Get More Information on Medical Robots Market - Request Sample Report

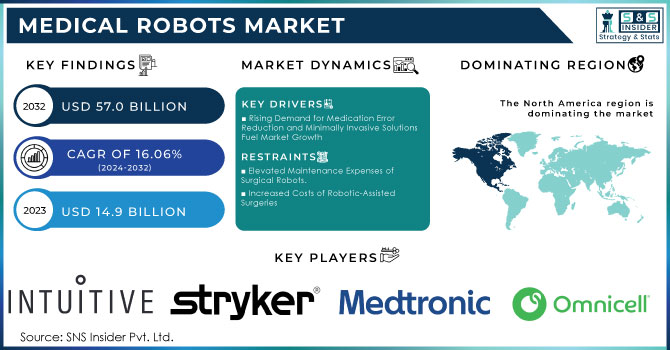

The Medical Robots Market Size was valued at USD 14.9 billion in 2023 and is expected to reach USD 57.0 billion by 2032 and grow at a CAGR of 16.06% over the forecast period 2024-2032.

The medical robots market is witnessing significant growth with the evolution of technology in its core forms, healthcare automation, enhanced funding, and the development of healthcare infrastructure. This trend of growth is further spurred by an increase in chronic diseases and population aging in the world. Growth is due to the high demand for the reduction of medication errors and improvement in precision for laparoscopic and other surgeries. For instance, the increasing levels of trauma injuries and the requirement for various surgical interventions among the aging population have given medical robots a place in high demand. There is a significant shift toward minimally invasive surgeries (MIS) compared to traditional open surgical procedures across the world, thus increasing the market opportunities available for the use of medical robots and promoting sales. It has been estimated that in the forecasting period, medical robotics will experience steady growth due to better advancements in the field of laparoscopic robotics and the introduction of procedure-specific new robots.

The market also benefits from fewer post-surgical complications, short durations of hospital stay, and lower operational costs relevant to robotic-assisted surgery. Increased neurological and orthopedic disorders alongside increased investment by companies in R&D and advanced healthcare infrastructure are further driving the medical robot market toward positive growth. Other factors revving the market forward include the popularity of MIS, the aging population, increased funding for research on robots, and acceptance of robotic-assisted laparoscopic procedures.

Expansion of healthcare centers, increasing patient visits, and increased government spending on the healthcare industry towards better care processes are also boosting demand for medical robots worldwide. Emerging markets present considerable opportunities for growth as these have an increasing number of surgical procedures, increased patient base, and growing medical tourism. India is one such market that provides low-cost treatment compared with developed economies and has relaxed regulation standards. The explosion of affordable healthcare and business-friendly policies encourages medical robot companies to focus on emerging markets in Asia-Pacific and Latin America. Coupled with rising healthcare spending, technological advancements, and expansive operations by larger players, such a trend will propel the global medical robots market share toward significant growth over the next few years.

| Application Area | Description | Example Technologies | Benefits |

|---|---|---|---|

| Surgery | Performing complex surgical procedures | Robotic surgical systems | Minimally invasive options |

| Rehabilitation | Assisting patient recovery and mobility | Exoskeletons, therapy robots | Faster recovery, increased independence |

| Diagnostics | Enhancing diagnostic accuracy and speed | Robotic imaging systems | Timely and accurate diagnoses |

| Telemedicine | Facilitating remote consultations | Telepresence robots | Expanded patient access |

| Hospital Logistics | Automating supply chain and delivery | Autonomous delivery robots | Cost and time efficiency |

Drivers

Rising Demand for Medication Error Reduction and Minimally Invasive Solutions Fuel Market Growth

The growing demand for the reduction of medication errors has become one of the significant driving forces behind increased automation in healthcare: medical robots. Medication errors - as defined by the National Coordinating Council for Medication Error Reporting and Prevention as any preventable event that may result in the following circumstances: improper medication use or patient harm to explain the most common causes for hospital readmission globally. Some of the current issues that may lead to such errors include poor communication between healthcare providers, look-alike packaging, similar prescriptions, and poor drug storage practices. To avoid all these types of medication errors, automated systems for pharmacies such as ADMs and ADCs have been found to help significantly minimize such errors and create safe environments in which care can be provided to patients. With this, more governments are promoting the adoption of such automated systems, which in turn extends pharmacy automation across the globe.

Another rapid growth in the medical robots market is due to the rising demand for MIS (minimally invasive surgeries). Surgical robots, specifically in complex laparoscopic procedures, have become more efficient with greater accuracy and better patient outcomes. Advances in technology in medical robotics are building up these applications and represent a trend toward more automated, minimally invasive healthcare solutions. Key trends driving the market for medical robots include automation and precision-based procedures, set to expand further into higher healthcare needs and better concerns over patient safety.

Restraints

Elevated Maintenance Expenses of Surgical Robots

Increased Costs of Robotic-Assisted Surgeries

By Robotic System

In 2023, surgical robots led the medical robots market, with nearly 65.0% share. This is largely because surgical robots are widely used in minimally invasive surgeries, especially orthopedics, neurosurgery, and laparoscopic procedures. Here, precision is high, and patients require minimal recovery time. These systems are increasingly becoming popular in hospitals as well as specialized surgical centers because their inclusion has been to enhance surgical accuracy and patient outcomes.

The fastest-growing segment of robotic systems is rehabilitation robots, expected to grow at a CAGR of over 17%. Physical rehabilitation needs among aging populations along with advancements in robotic-assisted therapy have accelerated the demand in this segment. Rehabilitation robots increase patient mobility and independence and are an attractive product for rehabilitation centers to provide more efficient, personal care.

By Application

As per application, laparoscopy dominated the market in 2023, accounting for about 40.0% share of the application market. It is more dominant because it plays a critical role in treating most medical conditions with minimal invasiveness, hence it is considered preferred in modern surgical practices. Demand for surgical robots in laparoscopy is growing continuously as patients and providers seek faster recovery times and fewer complications associated with traditional surgeries.

Neurosurgery is expected to grow the fastest, at 19% CAGR. The benefits of medical robots have been noticed most profoundly in neurosurgery when it comes to precision, which is one of the decisive factors in producing a proper outcome. Robotic-assisted neurosurgery reduces risk, maintains patient safety, and improves precision and is, therefore in great demand by hospitals and surgery centers.

By End-User

The end-user segment dominated by the hospital segment in 2023 held almost 60.0% of the market share. Hospitals are mostly adopting medical robots due to extensive resources and their ability to handle high-volume surgical and therapeutic applications. The growing hospital concern for improved patient outcomes and efficiency of operations has been a prime driver behind the adoption of surgical and pharmacy automation robots.

The fastest-growing end-user is rehabilitation centers, which is anticipated to grow at a CAGR of 16%. The demand for robotic assistance in rehabilitation centers is growing because such facilities emphasize advanced treatment methods to help patients recover. Rehabilitation robots facilitate customized interaction with patients, quickened recovery times, and self-reliance; thus, they form a core part of rehabilitation centers that would like to promote their service provision.

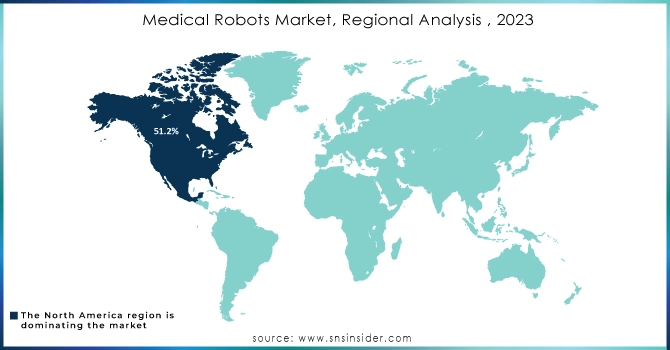

In 2023, North America accounted for 51.2% of the market share, due to its established healthcare network and mass investment from key players focused on developing new robotic technology. The region also boasts the highest patient adoption rates of minimally invasive surgical procedures, thereby propelling the demand for robotics to make operations more accurate and secure. This trend continues to gain momentum through intense focus on research and development in North America; constant improvements and expansion of robotic solutions contribute to a more advanced and efficient healthcare landscape.

The aging population, with a strong demand for minimally invasive and non-invasive surgical interventions, will fuel the growth of the Asia-Pacific medical robots market during 2024-2032. China will command the largest share in this region, primarily because of its large and significant health technology progress and increased investment in robotic solutions. India will be the leading market in Asia-Pacific- a sign of growing healthcare infrastructure, increasing patient awareness, and the adoption of advanced medical technologies. These factors combined support the Asian Pacific region to lead in terms of the global share of the medical robots market, which is likely to forecast this region to be a hotbed for growth and development over the years ahead.

Need Any Customization Research On Medical Robots Market - Inquiry Now

Intuitive Surgical, Inc. (da Vinci Surgical System)

Stryker Corporation (Mako Robotic-Arm Assisted Surgery)

Medtronic Plc (Robotic-assisted surgery platform)

Becton, Dickinson, and Company (Automated medication dispensing systems)

Omnicell, Inc. (Robotic dispensing systems)

Arxium (Automated pharmacy solutions)

Asensus Surgical, Inc. (Senhance Surgical System)

Zap Surgical Systems, Inc. (Zap-X platform)

Renishaw Plc (Robotic systems for neurosurgery)

Smith & Nephew Plc (CORI Surgical System)

Zimmer Biomet Holdings, Inc. (Rosa robotic surgical system)

DIH Holdings US Inc. (Robotic healthcare solutions)

Accuray Incorporated (CyberKnife System)

CMR Surgical (Versius Surgical Robot)

Ekso Bionics Holdings, Inc. (Exoskeletons for rehabilitation)

Bionik Laboratories Corp. (Robotic rehabilitation devices)

Lifeward, Inc. (Robotic healthcare solutions)

Cyberdyne Inc. (HAL - Hybrid Assistive Limb)

Avateramedical GmbH (Robotic surgical systems)

Johnson & Johnson (Surgical robots and technologies)

Swisslog Healthcare (Automated pharmacy solutions)

Relay Robotics (Disinfection and delivery robots)

Aethon (TUG robots)

Xenex Disinfection Services Inc. (UV-C disinfection robots)

Zoll Medical Corporation (Automated cardiac care devices)

In April 2024, iRobot Corporation introduced the Roomba Combo Essential Robot, a launch aimed at making robotic cleaning solutions more affordable for consumers.

In May 2024, Medrobotics Corporation sold its assets to address bankruptcy issues, resulting in a decrease in the company's market share within the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14.9 billion |

| Market Size by 2032 | US$ 57.0 billion |

| CAGR | CAGR of 16.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robotic Systems (Surgical Robots, Rehabilitation Robots, Telepresence Robots, Others) • By Application (Laparoscopy, Radiation Therapy, Orthopedic Surgery, Neurosurgery, Pharmacy, Others) • By End-User (Hospitals, Ambulatory Surgical Centers, Rehabilitation Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intuitive Surgical, Inc., Stryker Corporation, Medtronic Plc, Becton, Dickinson and Company, Omnicell, Inc., Arxium, Asensus Surgical, Inc., Zap Surgical Systems, Inc., Renishaw Plc, Smith & Nephew Plc, Zimmer Biomet Holdings, Inc., DIH Holdings US Inc., Accuray Incorporated, CMR Surgical, Ekso Bionics Holdings, Inc., Bionik Laboratories Corp., Lifeward, Inc., Cyberdyne Inc., Avateramedical GmbH, Johnson & Johnson, Swisslog Healthcare, Relay Robotics, Aethon, Xenex Disinfection Services Inc., Zoll Medical Corporation |

| Key Drivers | • Rising Demand for Medication Error Reduction and Minimally Invasive Solutions Fuel Market Growth |

| Restraints | • Elevated Maintenance Expenses of Surgical Robots • Increased Costs of Robotic-Assisted Surgeries |

Ans: The estimated compound annual growth rate is 16.06% during the forecast period for the Medical Robots market.

Ans: The projected market value of the Medical Robots market is estimated at USD 14.9 billion in 2023 and is expected to reach USD 57.0 billion by 2032.

Ans: Rising demand for medication error reduction and minimally invasive solutions fuel market growth.

Ans: The increased costs of robotic-assisted surgeries and elevated maintenance expenses of surgical robots are the restraints for the medical robot market.

Ans: North America is the dominant region with a 51.2% share in the Medical Robots market.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Surgery Statistics, By Country

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Medical Robots Market Segmentation, by Robotic Systems

7.1 Chapter Overview

7.2 Surgical Robots

7.2.1 Surgical Robots Market Trends Analysis (2020-2032)

7.2.2 Surgical Robots Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Rehabilitation Robots

7.3.1 Rehabilitation Robots Market Trends Analysis (2020-2032)

7.3.2 Rehabilitation Robots Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Telepresence Robots

7.4.1 Telepresence Robots Market Trends Analysis (2020-2032)

7.4.2 Telepresence Robots Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Medical Robots Market Segmentation, by Application

8.1 Chapter Overview

8.2 Laparoscopy

8.2.1 Laparoscopy Market Trends Analysis (2020-2032)

8.2.2 Laparoscopy Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Radiation Therapy

8.3.1 Radiation Therapy Market Trends Analysis (2020-2032)

8.3.2 Radiation Therapy Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Orthopedic Surgery

8.4.1 Orthopedic Surgery Market Trends Analysis (2020-2032)

8.4.2 Orthopedic Surgery Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Neurosurgery

8.5.1 Neurosurgery Market Trends Analysis (2020-2032)

8.5.2 Neurosurgery Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Pharmacy

8.6.1 Pharmacy Market Trends Analysis (2020-2032)

8.6.2 Pharmacy Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Medical Robots Market Segmentation, by End-User

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Ambulatory Surgical Centers

9.3.1 Ambulatory Surgical Centers Market Trends Analysis (2020-2032)

9.3.2 Ambulatory Surgical Centers Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Rehabilitation Centers

9.4.1 Rehabilitation Centers Market Trends Analysis (2020-2032)

9.4.2 Rehabilitation Centers Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Medical Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Medical Robots Market Estimates and Forecasts, by Drugs (2020-2032) (USD Million)

10.2.4 North America Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.5 North America Medical Robots Market Estimates and Forecasts, by End-User(2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Medical Robots Market Estimates and Forecasts, by Drugs (2020-2032) (USD Million)

10.2.6.2 USA Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6.3 USA Medical Robots Market Estimates and Forecasts, by End-User(2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Medical Robots Market Estimates and Forecasts, by Drugs (2020-2032) (USD Million)

10.2.7.2 Canada Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7.3 Canada Medical Robots Market Estimates and Forecasts, by End-User(2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Medical Robots Market Estimates and Forecasts, by Drugs (2020-2032) (USD Million)

10.2.8.2 Mexico Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8.3 Mexico Medical Robots Market Estimates and Forecasts, by End-User(2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Medical Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.1.6.2 Poland Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6.3 Poland Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.1.7.2 Romania Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7.3 Romania Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.1.8.2 Hungary Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8.3 Hungary Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.9 turkey

10.3.1.9.1 Turkey Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.1.9.2 Turkey Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9.3 Turkey Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Medical Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.4 Western Europe Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.5 Western Europe Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.6.2 Germany Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6.3 Germany Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.7.2 France Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7.3 France Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.8.2 UK Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8.3 UK Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.9.2 Italy Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9.3 Italy Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.10.2 Spain Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10.3 Spain Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.13.2 Austria Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13.3 Austria Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Medical Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.4 Asia Pacific Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.5 Asia Pacific Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.6.2 China Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6.3 China Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.7.2 India Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7.3 India Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.8.2 Japan Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8.3 Japan Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.9.2 South Korea Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9.3 South Korea Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.10.2 Vietnam Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10.3 Vietnam Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.11.2 Singapore Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11.3 Singapore Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.12.2 Australia Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12.3 Australia Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Medical Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.1.4 Middle East Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.5 Middle East Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.1.6.2 UAE Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6.3 UAE Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.1.7.2 Egypt Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7.3 Egypt Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.1.9.2 Qatar Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9.3 Qatar Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Medical Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.2.4 Africa Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.5 Africa Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.2.6.2 South Africa Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6.3 South Africa Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Medical Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.6.4 Latin America Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.5 Latin America Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.6.6.2 Brazil Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6.3 Brazil Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.6.7.2 Argentina Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7.3 Argentina Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Medical Robots Market Estimates and Forecasts, by Robotic Systems (2020-2032) (USD Million)

10.6.8.2 Colombia Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8.3 Colombia Medical Robots Market Estimates and Forecasts, by End-User(2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Medical Robots Market Estimates and Forecasts, by Drugs (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Medical Robots Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Medical Robots Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11. Company Profiles

11.1 Intuitive Surgical, Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Stryker Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Medtronic Plc

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Becton, Dickinson, and Company

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Omnicell, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Arxium

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Asensus Surgical, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Accuray Incorporated

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Relay Robotics

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Johnson & Johnson

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Robotic System

Surgical Robots

Rehabilitation Robots

Telepresence Robots

Others

By Application

Laparoscopy

Radiation Therapy

Orthopedic Surgery

Neurosurgery

Pharmacy

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Rehabilitation Centers

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Global Digital Hearing Aids Market, valued at USD 7.36 billion in 2023, is projected to reach USD 12.57 billion by 2032 at a CAGR of 6.15% during 2024-2032.

The Hospital Furniture market size was USD 9.06 billion in 2023 and is expected to reach USD 16.34 billion by 2032 and grow at a CAGR of 6.83% over the forecast period of 2024-2032.

Healthcare Claims Management Market was valued at USD 15.01 Bn in 2023 and is expected to reach USD 24.93 Bn by 2032, growing at a CAGR of 5.85% from 2024-2032.

Glycomics Market was valued at USD 1.68 billion in 2023 and is expected to reach USD 5.33 billion by 2032, growing at a CAGR of 13.76% from 2024 to 2032.

The Real World Evidence Solutions Market was valued at USD 1.71 Billion in 2023 and is expected to reach USD 6.97 Billion by 2032, growing at a CAGR of 16.7% over the forecast period 2024-2032.

The Oxytocin Market Size was valued at USD 88.86 Million in 2023 and is expected to reach USD 191.41 Million by 2032, growing at a CAGR of 8.90% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone