Medical Device Contract Manufacturing Market Overview:

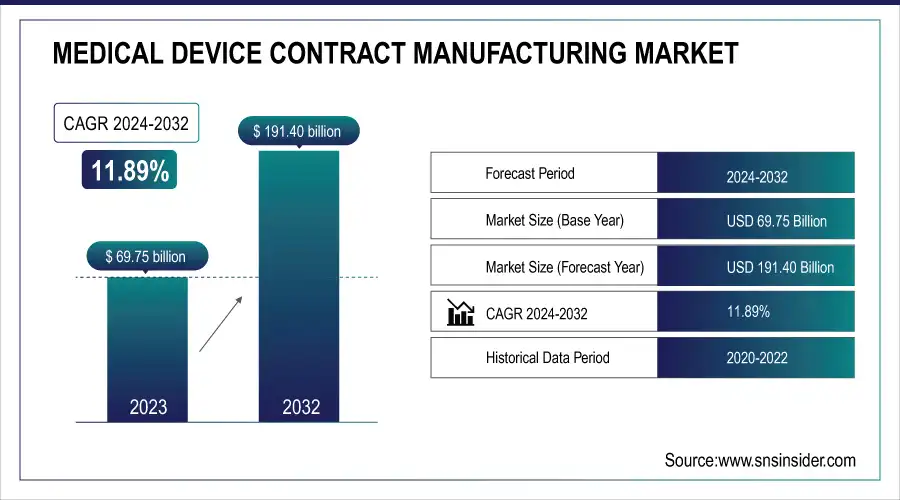

The Medical Device Contract Manufacturing Market Size was valued at USD 69.75 Billion in 2023 and is expected to reach USD 191.40 Billion by 2032 and grow at a CAGR of 11.89% over the forecast period 2024-2032. This report indicates the function of R&D and innovation in progressing manufacturing capability, in addition to cost analysis and pricing trends driving market competitiveness. The research identifies mergers, acquisitions, and strategic alliances, with a focus on their effects on industry growth and consolidation. It also explores employment and manpower trends, as well as how the demand for specialized skills for contract manufacturing increases. Investment patterns and capital spending are also evaluated, reflecting how market participants are deploying capital to optimize production efficiency and comply with changing regulatory requirements.

To Get more information on Medical Device Contract Manufacturing Market - Request Free Sample Report

Medical Device Contract Manufacturing Market Dynamics

Drivers

-

The increasing demand for cost-effective production, technological advancements, and the growing complexity of medical devices.

Increasing healthcare spending and demand for high-quality, precision-engineered products are compelling OEMs to outsource production. Aging populations and the growing incidence of chronic diseases, like cardiovascular conditions and diabetes, are driving demand for sophisticated medical devices, including implantable and wearables. Furthermore, automation, robotics, and 3D printing integration have improved manufacturing efficiency, enabling contract manufacturers to satisfy strict regulatory compliance while cutting costs. Global outsourcing trends among medical device manufacturers have exploded, with more than 70% of OEMs dependent on contract manufacturers to produce the goods to drive efficiencies. Additionally, growth in minimally invasive surgeries has necessitated specialized products, forcing contract manufacturers to upgrade and invest in smart manufacturing capabilities. Firms such as Phillips-Medisize and Jabil Inc. have strengthened their emphasis on drug delivery systems and connected health solutions, additionally fueling market growth. Another major driver is the transition to biocompatible and sustainable materials in the manufacture of medical devices, as companies aim to adapt to changing industry standards and patient safety protocols.

Restraints

-

The market faces restraints such as stringent regulatory compliance, high production costs, and intellectual property concerns.

Regulatory agencies such as the FDA, EMA, and CFDA impose strict approval procedures that can postpone product launches and add the cost of compliance. The cost of regulatory compliance is estimated to be up to 15% of overall production costs, thus constituting a high hurdle, particularly for small contract manufacturers. Moreover, the huge upfront cost of using sophisticated manufacturing processes like robotics and computer-based automation confines the involvement of small businesses in the industry. Supply chain interruptions, induced by worldwide crises like the COVID-19 pandemic, have affected raw materials and critical components availability, resulting in delayed production. Another significant constraint is intellectual property protection since production outsourcing to third-party manufacturers risks exposing designs to leaks and unauthorized copying of proprietary medical devices. In addition, volatility in raw material costs and labor rates impacts profitability, with cost control proving difficult for contract manufacturers. Relying on a few key suppliers for sensitive components, like semiconductors for diagnostic devices, only serves to further add to these challenges.

Opportunities

-

The rising demand for personalized medical devices, increased adoption of smart healthcare technologies, and the expansion of biologics-based treatments.

The rise of wearables and IoT-enabled connected medical devices has brought with it a surge in demand for contract manufacturing services in the field of IoT-enabled health monitoring solutions. Firms like FLEX Ltd. and Plexus Corp. are leveraging this trend by creating intelligent, sensor-enabled medical devices. The other huge opportunity is in the growth of combination drug-device products, including auto-injectors, inhalers, and prefilled syringes, which have posted double-digit growth over the past few years. The growing use of AI and machine learning in medical manufacturing is also likely to improve production efficiency and product quality, enabling manufacturers to provide value-added services like predictive maintenance and automated quality control. The advent of 3D printing in the manufacture of medical devices offers the potential for cost-effective, personalized implants and prosthetics. In addition, increasing emphasis on sustainability and biodegradable material use in device production follows regulatory direction and customer needs, promoting demand for green medical products. Growth in contract manufacturing services to lower-cost markets with increasing healthcare infrastructure further provides strong opportunities for growth.

Challenges

-

The medical device contract manufacturing market faces critical challenges such as supply chain disruptions, workforce shortages, cybersecurity risks, and increasing competition.

The worldwide shortage of semiconductors, for example, has had a major effect on the manufacture of imaging and diagnostic equipment, with shipments being delayed by 6-12 months in certain instances. Shortage of skilled manpower in sophisticated manufacturing processes like robotic-assisted manufacture and microfabrication has also been a challenge, as contract manufacturers find it difficult to recruit trained personnel. Cyber security threats to networked medical devices have also been a significant problem. With the advent of IoT-based and cloud-connected devices, there has been an enhanced risk of data breaches and regulatory non-compliance. A 2022 report showed that more than 60% of medical device companies experienced cybersecurity-related regulatory issues, impacting their market entry timelines. Moreover, increasing competition and pricing pressures from low-cost Chinese and Indian manufacturers have hindered the profitability of existing players. The increasing price of raw materials, along with volatile international trade policies, has further made supply chain management more complex. Contract manufacturers also have to invest continuously in new technologies and compliance practices, driving operational expenses and restricting profitability in a highly competitive market.

Medical Device Contract Manufacturing Market Segmentation Analysis

By Product

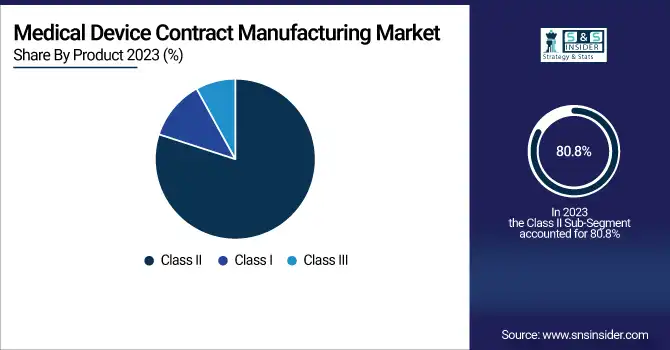

The Class II medical devices market led in revenue share of 80.8% in 2023. This leadership is mainly a result of the extensive number of Class II devices outsourced to be contract-manufactured, such as diagnostic machinery, infusion pumps, and power wheelchairs, that have specialized production facilities and need compliance with rules and regulations. Technological advancement and the increased need for efficient and cost-cutting manufacturing facilities are driving demand for Class II devices.

The Class III medical devices segment will be the highest-growing category during the forecast period. This is driven by growing demand for life-sustaining, high-risk medical devices such as pacemakers, implantable defibrillators, and artificial heart valves that need strict regulatory approvals and precision-based manufacturing. An increasing aging population and innovation in minimally invasive surgical techniques are also driving the growth of this segment.

By Services

The accessories manufacturing segment dominated the market with the highest revenue share of 47.5% in 2023, fueled by the growing demand for medical device parts like tubing, connectors, and sensors. The high volume of production and replacement cycles of these accessories are responsible for the strong market position of the segment. The growth of home healthcare and wearable medical devices has also substantially increased the demand for quality accessories.

The device manufacturing segment is expected to grow the most over the coming years. Increasing preference among OEMs for outsourcing entire device manufacturing to lower costs and simplify supply chains is one major driver of this segment's growth. Increasing complexity in medical devices, along with greater regulatory demands, is compelling manufacturers to outsource to contract manufacturers with in-depth know-how in full-device manufacturing.

By Therapeutic Area

The cardiovascular devices segment led the market with the largest revenue share of 26.67% in 2023. Growing prevalence of cardiovascular conditions, as well as progress in minimally invasive interventions, has stimulated the demand for contract-manufactured cardiovascular devices including stents, pacemakers, and catheter-based devices. Moreover, the aging population and the increased adoption of technologically advanced cardiac monitoring systems further contribute to the segment leadership.

The ophthalmic devices market is to see the highest growth. This growth is driven by the escalating prevalence of eye conditions like cataracts, glaucoma, and age-related macular degeneration. The expanding use of sophisticated ophthalmic surgical apparatus and increasing demand for minimally invasive vision correction surgeries are driving the growth of this segment of the contract manufacturing industry.

By End Use

The OEMs segment generated the highest revenue share of 45.5% in 2023 since OEMs increasingly outsource manufacturing to contract manufacturers to save on costs, increase efficiency, and concentrate on innovation. The technical complexity of medical devices, along with stringent regulatory compliance, has prompted OEMs to partner with specialized contract manufacturers to achieve high-quality production while speeding up time-to-market.

The pharmaceutical & biopharmaceutical companies’ segment is expected to develop at the highest rate during the forecast period. The growing incorporation of drug-device combination products, including prefilled syringes and inhalers, has resulted in a demand boom for specialty contract manufacturing services. Moreover, the growth of biologics and personalized medicine has compelled pharmaceutical firms to approach contract manufacturers for precision-engineered drug delivery devices.

Regional Analysis

Asia Pacific was the leading region in the medical device contract manufacturing industry in 2023 and held the highest revenue share of 38.7%. The region owes its leadership to its cost-effective manufacturing process, high-skilled workforce, and sophisticated infrastructure for manufacturing medical devices. China, India, and Malaysia are among countries that have emerged as major hubs for contract manufacturing because of pro-government policies, reduced production expenses, and robust supply chain. Moreover, rising demand for medical devices from a fast-growing aged population, accompanied by an escalation in chronic illnesses, has contributed to the boost in the market. The availability of large international contract manufacturers increasing their presence in the region is also a major growth driver.

Get Customized Report as per Your Business Requirement - Enquiry Now

The North American market is expected to be the most rapidly growing region in the coming years. This is driven by growing outsourcing by original equipment manufacturers (OEMs) looking for specialized knowledge and adherence to strict regulatory requirements like those of the FDA. The growing need for state-of-the-art medical technologies, such as robotic-assisted surgical devices and minimally invasive equipment, is also propelling the contract manufacturing sector in the region. Also, the U.S. and Canada are seeing rising investments in smart manufacturing technologies to make processes more efficient and lower the cost of production.

Leading Companies in the Medical Device Contract Manufacturing Industry

Key Players and Product Portfolio Overview

-

Jabil Inc. – Surgical instruments, diagnostic devices, wearables

-

Thermo Fisher Scientific Inc. – Laboratory equipment, diagnostic devices, consumables

-

Integer Holdings Corporation – Implantable devices, cardiac rhythm management products, neurostimulation devices

-

FLEX LTD. – Diagnostic imaging systems, medical wearables, surgical devices

-

Sanmina Corporation – Patient monitoring systems, imaging devices, drug delivery systems

-

Celestica Inc. – Medical imaging equipment, diagnostic devices, life sciences instruments

-

Phillips-Medisize – Drug delivery devices, inhalers, auto-injectors

-

Plexus Corp. – Diagnostic systems, surgical robotics, patient monitoring devices

-

Nipro Corporation – Dialysis equipment, infusion systems, blood management devices

-

Viant Technology LLC – Orthopedic implants, surgical instruments, cardiovascular devices

-

West Pharmaceutical Services, Inc. – Prefilled syringes, self-injection systems, containment solutions

-

Mack Molding – Medical enclosures, diagnostic equipment, orthopedic products

-

Cirtec Medical – Neurostimulation devices, vascular implants, minimally invasive surgical instruments

-

Cogmedix – Laser-based medical devices, surgical tools, ophthalmic instruments

-

Synecco Ltd. – Single-use medical devices, diagnostic equipment, drug delivery systems

-

TE Connectivity – Medical sensors, catheters, interconnect solutions

-

Keller Technology Corp. – Imaging systems, robotic surgical devices, medical automation equipment

-

HDA Technology, Inc. – Rehabilitation devices, medical imaging products, diagnostic instruments

Recent Developments

-

In Feb 2025, Arterex acquired Phoenix S.r.l., a leading Italian medical device solution provider, expanding its presence in Europe. This acquisition enhances Arterex’s capabilities in medical device development, finished device assembly, and packaging. The financial terms of the deal were not disclosed.

-

In Sep 2024, Sanner Group acquired Gilero, a U.S.-based medical device design, development, and contract manufacturer. This acquisition strengthens Sanner’s position in the medical device sector, expanding its drug delivery, diagnostics, and medtech capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 69.75 billion |

| Market Size by 2032 | USD 191.40 billion |

| CAGR | CAGR of 11.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Usage Mode [Thick Client Workstations, Thin Client Workstations]By Product [Class I, Class II, Class III] • By Services [Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, Device Manufacturing, Packaging and Labeling, Others] • By Therapeutic Area [Cardiovascular Devices, Orthopedic Devices, Ophthalmic Devices, Diagnostic Devices, Respiratory Devices, Surgical Instruments, Dental, Others] • By End Use [Original Equipment Manufacturers (OEMs), Pharmaceutical & Biopharmaceutical Companies, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Jabil Inc., Thermo Fisher Scientific Inc., Integer Holdings Corporation, FLEX LTD., Sanmina Corporation, Celestica Inc., Phillips-Medisize, Plexus Corp., Nipro Corporation, Viant Technology LLC, West Pharmaceutical Services, Inc., Mack Molding, Cirtec Medical, Cogmedix, Synecco Ltd, TE Connectivity, Keller Technology Corp., HDA Technology, Inc. |