Marine Fender Market Key Insights:

Get More Information on Marine Fender Market - Request Sample Report

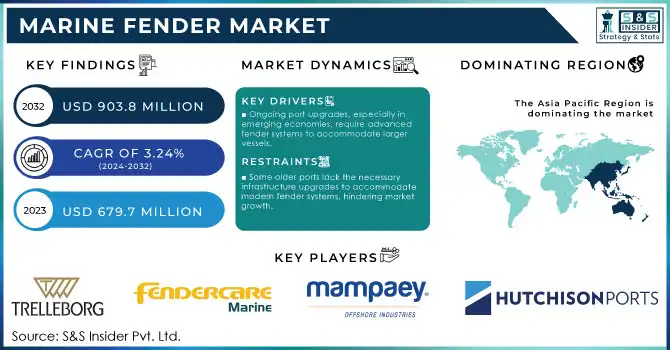

The Marine Fender Market Size was valued at USD 679.7 Million in 2023 and is expected to reach $903.8 Mn by 2032, growing at a CAGR of 3.24% over the forecast period of 2024-2032.

The marine fender market is an integral part of the global shipping and port infrastructure and serves a critical function by protecting ships and other docking facilities. These fender systems act as shock absorbers by soaking up impact from moored ships to protect vessels and port infrastructure. The continuing rise in global trade, the rapid pace of port modernization, and the growing demand for durable high-performance marine fenders drive the growth of the market.

Growth in the market is attributed to the growing trade globally and the number of ports under construction across the globe. For instance, the global container trade is expected to expand at 4 percent per annum over the next 10 years, and this will increase the need for robust fender systems. Ports are volume gearing towards bigger ships, especially container ships, resulting in more sophisticated fender solutions. In addition, material innovations such as high-performance polymers and composites delivering better durability and functionality of marine fenders have also contributed to the growth in marine fender adoption.

Asia-Pacific is driving market growth due to the continuous use by end-users from emerging economies. Nations such as China and India and those in Southeast Asia are pouring large amounts of capital into upgrading their ports for the increasing requirements of global maritime trade. As an example, the Port of Shanghai, one of most busiest ports in the world had implemented the fender systems with heavy infrastructure expansion. Another trend is the growing emphasis on sustainability, which has resulted in the adoption of sustainable fender designs, including those constructed from recycled materials. The growing adoption of automation and digitization in ports also has an impact on the marine fenders market. These kinds of systems that are automated in docking depend on accurate and dependable fender solutions that can facilitate seamless operational flow. The modernization and expansion of ports is expected to increase the demand for high-end marine fender systems, which, in turn, is anticipated to propel the market growth over the forecast period.

Market Dynamics

Drivers

-

The rising volume of global trade fuels the demand for enhanced protection in shipping ports.

-

Ongoing port upgrades, especially in emerging economies, require advanced fender systems to accommodate larger vessels.

-

Larger container ships necessitate more durable and efficient fender solutions.

The rising number of large container vessels coming into service globally is increasing pressure on the marine fender market to deliver more robust and operationally efficient fender solutions for safe berthing at ports. With shipping companies building larger vessels to meet rising global demand and achieve operational efficiencies, the growing size and weight of the vessels are presenting new challenges to port infrastructure in areas such as the fender systems that need to be accommodated. Marine fenders are essential for the cushioning effect between the docking processes and help in securing the right position between the ships and the port facilities as well as preventing damage. However, ship size keeps on growing, which means that the contact force when berthing increases. This means the fenders must be more resistant to pressure. The smaller mass and momentum that these ships possess, produce larger forces when they dock, hence requiring fenders with greater energy dissipation. The growing requirement for performance fenders has driven forward the development of material technologies in terms of better polymers, composites, and elastomers operating increasing durability and impact resistance. In addition, ports need to modernize their berth infrastructure to cope with these bigger ships, including lengthening quays, dredging deeper to realize the berths, and reinforcing berths to cope with the additional size and mass. These high-tech fender systems incorporated into the port, ensure that docking will be carried out without harming the ship or the port. The introduction of sophisticated technologies onboard these larger ships is creating a similar demand for highly accurate, dependable, and controlled means of docking, which, in turn, means an even greater demand for advanced Fender systems. More broadly, the trend toward increasingly larger container ships is a primary driver of growth in the marine Fender market as port authorities invest heavily in durable Fender solutions to maintain global shipping safety and efficiency.

Restraints

-

Some older ports lack the necessary infrastructure upgrades to accommodate modern fender systems, hindering market growth.

-

Developing regions may lack awareness of the importance of advanced fender systems, slowing adoption rates.

-

Economic slowdowns can lead to delays in port development and maintenance projects, impacting the demand for new fender systems.

Any economic slowdown leads to the postponement of new port development and existing port maintenance and repair projects hampering the demand for new fender systems and hurting marine fender market growth. In times of economic recession, both governments and private interests tend to cut or delay infrastructure investments such as improvements to port premises. This comprises the new docking infrastructure which is crucial for the growing scale of vessels as they continue to grow bigger. Expansion or refurbishment of ports, which are the centers of international commerce, involves significant financial expenditure. Economic uncertainty may cause such projects to be postponed, lessening the uptake of advanced fender systems.

They are important for protecting ships and port structures in the form of marine fenders. There is an ever-growing demand for our fender systems as global trade increases, not least due to the increasing size of container ships. Economic slowdowns, on the other hand, restrain the budget purse for infrastructure projects, and as such, ports may defer or cut back on replacing or refurbishing fender systems. Moreover, there are fender alternatives that will not get any maintenance or replacement priority, which also diminishes the demand for new products in the market.

Additionally, the financial burden during the timeline of such economic restlessness can force the port authorities to choose budget fendering solutions over durable and well-built fender installing systems, in spite of their high initial cost which generally pay off over a period of time. This transition to the potential measures for cost-cutting has a potential impact on the overall demand of high-performance fender systems in the market.

To conclude, financial issues arising from economic downturns hinder port development projects, thus delaying the issue of new fender technologies. The growing depth of world shipping has pushed demand for high-tech fenders higher, although the economic cycle can slow further market growth and adoption.

Key Segmentation Analysis

By Type

Rubber fenders have led the marine fender market with a revenue share of 45.29% in 2023, driven by their long service life, low capital cost, and predictable performance. Due to their high energy absorption and durability, they are applied in many port applications, including container ports as well as oil terminals. Since rubber fenders have an excellent track record in the protection of vessels and dock structures at both new and established ports, the concept of rubber fenders has been widely adopted. They are flexible, made-to-order, and come in different forms to serve particular port requirements. Rubber fenders will remain a viable solution for the foreseeable future, backed by continued investment in the global port infrastructure and the relentless trajectory of ships getting larger, sustaining demand over the coming years.

The foam fender segment is projected to grow at the highest CAGR from 2024-2032. The growth of the market is primarily attributed to the growing demand for lightweight, easy-to-handle, and maintenance-free fender solutions. Foam fenders are very energy-absorbent but are not easily damaged and are best suited for busy ports or tough marine environments. The transition of ports to accommodate larger vessels is causing a surge in demand for foam fenders across the globe, as they are lightweight and inexpensive to transit and install. Moreover, their cost-efficiency in maintenance is another reason why they are gaining so much adoption. Across Asia-Pacific, the increasing application of this segment in fast-growing port facilities is anticipated to propel its contribution in the segment in the future.

By Installation Location

The dock fenders dominated the market and held the largest revenue share of 46.80%, as these fenders play an important role in ensuring the safety of ship docking operations and the protection of port infrastructure. The Fenders are equipped to absorb the force produced whenever vessels collide with the docking facilities, protecting ships and docks from damage. Dock fending is crucial in busy ports, especially serving large container ships, tankers, or bulk carriers. As ports worldwide modernize and expand to cater to larger ships, the need for tougher and more efficient dock fenders is growing. Anticipated future growth for this segment is likely driven by heightened investments in port modernization and burgeoning activities in global trade.

The ship fenders segment is anticipated to register the highest CAGR in the marine fenders market. The increase in this growth, primarily, is due to the increasing application of fenders that protect the vessels during the docking and undocking processes. With the increasing size of ships, there is a growing demand for high-performance ship fenders. These fenders are used to protect vessels in case of collision damage when moored, or when vessels are in motion near docks, other ships, or similar structures. Increasing global trade and growing investments in port capacity expansion projects will be contributing to growth in the demand for ship fenders. This segment will continue witnessing maximum growth over the forecast period owing to the growing emphasis on minimizing damage to vessels along with enhancing safety.

Regional Analysis

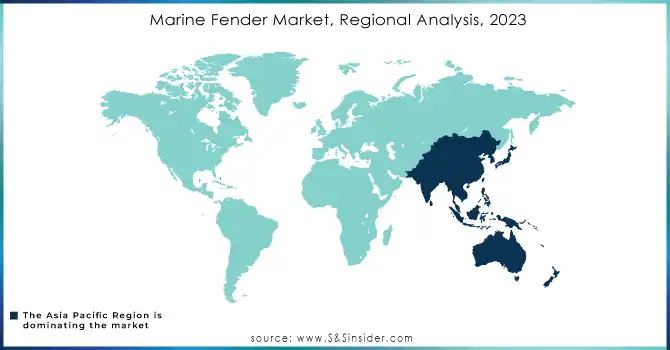

Asia Pacific accounts for the maximum share in the marine fender market owing to high port infrastructure development and high volume of maritime trade. This dominance is primarily driven by countries like China, Japan, South Korea, and India with their extensive port networks and dense shipping industries. The continuing modernization and expansion of port facilities to accommodate larger container vessels are further advancing the region's dominance. Given the ongoing investment by some of the world’s busiest port facilities including the Port of Shanghai, and the Port of Singapore into high-performance Fender systems, it is likely that the demand trend for high-durability Fender solutions will continue. The region's market size share is projected to stay strong on the back of consecutive port expansions and an increase in regional trade.

North America has the second largest share, the United States and Canada are the largest port infrastructure markets, and considering the demand from this region will mainly be driven by well-established ports from this region. The regional market is mainly driven by the Port of Los Angeles, the Port of New York, and the Port of Vancouver: all three have recently modernized to accommodate larger ships. North American ports are also pivoting to automated operations and, naturally, this means the arrival of new fender solutions that can optimize the entire docking process. Additionally, the region is transforming its focus towards sustainability and environmental initiatives which is further propelling the market towards eco-friendly fender solutions. The marine fender market in North America is predicted to grow on account of expansion going on in the respective countries related to ports in response to increasing demand for safer maritime operations.

Need Any Customization Research On Marine Fender Market - Inquiry Now

Key Players

-

Trelleborg Marine and Infrastructure - Trelleborg Marine Fender Systems

-

Fendercare Marine - Advanced Foam Fenders

-

Mampaey Offshore Industries - Mampaey Rubber Fenders

-

JIER Marine Rubber Fender Systems - D Type Rubber Fender

-

Viking SeaTech - Composite Marine Fenders

-

Tianjin Weflo Industry Co., Ltd.- High-Performance Rubber Fenders

-

Balmoral Offshore Engineering - Balmoral Rubber Fenders

-

Hutchinson Port Operations - Ship Fender Systems

-

Yokohama Rubber Co., Ltd. - Yokohama Pneumatic Fenders

-

Shinyo International - Marine Fender Solutions

-

Yantai Jereh Petroleum Equipment & Technologies Co., Ltd. - Foam-filled Fenders

-

Sumitomo Rubber Industries - Dockside Rubber Fenders

-

Blue Diamond Marine - Foam and Rubber Fender Systems

-

Lloyd’s Register - Fender Design & Inspection Services

-

Krupp Stahl GmbH - Composite Fendering Solutions

-

Polyfender - Polyurethane-based Marine Fenders

-

Shandong Jindong Marine Fenders Co., Ltd. - Jindong Rubber Fenders

-

Marinetech - Marine Fender Products

-

International Marine Fenders - Custom Dock Fenders

-

Fendertex - Fendertex Rubber Dock Fenders

Recent Developments

-

April 2024 – Trelleborg announced the launch of a new line of high-performance fender systems designed to reduce environmental impact while enhancing docking efficiency.

-

March 2024 – Yokohama introduced advanced anti-corrosion coatings for its marine fenders, providing longer service life and reduced maintenance needs

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 679.7 million |

| Market Size by 2032 | USD 903.8 million |

| CAGR | CAGR of 3.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type ( Rubber Fenders, Foam Fenders, Composite Fenders) • By Installation Location (Ship Fenders, Dock Fenders, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trelleborg Marine and Infrastructure, Fendercare Marine, Mampaey Offshore Industries, JIER Marine Rubber Fender Systems, Viking SeaTech, Tianjin Weflo Industry Co., Ltd., Balmoral Offshore Engineering, Hutchinson Port Operations, Yokohama Rubber Co., Ltd., Shinyo International. |

| Key Drivers | • The rising volume of global trade fuels the demand for enhanced protection in shipping ports. • Ongoing port upgrades, especially in emerging economies, require advanced fender systems to accommodate larger vessels. |

| Restraints | • Some older ports lack the necessary infrastructure upgrades to accommodate modern fender systems, hindering market growth. • Developing regions may lack awareness of the importance of advanced fender systems, slowing adoption rates. |