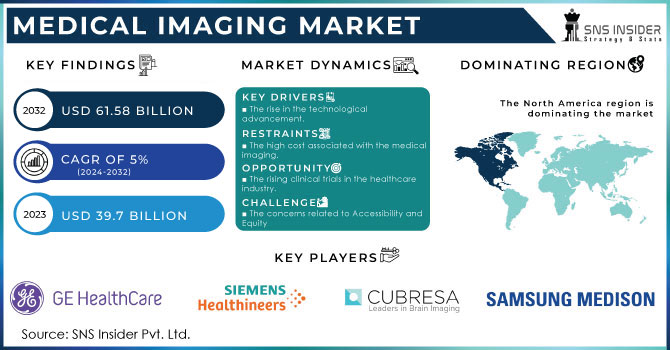

The Medical Imaging Devices Market size was valued at USD 39.7 billion in 2023 and is expected to reach USD 61.58 billion by 2032 and grow CAGR of 5% over the forecast period of 2024-2032.

Get More Information on Medical Imaging Devices Market - Request Sample Report

The Medical Imaging Devices Market is experiencing rapid growth due to advancements in technology, the increasing prevalence of chronic diseases, and a rising demand for early and accurate diagnosis. Key drivers include the aging population, technological innovations like AI-assisted analysis and 3D imaging, and the benefits of early detection. For instance, the demand for MRI scans is expected to increase due to their non-invasive nature and ability to provide detailed images of soft tissues.

The rising incidence of chronic diseases, such as cardiovascular disease, cancer, and neurological disorders, necessitates regular diagnosis and monitoring, which often rely on imaging techniques. Moreover, the aging population, with its increased susceptibility to chronic conditions, is driving demand. The United Nations Population Division projects that the number of people aged 65 and older will double within the next 30 years, reaching 1.6 billion by 2050. The increasing global life expectancy is a major factor driving growth in the medical imaging industry. Medical imaging is essential for diagnosing, managing, and treating these conditions, providing non-invasive insights into the body. With the global population aging, the demand for diagnostic imaging services is expected to rise significantly, fueling market growth. This trend highlights the importance of advanced imaging technologies in addressing the healthcare needs of an aging population. The United Nations predicts that a baby born in 2021 will live about 25 years longer than someone born in 1950, reaching an average age of 71. Women are generally expected to live five years longer than men.

Medical imaging plays a crucial role in early and accurate disease diagnosis, leading to effective treatment. In the United States, the National Center for Health Statistics estimates that there were 1,958,310 new cancer cases and 609,820 cancer-related deaths in 2023. The increasing prevalence of chronic diseases has significantly driven up the demand for medical imaging, resulting in a global rise in diagnostic imaging tests. According to the World Health Organization (WHO), approximately 3.6 billion diagnostic tests are performed worldwide each year, with around 350 million of these tests involving pediatric patients.

The supply side of the market is dominated by major multinational companies offering a wide range of imaging equipment and solutions. Ongoing research and development efforts are leading to continuous innovations, with a focus on improving image quality, reducing radiation exposure, and enhancing workflow efficiency. More sensitive detectors and AI-powered image reconstruction techniques are resulting in sharper, clearer images with lower noise levels and reduced artifacts. Additionally, manufacturers are developing technologies to reduce radiation exposure while maintaining diagnostic image quality, through techniques like iterative reconstruction, automatic exposure control, and personalized dose management. To improve workflow efficiency, automation, cloud-based solutions, and AI-assisted image interpretation are being implemented to streamline processes, facilitate collaboration, and improve accuracy. Another notable innovation is the development of portable imaging devices. These devices, such as handheld ultrasound scanners and wearable electrocardiogram monitors, allow for more convenient and accessible healthcare, particularly in remote or underserved areas. Government regulations play a crucial role in ensuring the safety and efficacy of medical imaging devices and establishing standards for equipment performance, radiation safety, and data privacy.

The FDA publication reported in January 2024 that as of July 2023, a total of 692 AI-enabled medical devices had been approved for market. Of these, over 75% were specifically designed for radiology applications.

Factors like increased investments, product innovation, and technological advancements, including AI and point-of-care imaging, are expected to drive further growth in the medical imaging industry.

Drivers

Fueled by Technological Innovations and Rising Chronic Disease Prevalence

One of the primary drivers is the increasing prevalence of chronic diseases, such as cardiovascular disease, cancer, and neurological disorders. These conditions often require regular monitoring and diagnosis, which rely heavily on medical imaging techniques. Additionally, the aging population is contributing to the rising demand for diagnostic imaging services, as older individuals are more likely to suffer from chronic health conditions. Technological advancements are also fueling the growth of the medical imaging market. The development of newer, more accurate, and less invasive imaging techniques, such as 3D imaging and AI-assisted analysis, enables earlier detection and more effective treatment of diseases. Furthermore, integrating AI into medical imaging improves image analysis, enhances diagnostic accuracy, and streamlines workflows.

Another important factor driving market growth is the increasing awareness of the benefits of early disease detection through medical imaging. As people become more informed about the importance of preventive healthcare, they are more likely to seek out diagnostic imaging services. This increased awareness is contributing to higher utilization rates and driving market expansion.

Restraints

High Costs and Regulatory Hurdles Impact Growth

One of the primary restraints is the high cost associated with medical imaging procedures. The cost of equipment, maintenance, and operation can be prohibitive for many healthcare facilities, limiting their ability to invest in advanced imaging technologies. Additionally, regulatory hurdles and reimbursement challenges can pose significant obstacles for market players. Government regulations regarding the use of medical imaging equipment, as well as reimbursement policies for diagnostic procedures, can impact market growth.

Moreover, a large and competitive refurbished equipment market, particularly in emerging economies, can limit the adoption of new and innovative imaging systems. Refurbished equipment often offers a more cost-effective alternative for smaller healthcare facilities, reducing the demand for new devices.

By Type

Computed tomography (CT) dominated the medical imaging device market in 2023, capturing a substantial 29.04% share. Its ability to provide detailed images of various body parts has made it indispensable for diagnosing a wide range of diseases. However, magnetic resonance imaging (MRI) is emerging as the fastest-growing segment, driven by its non-invasive nature and superior soft tissue visualization capabilities. This trend suggests a shift towards more advanced imaging techniques that offer greater diagnostic accuracy and patient comfort.

By Application

Cardiology emerged as the dominant segment in the medical imaging device market in 2023, capturing a substantial 25.66% share. This dominance is attributed to the rising prevalence of cardiovascular diseases and the critical role of medical imaging in diagnosis and monitoring. However, oncology is anticipated to experience the most rapid growth, driven by the increasing incidence of cancer and the indispensable nature of medical imaging in cancer detection and treatment. This shift reflects the evolving healthcare landscape and the growing demand for advanced imaging technologies to address complex medical conditions.

By End User

Hospitals dominated the medical imaging device market in 2023, capturing a substantial 45.99% share. Their comprehensive range of medical services and access to advanced imaging technologies contributed to this dominance. However, diagnostic imaging centers are poised for rapid growth, driven by the increasing demand for specialized diagnostic services and the growing trend of outsourcing imaging services. This shift reflects the evolving healthcare landscape and the need for more specialized and efficient imaging facilities.

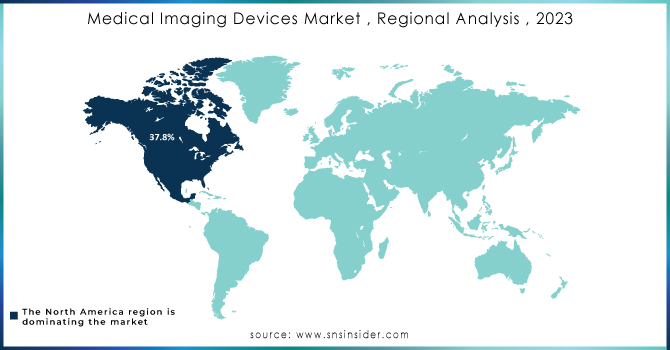

The Medical Imaging Devices Market is experiencing significant growth globally, driven by various factors. North America, particularly the United States, held the largest market share 37.8% in 2023 due to increased technology adoption, improved accessibility, and high healthcare spending. Europe is also witnessing growth, fueled by investments in R&D and the rising prevalence of chronic diseases. The Asia Pacific region is poised for the fastest growth, driven by population growth, increased R&D activity, and the need for advanced imaging devices. Key factors contributing to market growth include technological innovations, changing patient care strategies, and evolving epidemiological patterns. The demand for medical imaging professionals is also on the rise, with projected job growth in the coming years.

Need any customization research on Medical Imaging Devices Market - Enquiry Now

Samsung Medison Co., Ltd., Siemens Healthineers, GE Healthcare, Canon Medical Systems Corporation, Koninklijke Philips N.V., FUJIFILM VisualSonics Inc., Mindray Medical International, Konica Minolta, Carestream Health, Hitachi, Koning Corporation, Varex Imaging, Hologic, Inc., Esaote, PerkinElmer Inc. and others.

GE Healthcare introduced a new AI-powered ultrasound system in January 2024, designed to improve image quality and workflow efficiency. The system utilizes deep learning algorithms to enhance image clarity and reduce operator workload.

Siemens Healthineers launched a new CT scanner with advanced dose reduction technology in February 2024, aiming to minimize radiation exposure for patients. The scanner incorporates AI-based algorithms to optimize image quality while reducing scan times.

Philips unveiled a new MRI system with a wider bore size and improved patient comfort in March 2024. The system is designed to enhance patient experience and improve diagnostic accuracy for a variety of applications.

Canon Medical Systems announced the development of a new PET/CT scanner with advanced image reconstruction capabilities in April 2024. The scanner offers improved sensitivity and specificity for cancer detection and staging.

Agfa Healthcare released a new X-ray imaging system with enhanced image quality and workflow efficiency in May 2024. The system incorporates cloud-based software solutions to streamline image management and sharing.

| Report Attributes | Details |

| Market Size in 2023 | US$ 39.7 Bn |

| Market Size by 2032 | US$ 61.58 Bn |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Magnetic Resonance Imaging, Computed Tomography, X-ray, Ultrasound, Nuclear Imaging) • By Application (Cardiology, Neurology, Orthopedics, Gynecology, Oncology, Others) • By End User (Hospitals, Specialty Clinics, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Medison Co., Ltd., Siemens Healthineers, GE Healthcare, Canon Medical Systems Corporation, Koninklijke Philips N.V., FUJIFILM VisualSonics Inc., Mindray Medical International, Konica Minolta, Carestream Health, Hitachi, Koning Corporation, Varex Imaging, Hologic, Inc., Esaote, PerkinElmer Inc. and others |

| Key Drivers | • Fueled by Technological Innovations and Rising Chronic Disease Prevalence |

| Market Opportunities | • The rising clinical trials in the healthcare industry. |

Ans: The high cost associated with the medical imaging devices.

Ans: The Medical Imaging Devices Market size is projected to reach USD 61.58 billion by 2032.

Ans: North America will be the region which will have the highest growth rate for the medical imaging market

Ans: There might be a greater focus on cost-effectiveness in healthcare during a recession.

Ans: The major key players are Samsung Medison Co., Ltd., Siemens Healthineers, GE Healthcare, Canon Medical Systems Corporation, Koninklijke Philips N.V., FUJIFILM VisualSonics Inc., Mindray Medical International, Konica Minolta, Carestream Health, Hitachi, Koning Corporation, Varex Imaging, Hologic, Inc., Esaote, PerkinElmer Inc. and others

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Medical Imaging Devices Market Segmentation, by Type

7.1 Chapter Overview

7.2 Magnetic Resonance Imaging

7.2.1 Magnetic Resonance Imaging Market Trends Analysis (2020-2032)

7.2.2 Magnetic Resonance Imaging Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Computed Tomography

7.3.1 Computed Tomography Market Trends Analysis (2020-2032)

7.3.2 Computed Tomography Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 X-ray

7.4.1 X-ray Market Trends Analysis (2020-2032)

7.4.2 X-ray Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Ultrasound

7.5.1 Ultrasound Market Trends Analysis (2020-2032)

7.5.2 Ultrasound Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Nuclear Imaging

7.6.1 Nuclear Imaging Market Trends Analysis (2020-2032)

7.6.2 Nuclear Imaging Market Size Estimates and Forecasts to 2032 (USD Million)

8. Medical Imaging Devices Market Segmentation, by Application

8.1 Chapter Overview

8.2 Cardiology

8.2.1 Cardiology Market Trends Analysis (2020-2032)

8.2.2 Cardiology Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Neurology

8.3.1 Neurology Market Trends Analysis (2020-2032)

8.3.2 Neurology Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Orthopedics

8.4.1 Orthopedics Market Trends Analysis (2020-2032)

8.4.2 Orthopedics Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Gynecology

8.5.1 Gynecology Market Trends Analysis (2020-2032)

8.5.2 Gynecology Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Oncology

8.6.1 Oncology Market Trends Analysis (2020-2032)

8.6.2 Oncology Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Medical Imaging Devices Market Segmentation, by End User

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Specialty Clinics

9.3.1 Specialty Clinics Market Trends Analysis (2020-2032)

9.3.2 Specialty Clinics Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Diagnostic Imaging Centers

9.4.1 Diagnostic Imaging Centers Market Trends Analysis (2020-2032)

9.4.2 Diagnostic Imaging Centers Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Medical Imaging Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.4 North America Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.5 North America Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.2 USA Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6.3 USA Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.2 Canada Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7.3 Canada Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.2 Mexico Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8.3 Mexico Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Medical Imaging Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6.3 Poland Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7.3 Romania Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8.3 Hungary Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.9 turkey

10.3.1.9.1 Turkey Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9.3 Turkey Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Medical Imaging Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.5 Western Europe Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6.3 Germany Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.2 France Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7.3 France Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.2 UK Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8.3 UK Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9.3 Italy Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10.3 Spain Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13.3 Austria Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Medical Imaging Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.5 Asia Pacific Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.2 China Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6.3 China Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.2 India Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7.3 India Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.2 Japan Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8.3 Japan Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.2 South Korea Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9.3 South Korea Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10.3 Vietnam Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.2 Singapore Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11.3 Singapore Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.2 Australia Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12.3 Australia Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Medical Imaging Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.4 Middle East Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.5 Middle East Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6.3 UAE Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7.3 Egypt Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9.3 Qatar Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Medical Imaging Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.4 Africa Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.5 Africa Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6.3 South Africa Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Medical Imaging Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.4 Latin America Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.5 Latin America Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.2 Brazil Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6.3 Brazil Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.2 Argentina Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7.3 Argentina Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.2 Colombia Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8.3 Colombia Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Medical Imaging Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Medical Imaging Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Medical Imaging Devices Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11. Company Profiles

11.1 Samsung Medison Co., Ltd.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product / Services Offered

11.1.4 SWOT Analysis

11.2 Siemens Healthineers

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product / Services Offered

11.2.4 SWOT Analysis

11.3 GE Healthcare

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product / Services Offered

11.3.4 SWOT Analysis

11.4 Canon Medical Systems Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product / Services Offered

11.4.4 SWOT Analysis

11.5 Koninklijke Philips N.V.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product / Services Offered

11.5.4 SWOT Analysis

11.6 FUJIFILM VisualSonics Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product / Services Offered

11.6.4 SWOT Analysis

11.7 Mindray Medical International

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product / Services Offered

11.7.4 SWOT Analysis

11.8 Konica Minolta

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product / Services Offered

11.8.4 SWOT Analysis

11.9 Carestream Health

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product / Services Offered

11.9.4 SWOT Analysis

11.10 Hitachi

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product / Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Magnetic Resonance Imaging

X-ray

Ultrasound

By Application

Cardiology

Neurology

Orthopedics

Gynecology

Oncology

Others

By End User

Hospitals

Specialty Clinics

Diagnostic Imaging Centers

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Drug Addiction Treatment Market size was estimated at USD 18.81 billion in 2023 and is expected to reach USD 33.17 billion by 2031 at a CAGR of 7.35% during the forecast period of 2024-2031.

The Radiation Oncology Treatment Planning Software Market size was estimated at USD 2.18 billion in 2023 and is expected to reach USD 4.75 billion by 2032 at a CAGR of 9.04% during the forecast period of 2024-2032.

The Biological Safety Testing Products and Services Market was valued at USD 4.62 billion in 2023 and is expected to reach USD 11.58 billion by 2032, growing at a CAGR of 10.77% over the forecast period of 2024-2032.

Transport Chairs Market was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.26 billion by 2032, growing at a CAGR of 7.28% over the forecast period of 2024-2032.

Medical Gas Market Size was valued at USD 14.16 Billion in 2023 and is expected to reach USD 28.25 billion by 2032, growing at a CAGR of 8.0% over the forecast period 2024-2032.

Fondaparinux Market was valued at USD 605.76 million in 2023 and is expected to reach USD 1050.93 million by 2032, growing at a CAGR of 6.31% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone