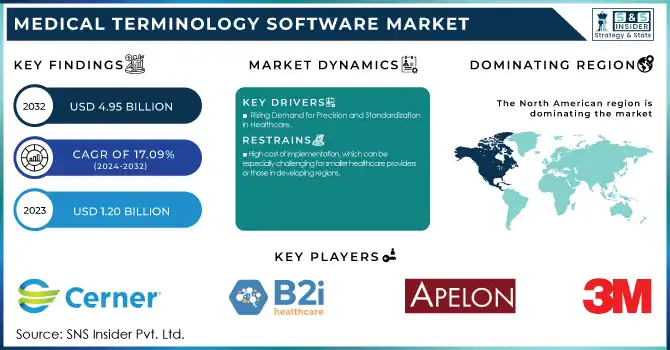

The Medical Terminology Software Market size was valued at USD 1.20 billion in 2023 and is expected to reach USD 4.95 billion by 2032 and grow at a CAGR of 17.09% over the forecast period 2024-2032.

Get more information on Medical Terminology Software Market - Request Sample Report

The medical terminology software market is witnessing rapid growth, driven by the increasing adoption of electronic health records and health information systems to enhance clinical documentation and data exchange. Studies reveal that approximately 89% of physicians in the U.S. use EHRs, underscoring the critical need for standardized terminology to improve interoperability and reduce documentation errors. Medical terminology software enables seamless communication by integrating coding systems such as ICD-10, SNOMED CT, and CPT, ensuring accuracy and compliance in clinical workflows. One example of its application is in telemedicine, where precise terminology is vital for remote consultations. Research highlights that telemedicine usage surged by over 154% during the COVID-19 pandemic, making uniform terminology essential for consistent diagnostics and treatment. For instance, platforms like Teladoc Health rely on standardized medical language to manage patient data across diverse healthcare ecosystems effectively.

Advancements in artificial intelligence and machine learning are further revolutionizing the market. AI-powered applications like Amazon HealthLake and Nuance’s Dragon Medical One leverage natural language processing to automate clinical note generation, saving physicians up to 2 hours per day on documentation tasks. This efficiency not only reduces burnout but also enhances patient-physician interaction. However, concerns over the accuracy of AI-generated notes remain, with some studies reporting error rates of 10-20%, emphasizing the need for rigorous validation processes.

The rising importance of multilingual support is another driving factor. Global healthcare systems demand software capable of translating medical terminology across languages to ensure equitable care. For instance, tools like SDL Trados streamline cross-linguistic communication, improving outcomes in regions with diverse patient populations.

Despite challenges such as implementation complexity and data privacy concerns, regulatory initiatives like the Health Level Seven (HL7) standards promote adoption by ensuring software compliance. For example, initiatives by the European Union's eHealth Network focus on harmonizing health data exchange, further boosting the market.

Drivers

Rising Demand for Precision and Standardization in Healthcare

The increasing complexity of healthcare operations, including multidisciplinary treatments and personalized medicine, is driving the adoption of medical terminology software. These systems standardize terminologies like ICD, SNOMED CT, and CPT to ensure accuracy in clinical documentation and seamless communication across departments. Precision is particularly critical in specialized fields such as oncology and cardiology, where errors in coding can lead to misdiagnoses or delayed treatments. This demand is further amplified by the global shift toward value-based care models, which prioritize patient outcomes and cost-efficiency. By minimizing documentation errors and ensuring interoperability, medical terminology software supports healthcare providers in achieving these objectives, making it a cornerstone of modern healthcare systems.

Governments and regulatory bodies worldwide are enforcing stringent data standardization and interoperability regulations.

In the U.S., the ONC’s interoperability rules mandate seamless data exchange among healthcare entities, while Europe’s GDPR requires secure and compliant handling of health information. These regulations emphasize the need for robust software solutions to meet compliance standards. Medical terminology software facilitates compliance by ensuring consistent and accurate data exchange, reducing the risk of penalties associated with non-compliance. Additionally, international initiatives like the WHO’s ICD-11 revision are fostering global standardization, further driving adoption. These mandates highlight the critical role of terminology software in aligning healthcare systems with evolving legal and operational frameworks.

Innovations in artificial intelligence, machine learning, and cloud technology are significantly boosting the adoption of medical terminology software.

AI-driven tools like NLP-powered clinical note generators automate documentation, saving time and reducing physician burnout. Cloud-based solutions offer scalability, real-time updates, and cross-platform integration, making them ideal for healthcare providers seeking cost-effective deployments. For instance, cloud-enabled systems allow rural or resource-limited healthcare facilities to access standardized terminology tools, leveling the playing field in healthcare delivery. Additionally, technological advancements ensure compatibility with evolving electronic health record systems, enhancing overall efficiency and interoperability. These innovations not only address existing challenges but also position medical terminology software as a critical enabler of future-ready healthcare systems.

Restraints

High cost of implementation, which can be especially challenging for smaller healthcare providers or those in developing regions.

The expenses associated with purchasing, customizing, and training staff on these systems can be a significant financial burden. Additionally, integrating medical terminology software into existing healthcare infrastructures, such as Electronic Health Records or other clinical platforms, often leads to compatibility issues. Healthcare organizations relying on outdated systems may struggle with the seamless integration of newer terminology software, potentially causing operational disruptions. Moreover, the ongoing need to update these systems to comply with ever-changing regulatory requirements introduces further complexity and costs. As a result, healthcare institutions must carefully consider the balance between the benefits of adopting these technologies and the financial and technical challenges associated with their implementation and long-term maintenance.

By Product & Service

In 2023, the Services segment dominated the medical terminology software market, holding a significant share of 60%. Services in this category include consulting, training, implementation, and maintenance, which are essential for the successful adoption and efficient functioning of medical terminology software in healthcare systems. The dominance of the Services segment is attributed to the growing complexity of integrating such software into healthcare IT infrastructure. Healthcare providers, particularly larger hospitals and clinics, require tailored services to ensure smooth integration with their existing systems, such as Electronic Health Records and Health Information Systems.

The platforms segment is growing rapidly as healthcare systems move toward more integrated, flexible, and scalable solutions. The demand for cloud-based platforms that can efficiently handle large volumes of medical terminology data and provide real-time updates is increasing. These platforms enable healthcare organizations to manage and standardize terminology like ICD, SNOMED CT, and CPT more effectively, improving the accuracy of clinical documentation and patient care. With the growing emphasis on interoperability and the need for robust, future-proof systems, healthcare providers are turning to platforms that can seamlessly integrate with other technologies and applications.

By Application

In 2023, data integration was the dominant application in the medical terminology software market. This segment accounted for a significant share of the market, primarily due to the critical need for healthcare systems to integrate disparate data sources seamlessly. Healthcare providers are increasingly relying on integrated systems to manage patient data efficiently, which is necessary for improving care coordination, reducing errors, and enhancing clinical outcomes.

The Clinical Trials segment is growing rapidly due to the increased need for precision, standardization, and regulatory compliance in clinical research. Medical terminology software plays a vital role in ensuring consistency across clinical trial data by standardizing the use of medical terms and codes, such as those from ICD, SNOMED CT, and MedDRA. As clinical trials become more complex, spanning multiple sites and involving diverse patient populations, the demand for robust systems that can ensure accurate and consistent data collection and reporting is rising. The growing focus on drug discovery, personalized medicine, and regulatory compliance is driving this trend.

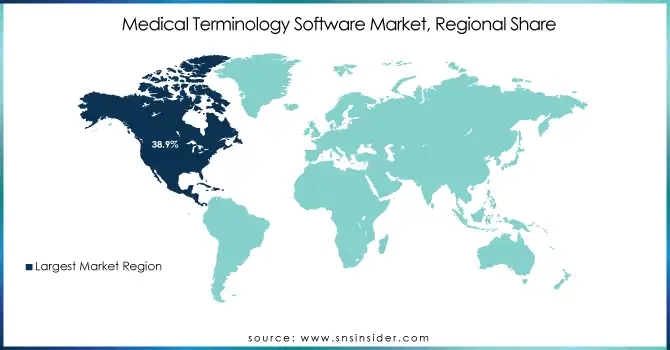

North America was the dominant region in the market, accounting for a 38.9% share in 2023. This is due to the advanced healthcare systems in the U.S. and Canada, where the adoption of Electronic Health Records and other healthcare technologies is widespread. Furthermore, the region's focus on regulatory compliance, such as the Health Insurance Portability and Accountability Act in the U.S., ensures a continuous need for standardized medical terminology systems. North America also leads in the integration of Artificial Intelligence and machine learning into healthcare systems, further driving the demand for advanced medical terminology solutions.

Europe followed closely, with countries like Germany, the UK, and France making substantial strides in adopting medical terminology software. The region is seeing growing investments in digital health technologies, with a particular focus on improving data interoperability and meeting EU regulations like the General Data Protection Regulation. These factors are propelling the demand for software that ensures data accuracy, consistency, and compliance.

Asia-Pacific is the fastest-growing region, driven by increasing investments in healthcare infrastructure and the growing adoption of digital health solutions in countries like China, India, and Japan. As healthcare systems in these regions modernize, there is a rising need for standardized data management, which is boosting the demand for medical terminology software. Government initiatives, coupled with increasing healthcare digitization, are expected to continue fueling the market growth in this region.

Need any customization research on Medical Terminology Software Market - Enquiry Now

3M – 3M CodeFinder Software, 3M Medical Terminology Solutions

Apelon, Inc. – Apelon DTS (Distributed Terminology System), Apelon FHIR Terminology Services

B2i Healthcare – B2i Terminology Manager, B2i Healthcare Terminology Services

BiTAC – BiTAC Terminology Integration Suite

BT Clinical Computing – BT Terminology Management Software

CareCom – CareCom Terminology Solutions

Cerner Corporation – Cerner PowerChart, Cerner Millennium

Clinical Architecture, LLC – 3M Clinical Terminology Manager, Clinical Architecture Terminology Manager

HiveWorx – HiveWorx Terminology Services

Intelligent Medical Objects, Inc. – IMO Terminology Solutions, IMO Coding and Billing

Medicomp Systems – Medicomp Quippe, Medicomp Clinical Knowledge Engine

NextGen Healthcare – NextGen Healthcare Terminology Solutions

Spellex Technologies – Spellex Medical Dictionary, Spellex Medical Spell Checker

West Coast Informatics – West Coast Informatics Terminology Solutions

Wolters Kluwer N.V. – UpToDate, Lexicomp, ClinicalKey

In March 2024, Google introduced Vertex AI Search for Healthcare, an AI-powered search and answer tool designed for medical professionals. This launch comes as the healthcare industry anticipates federal guidelines on the use of AI in healthcare.

In Jan 2024, A Penn Medicine resident launched an AI-powered dictation software aimed at alleviating administrative burdens for physicians. The software was designed to streamline documentation tasks, allowing healthcare professionals to focus more on patient care.

In Aug 2023, Vital launched a Doctor-to-Patient Translator powered by AI and LLMs, which simplifies complex medical jargon into easy-to-understand content at a 5th-grade reading level. This innovative tool translates doctor's notes, radiologist reports, discharge summaries, test results, and more, making medical information more accessible for patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.20 Billion |

| Market Size by 2032 | US$ 4.95 Billion |

| CAGR | CAGR of 17.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service (Services, Platform) • By Application (Data Aggregation, Reimbursement, Public Health Surveillance, Data Integration, Decision Support, Clinical Trials, Quality Reporting, Clinical Guidelines) • By End User (Healthcare Providers (Healthcare Information Exchanges, Healthcare Service Providers), Healthcare Payers (Public, Private), Healthcare IT Vendors, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | 3M, Apelon, B2i Healthcare, BiTAC, CareCom, Clinical Architecture, BT Clinical Computing, 3M, HiveWorx, Intelligent Medical Objects, Wolters Kluwer. |

| Drivers | • Rising Demand for Precision and Standardization in Healthcare • Governments and regulatory bodies worldwide are enforcing stringent data standardization and interoperability regulations. • Innovations in artificial intelligence, machine learning, and cloud technology are significantly boosting the adoption of medical terminology software. |

| Restraints | • High cost of implementation, which can be especially challenging for smaller healthcare providers or those in developing regions. |

Ans: The Medical Terminology Software Market size is projected to reach US$ 4.95 Bn by 2032.

Ans: The Medical Terminology Software Market is to grow at a CAGR of 17.09% over the forecast period 2024-2032.

The Technology type is divided into two sub-segments Services and Platforms.

The challenge faced by the Medical Terminology Software market is Reluctance to Replace Customary Procedures with Terminology-Based Approaches.

Top-down, bottom-up, Quantitative, Qualitative Research, Descriptive, Analytical, Applied, and Fundamental Research.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1. Adoption Trends (2023), by Region

5.2. Technology Adoption and Advancements (2023)

5.3. Growth in Healthcare Data Management (2023-2032)

5.4. Regulatory and Policy Insights (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Medical Terminology Software Market Segmentation, by Product & Service

7.1 Chapter Overview

7.2 Services

7.2.1 Services Market Trends Analysis (2020-2032)

7.2.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Platforms

7.3.1 Platforms Market Trends Analysis (2020-2032)

7.3.2 Platforms Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Medical Terminology Software Market Segmentation, by Application

8.1 Chapter Overview

8.2 Data Aggregation

8.2.1 Data Aggregation Market Trends Analysis (2020-2032)

8.2.2 Data Aggregation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Reimbursement

8.3.1 Reimbursement Market Trends Analysis (2020-2032)

8.3.2 Reimbursement Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Public Health Surveillance

8.4.1 Public Health Surveillance Market Trends Analysis (2020-2032)

8.4.2 Public Health Surveillance Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Data Integration

8.5.1 Data Integration Market Trends Analysis (2020-2032)

8.5.2 Data Integration Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Decision Support

8.6.1 Decision Support Market Trends Analysis (2020-2032)

8.6.2 Decision Support Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Clinical Trials

8.7.1 Clinical Trials Market Trends Analysis (2020-2032)

8.7.2 Clinical Trials Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Quality Reporting

8.8.1 Quality Reporting Market Trends Analysis (2020-2032)

8.8.2 Quality Reporting Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Clinical Guidelines

8.9.1 Clinical Guidelines Market Trends Analysis (2020-2032)

8.9.2 Clinical Guidelines Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Medical Terminology Software Market Segmentation, by End User

9.1 Chapter Overview

9.2 Healthcare Providers

9.2.1 Healthcare Providers Market Trends Analysis (2020-2032)

9.2.2 Healthcare Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.3 Healthcare Service Providers

9.2.3.1 Healthcare Service Providers Market Trends Analysis (2020-2032)

9.2.3.2 Healthcare Service Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.4 Health Information Exchanges

9.2.4.1 Health Information Exchanges Market Trends Analysis (2020-2032)

9.2.4.2 Health Information Exchanges Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Healthcare Payers

9.3.1 Healthcare Payers Market Trends Analysis (2020-2032)

9.3.2 Healthcare Payers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.3 Private Payers

9.3.3.1 Private Payers Market Trends Analysis (2020-2032)

9.3.3.2 Private Payers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.4 Public Payers

9.3.4.1 Public Payers Market Trends Analysis (2020-2032)

9.3.4.2 Public Payers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Healthcare IT Vendors

9.4.1 Healthcare IT Vendors Market Trends Analysis (2020-2032)

9.4.2 Healthcare IT Vendors Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Medical Terminology Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.2.4 North America Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.2.6.2 USA Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.2.7.2 Canada Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.2.8.2 Mexico Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Medical Terminology Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.1.6.2 Poland Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.1.7.2 Romania Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 turkey

10.3.1.9.1 Turkey Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Medical Terminology Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.4 Western Europe Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.6.2 Germany Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.7.2 France Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.8.2 UK Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.9.2 Italy Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.10.2 Spain Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.13.2 Austria Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Medical Terminology Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.4 Asia Pacific Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.6.2 China Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.7.2 India Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.8.2 Japan Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.9.2 South Korea Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.10.2 Vietnam Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.11.2 Singapore Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.12.2 Australia Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Medical Terminology Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.1.4 Middle East Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.1.6.2 UAE Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Medical Terminology Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.2.4 Africa Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Medical Terminology Software Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.6.4 Latin America Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.6.6.2 Brazil Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.6.7.2 Argentina Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.6.8.2 Colombia Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Medical Terminology Software Market Estimates and Forecasts, by Product & Service (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Medical Terminology Software Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Medical Terminology Software Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 3M

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product / Services Offered

11.1.4 SWOT Analysis

11.2 Apelon, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product / Services Offered

11.2.4 SWOT Analysis

11.3 B2i Healthcare

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product / Services Offered

11.3.4 SWOT Analysis

11.4 BT Clinical Computing

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product / Services Offered

11.4.4 SWOT Analysis

11.5 CareCom

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product / Services Offered

11.5.4 SWOT Analysis

11.6 Cerner Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product / Services Offered

11.6.4 SWOT Analysis

11.7 Clinical Architecture, LLC

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product / Services Offered

11.7.4 SWOT Analysis

11.8 Intelligent Medical Objects, Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product / Services Offered

11.8.4 SWOT Analysis

11.9 Medicomp Systems

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product / Services Offered

11.9.4 SWOT Analysis

11.10 NextGen Healthcare

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product / Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product & Service

Services

Platforms

By Application

Data Aggregation

Reimbursement

Public Health Surveillance

Data Integration

Decision Support

Clinical Trials

Quality Reporting

Clinical Guidelines

By End User

Healthcare Providers

Healthcare Service Providers

Health Information Exchanges

Healthcare Payers

Private Payers

Public Payers

Healthcare IT Vendors

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Surgical Imaging Market was valued at USD 148 billion in 2023 and is expected to reach USD 340.5 billion by 2032 and grow at a CAGR of 9.7% from 2024 to 2032.

The Empty IV Bags Market size was valued at USD 4.44 Billion in 2023 and is expected to reach USD 8.86 Billion by 2032 and grow at a CAGR of 7.31% over the forecast period 2024-2032.

The Analytical Standards Market Size was valued at USD 1.41 Billion in 2023 and is expected to reach USD 2.46 Billion by 2032, growing at a CAGR of 6.42% over the forecast period of 2024-2032.

The Digital Twins in Healthcare Market size was valued at USD 1.41 billion in 2023, and is expected to reach USD 28.88 billion by 2032, and grow at a CAGR of 40.01% over the forecast period 2024-2032.

The Non-opioid Pain Patches Market size was estimated at USD 991.40 million in 2023, projected to reach USD 1701.82 million by 2032, growing at a CAGR of 6.22%.

The Orthopedic Joint Replacement Market size was estimated at USD 22.45 billion in 2023 and is expected to reach USD 44.87billion by 2032 at a CAGR of 8% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone