Metrology Services Market Report Scope & Overview:

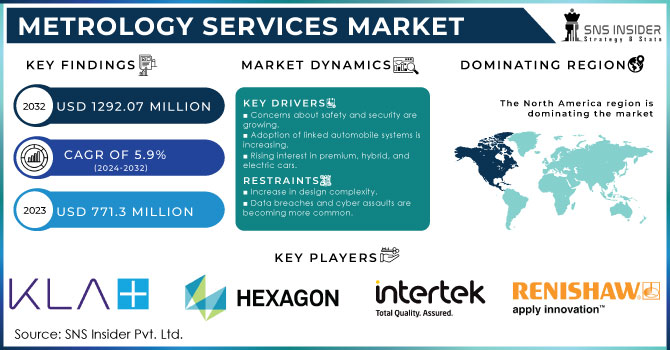

The Metrology Services Market was valued at USD 817.77 million in 2023 and is expected to reach USD 1370.14 million by 2032, growing at a CAGR of 5.95% over the forecast period 2025-2032. The increasing adoption of Metrology Services across various industries, from automotive, and aerospace to manufacturing, is attributed to the growing need for precision and regulatory compliance. Prices tend to vary with the nature of service and technology advancement, and hence the complexity of a given service. Lead time and turnaround time are important metrics, as most industries are focused on getting things done quickly and providing service at the right time to keep the production schedules on track. With the need of demand driven by the evolution of the industry, technology-based performance indicators such as AI, digital twin, and automation ensure that metrology services provide accuracy, efficiency, and reliability.

To get more information on Metrology Services Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Precision Measurement and Industry Advancements Drive Growth in Metrology Services Market with Automation and Innovation

The increasing requirement for precision measurement in industries such as automotive, aerospace, and electronics is fuelling the metrology services market growth. Increasing mergers and acquisitions due to market consolidation and implementation of Industry 4.0 along with advancements in automation and 3D scanning are anticipated to drive the X-ray inspection market expansion. Increasing complexity in manufacturing processes and stringent quality control regulations are pressuring businesses to adopt sophisticated metrology solutions. Findings also note inline inspection and the use of cloud-based metrology software increase data efficiency and accuracy.

Restrain:

-

Overcoming Challenges in Extreme Environments Data Security and Accuracy in Advanced Metrology Solutions for Industries

For many industries including aerospace and power generation, conventional metrology tools will not work under extreme conditions requiring precision measurement in high-temperature, high-pressure, or corrosive environments. In addition, although the utilization of non-contact measurement technologies is ever-present achieving high accuracy on complex geometries and reflective surfaces is notoriously challenging. Another issue is the data security in digital metrology because this kind of service needs to transfer and/or store sensitive manufacturing information. Cybersecurity and data breach prevention are still a must even among companies that leverage cloud-based or AI-assisted metrology solutions.

Opportunity:

-

Cloud-Based AI Technologies and Emerging Applications Drive Growth in Metrology Services for High-Precision Markets

With the proliferation of cloud-based metrology services and the increased adoption of AI-powered capabilities that guide predictive maintenance and data-based decision-making, opportunities within the market are increasing. Various applications using optical and noncontact measurement technologies are rapidly growing in high-precision markets, particularly for medical devices and renewable energy, which offers substantial growth opportunities. Rapid industrialization and infrastructure development needs in emerging markets, especially in the Asia-Pacific, are also fueling demand. In addition, the increasing demand for electric vehicles (EVs) and self-driving car technologies is establishing new applications for metrology services in areas such as battery production, sensor calibration, and vehicle part inspection, the market outlook remains favorable over the long term.

Challenges:

-

Integration Challenges Expertise Gap and Training Deficiencies Hinder Growth of Advanced Metrology Services in Industries

Complexities associated with integrating these advanced measurement technologies into existing manufacturing workflows have become a challenge for metrology services and thus are expected to hamper the growth of the market. In many industries, legacy systems are maintained, which makes it complex to implement modern metrology solutions in a high degree of seamless manner. Management problems across software and hardware platforms only make matters worse. Another enormous problem is the so-called expertise gap – there do not exist enough professionals who can operate and interpret the metrology data. With the change in metrology technologies, extensive training and experience will be needed, which leads to a shortage of qualified personnel in the field. Such a shortage can result in more measurement inaccuracies, sub-optimal data analytics, and poor decision-making within industries.

Segment Analysis

By Product

Coordinate Measuring Machines dominated the market with 63.6% of the share in 2023, owing to the large number of applications in the high-precision measurement industry. The versatility of CMMs with dimensional inspection with affordability, precision, and repeatability is advantageous and beneficial for sectors like automotive, aerospace, and industrial manufacturing. They can measure complex geometries and provide excellent quality assurance through contact-based probing methods, therefore are the go-to choice for traditional applications and large-scale production environments. Furthermore, the launch of software integration along with automation and multi-sensor upgradation also has strengthened the position of CMMs in the market.

Optical Digitizers and Scanners are also projected to experience the highest CAGR from 2024 to 2032 as they offer a non-contact method, and faster, and instantaneous measurement solutions. ODS allows for fast capturing of complex geometries with 3D scanners (particularly laser-based and structured light) for use cases such as reverse engineering, 3D modeling, and additive manufacturing. The scanners can capture millions of data points quickly and with very little contact with the surface, which reduces the turn-around times and enhances efficiency. Because of the pivoting of industries towards automation, in-line metrology, and digital twin applications, ODS is expected to see rapid growth and adoption, outpacing growth for traditional CMMs.

By Application

The automotive sector was the largest in the metrology services market, accounting for 46.2% of the global market in 2023, as the automotive industry is characterized by a high requirement for precise measurements related to vehicle manufacturing, quality control, and safety compliance. In the Automotive sector, both OEMs and suppliers depend on advanced metrology solutions such as Coordinate Measuring Machines (CMM) and Optical Digitizers & Scanners (ODS) to ensure part accuracy, reduce defects, and comply with regulatory requirements. Backed by the rise of electric vehicles (EV) and autonomous driving technologies, the need for accurate inspection of batteries, sensors, and lightweight materials has grown. Meanwhile, the automotive sector has further reinforced its position through production line automation and inline metrology solutions.

The aerospace industry has also been predicted to grow with the highest compound annual growth rate (CAGR) in the forecast period from 2024 to 2032 owing to the rising demand for high-precise measurement in airplane manufacturing, maintenance, and inspection processes. Laser Scanning of Aerospace Components Aerospace components such as turbine blades, fuselage structures, and engine parts are often critically defined by extremely tight tolerances and complex geometries, necessitating the best in advanced non-contact and 3D scanning technologies. Further strengthening the demand for metrology markets is the growth in commercial air travel increasing defense budgets; and the rise in the use of additive manufacturing in aircraft manufacturing. Since aerospace companies are primarily concentrating on automation and lightweight materials and digital twin technology via 3D scanning, these metrology services in the aerospace segment are expected to grow significantly.

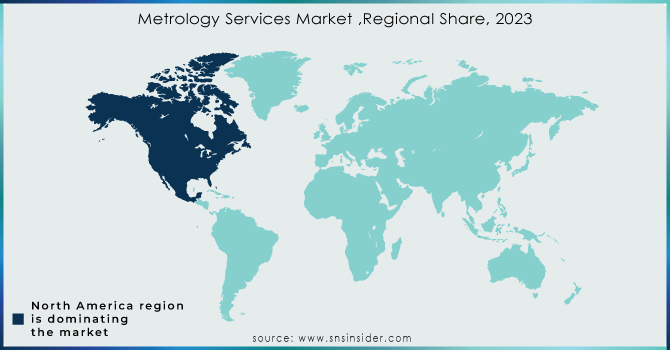

Regional Analysis

North America was the highest contributor to the metrology services market with a 35.2% share in 2023 owing to industries such as aerospace, automotive, and semiconductor manufacturing being widely present in the region. The demand for advanced metrology solutions in the region is driven by existing infrastructure in the region, high automation investment, and rigorous quality standards. For instance, Boeing and Lockheed Martin use coordinate measuring machines (CMM) and optical digitizers for aircraft component inspection to test for precision and safety compliance. Similarly, in the U.S. semiconductor sector, led by the likes of Intel and Texas Instruments, high-precision metrology tools are used to hold tight tolerances during chip manufacture for efficient production.

Asia-Pacific is projected to register the highest CAGR over the forecast period (2024 —2032) owing to the booming industrialization, substantial inflow of foreign investments, and thriving manufacturing sectors in China, India, Japan, and South Korea. Inline metrology and 3D scanning solutions for production enhance the quality of production and their adoption is increasing in the automotive industry in China, with companies like BYD and Geely Moreover, semiconductor fabrication and precision components business activity are driving demand for metrology in South Korea’s electronics sector led by Samsung and LG. Due to government-driven smart manufacturing initiatives and infrastructure developments, APAC will lead the growth and demand for metrology services.

Need any customization research/data on Metrology Services Market - Enquiry Now

Key players

Some of the major players in the Metrology Services Market are:

-

Mitutoyo Corporation (Coordinate Measuring Machines, Digital Micrometers)

-

Hexagon AB (Leica Absolute Tracker AT402, ROMER Absolute Arm)

-

Nikon Metrology (Laser Radar Systems, X-ray Computed Tomography Systems)

-

Renishaw plc (Touch Trigger Probes, Equator Gauging System)

-

Zeiss Industrial Metrology (CONTURA CMM, O-INSPECT Multisensor Measuring Machine)

-

FARO Technologies (FARO Laser Scanner, FARO Gage)

-

Keyence Corporation (IM Series Image Dimension Measurement System, XM Series Handheld Probe CMM)

-

Creaform (HandySCAN 3D, MetraSCAN 3D)

-

Ametek (Zygo Optical Profilers, Creaform 3D Scanners)

-

Perceptron, Inc. (AutoGauge, AutoScan)

-

GOM GmbH (ATOS 3D Scanner, TRITOP Photogrammetry System)

-

KLA Corporation (Tencor Metrology Systems, NanoSurf)

-

Bruker Corporation (ContourGT Optical Profiler, Dektak Stylus Profilers)

-

Heidenhain GmbH (Length Gauges, Rotary Encoders)

-

Jenoptik Group (Opticline Contour Measuring Systems, Hommel Etamic Roughness Measuring Systems)

Recent Trends

-

In October 2024, Mitutoyo America Corporation introduced the Metlogix M3 software for its Quick Image (QI) Vision System, enhancing precision with advanced video edge detection and automated measurement.

-

In November 2024, Exact Metrology partnered with Hexagon Manufacturing Intelligence to expand its coordinate metrology solutions, offering advanced CMMs, laser trackers, and measuring arms.

-

In November 2024, Nikon divested its laser scanning and Focus Inspection software division to UK’s LK Metrology, transferring R&D, service, and production teams.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 817.77 Million |

| Market Size by 2032 | USD 1370.14 Million |

| CAGR | CAGR of 5.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Coordinate Measuring Machines (CMM), Optical Digitizers and Scanners (ODS)) • By Application (Automotive, Aerospace, Industrial, Power Generation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mitutoyo Corporation, Hexagon AB, Nikon Metrology, Renishaw plc, Zeiss Industrial Metrology, FARO Technologies, Keyence Corporation, Creaform, Ametek, Perceptron, Inc., GOM GmbH, KLA Corporation, Bruker Corporation, Heidenhain GmbH, Jenoptik Group, Leica Microsystems, Tesa SA, Mahr GmbH, Optical Gaging Products (OGP), Vision Engineering Ltd. |