Get More Information on Metal Finishing Chemicals Market - Request Sample Report

The Metal Finishing Chemicals Market Size was valued at USD 12.1 billion in 2023, and is expected to reach USD 18.8 billion by 2032, and grow at a CAGR of 5.1% over the forecast period 2024-2032.

The Metal Finishing Chemicals Market is experiencing steady growth due to increasing demand from industries such as automotive, aerospace, electronics, and construction. Metal finishing chemicals are essential for improving the durability, appearance, and corrosion resistance of metal products. They are used in various processes such as electroplating, anodizing, and conversion coatings, which enhance the performance of metals in harsh environments. The growing emphasis on high performance and aesthetic appeal in the automotive and electronics sectors has fueled the demand for advanced metal finishing solutions. Additionally, the rising trend towards lightweight materials in aerospace is driving the need for chemical treatments that can strengthen and protect these metals without adding extra weight.

One of the key market dynamics is the increasing environmental regulations governing the use of hazardous chemicals in metal finishing processes. As governments impose stricter guidelines to reduce environmental pollution, companies are focusing on developing eco-friendly alternatives. For example, many manufacturers are shifting towards trivalent chromium plating as a safer alternative to hexavalent chromium, which has been linked to environmental and health concerns. Additionally, there is a growing demand for water-based and solvent-free solutions, particularly in Europe and North America, where environmental standards are more stringent. This shift towards green chemicals is becoming a crucial factor in the market, encouraging innovation among key players.

Recent developments in the market illustrate the competitive strategies and innovation among key industry participants. For instance, in 2023, BASF SE introduced a new line of metal finishing chemicals designed to meet the needs of the automotive sector by improving metal corrosion resistance while maintaining eco-friendly standards. Similarly, Chemetall, a BASF Group company, expanded its product line in early 2024 with a new range of anodizing chemicals that cater to aerospace manufacturers seeking to enhance the durability of aluminum components. These product launches reflect the ongoing efforts by companies to cater to industry-specific needs while adhering to stricter environmental regulations.

Another significant trend shaping the market is the growing investment in research and development to offer customized solutions for various end-use industries. Companies are investing in R&D to create specialized chemicals that enhance the functionality of metal parts used in electronics and electrical components, where precision is crucial. For instance, Element Solutions Inc. in mid-2023 unveiled a set of advanced plating chemicals that improve the conductivity and durability of metal parts used in high-tech electronic devices. This push towards customization and innovation is allowing companies to cater to the specific needs of different industries, thereby strengthening their position in the market.

Drivers:

Automotive and aerospace sectors boost metal finishing chemicals market with rising demand for corrosion resistance, durability, and enhanced metal performance

The automotive and aerospace industries are key consumers of metal finishing chemicals, as these sectors rely heavily on metals such as aluminum, steel, and alloys for manufacturing various components. In the automotive industry, the focus is on creating lighter, more fuel-efficient vehicles, which has driven the demand for high-performance metal treatments. Finishing chemicals are essential to enhance the strength, corrosion resistance, and aesthetic appeal of these metal components. For instance, zinc and nickel plating are widely used in automotive parts to improve their resistance to wear and tear, especially in critical parts like engines and transmissions. Similarly, in the aerospace sector, where safety and durability are paramount, advanced anodizing and electroplating processes are employed to protect aircraft parts from extreme conditions, including high altitudes and varying weather conditions. The increasing global production of automobiles and aircraft, along with the need for extended service life of metal parts, is expected to continue driving the demand for metal finishing chemicals in the coming years.

Environmental regulations on hazardous chemicals are driving manufacturers to adopt eco-friendly, water-based, and solvent-free metal finishing solutions.

Environmental regulations have become stricter, particularly in regions like North America and Europe, to mitigate the adverse effects of chemical discharge from industries. Hexavalent chromium, widely used in traditional metal finishing, has been identified as a carcinogen and an environmental hazard, prompting regulatory agencies like the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) to impose stringent restrictions on its use. As a result, manufacturers are being compelled to innovate and develop safer alternatives. Trivalent chromium, for example, is gaining traction as a less toxic alternative, while other companies are exploring water-based and solvent-free chemicals to reduce the environmental footprint of their finishing processes. These eco-friendly alternatives not only comply with the evolving regulatory framework but also align with the growing corporate responsibility toward sustainability. The shift towards greener solutions is not just a regulatory necessity but also a competitive advantage, as many end-users, especially in the automotive and aerospace industries, are increasingly prioritizing suppliers that offer sustainable, eco-friendly products.

Restraint:

High costs of eco-friendly metal finishing chemicals limit market growth, particularly for small and medium-sized manufacturers.

One of the major challenges facing the metal finishing chemicals market is the high cost associated with advanced and eco-friendly chemical formulations. The shift towards sustainable practices, while necessary, often involves complex R&D processes to create chemicals that can deliver the same level of performance as traditional products while minimizing environmental harm. For instance, trivalent chromium, though less toxic than hexavalent chromium, requires more sophisticated processing techniques, making it more expensive to produce. Similarly, water-based and solvent-free formulations often come with higher price tags due to the use of more expensive raw materials and production technologies. These high costs can be prohibitive for small and medium-sized enterprises (SMEs) that may lack the financial resources to invest in such alternatives. Moreover, the initial setup costs for adopting new technologies or converting existing processes to accommodate eco-friendly chemicals can be a burden for manufacturers. This has created a gap in adoption rates, with larger companies able to make the switch more readily than smaller players, thereby limiting the overall market growth.

Opportunity:

Technological advancements in metal finishing, including nanocoatings and laser-assisted treatments, enhance performance and durability, creating new market opportunities in electronics, healthcare, and energy.

The metal finishing chemicals market is witnessing a surge in technological innovations, which are opening up new avenues for growth across various industries. One of the most promising advancements is the development of nanotechnology-based coatings, which offer superior protection and durability compared to traditional coatings. Nanocoatings can significantly improve the resistance of metal surfaces to corrosion, wear, and chemical damage while maintaining a thinner and more lightweight profile. This is particularly beneficial in industries like electronics, where the trend toward miniaturization demands high-performance coatings that do not add bulk to components. Additionally, laser-assisted surface treatment is another cutting-edge technology gaining traction, offering precise, energy-efficient metal finishing solutions. This technique allows for the targeted modification of metal surfaces, improving their adhesion properties and enhancing their overall performance. As industries like healthcare and renewable energy continue to expand, the demand for these advanced metal-finishing processes is expected to rise, creating lucrative opportunities for market players to invest in R&D and introduce innovative products that cater to the evolving needs of these sectors.

Challenge:

Navigating diverse regional regulations in the metal finishing chemicals market complicates standardization and compliance for manufacturers.

The metal finishing chemicals market is subject to a complex web of regulations that differ significantly from one region to another. For instance, the European Union has implemented strict regulations under its REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) framework, which imposes stringent controls on the use of hazardous chemicals, including those commonly used in metal finishing. In contrast, countries in the Asia-Pacific region, such as China and India, have relatively less stringent regulations, although these are gradually becoming more aligned with international standards. For global manufacturers, this fragmented regulatory environment presents a major challenge. Companies must invest heavily in ensuring that their products comply with the varying standards across different markets, which can lead to increased operational costs and delays in product launches. Furthermore, staying updated with the ever-evolving regulations, particularly in environmentally conscious markets like North America and Europe, requires ongoing investment in compliance and testing. Failure to meet these regulatory requirements can result in costly fines, product recalls, and reputational damage, making regulatory compliance one of the biggest hurdles for market players.

By Product Type

In 2023, Plating Chemicals dominated the Metal Finishing Chemicals Market, holding an estimated market share of 45%. This segment's growth is primarily driven by the increasing demand for electroplating and electroless plating processes across various industries, particularly automotive and electronics. Plating chemicals are essential for enhancing the surface properties of metals, providing benefits such as corrosion resistance, wear resistance, and improved aesthetic appeal. For instance, the automotive sector extensively utilizes nickel and zinc plating to protect critical components from corrosion and wear, ensuring longevity and reliability. Similarly, the electronics industry relies on gold and silver plating for circuit boards and connectors to enhance conductivity and prevent oxidation. As manufacturers strive for higher performance and durability in their products, the demand for plating chemicals continues to rise, solidifying their leading position in the market.

By Process

In 2023, the Electroplating segment dominated the Metal Finishing Chemicals Market, capturing an estimated market share of 40%. This segment's prominence is largely attributed to the widespread adoption of electroplating processes in various industries, including automotive, electronics, and aerospace. Electroplating enhances the surface properties of metals by applying a thin layer of a more noble metal, thereby providing improved corrosion resistance, aesthetic appeal, and electrical conductivity. For example, in the automotive industry, components such as fasteners and decorative trims are often electroplated with chrome or nickel to prevent rust and enhance visual appeal. Similarly, the electronics sector utilizes electroplating for circuit boards and connectors to improve conductivity and protect against oxidation. As the demand for high-performance and visually appealing metal components continues to grow, the electroplating segment is expected to maintain its leading position in the market.

By Material

In 2023, the Nickel segment dominated the Metal Finishing Chemicals Market, holding an estimated market share of 30%. Nickel's widespread use in metal finishing is primarily due to its excellent corrosion resistance, durability, and aesthetic appeal, making it a preferred choice across various industries. For instance, in the automotive industry, nickel plating is commonly applied to components such as wheels, bumpers, and trim to enhance their resistance to wear and environmental damage while providing a shiny, attractive finish. Additionally, the electronics industry relies on nickel for electroplating circuit boards and connectors, where it acts as a barrier to oxidation and enhances conductivity. The versatility and performance characteristics of nickel make it a dominant material in metal finishing applications, contributing significantly to its substantial market share.

By End-Use Industry

In 2023, the Automotive & Transportation segment dominated the Metal Finishing Chemicals Market, capturing an estimated market share of 35%. This segment's dominance is primarily driven by the increasing production of vehicles and the growing demand for high-performance automotive components. Metal finishing plays a crucial role in enhancing the durability, corrosion resistance, and aesthetic appeal of automotive parts. For example, nickel and chrome plating are widely used on exterior trims, bumpers, and wheels to provide a shiny finish while protecting against rust and wear. Additionally, electroplating and other finishing processes are essential for various internal components, such as engine parts and transmission systems, where durability and performance are paramount. As the automotive industry continues to evolve with the advent of electric vehicles and advanced manufacturing techniques, the demand for specialized metal finishing solutions in this sector is expected to remain strong, reinforcing its leading position in the market.

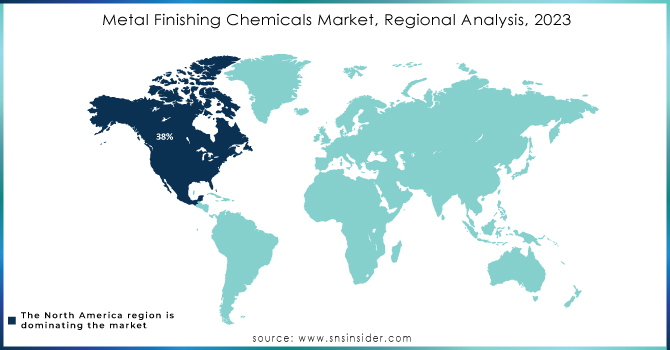

In 2023, North America dominated the Metal Finishing Chemicals Market, holding an estimated market share of 38%. This region's leadership can be attributed to the robust presence of key industries such as automotive, aerospace, and electronics, all of which significantly utilize metal finishing processes. The U.S. automotive industry, in particular, has been a major driver of demand for metal finishing chemicals, as manufacturers increasingly focus on enhancing the durability and aesthetic appeal of vehicles. Additionally, advancements in manufacturing technologies and strict environmental regulations in North America have led to a rising demand for eco-friendly and high-performance metal finishing solutions, further solidifying the region's dominant position in the market.

Moreover, the Asia-Pacific region emerged as the fastest-growing region in the Metal Finishing Chemicals Market in 2023, with an estimated CAGR of 6.5%. This rapid growth is primarily driven by the expanding automotive and electronics sectors in countries like China, India, and Japan. As these economies continue to industrialize, the demand for metal finishing chemicals is increasing significantly. For instance, China, being the largest automobile manufacturer in the world, is seeing a surge in vehicle production, which in turn drives the need for high-quality metal finishing solutions. Moreover, the growing focus on infrastructure development and urbanization in India is further fueling the demand for metal finishing chemicals across various applications, contributing to the Asia-Pacific region's strong growth trajectory.

Need any customization research on Metal Finishing Chemicals Market - Enquiry Now

A Brite Company (Brightener, Cleaner)

Advanced Chemical Company (Electrolytes, Surface Cleaners)

Atotech Deutschland GmbH (Plating Chemicals, Process Chemicals)

BASF SE (Plating Solutions, Surface Treatment Agents)

Chemetall (BASF Group) (Alodine, Oxsilan)

Element Solutions Inc. (Electroplating Solutions, Chemical Mechanical Polishing)

Houghton International Inc. (Metalworking Fluids, Cleaning Agents)

MacDermid Enthone (Electroplating Products, Surface Finishing Solutions)

Platform Specialty Products Corporation (Surface Treatment Chemicals, Plating Solutions)

Quaker Chemical Corporation (Metalworking Fluids, Coating Solutions)

Royal DSM (Surface Finishing Products, Adhesives)

Sakata INX Corporation (Metal Coatings, Cleaning Solutions)

Shandong Yanggu Huatai Chemical (Electroplating Chemicals, Surface Treatment Agents)

Sipchem (Chemical Solutions for Metal Finishing, Lubricants)

Standard Chemical & Supply Company (Cleaning Chemicals, Metal Finishing Solutions)

Surtec International (Surface Treatment Chemicals, Cleaning Products)

Tanaka Chemical Corporation (Electroplating Solutions, Cleaning Agents)

The Dow Chemical Company (Surface Finishing Chemicals, Cleaning Products)

Toyo Koatsu Co., Ltd. (Surface Treatment Chemicals, Electroplating Agents)

Umicore (Plating Products, Surface Finishing Chemicals)

January 2024: MacDermid Enthone acquired surface finishing and cleaning chemical solutions from All-Star Chemical Company to enhance its offerings in the automotive and electric vehicle sectors. Glen Breault, Vice President of North America, noted the potential to integrate All-Star's proprietary solutions to improve customer service and partnerships in the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.1 Billion |

| Market Size by 2032 | US$ 18.8 Billion |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Plating Chemicals, Cleaning Chemicals, Conversion Coating Chemicals, Others) •By Process (Pre-treatment, Electroplating, De-greasing, Polishing, Etching, Cleaning, Others) •By Material (Aluminium, Chromium, Nickel, Zinc, Gold, Silver, Copper, Others) •By End-Use Industry (Electrical & Electronics, Automotive & Transportation, Industrial Machinery, Building & Construction, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atotech Deutschland GmbH, BASF SE, Element Solutions Inc., The Dow Chemical Company, Advanced Chemical Company, Chemetall (BASF Group), Platform Specialty Products Corporation, A Brite Company, Houghton International Inc., Quaker Chemical Corporation and other key players |

| Key Drivers | • Automotive and aerospace sectors boost metal finishing chemicals market with rising demand for corrosion resistance, durability, and enhanced metal performance • Environmental regulations on hazardous chemicals are driving manufacturers to adopt eco-friendly, water-based, and solvent-free metal finishing solutions. |

| RESTRAINTS | • High costs of eco-friendly metal finishing chemicals limit market growth, particularly for small and medium-sized manufacturers. |

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Metal Finishing Chemicals Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Plating Chemicals

7.2.1 Plating Chemicals Market Trends Analysis (2020-2032)

7.2.2 Plating Chemicals Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Cleaning Chemicals

7.3.1 Cleaning Chemicals Market Trends Analysis (2020-2032)

7.3.2 Cleaning Chemicals Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Conversion Coating Chemicals

7.4.1 Conversion Coating Chemicals Market Trends Analysis (2020-2032)

7.4.2 Conversion Coating Chemicals Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Metal Finishing Chemicals Market Segmentation, by Process

8.1 Chapter Overview

8.2 Pre-treatment

8.2.1 Pre-treatment Market Trends Analysis (2020-2032)

8.2.2 Pre-treatment Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Electroplating

8.3.1 Electroplating Market Trends Analysis (2020-2032)

8.3.2 Electroplating Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 De-greasing

8.4.1 De-greasing Market Trends Analysis (2020-2032)

8.4.2 De-greasing Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Polishing

8.5.1 Polishing Market Trends Analysis (2020-2032)

8.5.2 Polishing Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Etching

8.6.1 Etching Market Trends Analysis (2020-2032)

8.6.2 Etching Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Cleaning

8.7.1 Cleaning Market Trends Analysis (2020-2032)

8.7.2 Cleaning Market Size Estimates and Forecasts to 2032 (USD Million)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Metal Finishing Chemicals Market Segmentation, by Material

9.1 Chapter Overview

9.2 Aluminium

9.2.1 Aluminium Market Trends Analysis (2020-2032)

9.2.2 Aluminium Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Chromium

9.3.1 Chromium Market Trends Analysis (2020-2032)

9.3.2 Chromium Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Nickel

9.4.1 Nickel Market Trends Analysis (2020-2032)

9.4.2 Nickel Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Zinc

9.5.1 Zinc Market Trends Analysis (2020-2032)

9.5.2 Zinc Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Gold

9.6.1 Gold Market Trends Analysis (2020-2032)

9.6.2 Gold Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Silver

9.7.1 Silver Market Trends Analysis (2020-2032)

9.7.2 Silver Market Size Estimates and Forecasts to 2032 (USD Million)

9.8 Copper

9.8.1 Copper Market Trends Analysis (2020-2032)

9.8.2 Copper Market Size Estimates and Forecasts to 2032 (USD Million)

9.9 Others

9.9.1 Others Market Trends Analysis (2020-2032)

9.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Metal Finishing Chemicals Market Segmentation, by End-Use Industry

10.1 Chapter Overview

10.2 Electrical & Electronics

10.2.1 Electrical & Electronics Market Trends Analysis (2020-2032)

10.2.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Automotive & Transportation

10.3.1 Automotive & Transportation Market Trends Analysis (2020-2032)

10.3.2 Automotive & Transportation Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Industrial Machinery

10.4.1 Industrial Machinery Market Trends Analysis (2020-2032)

10.4.2 Industrial Machinery Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 Building & Construction

10.5.1 Building & Construction Market Trends Analysis (2020-2032)

10.5.2 Building & Construction Market Size Estimates and Forecasts to 2032 (USD Million)

10.6 Aerospace

10.6.1 Aerospace Market Trends Analysis (2020-2032)

10.6.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Million)

10.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Metal Finishing Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.2.4 North America Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.2.5 North America Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.2.6 North America Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.2.7.2 USA Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.2.7.3 USA Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.2.7.4 USA Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.2.8.2 Canada Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.2.8.3 Canada Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.2.8.4 Canada Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.2.9.2 Mexico Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.2.9.3 Mexico Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.2.9.4 Mexico Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.6 Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.7.2 Poland Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.1.7.3 Poland Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.7.4 Poland Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.8.2 Romania Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.1.8.3 Romania Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.8.4 Romania Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.9.2 Hungary Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.1.9.3 Hungary Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.9.4 Hungary Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.10.2 Turkey Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.1.10.3 Turkey Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.10.4 Turkey Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.4 Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.5 Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.6 Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.7.2 Germany Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.7.3 Germany Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.7.4 Germany Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.8.2 France Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.8.3 France Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.8.4 France Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.9.2 UK Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.9.3 UK Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.9.4 UK Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.10.2 Italy Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.10.3 Italy Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.10.4 Italy Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.11.2 Spain Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.11.3 Spain Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.11.4 Spain Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.12.2 Netherlands Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.12.3 Netherlands Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.12.4 Netherlands Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.13.2 Switzerland Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.13.3 Switzerland Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.13.4 Switzerland Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.14.2 Austria Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.14.3 Austria Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.14.4 Austria Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.4 Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.5 Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.6 Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.7.2 China Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.7.3 China Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.7.4 China Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.8.2 India Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.8.3 India Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.8.4 India Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.9.2 Japan Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.9.3 Japan Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.9.4 Japan Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.10.2 South Korea Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.10.3 South Korea Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.10.4 South Korea Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.11.2 Vietnam Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.11.3 Vietnam Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.11.4 Vietnam Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.12.2 Singapore Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.12.3 Singapore Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.12.4 Singapore Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.13.2 Australia Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.13.3 Australia Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.13.4 Australia Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.4 Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.1.5 Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.6 Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.7.2 UAE Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.1.7.3 UAE Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.7.4 UAE Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.8.2 Egypt Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.1.8.3 Egypt Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.8.4 Egypt Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.10.2 Qatar Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.1.10.3 Qatar Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.10.4 Qatar Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.2.4 Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.2.5 Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.2.6 Africa Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.2.7.2 South Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.2.7.3 South Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.2.7.4 South Africa Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.2.8.2 Nigeria Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.2.8.4 Nigeria Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.4 Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.6.5 Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.6 Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.7.2 Brazil Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.6.7.3 Brazil Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.7.4 Brazil Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.8.2 Argentina Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.6.8.3 Argentina Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.8.4 Argentina Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.9.2 Colombia Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.6.9.3 Colombia Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.9.4 Colombia Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by Process (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America Metal Finishing Chemicals Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

12. Company Profiles

12.1 Atotech Deutschland GmbH

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 BASF SE

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Element Solutions Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 The Dow Chemical Company

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Advanced Chemical Company

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Chemetall (BASF Group)

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Platform Specialty Products Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 A Brite Company

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Houghton International Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Quaker Chemical Corporation

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Plating Chemicals

Cleaning Chemicals

Conversion Coating Chemicals

Others

By Process

Pre-treatment

Electroplating

De-greasing

Polishing

Etching

Cleaning

Others

By Material

Aluminium

Chromium

Nickel

Zinc

Gold

Silver

Copper

Others

By End Use Industry

Electrical & Electronics

Automotive & Transportation

Industrial Machinery

Building & Construction

Aerospace

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

3-Hydroxypropionic Acid Market was valued at USD 730.75 Mn in 2023 and is expected to reach USD 1,649.28 Mn by 2032, growing at a CAGR of 9.47% from 2024-2032.

Dimethylformamide (DMF) Market size was USD 2.53 Billion in 2023 and is expected to reach USD 3.92 Billion by 2032, growing at a CAGR of 4.98 % from 2024-2032.

The Thermoplastic Polyurethane (TPU) Market was valued at USD 2.91 billion in 2023 and is expected to reach USD 5.74 Billion by 2032, growing at a CAGR of 7.87% from 2024-2032.

The 3D Printing Plastics Market Size was valued at USD 1.6 billion in 2023 and is expected to reach USD 10.0 billion by 2032 and grow at a CAGR of 22.6% over the forecast period 2024-2032.

Biopesticides Market was valued at USD 7.75 Billion in 2023 and is expected to reach USD 25.82 Billion by 2032, growing at a CAGR of 14.07% from 2024-2032.

The Construction Sealants Market Size was valued at USD 4.7 billion in 2023 & it will reach USD 6.4 billion by 2032 & grow at a CAGR of 3.5% by 2024-2032

Hi! Click one of our member below to chat on Phone