To get more information on Metal Embossing Machine Market - Request Free Sample Report

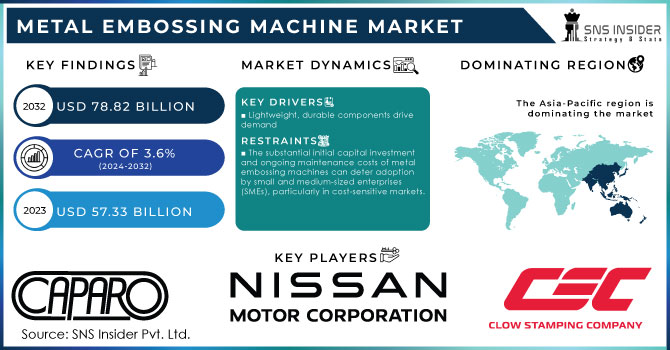

The Metal Embossing Machine Market size was valued at USD 57.33 Billion in 2023 and is expected to reach USD 78.82 Billion by 2032 with a growing CAGR of 3.6% over the forecast period 2024-2032.

The emergence of new manufacturers with new ideas and competition the imply a wider range of machines and innovative technologies, which caters to the growing demand from metal end-users. It is mainly the automotive, construction, and appliance manufacturing industries that require these machines. The demand for embossing machines is primarily in the industries utilizing such machines. They range from high-speed automation in the production of car parts to large machines. These are designed for heavy metal sheets to produce panels for architectural cladding. Except for the equipment itself, the factor on which these machines depend is the development of computer operating systems specifically designed for metals. They enable precise control over the embossing machine by utilizing a user-friendly CNC interface. The benefits of this are reduced waste and enhanced efficiency, as the automation results in faster production cycles with little labor. It also allows to save costs. Further, CNC systems can be incorporated with design software and with the help of robotic material handling. Sales of electric vehicles worldwide have to pass IEA to approximately 3.4 million. China accounted for the maximum share of 60%. Governmental support, including electric car subsidies, also providing local manufacturers of EVs to boost their presence, drives the growth of EV product, which is likely to drive the sheet metal usage during auto components production.

Automobile materials are the core materials that are used for making a vehicle. They include framework, interior and exterior structural, and transmission components. Market growth is driven by this factor during the forecast period. The market growth can be hampered as automobile manufacturers are replacing metals with plastics and carbon fiber as they help reduce the weight of vehicles. A reduction of 10% of the total weight of the vehicle results in 5% to 7% of increased fuel efficiency.

MARKET DYNAMICS

DRIVER

The metal embossing machine market is driven by the automotive and aerospace sectors' need for lightweight, durable, high-strength components to enhance performance and fuel efficiency, leading to increased demand as these industries expand.

The metal embossing machine market is growing at a quite considerable pace, primarily due to the expansion of the automotive and aerospace industries. The both spheres are increasingly committed to innovative materials assisting with the production of lightweight, highly-durable, and high-strength components. In particular, the automotive industry tends to design the parts promoting vehicle lightweighting. With reduced weight, the fuel economy of the cars can be effectively boosted as well as their overall performance. Thus, the metal embossing machines are employed in patterning and shaping metal sheets to create components that would satisfy the standards of strength and durability and be less heavy compared to their traditional alternatives.

The aerospace industry requires that component to be used in their vehicles be lightweight, durable, and withstand extreme conditions. Moreover, lightness, safety, and strength are key parameters facilitating aerospace applications. Possibly one of the key requirements for aircraft and space-related technology apart from the safety of the models is performance, more specifically fuel efficiency. The decreasing efficiency of high consumption of fuels is no longer acceptable in this era, especially considering the rising fuel costs. This results in the burgeoning production of advanced metal components capable of meeting aerospace standards to date; metal embossing machines cater to both the requirements of lightweighting parts, as well as ensuring product quality standard. Consequently, while the aerospace and automotive industry progress, they sparked an increasing demand for metal embossing machines. The need to reduce both the weight of the vehicle and the fuel consumption further increases demand.

Technological advancements, including the integration of IoT and AI for real-time monitoring and predictive maintenance, have significantly enhanced the efficiency and capabilities of metal embossing machines, driving market growth.

The metal embossing machines market has undergone significant changes due to technological progress, with the development of the Internet of Things and Artificial Intelligence playing major roles in the current growth of the sector. The former allow machines to be connected to networks, transmitting and analyzing data in real time. As a result, the work of the machines is constantly monitored to identify potential deviations and provide recommendations. Built-in sensors allow for the tracking of multiple parameters, including temperature, pressure, and vibration, with the data on these being sent to a corporate system. AI algorithms then analyze the information to determine if failures are imminent, allowing for the scheduling of timely maintenance. This in turn minimizes production losses and equipment repair expenditures. As a result, timely prevention measures are the most long-term and cost-effective, preventing the occurrence of unpredictable equipment breakdowns and achieving the longest possible machinery life cycles. This has the potential to largely eliminate the need for reactive maintenance work, which is typically costlier and leads to the stoppage of production. As a result, the machines perform embossing with greater precision and uniformity, resulting in higher product quality and less material waste. Finally, the use of IoT and AI technologies in such applications enables the accumulation of data to improve enterprise decision-making and future operations planning. As a result, combining these two solutions achieves greater efficiency and lowers costs in a variety of ways. It is no surprise that manufacturers use these technologies in their work to keep up with the times and obtain a competitive advantage by offering superior quality and lower prices. As a result, with the rapid rise of digitalization in business, the integration of AI and IoT in embossing machines is a major factor of the metal embossing machines market.

RESTRAIN

The substantial initial capital investment and ongoing maintenance costs of metal embossing machines can deter adoption by small and medium-sized enterprises (SMEs), particularly in cost-sensitive markets.

High requirement for initial capital investment that relates to metal embossing machine creates a strong obstacle for small and medium enterprises that may operate in cost-sensitive markets. Due to the demand for considerable investment in order to purchase and install this type of factory, a burden in for of maintenance and repair costs is also substantial. For SMEs, constantly paying both depends on success in operation, which complicates their financial management. For them, it is complicated to maintain investment in metal embossing machines while guaranteeing high levels of profit. As a result, SMEs may find it difficult to invest in advanced metal embossing technologies because of their high investment needs and need to pay repair and maintenance costs after the investment. In the end, these obstacles can prevent SMEs from employing advanced technologies related to metal embossing and reducing their level of competitiveness in the market.

The operation and maintenance of metal embossing machines require skilled labor and technical expertise, presenting challenges due to scarcity of operators and the involved technical complexity, particularly for companies lacking necessary expertise and resources.

The operation and maintenance of metal machines have a very high level of skilled and technical labor requirement. These make the machines technically very complicated and challenge for many companies. Besides this, the operators of these metal embossing machines need special handling, calibration, and troubleshooting of the equipment. The skill level required to operate these machines is specialized which makes the machines technically complicated. Because of these challenges, since the operator must be trained, they are very few found who run these machines and are also skilled in the establishing of uncouth parts. The machines high skilled labor requirement is a challenge for many companies especially when hiring operators who have high negotiated wage rates from the company. The training requirement by these machines is expensive as well considering the hiring of experienced operators exposing the company to increasing cost. The machines frequently require the maintenance and repairing of uncouth parts as a result of the frequent breakdown caused by the low technical knowledge of the participants. Many of these metal embossing companies are smaller and less experienced forcing them to act as and when a problem strikes.

By Product Type

The Manual Metal Embossing Machines held the largest share of over 62% in 2023 in terms of volume and value, as manual machines are generally less costly compared to the automatic ones. They are also considered to be user-friendly and therefore suitable for small workshops or for personal use.

The automatic machine is expected to be the fastest-growing segment over the forecast period, with an estimation that, in future these machines are projected to replace so much of the human effort, that is guaranteed to drive long-term productivity which eliminates manual labor and these machines can be operated automatically and they are best for large production.

By End-Use

The Low and Medium Volume dominated the market over 58% share in 2023. This is due to the demand in product manufacturing in various industries, Automotive, Aerospace, and other industries where three-dimensional patterns are required on metal products.

The High Volume, this segment is expected to grow but at relatively slower rate compared to low and medium volume. High volume embossing is used for mass production in the industries such as, Appliance manufacturing, Building materials etc.

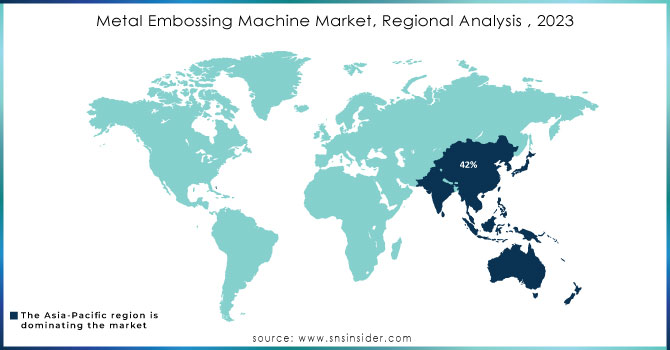

REGIONAL ANALYSIS

In 2023, Asia-Pacific dominated the metal embossing machine market in 2023 with a market share 42%. The development of manufacturing plants and increased investments could support the ongoing demand of such machines in the region. Chinese manufacturers, such as Harsle present cost-effective alternatives for the metal embossing machines. The reduced costs are primarily attributable to subsized labour and production. Therefore, such options could be especially attractive to budget-conscious customers rare to medium-complex machines. Meanwhile, the country is a hub for manufacturing domestic and export-oriented products that require metal embossing machines. Subsequently, China becomes a large market for Harsle, enabling the company to benefit from higher economies of scale and further reduce production costs. At the same time, since China is the key location of such machine manufacturers, the growth in demand for them is also expected in the region.

North America is anticipated to grow at the fastest rate, and its industrial growth is a major element driving the metal embossing machine market. metal embossing is a technique used in a range of industries to create shapes, reliefs, designs, and patterns. The United States and Canada have well-established ‘manufacturing’ across industries, such as automotive, construction, appliances, and aerospace, driving the growth of the metal embossing machines market. decorative purposes, to impart raised designs for aesthetics or for an impression of increased thickness and rigidity, or for functional foil embossing, which is an alternative to heat exchange in refrigerators or air conditioning, several metal embossing machines can emboss several colors in a single piece. The North American infrastructure is aging, including overpasses, bridges, and tunnels, which need renovation or replacement. The construction industry uses embossed metal products in roofing sheets, siding panels, and architectural panels, among other construction materials. Governments instill mandatory guidelines on product labeling, product safety, and quality.

Need any customization research on Metal Embossing Machine Market - Enquiry Now

The major key players are Caparo, Nissan Motor Company, Ltd, Kenmode, Inc., Acro Metal Stamping Co, Manor Tool & Manufacturing, D&H Industries, Inc., Klesk Metal Stamping Co., Clow Stamping Company, Goshen Stamping Company, Tempco Manufacturing Company, Inc., INTERPLEX HOLDINGS PTE. LTD., AAPICO Hitech Public Company Limited, Klesk Metal Stamping Co., and others.

RECENT DEVELOPMENT

In February 2024: Bosch Rexroth, this company might have showcased a new CNC-controlled embossing press at a trade show. This indicates a focus on automation and efficiency in the market.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 57.33 Billion |

|

Market Size by 2032 |

US$ 78.82 Billion |

|

CAGR |

CAGR of 3.6% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product Type (Manual Metal Embossing Machine and Automatic Metal Embossing Machine) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Caparo, Nissan Motor Company, Ltd, Kenmode, Inc., Acro Metal Stamping Co, Manor Tool & Manufacturing, D&H Industries, Inc., Klesk Metal Stamping Co., Clow Stamping Company, Goshen Stamping Company, Tempco Manufacturing Company, Inc., INTERPLEX HOLDINGS PTE. LTD., AAPICO Hitech Public Company Limited, Klesk Metal Stamping Co. |

|

Key Drivers |

• The metal embossing machine market is driven by the automotive and aerospace sectors' need for lightweight, durable, high-strength components to enhance performance and fuel efficiency, leading to increased demand as these industries expand. |

|

RESTRAINTS |

• The substantial initial capital investment and ongoing maintenance costs of metal embossing machines can deter adoption by small and medium-sized enterprises (SMEs), particularly in cost-sensitive markets. |

The Metal Embossing Machine Market is expected to grow at a CAGR of 3.6%.

Metal Embossing Machine Market size was USD 57.33 Billion in 2023 and is expected to Reach USD 78.82 Billion by 2032.

Manual Metal Embossing Machine is the dominating segment by product type capacity in the Metal Embossing Machine Market.

The metal embossing machine market is driven by the automotive and aerospace sectors' need for lightweight, durable, high-strength components to enhance performance and fuel efficiency, leading to increased demand as these industries expand.

Asia-Pacific is the dominating region in the Metal Embossing Machine Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Metal Embossing Machine Market Segmentation, By Product Type

7.1 Introduction

7.2 Manual Metal Embossing Machine

7.3 Automatic Metal Embossing Machine

8. Metal Embossing Machine Market Segmentation, By End-Use

8.1 Introduction

8.2 Low and Medium Volume

8.3 High Volume

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Metal Embossing Machine Market, By Country

9.2.3 North America Metal Embossing Machine Market, By Product Type

9.2.4 North America Metal Embossing Machine Market, By End-User

9.2.5 USA

9.2.5.1 USA Metal Embossing Machine Market, By Product Type

9.2.5.2 USA Metal Embossing Machine Market, By End-User

9.2.6 Canada

9.2.6.1 Canada Metal Embossing Machine Market, By Product Type

9.2.6.2 Canada Metal Embossing Machine Market, By End-User

9.2.7 Mexico

9.2.7.1 Mexico Metal Embossing Machine Market, By Product Type

9.2.7.2 Mexico Metal Embossing Machine Market, By End-User

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Metal Embossing Machine Market, By Country

9.3.2.2 Eastern Europe Metal Embossing Machine Market, By Product Type

9.3.2.3 Eastern Europe Metal Embossing Machine Market, By End-User

9.3.2.4 Poland

9.3.2.4.1 Poland Metal Embossing Machine Market, By Product Type

9.3.2.4.2 Poland Metal Embossing Machine Market, By End-User

9.3.2.5 Romania

9.3.2.5.1 Romania Metal Embossing Machine Market, By Product Type

9.3.2.5.2 Romania Metal Embossing Machine Market, By End-User

9.3.2.6 Hungary

9.3.2.6.1 Hungary Metal Embossing Machine Market, By Product Type

9.3.2.6.2 Hungary Metal Embossing Machine Market, By End-User

9.3.2.7 Turkey

9.3.2.7.1 Turkey Metal Embossing Machine Market, By Product Type

9.3.2.7.2 Turkey Metal Embossing Machine Market, By End-User

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Metal Embossing Machine Market, By Product Type

9.3.2.8.2 Rest of Eastern Europe Metal Embossing Machine Market, By End-User

9.3.3 Western Europe

9.3.3.1 Western Europe Metal Embossing Machine Market, By Country

9.3.3.2 Western Europe Metal Embossing Machine Market, By Product Type

9.3.3.3 Western Europe Metal Embossing Machine Market, By End-User

9.3.3.4 Germany

9.3.3.4.1 Germany Metal Embossing Machine Market, By Product Type

9.3.3.4.2 Germany Metal Embossing Machine Market, By End-User

9.3.3.5 France

9.3.3.5.1 France Metal Embossing Machine Market, By Product Type

9.3.3.5.2 France Metal Embossing Machine Market, By End-User

9.3.3.6 UK

9.3.3.6.1 UK Metal Embossing Machine Market, By Product Type

9.3.3.6.2 UK Metal Embossing Machine Market, By End-User

9.3.3.7 Italy

9.3.3.7.1 Italy Metal Embossing Machine Market, By Product Type

9.3.3.7.2 Italy Metal Embossing Machine Market, By End-User

9.3.3.8 Spain

9.3.3.8.1 Spain Metal Embossing Machine Market, By Product Type

9.3.3.8.2 Spain Metal Embossing Machine Market, By End-User

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Metal Embossing Machine Market, By Product Type

9.3.3.9.2 Netherlands Metal Embossing Machine Market, By End-User

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Metal Embossing Machine Market, By Product Type

9.3.3.10.2 Switzerland Metal Embossing Machine Market, By End-User

9.3.3.11 Austria

9.3.3.11.1 Austria Metal Embossing Machine Market, By Product Type

9.3.3.11.2 Austria Metal Embossing Machine Market, By End-User

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Metal Embossing Machine Market, By Product Type

9.3.2.12.2 Rest of Western Europe Metal Embossing Machine Market, By End-User

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Metal Embossing Machine Market, By Country

9.4.3 Asia Pacific Metal Embossing Machine Market, By Product Type

9.4.4 Asia Pacific Metal Embossing Machine Market, By End-User

9.4.5 China

9.4.5.1 China Metal Embossing Machine Market, By Product Type

9.4.5.2 China Metal Embossing Machine Market, By End-User

9.4.6 India

9.4.6.1 India Metal Embossing Machine Market, By Product Type

9.4.6.2 India Metal Embossing Machine Market, By End-User

9.4.7 Japan

9.4.7.1 Japan Metal Embossing Machine Market, By Product Type

9.4.7.2 Japan Metal Embossing Machine Market, By End-User

9.4.8 South Korea

9.4.8.1 South Korea Metal Embossing Machine Market, By Product Type

9.4.8.2 South Korea Metal Embossing Machine Market, By End-User

9.4.9 Vietnam

9.4.9.1 Vietnam Metal Embossing Machine Market, By Product Type

9.4.9.2 Vietnam Metal Embossing Machine Market, By End-User

9.4.10 Singapore

9.4.10.1 Singapore Metal Embossing Machine Market, By Product Type

9.4.10.2 Singapore Metal Embossing Machine Market, By End-User

9.4.11 Australia

9.4.11.1 Australia Metal Embossing Machine Market, By Product Type

9.4.11.2 Australia Metal Embossing Machine Market, By End-User

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Metal Embossing Machine Market, By Product Type

9.4.12.2 Rest of Asia-Pacific Metal Embossing Machine Market, By End-User

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Metal Embossing Machine Market, By Country

9.5.2.2 Middle East Metal Embossing Machine Market, By Product Type

9.5.2.3 Middle East Metal Embossing Machine Market, By End-User

9.5.2.4 UAE

9.5.2.4.1 UAE Metal Embossing Machine Market, By Product Type

9.5.2.4.2 UAE Metal Embossing Machine Market, By End-User

9.5.2.5 Egypt

9.5.2.5.1 Egypt Metal Embossing Machine Market, By Product Type

9.5.2.5.2 Egypt Metal Embossing Machine Market, By End-User

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Metal Embossing Machine Market, By Product Type

9.5.2.6.2 Saudi Arabia Metal Embossing Machine Market, By End-User

9.5.2.7 Qatar

9.5.2.7.1 Qatar Metal Embossing Machine Market, By Product Type

9.5.2.7.2 Qatar Metal Embossing Machine Market, By End-User

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Metal Embossing Machine Market, By Product Type

9.5.2.8.2 Rest of Middle East Metal Embossing Machine Market, By End-User

9.5.3 Africa

9.5.3.1 Africa Metal Embossing Machine Market, By Country

9.5.3.2 Africa Metal Embossing Machine Market, By Product Type

9.5.3.3 Africa Metal Embossing Machine Market, By End-User

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Metal Embossing Machine Market, By Product Type

9.5.2.4.2 Nigeria Metal Embossing Machine Market, By End-User

9.5.2.5 South Africa

9.5.2.5.1 South Africa Metal Embossing Machine Market, By Product Type

9.5.2.5.2 South Africa Metal Embossing Machine Market, By End-User

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Metal Embossing Machine Market, By Product Type

9.5.2.6.2 Rest of Africa Metal Embossing Machine Market, By End-User

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Metal Embossing Machine Market, By Country

9.6.3 Latin America Metal Embossing Machine Market, By Product Type

9.6.4 Latin America Metal Embossing Machine Market, By End-User

9.6.5 Brazil

9.6.5.1 Brazil Metal Embossing Machine Market, By Product Type

9.6.5.2 Brazil Metal Embossing Machine Market, By End-User

9.6.6 Argentina

9.6.6.1 Argentina Metal Embossing Machine Market, By Product Type

9.6.6.2 Argentina Metal Embossing Machine Market, By End-User

9.6.7 Colombia

9.6.7.1 Colombia Metal Embossing Machine Market, By Product Type

9.6.7.2 Colombia Metal Embossing Machine Market, By End-User

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Metal Embossing Machine Market, By Product Type

9.6.8.2 Rest of Latin America Metal Embossing Machine Market, By End-User

10. Company Profiles

10.1 Caparo

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Nissan Motor Company, Ltd

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 Kenmode, Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Acro Metal Stamping Co

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 Manor Tool & Manufacturing

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 D&H Industries, Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 Klesk Metal Stamping Co.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Clow Stamping Company

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 Goshen Stamping Company

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Tempco Manufacturing Company, Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Product Type

Manual Metal Embossing Machine

Automatic Metal Embossing Machine

By End-Use

Low And Medium Volume

High Volume

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Hydronic Control Market was estimated at USD 37.45 billion in 2023 and is expected to reach USD 49.25 billion by 2032, with a growing CAGR of 3.09% over the forecast period 2024-2032.

The Thermal Spray Coating Equipment and Services Market Size was valued at USD 12.77 Billion in 2023 and is expected to reach USD 18.88 Billion by 2032 and grow at a CAGR of 4.50% over the forecast period 2024-2032.

The District Heating Market Size was valued at USD 182.06 Billion in 2023 and is now anticipated to grow USD 263.19 Billion by 2032, displaying a compound annual growth rate (CAGR) of 4.18% during the forecast Period 2024-2032.

The Global Equipment Market size was estimated at USD 1113.90 billion in 2022 and is expected to reach USD 1587.74 billion by 2030 at a CAGR of 4.99% during the forecast period of 2023-2030.

The Manufacturing Execution Systems Market Size was valued at USD 14.7 Billion in 2023 and is now anticipated to grow by USD 32.9 by 2032, displaying a compound annual growth rate (CAGR) of 9.4% during the forecast Period 2024-2032.

The Chillers Market Size was valued at USD 10.71 billion in 2023 and is supposed to reach USD 16.25 billion by 2032, growing CAGR of 4.74% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone