Medical Ceramics Market Report Scope & Overview:

Get more information on Medical Ceramics Market - Request Sample Report

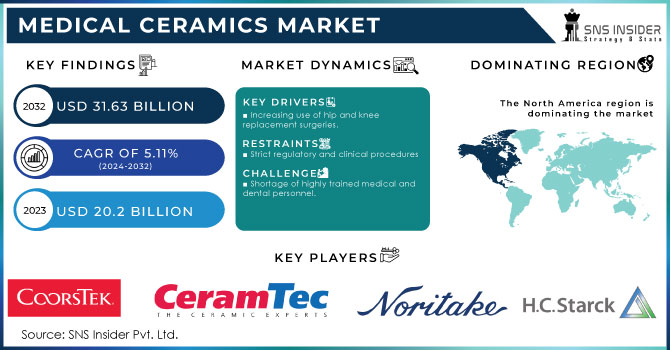

The Medical Ceramics Market Size was valued at USD 20.2 billion in 2023, and is expected to reach USD 31.63 billion by 2032, and grow at a CAGR of 5.11% over the forecast period 2024-2032.

The primary drivers of this market are the rising need for implantable devices, the rising number of hip and knee replacement surgeries, and the expanding demand for medical ceramics in plastic surgeries and wound healing applications. Medical ceramics are in greater demand in the healthcare sector, which presents growth opportunities for manufacturers.

Government programs also give participants a platform to take advantage of the opportunities. Governments have boosted funding for R&D projects aimed at the creation of novel technology, particularly in industrialized nations.

The sales of medical implants and gadgets directly affect the demand for medical ceramics. The sales of medical devices and implants are driven by the sharp increase in the world's population and the rise in the elderly population. Patients and physicians around the world are becoming more accepting of medical implants. The supply of medical ceramics is prone to disruptions and fluctuating pricing. Prices for medical ceramics fluctuate as a result of shifting mining outputs and market attitudes. Buyers of medical ceramics must endure lengthy lead times or secure large stocks, which raises buyer costs and restrains the market's expansion.

MARKET DYNAMICS

DRIVERS

-

Increasing use of hip and knee replacement surgeries.

The demand for hip and knee replacement surgeries is rising globally due to an increase in age-related diseases (including rheumatoid arthritis, osteoarthritis, osteoporosis, and fractures), as well as sports injuries. The WHO predicts that by 2020, osteoarthritis will rank as the fourth-leading cause of disability worldwide. The US will perform 3.6 million knee replacement surgeries a year by 2030, according to the American Academy of Orthopaedic Surgeons (AAOS). Additionally, it is anticipated that by 2030, more than 560,000 total hip replacement surgeries will be carried out each year in the United States.

RESTRAIN

-

Strict regulatory and clinical procedures

OPPORTUNITY

-

Gradual transition to new products and materials

All-ceramic prostheses and goods composed of biomaterials are gradually replacing conventional porcelain-fused-to-metal (PFM) dental restoration items. A durable ceramic biomaterial used in the creation of prostheses is zirconium oxide. Zirconium has been discovered to be stronger and more fracture-resistant than steel, in addition to being more aesthetically pleasing. When compared to the adhesive bonding used in conventional prosthetics, it also makes cementation easier. Many people choose zirconium crowns and bridges due to the benefits they offer over conventional materials. Many businesses in the medical ceramics industry are developing updated and enhanced products with increased biocompatibility and material sturdiness.

CHALLENGES

-

Shortage of highly trained medical and dental personnel.

IMPACT OF RUSSIAN UKRAINE WAR

Research and development expenditures Governments and businesses may spend less money on medical ceramics research and development if the conflict causes economic instability in the area. This might impede innovation and the release of new, better products. Changes in Demand During times of ambiguity, spending and priority in healthcare may vary. The market for specific medical ceramics products may be impacted if resources were diverted to meet more urgent medical requirements. Market Consolidation The medical ceramics sector may undergo consolidation as a result of economic difficulties. Smaller suppliers or manufacturers can run into problems, which could lead to mergers, acquisitions, or even closures. The market's competitive environment can change as a result. Impact on the Economy Long-Term Russia and Ukraine could potentially see the economic effects of the geopolitical situation. How long it takes for these countries to recover economically will depend on how long and how severe the conflict was. This could have an effect on their entire healthcare system, increasing their need for medical ceramics. To reduce the hazards associated with the supply chain, manufacturers and healthcare providers should look into other sources of medical ceramics. The sector's trading patterns and supplier relationships may change as a result.

IMPACT OF ONGOING RECESSION

Manufacturers face financial constraints. During a recession, medical ceramics producers can experience financial difficulties that could hinder their ability to innovate, spend on research and development, and keep up production levels. Competitive In times of economic uncertainty, pressures can increase as businesses compete for a smaller pool of clients and contracts. Price pressure and lower profit margins can result from this. Priorities May change. During a Recession, healthcare providers may give priority to necessary procedures over optional or less urgent ones. This can cause the types of medical ceramic goods that are in demand to change. Public healthcare During a recession, government spending on healthcare could be disrupted, which could have an impact on reimbursement rates and funding for medical operations, including medical ceramics. Development of New Products and Innovation Economic constraints could result in lower spending in R&D, which would have an impact on the release of novel and cutting-edge medical ceramics products. Mergers and Acquisitions As weaker enterprises struggle and larger businesses want to buy or merge with rivals, economic downturns can result in sector consolidation. This might alter the Medical Ceramics Market's competitive landscape.

KEY MARKET SEGMENTATION

By Material Type

-

Bioinert Ceramics

-

Zirconia

-

Aluminium Oxide

-

Other Bioinert Ceramics

-

-

Bioactive Ceramics

-

Hydroxyapatite

-

Glass Ceramics

-

-

Bioresorbable Ceramics

By Application

-

Dental Applications

-

Dental Crowns & Bridges

-

Braces

-

Inlays and Onlays

-

Dental Bone Grafts & Substitutes

-

Orthopedic Applications

- Joint Replacement

-

Knee Replacement

-

Hip Replacement

-

Shoulder Replacement

-

Others

-

-

Fracture Fixation

-

Synthetic Bone Grafts

-

Surgical Instruments

-

Plastic Surgery

-

Craniomaxillofacial Implants

-

Orbital/Ocular Implants

-

Dermal Fillers

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSES

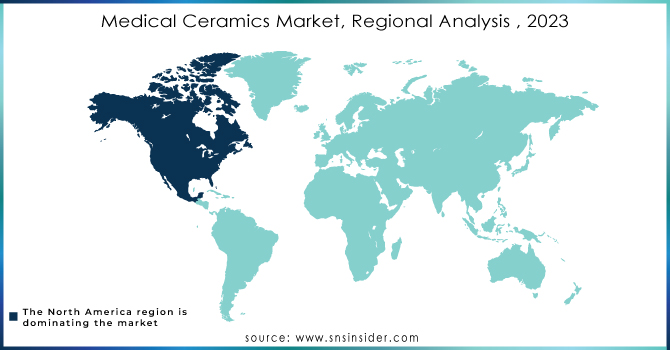

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa comprise the market segments for medical ceramics. In 2023, North America dominated the global market for medical ceramics. According to a study conducted in North America, among the 0.38 million female Medicare seniors who had fractures, 10% had another fracture within a year, 18% within two years, and 31% within five years.

Asia Pacific is anticipated to develop at a higher CAGR during the forecast period due to an expanding patient pool suffering from decreasing bone density and back pain, which is driving up demand for treatment options. European nations include the U.K., Germany, France, and others. On the other hand, the development of medical devices and methods for bone replacement and dental surgical treatment with medical ceramics is predicted to result in a somewhat lower CAGR in Latin America, the Middle East, and Africa over the course of the projection period.

Need any customization research on Medical Ceramics Market - Enquiry Now

Key Players

The major key players are CoorsTek Medical, H.C. Starck GmbH, Tosoh Corporation, Noritake Co., Ltd, 3M Company, Morgan Advanced Materials plc, Ceramtec, PI Ceramic GmbH, Lithoz, and Kyocera Corporation and others.

RECENT DEVELOPMENTS

CeramTec's: In 2022, CeramTec's innovative ceramic total knee replacement technology has been approved by the US FDA.

| Report Attributes | Details |

| Market Size in 2023 | US$ 20.2 Bn |

| Market Size by 2032 | US$ 31.63 Bn |

| CAGR | CAGR of 5.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Bioinert Ceramics, Zirconia, Aluminium Oxide, Other Bioinert Ceramics, Hydroxyapatite, Glass) • By Application (Dental Applications, Dental Implants, Dental Crowns & Bridges, Braces, Inlays and Onlays, Dental Bone Grafts & Substitutes, Orthopedic Applications, Joint Replacement, Knee Replacement, Fracture Fixation, Synthetic Bone Grafts, Surgical Instruments, Plastic Surgery, Craniomaxillofacial Implants, Orbital/Ocular Implants, Dermal Fillers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CoorsTek Medical, H.C. Starck GmbH,Tosoh Corporation, Noritake Co., Ltd, 3M Company, Morgan Advanced Materials plc, Ceramtec, PI Ceramic GmbH, Lithoz, and Kyocera Corporation |

| Key Drivers | • Increasing use of hip and knee replacement surgeries. |

| Market Restraints | • Strict regulatory and clinical procedures |