To Get More Information on Medical Clothing Market - Request Sample Report

The Medical Clothing Market valued USD 85.95 Billion in 2023 and anticipated to reach USD 163.84 billion by 2032 with compound annual growth rate 7.45% over the forecast period 2024-2032.

There are a number of factors that came together to create an incredibly high level of demand for medical apparel. An increasing focus on infection prevention and control has raised the profile of the crucial contribution high-quality garments can make amongst our healthcare staff. This coincides with some exciting innovations in the fabric technology. Now, new high-protection materials are being introduced with antimicrobial guards against germs, next-level moisture-wick fabrics for comfort and upgraded inside-address pockets to help, and improved breathability to keep wearers cool.

Second, recent global health crises like COVID-19 are a wakeup call about the important significance of medical apparel in preventing the spread of contagious diseases. That in turn has prompted a massive surge in investments around healthcare infrastructure, from the ground up leading to an increased requirement for protective gears - not only for medical professionals but also patients.

The healthcare industry works under stringent compliance regulations that demand them to use good quality medical garments for maintaining hygiene and safety. Such stringent regulations are a major cause of the market expansion, on manufacturers making efforts to develop and offer clothing that complies with these changing standards. The combination of these factors – increased awareness, technological breakthroughs and regulatory forces are driving the growth in medical clothing market.

The convergence of medical technology and clothing is a ripe field with possibilities, developing regularly in the area of antimicrobial fabrics. A common approach to this is embedding nanoparticles such as copper or silver directly into fibers. Innovating goes beyond that though - There is also the field of wearable sensors and sensory textiles thanks in part to nanotechnology. For instance, in Dec 2022 a paper of Nature Nanotechnology highlighted the great promise of one material-copper ion-textiles. Unlike traditional methods which use surface treatments, this thought of innovative approach incorporates copper straight to the cotton's central structure. This highlights more of the latest in high-tech materials from medical clothing market.

However, several challenges still remain within the medical clothing supply chain. This makes ownership, invention and intellectual property rights a convoluted maze due to its horizontal nature. Countries have significantly different laws related to patents and trademarks. As a hypothetical example, without legal inconsistencies regarding the components of an item being made exclusive to one manufacturer, innovation can be slowed down due to patents and patient outcomes with subpar technology.

Furthermore, regulatory agencies in each country have their own approval timelines for medical inventions. A more extensive development and supply chain would enable businesses to deploy products in some markets, even if approval is delayed elsewhere. This promotes a faster and more efficient medical clothing market.

For example, Inspired by Clothing 2.0, a biotech company infusing fabrics with medications, the medical clothing market is on the verge of a revolution. Imagine scrubs delivering pain relief or garments embedded with antiseptics. Clothing 2.0's technology, reaching over 15,000 stores, hints at a future of "Clothing 3.0" for medical wear. This could mean enhanced patient care, improved hygiene, and increased comfort, paving the way for a healthier future.

On the other hand, Careismatic Brands is one of the largest apparel providers across their market with a manufacturer donation worth over USD 5 million involving medical uniforms and equipment in May 2024. This was a focus of their program to help organizations working with healthcare professionals in under-served areas access PPE. This is just the latest example of medical industry expanding beyond garment supply and into a role in making healthcare more accessible around the world.

DRIVERS

Many of the deadly viruses such as COVID-19, SARS, Avian Influenza and Swine Flu have come under focus due to affecting the health negatively because these are preventable diseases which is transmissible by ignoring hygiene practices. This, in turn, is a major factor driving the demand for medical clothing.

At the top of list, RNA viruses that can jump into and between species, these pathogens create an ongoing challenge for healthcare professionals to defend themselves effectively against them, they need the best type of medical apparel that functions as a paramount hindrance preventing any kind infection from contamination.

High containment research and development of treatments for emerging heamorraghic fevers means that there will be a stronger need to have highly specialised barriers between those viruses which kill around half the people who get infected by them, and researchers working within high containment laboratories. This results in more advanced medical garments being required within the research industry.

In addition to the immediate requirement for protection, increased public consciousness around epidemics and pandemics is also leading a cultural change toward preventive action. This, combined with an ever-evolving medical advancement is the perfect soil to cultivate innovation in a field as vast as medical apparels. In years to come, we can look forward even more powerful and very much user-friendly medical garments.

For example, In Jan 2024, Sashafé shatters stereotypes by offering India's first designer medical wear, merging style, comfort, and functionality for healthcare heroes.

A growing elderly population, which is more prone to age-related conditions such as cataracts and glaucoma or heart arrhythmias, requires surgeries. Germany, to take another example saw a 1.2% increase in the number of cardiac interventions during just a year, so that spike in surgical cases means a big uptick on the need for disposable and reusable medical apparel - gowns, drapes etc.

In addition, workers in the healthcare industry are subject to high occupational risks. Healthcare workers routinely subject themselves to infections like hepatitis and tuberculosis resulting from needle sticks. The drive to prevent such infections has necessitated an obligatory surge in the usage of personal protective equipment (PPE). OSHA data shows that proper PPE use eliminates 37% of occupational injuries/illnesses. Such a high demand for protective clothing is further fueling the medical clothing market.

Restraints

Medical clothing is coming under increased scrutiny as well, since these products are paramount for both infection prevention and control. Valorising branding and marketing above the product have seen a growth of poor-quality goods that pseudo-mirrors an equivalent rise in components likely to undermine infection control.

Key Segmentation

By Product

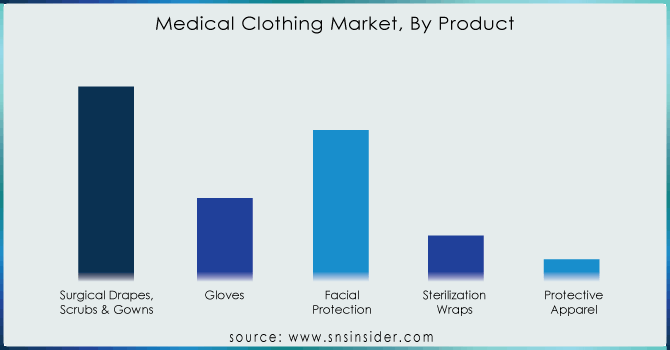

The largest share is occupied by surgical drapes, scrubs & gowns that is 43% in 2023 as there has been an increase in the infection control awareness and health-hygiene; also, since they are cost effective measures. The trend is reinforced within the category with more and better 'sustainable' options, such as this recent launch from Medu Protection: reusable (and virus resistant) sanitary protection.

By contrast, the segment for facial protection is expected to see rise following strong development during the COVID-19 pandemic. Even in face of the continuing threat from infectious disease, mandatory mask orders have become far less demanding through many regions. Nonetheless, continued safety and cleanliness concerns will keep demand for facial protection products at a heightened level even after lockdowns ease up, as well as the adoption of updated World Health Organization guidelines that increasingly recommend masks in certain circumstances.

Do You Need any Customization Research on Medical Clothing Market - Enquire Now

By Type

Disposable medical clothing is dominated the market with 72% share in 2023 due to several advantages. These include lower maintenance costs, reduced infection risks, and convenience. Developed countries, in particular, lean heavily towards disposable options. For instance, an approximately 90% of surgeries in the US utilize disposable gowns and drapes.

However, the reusable segment is experiencing growth driven by factors like environmental concerns, cost-efficiency in the long run, and recent shortages in disposable supplies. Healthcare facilities are increasingly focusing on waste reduction and sustainability, making reusable options more appealing.

By End-user

Hospitals dominated the market with 64% share in 2023 due to the high volume of surgical procedures, a growing patient population, and well-established infrastructure. Investments in healthcare infrastructure, particularly in emerging economies, are further fueling growth in this segment. For instance, the Rainbow Hospital's expansion in India exemplifies this trend. Moreover, the increasing number of surgical and non-surgical procedures globally, as highlighted by the ISAPS report, reinforces the demand for medical clothing within hospitals.

The outpatient facilities segment is fuelled for fastest growth. Factors driving this include a rising number of specialty clinics and a growing preference for outpatient care. The expansion of fields like sports medicine, as indicated by the Association of American Medical Colleges report, is contributing to the increased demand for medical scrubs and other apparel in outpatient settings.

Regional Analysis

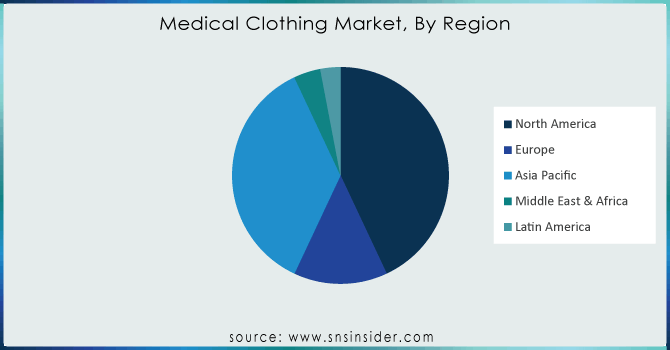

North America dominated the global medical clothing market with 43% share in 2023, driven by factors such as advanced healthcare infrastructure, high prevalence of chronic diseases, and a strong presence of major industry players. The region is also witnessing increased focus on product distribution channels, as evidenced by Figs Inc.'s launch of its first retail store.

The Asia Pacific region is anticipated to experience the fastest growth in the coming years. This growth is attributed to improving healthcare infrastructure, rising hygiene awareness, and a growing manufacturing base in countries like India and China. Companies like DONY VIETNAM COMPANY LIMITED are contributing to this growth by introducing innovative products like protective coveralls.

Europe holds a significant market share due to a focus on product innovation and sustainability initiatives.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Barco Uniforms, Mölnlycke Health Care AB, O&M Halyard Inc., ANSELL LTD., 3M Company, Medline Industries, Semperit AG Holding, Cardinal Health, Inc., Superior Uniform Groups, Narang Medical Limited and others.

Nov 2023, Cardinal Health's launch of the SmartGown EDGE highlights a trend towards incorporating innovative features. The gown's integrated instrument pockets improve efficiency and convenience during surgeries.

May 2023, Ansell LTD.'s AAA recyclability rating for its surgical gloves smart pack underscores the growing emphasis on environmentally friendly practices within the industry.

Feb 2023, Fabletics' entry into the medical apparel market with its activewear-inspired scrubs demonstrates the potential for crossover between fashion and function, while their donation initiative showcases corporate social responsibility.

| Report Attributes | Details |

| Market Size in 2023 | US$ 85.95 Bn |

| Market Size by 2032 | US$ 163.84 Bn |

| CAGR | CAGR of 7.45% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Facial protection, Surgical drapes and gowns, Gloves, Other) • by Usage (Patients, Health workers) • by End-user (Ambulatory Surgical Centers, Hospitals and Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa]), Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Barco Uniforms, Mölnlycke Health Care, O&M Halyard Inc., ANSELL LTD., 3M Company, Medline Industries, Semperit AG Holding, Cardinal Health, Superior Uniform Groups, Narang Medical Limited and others. |

| Key Drivers | • The prevalence of chronic diseases is increasing day by day. • The resident old age people are growing giving growth to the market |

| Market Opportunities | • Many countries are investing in expanding and upgrading their healthcare infrastructure, including the construction of new hospitals, clinics, and healthcare facilities. • The increasing usage of modern technologies would create advantageous prospects for the expansion of the medical clothing industry. |

Ans: The Medical Clothing Market is expected to grow at a CAGR of 7.45% From 2024 to 2032.

Ans: The Medical Clothing Market size is expected to Reach USD 163.84 billion by 2032.

Ans: The market's expansion may be attributed mostly to an increase in the number of surgical cases worldwide. Medical gear is required for sanitization and other processes during surgical operations caused by accidents and illnesses.

Ans: Gowns, gloves, masks, and scrubs are examples of medical clothes that are classed as medical devices and must be authorised by the FDA. They are often intended to provide degrees of protection ranging from low to high risk, depending on the risk involved.

Ans: North America dominates the medical clothing market due to the rising number of operations and well-developed healthcare infrastructure in this area.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Medical Clothing Market Segmentation, By Product

7.1 Introduction

7.2 Surgical Drapes, Scrubs & Gowns

7.3 Gloves

7.4 Facial Protection

7.5 Sterilization Wraps

7.6 Protective Apparel

7.7 Others

8. Medical Clothing Market Segmentation, By Type

8.1 Introduction

8.2 Disposable

8.3 Reusable

9. Medical Clothing Market Segmentation, By End-user

9.1 Introduction

9.2 Hospitals

9.3 Outpatient Facilities

9.4 Physicians’ Offices

9.5 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Medical Clothing Market by Country

10.2.3 North America Medical Clothing Market By Product

10.2.4 North America Medical Clothing Market By Type

10.2.5 North America Medical Clothing Market By End-user

10.2.6 USA

10.2.6.1 USA Medical Clothing Market By Product

10.2.6.2 USA Medical Clothing Market By Type

10.2.6.3 USA Medical Clothing Market By End-user

10.2.7 Canada

10.2.7.1 Canada Medical Clothing Market By Product

10.2.7.2 Canada Medical Clothing Market By Type

10.2.7.3 Canada Medical Clothing Market By End-user

10.2.8 Mexico

10.2.8.1 Mexico Medical Clothing Market By Product

10.2.8.2 Mexico Medical Clothing Market By Type

10.2.8.3 Mexico Medical Clothing Market By End-user

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Medical Clothing Market by Country

10.3.2.2 Eastern Europe Medical Clothing Market By Product

10.3.2.3 Eastern Europe Medical Clothing Market By Type

10.3.2.4 Eastern Europe Medical Clothing Market By End-user

10.3.2.5 Poland

10.3.2.5.1 Poland Medical Clothing Market By Product

10.3.2.5.2 Poland Medical Clothing Market By Type

10.3.2.5.3 Poland Medical Clothing Market By End-user

10.3.2.6 Romania

10.3.2.6.1 Romania Medical Clothing Market By Product

10.3.2.6.2 Romania Medical Clothing Market By Type

10.3.2.6.4 Romania Medical Clothing Market By End-user

10.3.2.7 Hungary

10.3.2.7.1 Hungary Medical Clothing Market By Product

10.3.2.7.2 Hungary Medical Clothing Market By Type

10.3.2.7.3 Hungary Medical Clothing Market By End-user

10.3.2.8 Turkey

10.3.2.8.1 Turkey Medical Clothing Market By Product

10.3.2.8.2 Turkey Medical Clothing Market By Type

10.3.2.8.3 Turkey Medical Clothing Market By End-user

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Medical Clothing Market By Product

10.3.2.9.2 Rest of Eastern Europe Medical Clothing Market By Type

10.3.2.9.3 Rest of Eastern Europe Medical Clothing Market By End-user

10.3.3 Western Europe

10.3.3.1 Western Europe Medical Clothing Market by Country

10.3.3.2 Western Europe Medical Clothing Market By Product

10.3.3.3 Western Europe Medical Clothing Market By Type

10.3.3.4 Western Europe Medical Clothing Market By End-user

10.3.3.5 Germany

10.3.3.5.1 Germany Medical Clothing Market By Product

10.3.3.5.2 Germany Medical Clothing Market By Type

10.3.3.5.3 Germany Medical Clothing Market By End-user

10.3.3.6 France

10.3.3.6.1 France Medical Clothing Market By Product

10.3.3.6.2 France Medical Clothing Market By Type

10.3.3.6.3 France Medical Clothing Market By End-user

10.3.3.7 UK

10.3.3.7.1 UK Medical Clothing Market By Product

10.3.3.7.2 UK Medical Clothing Market By Type

10.3.3.7.3 UK Medical Clothing Market By End-user

10.3.3.8 Italy

10.3.3.8.1 Italy Medical Clothing Market By Product

10.3.3.8.2 Italy Medical Clothing Market By Type

10.3.3.8.3 Italy Medical Clothing Market By End-user

10.3.3.9 Spain

10.3.3.9.1 Spain Medical Clothing Market By Product

10.3.3.9.2 Spain Medical Clothing Market By Type

10.3.3.9.3 Spain Medical Clothing Market By End-user

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Medical Clothing Market By Product

10.3.3.10.2 Netherlands Medical Clothing Market By Type

10.3.3.10.3 Netherlands Medical Clothing Market By End-user

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Medical Clothing Market By Product

10.3.3.11.2 Switzerland Medical Clothing Market By Type

10.3.3.11.3 Switzerland Medical Clothing Market By End-user

10.3.3.12 Austria

10.3.3.12.1 Austria Medical Clothing Market By Product

10.3.3.12.2 Austria Medical Clothing Market By Type

10.3.3.12.3 Austria Medical Clothing Market By End-user

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Medical Clothing Market By Product

10.3.3.13.2 Rest of Western Europe Medical Clothing Market By Type

10.3.3.13.3 Rest of Western Europe Medical Clothing Market By End-user

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Medical Clothing Market by Country

10.4.3 Asia-Pacific Medical Clothing Market By Product

10.4.4 Asia-Pacific Medical Clothing Market By Type

10.4.5 Asia-Pacific Medical Clothing Market By End-user

10.4.6 China

10.4.6.1 China Medical Clothing Market By Product

10.4.6.2 China Medical Clothing Market By Type

10.4.6.3 China Medical Clothing Market By End-user

10.4.7 India

10.4.7.1 India Medical Clothing Market By Product

10.4.7.2 India Medical Clothing Market By Type

10.4.7.3 India Medical Clothing Market By End-user

10.4.8 Japan

10.4.8.1 Japan Medical Clothing Market By Product

10.4.8.2 Japan Medical Clothing Market By Type

10.4.8.3 Japan Medical Clothing Market By End-user

10.4.9 South Korea

10.4.9.1 South Korea Medical Clothing Market By Product

10.4.9.2 South Korea Medical Clothing Market By Type

10.4.9.3 South Korea Medical Clothing Market By End-user

10.4.10 Vietnam

10.4.10.1 Vietnam Medical Clothing Market By Product

10.4.10.2 Vietnam Medical Clothing Market By Type

10.4.10.3 Vietnam Medical Clothing Market By End-user

10.4.11 Singapore

10.4.11.1 Singapore Medical Clothing Market By Product

10.4.11.2 Singapore Medical Clothing Market By Type

10.4.11.3 Singapore Medical Clothing Market By End-user

10.4.12 Australia

10.4.12.1 Australia Medical Clothing Market By Product

10.4.12.2 Australia Medical Clothing Market By Type

10.4.12.3 Australia Medical Clothing Market By End-user

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Medical Clothing Market By Product

10.4.13.2 Rest of Asia-Pacific Medical Clothing Market By Type

10.4.13.3 Rest of Asia-Pacific Medical Clothing Market By End-user

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Medical Clothing Market by Country

10.5.2.2 Middle East Medical Clothing Market By Product

10.5.2.3 Middle East Medical Clothing Market By Type

10.5.2.4 Middle East Medical Clothing Market By End-user

10.5.2.5 UAE

10.5.2.5.1 UAE Medical Clothing Market By Product

10.5.2.5.2 UAE Medical Clothing Market By Type

10.5.2.5.3 UAE Medical Clothing Market By End-user

10.5.2.6 Egypt

10.5.2.6.1 Egypt Medical Clothing Market By Product

10.5.2.6.2 Egypt Medical Clothing Market By Type

10.5.2.6.3 Egypt Medical Clothing Market By End-user

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Medical Clothing Market By Product

10.5.2.7.2 Saudi Arabia Medical Clothing Market By Type

10.5.2.7.3 Saudi Arabia Medical Clothing Market By End-user

10.5.2.8 Qatar

10.5.2.8.1 Qatar Medical Clothing Market By Product

10.5.2.8.2 Qatar Medical Clothing Market By Type

10.5.2.8.3 Qatar Medical Clothing Market By End-user

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Medical Clothing Market By Product

10.5.2.9.2 Rest of Middle East Medical Clothing Market By Type

10.5.2.9.3 Rest of Middle East Medical Clothing Market By End-user

10.5.3 Africa

10.5.3.1 Africa Medical Clothing Market by Country

10.5.3.2 Africa Medical Clothing Market By Product

10.5.3.3 Africa Medical Clothing Market By Type

10.5.3.4 Africa Medical Clothing Market By End-user

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Medical Clothing Market By Product

10.5.3.5.2 Nigeria Medical Clothing Market By Type

10.5.3.5.3 Nigeria Medical Clothing Market By End-user

10.5.3.6 South Africa

10.5.3.6.1 South Africa Medical Clothing Market By Product

10.5.3.6.2 South Africa Medical Clothing Market By Type

10.5.3.6.3 South Africa Medical Clothing Market By End-user

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Medical Clothing Market By Product

10.5.3.7.2 Rest of Africa Medical Clothing Market By Type

10.5.3.7.3 Rest of Africa Medical Clothing Market By End-user

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Medical Clothing Market by country

10.6.3 Latin America Medical Clothing Market By Product

10.6.4 Latin America Medical Clothing Market By Type

10.6.5 Latin America Medical Clothing Market By End-user

10.6.6 Brazil

10.6.6.1 Brazil Medical Clothing Market By Product

10.6.6.2 Brazil Medical Clothing Market By Type

10.6.6.3 Brazil Medical Clothing Market By End-user

10.6.7 Argentina

10.6.7.1 Argentina Medical Clothing Market By Product

10.6.7.2 Argentina Medical Clothing Market By Type

10.6.7.3 Argentina Medical Clothing Market By End-user

10.6.8 Colombia

10.6.8.1 Colombia Medical Clothing Market By Product

10.6.8.2 Colombia Medical Clothing Market By Type

10.6.8.3 Colombia Medical Clothing Market By End-user

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Medical Clothing Market By Product

10.6.9.2 Rest of Latin America Medical Clothing Market By Type

10.6.9.3 Rest of Latin America Medical Clothing Market By End-user

11. Company Profiles

11.1 Barco Uniforms

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Mölnlycke Health Care

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 O&M Halyard Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 ANSELL LTD.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 3M Company

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Medline Industries

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Semperit AG Holding

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Cardinal Health

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Superior Uniform Groups

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Narang Medical Limited

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Intraoperative Imaging Market Size was valued at USD 2.9 Billion in 2023 and is expected to reach USD 4.85 Billion by 2032, growing at a CAGR of 5.9% over the forecast period 2024-2032.

The Pharmaceutical Filtration Market Size was valued at USD 16.4 billion in 2023 and is expected to reach USD 43.9 billion by 2032 with a growing CAGR of 11.56 % over the forecast period 2024-2032.

The Urinary Catheters Market size was USD 5.80 billion in 2023 and is estimated to reach USD 9.50 billion by 2032 with a growing CAGR of 5.68% by 2024-2032.

The Artificial Intelligence (AI) in Breast Imaging Market Size was USD 423.9 million in 2023 & will reach USD 1886.4 million by 2032 with a growing CAGR of 16.1% Over the Forecast Period of 2024-2032.

The Bilirubin Blood Test Market Size was valued at USD 1.18 billion in 2023, and is expected to reach USD 2.11 billion by 2032, and grow at a CAGR of 6.7% over the forecast period 2024-2032.

The Stem Cell Therapy Market Size was valued at USD 287 million in 2023 and is witnessed to reach USD 1,113.12 million by 2032 and grow at a CAGR of 17.10% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone