Get more information on Medical Adhesives Market - Request Sample Report

The Medical Adhesives Market Size was valued at USD 10.5 billion in 2023 and is expected to reach USD 20.2 billion by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

Rising demand for advanced wound care, surgeries, and minimally invasive medical treatments supplement growth for medical adhesives market. The emergence of the trend of high chronic diseases and their subsequent need for an effective management solution for wounds will be pivotal to market growth. Advancement in adhesive formulations on the technological side is improving the performance and application of medical adhesives, which is crucial for better patient outcomes. Aging geriatric population growth further fosters a rise in medical care for extensive requirements, thereby boosting demand for application in medical adhesives.

Developments recently have demonstrated how the industry makes positive strides. For instance, in December 2023, demand for medical adhesives increased sharply, mainly due to the advancement in adhesive technology and an increasing level of awareness for these applications in healthcare. Thus, companies like 3M focus on developing products that especially meet a specific need in medicine, such as adhesives made for sensitive skin or those that can bring about faster healing times. This development creates competition where organizations continue to seek innovation that could meet the many demands of both healthcare professionals and their patients.

Similarly, in March of 2024, Wissen Research innovated some of the new inventive creations, from the adhesive type that improves the usability of medical adhesives across different applications. These innovations are important since they try to improve adhesion, biocompatibility, and easy usage of medical adhesives, which is solving some of the most important problems that exist in medical fields. Emphasis on user-friendly products is particularly important since this exactly reflects a continuation of the trend towards patient-centered care, where not only effectiveness but also comfort play a critical role in medical treatments.

Further development was seen in August 2024 with the launch of the learning center, focused on medical wearable adhesives, by Avery Dennison. This company will educate healthcare providers on what these medical adhesives are and their use in wearable medical products that are gaining popularity in the marketplace for tracking patient health. The company also obtained FDA clearance for two new high-viscosity tissue adhesives for innovations in skin closure. Again, this development requires an industry committed to developing effective, reliable solutions that can improve patients' care and the outcome of the surgery.

Drivers:

Rising Demand for Advanced Wound Care Solutions Drives Growth in the Medical Adhesives Market

The increasing demand for advanced solutions in wound care is driving medical adhesives. The rising importance that the healthcare segment is giving to effective and efficient management of wound care is making medical adhesives critical products in surgical and clinical settings. Advanced wound care products such as hydrocolloids, alginates, and foams require specialized adhesives to achieve optimum performance along with comfort for the patient. These adhesives also encourage faster healing as they maintain a moist environment and minimize trauma to the wound during changes in dressings, which are important for patient satisfaction and healing. Added to this is the increasing prevalence of chronic wounds caused by diseases such as diabetes and aging populations, which is functioning as a dominant force driving the growing demand for medical adhesives designed specifically for wound care. With the latest research related to adhesive solutions for dressing improvements without having complications such as infection or skin irritation, the demand for medical adhesives will be boosted widely with advanced wound care solutions as manufacturers innovate and expand the product range in this vital area of healthcare.

Increased Adoption of Minimally Invasive Surgical Techniques Fuels Medical Adhesives Market Growth

Extensive use of minimally invasive surgical (MIS) techniques has been the most prominent driving factor for the growth of the medical adhesives market. Popularized by its benefits, such as shorter recovery time, reduced postoperative pain, and lesser chances of complications compared with open surgery, this technique has experienced widespread acceptance. Medical adhesives have been used in various applications, including tissue sealing and wound closure in MIS, besides hemostasis. As healthcare providers and patients alike start to appreciate the benefits of minimally invasive approaches, the demand for effective medical adhesives used to facilitate those procedures continues to increase. Improvements in adhesive technology, such as biocompatible and bioactive adhesives, allow surgeons to use these products in more complex surgical scenarios. With greater attention to patient care and better surgical outcomes, there will be a boost in the adoption of medical adhesives in MIS. This will broaden the scope of products and applications of medical adhesives, further underlining their significance in surgery.

Restraint:

Concerns About Biocompatibility and Allergic Reactions Limit Medical Adhesives Market Growth

Despite greater demands for medical adhesives in the market, the largest difficulties facing growth for this market are biocompatibility issues and allergic reactions. Most of them carry chemical constituents that may cause skin irritation or hypersensitivity among their patients. These may lead to further complications including contact dermatitis and discomfort, and even an adverse reaction during treatment. The greater the education around these issues, the more cautious health care providers may become in using any of these adhesives in sensitive patient populations who already are suffering from some allergies or skin conditions. Regulatory scrutiny has also increased regarding the safety and efficacy of medical adhesives, an issue that has extended approval times for new products and innovations. Manufacturers face the challenge of coming up with adhesives that are not only effective but hypoallergenic and biocompatible as well. This can boost research and development costs, and eventually affect the supply and market expansion. As such, while the medical adhesive market continues to grow, meeting these challenges regarding biocompatibility and allergic reactions is still a significant challenge facing players in the industry.

Opportunity:

Expanding Applications of Medical Adhesives in Wearable Medical Devices Present New Growth Avenues

The growing applications of medical adhesives in wearable medical devices open up great growth opportunities in the market. As healthcare turns into remote patient monitoring and telehealth solutions, increasing demand has emerged for reliable and effective adhesives that can secure wearable devices. These include sensors that monitor critical parameters like vital signs, and blood glucose, among others, and adhesives applied for long-term performance with flexibility and minimum discomfort to the patient. In addition, advancements in smart wearable technologies with the inclusion of devices having artificial intelligence and data analytics increase demand for adhesives that can operate under varied environmental conditions while maintaining performance consistency. Manufacturers will be allowed to innovate and develop novel adhesive compounds specifically for these applications. The usability and performance of wearable devices will, therefore be maximized. The market for medical adhesives will, therefore likely expand considerably with the increasing trend in preventive health care and empowered patients.

Challenge:

Intense Competition and Pricing Pressure Hinder Profit Margins in the Medical Adhesives Market

The high competition, with intense price pressure, is expected to have serious implications on the profit margins of manufacturers in the medical adhesives market. Many companies have entered the market and continue to introduce new products, making the market highly competitive. Therefore, one has to do something different, such as innovation, quality, or customer service, from its competitors to survive in this market. This is because companies are compelled to use aggressive pricing to expand their client bases and preserve market shares. Such cost drivers are very hard, especially for smaller companies as they do not share the same economies of scale of scale as the bigger industry giants. Difficult also is maintaining quality at affordable prices. Companies have to spend on research and development to come up with innovative and effective adhesion solutions that will justify the price while, at the same time, finding avenues for cost savings in staying competitive. Coupled with the dynamic and fast nature of innovation in the market, with customers changing demands, this makes requirements for both quality and affordability a challenge that seems to keep hitting many manufacturers in the medical adhesives industry and will directly impact their profitability.

By Product Type

In 2023, the Synthetic and Semi-Synthetic segment dominated the Medical Adhesives Market with a market share of 60%. Among this segment, Cyanoacrylate emerged as the dominant subsegment, capturing approximately 40% of the synthetic adhesives market. Cyanoacrylate adhesives are widely used in surgical applications due to their rapid bonding capabilities and strong adhesion properties. For instance, they are utilized in various surgical procedures for skin closure and tissue bonding, offering advantages such as minimizing scarring and reducing healing time compared to traditional sutures. The growing preference for these adhesives in both surgical and clinical settings underlines their dominance within the synthetic adhesives category, driving the overall growth of the market.

By Technology

The Water-Based segment dominated the Medical Adhesives Market in 2023, holding a market share of 45%. This technology is favored due to its environmentally friendly properties and lower toxicity compared to solvent-based adhesives. Water-based adhesives are particularly popular in wound care applications, where patient safety is paramount. For example, manufacturers are developing water-based medical adhesives that can securely hold dressings in place without causing skin irritation, making them suitable for sensitive patients. Their versatility and ease of use in various applications further contribute to their strong market presence, solidifying their position as the leading technology in the medical adhesives sector.

By Application

In 2023, the external medical applications segment dominated the Medical Adhesives Market, with a market share of approximately 50%. Within this segment, wound care sub-applications emerged as the dominant category, accounting for around 30% of the overall market share. Wound care adhesives are critical for securing dressings, providing moisture management, and facilitating healing processes. For instance, hydrocolloid dressings that incorporate medical adhesives are extensively used to treat various types of wounds, including surgical and chronic wounds, due to their ability to maintain a moist environment and minimize trauma during dressing changes. The rising incidence of chronic wounds, alongside an increasing focus on effective wound management solutions, has significantly bolstered the wound care subsegment, reinforcing its dominance in the medical adhesives market.

By End-User

In 2023, the hospital segment emerged as the dominant player in the Medical Adhesives Market, holding an estimated market share of around 55%. Hospitals are the primary end-users of medical adhesives due to their extensive use in surgical procedures, wound management, and various medical applications. The high patient turnover in hospitals necessitates efficient and effective wound care solutions, driving the demand for advanced adhesives that offer quick bonding and reliable performance. For example, cyanoacrylate adhesives are frequently used in operating rooms for surgical skin closure, while polyurethane-based adhesives are employed in wound dressings. As hospitals continue to adopt innovative medical adhesives to enhance patient outcomes and streamline procedures, the hospital segment is expected to maintain its dominant position in the market.

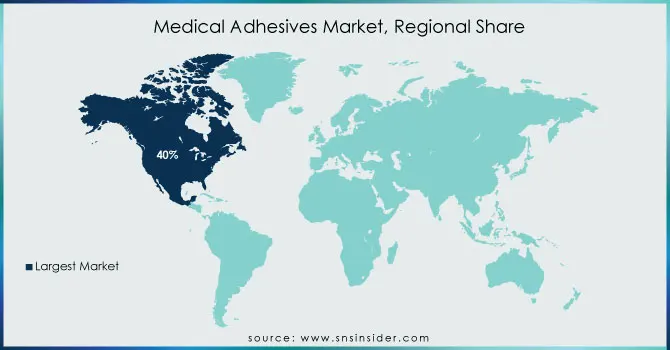

In 2023, North America dominated the Medical Adhesives Market, holding a market share of approximately 40%. The region's leadership can be attributed to the presence of advanced healthcare infrastructure, high rates of surgical procedures, and robust research and development activities. In particular, the United States is a significant contributor to this dominance, with its continuous innovation in medical technology and strong demand for advanced wound care solutions. For example, many leading manufacturers in North America are focusing on developing biocompatible and high-performance medical adhesives for various applications, including surgical adhesives and wound dressings. The increasing prevalence of chronic conditions requiring surgical interventions further drives the demand for effective medical adhesives, solidifying North America’s position as the leading region in the medical adhesives market.

Moreover, the Asia-Pacific region emerged as the fastest-growing region in the Medical Adhesives Market, with a CAGR of around 7%. This growth can be attributed to several factors, including the rapid expansion of healthcare facilities, increasing surgical procedures, and a rising awareness of advanced wound care management. Countries such as China and India are experiencing significant investments in healthcare infrastructure, leading to an increased demand for medical adhesives in various applications. For instance, the growing geriatric population in these countries, coupled with a rising incidence of chronic diseases, is driving the need for effective medical adhesives in surgical and wound care settings. Additionally, local manufacturers are entering the market with innovative products that cater to the specific needs of the region, further contributing to the market's rapid growth in Asia-Pacific.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

3M (Tegaderm, Vetbond, Steri-Strip)

Arkema Group (Bostik Medifirst, MEDIX adhesives)

Ashland Inc. (Dermabond, Purethane, Pureseal)

Avery Dennison Corporation (MED 5541U, MED 5663U, MED 5024)

H. B. Fuller (Swiftmelt, HL-1492, Fulltak)

Baxter International Inc. (Tisseel, CoSeal, Artiss)

Chemence (Krylex, Vitrex, Medibond)

Cohera Medical, Inc. (TissuGlu, Sylys Surgical Sealant)

ConvaTec Group Plc (AQUACEL, DuoDERM, Stomahesive)

Dow (DOWSIL, MG7-9900, MG7-9950)

GluStitch Inc. (GluStitch Twist, GluSeal, GluShield)

Henkel AG & Company (Loctite Hysol, Technomelt, Aquence)

Johnson & Johnson (Dermabond, Ethicon Securestrap, Prineo)

Medtronic Plc (Permacol, ProGrip, VenaSeal)

Nitto Denko Corporation (Hydrocolloid, AquaProtect, Medisafe Bond)

Scapa Group PLC (Scapa Soft-Pro, Bioflex, Hydrocolloid)

Stryker Corporation (Seal-N-Heal, TissuGlu, Floseal)

Takeda Pharmaceutical Company Limited (TachoSil, TachoComb, TachoBond)

Terumo Corporation (Aquabond, Hydrofit, Surpass Seal)

Wacker Chemie AG (Silpuran, Elastosil, Adhesive Gel)

Raw Materials and The Companies Providing the Raw Materials for Carbon

Acrylic Polymers:

3M Company

BASF SE

Kraton Corporation

Silicone Polymers:

Dow Inc.

Wacker Chemie AG

Momentive Performance Materials Inc.

Polyurethanes:

Huntsman Corporation

BASF SE

Covestro AG

Epoxy Resins:

Hexion Inc.

Mitsubishi Chemical Corporation

Epoxy Technology Inc.

Natural Polymers:

Collagen Solutions plc

Medtronic

Tissue Regenix Group plc

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.5 Billion |

| Market Size by 2032 | US$ 20.2 Billion |

| CAGR | CAGR of 7.5% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Natural [Fibrin, Collagen, Albumin], Synthetic and Semi-Synthetic [Cyanoacrylate, Epoxy, Acrylic, Polyurethane, Silicone, Others]) •By Technology (Water based, Solvent based, Solids and Hot melts, Others) •By Application (Dental [Denture Bonding Agents, Pit and Fissure Sealants, Restorative Adhesives, Luting Cements], Internal Medical Applications [Surgical Procedures, Organ Transplants, Tissue Engineering], External Medical Applications [Wound Care, Prosthetics) •By End-User (Hospitals, Clinics, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Company, Chemence, Ashland Inc., Dow, B. Fuller, Johnson & Johnson, Cohera Medical, Inc., Arkema Group, 3M, Avery Dennison Corporation and other key players |

| Drivers | • Rising Demand for Advanced Wound Care Solutions Drives Growth in the Medical Adhesives Market • Increased Adoption of Minimally Invasive Surgical Techniques Fuels Medical Adhesives Market Growth |

| Restraints | • Concerns About Biocompatibility and Allergic Reactions Limit Medical Adhesives Market Growth |

Ans: Primary or secondary type of research done by this reports.

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Water based, Solvent based, Solids and Hot melts and Others are the sub-segments of by Technology segment.

Ans: An increase in the demand for medical single-use items are the drivers for Medical Adhesives Market.

Ans: Global Medical Adhesives Market Size was valued at USD 9.13 billion in 2021, and expected to reach USD 15.15 billion by 2028, and grow at a CAGR of 7.5 % over the forecast period 2022-2028.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Regulatory Impact, by Country, by Region, 2023

5.3 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.4 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Medical Adhesives Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Natural

7.2.1 Natural Market Trends Analysis (2020-2032)

7.2.2 Natural Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Synthetic and Semi-Synthetic

7.3.1 Synthetic and Semi-Synthetic Market Trends Analysis (2020-2032)

7.3.2 Synthetic and Semi-Synthetic Market Size Estimates and Forecasts to 2032 (USD Million)

8. Medical Adhesives Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Water based

8.2.1 Water based Market Trends Analysis (2020-2032)

8.2.2 Water based Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Solvent based

8.3.1 Solvent based Market Trends Analysis (2020-2032)

8.3.2 Solvent based Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Solids and Hot melts

8.4.1 Solids and Hot melts Market Trends Analysis (2020-2032)

8.4.2 Solids and Hot melts Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Medical Adhesives Market Segmentation, by Application

9.1 Chapter Overview

9.2 Dental

9.2.1 Dental Market Trends Analysis (2020-2032)

9.2.2 Dental Market Size Estimates and Forecasts to 2032 (USD Million)

9.2.3 Denture Bonding Agents

9.2.3.1 Denture Bonding Agents Market Trends Analysis (2020-2032)

9.2.3.2 Denture Bonding Agents Market Size Estimates and Forecasts to 2032 (USD Million)

9.2.4 Pit and Fissure Sealants

9.2.4.1 Pit and Fissure Sealants Market Trends Analysis (2020-2032)

9.2.4.2 Pit and Fissure Sealants Market Size Estimates and Forecasts to 2032 (USD Million)

9.2.5 Restorative Adhesives

9.2.5.1 Restorative Adhesives Market Trends Analysis (2020-2032)

9.2.5.2 Restorative Adhesives Market Size Estimates and Forecasts to 2032 (USD Million)

9.2.6 Luting Cements

9.2.6.1 Luting Cements Market Trends Analysis (2020-2032)

9.2.6.2 Luting Cements Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Internal Medical Applications

9.3.1 Internal Medical Applications Market Trends Analysis (2020-2032)

9.3.2 Internal Medical Applications Market Size Estimates and Forecasts to 2032 (USD Million)

9.3.3 Surgical Procedures

9.3.3.1 Surgical Procedures Market Trends Analysis (2020-2032)

9.3.3.2 Surgical Procedures Market Size Estimates and Forecasts to 2032 (USD Million)

9.3.4 Organ Transplants

9.3.4.1 Organ Transplants Market Trends Analysis (2020-2032)

9.3.4.2 Organ Transplants Market Size Estimates and Forecasts to 2032 (USD Million)

9.3.5 Tissue Engineering

9.3.5.1 Tissue Engineering Market Trends Analysis (2020-2032)

9.3.5.2 Tissue Engineering Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 External Medical Applications

9.4.1 External Medical Applications Market Trends Analysis (2020-2032)

9.4.2 External Medical Applications Market Size Estimates and Forecasts to 2032 (USD Million)

9.4.3 Wound Care

9.5.3.1 Wound Care Market Trends Analysis (2020-2032)

9.5.3.2 Wound Care Market Size Estimates and Forecasts to 2032 (USD Million)

9.4.4 Prosthetics

9.6.4.1 Prosthetics Market Trends Analysis (2020-2032)

9.6.4.2 Prosthetics Market Size Estimates and Forecasts to 2032 (USD Million)

10. Medical Adhesives Market Segmentation, by End-User

10.1 Chapter Overview

10.2 Hospitals

10.2.1 Hospitals Market Trends Analysis (2020-2032)

10.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Clinics

10.3.1 Clinics Market Trends Analysis (2020-2032)

10.3.2 Clinics Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Ambulatory Surgical Centers

10.4.1 Ambulatory Surgical Centers Market Trends Analysis (2020-2032)

10.4.2 Ambulatory Surgical Centers Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 Others

10.5.1 Others Market Trends Analysis (2020-2032)

10.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Medical Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.2.4 North America Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.5 North America Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.6 North America Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.2.7.2 USA Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.7.3 USA Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.7.4 USA Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.2.8.2 Canada Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.8.3 Canada Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.8.4 Canada Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.2.9.2 Mexico Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.9.3 Mexico Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.9.4 Mexico Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Medical Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.6 Eastern Europe Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.7.2 Poland Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.7.3 Poland Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.7.4 Poland Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.8.2 Romania Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.8.3 Romania Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.8.4 Romania Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.9.2 Hungary Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.9.3 Hungary Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.9.4 Hungary Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.10.2 Turkey Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.10.3 Turkey Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.10.4 Turkey Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Medical Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.4 Western Europe Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.5 Western Europe Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.6 Western Europe Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.7.2 Germany Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.7.3 Germany Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.7.4 Germany Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.8.2 France Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.8.3 France Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.8.4 France Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.9.2 UK Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.9.3 UK Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.9.4 UK Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.10.2 Italy Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.10.3 Italy Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.10.4 Italy Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.11.2 Spain Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.11.3 Spain Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.11.4 Spain Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.12.2 Netherlands Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.12.3 Netherlands Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.12.4 Netherlands Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.13.2 Switzerland Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.13.3 Switzerland Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.13.4 Switzerland Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.14.2 Austria Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.14.3 Austria Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.14.4 Austria Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Medical Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.4 Asia Pacific Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.5 Asia Pacific Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.6 Asia Pacific Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.7.2 China Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.7.3 China Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.7.4 China Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.8.2 India Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.8.3 India Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.8.4 India Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.9.2 Japan Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.9.3 Japan Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.9.4 Japan Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.10.2 South Korea Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.10.3 South Korea Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.10.4 South Korea Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.11.2 Vietnam Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.11.3 Vietnam Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.11.4 Vietnam Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.12.2 Singapore Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.12.3 Singapore Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.12.4 Singapore Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.13.2 Australia Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.13.3 Australia Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.13.4 Australia Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Medical Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.4 Middle East Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.5 Middle East Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.6 Middle East Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.7.2 UAE Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.7.3 UAE Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.7.4 UAE Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.8.2 Egypt Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.8.3 Egypt Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.8.4 Egypt Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.10.2 Qatar Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.10.3 Qatar Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.10.4 Qatar Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Medical Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.2.4 Africa Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.5 Africa Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.6 Africa Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.2.7.2 South Africa Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.7.3 South Africa Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.7.4 South Africa Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.2.8.2 Nigeria Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.8.4 Nigeria Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Medical Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.4 Latin America Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.5 Latin America Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.6 Latin America Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.7.2 Brazil Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.7.3 Brazil Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.7.4 Brazil Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.8.2 Argentina Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.8.3 Argentina Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.8.4 Argentina Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.9.2 Colombia Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.9.3 Colombia Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.9.4 Colombia Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Medical Adhesives Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America Medical Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America Medical Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America Medical Adhesives Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

12. Company Profiles

12.1 Henkel AG & Company

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Chemence

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Ashland Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Dow

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 B. Fuller

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Johnson & Johnson

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Cohera Medical, Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Arkema Group

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 3M

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Avery Dennison Corporation

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Natural

Fibrin

Collagen

Albumin

Synthetic and Semi-Synthetic

Cyanoacrylate

Epoxy

Acrylic

Polyurethane

Silicone

Others

By Technology

Water based

Solvent based

Solids and Hot melts

Others

By Application

Dental

Denture Bonding Agents

Pit and Fissure Sealants

Restorative Adhesives

Luting Cements

Internal Medical Applications

Surgical Procedures

Organ Transplants

Tissue Engineering

External Medical Applications

Wound Care

Prosthetics

By End-User

Hospitals

Clinics

Ambulatory Surgical Centers

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Acrylic Polymer Market Size was valued at USD 610 million in 2023, and is expected to reach USD 883.4 million by 2032, and grow at a CAGR of 4.2% over the forecast period 2024-2032.

The Glutaraldehyde Market size was valued at USD 701.3 million in 2023. It is estimated to hit USD 1039.1 million by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

Biodegradable Plastics Market was valued at USD 6.7 Billion in 2023 and is anticipated to reach USD 28.7 Billion by 2032 at a CAGR of 15.2% from 2024-2032.

Dimethylformamide (DMF) Market size was USD 2.53 Billion in 2023 and is expected to reach USD 3.92 Billion by 2032, growing at a CAGR of 4.98 % from 2024-2032.

Electronic Chemicals CDMO & CRO Market was valued at USD 0.45 Bn in 2023 and is expected to reach USD 0.81 Bn by 2032, at a CAGR of 6.80% from 2024 to 2032.

The Slurry Oil market size was USD 3.51 Billion in 2023 and is expected to reach USD 5.23 Billion by 2032, growing at a CAGR of 4.53 % from 2024 to 2032.

Hi! Click one of our member below to chat on Phone