Get More Information on Medical Equipment Financing Market - Request Sample Report

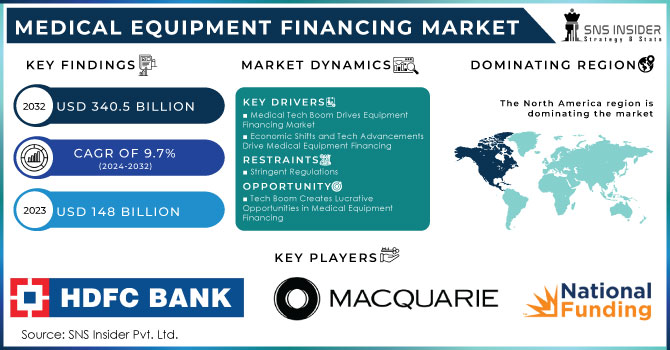

The Medical Equipment Financing Market size was valued at USD 148 Billion In 2023 & is estimated to reach USD 340.5 Billion by 2032 and increase at a CAGR of 9.7% between 2024 and 2032.

The Medical Equipment Financing Market refers to the financial sector dedicated to providing funding and financing solutions for medical equipment and healthcare technology. This market addresses the needs of healthcare providers, such as hospitals, clinics, diagnostic centres, and private practices, by offering them the necessary financial resources to acquire medical equipment and technology. Medical equipment can encompass a wide range of devices, instruments, machinery, and technology used for diagnosing, treating, and monitoring patients.

Medical equipment financing helps healthcare organizations and professionals acquire essential medical devices without the need for upfront capital investment. This is particularly important because medical equipment can be expensive and require periodic upgrades to stay current with medical advancements. Financing options in this market can include equipment leasing, where the healthcare provider pays a regular fee to use the equipment over a set period, and loans, which involve borrowing funds to purchase the equipment and paying back the loan in instalments over time. Medical equipment financing offers flexibility in payment structures, allowing healthcare providers to tailor their payments based on their budget and revenue streams. This can help prevent financial strain and maintain cash flow for other operational needs.

The healthcare industry is continuously evolving, with new and advanced medical technologies being developed. Medical equipment financing allows healthcare providers to keep up with these technological advancements by replacing outdated equipment with modern alternatives. Often, financing solutions are offered in collaboration with medical equipment manufacturers or suppliers. This enables seamless integration between equipment acquisition and financing, simplifying the procurement process for healthcare providers. The Medical Equipment Financing Market may be subject to regulations and guidelines that vary by region or country. This ensures that healthcare providers adhere to certain standards and compliance measures when acquiring medical equipment. The demand for medical equipment financing is driven by the growth of the healthcare industry, technological innovation, and the need to provide high-quality patient care. As healthcare services expand and equipment becomes more sophisticated, the market for medical equipment financing also expands. Medical equipment financing offers several benefits to healthcare providers, including the ability to access the latest medical technology, conserve working capital, manage budget constraints, and preserve credit lines for other needs. Overall, the Medical Equipment Financing Market plays a crucial role in supporting the healthcare sector's access to modern and advanced medical equipment, ultimately contributing to improved patient care and outcomes.

Medical Tech Boom Drives Equipment Financing Market

The medical equipment industry has witnessed a recent surge, fueled by exciting advancements in technology and the integration of AI. This innovation wave is attracting more doctors and healthcare providers to the equipment financing market.

The high cost of this advance equipment is a key driver. Hospitals, clinics, and diagnostic centers often require financing solutions to acquire these advanced tools. Fortunately, medical finance companies are stepping up by offering flexible financing options. Furthermore, constant upgrades to existing equipment push the cost barrier further, making it particularly challenging for doctors in developing nations. For example, consider Philips' launch of the Ingenia Ambition MR system in India (2019) – a next-generation MRI scanner boasting 50% faster scan times. To access such technology, Indian physicians often rely on equipment financing companies, highlighting the market's potential.

These trends are expected to continue propelling the medical equipment financing market forward in the coming years.

Economic Shifts and Tech Advancements Drive Medical Equipment Financing

The global medical equipment financing market is poised for growth due to a number of economic and technological factors. Unforeseen events like pandemics and international conflicts disrupt economies, placing immense strain on healthcare budgets. We saw this during COVID-19, when the sudden demand for additional beds, ventilators, and other equipment exposed the financial limitations of many healthcare providers. Looming recessions can further exacerbate this issue, tightening budgets and making it difficult for facilities to invest in new equipment.

However, the medical field is constantly innovating, developing advanced technologies that improve patient care. These advancements come at a cost, with sophisticated machinery like 16-slice CT scanners often priced between $80,000 and $110,000. This puts a significant financial burden on smaller medical facilities. Fortunately, medical equipment financing helps bridge this gap by offering flexible solutions, making these advancements more accessible and ensuring that even under economic pressure, healthcare providers can stay equipped with the latest technology.

Rising Demand for Medical Equipment

The healthcare sector constantly innovates, requiring facilities to upgrade equipment to maintain high standards of care.

Hospitals and clinics use financing to acquire advance equipment, allowing them to offer better services and attract more patients.

Stringent Regulations

Strict government regulations on financing options in the healthcare sector can limit market growth.

Tech Boom Creates Lucrative Opportunities in Medical Equipment Financing

The medical equipment financing market is on track for significant growth, fueled by a surge in spending on cutting-edge technologies and groundbreaking medical inventions. This wave of automation and mechanization offers exciting possibilities for improved medical care, enhanced patient experiences, and the ability to diagnose and treat conditions previously beyond human capabilities.

The growing adoption of technologies like machine learning, the Internet of Things (IoT), and artificial intelligence (AI) is expected to attract a wave of new buyers in the coming years. These advancements hold immense promise for the healthcare sector, but the high cost of such equipment can be a barrier for many facilities. Medical equipment financing steps in to bridge this gap, making these advancements more accessible and propelling market expansion.

The ability to offer financing options that address specific needs and budgets of healthcare providers can attract new customers.

Developing countries with growing healthcare needs present a significant opportunity for medical equipment financing.

Reimbursement Scenarios

Uncertainties in healthcare reimbursement policies can make it challenging for providers to secure financing.

Creditworthiness of Borrowers

Financial institutions may hesitate to offer loans to healthcare providers with weak credit history.

Following Russia's invasion, the Bank began channelling its own and other donors' resources to fund the wages of personnel who maintain key public services, particularly healthcare staff, under the Public Expenditures for Administrative Capacity Endurance (PEACE) programme. This initiative has also funded many of the government's social transfers for vulnerable individuals, such as pensions, disability subsidies, poor-people programmes, and payments to internally displaced people. To guarantee that money reaches the intended beneficiaries, the initiative is designed to transfer monies to the government retrospectively, after the government has completed its payments and following a spending verification procedure. Furthermore, the Bank enabled the delivery of $45 million in emergency medical equipment and supplies to more than 550 hospitals in 2022 by quickly pivoting and shifting resources from current health programmes such as the Serving People, Improving Health Project. In the context of this conflict, the Bank contributes to a market in medical equipment financing by providing certain emergency funding amounting to 4-5 %.

CNBC predicted in January that the chances of a 2023 recession were more than 62%, citing warning signs such as rising gas prices, inflation, and a faltering economy. A medical business owner must be cognizant of cash flow during a recession. You may get the advantages of new equipment when you need it most by financing it, while simultaneously maintaining a solid cash reserve. Equipment financing may be a significant option for medical firms looking to secure the equipment they need to function and develop during a downturn while saving money and taking advantage of potential tax breaks.

By Device Type

Therapeutic Equipment

Diagnostic Equipment

Others

By End User

Laboratories and Diagnostic Centers

Hospitals & Clinics

Others

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

REGIONAL ANALYSIS

North America: The size of the medical equipment finance market in North America emerged as dominating. The key reason for this domination is the region's highest financing rate for medical equipment. Continuous medical device innovation and expenditures in medical infrastructure have contributed to this region's dominance. In addition, due to the growing use of artificial intelligence for medical equipment financing and increasing investments in healthcare infrastructure, Europe has been ranked second in the market.

Asia Pacific: With the rise of the financial sector in the area, as well as the establishment of hospitals and cutting-edge labs and diagnostic centres in its rising countries, Asia Pacific is expected to expand quicker. Funding for the medical industry from various governments will also assist in market expansion. Nirmala Sitharaman, India's finance minister, just announced the budget for 2020. The allocation's primary goal was to establish a higher number of hospitals around the country. In the projected term, such investments are anticipated to raise market size.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Some major players in Medical Equipment Financing Market are HDFC Bank, CMS Funding, National Funding, Macquarie Group Limited, TIAA Bank, Toronto-Dominion Bank, Société General S.A., Bajaj Fiserv, First American Healthcare Finance, Amur Equipment Finance and other players.

In 2021: The International Finance Corporation (IFC) and the Multilateral Investment Guarantee Agency (MIGA) have announced the Trade Finance Guarantee programme, which will support trade flows of key items, including food and medical equipment, in low-income countries as they recover from the effects of the epidemic.

In 2021: G.E. Healthcare and NSIA Banque Cote d'Ivoire have launched a collaboration with the IFC's Africa Medical Equipment Facility to boost the healthcare industry and promote medical equipment financing throughout Africa.

In 2021: In partnership with Anaxago, IMAGENES secured USD 1.45 million in startup funding. This will bolster the company's staff with significant R&D skills in order to grow the implementation of its software products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 148 Bn |

| Market Size by 2032 | US$ 340.5 Bn |

| CAGR | CAGR of 9.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Therapeutic Equipment, Diagnostic Equipment, Others) • By End User (Laboratories and Diagnostic Centers, Hospitals & Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | HDFC Bank, CMS Funding, National Funding, Macquarie Group Limited, TIAA Bank, Toronto-Dominion Bank, Société General S.A., Bajaj Fiserv, First American Healthcare Finance, Amur Equipment Finance |

| Key Drivers |

|

| Market Restraints |

|

Ans. The Compound Annual Growth rate for Medical Equipment Financing Market over the forecast period is 9.7%.

Ans. USD 340.5 billion is the projected Medical Equipment Financing market size of the market by 2032.

Ans. During the projected period, the diagnostic equipment sector is likely to lead the market.

Ans. In 2023, North America dominated the market.

Ans. The emergence of technologically advanced equipment, rising capital investments, and demand for state-of-the-art facilities at hospitals and specialist clinics are the reasons driving medical equipment adoption.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Medical Equipment Financing Market Segmentation, By Device Type

8.1 Therapeutic Equipment

8.2 Diagnostic Equipment

8.3 Others

9. Medical Equipment Financing Market Segmentation, By End User

9.1 Laboratories and Diagnostic Centers

9.2 Hospitals & Clinics

9.3 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 North America Medical Equipment Financing Market by Country

10.2.2 North America Medical Equipment Financing Market by Device Type

10.2.3 North America Medical Equipment Financing Market by End User

10.2.4 USA

10.2.4.1 USA Medical Equipment Financing Market by Device Type

10.2.4.2 USA Medical Equipment Financing Market by End User

10.2.5 Canada

10.2.5.1 Canada Medical Equipment Financing Market by Device Type

10.2.5.2 Canada Medical Equipment Financing Market by End User

10.2.6 Mexico

10.2.6.1 Mexico Medical Equipment Financing Market by Device Type

10.2.6.2 Mexico Medical Equipment Financing Market by End User

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Eastern Europe Medical Equipment Financing Market by Country

10.3.1.2 Eastern Europe Medical Equipment Financing Market by Device Type

10.3.1.3 Eastern Europe Medical Equipment Financing Market by End User

10.3.1.4 Poland

10.3.1.4.1 Poland Medical Equipment Financing Market by Device Type

10.3.1.4.2 Poland Medical Equipment Financing Market by End User

10.3.1.5 Romania

10.3.1.5.1 Romania Medical Equipment Financing Market by Device Type

10.3.1.5.2 Romania Medical Equipment Financing Market by End User

10.3.1.6 Hungary

10.3.1.6.1 Hungary Medical Equipment Financing Market by Device Type

10.3.1.6.2 Hungary Medical Equipment Financing Market by End User

10.3.1.7 Turkey

10.3.1.7.1 Turkey Medical Equipment Financing Market by Device Type

10.3.1.7.2 Turkey Medical Equipment Financing Market by End User

10.3.1.8 Rest of Eastern Europe

10.3.1.8.1 Rest of Eastern Europe Medical Equipment Financing Market by Device Type

10.3.1.8.2 Rest of Eastern Europe Medical Equipment Financing Market by End User

10.3.2 Western Europe

10.3.2.1 Western Europe Medical Equipment Financing Market by Country

10.3.2.2 Western Europe Medical Equipment Financing Market by Device Type

10.3.2.3 Western Europe Medical Equipment Financing Market by End User

10.3.2.4 Germany

10.3.2.4.1 Germany Medical Equipment Financing Market by Device Type

10.3.2.4.2 Germany Medical Equipment Financing Market by End User

10.3.2.5 France

10.3.2.5.1 France Medical Equipment Financing Market by Device Type

10.3.2.5.2 France Medical Equipment Financing Market by End User

10.3.2.6 UK

10.3.2.6.1 UK Medical Equipment Financing Market by Device Type

10.3.2.6.2 UK Medical Equipment Financing Market by End User

10.3.2.7 Italy

10.3.2.7.1 Italy Medical Equipment Financing Market by Device Type

10.3.2.7.2 Italy Medical Equipment Financing Market by End User

10.3.2.8 Spain

10.3.2.8.1 Spain Medical Equipment Financing Market by Device Type

10.3.2.8.2 Spain Medical Equipment Financing Market by End User

10.3.2.9 Netherlands

10.3.2.9.1 Netherlands Medical Equipment Financing Market by Device Type

10.3.2.9.2 Netherlands Medical Equipment Financing Market by End User

10.3.2.10 Switzerland

10.3.2.10.1 Switzerland Medical Equipment Financing Market by Device Type

10.3.2.10.2 Switzerland Medical Equipment Financing Market by End User

10.3.2.11 Austria

10.3.2.11.1 Austria Medical Equipment Financing Market by Device Type

10.3.2.11.2 Austria Medical Equipment Financing Market by End User

10.3.2.12 Rest of Western Europe

10.3.2.12.1 Rest of Western Europe Medical Equipment Financing Market by Device Type

10.3.2.12.2 Rest of Western Europe Medical Equipment Financing Market by End User

10.4 Asia-Pacific

10.4.1 Asia Pacific Medical Equipment Financing Market by Country

10.4.2 Asia Pacific Medical Equipment Financing Market by Device Type

10.4.3 Asia Pacific Medical Equipment Financing Market by End User

10.4.4 China

10.4.4.1 China Medical Equipment Financing Market by Device Type

10.4.4.2 China Medical Equipment Financing Market by End User

10.4.5 India

10.4.5.1 India Medical Equipment Financing Market by Device Type

10.4.5.2 India Medical Equipment Financing Market by End User

10.4.6 Japan

10.4.6.1 Japan Medical Equipment Financing Market by Device Type

10.4.6.2 Japan Medical Equipment Financing Market by End User

10.4.7 South Korea

10.4.7.1 South Korea Medical Equipment Financing Market by Device Type

10.4.7.2 South Korea Medical Equipment Financing Market by End User

10.4.8 Vietnam

10.4.8.1 Vietnam Medical Equipment Financing Market by Device Type

10.4.8.2 Vietnam Medical Equipment Financing Market by End User

10.4.9 Singapore

10.4.9.1 Singapore Medical Equipment Financing Market by Device Type

10.4.9.2 Singapore Medical Equipment Financing Market by End User

10.4.10 Australia

10.4.10.1 Australia Medical Equipment Financing Market by Device Type

10.4.10.2 Australia Medical Equipment Financing Market by End User

10.4.11 Rest of Asia-Pacific

10.4.11.1 Rest of Asia-Pacific Medical Equipment Financing Market by Device Type

10.4.11.2 Rest of Asia-Pacific APAC Medical Equipment Financing Market by End User

10.5 Middle East & Africa

10.5.1 Middle East

10.5.1.1 Middle East Medical Equipment Financing Market by Country

10.5.1.2 Middle East Medical Equipment Financing Market by Device Type

10.5.1.3 Middle East Medical Equipment Financing Market by End User

10.5.1.4 UAE

10.5.1.4.1 UAE Medical Equipment Financing Market by Device Type

10.5.1.4.2 UAE Medical Equipment Financing Market by End User

10.5.1.5 Egypt

10.5.1.5.1 Egypt Medical Equipment Financing Market by Device Type

10.5.1.5.2 Egypt Medical Equipment Financing Market by End User

10.5.1.6 Saudi Arabia

10.5.1.6.1 Saudi Arabia Medical Equipment Financing Market by Device Type

10.5.1.6.2 Saudi Arabia Medical Equipment Financing Market by End User

10.5.1.7 Qatar

10.5.1.7.1 Qatar Medical Equipment Financing Market by Device Type

10.5.1.7.2 Qatar Medical Equipment Financing Market by End User

10.5.1.8 Rest of Middle East

10.5.1.8.1 Rest of Middle East Medical Equipment Financing Market by Device Type

10.5.1.8.2 Rest of Middle East Medical Equipment Financing Market by End User

10.5.2 Africa

10.5.2.1 Africa Medical Equipment Financing Market by Country

10.5.2.2 Africa Medical Equipment Financing Market by Device Type

10.5.2.3 Africa Medical Equipment Financing Market by End User

10.5.2.4 Nigeria

10.5.2.4.1 Nigeria Medical Equipment Financing Market by Device Type

10.5.2.4.2 Nigeria Medical Equipment Financing Market by End User

10.5.2.5 South Africa

10.5.2.5.1 South Africa Medical Equipment Financing Market by Device Type

10.5.2.5.2 South Africa Medical Equipment Financing Market by End User

10.5.2.6 Rest of Africa

10.5.2.6.1 Rest of Africa Medical Equipment Financing Market by Device Type

10.5.2.6.2 Rest of Africa Medical Equipment Financing Market by End User

10.6 Latin America

10.6.1 Latin America Medical Equipment Financing Market by Country

10.6.2 Latin America Medical Equipment Financing Market by Device Type

10.6.3 Latin America Medical Equipment Financing Market by End User

10.6.4 Brazil

10.6.4.1 Brazil Medical Equipment Financing Market by Device Type

10.6.4.2 Brazil Medical Equipment Financing Market by End User

10.6.5 Argentina

10.6.5.1 Argentina Medical Equipment Financing Market by Device Type

10.6.5.2 Argentina Medical Equipment Financing Market by End User

10.6.6 Colombia

10.6.6.1 Colombia Medical Equipment Financing Market by Device Type

10.6.6.2 Colombia Medical Equipment Financing Market by End User

10.6.7 Rest of Latin America

10.6.7.1 Rest of Latin America Medical Equipment Financing Market by Device Type

10.6.7.2 Rest of Latin America Medical Equipment Financing Market by End User

11. Company Profile

11.1 HDFC Bank

11.1.1 Company Overview

11.1.2 Financials

11.1.3 Product/Services Offered

11.1.4 SWOT Analysis

11.1.5 The SNS View

11.2 CMS Funding

11.2.1 Company Overview

11.2.2 Financials

11.2.3 Product/Services Offered

11.2.4 SWOT Analysis

11.2.5 The SNS View

11.3 National Funding

11.3.1 Company Overview

11.3.2 Financials

11.3.3 Product/Services Offered

11.3.4 SWOT Analysis

11.3.5 The SNS View

11.4 Macquarie Group Limited

11.4 Company Overview

11.4.2 Financials

11.4.3 Product/Services Offered

11.4.4 SWOT Analysis

11.4.5 The SNS View

11.5 TIAA Bank

11.5.1 Company Overview

11.5.2 Financials

11.5.3 Product/Services Offered

11.5.4 SWOT Analysis

11.5.5 The SNS View

11.6 Toronto-Dominion Bank

11.6.1 Company Overview

11.6.2 Financials

11.6.3 Product/Services Offered

11.6.4 SWOT Analysis

11.6.5 The SNS View

11.7 Société General S.A.

11.7.1 Company Overview

11.7.2 Financials

11.7.3 Product/Services Offered

11.7.4 SWOT Analysis

11.7.5 The SNS View

11.8 Bajaj Fiserv

11.8.1 Company Overview

11.8.2 Financials

11.8.3 Product/Services Offered

11.8.4 SWOT Analysis

11.8.5 The SNS View

11.9 First American Healthcare Finance

11.9.1 Company Overview

11.9.2 Financials

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.9.5 The SNS View

11.10 Amur Equipment Finance

11.10.1 Company Overview

11.10.2 Financials

11.10.3 Product/Services Offered

11.10.4 SWOT Analysis

11.10.5 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. USE Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Medical Power Supply Market Size was USD 1.64 billion in 2023 & is expected to reach $2.96 billion by 2032 & grow at a CAGR of 6.80% by 2024-2032.

The global dental regeneration market, valued at USD 5.03 Billion in 2023, is projected to reach USD 8.49 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.28% during the forecast period.

Veterinary Software Market was valued at USD 1.60 billion in 2023 and is expected to reach USD 3.38 billion by 2032, growing at a CAGR of 8.68% from 2024-2032.

The Drug Screening Market was valued at USD 7.6 billion in 2023 and is expected to reach USD 29.7 billion by 2032 and grow at a CAGR of 16.3% by 2024-2032.

The Urinary Catheters Market size was USD 5.80 billion in 2023 and is estimated to reach USD 9.50 billion by 2032 with a growing CAGR of 5.68% by 2024-2032.

Dermatology Devices Market Size was valued at USD 15.2 Billion in 2023 and is expected to reach USD 40.56 Billion by 2032, growing at a CAGR of 11.54% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone