Get more information on Media Asset Management Market - Request Sample Report

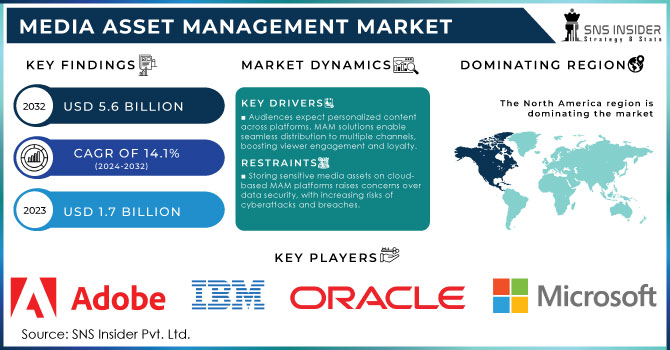

Media Asset Management Market size was valued at USD 1.7 billion in 2023 and is expected to grow to USD 5.6 billion by 2032 and grow at a CAGR of 14.1% over the forecast period of 2024-2032.

The media asset management market is witnessing rapid growth due to the increasing digitalization in all industries, led by the government’s efforts to promote innovation and technology. According to the latest statistics provided by the International Telecommunication Union and supported by national institutions, governments have invested $5.8 billion in media technology equipment as part of their ongoing digitalization efforts. The rise of content creators has fostered the development and use of over-the-top channels that require sophisticated MAM systems. The increase in demand has been influenced by the size of the media and entertainment industry in the United States, with the Department of Commerce estimating its worth at $660 billion. The European Union, spearheaded by the European Union’s Digital Decade, aims to ensure that its citizens have access to digital tools and services. As part of the media industry, the film and audiovisual sectors are set to benefit from the ruling, which will drive demand for MAM systems, among other digital tools.

The use of digital media has increased worldwide, assisted by government investments in high-speed internet and 5G connectivity. The consumption of digital media continues to rise, with South Korea, China, and India leveraging the available capacity in the cloud as well as the deployment of digital content distribution. Meanwhile, the increase in the use of smartphones is attributable to customers’ reliance on digital media for information, entertainment, and other purposes. There has been a rise in the demand for solutions that optimize content management across multiple channels.

| Category | Details |

|---|---|

| Key Function | Media Asset Management systems help organize, store, and retrieve digital media files, reducing content search time by 30-40%. |

| Cloud-based MAM Solutions | 55% of new MAM implementations are cloud-based, offering scalability and remote access, especially for OTT platforms. |

| Benefits | Reduces time to market for media content by 25% through efficient content management and streamlined workflows. |

| Integration with AI | AI-powered MAM solutions improve content tagging accuracy by 50-60%, leading to faster media retrieval and metadata management. |

| Content Storage Efficiency | MAM systems reduce storage space requirements by 30-35% through efficient file compression and archiving. |

| Demand in Broadcasting | Over 70% of broadcasters have adopted MAM to manage vast libraries of digital content, improving workflow efficiency. |

Drivers

Cloud-based MAM systems offer flexibility, scalability, and cost-efficiency, allowing media companies to store, manage, and distribute assets without hefty infrastructure costs. This trend is accelerating cloud adoption for media management.

Audiences expect personalized content experiences across various platforms. MAM solutions enable seamless content distribution to multiple channels and devices, enhancing viewer engagement and loyalty.

With the rise of digital platforms, OTT services, and social media, there is a growing demand for efficient management of media assets. Content creators and broadcasters require robust MAM systems to handle large volumes of video, audio, and image files.

Increased adoption of cloud-based solutions is one of the primary drivers in the media asset management market. The rise of such solutions has revolutionized the way media assets are stored, handled, and transferred. Cloud-based MAM systems show a unique level of flexibility and scalability in comparison to traditional on-premise platforms since they allow media companies to adjust to the dynamic loads without large-scale infrastructure investments. A report indicates that by 2024, more than 70% of media companies will have applied either cloud storage or cloud-based media processing.

This trend is being driven by the need for media companies to handle ever-growing volumes of content. For instance, streaming services such as Netflix, Amazon Prime, and Disney produce thousands of hours of new content every year. Handling such a large-scale media library requires an effective and efficient management of large-scale media libraries. Cloud-based MAM allows such companies to store and retrieve large amounts of collected data and to deliver media across the globe. Due to the utilization of high-speed networks, the shear latency becomes insignificant. For example, during the last coverage of the Olympics in 2020, BBC adopted the cloud-based MAM allowing all teams to access the same content in real-time across multiple locations. This was a breakthrough since it allowed all engineers, directors, producers, and reporters to work remotely and collaborate on the same content. The expansion of 5G networks drives the shift in cloud-based MAM because it ensures high-quality and fast data transfer. As a result, buffering becomes less evident, and content is delivered more effectively and efficiently.

Restraints:

The upfront cost of implementing MAM systems, especially for on-premise solutions, can be a barrier for smaller media companies, limiting widespread adoption.

Storing sensitive media assets on cloud-based MAM platforms raises concerns over data security, with increasing risks of cyberattacks and breaches.

One of the major limitations in the media asset management market is security and privacy concerns. In particular, as media organizations pursue the adoption of larger-scale cloud-based solutions, the threat of data breaches and depriving access to assets, intellectual and confidential production content, and clients’ data, is becoming more severe. Therefore, providing a secure solution and using encryption, access control, data-gravity guards, and audits are required for proper MAM. However, this process is rather expensive and complex, as the prior implementation of such measures requires substantial resource allocation before using the solutions on the corresponding cloud hosts. In addition, the adoption of MAM may become even more complicated due to new rules and regulations, such as GDPR, about the use of program solutions and customer data. As a result, concerns over security vulnerabilities and compliance with legal standards can hinder the broader adoption of cloud-based MAM systems.

By End-User

Media & Entertainment was the leading segment in this global media asset management market and accounted for a 29% share in 2023. The reasons were mainly the sheer volume of digital content that gets created every day and the need to store, retrieve, and disseminate it effectively. According to a recent report by the U.S. The Bureau of Labor Statistics projects that employment in the media and entertainment sector will rise 7% from 2023 to 2032, faster than for all occupations. This increase in demand is likely to lead to new demand for MAM systems as companies operating within this sector are likely to look towards managing their resources and distributing their assets more efficiently.

Moreover, this segment is witnessing growth with global demand for localization of content and government efforts to promote the creation and dissemination of digital content. The U.K. Department for Digital, Culture, Media, and Sport reported a 15% year-on-year increase in demand for media and entertainment technology in 2023, while India’s Ministry of Information and Broadcasting is promoting indigenous content creation under the "Digital India" initiative. With these government-sponsored initiatives, the industry will continually need scalable MAM systems to support its fast growth in content delivery and continue dominating the market.

By Organization Size

Large enterprises held 76% market share in 2023 because managing high volumes of digital assets efficiently is their demand. There is a demand for media asset management among large organizations, especially in broadcasting, OTT services, and advertising. According to the U.S. Department of Commerce, media companies with annual revenues greater than $1 billion have reported a 12% growth in digital content creation during the last year, attributing their aggressive spending to sophisticated media asset management systems.

Huge organizations will have an investment in customized and high-performance MAM systems, capable of processing vast amounts of data-the data that an individual organization can handle will be large enough for easy streamlining of their work, automation of processes, and protection of data. For example, according to the report of the European Commission in 2023, large enterprises remain a leading performer in the AI-driven MAM systems across organizations as they help optimize their media distribution strategy on multiple channels and further enforce their dominance in the market. Thus, large enterprises' commanding market share is mainly driven by the ability to afford and deploy advanced technologies at scale.

By Deployment

In 2023, the cloud deployment segment accounted for the highest market share, holding around 72%. The increasing adoption of cloud computing technologies across industries is a primary driver for this shift towards MAM solutions. Moreover, cloud solutions offer better scalability, flexibility, and cost-effectiveness. U.S. data revealed that. Federal Communications Commission, cloud computing investments grew 25% in 2023, mainly attributed to the demand for more infrastructure for cloud to support media storage and streaming services.

The cloud-first policies started by the European Union within the EU Cloud Strategy have also made companies begin to shift from the on-premises model of MAM systems to the cloud model. In this context, these solutions for the cloud enable media companies to manage vast amounts of digital assets remotely while offering better collaboration and security capabilities. This tendency is likely to grow as more and more organizations realize the importance of cloud-based deployments in running complex media ecosystems efficiently.

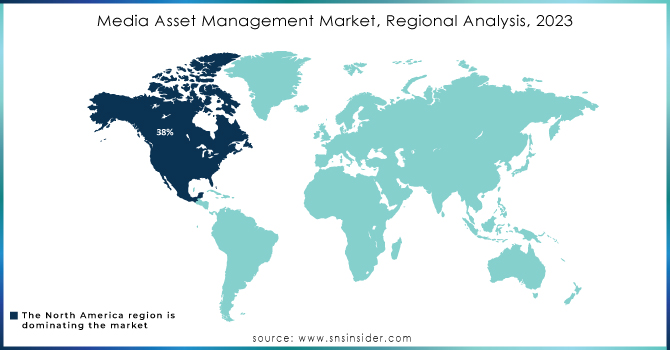

In 2023, North America dominated the media asset management market and accounted for about 38% of revenue shares. This dominance of regions is due to the United States, as the country is characterized by a developed digital ecosystem, large investments in media infrastructure, and industry participants. According to the U.S. Department of Commerce, investments in digital media technology continue to grow in North America in 2022, more than $12 billion was invested in MAM. Many key players are in the United States Adobe Systems, Avid Technology, Inc., and Qualcomm Inc./APIC. In the United States, there is the most developed network infrastructure, and high-speed internet, and there is also a wide use of OTT platforms, which has a positive effect on the development of media digital management.

The Asia-Pacific region shows the highest growth rate from 2024 to 2032. According to Asia-Pacific Telecommunity, investments in digital transformation activities in emerging markets: India, China, and Southeast Asia rigid speed. The governments of these countries are focusing heavily on 5G rollouts and cloud computing infrastructure to keep up with the demand for digital content. For example, according to the Ministry of Industry and Information Technology of China, in 2023 the country’s digital economy grew by 18%, which has a positive effect on the growing interest in the MAM system. Improving digital infrastructure and the government’s support through national digital localized infrastructure are the key factors that contribute to the growth of traffic in this region.

Need any customization research/data on Media Asset Management Market - Enquiry Now

The U.S. Department of Commerce reported in January 2024 that it had invested $3 billion in digital media infrastructure, to support cloud-based MAM solutions; The investment is to enable the scaling up of storage and processing capacities, essential for handling larger amounts of digital media with the advent on over-the-top (OTT) platforms as well as content creators based solely in-digital.

Cloudinary has announced enhancements to its programmable media API and enterprise media asset management (MAM) solution in December 2023, including additions that improve tools for automated image editing at a massive scale. These upgrades are engineered to boost digital asset time-to-market and provide a simple yet effective way for both tech-savvy users as well as non-technical ones. The improvements also foster employee autonomy and efficiency, thus improving media management.

In May 2022, Arvato Systems upgraded VidiNet, its cloud-based media services platform adding technology capabilities to add metadata on new recorded videos and images. Cataloging and retrieval of media assets were significantly faster and more efficient, creating a better bookend-to-end solution for overall media asset management workflows.

Key Service Providers:

Adobe Systems Incorporated (Adobe Premiere Pro, Adobe Creative Cloud)

IBM Corporation (IBM Aspera, IBM Watson Media)

Oracle Corporation (Oracle Content Management, Oracle Cloud Infrastructure)

Microsoft Corporation (Azure Media Services, Microsoft Stream)

Cloudinary (Media Optimizer, Programmable Media API)

Avid Technology, Inc. (Avid MediaCentral, Avid Nexis)

Dalet Digital Media Systems (Dalet Galaxy five, Dalet Flex)

Widen Enterprises (Widen Collective, Widen Media Asset Management)

Vimeo, Inc. (Vimeo OTT, Vimeo Enterprise)

Arvato Systems (VidiNet, Media Management Cloud)

Users of MAM Services

The Walt Disney Company

Netflix, Inc.

BBC (British Broadcasting Corporation)

Warner Bros. Discovery, Inc.

NBCUniversal Media, LLC

ViacomCBS (now Paramount Global)

Sony Pictures Entertainment

Hulu, LLC

Spotify Technology S.A.

Fox Corporation

| Report Attributes | Details |

| Market Size in 2023 | USD 1.7 Bn |

| Market Size by 2032 | USD 5.6 Bn |

| CAGR | CAGR of 14.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Organization Size (SMEs (Small and Medium Enterprises), and Large Enterprises) • By Deployment (On-Premise, Cloud) • By End-User (Media and Entertainment, BFSI, Government, Healthcare, Retail, Manufacturing, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adobe Systems Incorporated, IBM Corporation, Oracle Corporation, Microsoft Corporation, Cloudinary, Avid Technology, Inc., Dalet Digital Media Systems, Widen Enterprises, Vimeo, Inc., Arvato Systems |

| Key Drivers | • Cloud-based MAM systems offer flexibility, scalability, and cost-efficiency, allowing media companies to store, manage, and distribute assets without hefty infrastructure costs. This trend is accelerating cloud adoption for media management. • Audiences expect personalized content experiences across various platforms. MAM solutions enable seamless content distribution to multiple channels and devices, enhancing viewer engagement and loyalty. • With the rise of digital platforms, OTT services, and social media, there is a growing demand for efficient management of media assets. Content creators and broadcasters require robust MAM systems to handle large volumes of video, audio, and image files. |

| Market Restraints | • The upfront cost of implementing MAM systems, especially for on-premise solutions, can be a barrier for smaller media companies, limiting widespread adoption. • Storing sensitive media assets on cloud-based MAM platforms raises concerns over data security, with increasing risks of cyberattacks and breaches. |

The CAGR of the Media Asset Management Market for the forecast period 2024-2032 is 14.1%.

The Media Asset Management Market is expected to reach USD 5.6 billion by 2032.

Some of the major key players in the Media Asset Management Market are Adobe Systems Incorporated, IBM Corporation, Oracle Corporation, Microsoft Corporation, Cloudinary, Avid Technology, Inc., Dalet Digital Media Systems, Widen Enterprises, Vimeo, Inc., Arvato Systems, and others.

The Media Asset Management Market was valued at USD 1.7 billion in 2023.

The North American region dominated the Media Asset Management Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Media Asset Management (MAM) Market Segmentation, By Organization Size

7.1 Chapter Overview

7.2 SMEs (Small and Medium Enterprises)

7.2.1 SMEs (Small and Medium Enterprises) Market Trends Analysis (2020-2032)

7.2.2 SMEs (Small and Medium Enterprises) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Large Enterprises

7.3.1 Large Enterprises Market Trends Analysis (2020-2032)

7.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Media Asset Management (MAM) Market Segmentation, By Deployment

8.1 Chapter Overview

8.2 On-Premise

8.2.1 On-Premise Market Trends Analysis (2020-2032)

8.2.2 On-Premise Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cloud

8.3.1 Cloud Market Trends Analysis (2020-2032)

8.3.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Media Asset Management (MAM) Market Segmentation, By End-User

9.1 Chapter Overview

9.2 Media and Entertainment

9.2.1 Media and Entertainment Market Trends Analysis (2020-2032)

9.2.2 Media and Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 BFSI

9.3.1 BFSI Market Trends Analysis (2020-2032)

9.3.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Healthcare

9.4.1 Healthcare Market Trends Analysis (2020-2032)

9.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Government

9.5.1 Government Market Trends Analysis (2020-2032)

9.5.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Retail

9.6.1 Retail Market Trends Analysis (2020-2032)

9.6.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Manufacturing

9.7.1 Manufacturing Market Trends Analysis (2020-2032)

9.7.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Other

9.8.1 Other Market Trends Analysis (2020-2032)

9.8.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Media Asset Management (MAM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.2.4 North America Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.2.5 North America Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.2.6.2 USA Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.2.6.3 USA Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.2.7.2 Canada Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.2.7.3 Canada Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.2.8.2 Mexico Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.2.8.3 Mexico Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Media Asset Management (MAM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.1.6.2 Poland Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.1.6.3 Poland Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.1.7.2 Romania Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.1.7.3 Romania Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Media Asset Management (MAM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.4 Western Europe Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.5 Western Europe Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.6.2 Germany Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.6.3 Germany Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.7.2 France Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.7.3 France Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.8.2 UK Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.8.3 UK Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.9.2 Italy Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.9.3 Italy Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.10.2 Spain Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.10.3 Spain Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.13.2 Austria Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.13.3 Austria Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Media Asset Management (MAM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.4 Asia Pacific Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.5 Asia Pacific Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.6.2 China Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.6.3 China Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.7.2 India Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.7.3 India Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.8.2 Japan Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.8.3 Japan Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.9.2 South Korea Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.9.3 South Korea Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.10.2 Vietnam Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.10.3 Vietnam Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.11.2 Singapore Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.11.3 Singapore Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.12.2 Australia Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.12.3 Australia Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Media Asset Management (MAM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.1.4 Middle East Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.1.5 Middle East Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.1.6.2 UAE Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.1.6.3 UAE Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Media Asset Management (MAM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.2.4 Africa Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.2.5 Africa Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Media Asset Management (MAM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.6.4 Latin America Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.6.5 Latin America Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.6.6.2 Brazil Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.6.6.3 Brazil Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.6.7.2 Argentina Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.6.7.3 Argentina Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.6.8.2 Colombia Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.6.8.3 Colombia Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Media Asset Management (MAM) Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Media Asset Management (MAM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Media Asset Management (MAM) Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Adobe Systems Incorporated

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 IBM Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Oracle Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Microsoft Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Cloudinary

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Avid Technology, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Dalet Digital Media Systems

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Widen Enterprises

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Vimeo, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Arvato Systems

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Organization Size

By Deployment

By End-User

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The E-passport Market was valued at USD 32.67 Billion in 2023 and is expected to reach USD 145.45 Billion by 2032, growing at a CAGR of 18.08% over the forecast period 2024-2032.

The Virtual Fitting Room Market Size was valued at USD 4.63 Billion in 2023 and will reach USD 28.29 Billion by 2032 and grow at a CAGR of 22.3% by 2032.

The AI In Telecommunication Market was valued at USD 2.6 Billion in 2023 and will reach USD 65.9 Billion by 2032, growing at a CAGR of 42.94% by 2032.

The Process Orchestration Market size was valued at USD 7.4 billion in 2023 and will reach USD 33.5 billion by 2032 and grow at a CAGR of 18.3% by 2032.

The Reconciliation Software Market size was USD 1.72 Billion in 2023 and is expected to grow to USD 6.49 Bn by 2032 and grow at a CAGR of 15.9% by 2024-2032.

The Generative AI Chipset Market Size was valued at USD 37.29 Billion in 2023 and will reach USD 454.50 Billion by 2032 and grow at a CAGR of 32.2% by 2032.

Hi! Click one of our member below to chat on Phone