Get more information on Medical Device Reprocessing Market - Request Sample Report

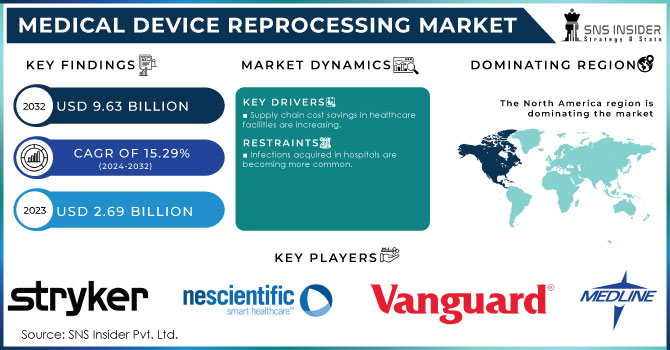

The Medical Device Reprocessing Market size was estimated at USD 2.69 billion in 2023 and is expected to reach USD 9.63 billion by 2032 at a CAGR of 15.29% during the forecast period of 2024-2032.

Reusable medical devices are essential tools in healthcare, offering cost-effective solutions for diagnosing and treating multiple patients. Examples include surgical forceps, endoscopes, and laryngoscopes. Respiratory diseases, such as asthma and COPD, affect millions worldwide. For instance, over 34 million Americans grapple with these conditions. Reprocessing surgical instruments, used in treating such diseases, offers a dual benefit. It significantly reduces the financial burden on healthcare systems, similar to the cost-saving measures employed by organizations supporting those with lung diseases. Additionally, it aligns with sustainability goals by minimizing waste, much like efforts to reduce the environmental impact of these chronic illnesses. However, their reuse necessitates rigorous reprocessing to eliminate contaminants and prevent infections. While the risk of infection from inadequately reprocessed devices is relatively low, the potential for outbreaks remains a significant public health concern. Proper disinfection and sterilization of medical devices are crucial for preventing the spread of infectious diseases to patients, as emphasized by the Centers for Disease Control and Prevention (CDC). Adherence to industry standards and best practices in medical device reprocessing significantly reduces infection risk and enhances patient outcomes within healthcare settings.

Market demand for these devices is substantial, driven by increasing surgical procedures and the need for durable, high-quality equipment. The substantial volume of surgical procedures performed underscores the critical role of medical device reprocessing. Between 2019 and 2020, over 13 million surgical procedures were conducted, with women accounting for more than half of these. This massive number highlights the essential need for effective and efficient medical device reprocessing to ensure patient safety and prevent the spread of infections across procedures. Key segments include surgical instruments, endoscopy equipment, and respiratory care devices. Despite this demand, supply chain challenges, including material shortages and manufacturing complexities, can impact availability. Additionally, stringent sterilization requirements and the risk of contamination contribute to the overall cost of these devices, affecting affordability and accessibility in certain healthcare settings.

To ensure patient and staff safety as well as stay compliant, reprocessing medical devices is a necessary practice when the device or instrument is reusable. Reprocessing a device offer economic benefits for the healthcare facility, as the alternative is purchasing disposable instruments or devices for use during only a single patient procedure. While other costs are associated with medical device reprocessing (device repair and replacement, cleaning chemistries, capital purchases like sinks, washer/disinfectors, sterilizers, etc.), reprocessing through a third party or within the hospital has economic benefits for the facility.

Moreover, the disposal of medical waste is a complex process requiring strict adherence to OSHA guidelines for containment and treatment in US. This highlights the environmental and health risks associated with single-use medical devices. In contrast, medical reprocessing offers a sustainable alternative by extending the life of equipment, reducing waste, and conserving resources. This approach not only minimizes the environmental impact but also presents potential cost savings for healthcare facilities.

While the risk of infection from an improperly reprocessed medical device is relatively low due to the vast number of devices in use, the potential for outbreaks remains a significant public health concern. Unfortunately, these infections are often undetected and unreported to the FDA. As a result, the true number of healthcare-associated infections linked to inadequate device reprocessing is unknown.

To address this issue, the FDA is actively working to reduce the risk of infection from reprocessed devices. Leveraging their comprehensive oversight of the medical device industry, they establish clear regulations, promote manufacturing excellence, and collaborate with manufacturers to resolve emerging public health challenges. The FDA also plays a crucial role in raising awareness, fostering collaboration among healthcare stakeholders, and driving innovation in device design to prevent future issues.

While the potential benefits of reprocessing medical devices including cost savings and environmental impact are substantial, implementing and maintaining effective reprocessing procedures present significant challenges. Adherence to rigorous standards set forth by organizations like the Association for the Advancement of Medical Instrumentation (AAMI) is crucial to mitigate risks and ensure patient safety. Meticulous attention to every stage of the reprocessing cycle is imperative to prevent healthcare-associated infections. Balancing these complexities with the pursuit of optimal patient outcomes necessitates a robust reprocessing program founded on hospital policies, industry best practices, and original equipment manufacturer guidelines. Despite of the challenges the medical device reprocessing market have the potential to accelerate with a great value and propel the rate of growth of the market in coming years.

DRIVERS

Supply chain cost savings in healthcare facilities are increasing.

Reprocessing medical devices and equipment has received a lot of attention in recent years, not only in healthcare facilities for saving millions of dollars each year but also among manufacturers, who see it as a way to gain a significant competitive edge. According to the Association of Medical Device Reprocessors (AMDR, US), reprocessed medical devices are 30% to 50% less expensive than their new counterparts; as a result, medical device reprocessing has become one of the most widely used supply chain cost-cutting strategies among hospitals, surgical centers, and other healthcare facilities. This frees up funds for end users to recruit more people, modernize technology, and improve healthcare quality, among other things.

RESTRAIN

Infections acquired in hospitals are becoming more common.

Hospital-acquired infections (HAls) are nosocomial infections that occur during a patient's stay in a hospital or other healthcare facility. HAIs are not detected at the time of admission and are a major cause of morbidity and mortality worldwide. Despite the existence of reprocessing guidelines and advances in device reprocessing methods, inadequate reprocessing of medical devices contributes to a significant proportion of hospital-acquired infection, with inadequate reprocessing of medical devices contributing to 22% of all surgical site infections (SSIs), one of the most common types of HAls cases.

OPPORTUNITY

Regulatory reforms that encourage the use of medical device reprocessing.

CHALLENGES

Strict regulatory requirements for remanufactured medical devices

By Type

In 2023, the reprocessing support and services segment is projected to experience the most significant growth with 56% during the forecast period. This rapid expansion is driven by the increasing preference of healthcare facilities to outsource reprocessing operations to third-party providers to reduce internal costs.

By Device Category

In 2023, critical devices with 44% represented the largest segment of the market. This growth is primarily attributed to the escalating global prevalence of cardiac diseases and the increasing adoption of reprocessed catheters as a cost-effective alternative for hospitals and procedures.

By Application

In 2023, cardiology with 35% was the largest segment. The increasing prevalence of heart diseases has led to a surge in diagnostic and cardiac procedures. To manage the rising costs associated with purchasing new medical devices for each procedure, healthcare facilities are increasingly adopting reprocessed devices in cardiology.

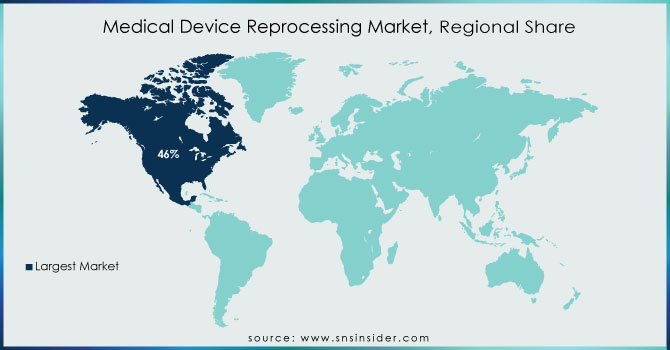

REGIONAL ANALYSES

North America had the greatest revenue share, accounting for more than 46% of the global market. The growing need to decrease hospital waste and the potential environmental damage caused by the region's expanding waste landfills are major market drivers. Furthermore, favorable government measures and strategic actions conducted by healthcare institutions to raise awareness about equipment reprocessing are projected to generate considerable potential for this market.

Over the forecast period, Asia-Pacific is expected to increase at the fastest rate. The developing regional market for reprocessed medical equipment has been fueled by the growing economy, rising prevalence of chronic illnesses, and rising demand to reduce hospital expenses. Developing countries, such as China and India, have seen an increase in the occurrence of chronic diseases, as has the rest of the world. This has resulted in a greater emphasis on healthcare, with governments investing in healthcare infrastructure but limiting their spending.

Need any customization research on Medical Device Reprocessing Market - Enquiry Now

The major key players are Stryker, Innovative Health, NEScientific, Inc., Medline Industries, LP, Arjo, Vanguard AG, Cardinal Health, SureTek Medical, Soma Tech Intl, Johnson & Johnson MedTech and other players.

Health, LLC: In 2022, Innovative Health, LLC has been granted authorization to reprocess the Philips Eagle Eye Platinum digital IVUS (intravascular ultrasonography) catheter. This approval effectively marks the company's entry into the cath lab area, extending the company's medical device reprocessing market reach in cardiology applications.

Medline ReNewal: In 2022, In Southaven, Mississippi, Medline ReNewal opened a new distribution hub. The facility services the region's largest hospitals, nursing homes, and military bases. To meet the product needs of its healthcare customers, the company invested in expanding its storage and distribution capacity in Mississippi. Annual orders of more than USD 350.0 million are projected. The Southaven facility handles everything.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.69 Bn |

| Market Size by 2032 | US$ 9.63 Bn |

| CAGR | CAGR of 15.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Reprocessing Support & Services, Reprocessed medical devices) • By Device Category (Critical Devices, Semi- Critical Devices, Non- Critical Device) • By Application (Cardiology, Gastroenterology, Gynecology, Arthroscopy & Orthopedic Surgery, General Surgery and Anesthesia, Other Device Categorys (Urology, non-invasive surgeries, patient monitoring) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Stryker, Innovative Health, NEScientific, Inc., Medline Industries, LP, Arjo, Vanguard AG, Cardinal Health, SureTek Medical, Soma Tech Intl, Johnson & Johnson MedTech |

| Key Drivers | • Supply chain cost savings in healthcare facilities are increasing. |

| Market Restraints | • Infections acquired in hospitals are becoming more common. |

Ans: The Medical Device Reprocessing Market is expected to grow at 15.29% CAGR from 2024 to 2032.

Ans: The Medical Device Reprocessing Market is anticipated to reach USD 9.63 billion By 2032.

Ans: The leading participants in the,Stryker, Innovative Health, NEScientific, Inc., Medline Industries, LP, Arjo, Vanguard AG, Cardinal Health.

Ans: Clinical urgency to reduce medical waste output in hospitals and other healthcare settings, as well as increased acceptance of reprocessed medical devices, are key factors driving the medical device reprocessing market's growth.

Ans: Yes, you may request customization based on your company's needs.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Medical Device Reprocessing Market Segmentation, by Type

7.1 Introduction

7.2 Reprocessing Support & Services

7.3 Reprocessed medical devices

8. Medical Device Reprocessing Market Segmentation, by Device Category

8.1 Introduction

8.2 Critical Devices

8.3 Semi- Critical Devices

8.4 Non- Critical Devices

9. Medical Device Reprocessing Market Segmentation, by Application

9.1 Introduction

9.2 Cardiology

9.3 Gastroenterology

9.4 Gynecology

9.5 Arthroscopy & Orthopedic Surgery

9.6 General Surgery and Anesthesia

9.7 Other Device Categories (Urology, non-invasive surgeries, patient monitoring)

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Medical Device Reprocessing Market by Country

10.2.3 North America Medical Device Reprocessing Market by Type

10.2.4 North America Medical Device Reprocessing Market by Device Category

10.2.5 North America Medical Device Reprocessing Market by Application

10.2.6 USA

10.2.6.1 USA Medical Device Reprocessing Market by Type

10.2.6.2 USA Medical Device Reprocessing Market by Device Category

10.2.6.3 USA Medical Device Reprocessing Market by Application

10.2.7 Canada

10.2.7.1 Canada Medical Device Reprocessing Market by Type

10.2.7.2 Canada Medical Device Reprocessing Market by Device Category

10.2.7.3 Canada Medical Device Reprocessing Market by Application

10.2.8 Mexico

10.2.8.1 Mexico Medical Device Reprocessing Market by Type

10.2.8.2 Mexico Medical Device Reprocessing Market by Device Category

10.2.8.3 Mexico Medical Device Reprocessing Market by Application

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Medical Device Reprocessing Market by Country

10.3.2.2 Eastern Europe Medical Device Reprocessing Market by Type

10.3.2.3 Eastern Europe Medical Device Reprocessing Market by Device Category

10.3.2.4 Eastern Europe Medical Device Reprocessing Market by Application

10.3.2.5 Poland

10.3.2.5.1 Poland Medical Device Reprocessing Market by Type

10.3.2.5.2 Poland Medical Device Reprocessing Market by Device Category

10.3.2.5.3 Poland Medical Device Reprocessing Market by Application

10.3.2.6 Romania

10.3.2.6.1 Romania Medical Device Reprocessing Market by Type

10.3.2.6.2 Romania Medical Device Reprocessing Market by Device Category

10.3.2.6.4 Romania Medical Device Reprocessing Market by Application

10.3.2.7 Hungary

10.3.2.7.1 Hungary Medical Device Reprocessing Market by Type

10.3.2.7.2 Hungary Medical Device Reprocessing Market by Device Category

10.3.2.7.3 Hungary Medical Device Reprocessing Market by Application

10.3.2.8 Turkey

10.3.2.8.1 Turkey Medical Device Reprocessing Market by Type

10.3.2.8.2 Turkey Medical Device Reprocessing Market by Device Category

10.3.2.8.3 Turkey Medical Device Reprocessing Market by Application

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Medical Device Reprocessing Market by Type

10.3.2.9.2 Rest of Eastern Europe Medical Device Reprocessing Market by Device Category

10.3.2.9.3 Rest of Eastern Europe Medical Device Reprocessing Market by Application

10.3.3 Western Europe

10.3.3.1 Western Europe Medical Device Reprocessing Market by Country

10.3.3.2 Western Europe Medical Device Reprocessing Market by Type

10.3.3.3 Western Europe Medical Device Reprocessing Market by Device Category

10.3.3.4 Western Europe Medical Device Reprocessing Market by Application

10.3.3.5 Germany

10.3.3.5.1 Germany Medical Device Reprocessing Market by Type

10.3.3.5.2 Germany Medical Device Reprocessing Market by Device Category

10.3.3.5.3 Germany Medical Device Reprocessing Market by Application

10.3.3.6 France

10.3.3.6.1 France Medical Device Reprocessing Market by Type

10.3.3.6.2 France Medical Device Reprocessing Market by Device Category

10.3.3.6.3 France Medical Device Reprocessing Market by Application

10.3.3.7 UK

10.3.3.7.1 UK Medical Device Reprocessing Market by Type

10.3.3.7.2 UK Medical Device Reprocessing Market by Device Category

10.3.3.7.3 UK Medical Device Reprocessing Market by Application

10.3.3.8 Italy

10.3.3.8.1 Italy Medical Device Reprocessing Market by Type

10.3.3.8.2 Italy Medical Device Reprocessing Market by Device Category

10.3.3.8.3 Italy Medical Device Reprocessing Market by Application

10.3.3.9 Spain

10.3.3.9.1 Spain Medical Device Reprocessing Market by Type

10.3.3.9.2 Spain Medical Device Reprocessing Market by Device Category

10.3.3.9.3 Spain Medical Device Reprocessing Market by Application

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Medical Device Reprocessing Market by Type

10.3.3.10.2 Netherlands Medical Device Reprocessing Market by Device Category

10.3.3.10.3 Netherlands Medical Device Reprocessing Market by Application

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Medical Device Reprocessing Market by Type

10.3.3.11.2 Switzerland Medical Device Reprocessing Market by Device Category

10.3.3.11.3 Switzerland Medical Device Reprocessing Market by Application

10.3.3.12 Austria

10.3.3.12.1 Austria Medical Device Reprocessing Market by Type

10.3.3.12.2 Austria Medical Device Reprocessing Market by Device Category

10.3.3.12.3 Austria Medical Device Reprocessing Market by Application

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Medical Device Reprocessing Market by Type

10.3.3.13.2 Rest of Western Europe Medical Device Reprocessing Market by Device Category

10.3.3.13.3 Rest of Western Europe Medical Device Reprocessing Market by Application

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Medical Device Reprocessing Market by Country

10.4.3 Asia-Pacific Medical Device Reprocessing Market by Type

10.4.4 Asia-Pacific Medical Device Reprocessing Market by Device Category

10.4.5 Asia-Pacific Medical Device Reprocessing Market by Application

10.4.6 China

10.4.6.1 China Medical Device Reprocessing Market by Type

10.4.6.2 China Medical Device Reprocessing Market by Device Category

10.4.6.3 China Medical Device Reprocessing Market by Application

10.4.7 India

10.4.7.1 India Medical Device Reprocessing Market by Type

10.4.7.2 India Medical Device Reprocessing Market by Device Category

10.4.7.3 India Medical Device Reprocessing Market by Application

10.4.8 Japan

10.4.8.1 Japan Medical Device Reprocessing Market by Type

10.4.8.2 Japan Medical Device Reprocessing Market by Device Category

10.4.8.3 Japan Medical Device Reprocessing Market by Application

10.4.9 South Korea

10.4.9.1 South Korea Medical Device Reprocessing Market by Type

10.4.9.2 South Korea Medical Device Reprocessing Market by Device Category

10.4.9.3 South Korea Medical Device Reprocessing Market by Application

10.4.10 Vietnam

10.4.10.1 Vietnam Medical Device Reprocessing Market by Type

10.4.10.2 Vietnam Medical Device Reprocessing Market by Device Category

10.4.10.3 Vietnam Medical Device Reprocessing Market by Application

10.4.11 Singapore

10.4.11.1 Singapore Medical Device Reprocessing Market by Type

10.4.11.2 Singapore Medical Device Reprocessing Market by Device Category

10.4.11.3 Singapore Medical Device Reprocessing Market by Application

10.4.12 Australia

10.4.12.1 Australia Medical Device Reprocessing Market by Type

10.4.12.2 Australia Medical Device Reprocessing Market by Device Category

10.4.12.3 Australia Medical Device Reprocessing Market by Application

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Medical Device Reprocessing Market by Type

10.4.13.2 Rest of Asia-Pacific Medical Device Reprocessing Market by Device Category

10.4.13.3 Rest of Asia-Pacific Medical Device Reprocessing Market by Application

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Medical Device Reprocessing Market by Country

10.5.2.2 Middle East Medical Device Reprocessing Market by Type

10.5.2.3 Middle East Medical Device Reprocessing Market by Device Category

10.5.2.4 Middle East Medical Device Reprocessing Market by Application

10.5.2.5 UAE

10.5.2.5.1 UAE Medical Device Reprocessing Market by Type

10.5.2.5.2 UAE Medical Device Reprocessing Market by Device Category

10.5.2.5.3 UAE Medical Device Reprocessing Market by Application

10.5.2.6 Egypt

10.5.2.6.1 Egypt Medical Device Reprocessing Market by Type

10.5.2.6.2 Egypt Medical Device Reprocessing Market by Device Category

10.5.2.6.3 Egypt Medical Device Reprocessing Market by Application

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Medical Device Reprocessing Market by Type

10.5.2.7.2 Saudi Arabia Medical Device Reprocessing Market by Device Category

10.5.2.7.3 Saudi Arabia Medical Device Reprocessing Market by Application

10.5.2.8 Qatar

10.5.2.8.1 Qatar Medical Device Reprocessing Market by Type

10.5.2.8.2 Qatar Medical Device Reprocessing Market by Device Category

10.5.2.8.3 Qatar Medical Device Reprocessing Market by Application

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Medical Device Reprocessing Market by Type

10.5.2.9.2 Rest of Middle East Medical Device Reprocessing Market by Device Category

10.5.2.9.3 Rest of Middle East Medical Device Reprocessing Market by Application

10.5.3 Africa

10.5.3.1 Africa Medical Device Reprocessing Market by Country

10.5.3.2 Africa Medical Device Reprocessing Market by Type

10.5.3.3 Africa Medical Device Reprocessing Market by Device Category

10.5.3.4 Africa Medical Device Reprocessing Market by Application

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Medical Device Reprocessing Market by Type

10.5.3.5.2 Nigeria Medical Device Reprocessing Market by Device Category

10.5.3.5.3 Nigeria Medical Device Reprocessing Market by Application

10.5.3.6 South Africa

10.5.3.6.1 South Africa Medical Device Reprocessing Market by Type

10.5.3.6.2 South Africa Medical Device Reprocessing Market by Device Category

10.5.3.6.3 South Africa Medical Device Reprocessing Market by Application

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Medical Device Reprocessing Market by Type

10.5.3.7.2 Rest of Africa Medical Device Reprocessing Market by Device Category

10.5.3.7.3 Rest of Africa Medical Device Reprocessing Market by Application

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Medical Device Reprocessing Market by country

10.6.3 Latin America Medical Device Reprocessing Market by Type

10.6.4 Latin America Medical Device Reprocessing Market by Device Category

10.6.5 Latin America Medical Device Reprocessing Market by Application

10.6.6 Brazil

10.6.6.1 Brazil Medical Device Reprocessing Market by Type

10.6.6.2 Brazil Medical Device Reprocessing Market by Device Category

10.6.6.3 Brazil Medical Device Reprocessing Market by Application

10.6.7 Argentina

10.6.7.1 Argentina Medical Device Reprocessing Market by Type

10.6.7.2 Argentina Medical Device Reprocessing Market by Device Category

10.6.7.3 Argentina Medical Device Reprocessing Market by Application

10.6.8 Colombia

10.6.8.1 Colombia Medical Device Reprocessing Market by Type

10.6.8.2 Colombia Medical Device Reprocessing Market by Device Category

10.6.8.3 Colombia Medical Device Reprocessing Market by Application

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Medical Device Reprocessing Market by Type

10.6.9.2 Rest of Latin America Medical Device Reprocessing Market by Device Category

10.6.9.3 Rest of Latin America Medical Device Reprocessing Market by Application

11. Company Profiles

11.1 Stryker

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Innovative Health

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 NEScientific, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Medline Industries

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 LP

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Arjo

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Vanguard AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Cardinal Health

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 SureTek Medical

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Soma Tech Intl

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Reprocessing Support & Services

Reprocessed medical devices

By Device Category

Critical Devices

Semi- Critical Devices

Non- Critical Devices

By Application

Cardiology

Gastroenterology

Gynecology

Arthroscopy & Orthopedic Surgery

General Surgery and Anesthesia

Other Device Categories (Urology, non-invasive surgeries, patient monitoring)

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Healthcare Workforce Management Systems Market Size was valued at USD 1.69 billion in 2023, and is expected to reach USD 4.20 billion by 2032, and grow at a CAGR of 10.65% over the forecast period 2024-2032.

Hemostats Market Size was valued at USD 2.74 billion in 2023 and is expected to reach USD 4.93 billion by 2032 and grow at a CAGR of 6.76% from 2024-2032.

The Ophthalmic Perimeters Market size is projected to reach USD 436.56 million by 2032 and was valued at USD 281.05 million in 2023 and growing at a CAGR of 4.55% over the forecast period of 2024-2032.

The Veterinary Wound Cleansers Market was valued at USD 193 million in 2023 and is expected to reach USD 412.67 million by 2032, growing at a CAGR of 8.8% over the forecast period of 2024-2032.

Empty Capsules Market was valued at USD 3.35 billion in 2023 and is expected to reach USD 5.36 billion by 2032, growing at a CAGR of 5.37% from 2024-2032.

Computational Biology Market was valued at USD 6.32 Billion in 2023, projected to reach USD 25.46 Billion by 2032, growing at a 16.80% CAGR from 2024-2032.

Hi! Click one of our member below to chat on Phone