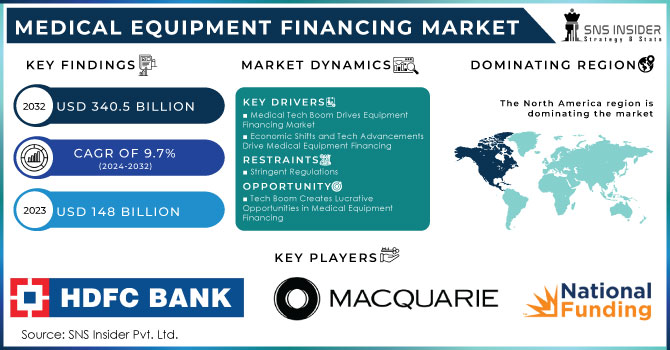

The Medical Equipment Financing market size was USD 157.09 billion in 2023 and is expected to reach USD 305.98 billion by 2032 and grow at a CAGR of 7.69% over the forecast period of 2024-2032. This report provides in-depth insights into the medical equipment financing market, covering key trends such as the increasing demand for leasing solutions, the impact of fluctuating interest rates on financing decisions, and the growing role of vendor-backed financing programs. It analyzes loan approval rates, delinquency trends, and the preference for leasing versus traditional loans among healthcare providers. The report also explores government-backed funding initiatives, tax incentives, and the role of private financial institutions in expanding medical equipment accessibility. Additionally, it highlights segment-wise financing trends across hospitals, diagnostic centers, and ambulatory surgical centers. Regional financing disparities, competitive dynamics, and mergers & acquisitions in the financial services sector are examined. Overall, this study provides a data-driven outlook on how evolving financial models are shaping the medical equipment acquisition landscape.

Get More Information on Medical Equipment Financing Market - Request Sample Report

The U.S. held the largest market share of 74%, valued at USD 44.17 billion, in the medical equipment financing market due to its well-established healthcare infrastructure, high adoption of advanced medical technologies, and strong presence of financial institutions offering tailored financing solutions. Favorable government initiatives, such as Medicare and Medicaid reimbursement programs, encourage healthcare providers to opt for financing solutions to manage capital costs efficiently. Additionally, the growing demand for diagnostic imaging, surgical instruments, and patient monitoring devices has driven the need for flexible financing options. The presence of major medical equipment manufacturers and financial service providers further strengthens the market. Rising hospital consolidation and an increasing preference for leasing over direct purchases continue to boost the U.S. market dominance.

Drivers

Increasing healthcare infrastructure investments and rising demand for advanced medical equipment are propelling the medical equipment financing market growth.

The rapid expansion of the healthcare infrastructure, coupled with the increasing demand for technologically advanced medical equipment, is significantly driving the medical equipment financing market. Governments and private healthcare providers worldwide are heavily investing in upgrading hospitals, diagnostic centers, and ambulatory surgical facilities, necessitating financing solutions to manage high capital costs. In 2023, U.S. healthcare spending exceeded USD 4.5 trillion, emphasizing the growing need for financial assistance in acquiring cutting-edge medical devices. Additionally, the rising prevalence of chronic diseases has accelerated the adoption of imaging systems, surgical equipment, and patient monitoring devices, further driving demand for financing. Financial institutions and manufacturers are offering customized loan and leasing options, making high-cost medical equipment more accessible to healthcare providers. This trend is expected to sustain the market’s strong growth trajectory in the coming years.

Restrain

Stringent regulatory policies and compliance requirements limit the growth of the medical equipment financing market.

The medical equipment financing market faces significant challenges due to strict regulatory policies and compliance requirements imposed by governments and financial authorities. Regulations governing healthcare financing, such as HIPAA in the U.S. and MDR in Europe, demand stringent compliance, making loan approval processes complex and time-consuming. Additionally, financial institutions must assess risks associated with equipment obsolescence, borrower creditworthiness, and repayment capabilities, further limiting accessibility to financing solutions. Stringent capital adequacy norms for banks and non-banking financial companies (NBFCs) can restrict lending flexibility, impacting loan availability for small and mid-sized healthcare providers. Moreover, variations in regional regulatory frameworks create inconsistencies in financing approval rates, delaying equipment acquisitions. These factors collectively hinder market growth by increasing operational challenges for financial institutions and limiting seamless access to capital for healthcare providers.

Opportunity

Integration of ai and digital platforms in loan processing creates growth opportunities for the medical equipment financing market.

The growing integration of AI-driven financial assessment tools and digital lending platforms is revolutionizing the medical equipment financing market by streamlining loan approvals, reducing paperwork, and improving credit risk analysis. AI-powered financial models can efficiently assess borrower profiles, predict default risks, and automate approval processes, thereby reducing turnaround time. Additionally, the adoption of blockchain-based smart contracts enhances security, transparency, and fraud prevention in financial transactions. Several fintech companies and banks are leveraging AI to provide real-time loan approvals and offer customized financing solutions for medical equipment purchases. The rise of embedded finance within healthcare procurement platforms allows seamless financing integration at the point of purchase, further enhancing accessibility. These technological advancements create significant opportunities for financial institutions to expand their market presence and improve service efficiency.

Challenge

High risk of equipment obsolescence and depreciation poses a major challenge to the medical equipment financing market.

One of the biggest challenges in the medical equipment financing market is the rapid obsolescence and depreciation of medical devices, which significantly impact loan repayment structures and resale values. Medical technology is evolving at an unprecedented pace, with continuous innovations in imaging systems, robotic-assisted surgery, and AI-driven diagnostics. As newer models enter the market, previously financed equipment may lose its market value quickly, creating risks for lenders in terms of collateral devaluation. Financial institutions must carefully structure financing terms to mitigate losses associated with outdated equipment, often resulting in higher interest rates or stricter repayment conditions for borrowers. Additionally, healthcare providers face difficulties in upgrading to newer technologies while still repaying previous loans, leading to financial strain. Addressing these challenges requires flexible financing models, including shorter loan tenures and structured leasing options.

By Device Type

Diagnostic Equipment held the largest market share around 48%, in 2023. It is associated with high demand, frequent technology upgrades, and large investment. The growing burden of chronic diseases, including cancer, cardiac, and respiratory diseases, require substantial financial investment in high-end imaging systems, which include MRI, CT scans, ultrasound, and X-ray machines. Moreover, increasing implementation of AI-based diagnostic and digital imaging solutions has contributed to the rising demand for financing. Diagnostic imaging makes up a significant share of hospital capital expenditure, which has forced health care providers to depend upon leasing and loan options for the procurement of equipment, as per reports in the industry. Additionally, growth is driven by government initiatives and private-sector funding programs that support early disease detection and preventive healthcare. This continuous upgrade cycle in diagnostic technology, along with increasing demand for leasing as opposed to direct purchase, make diagnostic equipment holding sway in the market.

By End-User Industry

Hospitals & Clinics held the largest market share at around 42% in 2023. It is owing to high demand for advanced medical technologies, large-scale patient care, and substantial capital requirements. Hospitals and clinics act as the primary healthcare providers requiring a large variety of medical equipment such as diagnostic imaging systems, surgical instruments, patient monitoring devices, and life-support equipment, and these usually represent very costly investments. As chronic diseases grow and hospital admissions increase, healthcare infrastructure facilities are regularly upgrading their MedTech capabilities for the best patient care. Because cutting-edge scientific equipment is so expensive to acquire and maintain, financing is often the best alternative. Hospitals and clinics have been prompted to adopt financing solutions with additional government funding programs, private investment initiatives, and flexible leasing options. They remain dominant in the market as well on the back of sustainably high demand for medical equipment financing ever since the proliferation of multi-specialty hospitals and private healthcare networks.

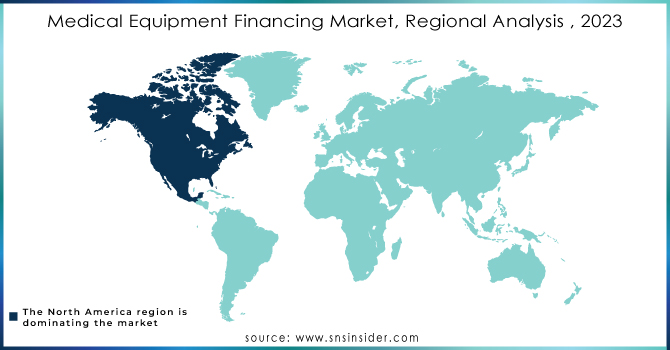

North America held the largest market share at around 38% in 2023. It is due to an organized healthcare infrastructure, enormous healthcare spending, and an enormous financial service provider market. There exists a strong medical industry in the region (especially in the U.S. and Canada) wherein there is a huge demand for technologically inclined gear, including MRI machines, robotic surgical systems, and AI-based diagnostic instruments, which require a substantial financial commitment. Furthermore, positive government initiatives, such as Medicare, Medicaid, and tax incentives in healthcare investments, have driven hospitals, clinics, and diagnostic centers to go for lease and loan options. Major financial institutions providing medical equipment financing plans tailored to suit the needs of consumers, along with the rise of the private-sector healthcare expansion, will bolster the market in North America.

Asia Pacific held the significant market share. This is due to the rapidly growing healthcare investments in China, India, Japan, and South Korea for upgrading hospitals, diagnostic centers, and specialty clinics. High-cost equipment, including MRI machines, CT (computerized tomography) scanners, and robotic surgical systems, costs, and financing solutions are some of the other aspects driving the global healthcare equipment financing market due to the increasing burden of chronic diseases, rising geriatric populations, and the increasing medical tourism industry. Government-sponsored initiatives such as funding programs, public-private partnerships (PPPs), and tax incentives for medical equipment procurement have further improved affordability by making capital funds more accessible. The market is also growing in Asia Pacific due to the presence of regional and global financial institutions providing low-interest loans and leasing options, making the region a crucial market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

HDFC Bank (Medical Equipment Loans, Healthcare Infrastructure Financing)

CMS Funding (Equipment Leasing, Working Capital Loans)

National Funding (Medical Equipment Financing, Business Loans)

Macquarie Group Limited (Healthcare Asset Financing, Medical Equipment Leasing)

TIAA Bank (Healthcare Equipment Loans, Vendor Financing)

Toronto-Dominion Bank (Medical Equipment Leasing, Healthcare Business Loans)

Société General S.A (Medical Equipment Lease Financing, Capital Equipment Loans)

Bajaj Finserv (Doctor Loan, Medical Equipment Finance)

First American Healthcare Finance (Medical Equipment Leasing, Capital Loans)

Amur Equipment Finance (Equipment Leasing, Business Line of Credit)

GE Healthcare Financial Services (Capital Equipment Financing, Diagnostic Imaging Loans)

Siemens Financial Services (Medical Technology Financing, Radiology Equipment Loans)

Wells Fargo Healthcare Finance (Medical Equipment Leasing, Healthcare Real Estate Loans)

Bank of America Healthcare Finance (Medical Equipment Leasing, Healthcare Working Capital)

Hitachi Capital America (Imaging Equipment Financing, Surgical Equipment Leasing)

Stryker Flex Financial (Operating Room Equipment Financing, Surgical Equipment Leasing)

Canon Medical Finance (Imaging System Loans, Healthcare Equipment Leasing)

MED One Group (Hospital Equipment Leasing, Patient Monitoring System Financing)

PNC Healthcare (Healthcare Equipment Financing, Medical Practice Loans)

KeyBank Healthcare Finance (Medical Equipment Loans, Diagnostic Equipment Leasing)

In 2024, GE HealthCare formed strategic alliances with Sutter Health in the U.S. and Nuffield Health in the UK to deploy AI-powered diagnostic equipment across hospital networks.

In December 2024, Bajaj Finserv Asset Management Ltd. introduced the Bajaj Finserv Healthcare Fund, an equity mutual fund designed to invest in healthcare-related sectors, including hospitals, pharmaceuticals, and diagnostics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD157.09 Billion |

| Market Size by 2032 | USD305.98 Billion |

| CAGR | CAGR of7.69 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Therapeutic Equipment, Diagnostic Equipment, Therapeutic Equipment, Others) • By End User (Laboratories and Diagnostic Centers, Hospitals & Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HDFC Bank, CMS Funding, National Funding, Macquarie Group Limited, TIAA Bank, Toronto-Dominion Bank, Société Générale S.A., Bajaj Finserv, First American Healthcare Finance, Amur Equipment Finance, GE Healthcare Financial Services, Siemens Financial Services, Wells Fargo Healthcare Finance, Bank of America Healthcare Finance, Hitachi Capital America, Stryker Flex Financial, Canon Medical Finance, MED One Group, PNC Healthcare, KeyBank Healthcare Finance |

Ans: The Medical Equipment Financing Market was valued at USD 157.09 Billion in 2023.

Ans: The expected CAGR of the global Medical Equipment Financing Market during the forecast period is 7.69%

Ans: Diagnostic Equipment will grow rapidly in the Medical Equipment Financing Market from 2024 to 2032.

Ans: Increasing healthcare infrastructure investments and rising demand for advanced medical equipment are propelling the medical equipment financing market growth.

Ans: North America led the Medical Equipment Financing Market in the region with the highest revenue share in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Healthcare Facility Loan Distribution

5.2 Technology Adoption & Equipment Lifecycle Data

5.3 Mergers & Acquisitions in Medical Financing Sector

5.4 Growth in Demand for Financing Solutions

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Medical Equipment Financing Market Segmentation Device Type

7.1 Chapter Overview

7.2 Therapeutic Equipment

7.2.1 Therapeutic Equipment Trends Analysis (2020-2032)

7.2.2 Therapeutic Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Diagnostic Equipment

7.3.1 Diagnostic Equipment Market Trends Analysis (2020-2032)

7.3.2 Diagnostic Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Others

7.4.1 Others Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Medical Equipment Financing Market Segmentation By End Use Industry

8.1 Chapter Overview

8.2 Laboratories and Diagnostic Centers

8.2.1 Laboratories and Diagnostic Centers Market Trends Analysis (2020-2032)

8.2.2 Laboratories and Diagnostic Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Hospitals & Clinics

8.3.1 Hospitals & Clinics Market Trends Analysis (2020-2032)

8.3.2 Hospitals & Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Medical Equipment Financing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.2.4 North America Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.2.5.2 USA Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.2.6.2 Canada Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Medical Equipment Financing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Medical Equipment Financing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.6.2 France Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Medical Equipment Financing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.4.5.2 China Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.4.5.2 India Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.4.5.2 Japan Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.4.9.2 Australia Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Medical Equipment Financing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Medical Equipment Financing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.2.4 Africa Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Medical Equipment Financing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.6.4 Latin America Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Medical Equipment Financing Market Estimates and Forecasts, Device Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Medical Equipment Financing Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 HDFC Bank

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 CMS Funding

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product/ Services Offered

10.2.4 SWOT Analysis

10.3 National Funding

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product/ Services Offered

10.3.4 SWOT Analysis

10.4 Macquarie Group Limited

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product/ Services Offered

10.4.4 SWOT Analysis

10.5 TIAA Bank

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product/ Services Offered

10.5.4 SWOT Analysis

10.6 Toronto-Dominion Bank

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product/ Services Offered

10.6.4 SWOT Analysis

10.7 Société General S.A.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product/ Services Offered

10.7.4 SWOT Analysis

10.8 Bajaj Fiserv,

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product/ Services Offered

10.8.4 SWOT Analysis

10.9 First American Healthcare Finance

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product/ Services Offered

10.9.4 SWOT Analysis

10.10 Amur Equipment Finance

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

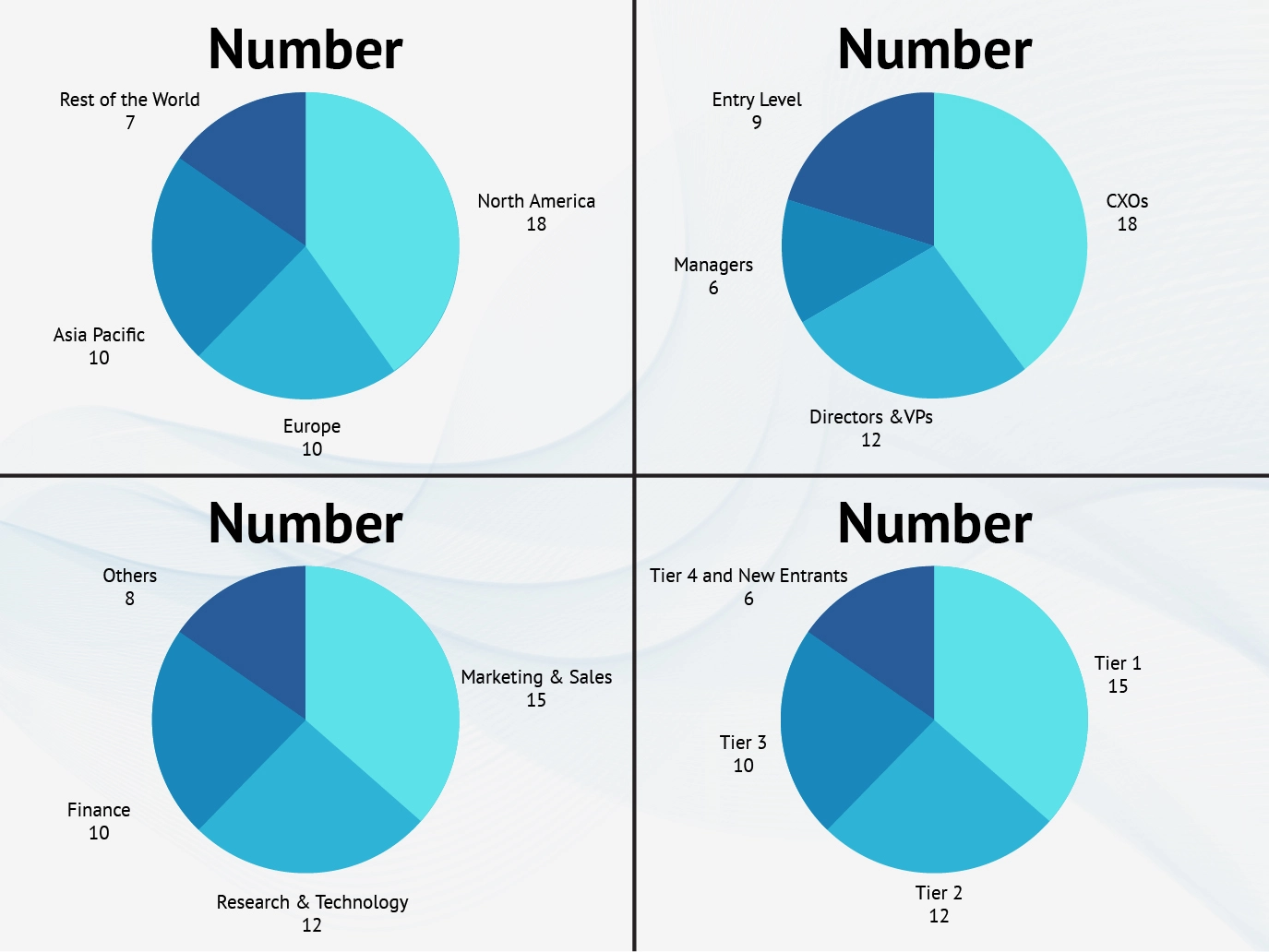

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Device Type

Therapeutic Equipment

Diagnostic Equipment

Others

By End User Industry

Laboratories and Diagnostic Centers

Hospitals & Clinics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players