Get more information on Medical Aesthetics Market - Request Sample Report

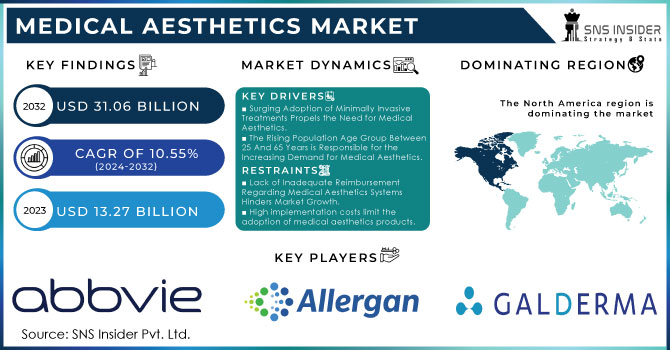

The Medical Aesthetics Market Size was valued at USD 13.27 billion in 2023 and is witnessed to reach USD 31.06 billion by 2032 and grow at a CAGR of 10.55% over the forecast period 2024-2032.

One of the key factors leading to the flourishing medical aesthetics market is growing attention towards an individual appearance by society which will further upsurge in demand for medical aesthetic procedures. The lifting of cultural norms with a broadening idea around the range of medical aesthetic treatments accessible has also greatly encouraged market expansion accordingly. The increasing recognition and demand for a range of aesthetic therapies mirror an ideological shift in how individuals perceive ways to enhance personal appearance, thus supporting the growth in the medical aesthetics market.

Key insights for the aesthetic medicine market: Highlights from 2022 International Society of Aesthetic Plastic Surgery data on top five global surgical procedures Liposuction came in as the most popular procedure done 2,303,929 times with Breast Augmentation close behind at a respective total of 2,174,616. Eyelid Surgery finished third, with 1,409,103 and Abdominoplasty came in fourth with a total of 1,180,623 At number five was Breast Lift with 955,026 procedures.

As such, the market has seen a rise over the recent period and is also anticipated to experience significant demand during our forecasted year period. Increased knowledge regarding appearance & fitness has created a higher demand for medical aesthetic treatments in emerging countries. In India and South Korea, aesthetic procedures, including liposuction or nose reshaping to a Botox injection are inbred from consumers. India was in the top 5 countries globally with its non-surgical procedures according to the International Society of Aesthetic Plastic Surgery (ISAPS) Year-2022. This accentuates residual opportunities to cash in on growth at the hands of industry participants across the world.

MARKET DYNAMICS:

KEY DRIVERS:

RESTRAINTS:

OPPORTUNITY:

KEY MARKET SEGMENTATION:

By Product Type

The facial aesthetic product is one of the types of products and holds a significant share in 2023 which is 22% within the medical aesthetics market. The dominance of this segment is mainly due to the rising demand for facial aesthetic procedures, which are minimally invasive. According to the American Academy of Facial Plastic and Reconstructive Surgery Annual Survey, 85% said they had a surge in injectable treatments last year alone from Botox followed by dermal fillers as patients sought out more non-invasive ways to reduce signs of aging. The survey also revealed a trend where more, especially younger demographics such as those in their 20s and 30s are finding interest in Botox for preventive therapies. These procedures are popular because they combat wrinkles and fine lines, and provide a more youthful appearance with little downtime. Moreover, technological advancements in facial aesthetic products such as durable gel fillers and smoother botulinum toxin preparations have made their usage even more rampant. Growing societal pressure to look facially appealing combined with the increasing geriatric population choosing anti-aging solutions are among the factors that drive demand for facial aesthetic products, making them the leading segment of the medical aesthetics market.

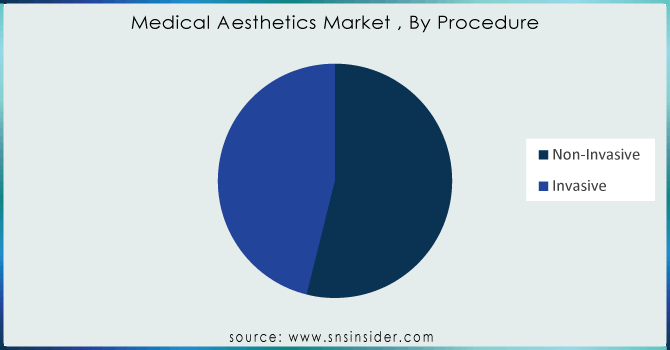

By Procedure

The procedure section is bifurcated into invasive procedures and non-invasive procedures. The non-invasive segment held the largest market share, accounting for approximately 54.01% in 2023. Because of the convenience offered by non-invasive procedures. As compared to invasive the non-invasive procedures can be performed in the office setting with minimal recovery time enabling patients to go about their usual activities immediately. Furthermore, the ease of access to these procedures is substantiating this growth. Such procedures are affordable and easily accessible for a large cross-section of people; Besides, technological developments and the advent of the latest techniques are imperative reasons for booming demand for medical aesthetics.

Need any customization research on Medical Aesthetics Market - Enquiry Now

By End Users

The Clinics were holding 50.02% of the market share in 2023 owing to the increasing preference of people for aesthetic procedures and a rise in per capita disposable income in both developing and well-developed economies. Hospitals have the resources and also the best expert healthcare professionals who can operate these high-tech but very expensive instruments on a timely basis that many vendors do not provide. Similarly, the surge in aesthetic procedures and numerous non-surgical services that can be performed at medical spas or beauty centers have significantly contributed to their immense growth. Additionally, there is a significant increase in non-invasive skin rejuvenation procedures like microdermabrasion, chemical peels, and other skin resurfacing which would further escalate the revenue yield from medical spas & beauty centers.

REGIONAL COVERAGE:

REGIONAL ANALYSES

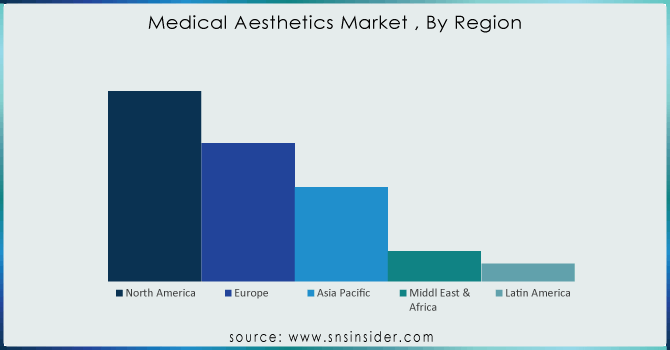

In 2023, the North American region held a market share of 42%, owing to high demand for aesthetic treatments and rising consumer awareness The American Society of Plastic Surgeons (ASPS) states that aesthetic procedures are a major share in the US medical industry, and this has increased because of its robust healthcare infrastructure with technologically sophisticated features. The American Society of Plastic Surgeons reported over 15.6 million cosmetic procedures were performed in the United States last year alone - a testament to how aware and interested consumers are! Furthermore, The Centers for Medicare & Medicaid Services (CMS) stated that the US healthcare spending increased to $4.1 trillion in 2020, which further supported the medical aesthetics market growth of this region Availability of alternatives, and innovative products under the aesthetic market are likely to further medical aesthetics drive growth and support economy in US due presence major industries contributing.

The global market is very fragmented with lots of local fights between different international players Nevertheless, the prolonged regulatory approval process is inhibiting the introduction of new products in the market. Key factors driving competitiveness include the quick uptake of advanced solutions for better treatments and technological advancements. The leading players are engaging in several mergers & acquisitions to maintain their dominance within the industry. The key market players include AbbVie, Allergan, Galderma, Cynosure, Johnson & Johnson, Revance Therapeutics, Inc., Evolus Inc., Lumenis, Alma Laser, Syneron Candela Solta Medical & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.27 Billion |

| Market Size by 2032 | US$ 31.06 Billion |

| CAGR | CAGR of 10.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Facial Aesthetic Products, Body Contouring Devices, Cosmetic Implants, Hair Removal Devices, Skin Aesthetic Devices, Tattoo Removal Devices) •By Procedure (Invasive, Non-Invasive) •By End Users (Clinics and Medical Spas, Hospitals, Dermatology Clinics, Cosmetic Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie, Allergan, Galderma, Cynosure, Johnson & Johnson, Revance Therapeutics, Inc., Evolus Inc., Lumenis, Alma Laser, Syneron Candela Solta Medical & Other Players |

| Key Drivers | •Surging Adoption of Minimally Invasive Treatments Propels the Need for Medical Aesthetics. •The Rising Population Age Group Between 25 And 65 Years is Responsible for the Increasing Demand for Medical Aesthetics. |

| RESTRAINTS | •Lack of Inadequate Reimbursement Regarding Medical Aesthetics Systems Hinders Market Growth. •The Higher Implementation Costs of Medical Aesthetics Products Limit the Adoption of Medical Aesthetics. |

Ans: The CAGR of 10.55% for the forecast period of 2024-2032.

Ans: The Medical Aesthetics Market Size was valued at USD 13.27 billion in 2023 and is witnessed to reach USD 31.06 billion by 2032.

Ans: The Key Players are AbbVie, Allergan, Galderma, Cynosure, Johnson & Johnson, Revance Therapeutics, Inc., Evolus Inc., Lumenis, Alma Laser, Syneron Candela Solta Medical & Other Players.

Ans: Surging Adoption of Minimally Invasive Treatments Propels the Need for Medical Aesthetics.

2. The Rising Population Age Group Between 25 And 65 Years is Responsible for the Increasing Demand for Medical Aesthetics.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Medical Aesthetics Market Segmentation, By Product Type

7.1 Introduction

7.2 Facial Aesthetic Products

7.3 Cosmetic Implants

7.4 Body Contouring Devices

7.5 Hair Removal Devices

7.6 Tattoo Removal Devices

7.7 Skin Aesthetic Devices

7.8 Others

8. Medical Aesthetics Market Segmentation, By Procedure

8.1 Introduction

8.2 Invasive

8.3 Non-Invasive

9. Medical Aesthetics Market Segmentation, By End Userr

9.1 Introduction

9.2 Clinics and Medical Spas

9.3 Hospitals

9.4 Dermatology Clinics

9.5 Cosmetic Centers

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Medical Aesthetics Market by Country

10.2.3 North America Medical Aesthetics Market By Product Type

10.2.4 North America Medical Aesthetics Market By Procedure

10.2.5 North America Medical Aesthetics Market By End User

10.2.6 USA

10.2.6.1 USA Medical Aesthetics Market By Product Type

10.2.6.2 USA Medical Aesthetics Market By Procedure

10.2.6.3 USA Medical Aesthetics Market By End User

10.2.7 Canada

10.2.7.1 Canada Medical Aesthetics Market By Product Type

10.2.7.2 Canada Medical Aesthetics Market By Procedure

10.2.7.3 Canada Medical Aesthetics Market By End User

10.2.8 Mexico

10.2.8.1 Mexico Medical Aesthetics Market By Product Type

10.2.8.2 Mexico Medical Aesthetics Market By Procedure

10.2.8.3 Mexico Medical Aesthetics Market By End User

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Medical Aesthetics Market by Country

10.3.2.2 Eastern Europe Medical Aesthetics Market By Product Type

10.3.2.3 Eastern Europe Medical Aesthetics Market By Procedure

10.3.2.4 Eastern Europe Medical Aesthetics Market By End User

10.3.2.5 Poland

10.3.2.5.1 Poland Medical Aesthetics Market By Product Type

10.3.2.5.2 Poland Medical Aesthetics Market By Procedure

10.3.2.5.3 Poland Medical Aesthetics Market By End User

10.3.2.6 Romania

10.3.2.6.1 Romania Medical Aesthetics Market By Product Type

10.3.2.6.2 Romania Medical Aesthetics Market By Procedure

10.3.2.6.4 Romania Medical Aesthetics Market By End User

10.3.2.7 Hungary

10.3.2.7.1 Hungary Medical Aesthetics Market By Product Type

10.3.2.7.2 Hungary Medical Aesthetics Market By Procedure

10.3.2.7.3 Hungary Medical Aesthetics Market By End User

10.3.2.8 Turkey

10.3.2.8.1 Turkey Medical Aesthetics Market By Product Type

10.3.2.8.2 Turkey Medical Aesthetics Market By Procedure

10.3.2.8.3 Turkey Medical Aesthetics Market By End User

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Medical Aesthetics Market By Product Type

10.3.2.9.2 Rest of Eastern Europe Medical Aesthetics Market By Procedure

10.3.2.9.3 Rest of Eastern Europe Medical Aesthetics Market By End User

10.3.3 Western Europe

10.3.3.1 Western Europe Medical Aesthetics Market by Country

10.3.3.2 Western Europe Medical Aesthetics Market By Product Type

10.3.3.3 Western Europe Medical Aesthetics Market By Procedure

10.3.3.4 Western Europe Medical Aesthetics Market By End User

10.3.3.5 Germany

10.3.3.5.1 Germany Medical Aesthetics Market By Product Type

10.3.3.5.2 Germany Medical Aesthetics Market By Procedure

10.3.3.5.3 Germany Medical Aesthetics Market By End User

10.3.3.6 France

10.3.3.6.1 France Medical Aesthetics Market By Product Type

10.3.3.6.2 France Medical Aesthetics Market By Procedure

10.3.3.6.3 France Medical Aesthetics Market By End User

10.3.3.7 UK

10.3.3.7.1 UK Medical Aesthetics Market By Product Type

10.3.3.7.2 UK Medical Aesthetics Market By Procedure

10.3.3.7.3 UK Medical Aesthetics Market By End User

10.3.3.8 Italy

10.3.3.8.1 Italy Medical Aesthetics Market By Product Type

10.3.3.8.2 Italy Medical Aesthetics Market By Procedure

10.3.3.8.3 Italy Medical Aesthetics Market By End User

10.3.3.9 Spain

10.3.3.9.1 Spain Medical Aesthetics Market By Product Type

10.3.3.9.2 Spain Medical Aesthetics Market By Procedure

10.3.3.9.3 Spain Medical Aesthetics Market By End User

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Medical Aesthetics Market By Product Type

10.3.3.10.2 Netherlands Medical Aesthetics Market By Procedure

10.3.3.10.3 Netherlands Medical Aesthetics Market By End User

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Medical Aesthetics Market By Product Type

10.3.3.11.2 Switzerland Medical Aesthetics Market By Procedure

10.3.3.11.3 Switzerland Medical Aesthetics Market By End User

10.3.3.12 Austria

10.3.3.12.1 Austria Medical Aesthetics Market By Product Type

10.3.3.12.2 Austria Medical Aesthetics Market By Procedure

10.3.3.12.3 Austria Medical Aesthetics Market By End User

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Medical Aesthetics Market By Product Type

10.3.3.13.2 Rest of Western Europe Medical Aesthetics Market By Procedure

10.3.3.13.3 Rest of Western Europe Medical Aesthetics Market By End User

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Medical Aesthetics Market by Country

10.4.3 Asia-Pacific Medical Aesthetics Market By Product Type

10.4.4 Asia-Pacific Medical Aesthetics Market By Procedure

10.4.5 Asia-Pacific Medical Aesthetics Market By End User

10.4.6 China

10.4.6.1 China Medical Aesthetics Market By Product Type

10.4.6.2 China Medical Aesthetics Market By Procedure

10.4.6.3 China Medical Aesthetics Market By End User

10.4.7 India

10.4.7.1 India Medical Aesthetics Market By Product Type

10.4.7.2 India Medical Aesthetics Market By Procedure

10.4.7.3 India Medical Aesthetics Market By End User

10.4.8 Japan

10.4.8.1 Japan Medical Aesthetics Market By Product Type

10.4.8.2 Japan Medical Aesthetics Market By Procedure

10.4.8.3 Japan Medical Aesthetics Market By End User

10.4.9 South Korea

10.4.9.1 South Korea Medical Aesthetics Market By Product Type

10.4.9.2 South Korea Medical Aesthetics Market By Procedure

10.4.9.3 South Korea Medical Aesthetics Market By End User

10.4.10 Vietnam

10.4.10.1 Vietnam Medical Aesthetics Market By Product Type

10.4.10.2 Vietnam Medical Aesthetics Market By Procedure

10.4.10.3 Vietnam Medical Aesthetics Market By End User

10.4.11 Singapore

10.4.11.1 Singapore Medical Aesthetics Market By Product Type

10.4.11.2 Singapore Medical Aesthetics Market By Procedure

10.4.11.3 Singapore Medical Aesthetics Market By End User

10.4.12 Australia

10.4.12.1 Australia Medical Aesthetics Market By Product Type

10.4.12.2 Australia Medical Aesthetics Market By Procedure

10.4.12.3 Australia Medical Aesthetics Market By End User

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Medical Aesthetics Market By Product Type

10.4.13.2 Rest of Asia-Pacific Medical Aesthetics Market By Procedure

10.4.13.3 Rest of Asia-Pacific Medical Aesthetics Market By End User

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Medical Aesthetics Market by Country

10.5.2.2 Middle East Medical Aesthetics Market By Product Type

10.5.2.3 Middle East Medical Aesthetics Market By Procedure

10.5.2.4 Middle East Medical Aesthetics Market By End User

10.5.2.5 UAE

10.5.2.5.1 UAE Medical Aesthetics Market By Product Type

10.5.2.5.2 UAE Medical Aesthetics Market By Procedure

10.5.2.5.3 UAE Medical Aesthetics Market By End User

10.5.2.6 Egypt

10.5.2.6.1 Egypt Medical Aesthetics Market By Product Type

10.5.2.6.2 Egypt Medical Aesthetics Market By Procedure

10.5.2.6.3 Egypt Medical Aesthetics Market By End User

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Medical Aesthetics Market By Product Type

10.5.2.7.2 Saudi Arabia Medical Aesthetics Market By Procedure

10.5.2.7.3 Saudi Arabia Medical Aesthetics Market By End User

10.5.2.8 Qatar

10.5.2.8.1 Qatar Medical Aesthetics Market By Product Type

10.5.2.8.2 Qatar Medical Aesthetics Market By Procedure

10.5.2.8.3 Qatar Medical Aesthetics Market By End User

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Medical Aesthetics Market By Product Type

10.5.2.9.2 Rest of Middle East Medical Aesthetics Market By Procedure

10.5.2.9.3 Rest of Middle East Medical Aesthetics Market By End User

10.5.3 Africa

10.5.3.1 Africa Medical Aesthetics Market by Country

10.5.3.2 Africa Medical Aesthetics Market By Product Type

10.5.3.3 Africa Medical Aesthetics Market By Procedure

10.5.3.4 Africa Medical Aesthetics Market By End User

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Medical Aesthetics Market By Product Type

10.5.3.5.2 Nigeria Medical Aesthetics Market By Procedure

10.5.3.5.3 Nigeria Medical Aesthetics Market By End User

10.5.3.6 South Africa

10.5.3.6.1 South Africa Medical Aesthetics Market By Product Type

10.5.3.6.2 South Africa Medical Aesthetics Market By Procedure

10.5.3.6.3 South Africa Medical Aesthetics Market By End User

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Medical Aesthetics Market By Product Type

10.5.3.7.2 Rest of Africa Medical Aesthetics Market By Procedure

10.5.3.7.3 Rest of Africa Medical Aesthetics Market By End User

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Medical Aesthetics Market by country

10.6.3 Latin America Medical Aesthetics Market By Product Type

10.6.4 Latin America Medical Aesthetics Market By Procedure

10.6.5 Latin America Medical Aesthetics Market By End User

10.6.6 Brazil

10.6.6.1 Brazil Medical Aesthetics Market By Product Type

10.6.6.2 Brazil Medical Aesthetics Market By Procedure

10.6.6.3 Brazil Medical Aesthetics Market By End User

10.6.7 Argentina

10.6.7.1 Argentina Medical Aesthetics Market By Product Type

10.6.7.2 Argentina Medical Aesthetics Market By Procedure

10.6.7.3 Argentina Medical Aesthetics Market By End User

10.6.8 Colombia

10.6.8.1 Colombia Medical Aesthetics Market By Product Type

10.6.8.2 Colombia Medical Aesthetics Market By Procedure

10.6.8.3 Colombia Medical Aesthetics Market By End User

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Medical Aesthetics Market By Product Type

10.6.9.2 Rest of Latin America Medical Aesthetics Market By Procedure

10.6.9.3 Rest of Latin America Medical Aesthetics Market By End User

11. Company Profiles

11.1 Allergan

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Johnson & Johnson

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Cynosure

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 AbbVie

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Evolus Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Revance Therapeutics, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Galderma

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Lumenis

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Solta Medical

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Syneron Candela

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Cosmetic Dentistry Market was valued at USD 37.16 billion in 2023 and is expected to reach USD 115.09 billion by 2032, growing at a CAGR of 13.21% from 2024-2032.

The Chromatography Instruments Market was valued at USD 9.47 billion in 2023 and is expected to reach USD 14.90 billion by 2032, growing at a CAGR of 5.19% from 2024-2032.

The Spinal Muscular Atrophy Treatment Market size was estimated at USD 4.48 billion in 2023 and is expected to reach USD 8.16 billion by 2032 at a CAGR of 6.9% during the forecast period of 2024-2032.

The Cardiac Monitoring Devices Market size is projected to grow from USD 29.15 billion in 2023 to USD 48.58 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 5.84% during the forecast period 2024-2032.

The Ambulatory EHR Market size was valued at USD 5.62 billion in 2023 and is projected to at a CAGR of 5.73% to reach USD 9.27 billion by 2032.

The Bioremediation Market size was estimated at USD 14.95 billion in 2023 and is expected to reach USD 34.27 billion by 2032 with a growing CAGR of 9.69% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone