Get more information on Medical Tubing Market - Request Sample Report

The Medical Tubing Market Size was valued at USD 10.7 billion in 2023 and is expected to reach USD 21.8 billion by 2032 and grow at a CAGR of 8.3% over the forecast period 2024-2032.

The Medical Tubing market is experiencing a surge in innovation and investment, driven by various factors such as the rising demand for minimally invasive surgeries, the prevalence of chronic illnesses, and advancements in medical device technology. The need for medical tubing is expanding across numerous applications, including catheters, endotracheal tubes, IV tubes, and surgical instruments. Commonly used materials like silicone, polyurethane, and polyethylene are favored for their flexibility, durability, and biocompatibility. To meet the evolving requirements of healthcare, companies are developing advanced materials such as thermoplastic elastomers and fluoropolymers, which address specific challenges in medical procedures. Additionally, the growing trend of outpatient care and home healthcare prompts demand for specialized and cost-effective medical tubing solutions. Regulatory developments and the emphasis on higher safety and performance standards further motivate innovation and the introduction of new products.

Recent advancements highlight the focus on enhancing production capabilities and forming strategic partnerships in the medical tubing sector. For instance, a notable collaboration emerged in November 2024 when a prominent manufacturer announced plans to invest ₹200 crore in a new medical tube manufacturing facility near Chennai, aimed at increasing production capacity to meet the escalating demand in India and neighboring regions. In a related development, a leading medical supplier expanded its biopharma product portfolio in August 2024 by introducing single-use assemblies that incorporate medical tubing components, catering to the rising need for sterile systems in biopharmaceutical applications. Furthermore, another major player announced in February 2023 the expansion of its medical tubing production in Massachusetts, strategically designed to enhance its ability to supply high-quality tubing in response to global healthcare demands. These investments and innovations illustrate the critical role of reliable, high-performance medical tubing in facilitating complex healthcare procedures and treatments, underscoring the industry's commitment to meeting the increasing needs of the medical community.

Drivers:

Rising Demand for Minimally Invasive Surgeries Drives the Need for Advanced Medical Tubing Solutions

The growing preference for minimally invasive surgeries (MIS) is one of the primary drivers for the expansion of the medical tubing market. MIS techniques, such as laparoscopy and endoscopy, have seen a significant rise due to their advantages, including smaller incisions, reduced risk of infection, and shorter recovery times. These procedures require specialized medical tubing, which provides the flexibility, strength, and biocompatibility necessary for these complex operations. Tubing is used in a variety of devices like catheters, endoscopes, and surgical instruments, and the need for reliable and high-performance materials is growing as the volume of such surgeries increases. As healthcare providers aim to reduce patient recovery times and improve surgical outcomes, the demand for advanced medical tubing technologies is expected to continue growing, fueling market expansion.

Increasing Incidence of Chronic Diseases and Aging Populations Accelerates Medical Tubing Market Growth

Growing Demand for Home Healthcare Solutions Stimulates Medical Tubing Market Expansion

Restraint:

Stringent Regulatory Standards for Medical Tubing Production May Hinder Market Growth

Opportunity:

Advancements in Biocompatible and Eco-Friendly Medical Tubing Materials Present New Market Opportunities

Increasing Demand for Personalized Medicine Fuels Growth in Custom Medical Tubing Solutions

Expanding Healthcare Infrastructure in Emerging Markets Opens New Opportunities for Medical Tubing Manufacturers

The rapid expansion of healthcare infrastructure in emerging markets offers new growth opportunities for medical tubing manufacturers. As healthcare access improves in regions such as Asia-Pacific, Latin America, and the Middle East, the demand for medical devices, including those requiring tubing, is increasing. The expansion of healthcare facilities, along with the rising prevalence of chronic diseases and an aging population in these regions, creates a need for high-quality medical tubing solutions. Manufacturers who can establish a presence in these emerging markets and meet the growing demand for medical devices will be well-positioned to capitalize on these new opportunities, driving long-term market growth.

Raw Material Price Volatility and Supply Chain Disruptions Pose Challenges to Medical Tubing Manufacturers

Fluctuating prices of raw materials and disruptions in supply chains represent significant challenges for manufacturers in the medical tubing market. The cost of raw materials such as plastics, silicones, and elastomers can be volatile due to factors such as global demand, geopolitical instability, and natural disasters. These price fluctuations can increase production costs, which may affect the pricing of final medical tubing products. Additionally, disruptions in supply chains, such as delays in material delivery or manufacturing capacity constraints, can lead to production delays and unmet demand. Manufacturers must navigate these challenges while maintaining product quality and competitive pricing, which can be particularly difficult during periods of economic instability or global supply chain interruptions.

Consumer Trends in the Medical Tubing Market

| Consumer Trend | Explanation |

|---|---|

| Increased demand for biocompatible materials | Consumers are increasingly opting for biocompatible materials that minimize adverse reactions in patients, especially in critical applications like catheters and infusion tubing. |

| Growing preference for custom medical tubing solutions | With personalized healthcare rising, there is a demand for custom-sized and tailor-made medical tubing solutions to fit specific medical applications. |

| Focus on safety and reliability | Safety and reliability are key factors driving purchasing decisions, particularly for high-risk applications where tube failure could lead to serious consequences. |

| Shift towards eco-friendly and sustainable products | Environmental concerns are pushing for products made from recyclable or biodegradable materials, with companies focusing on reducing waste and improving sustainability. |

| Rising demand for minimally invasive medical devices | There is a growing preference for minimally invasive techniques in healthcare, which require smaller, more flexible medical tubing that supports precise and less invasive treatments. |

The medical tubing market has seen several consumer-driven trends that shape product development and purchasing decisions. One significant trend is the increased demand for biocompatible materials, which are essential in critical applications where patient safety is a priority. Another important factor is the growing preference for custom solutions, driven by personalized healthcare needs. Safety and reliability are consistently prioritized, particularly in high-risk applications. Along with this, there is a clear shift towards eco-friendly products, as consumers and healthcare providers alike seek sustainable options that reduce environmental impact. Additionally, the rising demand for minimally invasive devices is pushing for smaller and more flexible medical tubing, supporting the trend toward less invasive medical procedures and precision treatments. These trends highlight the growing demand for more specialized, safe, and environmentally conscious products in the medical tubing market.

By Product Type

In 2023, silicone-based medical dominated the product type segment in the medical tubing market, holding a market share of 30%. This prominence can be attributed to silicone's unique properties that make it particularly well-suited for medical applications. Silicone is renowned for its excellent biocompatibility, which is crucial in applications involving direct contact with body tissues and fluids. Additionally, silicone exhibits high flexibility, allowing for easier maneuverability in various medical devices, including catheters and surgical drains. Its thermal stability ensures that it can withstand sterilization processes, maintaining integrity and performance in critical settings. For example, silicone tubing is widely used in neonatal and pediatric care, where patient safety and comfort are paramount. Furthermore, silicone's ability to resist degradation from various chemicals and its non-reactive nature make it an ideal choice for applications involving sensitive medications. As healthcare providers increasingly prioritize patient safety and comfort, the preference for silicone in high-precision medical devices continues to drive its demand, solidifying its position as the leading product type in the medical tubing market.

By Material

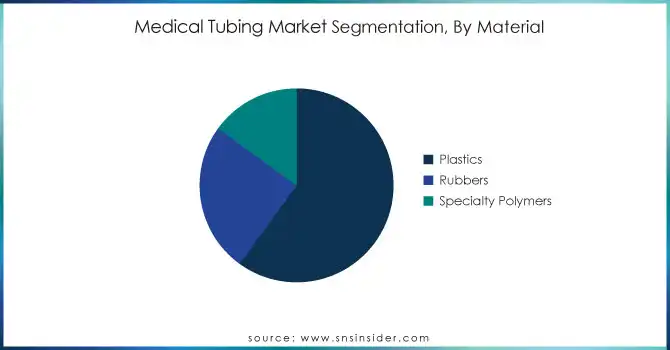

In 2023, the plastics segment dominated the material segment of the medical tubing market, with a market share of 60%. The extensive use of plastics in medical tubing can be attributed to their versatility, cost-effectiveness, and favorable mechanical properties. Key plastics such as polyolefins (including polyethylene and polypropylene) and polyvinyl chloride (PVC) are commonly employed due to their excellent flexibility, durability, and ease of manufacturing. PVC, in particular, is widely used in intravenous (IV) tubing and blood bags, as it offers clarity and strength, ensuring safe and effective fluid transfer. The ability to customize plastics for specific applications further enhances their appeal; they can be produced in various sizes, shapes, and colors, accommodating a wide range of medical devices. Moreover, the growing focus on cost-effective healthcare solutions drives the demand for plastic tubing, especially in settings where disposable options are preferred. As the healthcare industry continues to expand and evolve, the reliance on plastics in medical tubing applications is expected to remain strong, reinforcing their leading position in the market.

By Structure

In 2023, single-lumen structures dominated the medical tubing market, capturing a market share of 40%. Single-lumen tubing is characterized by its straightforward design, featuring a single channel through which fluids or medications can be delivered. This simplicity makes it an ideal choice for various medical applications, including catheters used for urinary drainage, intravenous (IV) access, and fluid administration. The ease of use associated with single-lumen tubing contributes significantly to its popularity among healthcare professionals, as it simplifies procedures and reduces the risk of complications associated with more complex tubing structures. Additionally, single-lumen tubing is generally more cost-effective than multi-lumen or co-extruded options, making it accessible for a wide range of medical settings. As healthcare facilities seek to optimize efficiency while ensuring patient safety, the demand for reliable and easy-to-handle single-lumen tubing continues to grow. Moreover, the increasing emphasis on minimally invasive procedures further supports the expansion of this segment, as single-lumen tubes are often preferred for their straightforward application in various surgical and diagnostic interventions.

By Application

In 2023, the catheters and cannulas segment dominated the medical tubing market, holding a market share of 35%. The widespread use of catheters and cannulas in various medical procedures drives the demand for high-quality medical tubing. Catheters are essential in numerous applications, including cardiovascular interventions, dialysis, and drug administration, where precise fluid management is crucial. The increasing prevalence of chronic diseases, such as diabetes and heart conditions, has further accelerated the demand for catheters, as many patients require ongoing management and treatment. Additionally, the growing trend toward minimally invasive surgeries has heightened the reliance on catheters, which are often used to facilitate procedures with reduced patient recovery times and lower risks of infection. Innovations in catheter design and materials, aimed at enhancing patient comfort and safety, also contribute to the segment's growth. As healthcare providers continue to seek effective solutions for patient care, the catheters and cannulas segment is expected to maintain its leading position in the medical tubing market, reflecting the critical role these devices play in modern healthcare.

By End-User

In 2023, hospitals and clinics dominated the medical tubing market, with a market share of 50%. This dominance is primarily driven by the high volume of medical procedures performed in these settings, which necessitates a wide range of medical tubing applications. Hospitals and clinics are the frontlines of patient care, where various medical devices, such as infusion systems, catheters, and respiratory support equipment, are utilized extensively. The increasing number of surgical procedures, diagnostic tests, and emergency care situations underscores the ongoing demand for reliable medical tubing solutions in these environments. Furthermore, the trend toward outpatient care and the rising prevalence of chronic diseases that require regular treatment have also contributed to the growing utilization of medical tubing in hospitals and clinics. The continuous focus on enhancing patient outcomes and safety leads healthcare providers to invest in high-quality medical tubing products that ensure efficacy and reliability. As healthcare infrastructure expands globally, hospitals and clinics are expected to maintain their dominant position in the medical tubing market, reflecting the critical role they play in delivering comprehensive patient care.

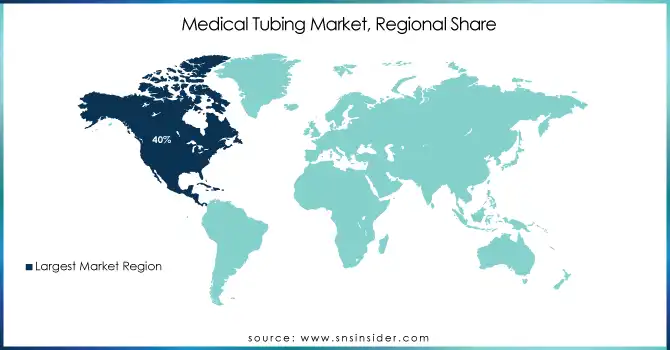

In 2023, North America dominated the medical tubing market, capturing a market share of 40%. The region's leadership can be attributed to its advanced healthcare infrastructure, high demand for medical devices, and increasing investment in medical technologies. The U.S., in particular, is a key player in this region, with a significant portion of the market share. The country’s well-established healthcare system and a strong focus on innovative medical solutions contribute to the large-scale consumption of medical tubing. The prevalence of chronic diseases, such as heart disease, diabetes, and cancer, has significantly increased the demand for medical devices like catheters, dialysis tubing, and infusion lines, all of which rely on medical tubing. Additionally, the presence of leading medical device manufacturers, including Medtronic and Boston Scientific, further drives the demand for high-quality medical tubing products. Moreover, the continuous advancements in minimally invasive surgeries and diagnostic techniques in North America also contribute to the growing demand for medical tubing. This demand is bolstered by regulatory support, such as the FDA’s approval of advanced medical devices, ensuring that the region maintains its position as the market leader in the medical tubing sector.

Moreover, in 2023, the Asia Pacific region emerged as the fastest-growing market for medical tubing, with a CAGR of 8.5%. The rapid growth of this region can be attributed to the expansion of the healthcare infrastructure, increasing healthcare expenditures, and a rising population in countries such as China and India. The growing prevalence of chronic diseases, coupled with an aging population, has led to an increase in demand for medical devices, including catheters, infusion sets, and diagnostic tubes. For instance, the Chinese healthcare market is expected to see rapid growth due to the country's aging population and a surge in healthcare investments. In India, rising awareness about healthcare and the improvement of medical services are expected to contribute to the strong demand for medical tubing products. Furthermore, the expanding medical device manufacturing sector in countries like Japan, South Korea, and Singapore is fueling the demand for high-quality medical tubing materials, particularly in the fields of oncology and cardiac treatments. As the demand for advanced medical treatments continues to rise in these countries, the medical tubing market in Asia Pacific is expected to maintain its rapid growth trajectory, driven by both domestic consumption and export opportunities.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments

November 2024: Lubrizol partnered with Polyhose to open a medical tubing production facility in India, addressing the growing demand for high-performance tubing in critical healthcare applications.

February 2023: Freudenberg Medical expanded its production capabilities with a new facility in Massachusetts to meet rising demand for custom medical tubing in biopharma and diagnostics.

Key Players:

AP Technologies Group Pte. Ltd. (Custom medical tubing, Multi-lumen tubing)

Davis Standard (Medical extrusion systems, Tubing extrusion machinery)

Fine Tubes Ltd. (Medical-grade stainless steel tubing, Catheter shafts)

Lubrizol Corporation (Thermoplastic elastomers, Crosslinked PE tubing)

Nordson Corporation (Hot melt adhesive equipment, Medical tube bonding systems)

Optinova (PVC medical tubing, Multi-lumen medical tubing)

Putnam Plastics (PTFE tubing, Multi-lumen catheter tubing)

RAUMEDIC AG (Silicone tubing, Micro tubing for medical applications)

Saint-Gobain Performance Plastics (Tygon medical tubing, Platinum-cured silicone tubing)

Teleflex Incorporated (Endotracheal tubes, Catheter tubing)

Zeus Industrial Products, Inc. (PTFE medical tubing, FEP and PEEK tubing)

Abbott Laboratories (Diagnostic tubing, Catheters)

B Braun Melsungen AG (IV tubing, Catheter tubing)

Conmed Corporation (Laparoscopic tubing, Electrosurgical tubing)

DSM Biomedical (Polymer medical tubing, Polycarbonate tubing)

Freudenberg Medical (Silicone rubber tubing, Tubing for medical devices)

Heraeus Medical Components (Silicone tubing, Catheter shafts)

Johnson & Johnson (Catheter tubing, Surgical instrument tubing)

Medtronic (Catheters, Infusion tubing)

TE Connectivity (Medical-grade connectors, Custom tubing for medical devices)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.7 Billion |

| Market Size by 2032 | USD 21.8 Billion |

| CAGR | CAGR of 8.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Silicone, Polyolefins, Polyimide, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, Others) •By Material (Plastics, Rubbers, Specialty Polymers) •By Structure (Single-lumen, Co-extruded, Multi-lumen, Tapered or Bump tubing,, Braided tubing) •By Application (Bulk disposable tubing, Catheters & cannulas, Drug delivery system, Biopharmaceutical laboratory equipment, Others) •By End-User (Hospitals and Clinics, Medical Device Manufacturers, Ambulatory Surgical Centers (ASCs), Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Bayer AG, Lonza Group AG, Azelis, Huntsman Corporation, Evonik Industries AG, Syngenta AG, Wacker Chemie AG, Albemarle Corporation, Taj Pharmaceuticals Ltd. and other key players |

| Key Drivers | •Increasing Incidence of Chronic Diseases and Aging Populations Accelerates Medical Tubing Market Growth •Growing Demand for Home Healthcare Solutions Stimulates Medical Tubing Market Expansion |

| Restraints | •Stringent Regulatory Standards for Medical Tubing Production May Hinder Market Growth |

Ans: The Medical Tubing Market is expected to grow at a CAGR of 8.3%

Ans: The Medical Tubing Market Size was valued at USD 10.7 billion in 2023 and is expected to reach USD 21.8 billion by 2032

Ans: New opportunities in medical tubing arise from progress in sustainable materials, growing personalized healthcare needs, and expanding healthcare systems in emerging regions.

Ans: Fluctuating raw material prices and supply chain disruptions present significant challenges for medical tubing manufacturers, impacting production costs and delivery timelines.

Ans: North America dominated the medical tubing market with a 40% share, driven by advanced healthcare infrastructure, high medical device demand, and significant investment in medical technologies, particularly in the U.S.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production and Sales Volumes, 2020-2032, by Region

5.2 Product Type Adoption Rates, by Region

5.3 Innovation and R&D Spending, by Region

5.4 Regulatory Impact, by Region

5.5 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Medical Tubing Market Segmentation, By Product Type

7.1 Chapter Overview

7.2 Silicone

7.2.1 Silicone Market Trends Analysis (2020-2032)

7.2.2 Silicone Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Polyolefins

7.3.1 Polyolefins Market Trends Analysis (2020-2032)

7.3.2 Polyolefins Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Polyimide

7.4.1 Polyimide Market Trends Analysis (2020-2032)

7.4.2 Polyimide Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Polyvinyl Chloride

7.5.1 Polyvinyl Chloride Market Trends Analysis (2020-2032)

7.5.2 Polyvinyl Chloride Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Polycarbonates

7.6.1 Polycarbonates Market Trends Analysis (2020-2032)

7.6.2 Polycarbonates Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Fluoropolymers

7.7.1 Fluoropolymers Market Trends Analysis (2020-2032)

7.7.2 Fluoropolymers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Others

7.8.1 Others Market Trends Analysis (2020-2032)

7.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Medical Tubing Market Segmentation, By Material

8.1 Chapter Overview

8.2 Plastics

8.2.1 Plastics Market Trends Analysis (2020-2032)

8.2.2 Plastics Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Rubbers

8.3.1 Rubbers Market Trends Analysis (2020-2032)

8.3.2 Rubbers Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Specialty Polymers

8.4.1 Specialty Polymers Market Trends Analysis (2020-2032)

8.4.2 Specialty Polymers Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Medical Tubing Market Segmentation, By Structure

9.1 Chapter Overview

9.2 Single-lumen

9.2.1 Single-lumen Market Trends Analysis (2020-2032)

9.2.2 Single-lumen Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Co-extruded

9.3.1 Co-extruded Market Trends Analysis (2020-2032)

9.3.2 Co-extruded Market Size Estimates And Forecasts To 2032 (USD Billion)

9.4 Multi-lumen

9.4.1 Multi-lumen Market Trends Analysis (2020-2032)

9.4.2 Multi-lumen Market Size Estimates And Forecasts To 2032 (USD Billion)

9.5 Tapered or Bump tubing

9.5.1 Tapered or Bump tubing Market Trends Analysis (2020-2032)

9.5.2 Tapered or Bump tubing Market Size Estimates And Forecasts To 2032 (USD Billion)

9.6 Braided tubing

9.6.1 Braided tubing Market Trends Analysis (2020-2032)

9.6.2 Braided tubing Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Medical Tubing Market Segmentation, By Application

10.1 Chapter Overview

10.2 Bulk disposable tubing

10.2.1 Bulk disposable tubing Market Trends Analysis (2020-2032)

10.2.2 Bulk disposable tubing Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Catheters & cannulas

10.3.1 Catheters & cannulas Market Trends Analysis (2020-2032)

10.3.2 Catheters & cannulas Market Size Estimates And Forecasts To 2032 (USD Billion)

10.4 Drug delivery system

10.4.1 Drug delivery system Market Trends Analysis (2020-2032)

10.4.2 Drug delivery system Market Size Estimates And Forecasts To 2032 (USD Billion)

10.5 Biopharmaceutical laboratory equipment

10.5.1 Biopharmaceutical laboratory equipment Market Trends Analysis (2020-2032)

10.5.2 Biopharmaceutical laboratory equipment Market Size Estimates And Forecasts To 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Medical Tubing Market Segmentation, By End-User

11.1 Chapter Overview

11.2 Hospitals and Clinics

11.2.1 Hospitals and Clinics Market Trends Analysis (2020-2032)

11.2.2 Hospitals and Clinics Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Medical Device Manufacturers

11.3.1 Medical Device Manufacturers Market Trends Analysis (2020-2032)

11.3.2 Medical Device Manufacturers Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 Ambulatory Surgical Centers (ASCs)

11.4.1 Ambulatory Surgical Centers (ASCs) Market Trends Analysis (2020-2032)

11.4.2 Ambulatory Surgical Centers (ASCs) Market Size Estimates And Forecasts To 2032 (USD Billion)

11.5 Others

11.5.1 Others Market Trends Analysis (2020-2032)

11.5.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Medical Tubing Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.2.4 North America Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.2.5 North America Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.2.6 North America Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.7 North America Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.2.8.2 USA Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.2.8.3 USA Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.2.8.4 USA Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.8.5 USA Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.2.9.2 Canada Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.2.9.3 Canada Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.2.9.4 Canada Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.9.5 Canada Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.2.10.2 Mexico Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.2.10.3 Mexico Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.2.10.4 Mexico Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.10.5 Mexico Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Medical Tubing Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.1.8.2 Poland Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.1.8.3 Poland Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.1.8.4 Poland Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8.5 Poland Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.1.9.2 Romania Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.1.9.3 Romania Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.1.9.4 Romania Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9.5 Romania Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Medical Tubing Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.4 Western Europe Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.5 Western Europe Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.6 Western Europe Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.7 Western Europe Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.8.2 Germany Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.8.3 Germany Medical Tubing Market Estimates And Forecasts, By Material Vehicle Material (2020-2032) (USD Billion)

12.3.2.8.4 Germany Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8.5 Germany Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.9.2 France Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.9.3 France Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.9.4 France Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9.5 France Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.10.2 UK Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.10.3 UK Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.10.4 UK Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10.5 UK Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.11.2 Italy Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.11.3 Italy Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.11.4 Italy Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11.5 Italy Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.12.2 Spain Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.12.3 Spain Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.12.4 Spain Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.5 Spain Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.15.2 Austria Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.15.3 Austria Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.15.4 Austria Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15.5 Austria Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Medical Tubing Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.4 Asia Pacific Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.5 Asia Pacific Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.6 Asia Pacific Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.7 Asia Pacific Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.8.2 China Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.8.3 China Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.8.4 China Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.8.5 China Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.9.2 India Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.9.3 India Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.9.4 India Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.9.5 India Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.10.2 Japan Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.10.3 Japan Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.10.4 Japan Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.10.5 Japan Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.11.2 South Korea Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.11.3 South Korea Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.11.4 South Korea Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.11.5 South Korea Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.12.2 Vietnam Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.12.3 Vietnam Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.12.4 Vietnam Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.12.5 Vietnam Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.13.2 Singapore Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.13.3 Singapore Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.13.4 Singapore Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.13.5 Singapore Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.14.2 Australia Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.14.3 Australia Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.14.4 Australia Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.14.5 Australia Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Medical Tubing Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.1.4 Middle East Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.5 Middle East Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.1.6 Middle East Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.7 Middle East Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.1.8.2 UAE Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8.3 UAE Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.1.8.4 UAE Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8.5 UAE Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Medical Tubing Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.2.4 Africa Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.5.2.5 Africa Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.2.6 Africa Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.7 Africa Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Medical Tubing Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.6.4 Latin America Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.6.5 Latin America Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.6.6 Latin America Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.7 Latin America Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.6.8.2 Brazil Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.6.8.3 Brazil Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.6.8.4 Brazil Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.8.5 Brazil Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.6.9.2 Argentina Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.6.9.3 Argentina Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.6.9.4 Argentina Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.9.5 Argentina Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.6.10.2 Colombia Medical Tubing Market Estimates And Forecasts, By Material (2020-2032) (USD Billion)

12.6.10.3 Colombia Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.6.10.4 Colombia Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.10.5 Colombia Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Medical Tubing Market Estimates And Forecasts, By Product Type (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Medical Tubing Market Estimates And Forecasts, By Structure (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Medical Tubing Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Medical Tubing Market Estimates And Forecasts, By End-User (2020-2032) (USD Billion)

13. Company Profiles

13.1 Nordson Corporation

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Zeus Industrial Products, Inc.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Optinova

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Putnam Plastics

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Fine Tubes Ltd.

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Davis Standard

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Lubrizol Corporation

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Teleflex Incorporated

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 RAUMEDIC AG

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Saint-Gobain Performance Plastics

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Silicone

Polyolefins

Polyimide

Polyvinyl Chloride

Polycarbonates

Fluoropolymers

Others

By Material

Plastics

Rubbers

Specialty Polymers

By Structure

Single-lumen

Co-extruded

Multi-lumen

Tapered or Bump tubing

Braided tubing

By Application

Bulk disposable tubing

Catheters & cannulas

Drug delivery system

Biopharmaceutical laboratory equipment

Others

By End-User

Hospitals and Clinics

Medical Device Manufacturers

Ambulatory Surgical Centers (ASCs)

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Low Dielectric Materials Market was USD 1.61 billion in 2023 and is expected to reach USD 2.81 Bn by 2032, growing at a CAGR of 6.44% by 2024-2032.

The Rubber Additives Market Size was valued at USD 8.5 billion in 2023 and is expected to reach USD 12.2 billion by 2032 and grow at a CAGR of 4.0% over the forecast period 2024-2032.

Acrylate Market Size was valued at USD 11.60 Billion in 2023 and is expected to reach USD 19.81 Billion by 2032, growing at a CAGR of 6.13% from 2024 to 2032.

The Carbonyl Iron Powder Market size was USD 240 million in 2023 and is expected to reach USD 375 million by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

The Geocomposites Market Size was valued at USD 445.3 million in 2023, and is expected to reach USD 776.0 million by 2032, and grow at a CAGR of 6.4% over the forecast period 2024-2032.

The HVAC Filters Market size was valued at USD 3.90 billion in 2023 and is expected to reach USD 6.59 billion by 2032 and grow at a CAGR of 6.00% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone