Get more Information on Metal Casting Market - Request Sample Report

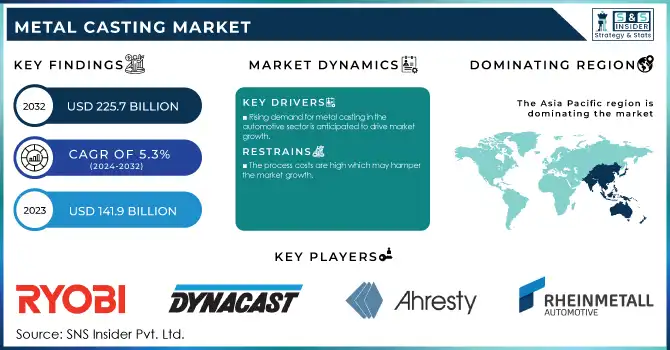

The Metal Casting Market Size was USD 141.9 billion in 2023 and is expected to reach USD 225.7 billion by 2032 and grow at a CAGR of 5.3% over the forecast period of 2024-2032.

The expansion of the energy and power sector is significantly driving the demand for metal casting, particularly in renewable energy and power generation infrastructure. As nations transition to renewable energy, investment in wind, solar, and hydro projects is increasing quickly. High-quality cast parts including nacelles, hubs, and gearboxes are essential to wind turbines. Similarly, caster pieces are used in hydropower and thermal plants to ensure grant completion in incidental circumstances. Therefore, the need for improved casting techniques is growing along with the necessity for high-strength, custom-designed parts in these energy systems. The metal casting market is a major participant in the worldwide energy transition because the government supported this trend and its incentives for renewable energy.

The International Energy Agency (IEA) highlights that renewable power generation is set to overtake coal by 2025, with solar and wind dominating new installations. This evolution underscores the increasing demand for precision-engineered castings to ensure efficiency in renewable energy applications

The increasing use of aluminum and magnesium alloys is a transformative trend across various industries due to their lightweight, high-strength, and corrosion-resistant properties. Such materials are in particularly high demand within the automotive, aerospace, and electronics industries, were decreased component mass increases performance and fuel efficiency. For instance, the majority of automotive OEMs use cast aluminum engine blocks, cast aluminum cylinder heads, and cast aluminum transmission cases for reduced vehicle weight to comply with specific stringent emission norms and enforce fuel economy. Likewise, magnesium alloys became popular in aerospace as their excellent strength-to-weigh proportion offered a fantastic way to achieve decreased structural mass without compromising rigidity. Making matters worse, demand for electric vehicles (EVs) continues to climb, and these alloys are now at an even higher value, as lighter materials allow for an extended battery range and reduced energy consumption.

In 2023, the aluminum content in a typical U.S. vehicle was approximately 280 lbs, and the use of lightweight aluminum alloys continues to rise, driven by the need to meet stricter fuel economy standards and reduce carbon emissions.

Drivers

Rising demand for metal casting in the automotive sector is anticipated to drive market growth.

Increasing automotive industry requirements for cast components owing to performance, safety, and environmental standards is a major driving factor for metal casting market growth over the next eight years. As the automotive industry trends toward lightweight materials for better fuel economy and lower carbon emissions, aluminum, magnesium, and other alloy-cast metal parts are gaining further market momentum. Through these materials, high-strength and low-weight components can be produced such as engine blocks, cylinder heads, and suspension components. This demand is also due to the global getaway from fossil fuel vehicles towards electric vehicles (EVs) since automakers need cast components to improve battery performance and lighten vehicle weight.

Also, complex high-performance components for the automotive sector are produced using advanced casting processes in response to more stringent regulatory standards for combustion engine efficiency and safety. With increasing government regulations like the Corporate Average Fuel Economy (CAFE) standards in the U.S. and other similar frameworks in Europe and Asia pushing automakers to pursue lightweight casting solutions to meet fuel consumption and emissions target trends, the automotive manufacturing industry's requirement for metal casting is likely to grow, further fueling the metal casting market expansion.

Restraint

The process costs are high which may hamper the market growth.

Metal casting processes are cost-intensive, which is a major restraint for metal casting market growth. Casting operations, especially for high-value materials such as aluminum, magnesium, and titanium alloys involve costly machinery, skilled labor, and considerable energy pay-offs. The cost-saving potential from casting technologies lies in the very high initial equipment investment needed for setting up casting systems (purchase of molds, furnaces, and other equipment) and in the significant costs of maintaining complex systems. Moreover, processes such as die casting or investment casting providing precision components for automotive and aerospace use entail even higher operational costs (due to the complexity of process methods and the use of duly alloyed materials).

Such high process costs can restrict the metal casting solutions for small-scale manufacturers, especially ones with less-developed industrial infrastructure. These extra cost responsibilities might also cause some trouble in new industries or startups (which are typically limited in their budget plans) that could benefit from the adoption of metal casting technologies.

By Material

Aluminum held the largest market share around 40% in 2023. It is owing to its lightweight and relatively lower cost along with its applicability in a diverse number of industries. Aluminum is a single example of material specially used in automotive, aerospace, and construction sectors due to a rising need for lightweight material with sturdiness and dependability. Add to this its sublime corrosion resistance, ease of molding, and high recyclability, and it's not hard to see why. Aluminum casting, for instance, is widely used within the auto business in hardware parts similar to engine blocks, transmission instances, and chassis components to cut back vehicle weight and enhance gas effectivity. In addition, its low price compared with titanium or magnesium, combined with its excellent mechanical properties, makes aluminum the material of choice for high-volume manufacturing and custom applications.

By Application

The automotive & transportation sector held the largest market around 55% in 2023. Metal casting plays an important role in the fabrication of many automotive components such as engine blocks, transmission parts, wheels, and suspension and body structures. Due to the ever-growing emphasis on weight reduction in the automotive industry to enhance fuel economy and minimize emissions, casting-friendly metals like aluminum and magnesium have taken center stage. Production of EVs has become one of the major drivers of automotive casting, largely owing to the wide adoption of lightweight cast components for higher battery efficiency and greater range in electric cars.

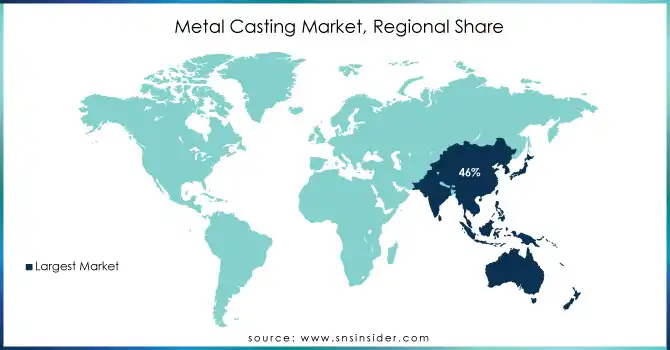

Asia Pacific held the highest market share around 46% in 2023 due to rapid industrialization, strong manufacturing capabilities, and demand in key sectors such as automotive, aerospace, and construction. Countries such as China, India, Japan, and South Korea are prominent consumers and producers of cast components due to the large-scale automotive manufacturing industries and infrastructure development projects in these countries. Automotive production is well established in the country, and his growing investment in electric vehicles EV boosts demand from the automotive sector for cast aluminum as a lightweight, high-strength material The competitive labor costs, productivity in engineering, and advanced manufacturing infrastructure coupled with government incentives for industrial development also enhance the growth of metal casting production in the region

In contrast, the growth of the automotive and transportation sectors in India has led to a rising demand for metal casting solutions. This industry is still one of the key consumers of metal cast parts in the region, as the automotive industry's mass production volume is still running at the top in the world. In addition, urbanization in Asia-Pacific countries is leading to increased infrastructure and construction projects, which is another factor supporting the demand for cast metal components in these industries.

Get Customized Report as per your Business Requirement - Request For Customized Report

Ryobi Limited (Die-cast aluminum components, Engine parts)

Dynacast (Zinc die-cast components, Aluminum die-cast parts)

MINO Industry USA, Inc. (Die-casting machines, Precision die-cast parts)

Ahresty Corporation (Aluminum die-casting, Engine components)

GIBBS (Automotive castings, Die-cast aluminum products)

Rheinmetall Automotive AG (Aluminum castings, Engine parts)

Endurance Technologies Limited (Automotive components, Aluminum die-casting)

Aisin Automotive Casting, LLC. (Aluminum castings, Transmission components)

Nemak (Engine blocks, Transmission components)

Georg Fischer Ltd (Automotive components, Precision casting)

Castrol (Lubricants for casting, Industrial casting oils)

BASF (Casting resins, Chemical products for casting processes)

Alcoa Corporation (Aluminum castings, Automotive structural components)

Magna International (Aluminum die-casting, Automotive parts)

KSM Castings Group (Aluminum castings, Cylinder heads)

ZOLLERN GmbH & Co. KG (Steel castings, Gear components)

Eagle Aluminum Cast Products (Aluminum castings, Pressure die-cast products)

Precision Castparts Corp. (Aerospace components, Industrial castings)

Duncan Industries, Inc. (Sand castings, Engine parts)

Bühler Group (Die-casting machines, Precision parts)

In 2024, Ryobi Aluminium Casting UK has significantly advanced its manufacturing capabilities, integrating cutting-edge processes into its operations. This includes the continued use of their patented Ryobi Shut Valve (RSV), a vacuum-assisted die-casting process.

In 2022, POSCO announced that its Pohang and Gwangyang steel plants received certification for their outstanding efforts in advancing sustainability within the steel industry. This achievement highlights the plants' strong dedication to environmental, social, and corporate governance (ESG) goals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 141.9 Billion |

| Market Size by 2032 | US$ 225.7 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Cast Iron, Aluminium, Stainless Steel, Zinc, Magnesium, Carbon Steel, High Steel Alloy, Others) • By Process Type (Sand Casting, Die Casting, Shell Mold Casting, Gravity Casting, Vacuum Casting, Investment Casting, Others) • By End-use (Automotive & Transportation, Building & Construction, Mining, Equipment & Machine, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ryobi Limited, Dynacast, MINO Industry USA, Inc., Ahresty Corporation, GIBBS, Rheinmetall Automotive AG, Endurance Technologies Limited, Aisin Automotive Casting, LLC., Nemak, Georg Fischer Ltd, and other players. |

| DRIVERS | • Emission and fuel efficiency rules that are strict • Lack of a different way to make things • More and more people are buying hybrid and electric cars. |

| Restraints | • The process costs a lot of money because it needs a lot of tools, dies, and energy. |

Ans: Primary or secondary type of research done by this reports.

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Ryobi Limited, Dynacast, MINO Industry USA, Inc., Ahresty Corporation, GIBBS, Rheinmetall Automotive AG, Endurance Technologies Limited, Aisin Automotive Casting, LLC., Nemak and Georg Fischer Ltd.

Ans: The process costs a lot of money because it needs a lot of tools, dies, and energy are the restraints for Global Metal Casting Market.

Ans: The Metal Casting Market Size was USD 141.9 billion in 2023 and is expected to reach USD 225.7 billion by 2032 and grow at a CAGR of 5.3% over the forecast period of 2024-2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 By Material Benchmarking

6.3.1 By Material specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new By Material launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Metal Casting Market Segmentation, By Material

7.1 Chapter Overview

7.2 Iron

7.2.1 Iron Market Trends Analysis (2020-2032)

7.2.2 Iron Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Steel

7.3.1 Steel Market Trends Analysis (2020-2032)

7.3.2 Steel Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Aluminum

7.4.1 Aluminum Market Trends Analysis (2020-2032)

7.4.2 Aluminum Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Metal Casting Market Segmentation, by Application

8.1 Chapter Overview

8.2 Automotive & Transportation

8.2.1 Automotive & Transportation Market Trends Analysis (2020-2032)

8.2.2 Automotive & Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Industrial

8.3.1 Industrial Market Trends Analysis (2020-2032)

8.3.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Building & Construction

8.4.1 Building & Construction Market Trends Analysis (2020-2032)

8.4.2 Building & Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Metal Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.2.4 North America Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.2.5.2 USA Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.2.6.2 Canada Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.2.7.2 Mexico Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Metal Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.1.5.2 Poland Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.1.6.2 Romania Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Metal Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.4 Western Europe Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.5.2 Germany Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.6.2 France Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.7.2 UK Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.8.2 Italy Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.9.2 Spain Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.12.2 Austria Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Metal Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.4.4 Asia Pacific Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.4.5.2 China Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.4.5.2 India Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.4.5.2 Japan Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.4.6.2 South Korea Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.2.7.2 Vietnam Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.4.8.2 Singapore Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.4.9.2 Australia Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Metal Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.1.4 Middle East Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.1.5.2 UAE Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Metal Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.2.4 Africa Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Metal Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.6.4 Latin America Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.6.5.2 Brazil Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.6.6.2 Argentina Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.6.7.2 Colombia Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Metal Casting Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Metal Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Ryobi Limited

10.1.1 Company Overview

10.1.2 Financial

10.1.3 By Product / Services Offered

10.1.4 SWOT Analysis

10.2 Dynacast

10.2.1 Company Overview

10.2.2 Financial

10.2.3 By Product / Services Offered

10.2.4 SWOT Analysis

10.3 MINO Industry USA, Inc

10.3.1 Company Overview

10.3.2 Financial

10.3.3 By Product / Services Offered

10.3.4 SWOT Analysis

10.4 Ahresty Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 By Product / Services Offered

10.4.4 SWOT Analysis

10.5 GIBBS

10.5.1 Company Overview

10.5.2 Financial

10.5.3 By Product / Services Offered

10.5.4 SWOT Analysis

10.6 Rheinmetall Automotive AG

10.6.1 Company Overview

10.6.2 Financial

10.6.3 By Product / Services Offered

10.6.4 SWOT Analysis

10.7 Endurance Technologies Limited

10.7.1 Company Overview

10.7.2 Financial

10.7.3 By Product / Services Offered

10.7.4 SWOT Analysis

10.8 Aisin Automotive Casting, LLC

10.8.1 Company Overview

10.8.2 Financial

10.8.3 By Product / Services Offered

10.8.4 SWOT Analysis

10.9 Nemak

10.9.1 Company Overview

10.9.2 Financial

10.9.3 By Product / Services Offered

10.9.4 SWOT Analysis

10.10 Georg Fischer Ltd

10.10.1 Company Overview

10.10.2 Financial

10.10.3 By Product / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Material

Iron

Steel

Aluminium

Others

By Application

Automotive & Transportation

Industrial

Building & Construction

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Acetonitrile Market size was USD 414.94 Million in 2023 and is expected to reach USD 692.74 Million by 2032, growing at a CAGR of 5.86 % from 2024-2032.

Technical Textile Market was valued at USD 210.2 billion in 2023 and is expected to reach USD 349.2 billion by 2032, growing at a CAGR of 5.8% from 2024-2032.

The Fungicides Market Size was USD 22.1 billion in 2023, and is expected to reach USD 37.8 billion by 2032, and grow at a CAGR of 6.2% by 2024-2032.

The Thermic Fluids Market Size was valued at USD 11.6 Billion in 2023 and is expected to reach USD 16.3 Billion by 2032, growing at a CAGR of 3.9% over the forecast period of 2024-2032.

The Core Material Market Size was valued at USD 1.80 Billion in 2023 and is expected to reach USD 4.66 Billion by 2032, growing at a CAGR of 11.15% over the forecast period of 2024-2032.

The Electrical Conduit Market Size was valued at USD 8.713 billion in 2023 and is expected to reach USD 16.27 billion by 2032 and grow at a CAGR of 7.19 % over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone