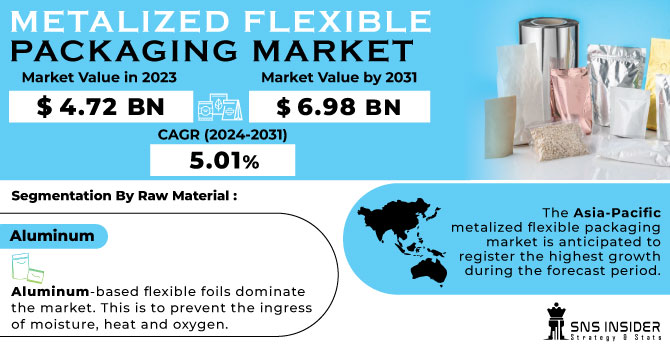

The Metalized Flexible Packaging Market size was valued at USD 4.72 billion in 2023 and is expected to Reach USD 6.98 billion by 2031 and grow at a CAGR of 5.01% over the forecast period of 2024-2031.

Customer demand for convenient food packaging and increasingly busy lifestyles are driving the metalized flexible packaging market. Metalized customizable bundles extend the lifespan of items while reducing the need for additives. The food and beverage industry are phasing out traditional packaging designs in favor of lightweight, easy-to-handle packages. Metalized flexible packages help meet this demand because they are lighter than rigid packages and do not contain glass or cans that add weight to the package.

Get More Information on Metalized Flexible Packaging Market - Request Sample Report

The texture and quality of foods, pharmaceuticals, and foodstuffs are all affected by the increase or decrease of moisture. It can also accelerate the breakdown of fatty products. Solid beverages such as espresso tend to lose flavor, while unflavoured foods retain their flavor. Metalized foils are used to prevent the lack of scent by protecting against oxygen, moisture, smoke and odors. Food waste is reduced when metalized films are used in food packaging to extend product shelf life limit.

Most of the manufacturing costs for metalized flexible packaging come from raw materials. Metalized conformal bundling polymers are petroleum-derived. Input cost pressures are expected to fluctuate due to unpredictable trends in oil prices and polymer demand for various applications.

Manufacturer productivity is impacted by fluctuations in the cost of natural materials, which can limit the development of customizable metalized bundles. Dynamic changes in the industry, including the introduction of new regulatory measures, are forcing manufacturers to develop new packaging options. In response to environmental concerns regarding the use of biodegradable metalized flexible packaging, manufacturers have developed environmentally friendly and safe packaging alternatives. Environmental concerns, changing consumer tastes, and government regulations all contribute to the current situation. Recyclable and eco-friendly products are an area that manufacturers are focusing on.

KEY DRIVERS:

Products with long shelf life are in high demand.

More and more consumers are seeking products that can be maintained for longer periods of time in terms of freshness, quality or safety. In order to meet this demand, metalized flexible packaging can play an important role in ensuring good barrier performance against moisture, oxygen, light and others that may adversely affect the product.

The metalized flexible packaging market is supported by the growth of developing economies and increasing consumer spending.

RESTRAIN:

Volatility in prices of raw materials causing hinder in market growth.

OPPORTUNITY:

There is still a growing demand for sustainable packaging solutions.

As consumers and regulators emphasize environmental responsibility, manufacturers of metalized flexible packaging have an opportunity to develop and promote more sustainable options. This includes searching for recyclable, compostable and biodegradable materials and implementing metalized film recycling programs to reduce our environmental impact.

Opportunities for metalized flexible packaging arise from the fast growth of e-commerce.

CHALLENGES:

When it comes to recycling, metalized flexible packaging is a problem.

During the war, there was a huge impact on metal imports and exports across the globe. This was majorly due to trade disruptions and increased shipping costs.

Russia accounts for about 10 % of the global output of Nickel and 5 % of aluminium exports. Due to fewer aluminium imports from Russia by other countries, the production of this packaging material was reduced which affected the food and beverage industry. The food and Beverage segment accounts for the highest market share in end-use industries that is nearly about 25 %. The cost of overall packaging went high due to which end users also increased the cost of final products produced. One of the materials used for making this packaging is a polymer that is derived from petroleum. The rise in prices of crude oil, this is affecting the production cost. Due to the war crude oil prices have reached $112/barrel.

Recession is not showing an impact on business. Comparing annual sales of major companies involved in metalized flexible packaging it has shown an average gain of 3.1% as compared to 2021. But businesses are having problems dealing with the rising prices of raw materials. Manufacturers’ main revenue comes from sales, due to the recession the prices of raw materials increased which affected the overall profitability. Prices of raw materials such as aluminium, and polymers depend on changing economic conditions, and the availability of resources. Aluminium cost is rising since 2022 and is arrived at $ 4100 which is a bad sign for manufacturers as it may affect their businesses.

By Raw Material

Aluminum

Chromium

Nickel

Based on the raw material, aluminum-based flexible foils dominate the market. This is to prevent the ingress of moisture, heat and oxygen. Aluminium foil blocks out light, oxygen, moisture and bacteria. Therefore, films are widely used in food and pharmaceutical packaging.

By Packaging Type

Wraps

Bags

Pouches

Roll Stock

Others

Based on Packaging Type, It is expected that the popularity of the pouch will increase further. One of his driving factors for this development is the fact that the bag takes up significantly less storage space. With so many finishes, there is a lot of branding potential.

By Structure

Laminated

Mono Extruded

Others

By End Use

Pharmaceuticals

Food & Beverages

Personal Care

Others

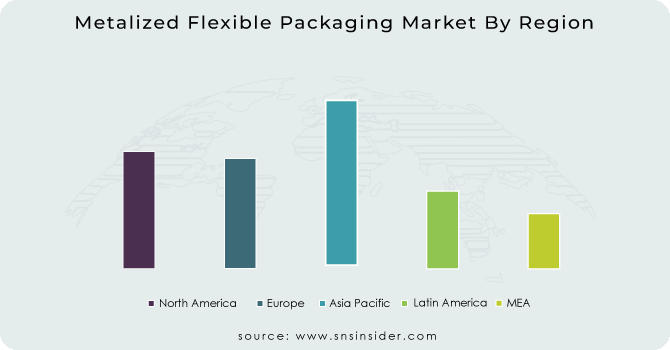

The Asia-Pacific metalized flexible packaging market is anticipated to register the highest growth during the forecast period. This growth is mainly due to the rapid expansion of end-use industries such as food and beverages, healthcare, and personal care. Factors such as increasing disposable income, changing lifestyles, and the rising middle class are driving the demand for packaging, which is expected to support the growth of the metalized flexible packaging market. Additionally, increasing demand for ready-to-eat foods and instant meals presents growth opportunities for the metalized flexible packaging market in the region.

The European metalized flexible packaging market is expected to witness steady growth during the forecast period. The main driver of growth in the European region is the demand for lightweight, user-friendly and easy-to-handle products. Growing focus on sustainability, growing need for longer shelf life, improved hygiene standards, and consumer interest in ease of use are the major factors driving the market in the region.

In the European region, Germany will account for the largest market share followed by France.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Metalized Flexible Packaging market are Amcor Limited, Sonoco Products Company, Mondi Group, Huhtamaki, Sealed Air Corporation, Cosmo Films Limited, Polyplex Corporation Limited, Transcontinental Inc, Constantia Flexibles, CLONDALKIN GROUP and other players.

TUV OK Compost Home and TUV OK Compost Industrial Certifications have been awarded to SOne compostable labels and packaging ReEarth compostable flexible packaging films.

The British vacuum research and development specialist Idvac Ltd has developed a translucent, Non-pigmented Metalized Film without titanium dioxide which is able to be applied for applications such as barrier packaging labels and labeling.

Luxembourg BOPP or BROPE film specialist Jindal launched a new High Barrier EthyLyte film, which could be used in the flexible packaging market as PET Packaging Films for Recyclable Monolayers.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.72 Bn |

| Market Size by 2031 | US$ 6.98 Bn |

| CAGR | CAGR of 5.01% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Aluminium, Chromium, Nickel) • By Packaging Type (Wraps, Bags, Pouches, Roll Stock, Others) • By Structure (Laminated, Mono Extruded, Others) • By End Use (Pharmaceuticals, Food & Beverages, Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Limited, Sonoco Products Company, Mondi Group, Huhtamaki, Sealed Air Corporation, Cosmo Films Limited, Polyplex Corporation Limited, Transcontinental Inc, Constantia Flexibles, CLONDALKIN GROUP |

| Key Drivers | • Products with long shelf life are in high demand • The metalized flexible packaging market is supported by the growth of developing economies and increasing consumer spending. |

| Market Restraints | • Volatility in prices of raw materials causing hinder in market growth. |

Ans. The Compound Annual Growth rate for Metalized Flexible Packaging Market over the forecast period is 4.85 %.

Ans. Metalized Flexible Packaging Market is expected to Reach USD 6.62 billion by 2030.

Ans. Asia Pacific is the fastest-growing region of the Metalized Flexible Packaging Market.

Ans. Volatility in prices of raw materials.

Ans. Products with long shelf life are in high demand giving rise to the market growth.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Metalized Flexible Packaging Market Segmentation, by Raw Material

8.1 Aluminum

8.2 Chromium

8.3 Nickel

9. Metalized Flexible Packaging Market Segmentation, by Packaging Type

9.1 Wraps

9.2 Bags

9.3 Pouches

9.4 Roll Stock

9.5 Others

10. Metalized Flexible Packaging Market Segmentation, by Structure

10.1 Laminated

10.2 Mono Extruded

10.3 Others

11. Metalized Flexible Packaging Market Segmentation, by End Use

11.1 Pharmaceuticals

11.2 Food & Beverages

11.3 Personal Care

11.4 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America Metalized Flexible Packaging Market by Country

12.2.2North America Metalized Flexible Packaging Market by Raw Material

12.2.3 North America Metalized Flexible Packaging Market by Packaging Type

12.2.4 North America Metalized Flexible Packaging Market by Structure

12.2.5 North America Metalized Flexible Packaging Market by End Use

12.2.6 USA

12.2.6.1 USA Metalized Flexible Packaging Market by Raw Material

12.2.6.2 USA Metalized Flexible Packaging Market by Packaging Type

12.2.6.3 USA Metalized Flexible Packaging Market by Structure

12.2.6.4 USA Metalized Flexible Packaging Market by End Use

12.2.7 Canada

12.2.7.1 Canada Metalized Flexible Packaging Market by Raw Material

12.2.7.2 Canada Metalized Flexible Packaging Market by Packaging Type

12.2.7.3 Canada Metalized Flexible Packaging Market by Structure

12.2.7.4 Canada Metalized Flexible Packaging Market by End Use

12.2.8 Mexico

12.2.8.1 Mexico Metalized Flexible Packaging Market by Raw Structure

12.2.8.2 Mexico Metalized Flexible Packaging Market by Packaging Type

12.2.8.3 Mexico Metalized Flexible Packaging Market by Structure

12.2.8.4 Mexico Metalized Flexible Packaging Market by End Use

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Eastern Europe Metalized Flexible Packaging Market by Country

12.3.1.2 Eastern Europe Metalized Flexible Packaging Market by Raw Material

12.3.1.3 Eastern Europe Metalized Flexible Packaging Market by Packaging Type

12.3.1.4 Eastern Europe Metalized Flexible Packaging Market by Structure

12.3.1.5 Eastern Europe Metalized Flexible Packaging Market by End Use

12.3.1.6 Poland

12.3.1.6.1 Poland Metalized Flexible Packaging Market by Raw Material

12.3.1.6.2 Poland Metalized Flexible Packaging Market by Packaging Type

12.3.1.6.3 Poland Metalized Flexible Packaging Market by Structure

12.3.1.6.4 Poland Metalized Flexible Packaging Market by End Use

12.3.1.7 Romania

12.3.1.7.1 Romania Metalized Flexible Packaging Market by Raw Material

12.3.1.7.2 Romania Metalized Flexible Packaging Market by Packaging Type

12.3.1.7.3 Romania Metalized Flexible Packaging Market by Structure

12.3.1.7.4 Romania Metalized Flexible Packaging Market by End Use

12.3.1.8 Hungary

12.3.1.8.1 Hungary Metalized Flexible Packaging Market by Raw Material

12.3.1.8.2 Hungary Metalized Flexible Packaging Market by Packaging Type

12.3.1.8.3 Hungary Metalized Flexible Packaging Market by Structure

12.3.1.8.4 Hungary Metalized Flexible Packaging Market by End Use

12.3.1.9 Turkey

12.3.1.9.1 Turkey Metalized Flexible Packaging Market by Raw Material

12.3.1.9.2 Turkey Metalized Flexible Packaging Market by Packaging Type

12.3.1.9.3 Turkey Metalized Flexible Packaging Market by Structure

12.3.1.9.4 Turkey Metalized Flexible Packaging Market by End Use

12.3.1.10 Rest of Eastern Europe

12.3.1.10.1 Rest of Eastern Europe Metalized Flexible Packaging Market by Raw Material

12.3.1.10.2 Rest of Eastern Europe Metalized Flexible Packaging Market by Packaging Type

12.3.1.10.3 Rest of Eastern Europe Metalized Flexible Packaging Market by Structure

12.3.1.10.4 Rest of Eastern Europe Metalized Flexible Packaging Market by End Use

12.3.2 Western Europe

12.3.2.1 Western Europe Metalized Flexible Packaging Market by Country

12.3.2.2 Western Europe Metalized Flexible Packaging Market by Raw Material

12.3.2.3 Western Europe Metalized Flexible Packaging Market by Packaging Type

12.3.2.4 Western Europe Metalized Flexible Packaging Market by Structure

12.3.2.5 Western Europe Metalized Flexible Packaging Market by End Use

12.3.2.6 Germany

12.3.2.6.1 Germany Metalized Flexible Packaging Market by Raw Material

12.3.2.6.2 Germany Metalized Flexible Packaging Market by Packaging Type

12.3.2.6.3 Germany Metalized Flexible Packaging Market by Structure

12.3.2.6.4 Germany Metalized Flexible Packaging Market by End Use

12.3.2.7 France

12.3.2.7.1 France Metalized Flexible Packaging Market by Raw Material

12.3.2.7.2 France Metalized Flexible Packaging Market by Packaging Type

12.3.2.7.3 France Metalized Flexible Packaging Market by Structure

12.3.2.7.4 France Metalized Flexible Packaging Market by End Use

12.3.2.8 UK

12.3.2.8.1 UK Metalized Flexible Packaging Market by Raw Material

12.3.2.8.2 UK Metalized Flexible Packaging Market by Packaging Type

12.3.2.8.3 UK Metalized Flexible Packaging Market by Structure

12.3.2.8.4 UK Metalized Flexible Packaging Market by End Use

12.3.2.9 Italy

12.3.2.9.1 Italy Metalized Flexible Packaging Market by Raw Material

12.3.2.9.2 Italy Metalized Flexible Packaging Market by Packaging Type

12.3.2.9.3 Italy Metalized Flexible Packaging Market by Structure

12.3.2.9.4 Italy Metalized Flexible Packaging Market by End Use

12.3.2.10 Spain

12.3.2.10.1 Spain Metalized Flexible Packaging Market by Raw Material

12.3.2.10.2 Spain Metalized Flexible Packaging Market by Packaging Type

12.3.2.10.3 Spain Metalized Flexible Packaging Market by Structure

12.3.2.10.4 Spain Metalized Flexible Packaging Market by End Use

12.3.2.11 Netherlands

12.3.2.11.1 Netherlands Metalized Flexible Packaging Market by Raw Material

12.3.2.11.2 Netherlands Metalized Flexible Packaging Market by Packaging Type

12.3.2.11.3 Netherlands Metalized Flexible Packaging Market by Structure

12.3.2.11.4 Netherlands Metalized Flexible Packaging Market by End Use

12.3.2.12 Switzerland

12.3.2.12.1 Switzerland Metalized Flexible Packaging Market by Raw Material

12.3.2.12.2 Switzerland Metalized Flexible Packaging Market by Packaging Type

12.3.2.12.3 Switzerland Metalized Flexible Packaging Market by Structure

12.3.2.12.4 Switzerland Metalized Flexible Packaging Market by End Use

12.3.2.13 Austria

12.3.2.13.1 Austria Metalized Flexible Packaging Market by Raw Material

12.3.2.13.2 Austria Metalized Flexible Packaging Market by Packaging Type

12.3.2.13.3 Austria Metalized Flexible Packaging Market by Structure

12.3.2.13.4 Austria Metalized Flexible Packaging Market by End Use

12.3.2.14 Rest of Western Europe

12.3.2.14.1 Rest of Western Europe Metalized Flexible Packaging Market by Raw Material

12.3.2.14.2 Rest of Western Europe Metalized Flexible Packaging Market by Packaging Type

12.3.2.14.3 Rest of Western Europe Metalized Flexible Packaging Market by Structure

12.3.2.14.4 Rest of Western Europe Metalized Flexible Packaging Market by End Use

12.4 Asia-Pacific

12.4.1 Asia Pacific Metalized Flexible Packaging Market by Country

12.4.2 Asia Pacific Metalized Flexible Packaging Market by Raw Material

12.4.3 Asia Pacific Metalized Flexible Packaging Market by Packaging Type

12.4.4 Asia Pacific Metalized Flexible Packaging Market by Structure

12.4.5 Asia Pacific Metalized Flexible Packaging Market by End Use

12.4.6 China

12.4.6.1 China Metalized Flexible Packaging Market by Raw Material

12.4.6.2 China Metalized Flexible Packaging Market by Packaging Type

12.4.6.3 China Metalized Flexible Packaging Market by Structure

12.4.6.4 China Metalized Flexible Packaging Market by End Use

12.4.7 India

12.4.7.1 India Metalized Flexible Packaging Market by Raw Material

12.4.7.2 India Metalized Flexible Packaging Market by Packaging Type

12.4.7.3 India Metalized Flexible Packaging Market by Structure

12.4.7.4 India Metalized Flexible Packaging Market by End Use

12.4.8 Japan

12.4.8.1 Japan Metalized Flexible Packaging Market by Raw Material

12.4.8.2 Japan Metalized Flexible Packaging Market by Packaging Type

12.4.8.3 Japan Metalized Flexible Packaging Market by Structure

12.4.8.4 Japan Metalized Flexible Packaging Market by End Use

12.4.9 South Korea

12.4.9.1 South Korea Metalized Flexible Packaging Market by Raw Material

12.4.9.2 South Korea Metalized Flexible Packaging Market by Packaging Type

12.4.9.3 South Korea Metalized Flexible Packaging Market by Structure

12.4.9.4 South Korea Metalized Flexible Packaging Market by End Use

12.4.10 Vietnam

12.4.10.1 Vietnam Metalized Flexible Packaging Market by Raw Material

12.4.10.2 Vietnam Metalized Flexible Packaging Market by Packaging Type

12.4.10.3 Vietnam Metalized Flexible Packaging Market by Structure

12.4.10.4 Vietnam Metalized Flexible Packaging Market by End Use

12.4.11 Singapore

12.4.11.1 Singapore Metalized Flexible Packaging Market by Raw Material

12.4.11.2 Singapore Metalized Flexible Packaging Market by Packaging Type

12.4.11.3 Singapore Metalized Flexible Packaging Market by Structure

12.4.11.4 Singapore Metalized Flexible Packaging Market by End Use

12.4.12 Australia

12.4.12.1 Australia Metalized Flexible Packaging Market by Raw Material

12.4.12.2 Australia Metalized Flexible Packaging Market by Packaging Type

12.4.12.3 Australia Metalized Flexible Packaging Market by Structure

12.4.12.4 Australia Metalized Flexible Packaging Market by End Use

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Metalized Flexible Packaging Market by Raw Material

12.4.13.2 Rest of Asia-Pacific APAC Metalized Flexible Packaging Market by Packaging Type

12.4.13.3 Rest of Asia-Pacific Metalized Flexible Packaging Market by Structure

12.4.13.4 Rest of Asia-Pacific Metalized Flexible Packaging Market by End Use

12.5 Middle East & Africa

12.5.1 Middle East

12.5.1.1 Middle East Metalized Flexible Packaging Market by Country

12.5.1.2 Middle East Metalized Flexible Packaging Market by Raw Material

12.5.1.3 Middle East Metalized Flexible Packaging Market by Packaging Type

12.5.1.4 Middle East Metalized Flexible Packaging Market by Structure

12.5.1.5 Middle East Metalized Flexible Packaging Market by End Use

12.5.1.6 UAE

12.5.1.6.1 UAE Metalized Flexible Packaging Market by Raw Material

12.5.1.6.2 UAE Metalized Flexible Packaging Market by Packaging Type

12.5.1.6.3 UAE Metalized Flexible Packaging Market by Structure

12.5.1.6.4 UAE Metalized Flexible Packaging Market by End Use

12.5.1.7 Egypt

12.5.1.7.1 Egypt Metalized Flexible Packaging Market by Raw Material

12.5.1.7.2 Egypt Metalized Flexible Packaging Market by Packaging Type

12.5.1.7.3 Egypt Metalized Flexible Packaging Market by Structure

12.5.1.7.4 Egypt Metalized Flexible Packaging Market by End Use

12.5.1.8 Saudi Arabia

12.5.1.8.1 Saudi Arabia Metalized Flexible Packaging Market by Raw Material

12.5.1.8.2 Saudi Arabia Metalized Flexible Packaging Market by Packaging Type

12.5.1.8.3 Saudi Arabia Metalized Flexible Packaging Market by Structure

12.5.1.8.4 Saudi Arabia Metalized Flexible Packaging Market by End Use

12.5.1.9 Qatar

12.5.1.9.1 Qatar Metalized Flexible Packaging Market by Raw Material

12.5.1.9.2 Qatar Metalized Flexible Packaging Market by Packaging Type

12.5.1.9.3 Qatar Metalized Flexible Packaging Market by Structure

12.5.1.9.4 Qatar Metalized Flexible Packaging Market by End Use

12.5.1.10 Rest of Middle East

12.5.1.10.1 Rest of Middle East Metalized Flexible Packaging Market by Raw Material

12.5.1.10.2 Rest of Middle East Metalized Flexible Packaging Market by Packaging Type

12.5.1.10.3 Rest of Middle East Metalized Flexible Packaging Market by Structure

12.5.1.10.4 Rest of Middle East Metalized Flexible Packaging Market by End Use

12.5.2. Africa

12.5.2.1 Africa Metalized Flexible Packaging Market by Country

12.5.2.2 Africa Metalized Flexible Packaging Market by Raw Material

12.5.2.3 Africa Metalized Flexible Packaging Market by Packaging Type

12.5.2.4 Africa Metalized Flexible Packaging Market by Structure

12.5.2.5 Africa Metalized Flexible Packaging Market by End Use

12.5.2.6 Nigeria

12.5.2.6.1 Nigeria Metalized Flexible Packaging Market by Raw Material

12.5.2.6.2 Nigeria Metalized Flexible Packaging Market by Packaging Type

12.5.2.6.3 Nigeria Metalized Flexible Packaging Market by Structure

12.5.2.6.4 Nigeria Metalized Flexible Packaging Market by End Use

12.5.2.7 South Africa

12.5.2.7.1 South Africa Metalized Flexible Packaging Market by Raw Material

12.5.2.7.2 South Africa Metalized Flexible Packaging Market by Packaging Type

12.5.2.7.3 South Africa Metalized Flexible Packaging Market by Structure

12.5.2.7.4 South Africa Metalized Flexible Packaging Market by End Use

12.5.2.8 Rest of Africa

12.5.2.8.1 Rest of Africa Metalized Flexible Packaging Market by Raw Material

12.5.2.8.2 Rest of Africa Metalized Flexible Packaging Market by Packaging Type

12.5.2.8.3 Rest of Africa Metalized Flexible Packaging Market by Structure

12.5.2.8.4 Rest of Africa Metalized Flexible Packaging Market by End Use

12.6. Latin America

12.6.1 Latin America Metalized Flexible Packaging Market by Country

12.6.2 Latin America Metalized Flexible Packaging Market by Raw Material

12.6.3 Latin America Metalized Flexible Packaging Market by Packaging Type

12.6.4 Latin America Metalized Flexible Packaging Market by Structure

12.6.5 Latin America Metalized Flexible Packaging Market by End Use

12.6.6 Brazil

12.6.6.1 Brazil Metalized Flexible Packaging Market by Raw Material

12.6.6.2 Brazil Africa Metalized Flexible Packaging Market by Packaging Type

12.6.6.3 Brazil Metalized Flexible Packaging Market by Structure

12.6.6.4 Brazil Metalized Flexible Packaging Market by End Use

12.6.7 Argentina

12.6.7.1 Argentina Metalized Flexible Packaging Market by Raw Material

12.6.7.2 Argentina Metalized Flexible Packaging Market by Packaging Type

12.6.7.3 Argentina Metalized Flexible Packaging Market by Structure

12.6.7.4 Argentina Metalized Flexible Packaging Market by End Use

12.6.8 Colombia

12.6.8.1 Colombia Metalized Flexible Packaging Market by Raw Material

12.6.8.2 Colombia Metalized Flexible Packaging Market by Packaging Type

12.6.8.3 Colombia Metalized Flexible Packaging Market by Structure

12.6.8.4 Colombia Metalized Flexible Packaging Market by End Use

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Metalized Flexible Packaging Market by Raw Material

12.6.9.2 Rest of Latin America Metalized Flexible Packaging Market by Packaging Type

12.6.9.3 Rest of Latin America Metalized Flexible Packaging Market by Structure

12.6.9.4 Rest of Latin America Metalized Flexible Packaging Market by End Use

13 Company Profile

13.1 Amcor Limited

13.1.1 Company Overview

13.1.2 Financials

13.1.3 Product/Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Sonoco Products Company

13.2.1 Company Overview

13.2.2 Financials

13.2.3 Product/Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Mondi Group

13.3.1 Company Overview

13.3.2 Financials

13.3.3 Product/Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Huhtamaki

13.4 Company Overview

13.4.2 Financials

13.4.3 Product/Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Sealed Air Corporation

13.5.1 Company Overview

13.5.2 Financials

13.5.3 Product/Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Cosmo Films Limited

13.6.1 Company Overview

13.6.2 Financials

13.6.3 Product/Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Polyplex Corporation Limited

13.7.1 Company Overview

13.7.2 Financials

13.7.3 Product/Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Transcontinental Inc

13.8.1 Company Overview

13.8.2 Financials

13.8.3 Product/Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Constantia Flexibles

13.9.1 Company Overview

13.9.2 Financials

13.9.3 Product/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 CLONDALKIN GROUP

13.10.1 Company Overview

13.10.2 Financials

13.10.3 Product/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Flexible Packaging Market size was valued at USD 257.14 billion in 2023 and is expected to Reach USD 411.78 billion by 2032 and grow at a CAGR of 5.37% over the forecast period of 2024-2032.

The Trash Bags Market size was USD 12.95 billion in 2023 and is expected to Reach USD 26.10 billion by 2032 and grow at a CAGR of 8.1% over the forecast period of 2024-2032.

The Green Packaging Market size was USD 325.74 billion in 2023 and is expected to Reach USD 527.08 billion by 2031 and grow at a CAGR of 6.2 % over the forecast period of 2024-2031.

The Single-Use Packaging Market size was USD 26.12 billion in 2023 and is expected to Reach USD 42.27 billion by 2031 and grow at a CAGR of 6.2% over the forecast period of 2024-2031.

The Jerry Cans Market size was USD 2.34 billion in 2023 and is expected to Reach USD 3.51 billion by 2031 and grow at a CAGR of 4.64 % over the forecast period of 2024-2031.

The Edible Water Bottles Market Size was valued at USD 128.12 million in 2023 and is expected to reach USD 283.75 million by 2031 and grow at a CAGR of 10.45% over the forecast period 2024-2031

Hi! Click one of our member below to chat on Phone