To Get More Information on Medical Electrodes Market - Request Sample Report

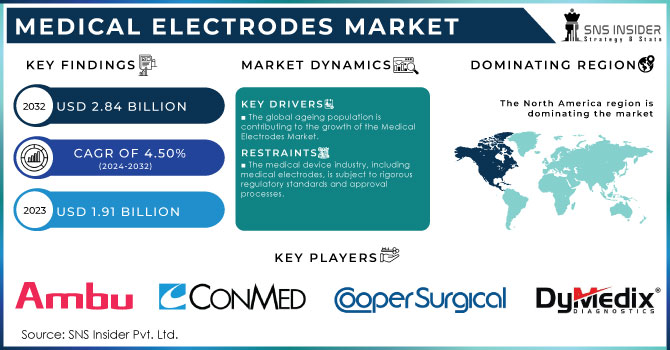

The Medical Electrodes Market size was valued at USD 1.91 Billion in 2023 & is estimated to reach USD 2.84 Billion by 2032 with a growing CAGR of 4.50% between 2024 and 2032.

The Medical Electrodes Market refers to the global industry that produces and sells medical electrodes, which are specialized devices used to detect and transmit electrical signals from the body to medical equipment for diagnostic, monitoring, or therapeutic purposes. These electrodes are commonly used in various medical procedures, such as electrocardiography (ECG), electroencephalography (EEG), electromyography (EMG), and more. Medical electrodes are usually made of conductive materials, such as metals or metal compounds, and they come in various shapes and sizes depending on their intended application. They are attached to the skin or inserted into specific body parts to capture electrical signals generated by the body's physiological processes. These signals are then amplified, processed, and displayed on medical equipment for healthcare professionals to analyze and interpret. Key factors driving the growth of the Medical Electrodes Market include the increasing prevalence of chronic diseases, technological advancements in electrode design and materials, rising demand for non-invasive diagnostic techniques, and the growing ageing population. Additionally, the adoption of remote patient monitoring and telemedicine practices has further boosted the demand for medical electrodes.

The market includes a wide range of players, including medical device manufacturers, suppliers, and distributors. Electrode types can vary based on application and design, including surface electrodes, invasive electrodes, and needle electrodes. The market is also influenced by factors such as regulatory standards, reimbursement policies, and healthcare infrastructure development in different regions. Overall, the Medical Electrodes Market plays a crucial role in modern healthcare by enabling accurate diagnosis, monitoring, and treatment of various medical conditions through the use of electrical signals generated by the body. The medical electrodes market is divided into three categories: product type, application, and modality. Surface electrodes and needle electrodes are the two types of electrodes. It is classified into intraoperative monitoring, cardiology, electrosurgery, neurophysiology, and sleep research applications. somatosensory evoked potentials, Motor evoked potentials, electrocardiography, brainstem auditory evoked potentials, electroencephalography, and visual evoked potentials are the different types.

DRIVERS:

The global ageing population is contributing to the growth of the Medical Electrodes Market.

The rising prevalence of chronic diseases is a driving force in the medical electrodes market.

The increasing incidence of chronic diseases, such as cardiovascular disorders, neurological disorders, and muscle-related conditions, has led to a higher demand for diagnostic and monitoring tools like medical electrodes. These devices are crucial for accurate diagnosis, disease management, and treatment monitoring.

RESTRAIN:

The medical device industry, including medical electrodes, is subject to rigorous regulatory standards and approval processes.

The Medical Electrodes Market is hampered by competition from substitutes.

In some cases, alternative diagnostic or monitoring methods that don't require the use of medical electrodes might be preferred due to cost, patient comfort, or ease of use. This can limit the market growth for medical electrodes, especially if alternative technologies are widely adopted.

OPPORTUNITY:

The increasing adoption of remote patient monitoring, telehealth, and home-based care offers a significant opportunity for medical electrodes.

Sports and Fitness Monitoring is an opportunity for the Medical Electrodes Market.

There's a growing interest in wearable health and fitness monitoring devices. Medical electrodes can play a role in accurately tracking heart rate, muscle activity, and other physiological parameters during exercise and training, enhancing personalized fitness regimes.

CHALLENGES:

Medical electrodes frequently need to be worn for lengthy periods of time.

The primary hurdles of the Medical Electrodes Market are user interface and data interpretation.

Presenting the collected data in a clear and actionable format for healthcare professionals can be challenging. User-friendly interfaces and data analysis tools are essential for efficient diagnosis and decision-making.

Russia launched an unprovoked and unjustifiable full-scale invasion of Ukraine, prompting the US, the UN, and other countries to censure the country. In 2022, one medical technology firm based in the US, Conformis suspended all its distribution operations and business development in Russia amid the Ukraine crisis. They also reaffirmed their commitment not to engage in any future business opportunities in Russia for the time being. The Russo-Ukraine war will have a detrimental effect on Russia's medical equipment trade, given that the vast majority of healthcare goods are imported from the United States and Europe. The financial choice to end trade with Russia has also an impact on society. Russian medical equipment accounts for less than 0.28% of all medical devices marketed globally in terms of value. In the Russia-Ukraine conflict, the medical electrodes are increasing their product & services price up to 3.8-4.3%.

IMPACT OF ONGOING RECESSION

The Great Recession has a period of economic insecurity in the United States. The Recession affected medical spending habits in addition to general consumer spending patterns, resulting in lower diagnostic rates, frequency of physician visits, and prescription dosages utilised. This year's ETF index for the medical devices sector is down 20-23%, while the first two companies in William Blair's list of SMEs have dropped their prices. In 2022, the number of Aspira Women's Health and Accelerate Diagnostics declined by 68% and 85%, respectively. At the end of it all, Aspira held a balance of 25.6 million and Accelerate Diagnostics was holding 52.6 million in cash and investments. In this recession the medical electrodes grain profits up to 2.7-3.4%

By Product

Dry Electrodes

Wet Electrodes

Needle Electrodes

By Application

Neurophysiology

Cardiology

Others

By Usage

Reusable Medical Electrodes

Disposable Medical Electrodes

By End User

Specialty Clinics & Diagnostics Centers

Hospitals & Ambulatory Surgery Centers

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

REGIONAL ANALYSIS

North America: The North American area controls a considerable portion of the market examined, owing to its better healthcare infrastructure, strong government regulations, large multinational corporate base, and a high degree of knowledge about testing and testing equipment in healthcare. In comparison to other chronic indications, this region also has a high frequency of chronic inflammatory illnesses such as cardiovascular disease, diabetes, inflammatory bowel disease (IBD), and cancer.

Asia Pacific: In Asia Pacific, the market is expected to develop at a rapid pace, owing to a rising number of suppliers entering untapped emerging economies. Furthermore, rising healthcare development spending in developing economies would drive regional growth even further.

Do You Need any Customization Research on Medical Electrodes Market - Enquire Now

Some major players in Medical Electrodes Market are Cognionics Inc., Ambu A/S, Dymedix, CooperSurgical, Inc., BD, Medtronic, Natus Medical Incorporated, CONMED Corporation, 3M Company, Koninklijke Philips N.V. and other players.

In 2022: In accordance with their agreement, NeuroOne Medical Technologies Corporation has fulfilled a commercial order of sEG electrodes and is sending them to Zimmer Biomet. This development is crucial for the company's ambitions to grow its market presence.

In 2022: Nihon Kohden introduced the Smart Cable NMT Pod with disposable electrodes. This gadget allows doctors to objectively assess the level of paralysis in patients during surgery whether a non-depolarizing or depolarizing neuromuscular blocking agent (NMBA) is delivered. Clinicians may confidently monitor neuromuscular blockade with this invention, improving patient outcomes and surgical procedures.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.91 Bn |

| Market Size by 2032 | US$ 2.84 Bn |

| CAGR | CAGR of 4.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Dry Electrodes, Wet Electrodes, Needle Electrodes) • By Application (Neurophysiology, Cardiology, Others) • By Usage (Reusable Medical Electrodes, Disposable Medical Electrodes,) • By End Use (Specialty Clinics & Diagnostics Centers, Hospitals & Ambulatory Surgery Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cognionics Inc., Ambu A/S, Dymedix, CooperSurgical, Inc., BD, Medtronic, Natus Medical Incorporated, CONMED Corporation, 3M Company, Koninklijke Philips N.V. |

| Key Drivers | • The global ageing population is contributing to the growth of the Medical Electrodes Market. • The rising prevalence of chronic diseases is a driving force in the medical electrodes market. |

| Market Restraints | • The medical device industry, including medical electrodes, is subject to rigorous regulatory standards and approval processes. • The Medical Electrodes Market is hampered by competition from substitutes. |

Ans. The compound annual growth rate for Medical Electrodes Market for the forecast period is 4.50%.

Ans. In 2023, the Medical Electrodes market is expected to be valued at USD 1.91 billion.

Ans. North America would hold the greatest market share in the Medical Electrodes Market by 2023.

Ans. The market for Medical Electrodes is anticipated to be worth USD 2.84 Billion by 2032.

Ans. During the projected period, the wet electrodes segment is likely to be the market leader.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Medical Electrodes Market Segmentation, By Product

8.1 Dry Electrodes

8.2 Wet Electrodes

8.3 Needle Electrodes

9. Medical Electrodes Market Segmentation, By Application

9.1 Neurophysiology

9.2 Cardiology

9.3 Others

10. Medical Electrodes Market Segmentation, By Usage

10.1 Reusable Medical Electrodes

10.2 Disposable Medical Electrodes

11. Medical Electrodes Market Segmentation, By End User

11.1 Specialty Clinics & Diagnostics Centers

11.2 Hospitals & Ambulatory Surgery Centers

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America Medical Electrodes Market by Country

12.2.2 North America Medical Electrodes Market by Product

12.2.3 North America Medical Electrodes Market by Application

12.2.4 North America Medical Electrodes Market by Usage

12.2.5 North America Medical Electrodes Market by End User

12.2.6 USA

12.2.6.1 USA Medical Electrodes Market by Product

12.2.6.2 USA Medical Electrodes Market by Application

12.2.6.3 USA Medical Electrodes Market by Usage

12.2.6.4 USA Medical Electrodes Market by End User

12.2.7 Canada

12.2.7.1 Canada Medical Electrodes Market by Product

12.2.7.2 Canada Medical Electrodes Market by Application

12.2.7.3 Canada Medical Electrodes Market by Usage

12.2.7.4 Canada Medical Electrodes Market by End User

12.2.8 Mexico

12.2.8.1 Mexico Medical Electrodes Market by Product

12.2.8.2 Mexico Medical Electrodes Market by Application

12.2.8.3 Mexico Medical Electrodes Market by Usage

12.2.8.4 Mexico Medical Electrodes Market by End User

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Eastern Europe Medical Electrodes Market by Country

12.3.1.2 Eastern Europe Medical Electrodes Market by Product

12.3.1.3 Eastern Europe Medical Electrodes Market by Application

12.3.1.4 Eastern Europe Medical Electrodes Market by Usage

12.3.1.5 Eastern Europe Medical Electrodes Market by End User

12.3.1.6 Poland

12.3.1.6.1 Poland Medical Electrodes Market by Product

12.3.1.6.2 Poland Medical Electrodes Market by Application

12.3.1.6.3 Poland Medical Electrodes Market by Usage

12.3.1.6.4 Poland Medical Electrodes Market by End User

12.3.1.7 Romania

12.3.1.7.1 Romania Medical Electrodes Market by Product

12.3.1.7.2 Romania Medical Electrodes Market by Application

12.3.1.7.3 Romania Medical Electrodes Market by Usage

12.3.1.7.4 Romania Medical Electrodes Market by End User

12.3.1.8 Hungary

12.3.1.8.1 Hungary Medical Electrodes Market by Product

12.3.1.8.2 Hungary Medical Electrodes Market by Application

12.3.1.8.3 Hungary Medical Electrodes Market by Usage

12.3.1.8.4 Hungary Medical Electrodes Market by End User

12.3.1.9 Turkey

12.3.1.9.1 Turkey Medical Electrodes Market by Product

12.3.1.9.2 Turkey Medical Electrodes Market by Application

12.3.1.9.3 Turkey Medical Electrodes Market by Usage

12.3.1.9.4 Turkey Medical Electrodes Market by End User

12.3.1.10 Rest of Eastern Europe

12.3.1.10.1 Rest of Eastern Europe Medical Electrodes Market by Product

12.3.1.10.2 Rest of Eastern Europe Medical Electrodes Market by Application

12.3.1.10.3 Rest of Eastern Europe Medical Electrodes Market by Usage

12.3.1.10.4 Rest of Eastern Europe Medical Electrodes Market by End User

12.3.2 Western Europe

12.3.2.1 Western Europe Medical Electrodes Market by Country

12.3.2.2 Western Europe Medical Electrodes Market by Product

12.3.2.3 Western Europe Medical Electrodes Market by Application

12.3.2.4 Western Europe Medical Electrodes Market by Usage

12.3.2.5 Western Europe Medical Electrodes Market by End User

12.3.2.6 Germany

12.3.2.6.1 Germany Medical Electrodes Market by Product

12.3.2.6.2 Germany Medical Electrodes Market by Application

12.3.2.6.3 Germany Medical Electrodes Market by Usage

12.3.2.6.4 Germany Medical Electrodes Market by End User

12.3.2.7 France

12.3.2.7.1 France Medical Electrodes Market by Product

12.3.2.7.2 France Medical Electrodes Market by Application

12.3.2.7.3 France Medical Electrodes Market by Usage

12.3.2.7.4 France Medical Electrodes Market by End User

12.3.2.8 UK

12.3.2.8.1 UK Medical Electrodes Market by Product

12.3.2.8.2 UK Medical Electrodes Market by Application

12.3.2.8.3 UK Medical Electrodes Market by Usage

12.3.2.8.4 UK Medical Electrodes Market by End User

12.3.2.9 Italy

12.3.2.9.1 Italy Medical Electrodes Market by Product

12.3.2.9.2 Italy Medical Electrodes Market by Application

12.3.2.9.3 Italy Medical Electrodes Market by Usage

12.3.2.9.4 Italy Medical Electrodes Market by End User

12.3.2.10 Spain

12.3.2.10.1 Spain Medical Electrodes Market by Product

12.3.2.10.2 Spain Medical Electrodes Market by Application

12.3.2.10.3 Spain Medical Electrodes Market by Usage

12.3.2.10.4 Spain Medical Electrodes Market by End User

12.3.2.11 Netherlands

12.3.2.11.1 Netherlands Medical Electrodes Market by Product

12.3.2.11.2 Netherlands Medical Electrodes Market by Application

12.3.2.11.3 Netherlands Medical Electrodes Market by Usage

12.3.2.11.4 Netherlands Medical Electrodes Market by End User

12.3.2.12 Switzerland

12.3.2.12.1 Switzerland Medical Electrodes Market by Product

12.3.2.12.2 Switzerland Medical Electrodes Market by Application

12.3.2.12.3 Switzerland Medical Electrodes Market by Usage

12.3.2.12.4 Switzerland Medical Electrodes Market by End User

12.3.2.13 Austria

12.3.2.13.1 Austria Medical Electrodes Market by Product

12.3.2.13.2 Austria Medical Electrodes Market by Application

12.3.2.13.3 Austria Medical Electrodes Market by Usage

12.3.2.13.4 Austria Medical Electrodes Market by End User

12.3.2.14 Rest of Western Europe

12.3.2.14.1 Rest of Western Europe Medical Electrodes Market by Product

12.3.2.14.2 Rest of Western Europe Medical Electrodes Market by Application

12.3.2.14.3 Rest of Western Europe Medical Electrodes Market by Usage

12.3.2.14.4 Rest of Western Europe Medical Electrodes Market by End User

12.4 Asia-Pacific

12.4.1 Asia Pacific Medical Electrodes Market by Country

12.4.2 Asia Pacific Medical Electrodes Market by Product

12.4.3 Asia Pacific Medical Electrodes Market by Application

12.4.4 Asia Pacific Medical Electrodes Market by Usage

12.4.5 Asia Pacific Medical Electrodes Market by End User

12.4.6 China

12.4.6.1 China Medical Electrodes Market by Product

12.4.6.2 China Medical Electrodes Market by Application

12.4.6.3 China Medical Electrodes Market by Usage

12.4.6.4 China Medical Electrodes Market by End User

12.4.7 India

12.4.7.1 India Medical Electrodes Market by Product

12.4.7.2 India Medical Electrodes Market by Application

12.4.7.3 India Medical Electrodes Market by Usage

12.4.7.4 India Medical Electrodes Market by End User

12.4.8 Japan

12.4.8.1 Japan Medical Electrodes Market by Product

12.4.8.2 Japan Medical Electrodes Market by Application

12.4.8.3 Japan Medical Electrodes Market by Usage

12.4.8.4 Japan Medical Electrodes Market by End User

12.4.9 South Korea

12.4.9.1 South Korea Medical Electrodes Market by Product

12.4.9.2 South Korea Medical Electrodes Market by Application

12.4.9.3 South Korea Medical Electrodes Market by Usage

12.4.9.4 South Korea Medical Electrodes Market by End User

12.4.10 Vietnam

12.4.10.1 Vietnam Medical Electrodes Market by Product

12.4.10.2 Vietnam Medical Electrodes Market by Application

12.4.10.3 Vietnam Medical Electrodes Market by Usage

12.4.10.4 Vietnam Medical Electrodes Market by End User

12.4.11 Singapore

12.4.11.1 Singapore Medical Electrodes Market by Product

12.4.11.2 Singapore Medical Electrodes Market by Application

12.4.11.3 Singapore Medical Electrodes Market by Usage

12.4.11.4 Singapore Medical Electrodes Market by End User

12.4.12 Australia

12.4.12.1 Australia Medical Electrodes Market by Product

12.4.12.2 Australia Medical Electrodes Market by Application

12.4.12.3 Australia Medical Electrodes Market by Usage

12.4.12.4 Australia Medical Electrodes Market by End User

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Medical Electrodes Market by Product

12.4.13.2 Rest of Asia-Pacific Medical Electrodes Market by Application

12.4.13.3 Rest of Asia-Pacific Medical Electrodes Market by Usage

12.4.13.4 Rest of Asia-Pacific Medical Electrodes Market by End User

12.5 Middle East & Africa

12.5.1 Middle East

12.5.1.1 Middle East Medical Electrodes Market by Country

12.5.1.2 Middle East Medical Electrodes Market by Product

12.5.1.3 Middle East Medical Electrodes Market by Application

12.5.1.4 Middle East Medical Electrodes Market by Usage

12.5.1.5 Middle East Medical Electrodes Market by End User

12.5.1.6 UAE

12.5.1.6.1 UAE Medical Electrodes Market by Product

12.5.1.6.2 UAE Medical Electrodes Market by Application

12.5.1.6.3 UAE Medical Electrodes Market by Usage

12.5.1.6.4 UAE Medical Electrodes Market by End User

12.5.1.7 Egypt

12.5.1.7.1 Egypt Medical Electrodes Market by Product

12.5.1.7.2 Egypt Medical Electrodes Market by Application

12.5.1.7.3 Egypt Medical Electrodes Market by Usage

12.5.1.7.4 Egypt Medical Electrodes Market by End User

12.5.1.8 Saudi Arabia

12.5.1.8.1 Saudi Arabia Medical Electrodes Market by Product

12.5.1.8.2 Saudi Arabia Medical Electrodes Market by Application

12.5.1.8.3 Saudi Arabia Medical Electrodes Market by Usage

12.5.1.8.4 Saudi Arabia Medical Electrodes Market by End User

12.5.1.9 Qatar

12.5.1.9.1 Qatar Medical Electrodes Market by Product

12.5.1.9.2 Qatar Medical Electrodes Market by Application

12.5.1.9.3 Qatar Medical Electrodes Market by Usage

12.5.1.9.4 Qatar Medical Electrodes Market by End User

12.5.1.10 Rest of Middle East

12.5.1.10.1 Rest of Middle East Medical Electrodes Market by Product

12.5.1.10.2 Rest of Middle East Medical Electrodes Market by Application

12.5.1.10.3 Rest of Middle East Medical Electrodes Market by Usage

12.5.1.10.4 Rest of Middle East Medical Electrodes Market by End User

12.5.2. Africa

12.5.2.1 Africa Medical Electrodes Market by Country

12.5.2.2 Africa Medical Electrodes Market by Product

12.5.2.3 Africa Medical Electrodes Market by Application

12.5.2.4 Africa Medical Electrodes Market by Usage

12.5.2.5 Africa Medical Electrodes Market by End User

12.5.2.6 Nigeria

12.5.2.6.1 Nigeria Medical Electrodes Market by Product

12.5.2.6.2 Nigeria Medical Electrodes Market by Application

12.5.2.6.3 Nigeria Medical Electrodes Market by Usage

12.5.2.6.4 Nigeria Medical Electrodes Market by End User

12.5.2.7 South Africa

12.5.2.7.1 South Africa Medical Electrodes Market by Product

12.5.2.7.2 South Africa Medical Electrodes Market by Application

12.5.2.7.3 South Africa Medical Electrodes Market by Usage

12.5.2.7.4 South Africa Medical Electrodes Market by End User

12.5.2.8 Rest of Africa

12.5.2.8.1 Rest of Africa Medical Electrodes Market by Product

12.5.2.8.2 Rest of Africa Medical Electrodes Market by Application

12.5.2.8.3 Rest of Africa Medical Electrodes Market by Usage

12.5.2.8.4 Rest of Africa Medical Electrodes Market by End User

12.6. Latin America

12.6.1 Latin America Medical Electrodes Market by Country

12.6.2 Latin America Medical Electrodes Market by Product

12.6.3 Latin America Medical Electrodes Market by Application

12.6.4 Latin America Medical Electrodes Market by Usage

12.6.5 Latin America Medical Electrodes Market by End User

12.6.6 Brazil

12.6.6.1 Brazil Medical Electrodes Market by Product

12.6.6.2 Brazil Medical Electrodes Market by Application

12.6.6.3 Brazil Medical Electrodes Market by Usage

12.6.6.4 Brazil Medical Electrodes Market by End User

12.6.7 Argentina

12.6.7.1 Argentina Medical Electrodes Market by Product

12.6.7.2 Argentina Medical Electrodes Market by Application

12.6.7.3 Argentina Medical Electrodes Market by Usage

12.6.7.4 Argentina Medical Electrodes Market by End User

12.6.8 Colombia

12.6.8.1 Colombia Medical Electrodes Market by Product

12.6.8.2 Colombia Medical Electrodes Market by Application

12.6.8.3 Colombia Medical Electrodes Market by Usage

12.6.8.4 Colombia Medical Electrodes Market by End User

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Medical Electrodes Market by Product

12.6.9.2 Rest of Latin America Medical Electrodes Market by Application

12.6.9.3 Rest of Latin America Medical Electrodes Market by Usage

12.6.9.4 Rest of Latin America Medical Electrodes Market by End User

13 Company Profile

13.1 Cognionics Inc.

13.1.1 Company Overview

13.1.2 Financials

13.1.3 Product/Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Ambu A/S

13.2.1 Company Overview

13.2.2 Financials

13.2.3 Product/Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Dymedix

13.3.1 Company Overview

13.3.2 Financials

13.3.3 Product/Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 CooperSurgical, Inc.

13.4 Company Overview

13.4.2 Financials

13.4.3 Product/Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 BD

13.5.1 Company Overview

13.5.2 Financials

13.5.3 Product/Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Medtronic

13.6.1 Company Overview

13.6.2 Financials

13.6.3 Product/Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Natus Medical Incorporated

13.7.1 Company Overview

13.7.2 Financials

13.7.3 Product/Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 CONMED Corporation

13.8.1 Company Overview

13.8.2 Financials

13.8.3 Product/Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 3M Company

13.9.1 Company Overview

13.9.2 Financials

13.9.3 Product/Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Koninklijke Philips N.V.

13.10.1 Company Overview

13.10.2 Financials

13.10.3 Product/Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Healthcare Biometrics Market Size was valued at USD 23.05 billion in 2023 and is expected to reach USD 136.02 billion by 2032 and grow at a CAGR of 21.8% over the forecast period 2024-2032.

The BOTOX Market Size was valued at USD 8.13 billion in 2023, and is expected to reach USD 16.25 billion by 2032, and grow at a CAGR of 8% over the forecast period 2024-2032.

The Over-The-Counter (OTC) Drugs market was USD 87.32 bn in 2023 and is projected to grow at a CAGR of 6.18%, reaching USD 149.72 bn by 2032.

The Biobanking Market size was valued at USD 76.68 billion in 2023, and is expected to reach USD 151.11 billion by 2031 and grow at a CAGR of 8.85% over the forecast period 2024-2031.

The Vagus Nerve Stimulation Market Size was valued at USD 456.88 Million in 2023, and is expected to reach USD 1,074.62 Million by 2032, and grow at a CAGR of 10.48% over the forecast period 2024-2032.

The Specialty PACS Market Size was valued at USD 3.3 billion in 2023, and expected to reach USD 5.29 billion by 2031, and grow at a CAGR of 6.1% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone