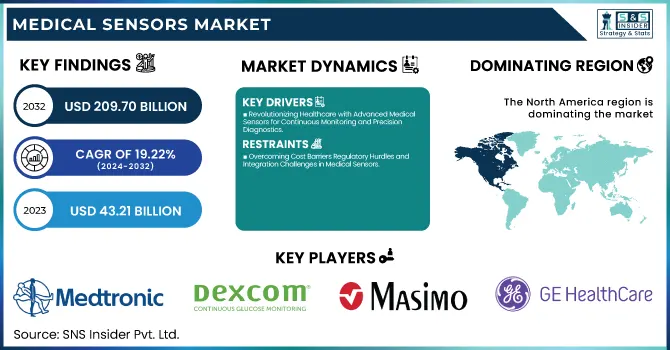

The Medical Sensors Market Size was valued at USD 43.21 billion in 2023 and is expected to reach USD 209.70 billion by 2032, growing at a CAGR of 19.22% over the forecast period 2024-2032. Medical sensor market is growing rapidly due to their increasing adoption in wearable health devices, remote monitoring, and home healthcare solutions. Increasing demand for high-precision real-time monitoring pushes the advancements in the field of sensor performance, miniaturization, and energy efficiency.

To Get more information on Medical Sensors Market - Request Free Sample Report

Enhanced interoperability via IoT, 5G, and the cloud facilitates smooth data transfer and interoperability with health systems. Furthermore, demand for predictive analytics and AI-driven sensors, anomaly detection, and automated diagnostics is poised to improve patient prognosis and lower patient hospital visits. With an increasingly close transition of healthcare towards the direction of personalized and preventive care, smart medical sensors have found their way into continuously monitoring patients and real-time clinical decision-making.

Key Drivers:

Revolutionizing Healthcare with Advanced Medical Sensors for Continuous Monitoring and Precision Diagnostics

The medical sensors market continues to expand with the growing incidence of chronic diseases like diabetes, cardiovascular disorders, and neurological ailments that require continuous monitoring of the patient and early diagnosis. With the increase in patient health data collection via wearable & implantable devices, the demand for biosensors, pressure sensors, and image sensors has increased. Over the years, miniaturization coupled with developments in AI integration and non-invasive diagnostics have led to significant improvements in sensor accuracy, efficiency, and usability. Furthermore, increasing penetration of personalized medicine and bioelectronic healthcare solutions is projected to foster the demand for advanced sensors. The market growth is also supported by increasing government initiatives for digital healthcare and medical device innovation with rising healthcare expenditure.

Restrain:

Overcoming Cost Barriers Regulatory Hurdles and Integration Challenges in Medical Sensors

A key challenge is the expense of advanced medical sensors, particularly in wearables and implants. Very high-precision sensors are costly for both healthcare providers and end users as they need huge investments in terms of research, miniaturization, and regulatory compliance. Although medical devices are lucrative; stringent regulatory approvals in different regions, make them challenging for the market players as compliance with different international standards may delay product launches and raise the cost of launching the device. Similarly, practical adoption is limited due to integration complexities with existing healthcare infrastructure and electronic health record (EHR) systems.

Opportunity:

Unlocking New Frontiers in AI Diagnostics Smart Implants and Next-Gen Medical Sensors

There are plenty of opportunities in the medical sensors market, particularly around AI-led diagnostics, smart implants, and point-of-care testing. The rising popularity of home-based healthcare is driving the growth of portable medical devices with high-accuracy sensors inside. Novel technologies such as neuromodulation and bioelectronic medicine are on the horizon, broadening the reach of SQUID sensors and biosensors within the realm of advanced therapeutics. Also, rising investments in healthcare infrastructure in several emerging economies offer vast opportunities for sensor producers. Discovering a next-generation sensor technology based on flexible and biocompatible materials will help companies get ahead in the rapidly changing medical technology space.

Challenges:

Ensuring Data Security Sensor Reliability and Awareness for Advancing Medical Sensors

An additional key challenge is data security and privacy, especially with the rise of IoT-enabled sensors that collect patient health data. Cybersecurity attacks and data breaches can also raise legal and ethical issues, leading to trust deficits between patients and providers of care. Last but not least, this type of system must ensure sensor reliability and accuracy in both stable and dynamic environments, since any malfunction or hesitation of the readings i.e. sensor can lead to misdiagnosis or wrong treatment. Additionally, the growth of the market is limited due to low awareness and access to such advanced medical sensors in various developing regions. Efforts to address these hurdles consist of ongoing innovation, regulatory streamlining, and correct investments in cyber defenses to enable secure and efficient healthcare solutions.

By Application

The surgical segment accounted for 33.6% of the medical sensors market share in 2023, owing to an increase in the adoption of robotic-assisted surgery, sensor-based surgical tools, and minimally invasive procedures. Market Dynamics The growing demand for high-precision sensors used in real-time monitoring and intraoperative imaging is expected to drive market growth.

The diagnostics segment is expected to register the fastest CAGR from 2024 to 2032. Key Factors Accelerating the Demand for High-Throughput, Non-invasive Diagnostic Sensors Chronic diseases are spreading worldwide, and personalized medicine, and AI-enabled diagnostic technologies are two main drivers pushing forward the demand for diagnostic sensors that are high-throughput and non-invasive.

By Product

Biosensors dominated the medical sensors market segment in 2023, commanding a 42.6% market share, due to their broad application in glucose monitoring, infectious disease detection, and personalized healthcare solutions. Due to the growing need for wearables and implantable biosensors for real-time health monitoring, these have emerged as the market leaders.

Image sensors are anticipated to exhibit the fastest CAGR from 2024-2032, largely driven by developments in specialty medical imaging disciplines such as endoscopy and image-enabled AI-assisted diagnostics. Increasing demand for resolution imaging required for disease detection as well as advancements in CMOS and CCD sensors are expected to boost image sensors in health care market growth.

By End User

The hospitals segment held the largest share of the medical sensors market in 2023, at 60.8%, owing to the strong adoption of various advanced diagnostic, surgical, and monitoring sensors for clinical use. Increased need for patient care with precision along with investments in smart hospital infrastructure fortifying market dominance by hospitals

The segment of home healthcare is anticipated to grow with the highest compound annual growth rate during the predicted period of 2024 to 2032, owing to the growing need for remote patient monitoring, wearable biosensors, and point-of-care testing. Home healthcare adoption is quickly gaining steam, driven by both a greater desire among patients for cost-effective, non-invasive healthcare solutions and an expansion of telemedicine.

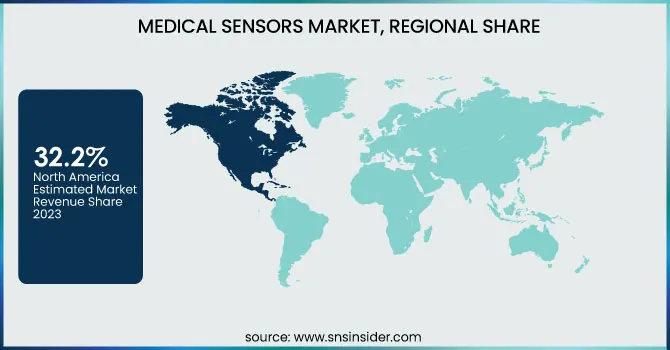

North America held a 32.2% share of the medical sensors market in 2023 due to the presence of sophisticated healthcare infrastructure, a well-established R&D sector, and widespread utilization of digital healthcare technologies. The market is further reinforced by the presence of leading medical device manufacturers in the region which includes, Medtronic, Abbott, and GE Healthcare among others. The sensor solutions market retains its growing trend during the forecast period as the number of chronic diseases rises, and the requirement of remote patient monitoring and artificial intelligence-based diagnostics increases across hospitals and the home healthcare sector. Apart from this, government support such as that from the U.S. FDA in terms of regulatory support for new upcoming technology in medical devices is paving the way for an upsurge in medical sensors in the market.

Asia Pacific is projected to grow at the fastest CAGR from 2024 to 2032, due to modernization and advancements in the healthcare infrastructure, increasing health care expenditure, and an upsurge use of wearable medical devices. Nihon Kohden and Shenzhen Mindray are expanding in countries such as China, Japan, and India, which are focusing on medical technology. The increase in geriatric demographics, increasing cases of chronic diseases, and the rising need for affordable healthcare solutions are the major driving forces behind the growth of the market. Moreover, medical sensor adoption in diagnostics and home healthcare is being accelerated by government-led digital health initiatives at the country level (e.g., Ayushman Bharat in India).

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Medical Sensors Market are:

Medtronic (Pacemakers, Implantable Cardioverter Defibrillators)

Dexcom (G6 Continuous Glucose Monitoring System, G7 Continuous Glucose Monitoring System)

Masimo (SafetyNet Remote Monitoring System, Rainbow Acoustic Monitoring)

Abbott Laboratories (FreeStyle Libre Glucose Monitoring System, i-STAT Handheld Blood Analyzer)

GE Healthcare (Revolution CT Scanner, CARESCAPE Patient Monitoring)

Philips Healthcare (IntelliVue Patient Monitors, Affiniti Ultrasound Systems)

Siemens Healthineers (ACUSON Ultrasound Systems, Atellica Solution Immunoassay Analyzer)

Boston Scientific (WATCHMAN Left Atrial Appendage Closure Device, EMBLEM Subcutaneous Implantable Defibrillator)

Johnson & Johnson (Thermocool SmartTouch Catheter, OneTouch Verio Flex Blood Glucose Meter)

Honeywell (ABP300 Blood Pressure Monitor, HPM Series Particle Sensors)

Medline Industries (FitRight Incontinence Products, CURAD Medical Sensors)

Smith & Nephew (PICO Single Use Negative Pressure Wound Therapy System, ALLEVYN Life Foam Dressings)

Becton Dickinson (BD) (BD Alaris Infusion Pumps, BD Veritor Plus System)

Zimmer Biomet (Rosa Knee System, Persona Knee Implant)

Stryker Corporation (Mako Robotic-Arm Assisted Surgery System, LIFEPAK Defibrillators)

In January 2024, Medtronic secured the world's first approval for the MiniMed 780G System with Simplera Sync sensor, a disposable, all-in-one CGM designed for simplified diabetes management.

In May 2024, Dexcom launched the Dexcom ONE+ CGM, enhancing real-time glucose monitoring for type 2 diabetes management.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 43.21 Billion |

| Market Size by 2032 | USD 209.70 Billion |

| CAGR | CAGR of 19.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Surgical, Diagnostics, Therapeutics, Monitoring) • By Product (Pressure Sensors, Temperature Sensor, Image Sensors, Accelerometer, Biosensors, Flow Sensors, Squid Sensors, Others) • By End User (Hospital, Stand Alone clinics, Nursing Homes, Home Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Dexcom, Masimo, Abbott Laboratories, GE Healthcare, Philips Healthcare, Siemens Healthineers, Boston Scientific, Johnson & Johnson, Honeywell, Medline Industries, Smith & Nephew, Becton Dickinson (BD), Zimmer Biomet, Stryker Corporation. |

Ans: The Medical Sensors Market is expected to grow at a CAGR of 19.22% during 2024-2032.

Ans: Medical Sensors Market size was USD 43.21 billion in 2023 and is expected to Reach USD 209.70 billion by 2032.

Ans: The major growth factor of the Medical Sensors Market is the increasing adoption of wearable and remote patient monitoring devices driven by advancements in IoT, AI, and miniaturized sensor technologies for real-time health tracking.

Ans: The Surgical segment dominated the Medical Sensors Market in 2023.

Ans: North America dominated the Medical Sensors Market in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption & Demand Metrics

5.2 Performance & Efficiency Metrics

5.3 Connectivity & Data Metrics

5.4 AI & Automation in Medical Sensors

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and Promotional Activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Medical Sensors Market Segmentation, By Application

7.1 Chapter Overview

7.2 Surgical

7.2.1 Surgical Market Trends Analysis (2020-2032)

7.2.2 Surgical Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Diagnostics

7.3.1 Diagnostics Market Trends Analysis (2020-2032)

7.3.2 Diagnostics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Therapeutics

7.4.1 Therapeutics Market Trends Analysis (2020-2032)

7.4.2 Therapeutics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Monitoring

7.5.1 Monitoring Market Trends Analysis (2020-2032)

7.5.2 Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Medical Sensors Market Segmentation, By Product

8.1 Chapter Overview

8.2 Pressure Sensors

8.2.1 Pressure Sensors Market Trends Analysis (2020-2032)

8.2.2 Pressure Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Image Sensors

8.3.1 Temperature Sensor Market Trends Analysis (2020-2032)

8.3.2 Temperature Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Accelerometer

8.4.1 Accelerometer Market Trends Analysis (2020-2032)

8.4.2 Accelerometer Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Biosensors

8.5.1 Biosensors Market Trends Analysis (2020-2032)

8.5.2 Biosensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Flow Sensors

8.6.1 Flow Sensors Market Trends Analysis (2020-2032)

8.6.2 Flow Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Squid Sensors

8.7.1 Squid Sensors Market Trends Analysis (2020-2032)

8.7.2 Squid Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Medical Sensors Market Segmentation, By End User

9.1 Chapter Overview

9.2 Hospital

9.2.1 Hospital Market Trends Analysis (2020-2032)

9.2.2 Hospital Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Stand Alone clinics

9.3.1 Stand Alone clinics Market Trends Analysis (2020-2032)

9.3.2 Stand Alone clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Home Healthcare

9.4.1 Home Healthcare Market Trends Analysis (2020-2032)

9.4.2 Home Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Medical Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.4 North America Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.5 North America Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.2 USA Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.6.3 USA Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.2 Canada Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.7.3 Canada Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.2 Mexico Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.8.3 Mexico Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Medical Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.2 Poland Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.6.3 Poland Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.2 Romania Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.7.3 Romania Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Medical Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.4 Western Europe Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.5 Western Europe Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.2 Germany Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.6.3 Germany Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.2 France Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.7.3 France Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.2 UK Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.8.3 UK Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.2 Italy Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.9.3 Italy Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.2 Spain Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.10.3 Spain Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.2 Austria Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.13.3 Austria Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Medical Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.4 Asia Pacific Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.5 Asia Pacific Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.2 China Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.6.3 China Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.2 India Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.7.3 India Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.2 Japan Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.8.3 Japan Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.2 South Korea Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.9.3 South Korea Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.2 Vietnam Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.10.3 Vietnam Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.2 Singapore Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.11.3 Singapore Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.2 Australia Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.12.3 Australia Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Medical Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.4 Middle East Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.5 Middle East Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.2 UAE Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.6.3 UAE Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Medical Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.4 Africa Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.5 Africa Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Medical Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.4 Latin America Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.5 Latin America Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.2 Brazil Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.6.3 Brazil Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.2 Argentina Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.7.3 Argentina Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.2 Colombia Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.8.3 Colombia Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Medical Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Medical Sensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Medical Sensors Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Medtronic.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Dexcom

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Masimo

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Abbott Laboratories

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 GE Healthcare

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Philips Healthcare

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Siemens Healthineers.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Boston Scientific.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Johnson & Johnson

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Honeywell

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Application

Surgical

Diagnostics

Therapeutics

Monitoring

By Product

Pressure Sensors

Image Sensors

Accelerometer

Biosensors

Flow Sensors

Squid Sensors

Others

By End User

Hospital

Stand Alone clinics

Nursing Homes

Home Healthcare

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Flat Panel Displays Market Size was valued at USD 151.4 Billion in 2023 and is expected to reach USD 233.90 Billion by 2032 and grow at a CAGR of 4.98% over the forecast period 2024-2032.

The Fiber Optical Cable Market size was valued at USD 14.64 billion in 2023. It is expected to reach USD 43.99 billion by 2032 and grow at a CAGR of 13.00% over the forecast period 2024-2032.

The Flexible Display Market Size was valued at USD 36.78 billion in 2023 and is expected to reach USD 255.29 billion by 2032 and grow at a CAGR of 24.02% over the forecast period 2024-2032.

The PCIe Switches Market was valued at USD 1.78 billion in 2023 and is expected to reach USD 4.80 billion by 2032, growing at a CAGR of 11.70% over the forecast period 2024-2032.

The Call Control (PBX-IP PBX) Market Size was valued at USD 34.66 billion in 2023, and is expected to reach USD 252.71 billion by 2032 and grow at a CAGR of 24.7% over the forecast period 2024-2032.

The Nuclear Robots Market was valued at USD 1.82 billion in 2023 and is expected to reach USD 5.23 billion by 2032, growing at a CAGR of 12.48% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone