Get More Information on Medical Adhesive Tapes Market - Request Sample Report

The Medical Adhesive Tapes Market Size was valued at USD 9.66 Billion in 2023 and is expected to reach USD 16.30 billion by 2032 and grow at a CAGR of 6.87% over the forecast period 2024-2032.

The increasing understanding of the advantages of medical adhesive tape is greatly driving their use in the healthcare sector. Medical adhesive tapes are increasingly acknowledged for their convenience, dependability, and efficacy in fastening dressings, catheters, and other medical equipment. Recent developments and government statistics provide additional support for this awareness. The FDA has also given the green light to numerous newly developed medical adhesive tapes with enhanced hypoallergenic characteristics and improved sticking power, guaranteeing patient safety and comfort.

The European Medical Device Regulation that came into effect in 2021 requires more stringent safety and performance criteria, motivating manufacturers to be innovative and manufacture adhesive tapes of better quality. These regulatory and market trends are driving the uptake of medical adhesive tapes, as healthcare providers and patients are acknowledging more and more their crucial importance in effective medical care and device management.

The increasing cost of healthcare around the world is a key factor leading to the need for advanced medical products, such as adhesive tapes utilized in different medical settings. With increased investments in healthcare infrastructure by both governments and private sectors, there has been a rise in funding for innovative and efficient medical supplies. For instance, The Centers for Medicare & Medicaid Services (CMS) reported that U.S. healthcare spending reached approximately USD 4800 Billion in 2024, reflecting a significant increase in funding allocated to healthcare infrastructure and innovation.

As a result, the increase in healthcare spending directly contributes to the expansion and advancement in the market for medical adhesive tapes, addressing the changing requirements of contemporary healthcare systems.

For instance, in 2023, the European Union allocated over USD 32.82 billion in funding through the Horizon Europe program for healthcare research and innovation in 2023. This funding supports the development of advanced medical technologies, including adhesive products used in wound care and surgical applications.

Furthermore, the rising popularity of home healthcare and self-treatment is driving the need for easy-to-use medical tapes suitable for use beyond conventional medical environments. With an increase in the number of patients handling chronic illnesses and recuperating at home, there is a greater demand for medical products that are user-friendly and dependable. Factors such as the growing elderly population, increasing healthcare expenses, and improvements in telemedicine are pushing this change.

Drivers

An increase in surgical procedures will drive medical adhesive tape market growth.

A rise in surgical interventions plays a major role in fueling the expansion of the medical adhesive tapes market. As the world's population gets older and chronic diseases become more common, the number of surgeries done across the globe is increasing. The World Health Organization reported that around 300 million significant surgical procedures were carried out worldwide in 2020, marking a significant rise from previous years. The increase in surgical procedures, whether planned or urgent, requires the widespread utilization of medical adhesive tapes for closing wounds, securing dressings, and fastening medical equipment. Medical adhesive tapes are crucial for postoperative care to maintain wound integrity, decrease infection risks, and ensure patient comfort. Furthermore, the market demand is also influenced by advancements in minimally invasive surgical techniques that necessitate specialized adhesive tapes. The increasing number of surgical operations highlights the urgent requirement for dependable and top-notch medical adhesive tapes, boosting their market expansion as medical professionals aim to improve surgical results and patient recovery journeys.

Restrain

The high cost of advanced tapes may hamper the market growth.

The expensive price of innovative medical adhesive tapes could hinder market expansion by restricting their availability and usage. Advanced adhesive tapes, with upgraded features like improved hypoallergenic formulas, stronger adhesion, and increased moisture resistance, usually come with a higher development and production cost. The increased expenses may be too expensive for smaller healthcare providers, medical facilities with limited budgets, and patients in low- and middle-income areas. Therefore, these individuals may choose cheaper but less advanced options. Moreover, the higher expenses can put pressure on healthcare funds, particularly when extensive amounts are required for continuous therapies and operations.

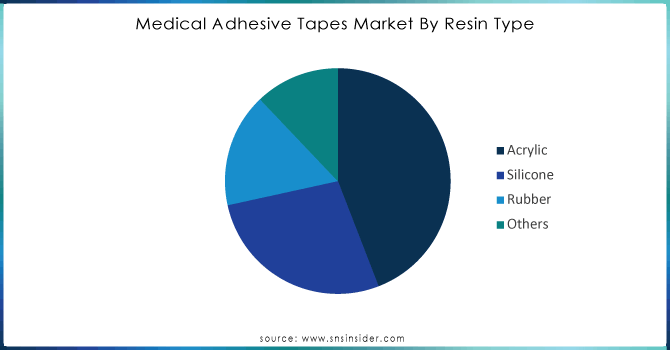

By Resin Type

The Acrylic held the largest market share in the type segment around 44.12% in 2023. Acrylic adhesive tapes are popular for their strong adhesion, versatility, and ability to bond with various surfaces. These tapes offer durable bonds and can withstand environmental elements like moisture and temperature changes, which makes them appropriate for different medical uses like wound dressings, surgeries, and securing medical devices.

Acrylic adhesives provide excellent breathability, essential for patient comfort and skin health, decreasing the chances of maceration and speeding up the healing process. Their hypoallergenic quality reduces the chance of allergic reactions, making them safe to use on sensitive skin. Moreover, acrylic adhesive tapes offer the capability of being easily applied to various backing materials, allowing for versatility in both product design and usage.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Backing Material

In the backing material segment paper type held the largest market share around 41.63% in 2023. Paper-backed tapes are popular in various medical applications for their cost-effectiveness compared to other materials, such as for wound care and surgical procedures. The paper backing offers a seamless surface for applying adhesive and can be removed easily without leaving any residue, which is essential for ensuring patient comfort and effective wound care. Furthermore, paper-backed tapes provide excellent airflow, which aids in avoiding skin maceration and promotes healing. Their practicality is further increased by the ease with which medical information or instructions can be printed on them. The characteristics of paper-backed medical adhesive tapes have led to their significant market share in the healthcare sector as a popular and reliable choice.

By Application

In the application segment surgery segment held the largest market share around 45.63% in 2023. Surgical uses demand dependable and efficient adhesive tapes for securing dressings, managing wounds, and attaching medical devices. These tapes are necessary for upholding clean conditions, securing wounds correctly, and offering assistance throughout the healing period. Their indispensable use in the operating room comes from their strong adhesion, ability to conform to various skin types, and withstand exposure to bodily fluids. Moreover, the growing number of surgeries performed worldwide, due to reasons like the aging population and advancements in surgical methods, enhances the need for specific adhesive tapes. The surgery sector is at the forefront of the market due to the demand for long-lasting, efficient, and top-notch adhesive products in surgical environments.

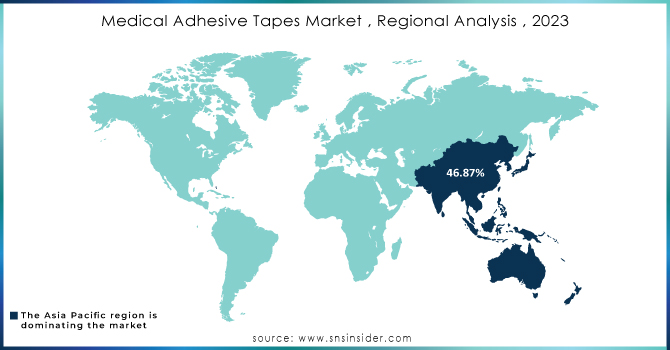

Asia Pacific held the largest market share in the medical adhesive tapes market about 46.87% in 2023 because of multiple important factors. The rising need for advanced medical products is growing due to increased healthcare infrastructure development in the region, supported by government and private sector investments. Moreover, the increased number of elderly individuals and the growing presence of chronic illnesses result in an increased need for medical services and related items such as adhesive tapes. The expansion of the market is also fueled by the rise of medical tourism and enhancements in healthcare accessibility in developing countries. Furthermore, the region's growing emphasis on enhancing healthcare quality and incorporating cutting-edge technologies promotes the utilization of modern medical adhesive tapes. Together, these elements contribute to a thriving and quickly expanding market for medical adhesive tapes in the Asia-Pacific area.

Avery Dennison Corporation (US), 3M Company (US), Johnson & Johnson (US), Medtronic PLC (Ireland) , Scapa Group PLC (UK), Nichiban Co., Ltd. (Japan), Paul Hartmann AG (Germany), Nitto Denko Corporation (Japan), Medline Industries, Inc. (US), Smith & Nephew PLC (UK), Mactac Mexico, Lohmann GmbH & Co.KG. and others.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.66 Billion |

| Market Size by 2032 | US$ 16.30 Billion |

| CAGR | CAGR of 6.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By resin type (Acrylic, Silicone, Rubber, Others) • By backing material (Paper, Fabric, Plastic, Others) • By application (Surgery, Wound Dressing, Splints, Secure IV lines, Ostomy Seals, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Avery Dennison Corporation (US), 3M Company (US), Johnson & Johnson (US), Medtronic PLC (Ireland) , Scapa Group PLC (UK), Nichiban Co., Ltd. (Japan), Paul Hartmann AG (Germany, Nitto Denko Corporation (Japan), Medline Industries, Inc. (US), Smith & Nephew PLC (UK), Mactac Mexico, Lohmann GmbH & Co.KG |

| DRIVERS | • An increase in surgical procedures will drive medical adhesive tape market growth. |

| Restraints | •The high cost of advanced tapes may hamper the market growth. |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Surgery, Wound Dressing, Splints, Secure IV lines, Ostomy Seals and Others are the sub-segments of by application segment.

Ans: Due to the spread of COVID-19, there have been a number of problems in the value chain of medical adhesive tapes. The lack of suppliers has caused the most trouble in the value chain. This is because many industries have shut down, including raw material manufacturers. This was made worse by road restrictions put in place all over the world to stop the pandemic from spreading. Because of this, the prices of raw materials like PVC and paper went up by 11% to 50% for a short time.

Ans: Putting more price pressure on market participants, Getting the word out about high-tech wound care products and Putting in place strict rules and regulations are the challenges faced by the Medical Adhesive Tapes Market.

Ans: Medical Adhesive Tapes Market Size was valued at USD 9.66 billion in 2023, and is expected to reach USD 16.30 billion by 2032, and grow at a CAGR of 6.87 % over the forecast period 2024-2032.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Medical Adhesive Tapes Market Segmentation, by Resin Type

7.1 Chapter Overview

7.2 Acrylic

7.2.1 Acrylic Market Trends Analysis (2020-2032)

7.2.2 Acrylic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Silicone

7.3.1 Silicone Market Trends Analysis (2020-2032)

7.3.2 Silicone Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Rubber

7.4.1 Rubber Market Trends Analysis (2020-2032)

7.4.2 Rubber Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Medical Adhesive Tapes Market Segmentation, by Backing Material

8.1 Chapter Overview

8.2 Paper

8.2.1 Paper Market Trends Analysis (2020-2032)

8.2.2 Paper Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Fabric

8.3.1 Fabric Market Trends Analysis (2020-2032)

8.3.2 Fabric Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Plastic

8.4.1 Plastic Market Trends Analysis (2020-2032)

8.4.2 Plastic Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Medical Adhesive Tapes Market Segmentation, by End-use Industry

9.1 Chapter Overview

9.2 Surgery

9.2.1 Surgery Market Trends Analysis (2020-2032)

9.2.2 Surgery Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Wound Dressing

9.3.1 Wound Dressing Market Trends Analysis (2020-2032)

9.3.2 Wound Dressing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Splints

9.4.1 Splints Market Trends Analysis (2020-2032)

9.4.2 Splints Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Secure IV lines

9.5.1 Secure IV lines Market Trends Analysis (2020-2032)

9.5.2 Secure IV lines Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Ostomy Seals

9.6.1 Ostomy Seals Market Trends Analysis (2020-2032)

9.6.2 Ostomy Seals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Medical Adhesive Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.2.4 North America Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.2.5 North America Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.2.6.2 USA Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.2.6.3 USA Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.2.7.2 Canada Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.2.7.3 Canada Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.2.8.3 Mexico Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.1.6.3 Poland Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.1.7.3 Romania Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.5 Western Europe Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.6.3 Germany Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.7.2 France Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.7.3 France Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.8.3 UK Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.9.3 Italy Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.10.3 Spain Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.13.3 Austria Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Medical Adhesive Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.5 Asia Pacific Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.6.2 China Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.6.3 China Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.7.2 India Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.7.3 India Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.8.2 Japan Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.8.3 Japan Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.9.3 South Korea Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.10.3 Vietnam Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.11.3 Singapore Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.12.2 Australia Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.12.3 Australia Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Medical Adhesive Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.1.5 Middle East Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.1.6.3 UAE Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Medical Adhesive Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.2.4 Africa Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.2.5 Africa Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Medical Adhesive Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.4 Latin America Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.6.5 Latin America Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.6.6.3 Brazil Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.6.7.3 Argentina Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.6.8.3 Colombia Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Medical Adhesive Tapes Market Estimates and Forecasts, by Resin Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Medical Adhesive Tapes Market Estimates and Forecasts, by Backing Material (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Medical Adhesive Tapes Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11. Company Profiles

11.1 Avery Dennison Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 3M Company

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Johnson & Johnson

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Medtronic PLC

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Scapa Group PLC

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Nichiban Co., Ltd.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Paul Hartmann AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Nitto Denko Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Medline Industries, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Smith & Nephew PLC

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin Type

Acrylic

Silicone

Rubber

Others

By Backing Material

Paper

Fabric

Plastic

Other

By Application

Surgery

Wound Dressing

Splints

Secure IV lines

Ostomy Seals

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Liquid Crystal Polymers Market size was valued at USD 1.53 billion in 2023 and is expected to reach USD 3.18 billion by 2032 and grow at a CAGR of 9.77% over the forecast period of 2024-2032.

Green Coatings Market was valued at USD 98.64 Billion in 2023 and is expected to reach USD 144.21 Billion by 2032, growing at a CAGR of 4.31% from 2024-2032.

The Intumescent Coatings Market Size was valued at USD 1.18 Billion in 2023 and is expected to reach USD 1.97 Billion by 2032, growing at a CAGR of 5.88% over the forecast period of 2024-2032.

The Epoxy Resins Market Size was valued at USD 12.89 billion in 2023 and is expected to reach USD 20.85 billion by 2032 and grow at a CAGR of 5.49% over the forecast period 2024-2032.

Acrylonitrile Market size was USD 12.46 Billion in 2023 and is expected to reach USD 17.04 Billion by 2032, growing at a CAGR of 3.54% from 2024 to 2032.

Insoluble Sulfur Market was valued at USD 1.13 Billion in 2023 and is expected to reach USD 1.91 Billion by 2032, growing at a CAGR of 6.00% from 2024-2032.

Hi! Click one of our member below to chat on Phone