations, such as microducts, may involve a long and complicated procedure. Local authorities might demand thorough planning and environmental evaluations before authorizing permits for such undertakings, potentially leading to delays in implementation and higher expenses. These regulations can impede the fast deployment of microduct systems and the expansion of fiber optic networks for companies.

by Type

The flame retardant segment dominated with a 45% market share in 2023. These microducts are created to withstand fire, guaranteeing safety in settings at high risk, like data centers, office buildings, and transportation hubs. Their improved insulation and fire-resistant materials are crucial for ensuring continuous network operations in regions prone to fire hazards. Primary uses involve structured cabling for extensive telecom and IT endeavors. Companies like Corning and Hexatronic supply flame retardant microducts for data centers and urban infrastructure projects, where strict safety regulations are enforced.

The direct installation segment is projected to have the fastest CAGR from 2024 to 2032 because of its easy deployment and cost efficiency. These small ducts are created for quick installation in different landscapes, reducing the need for digging and allowing for faster deployment of fiber-optic cables. The ducts' flexibility and durability lower installation expenses and time, which is why they are favored in fast-developing areas such as Asia-Pacific and Africa. Prysmian Group and Emtelle are examples of companies that offer telecom operators direct installation of microducts to help them expand their fiber networks more efficiently.

by Application

FTTX (Fiber to the X) segment dominated the microduct market in 2023 with a 56% market share, as a result of the increasing worldwide need for high-speed internet and connectivity. These networks utilize microducts to protect optical fibers that link end-users with core telecommunication infrastructure, improving internet speeds and dependability. The growth of smart homes, IoT devices, and 5G deployments has increased the use of FTTX, especially in cities. For instance, Corning's ClearCurve microducts are commonly utilized in Fiber-to-the-Home (FTTH) setups to guarantee efficient fiber management that saves money and space.

The data centers segment is going to be the fastest-growing segment during the forecast period 2024-2032, due to the increasing need for data centers, which is being fueled by the rising popularity of cloud services, AI applications, and edge computing. Microducts play a vital role in the organization and protection of high-density optical fiber cables in data centers, guaranteeing fast data transfer and minimal latency. Nexans and Emtelle are examples of companies that focus on serving this market by offering specialized products, including high-capacity microduct bundles designed for fiber management in large data centers.

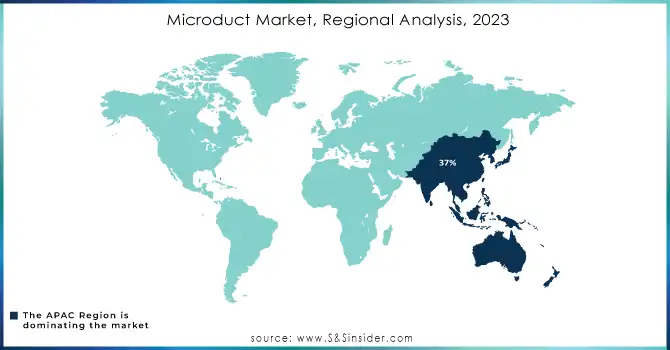

In 2023, APAC led the microduct market with a 37% market share, fueled by fast urban growth and widespread fiber optic network rollouts in nations such as China, India, and Japan. Governments in this area have been actively backing digital transformation projects like the 5G rollout in China and the BharatNet project in India, which heavily depend on microduct systems for effective fiber installations. For example, Emtelle and Hexatronic Group are major players in the APAC region, with their microducts being commonly utilized for telecommunications and broadband purposes.

North America is going to witness the fastest growth rate during 2024-2032, due to advancements in 5G infrastructure and growing investments in rural broadband connectivity. Government efforts in the United States, like the Rural Digital Opportunity Fund, are speeding up the installation of fiber optics and increasing the need for microduct solutions. The increase in smart home technologies, IoT applications, and data centers in Canada and the U.S. also adds to this expansion. Companies like Prysmian Group and Dura-Line play a crucial role in providing microducts for telecom operators and data centers.

Need any customization research on Microduct Market - Enquiry Now

Key Players

The major players in the Microduct Market are:

Emtelle Holdings Ltd (Emtelle RDB Microducts, Emtelle Blown Fibre Tubing)

Primo (Multi-microducts, Customized Microduct Solutions)

Hexatronic Group AB (Hexatronic Stingray Microducts, Hexatronic Air Blown Micro Cables)

Prysmian Group (Prysmian Multiway Microduct, Prysmian Retractanet Microduct)

Datwyler IT Infra. (Datwyler Multi-layer Microducts, Datwyler Fire Retardant Ducts)

Egeplast International GmbH (Egeplast Microduct-HDPE, Egeplast Multilayer Pipe Systems)

Clearfield Inc. (FieldShield Microduct, Clearview Cassettes with Microduct Technology)

Spur AS (Spur Multi-Microducts, Spur Single Microduct Systems)

GM Plast A/S (GM Blown Microducts, GM Multi Duct HDPE)

Belden Inc. (Belden Microduct Cable, Belden FiberExpress Microducts)

Rehau Group (RAU-Therm Microducts, RAU-Microcable Systems)

Dura-Line (FuturePath Microducts, Dura-Line Standard HDPE Microducts)

KNET (Micro Duct Assemblies, Flexible Mini Microducts)

Opterna (Opterna Microduct Cable Solutions, Opterna Single Microducts)

Fibrain (Fibrain MICRO-D HDPE Ducts, Fibrain Blowable Fiber Microducts)

Exel Composites (Exel Telecom Microducts, Lightweight Microduct Tubes)

Blue Diamond Industries (BDI Microduct Bundles, BDI Flame Retardant Microducts)

Draka Communications (Draka JetNet Microduct, Draka Blown Fiber Solutions)

Acome (Acome Microduct Solutions, Acome Low-friction Microducts)

Polieco Group (Polieco HDPE Microducts, Polieco Specialty Ducts)

Suppliers for Raw Materials/Components

Borealis AG (Polyethylene for microducts)

Sabic (Advanced polymers)

LyondellBasell (Polymer solutions for microduct manufacturing)

ExxonMobil Chemical (HDPE resins)

INEOS Olefins & Polymers (High-performance plastics)

DuPont (Specialized additives for durability)

Clariant (Color masterbatches for duct markings)

Evonik Industries (Flame retardant additives)

3M (Cable lubrication solutions)

BASF (UV stabilizers and impact modifiers for plastics)

Recent Development

October 2024, KEZAD Group and Emtelle, a producer of fiber-optic and microduct solutions, revealed the inauguration of Emtelle's new USD 50 million global innovation and manufacturing center in KEZAD Area A (KEZAD Al Ma'mourah).

August 2023, Prysmian announced two events--Fiber Connect 2023 and the ISE EXPO 2023 shows--to unveil a new range of fiber optic cable and connectivity products targeted at major and remote broadband providers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.21 Billion |

| Market Size by 2032 | USD 13.63 Billion |

| CAGR | CAGR of 11.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Direct Install, Direct Burial, Flame Retardant) • By Application (FTTX Networks, Access Networks, Backbone Networks, Data Center, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emtelle Holdings Ltd, Primo, Hexatronic Group AB, Prysmian Group, Datwyler IT Infra., Egeplast International GmbH, Clearfield Inc., Spur AS, GM Plast A/S, Belden Inc., Rehau Group, Dura-Line, KNET, Opterna, Fibrain, Exel Composites, Blue Diamond Industries, Draka Communications, Acome, Polieco Group |

| Key Drivers | • Microducts play a crucial role in housing and protecting fiber optic cables, enabling efficient installation and maintenance, driving the market growth. • The cost-effectiveness and reduced installation time that microduct systems offer are key factors driving the market. |

| RESTRAINTS | • The microduct market is subject to a variety of regulatory challenges that can hinder growth. |

Ans: Microducts play a crucial role in housing and protecting fiber optic cables, enabling efficient installation and maintenance.

Ans: Microduct Market size was USD 5.21 Billion in 2023 and is expected to Reach USD 13.63 Billion by 2032.

Ans: APAC dominated the Microduct Market in 2023.

Ans: The Flame retardant segment dominated the Microduct Market.

Ans: The Microduct Market is expected to grow at a CAGR of 11.30% during 2024-2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Microduct Production Volumes, by Region (2023)

5.2 Microduct Design Trends (Historic and Future)

5.3 Microduct Adoption Metrics (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Microduct Market Segmentation, by Type

7.1 Chapter Overview

7.2 Direct Install

7.2.1 Direct Install Market Trends Analysis (2020-2032)

7.2.2 Direct Install Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Direct Burial

7.3.1 Direct Burial Market Trends Analysis (2020-2032)

7.3.2 Direct Burial Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Flame Retardant

7.4.1 Flame Retardant Market Trends Analysis (2020-2032)

7.4.2 Flame Retardant Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Microduct Market Segmentation, by Application

8.1 Chapter Overview

8.2 FTTX Networks

8.2.1 FTTX Networks Market Trends Analysis (2020-2032)

8.2.2 FTTX Networks Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Access Networks

8.3.1 Access Networks Market Trends Analysis (2020-2032)

8.3.2 Access Networks Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Backbone Networks

8.4.1 Backbone Networks Market Trends Analysis (2020-2032)

8.4.2 Backbone Networks Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Data Center

8.5.1 Data Center Market Trends Analysis (2020-2032)

8.5.2 Data Center Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Microduct Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Microduct Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Microduct Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Microduct Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Microduct Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Microduct Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Microduct Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Microduct Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Microduct Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Emtelle Holdings Ltd

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Primo

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Hexatronic Group AB

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Prysmian Group

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Datwyler Holding Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Egeplast International GmbH

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Clearfield Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Belden Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Rehau Group

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Blue Diamond Industries

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Direct Install

Direct Burial

By Application

FTTX Networks

Access Networks

Backbone Networks

Data Center

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Smart Set-Top Box Market Size was valued at USD 32.69 billion in 2023 and is expected to grow at a CAGR of 9.2% to reach USD 66.30 billion by 2032.

The Ultrafast Laser Market Size was valued at USD 1.87 billion in 2023 and is expected to grow at a CAGR of 16.94% to reach USD 7.54 billion by 2032.

The Thermal Imaging Market Size was valued at USD 5.94 Billion in 2023 and is expected to grow at a CAGR of 7.67% to reach USD 11.54 Billion by 2032.

The AI Infrastructure Market Size was valued at USD 36.35 billion in 2023 and is expected to grow at a CAGR of 29.06% to reach USD 360.59 billion by 2032.

The Machine Condition Monitoring Market size was valued at USD 2.61 Billion in 2023. It is estimated to reach USD 5.27 Billion at a CAGR of 8.14% by 2032

The Barcode Label Printer Market Size was valued at USD 3.08 Billion in 2023 and is expected to grow at a CAGR of 5.57% to reach USD 5.01 Billion by 2032.

Hi! Click one of our member below to chat on Phone