Manufacturing Execution Systems Market Report Scope and Overview:

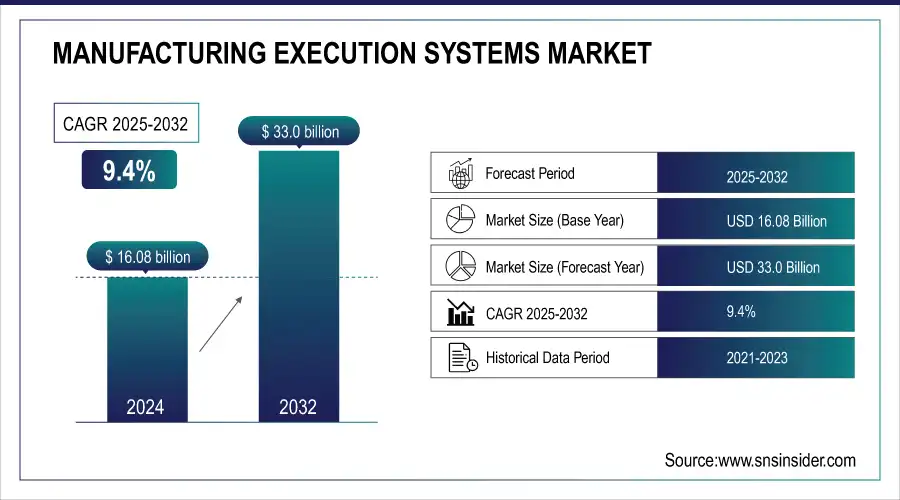

The Manufacturing Execution Systems Market size was valued at USD 16.08 Billion in 2024 and is expected to reach USD 33.0 Billion by 2032, expanding at CAGR of 9.4% during the 2025-2032.

The manufacturing execution systems market analysis highlights that the manufacturing execution systems adoption is increasing due to the rising trend toward Industry 4.0 and smart manufacturing. The producers are focused on digitizing and automating their manufacturing lines to raise efficiency and decrease downtime. MES solutions primarily provide real-time data tracking, which allow producers manufacturers modify and monitor manufacturing processes as per the requirements. This surging shift toward digital transformation has increased the demand for MES systems in industries including aerospace, automotive, pharmaceuticals, and electronics. In recent manufacturing execution systems market trends in the MES market include the increasing use of cloud-based solutions, which provide flexibility, scalability, and cost-effectiveness. Cloud-based MES platforms allow manufacturers to centralize data and improve collaboration across multiple facilities, making it easier to manage production processes remotely.

Get More Information on Manufacturing Execution Systems Market - Request Sample Report

Additionally, the integration of artificial intelligence (AI) and machine learning (ML) within MES is helping manufacturers predict equipment failures, optimize production schedules, and improve overall productivity. Manufacturing industries in the U.S. are responsible for 24% of the country's greenhouse gas emissions, making them a significant contributor to environmental challenges. To solve these problems, over 20% of the biggest public manufacturing companies globally have made commitments to reach net-zero carbon emissions going forward. These promises underline the increasing corporate accountability down the line along with the initiatives to reduce carbon footprints. These top companies are also implementing strict environmental rules and regulations, and match the global emission targets by making substantial investments in sustainable technologies, carbon capture systems, and energy efficiency, further promoting a change toward greener industrial practices.

Manufacturing Execution Systems Market Highlights:

-

Strong growth driven by smart manufacturing and Industry 4.0 with increasing automation, IIoT, and advanced production technologies fueling adoption globally

-

Significant operational benefits as manufacturers report 10–15 percent reduction in production lead times and 15–20 percent increase in operational efficiency

-

Rising demand for real time data and visibility with MES enabling live monitoring of production, inventory, and machine performance to enhance decision making and reduce downtime

-

Predictive maintenance and energy optimization supported by integration with IIoT devices to forecast equipment issues, manage energy consumption, and improve machine utilization

-

Integration challenges with legacy systems due to high costs, customization needs, and prolonged implementation timelines affecting seamless deployment

-

Growing investments in digital transformation as industries prioritize MES to improve agility, product quality, and resource utilization in competitive manufacturing environments

MES may gather data from linked devices and machines by using IIoT, so providing predictive maintenance, energy consumption, and machine performance insights. Increasing operational efficiency and enabling producers to make wise decisions are results of this data-driven approach. Growing fast owing to more investments in smart manufacturing, the MES market is following MES systems, manufacturers have reportedly observed a 10–15% drop in the production lead times and a 15–20% increase in operational efficiency. Keeping up with changing market needs, these systems are becoming essential for manufacturers trying to improve quality, production, and agility.

Manufacturing Execution Systems Market Drivers:

-

Growing adoption of smart manufacturing and Industry 4.0 Technologies is Driving Demand for MES Solutions Globally

Industrial automation and digitization are revolutionizing the manufacturing sector through the integration of smart technologies including Industry 4.0 and smart manufacturing. These advancements are driving the demand for Manufacturing Execution Systems (MES) solutions. MES solutions play a crucial role in optimizing production processes by providing real-time data, automating workflows, and enhancing operational efficiency. The adoption of automation in industrial environments allows manufacturers to reduce human error, streamline operations, and increase overall productivity.

Businesses using linked devices and data-driven insights to monitor and control every stage of the manufacturing process are exploiting Industry 4.0's growth More informed decision-making, less downtime, and faster time-to-market for products are outcomes of this digitizing of decisions. Automation also lessens dependency on labor-intensive tasks, therefore enhancing manufacturing uniformity and quality. MES solutions' integration guarantees correct capture, analysis, and utilization of production data, therefore facilitating smooth communication across systems and enabling ongoing development from this basis. Companies are progressively using these technologies in a competitive industrial environment to keep efficiency, lower costs, and improve their response to market needs, thereby confirming the rising trend of automation and digitalization in production.

-

Rising Need for Real-Time Data and Visibility Propel Market Growth

The rising need for real-time data and visibility is driving the adoption of Manufacturing Execution Systems (MES) across industries. MES offers manufacturers the ability to monitor production, inventory levels, and machine performance in real time, which is critical for maintaining efficiency and agility in today's fast-paced manufacturing environment. By providing real-time data, MES helps identify issues, such as equipment malfunctions or production bottlenecks early, allowing for immediate corrective action. This minimizes downtime and ensures smoother operations.

Additionally, real-time visibility into workflows allows manufacturers to optimize processes, making adjustments on the fly to improve throughput and resource utilization. This level of insight also enhances product quality, as deviations or defects can be detected and corrected promptly, reducing waste and rework. Furthermore, having a real-time view of inventory levels ensures accurate material management, preventing shortages or overstock situations. Overall, MES empowers manufacturers with the data needed to make informed decisions, streamline operations, and meet customer demands more efficiently, making it an indispensable tool in modern production environments.

Manufacturing Execution Systems Market Restraints:

-

Complex Integration with Legacy Systems Can Hamper Market Expansion

Integrating Manufacturing Execution Systems (MES) with outdated legacy systems presents significant challenges for organizations. These legacy systems, often built on obsolete technologies, lack the flexibility and compatibility required to interface seamlessly with modern MES solutions. This complexity arises from differences in data formats, communication protocols, and user interfaces, necessitating extensive customization or middleware solutions to facilitate integration. As a result, organizations may face prolonged implementation timelines, as teams must allocate additional resources to troubleshoot and adapt the legacy systems.

Furthermore, the need for specialized knowledge to navigate these outdated technologies can drive up costs, making the integration process more expensive than anticipated. Consequently, businesses may experience delays in realizing the full benefits of their MES investments, hindering operational efficiency and responsiveness. Addressing these integration challenges is crucial for achieving a cohesive manufacturing environment and maximizing the return on investment in MES technologies.

Manufacturing Execution Systems Market Segment Analysis:

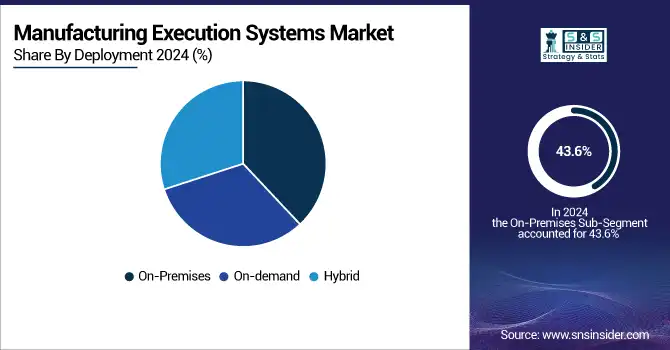

By Deployment

The On-Premises segment dominated with a manufacturing execution systems market share of 43.6% in 2024, due to the security concerns related to data privacy and compliance with regulations are the key factors for the adoption of on-premise deployment. On-premise deployments provide greater flexibility for customization and integration with existing infrastructure ensuring smooth flow of data and operational efficiency.

By Offering

The Services Offering segment dominated the market with a share of 51.02% in 2024, which involves in the Implementation of software into the system, Upgradation of software, Training of workforce and Maintenance of systems making service offering a dominating segment in the market. These services contribute to a smooth deployment, improved efficiency, and increased adaptability of MES within manufacturing operations.

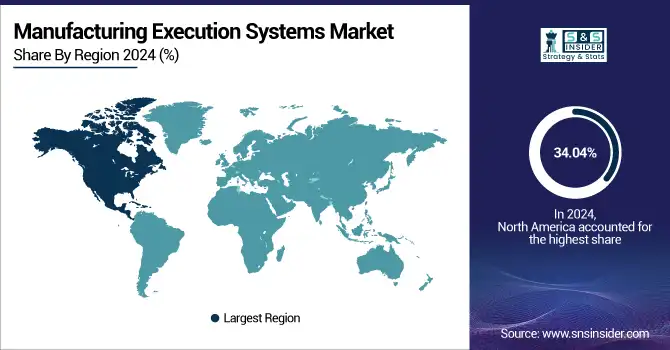

Manufacturing Execution Systems Market Regional Analysis:

North America Manufacturing Execution Systems Market Trends:

North America region dominated the market share by over 34.04% in 2024, primarily driven by the presence of advanced manufacturing facilities, high investments in automation, and a strong emphasis on operational efficiency. The region benefits from well-established industrial sectors such as automotive, aerospace, and pharmaceuticals, which are increasingly adopting MES solutions to enhance productivity and traceability.

Need any customization research on Manufacturing Execution Systems Market - Enquiry Now

Asia-Pacific Manufacturing Execution Systems Market Trends:

Asia-Pacific region is the fastest-growing market for MES. This Asia Pacific manufacturing execution systems market growth is fueled by rapid industrialization, increasing adoption of smart manufacturing technologies, and government initiatives aimed at promoting manufacturing efficiency.

Europe Manufacturing Execution Systems Market Trends:

Europe region held a significant market share in 2024, driven by the strong presence of advanced manufacturing hubs in Germany, France, and the UK. The region benefits from stringent regulatory standards, high adoption of Industry 4.0 technologies, and a strong emphasis on sustainability and energy efficiency within the manufacturing sector.

Latin America Manufacturing Execution Systems Market Trends:

Latin America region is experiencing steady growth, supported by increasing investments in industrial automation and the expansion of automotive and food & beverage manufacturing industries. Countries such as Brazil and Mexico are key contributors, with government initiatives encouraging digitalization in production facilities.

Middle East & Africa Manufacturing Execution Systems Market Trends:

Middle East & Africa (MEA) region is emerging as a promising market, driven by growing infrastructure development, expansion of oil & gas, and mining sectors. Investments in industrial modernization and the gradual shift toward smart manufacturing practices are contributing to the adoption of MES solutions in the region.

Manufacturing Execution Systems Market Key Players:

-

Siemens AG

-

Schneider Electric SE

-

ABB Ltd

-

Honeywell International Inc

-

Rockwell Automation Inc

-

Dassault Systèmes SE

-

General Electric (GE) Digital

-

SAP SE

-

Emerson Electric Co

-

AVEVA Group plc

-

Oracle Corporation

-

Tata Consultancy Services (TCS)

-

Atos SE

-

HCL Technologies Ltd

-

Mitsubishi Electric Corporation

-

Plex Systems Inc

-

iBASEt

-

Critical Manufacturing S.A.

-

PTC Inc

-

Infor

Manufacturing Execution Systems Market Competitive Landscape:

Siemens AG (established in 1847) is a leading provider of Manufacturing Execution Systems (MES) solutions, offering advanced software and automation technologies to optimize production processes. Headquartered in Germany, Siemens delivers real time monitoring, predictive maintenance, and digital manufacturing solutions that enhance efficiency, reduce lead times, and support Industry 4.0 adoption globally.

- In October 2023, Siemens Digital Industries Software and CEA-List, officially entered into a memorandum of understanding (MoU). This agreement signifies their joint commitment to collaborative research aimed at advancing and enriching digital twin capabilities through the incorporation of artificial intelligence (AI). The partnership also aims to explore deeper integration of embedded software on virtual and hybrid platforms.

Emerson Electric Co. (established in 1890) is a global leader in automation solutions, providing advanced Manufacturing Execution Systems (MES) to enhance production efficiency and real time process control. Headquartered in the United States, Emerson focuses on digital transformation, predictive maintenance, and smart manufacturing to optimize industrial operations across various sectors worldwide.

- In June 2023: Emerson Electric Co. entered into a collaborative agreement with Continua Process Systems. Continua offers comprehensive software, consulting, and support solutions to empower life science companies in enhancing flexibility, adaptability, and speed-to-market. In this partnership, Emerson will contribute its extensive life sciences software portfolio, complemented by Continua's specialized expertise in continuous manufacturing and process analytical technology (PAT).

AVEVA Group plc (established in 1967) is a global leader in industrial software, offering advanced Manufacturing Execution Systems (MES) solutions to optimize production and improve operational visibility. Headquartered in the United Kingdom, AVEVA specializes in digital transformation, real time data integration, and smart manufacturing to drive efficiency and innovation across industries.

- In February 2023: AVEVA Group PLC launched a new version of the manufacturing execution system software to support data center deployments. The latest iteration of the AVEVA Manufacturing Execution System (MES) will speed up the standardization and large-scale introduction of best practices, increasing operational sustainability & efficiency. By providing unified visibility, reporting, and KPIs across multi-site operations, the new AVEVA Manufacturing Execution System 2023 also encourages enhanced supply chain resilience and agility.

Dassault Systèmes SE (established in 1981) is a leading provider of 3D design and engineering software, offering advanced Manufacturing Execution Systems (MES) solutions to streamline production and enhance real time decision making. Headquartered in France, Dassault Systèmes focuses on digital manufacturing, process optimization, and Industry 4.0 integration across diverse industrial sectors.

- In May 2022: Dassault Systèmes collaborated with Comez International, a global leader in crochet warp knitting machine technology. Comez has used Dassault Systèmes' DELMIA Ortems software to digitize manufacturing planning, improving measurability, predictability, and the smooth flow of production processes.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.7 Billion |

| Market Size by 2032 | USD 33.0 Billion |

| CAGR | CAGR of 9.4% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premises, On-demand, Hybrid) •By Offering (Software, Services (Implementation, Software Upgrade, Training, Maintenance) •By Discrete Industry (Automotive, Aerospace, Medical Devices, Consumer Packaged Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens AG, Schneider Electric SE, ABB Ltd, Honeywell International Inc, Rockwell Automation Inc, Dassault Systèmes SE, General Electric (GE) Digital, SAP SE, Emerson Electric Co, AVEVA Group plc, Oracle Corporation, Tata Consultancy Services (TCS), Atos SE, HCL Technologies Ltd, Mitsubishi Electric Corporation, Plex Systems Inc, iBASEt, Critical Manufacturing S.A., PTC Inc, Infor |