Medical Refrigerators Market Report Scope & Overview:

Get More Information on Medical Refrigerators Market - Request Sample Report

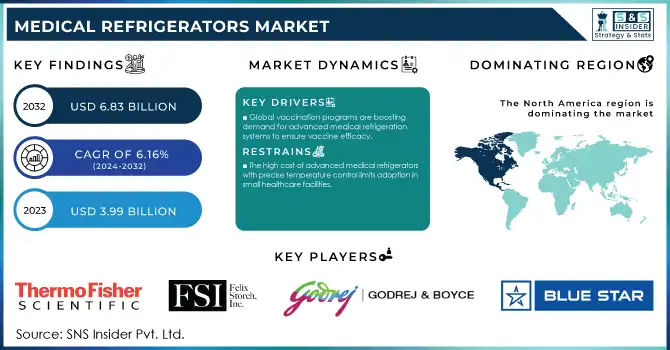

The Medical Refrigerators Market size was estimated at USD 3.99 billion in 2023 and is expected to reach USD 6.83 billion by 2032 at a CAGR of 6.16% during the forecast period of 2024-2032.

The medical refrigerators market is witnessing significant growth, driven by global advancements in healthcare infrastructure and increasing demand for cold storage solutions in vaccine distribution and biologics production. Immunization programs worldwide, particularly after the COVID-19 pandemic, have intensified the need for efficient cold-chain logistics. Alongside this, the market is experiencing a shift toward sustainable and energy-efficient refrigeration technologies, encouraged by green initiatives and government incentives. Technological innovations, including Wi-Fi-enabled monitoring and automated inventory systems, are redefining traditional cold storage solutions by providing real-time control and improved efficiency. Furthermore, the growing prevalence of chronic diseases and the expanding focus on biotechnology and life sciences research are further propelling the market forward.

Globally, vaccine demand has increased by over 300% since the pandemic, underscoring the critical role of medical refrigerators in cold chain management. Blood banks process approximately 118.5 million donations annually, necessitating robust refrigeration systems for storage. Additionally, 80% of temperature-sensitive drugs rely on stringent refrigeration requirements. With global R&D spending surpassing USD 2.4 trillion in 2023, laboratories invest heavily in advanced refrigeration systems to safeguard valuable biological materials, ensuring the medical refrigerators market remains a vital component of the healthcare and research sectors.

Medical Refrigerators Market Dynamics

DRIVERS

- The growing vaccination programs worldwide have driven the demand for advanced medical refrigeration systems to maintain vaccine efficacy.

The increasing demand for vaccine storage is a key driver in the growth of the medical refrigerators market. Global vaccination programs, including those for COVID-19, influenza, and routine immunizations, have surged, necessitating reliable refrigeration systems to maintain the efficacy of temperature-sensitive vaccines. The WHO's Expanded Programme on Immunization and other government initiatives to enhance vaccination coverage further boost this demand. Additionally, the development and distribution of mRNA-based vaccines, which require ultra-low temperature storage, have driven advancements in medical refrigeration technology, such as ultra-low temperature freezers. The integration of IoT-enabled monitoring systems and energy-efficient refrigeration solutions are shaping the market. The increasing focus on equitable vaccine distribution in emerging economies, supported by international organizations, is also expected to fuel market growth. As vaccination campaigns continue globally, the need for high-quality medical refrigerators is anticipated to remain robust in the coming years.

RESTRAIN

- The high initial cost of advanced medical refrigerators with precise temperature control limits their adoption by small healthcare facilities.

The high initial cost of medical refrigerators is a significant restraint for the market, particularly for small and medium-sized healthcare facilities. Advanced medical refrigerators are equipped with precise temperature control, IoT-enabled monitoring, and ultra-low temperature capabilities to ensure the safety and efficacy of sensitive pharmaceuticals and vaccines. However, these features come at a premium price, making it difficult for smaller clinics, pharmacies, and diagnostic centers with limited budgets to invest in such equipment. This challenge is more pronounced in developing regions, where healthcare infrastructure and funding are still evolving. Additionally, the cost of regular maintenance and calibration adds to the overall expense, further discouraging adoption. While government subsidies and public-private partnerships aim to address this issue, the financial barrier remains a hurdle for widespread deployment. Addressing affordability through cost-efficient manufacturing and leasing models could be pivotal in expanding the accessibility of medical refrigerators globally.

Medical Refrigerators Market Segmentation:

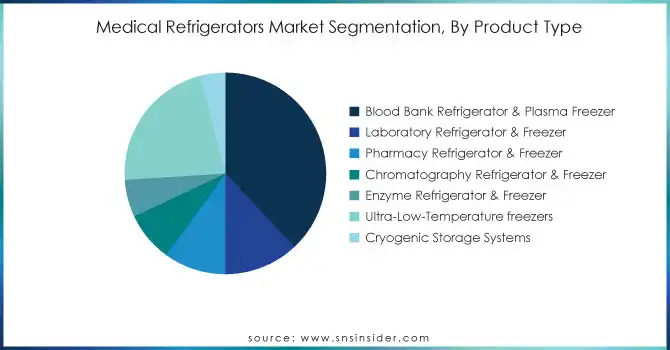

By Product Type

The Blood Bank Refrigerator & Plasma Freezer segment dominated with the market share over 38% in 2023, driven by its essential role in the healthcare sector. Hospitals and clinics rely heavily on these specialized refrigerators to store blood, plasma, and other blood-derived products at precise temperatures to preserve their integrity and effectiveness. Maintaining these products within a specific temperature range is crucial for preventing degradation and ensuring patient safety. Blood banks use these refrigerators to store donated blood for transfusions, while plasma freezers are vital for preserving plasma for medical treatments. The consistent demand for these products, coupled with strict regulatory standards regarding the safe storage of blood and plasma, supports the segment's significant market share.

By End Use

The Hospitals & Pharmacies segment dominated with the market share over 32% in 2023. Hospitals and pharmacies rely on medical refrigerators to store a variety of temperature-sensitive products, including vaccines, insulin, blood, biologics, and critical medicines. These items must be maintained at specific temperatures to ensure their efficacy and safety. The consistent and increasing demand for pharmaceuticals, vaccines, and life-saving treatments contributes to the growth and dominance of this segment. Furthermore, hospitals and pharmacies are expanding globally, driven by advancements in healthcare services, an aging population, and an increased prevalence of chronic diseases, further boosting the demand for medical refrigerators.

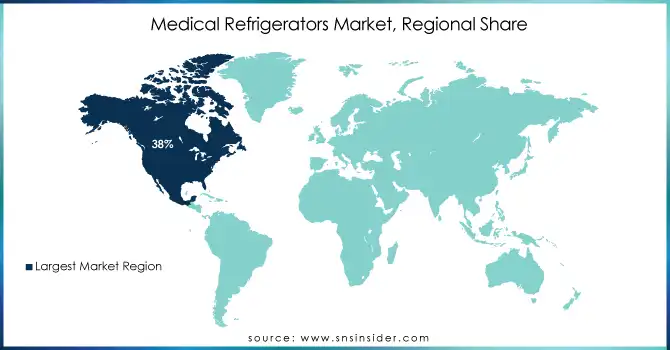

Medical Refrigerators Market Regional Analysis

North America region dominated with a market share of over 38% in 2023, primarily due to its advanced healthcare infrastructure and high demand for reliable refrigeration solutions. The region has a well-established healthcare system with state-of-the-art facilities that require consistent and safe storage of pharmaceuticals, vaccines, and biological samples. This demand is further driven by the rapid adoption of healthcare technologies, including the use of cold chain logistics to preserve sensitive medical supplies during transportation and storage. Additionally, stringent regulations and standards set by authorities like the FDA ensure that medical products are stored at specific temperatures to maintain their efficacy and safety.

The Asia-Pacific region is the fastest-growing in the medical refrigerators market, driven by several key factors. The expanding healthcare sector in countries like China, India, and other developing nations has led to a growing demand for reliable refrigeration solutions for the storage of vaccines, medicines, and other temperature-sensitive medical products. Rapid urbanization, combined with increasing investments in healthcare infrastructure, has bolstered the need for advanced medical refrigerators in hospitals, clinics, and pharmaceutical industries.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Some of the major key players in the Medical Refrigerators Market

-

Blue Star Limited (Medical Refrigerators, Freezers)

-

Godrej & Boyce Manufacturing Co. Ltd. (Medical Refrigerators, Blood Bank Refrigerators)

-

Felix Storch, Inc. (Summit Medical Refrigerators, Laboratory Refrigerators)

-

Thermo Fisher Scientific Inc. (Ultra-Low Freezers, Lab Refrigerators, Vaccine Storage Units)

-

Aucma (Medical Refrigerators, Chest Freezers)

-

Helmer Scientific, (Blood Bank Refrigerators, Pharmacy Refrigerators)

-

PHC Holdings Corporation (Biomedical Freezers, Medical Refrigerators)

-

Philipp Kirsch GmbH (Medical Refrigerators, Freezers)

-

Haier Biomedical (Ultra-Low Temperature Freezers, Medical Refrigerators)

-

Vestfrost Solutions (Medical Refrigerators, Freezers)

-

LEC Medical (Laboratory Refrigerators, Medical Refrigerators)

-

Follett LLC (Ice and Water Dispensers, Pharmacy Refrigerators)

-

Standex International Corporation (Medical Refrigerators, Ultra-Low Freezers)

-

Zhongke Meiling Cryogenics Company Limited (Medical Refrigerators, Cryogenic Freezers)

-

Panasonic Healthcare Co., Ltd. (Biomedical Freezers, Medical Refrigerators)

-

Liebherr Group (Medical Refrigerators, Pharma Freezers)

-

Dometic Group (Medical Refrigerators, Portable Fridges)

-

VWR International (Laboratory Refrigerators, Ultra-Low Freezers)

-

Indrel (Medical Refrigerators, Vaccine Storage Units)

-

B Medical Systems (Blood Bank Refrigerators, Vaccine Freezers)

Suppliers for (Laboratory refrigerators, medical freezers, ultra-low temperature freezers, etc) of the Medical Refrigerators Market

-

Thermo Fisher Scientific

-

Aegis Scientific, Inc.

-

Haier Biomedical

-

Panasonic Healthcare

-

Lec Medical

-

B Medical Systems

-

Dometic

-

Vestfrost Solutions

-

Philipp Kirsch GmbH

-

Helmer Scientific

Recent Development

In December 2024: Blue Star unveils its new range of energy-efficient Deep Freezers, designed to enhance performance and reduce energy consumption. The launch emphasizes Blue Star's commitment to sustainability, offering innovative refrigeration solutions tailored to meet the needs of both businesses and consumers.

In August 2023: Thermo Fisher Scientific introduced its TSV range of laboratory refrigerators and freezers, targeting the Indian market. This series features advanced microprocessor-based temperature control technologies, enhanced safety measures for users, and a focus on sustainability with the use of natural refrigerants.

In December 2023: Haier Biomedical presented its full range of cold chain solutions at MEDICA 2023, collaborating with global distributors and outlining its future growth plans. The company emphasized its commitment to innovation in medical refrigeration and cold chain management, both of which are essential for vaccine storage and biomedicine.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.99 Billion |

| Market Size by 2032 | USD 6.43 Billion |

| CAGR | CAGR of 6.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Blood Bank Refrigerator & Plasma Freezer, Laboratory Refrigerator & Freezer, Pharmacy Refrigerator & Freezer, Chromatography Refrigerator & Freezer, Enzyme Refrigerator & Freezer, Ultra-Low-Temperature freezers, Cryogenic Storage Systems) • By End Use (Blood Banks, Pharmaceutical Companies, Hospital & Pharmacies, Research Institutes, Medical Laboratories, Diagnostic Centre) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Blue Star Limited, Godrej & Boyce Manufacturing Co. Ltd., Felix Storch, Inc., Thermo Fisher Scientific Inc., Aucma, Helmer Scientific, PHC Holdings Corporation, Philipp Kirsch GmbH, Haier Biomedical, Vestfrost Solutions, LEC Medical, Follett LLC, Standex International Corporation, Zhongke Meiling Cryogenics Company Limited, Panasonic Healthcare Co., Ltd., Liebherr Group, Dometic Group, VWR International, Indrel, B Medical Systems. |

| Key Drivers | • The growing vaccination programs worldwide have driven the demand for advanced medical refrigeration systems to maintain vaccine efficacy. |

| Restraints | • The high initial cost of advanced medical refrigerators with precise temperature control limits their adoption by small healthcare facilities. |