Medical Robotics Market Size & Growth Trends:

The Medical Robotics Market Size was valued at USD 16.6 billion in 2023 and is expected to reach USD 63.84 billion by 2032, growing at a CAGR of 16.19% from 2024-2032.

The medical robotics market is growing significantly, mainly fueled by technological advancements and the increasing need for minimally invasive surgeries. About 50% of surgeries in the U.S. are currently carried out using minimally invasive methods, a trend greatly enhanced by robotic technology.

Get More Information on Medical Robotics Market - Request Sample Report

Studies indicate that surgeries assisted by robots can shorten recovery periods by 20-30%, allowing patients to resume their daily activities more quickly. With healthcare systems aiming for enhanced precision, minimizing human error, and quicker recovery durations, medical robots have surfaced as essential instruments in realizing these objectives. This change is driven by the rising occurrence of chronic illnesses, the aging demographic, and the growing necessity for better surgical results, which have all intensified the demand for robotic technologies in healthcare environments. As a result, surgical robots, rehabilitation robots, and diagnostic robots are experiencing greater acceptance in hospitals and clinics worldwide.

Looking ahead, the market is projected to keep growing with technological advancements, offering improved functionalities to medical robotics. These advancements, especially in artificial intelligence, machine learning, and 3D imaging, will enhance the variety of procedures that robots can assist with and also increase the accuracy and cost-effectiveness of treatments. In August 2024, Omnicell introduced its Central Med Automation Service, utilizing robotics and intelligent devices to enhance medication management in pharmacies, highlighting the increasing incorporation of robotics in the healthcare sector. As robotic systems advance in complexity, they will meet the increasing need for affordable healthcare solutions, providing care options that are more accessible and precise

The future presents significant prospects for the medical robotics sector, especially as healthcare providers strive to lower expenses while enhancing patient results. Advancements aimed at enhancing the affordability, accessibility, and ease of use of robotic solutions are anticipated to drive significant market expansion. In January 2025, BD and Biosero revealed a partnership to combine robotic technologies with BD's flow cytometers, improving drug discovery and development processes. Additionally, the growth of home healthcare services and telemedicine is opening up new avenues for utilizing robotics in patient care. As these technologies gain more traction, the medical robotics sector will keep evolving and assist in tackling the worldwide deficit of skilled healthcare personnel, transforming the future of healthcare provision.

Medical Robots Market Dynamics

Drivers

-

Minimally Invasive Robotic-Assisted Surgeries Offer Faster Recovery, Reduced Risk, and Enhanced Precision, Driving Market Growth

The demand for robotic-assisted surgeries keeps increasing because of their considerable advantages in minimally invasive techniques. These cutting-edge technologies allow for smaller cuts, resulting in less pain and scarring for patients. Consequently, recovery durations are considerably reduced, enabling individuals to resume their daily routines more swiftly. The accuracy of robotic systems also reduces the likelihood of complications during surgery, making them especially appealing for high-risk operations. Surgeons are able to execute intricate procedures with enhanced precision, resulting in better results. The blend of quicker recovery, minimized risks, and improved surgical accuracy is propelling the adoption of robotic systems in multiple medical fields. As both healthcare providers and patients emphasize these advantages, the acceptance and use of robotic surgery keep expanding throughout the sector.

-

Technological Advancements in AI, Machine Learning, and Sensors Enhance Precision, Versatility, and Affordability of Medical Robotics

Advancements in artificial intelligence, machine learning, and sensor technologies is transforming medical robotics, enhancing their accuracy, flexibility, and availability. Algorithms powered by AI allow robots to assess intricate medical data instantly, aiding surgeons in their decision-making and improving the precision of operations. Machine learning enables these systems to consistently enhance their performance through experience, resulting in improved outcomes over time. Improved sensors offer enhanced control and feedback, allowing robots to execute complex tasks with unmatched accuracy. Moreover, these advancements in technology are lowering production expenses, making robotic systems more cost-effective for medical institutions. The incorporation of advanced technologies is broadening the field of medical robotics, fostering their use in diverse applications, including minimally invasive surgeries, patient care, diagnostics, and rehabilitation. This trend is transforming the future of healthcare provision.

Restraints

-

High Upfront Costs and Maintenance Expenses Limit Accessibility and Adoption of Medical Robotics in Smaller Healthcare Facilities

The significant expense of obtaining and installing robotic systems presents a major obstacle for healthcare institutions, particularly smaller clinics and hospitals with constrained financial resources. Sophisticated robotic systems necessitate a substantial financial investment, which includes purchasing, setting up, and the essential training for healthcare workers to use them efficiently. This complicates smaller institutions' ability to rationalize the costs, even with the potential advantages these systems provide. In addition, continuous expenses like upkeep, software upgrades, and repairs increase the financial strain, hindering adoption. For numerous healthcare providers, the return on investment may take years to become evident, rendering these technologies less attractive in settings with limited resources. Although bigger hospitals and well-funded institutions might manage to navigate these challenges, the financial aspect still restricts the accessibility and expansion of medical robotics throughout the wider healthcare system.

Medical Robotic System Market Segmentation Outlook

By Type

In 2023, the Surgical Robotic Systems segment dominated the medical robotics market with the highest revenue share of approximately 44%. This dominance can be attributed to the widespread adoption of robotic-assisted surgeries across multiple medical specialties, including general surgery, orthopedics, and gynecology. These systems are highly valued for their precision, reduced patient recovery times, and lower complication rates, which improve clinical outcomes. Additionally, increasing investments in advanced robotic technologies by healthcare providers and manufacturers further solidified the segment's leading position.

The Rehabilitation Robotic Systems segment is projected to grow at the fastest CAGR of about 18.31% from 2024 to 2032. This growth is fueled by the rising prevalence of neurological and musculoskeletal disorders, along with an aging population requiring long-term rehabilitative care. The integration of AI and machine learning into rehabilitation robots is enhancing their ability to deliver personalized therapy and accelerate recovery. Growing awareness of these systems' effectiveness in improving patient mobility and independence is driving their adoption in both hospitals and home-care settings, positioning them as a critical innovation inpatient rehabilitation.

By End User

In 2023, the Hospitals & Clinics segment held the largest revenue share of about 45% in the medical robotics market. This dominance is driven by the widespread integration of robotic systems in large healthcare facilities to enhance surgical precision, reduce patient recovery times, and improve overall outcomes. Hospitals and clinics often have the financial resources and infrastructure to invest in advanced robotics, enabling them to cater to a wide range of medical procedures. Additionally, the rising number of complex surgeries performed in these settings underscores their reliance on robotic technologies for efficiency and accuracy.

The Ambulatory Surgery Centers segment is anticipated to grow at the fastest CAGR of approximately 18.70% from 2024 to 2032. This rapid growth is attributed to the increasing demand for cost-effective, minimally invasive procedures performed in outpatient settings. ASCs are leveraging robotic systems to enhance surgical capabilities while maintaining lower operational costs compared to hospitals. Their ability to deliver high-quality care with shorter patient stays is driving a shift toward these facilities, particularly as healthcare systems emphasize value-based care and patient convenience.

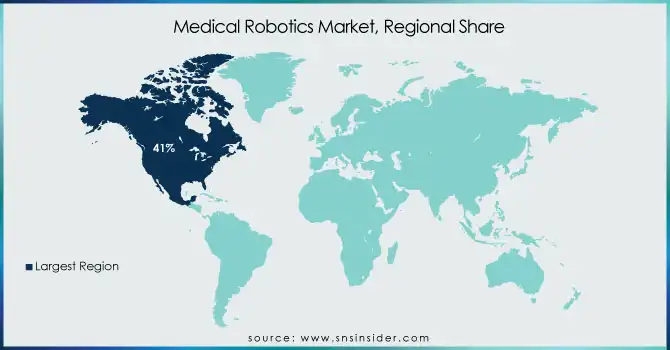

Medical Robotics Market Regional Analysis

North America led the medical robotics market in 2023, accounting for the highest revenue share of approximately 41%. This dominance is driven by the region's advanced healthcare infrastructure, significant investment in cutting-edge robotic technologies, and high adoption rates of surgical and rehabilitation robotics. Additionally, the presence of leading market players, coupled with favorable government policies and reimbursement frameworks, has bolstered the widespread deployment of medical robots in hospitals and specialized clinics.

The Asia Pacific region is expected to grow at the fastest CAGR of about 18.08% from 2024 to 2032. This growth is fueled by rising healthcare expenditure, increasing demand for minimally invasive procedures, and rapid advancements in healthcare infrastructure. Growing awareness of robotic-assisted healthcare solutions, combined with supportive government initiatives and expanding medical tourism, is further accelerating adoption. The region’s large and aging population is also contributing to the growing need for robotic systems in both surgical and rehabilitation applications.

Need any customization research on Medical Robotics Market - Inquiry Now

Key Players

-

Intuitive Surgical, Inc. (da Vinci Surgical System, Ion Endoluminal System)

-

Stryker Corporation (MAKO System, SpineAssist)

-

Medtronic Plc (Hugo Surgical System, Mazor X Stealth Edition)

-

Becton, Dickinson and Company (SmartSite Infusion Set, BD Pyxis MedStation)

-

Omnicell, Inc. (Omnicell Robotics, OmniFlex Medication Dispensing Robot)

-

Arxium (Arxium Automated Pharmacy, RIVA Pharmacy Automation)

-

Asensus Surgical, Inc. (Senhance Surgical System, Aesculus 3D Visualization System)

-

Zap Surgical Systems, Inc. (Zap-X Radiosurgery System, Zap-X Surgical Robot)

-

Renishaw Plc (Neuroinspire, Renishaw Spine Robotics)

-

Smith & Nephew Plc (RAS System, Navio Surgical System)

-

Zimmer Biomet Holdings, Inc. (MOTION Platform, ROSA Knee System)

-

DIH Holdings US Inc. (DIH Surgical Robot, DIH Modular Robotic Arm)

-

Accuray Incorporated (CyberKnife, TomoTherapy)

-

CMR Surgical (Versius Surgical System, Versius Robotic System)

-

Ekso Bionics Holdings, Inc. (EksoGT, EksoHealth)

-

Bionik Laboratories Corp. (ARKE Robotics, INNOVA System)

-

Lifeward, Inc. (Lifeward Exoskeleton, Lifeward Robotic Arm)

-

Cyberdyne Inc. (HAL Exoskeleton, Cybernic Treatment)

-

Avateramedical Gmbh. (Avatera Surgical Robot, Avatera Robotic Surgery System)

-

Johnson & Johnson (Verb Surgical System, Monarch Platform)

-

Swisslog Healthcare (Swisslog Automated Dispensing, PillPick)

-

Relay Robotics (Relay Robot, Relay Hybrid System)

-

Aethon (TUG Autonomous Mobile Robot, Aethon Smart Logistics)

-

Xenex Disinfection Services Inc. (Xenex LightStrike Robot, LightStrike Germ-Zapping Robot)

-

Zoll Medical Corporation (ZOLL Robotic Assisted Cardiopulmonary Resuscitation, ZOLL Medical ECG Management)

Recent Developments:

-

In September 2024, Stryker completed its acquisition of care.ai, a company specializing in AI-assisted virtual care workflows and smart room technology. This move strengthens Stryker's digital healthcare solutions.

-

In April 2024, Medtronic unveiled new AI capabilities for its Touch Surgery ecosystem, enhancing laparoscopic and robotic surgery with 14 new algorithms. These advancements offer better post-operative analysis and aim to improve surgical training through live-streamed procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.6 Billion |

| Market Size by 2032 | USD 63.84 Billion |

| CAGR | CAGR of 16.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Surgical Robotic Systems, Rehabilitation Robotic Systems, Radiosurgery Robotic Systems, Hospital & Pharmacy Robotic Systems) • By End User (Hospitals & Clinics, Ambulatory Surgery Centers, Pharmacies, Rehabilitation Centers, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intuitive Surgical, Stryker Corporation, Medtronic, Becton, Dickinson and Company, Omnicell, Arxium, Asensus Surgical, Zap Surgical Systems, Renishaw, Smith & Nephew, Zimmer Biomet Holdings, DIH Holdings US, Accuray, CMR Surgical, Ekso Bionics, Bionik Laboratories, Lifeward, Cyberdyne, Avateramedical, Johnson & Johnson, Swisslog Healthcare, Relay Robotics, Aethon, Xenex Disinfection Services, Zoll Medical Corporation. |

| Key Drivers | • Minimally Invasive Robotic-Assisted Surgeries Offer Faster Recovery, Reduced Risk, and Enhanced Precision, Driving Market Growth. • Technological Advancements in AI, Machine Learning, and Sensors Enhance Precision, Versatility, and Affordability of Medical Robotics. |

| RESTRAINTS | • High Upfront Costs and Maintenance Expenses Limit Accessibility and Adoption of Medical Robotics in Smaller Healthcare Facilities. |