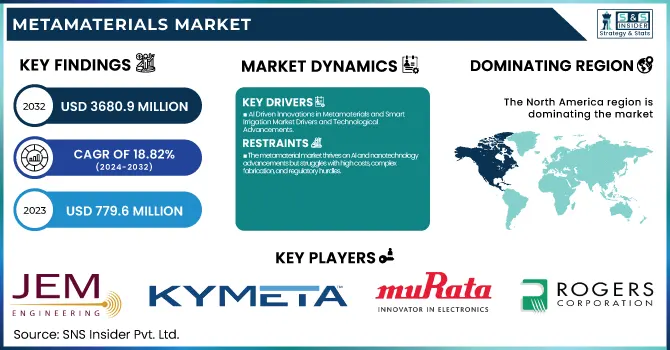

Metamaterials Market Size & Trends:

The Metamaterials Market size was valued at USD 779.6 Million in 2023, and expected to reach USD 3680.9 Million by 2032, growing at a CAGR of 18.82 % during 2024-2032. This rapid market growth can be attributed to the growing adoption of technology, especially in industries such as telecommunications, aerospace, healthcare, and automotive, where metamaterials are used to improve signal transmission, radar systems, and energy efficiency. Add to those macroeconomic and geopolitical trends, like government investments in defense and communications infrastructure that are driving demand higher.

To Get more information on Metamaterials Market - Request Free Sample Report

In particular, advancements in AI and automation integration in metamaterial design and manufacturing are enhancing efficiency and scalability, driving even more growth. In addition, increasing focus towards environmental sustainability is driving the advancement of sustainable, energy-efficient, and recyclable metamaterials products. Lastly, continuous R&D and innovation, supported by substantial funding, are unlocking new applications, solidifying the market’s strong growth trajectory.

Metamaterials Market Dynamics:

Drivers

-

AI Driven Innovations in Metamaterials and Smart Irrigation Market Drivers and Technological Advancements

Machine learning and artificial intelligence (AI) driven metamaterial design is another key factor pushing the metamaterial market. AI also makes it possible to optimize the properties of metamaterials to engineer a structure with specific electromagnetic, mechanical and thermal properties. This development speeds up the creation of novel applications in optics, healthcare, acoustics and power systems. AI enables researchers to systematically search vast design spaces, revealing new metamaterials that would have eluded conventional approaches. The synergistic combination of AI and metamaterials can lead not only to enhanced efficiency of current technologies but also to new functionalities, consequently driving the market growth.

Restraints:

-

The metamaterial market thrives on AI and nanotechnology advancements but struggles with high costs, complex fabrication, and regulatory hurdles.

Metamaterials, engineered to exhibit properties not found in nature, have transformative applications in telecommunications, aerospace, healthcare, and defense. Using their ability to manipulate electromagnetic waves, they can work towards building high-resolution, low-power MRI systems, which could help improve image fidelity while lowering scanning time and costs. Moreover, metamaterial-based biosensors provide high sensitivity for biomarker detection, which enables earlier diagnosis of diseases and more effective treatment protocols. Metamaterials-based non-invasive diagnostic tools can augment the effectiveness of ultrasound and optical imaging with less invasive discomfort to consumers. This technology will be especially helpful for neurology, oncology and cardiovascular diagnostics, areas requiring detailed imaging. With healthcare systems moving towards AI and smart technologies, we expect to see further integration of metamaterials in medical applications. As investment in research and development increases, and demand for high-speed and portable imaging solutions rises, metamaterials have the potential to transform modern healthcare and enhance patient outcomes.

Opportunities:

-

Metamaterials enhance MRI, biosensing, and diagnostics, enabling high-resolution imaging, early disease detection, and better patient outcomes.

Metamaterials are unlocking new possibilities in healthcare by enhancing medical imaging, diagnostics, and biosensing technologies. Their ability to manipulate electromagnetic waves allows for the development of high-resolution, low-power MRI systems, improving image clarity while reducing scanning time and costs. Additionally, metamaterial-based biosensors enable highly sensitive detection of biomarkers, leading to earlier disease diagnosis and more treatment that is effective plans. Non-invasive diagnostic tools leveraging metamaterials enhance the precision of ultrasound and optical imaging, minimizing patient discomfort. These advancements are particularly beneficial for neurology, oncology, and cardiovascular diagnostics, where detailed imaging is crucial. As healthcare systems increasingly adopt AI and smart technologies, the integration of metamaterials in medical applications is expected to accelerate. With growing investment in research and development, alongside rising demand for efficient and portable imaging solutions, metamaterials present a significant opportunity to revolutionize modern healthcare and improve patient outcomes.

Challenges:

-

High production costs, complex design, scalability issues, regulatory hurdles, and low market awareness hinder the growth of the metamaterial market.

The metamaterial market faces significant challenges, including high production costs due to complex fabrication techniques and specialized materials. Their complex design makes development expensive and time-consuming when using AI-driven tools and a lot of computational resources during development. However, research is well ahead of commercialization, as scaling production and incorporation of metamaterials into real-world applications present significant barriers to their widespread use. Regulations and compliance requirements, labelled significantly in the aerospace, defense, and telecommunications, slow adoption. Moreover, due to lack of standards in various industries, interoperability and implementation widely becomes difficult. Most of these manufacturing approaches cannot be scaled economically to manufacturing volume due production limits. The other pillar has to do with market awareness and the relatively poor knowledge of the benefits and applications of metamaterials in industry. In order to overcome these challenges, the growth of metamaterials and their applications will need investment in and commitment to research, government support, and technological progress toward overcoming fabrication barriers, driving down costs, and increasing the feasibility of mass production, which together will promote the uptake of these materials across multiple industries.

Metamaterials Market Segment Analysis:

By Product

The electromagnetic segment dominated the Metamaterial Market in 2023, accounting for approximately 40% of revenue. Its dominance is driven by widespread applications in antennas, waveguides, radar systems and next-generation wireless communication technologies, specifically 5G and 6G. Electromagnetic metamaterials enable signal transmission, minimize interference, and increase operational efficiency in sectors, including defense, aerospace, and telecommunications. Their ability to manipulate electromagnetic waves could lead to all kinds of advanced stealth technology in military applications and high-performance imaging in medical diagnostics. The growth is also due to the rise in demand for smaller and more effective antennas in consumer electronics, IoT devices, and satellite communications. Further, AI-powered design tools and computational modeling speed up innovation in this segment as well. While commercialization efforts have faced challenges, ongoing investment in research and collaboration with industry are broadening the range of real-world applications for electromagnetic metamaterials.

The terahertz (THz) segment is the fastest-growing category in the Metamaterial Market, projected to expand significantly over the forecast period from 2024 to 2032. This growth is propelled by the rising acceptance of terahertz metamaterials in various applications such as security screening, medical imaging, and high-speed wireless communication. TERAHERTZ (THz) technology offers numerous advantages, such as penetration into non-conductive materials and non-ionizing ability, making it an excellent candidate for non-destructive imaging and material characterization. Healthcare: In the medical field, THz metamaterials are utilized for high-resolution imaging in early disease detection, including cancer diagnosis, with low radiation exposure. THz-based scanners are also superior in their ability to detect hidden weapons and explosives, helping drive demand from the defense and security sectors. Moreover, the THz segment acts as the backbone of next-generation telecommunications, as 6G technology is expected to utilize THz frequencies for the ultra-high-speed transmission of data. Continued research and technological innovations are expected to drive the rapid growth of the terahertz metamaterial market.

By Application

The antenna segment dominated the Metamaterial Market in 2023, capturing around 45% of total revenue due to its widespread applications in telecommunications, defense, aerospace, and consumer electronics. Metamaterial-based antennas enhance signal strength, minimize interference, and enable compact, lightweight designs, making them essential for next-generation wireless communication. The rapid expansion of 5G and emerging 6G networks has driven demand for high-performance antennas with improved efficiency. In defense, these antennas support stealth technology, advanced radar systems, and secure communications, while the aerospace sector benefits from their lightweight, high-gain capabilities for satellite communication. Additionally, the growing adoption of IoT, smart devices, and autonomous vehicles has further accelerated market expansion. With ongoing innovations and rising investments in advanced communication technologies, the metamaterial antenna segment is expected to maintain its leading position in the coming years.

The absorber segment is the fastest-growing category in the Metamaterial Market, projected to witness significant expansion over the forecast period from 2024 to 2032. This growth is driven by the increasing demand for advanced electromagnetic wave absorption technologies in defense, telecommunications, and automotive sectors. Metamaterial absorbers are widely used in stealth technology for military applications, helping reduce radar cross-section (RCS) and enhancing the invisibility of aircraft, ships, and vehicles. In telecommunications, these absorbers minimize signal interference, improving network efficiency and security. Additionally, their application in automotive radar systems for collision avoidance and autonomous driving is further propelling market growth. The rising need for energy-efficient, lightweight, and broadband absorbers in consumer electronics and satellite communications also contributes to their adoption.

By End Use

The aerospace and defense sector dominated the Metamaterial Market in 2023, accounting for approximately 50% of total revenue due to their extensive use across stealth technology, radar systems, and secure communication. Towards enhancing military stealth capabilities, metamaterials are increasingly deployed to reduce radar cross-section (RCS) in military aircraft, ships, and vehicles. In addition, these materials also enhance radar and sensor performance through high-performance signal absorption and wave manipulation. In aerospace, high-gain antennas based on metamaterials offer lighter, more efficient solutions suitable for satellite communications and avionics to enhance the effectiveness of signal transmission. The increasing focus on advanced surveillance, electronic warfare, and next-generation aircraft has further fueled demand for metamaterial technologies.

The medical segment is the fastest-growing sector in the Metamaterial Market, projected to expand significantly over the forecast period from 2024 to 2032. The market is growing due to the increased use of metamaterials in advanced medical imaging, biosensing, and non-invasive diagnostics. Imaging systems based on metamaterials improve MRI efficiency by increasing the intelligibility of signals, shortening the time of scan, and lowering energy supplies, resulting in better diagnoses. Moreover, metamaterials show extremely high sensitivity in biosensing biomolecules for early disease detection of cancers or neurological diseases. Metamaterials in Non-invasive Wearable Medical Devices Offering patients real-time health monitoring and vastly improving patient outcomes. The growing demand for innovative healthcare solutions, coupled with rising investments in biomedical research and AI-driven metamaterial design, is accelerating adoption.

Metamaterials Market Regional Insights:

North America dominated the Metamaterial Market in 2023, accounting for approximately 40% of total revenue, due to significant investments in the areas of defense, aerospace, telecommunications, and healthcare applications. The large industrial players, research activities, supported by government funding underpin the regional leadership in the market for advanced metamaterial technologies. For defense, the U.S. military widely uses metamaterials for stealth technology, radar systems and secure communication, and the aerospace domain benefits from lightweight, high-performance antennas for satellite and avionics applications. The high deployment and encouraging implementation of 5G and advanced 6G networks is also driving demand for these kinds of metamaterial-based antennas as well as waveguides.

Asia-Pacific is the fastest-growing region in the Metamaterial Market, expected to witness substantial expansion over the forecast period from 2024 to 2032. Such rapid growth is powered by rising investments in telecommunications, defense, aerospace, and healthcare. The continued research and investment in 5G and next-generation 6G networks by nations including China, Japan, South Korea, and India will drive demand for metamaterial four antennas and waveguides that overcome severe obstacles in signal transmission and interference. On the defense front, governments concentrating on advanced radar systems, stealth technology, and secure communications are spurring the adoption of metamaterials. Metamaterials are also being used by the aerospace industry to create lightweight, high-efficiency antennas and satellite communication systems. The healthcare sector is also flourishing in the region, and diagnostic practices are being enhanced by incorporating metamaterial-based imaging and biosensing technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Key Players in Metamaterials Market along with their product:

-

Metamaterial Technologies Inc. (Canada) – Develops metamaterial-based optical filters, lenses, and smart materials for aerospace and healthcare applications.

-

JEM Engineering LLC (USA) – Specializes in metamaterial-based antennas for military, aerospace, and commercial communications.

-

Kymeta Corporation (USA) – Produces metamaterial-based flat-panel satellite antennas for mobile communications.

-

Microwave Measurement Systems LLC (USA) – Focuses on metamaterial-based microwave components for radar and communication systems.

-

Applied EM, Inc. (USA) – Designs metamaterial-based electromagnetic solutions, including antennas and stealth technology.

-

Teraview (UK) – Develops terahertz imaging and sensing systems using metamaterials for medical and security applications.

-

Alps Electric Co., Ltd. (Japan) – Manufactures metamaterial-based sensors and communication devices for automotive and consumer electronics.

-

PARC (USA) – Engages in R&D for metamaterial-based photonic and electromagnetic applications.

-

Echodyne (USA) – Produces metamaterial-based radar systems for defense, aerospace, and autonomous vehicles.

-

Phoebus Optoelectronics (China) – Specializes in metamaterial-based optical components for imaging and communication.

List of Suppliers providing raw materials and components for the Metamaterial Market:

-

Meta Materials Inc.

-

Phomera Metamaterials

-

Murata Manufacturing

-

Nanotech Security Corp.

-

Rogers Corporation

-

NKT Photonics

-

Nissan Chemical Corporation

-

Henkel AG & Co. KGaA

-

Materion Corporation

-

DuPont

Recent Development:

-

On March 17, 2025, CA Global Partners announced a Live Webcast Auction of META Material Technologies Inc., scheduled for April 3, 2025, due to bankruptcy proceedings. This auction offers advanced nanocomposite and functional material equipment, including high-value vacuum web coating and deposition systems.

-

On April 2, 2024, Kymeta announced its search for a strategic integration partner to enter the inflight connectivity market. The company aims to overcome aviation certification challenges by collaborating with an experienced aero partner.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 779.6 Million |

| Market Size by 2032 | USD 3680.9 Million |

| CAGR | CAGR of 18.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Electromagnetic, Terahertz, Photonic, Tunable, Frequency Selective Surface, Non-linear) • By Application (Antenna, Absorber, Superlens, Cloaking Devices, Others) • By End Use (Aerospace & Defense, Medical, Automotive, Consumer Electronics, Energy & Power) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Metamaterial Technologies Inc., JEM Engineering LLC, Kymeta Corporation, Microwave Measurement Systems LLC, Applied EM Inc., Teraview, Alps Electric Co. Ltd., PARC, Echodyne, and Phoebus Optoelectronics. |