The Malic Acid Market size was valued at USD 228.2 million in 2023 and is expected to reach USD 364.8 million by 2032, growing at a CAGR of 5.4% over the forecast period 2024-2032.

Get more information on Malic Acid Market - Request Sample Report

The malic acid market is witnessing significant growth driven by its versatile applications across industries, including food and beverages, pharmaceuticals, personal care, and animal feed. The compound's use as a flavor enhancer, preservative, and pH regulator has spurred demand, particularly in the food and beverage sector, where it is a critical ingredient in carbonated beverages, fruit-based products, and confectionery. The personal care industry also contributes to its rising demand, leveraging malic acid in formulations for skin and hair care products due to its exfoliating and conditioning properties. For instance, in July 2023, pH Plex launched a shampoo and conditioner containing malic acid, emphasizing its effectiveness in improving hair health. The pharmaceutical industry benefits from its buffering and stabilizing properties, incorporating it into drug formulations and oral care products. In animal feed, malic acid enhances digestion and supports livestock health, reflecting its multifunctional benefits.

Key market dynamics include increasing investments in production capacities and technological advancements by leading players. Bartek Ingredients has been proactive in enhancing its market presence through capacity expansions and strategic developments. In March 2020, Bartek completed a 10,000 MT malic acid capacity expansion to cater to growing global demand. Further, in April 2022, the company announced the construction of the world's largest malic and fumaric acid facility, strengthening its position as a leader in the market. This expansion was followed by a May 2022 development in which Bartek confirmed its capacity for malic and fumaric acid would double, reflecting the industry's shift towards scalability and innovation. Additionally, in November 2018, Bartek was acquired by TorQuest Partners, which provided financial backing to support its ambitious growth plans. These developments, along with the growing adoption of malic acid in innovative product formulations, illustrate the market's dynamic nature and its capacity to meet evolving consumer and industrial demands.

Drivers:

Increasing Applications of Malic Acid in Food and Beverage Industry to Enhance Taste, Texture, and Shelf Life of Products

Malic acid plays a pivotal role in the food and beverage industry due to its distinctive flavor-enhancing and stabilizing properties. It imparts a natural tartness to fruit juices, carbonated beverages, and confectioneries, appealing to consumers seeking refreshing and flavorful products. Beyond taste, malic acid stabilizes pH levels, ensuring consistency in flavor and quality across a product’s shelf life. Its preservative properties make it an indispensable ingredient in processed and ready-to-eat foods, helping manufacturers cater to the growing demand for convenience without compromising on freshness. Moreover, malic acid’s synergy with artificial sweeteners supports the formulation of sugar-free products, aligning with the rising health consciousness among consumers. As the global demand for healthier and functional food products accelerates, malic acid’s multifaceted applications position it as a cornerstone of innovation in the food and beverage sector.

Rising Demand for Personal Care Products Leveraging Malic Acid’s Exfoliating and Skin-Brightening Properties

Growing Adoption of Malic Acid in Animal Feed to Enhance Livestock Health and Digestive Efficiency

Malic acid has gained substantial traction in the animal feed industry due to its ability to enhance digestive health and overall livestock performance. As a natural acidifier, it helps balance gut pH levels, promoting the growth of beneficial bacteria while suppressing harmful microorganisms. This function is particularly crucial in reducing the dependency on antibiotics, aligning with the global shift towards sustainable and antibiotic-free animal farming. Additionally, malic acid improves feed palatability, encouraging higher consumption rates among livestock, which translates to improved growth and productivity. The agricultural sector’s increasing focus on high-quality meat and dairy products has further amplified the demand for malic acid. As farmers and feed manufacturers prioritize efficiency and sustainability, the adoption of malic acid in feed formulations is poised to expand significantly.

Restraint:

High Production Costs and Price Volatility of Raw Materials for Malic Acid Pose Challenges to Market Growth

The production of malic acid is heavily reliant on raw materials such as maleic anhydride and fumaric acid, whose prices are subject to market fluctuations. This volatility stems from supply chain disruptions, geopolitical tensions, and varying demand dynamics in the petrochemical industry. These factors contribute to elevated and inconsistent production costs, posing a challenge for manufacturers, particularly those operating on smaller scales. Moreover, the energy-intensive nature of malic acid production further compounds these costs, making it less economically viable for certain regions. Manufacturers often pass these costs onto end-users, potentially affecting demand in price-sensitive markets. Efforts to develop cost-effective and sustainable production methods are underway, but high costs remain a significant restraint on the malic acid market’s growth potential.

Opportunity:

Development of Bio-Based Malic Acid as a Sustainable Alternative to Meet Environmental Regulations and Consumer Preferences

Expanding Market Potential for Malic Acid in Functional Food and Dietary Supplements

The global shift towards health and wellness has opened significant opportunities for malic acid in functional foods and dietary supplements. Its role in energy metabolism, muscle recovery, and oral health has made it a key ingredient in sports nutrition and wellness products. For instance, malic acid is increasingly included in formulations aimed at improving endurance and reducing fatigue, targeting athletes and active individuals. Its incorporation into dental health products further underscores its versatility. As consumers seek holistic solutions for health, malic acid’s multifunctional properties offer food and supplement manufacturers a unique value proposition, paving the way for innovative product development.

Challenge:

Intense Competition Among Manufacturers Due to Limited Product Differentiation and High Market Fragmentation

The malic acid market faces intense competition, with numerous players offering similar products, leading to limited differentiation. This saturation pressures manufacturers to compete on pricing, affecting profit margins and sustainability. Market fragmentation further challenges smaller players who struggle to achieve economies of scale. In addition, the presence of well-established companies with strong distribution networks creates barriers for new entrants. To overcome these challenges, companies must focus on innovation, such as developing bio-based alternatives or expanding into niche applications. However, navigating these competitive dynamics remains a significant obstacle to sustained growth in the malic acid market.

Supply Chain Analysis and Raw Material Dynamics for Malic Acid Market

| Stage | Raw Material | Suppliers/Regions | Challenges | Impact on Cost |

|---|---|---|---|---|

| Upstream | Maleic Anhydride | China, USA, Europe | Volatility in supply and price | Price fluctuations impact cost |

| Manufacturing | Fumaric Acid (Intermediate) | China, India, USA | High energy consumption | Production cost increases |

| Packaging | PET, HDPE, or Glass Containers | Global suppliers (e.g., USA, Europe) | Environmental regulations for recyclability | Recycling costs raise overall packaging cost |

| Distribution | Transportation (Fuel) | Global transport networks | Fuel price hikes, global supply chain disruptions | Transportation cost surges |

| End User (F&B, Pharma) | Additives, Other Acids | Regional suppliers | Changing regulatory standards | Compliance costs increase |

The Supply Chain Analysis and Raw Material Dynamics for malic acid production involves several stages, each influenced by specific raw materials, their suppliers, and challenges that may disrupt the cost structure. The upstream supply of maleic anhydride from regions like China, USA, and Europe is prone to price volatility, impacting production costs. As fumaric acid is an intermediate in the process, suppliers from China, India, and the USA face challenges such as high energy consumption, which further increases production expenses. In the packaging stage, the transition to eco-friendly materials such as PET or HDPE has been driven by environmental regulations, but this adds to overall packaging costs due to higher recycling expenses. Additionally, global transportation networks for distribution are vulnerable to fuel price hikes and logistical disruptions, ultimately contributing to rising transportation costs. Lastly, in the final end-user stage (F&B, pharmaceuticals), fluctuating additives and other acids prices and stricter regulatory standards affect both the production and compliance costs. Understanding these raw material dynamics is key to analyzing cost fluctuations and identifying opportunities for supply chain optimization in the malic acid market.

By Source

The natural segment dominated the Malic Acid Market in 2023 with a market share of 60%. The preference for natural ingredients has been on the rise due to increasing consumer awareness about health and wellness. This trend is particularly significant in the food and beverage industry, where consumers are leaning toward clean-label products that feature natural components. Natural malic acid is often derived from fruits like apples, and its sourcing aligns with consumer demands for transparency and sustainability. Additionally, the cosmetic and pharmaceutical industries are also contributing to the growth of natural malic acid, as manufacturers seek to formulate products that appeal to health-conscious consumers. The use of natural malic acid as a flavor enhancer in beverages, candies, and jams not only enhances taste but also provides an edge in marketing products as healthier alternatives. As consumers increasingly prefer products that are free from synthetic additives, manufacturers are likely to continue investing in natural malic acid production to meet this growing demand, making it a crucial segment within the malic acid market.

By Type

L-Malic Acid dominated the Malic Acid Market in 2023 with a market share of 45%. L-Malic Acid is favored in the malic acid market primarily due to its extensive applications across various industries, particularly in food and beverages. Its natural origin, typically derived from fruits, makes it appealing to consumers who prioritize clean and organic ingredients. As a result, L-Malic Acid is commonly used as a flavoring agent and acidulant in soft drinks, candies, and other food products. Additionally, its ability to enhance flavors and provide a balanced acidity makes it an attractive option for food manufacturers. Furthermore, the pharmaceutical industry utilizes L-Malic Acid for its health benefits, including its role in energy metabolism and its potential antioxidant properties. The growing trend toward health-conscious products and the demand for naturally derived ingredients in both the food and pharmaceutical sectors are driving the preference for L-Malic Acid. This trend highlights the significance of L-Malic Acid as a vital component in formulations aimed at health-conscious consumers, reinforcing its dominance in the market.

By Form

Powder form dominated the Malic Acid Market in 2023 with a market share of 55%. The powdered form of malic acid is preferred in various applications due to its versatility and ease of handling. Powdered malic acid is not only stable but also offers advantages in terms of transportation and storage compared to liquid forms. In the food and beverage industry, the powdered format is especially popular for use in products like powdered drink mixes, baking products, and candies, where it can enhance flavor and acidity. This form also provides manufacturers with greater flexibility in dosage and formulation, making it easier to incorporate into a variety of products. Additionally, the powder form of malic acid allows for easy blending with other ingredients, contributing to its widespread use in food products. The stability of powdered malic acid under varying environmental conditions further supports its dominance, as it remains effective over longer periods. As industries continue to seek efficient and cost-effective solutions for ingredient formulations, the powdered form of malic acid is expected to maintain its leading position in the market.

By Application

Food & Beverages segment dominated the Malic Acid Market in 2023 with a market share of 50%. The food and beverages sector remains the largest application area for malic acid, driven by its extensive use as a flavor enhancer and acidulant. With the rising consumer preference for flavorful yet balanced food products, malic acid is favored for its ability to enhance taste profiles without overpowering other ingredients. Its presence in a wide range of products, from soft drinks to confections, underscores its significance in this sector. Additionally, malic acid's functional properties, such as improving the texture and shelf life of food products, further boost its demand. As consumers increasingly gravitate toward natural ingredients and healthier formulations, the demand for naturally sourced malic acid in food products continues to rise. Moreover, the ongoing trend of clean-label products has prompted manufacturers to incorporate malic acid as a key ingredient, positioning it as a preferred choice in formulations that appeal to health-conscious consumers. This growing application of malic acid within the food and beverage sector solidifies its dominant role in the market.

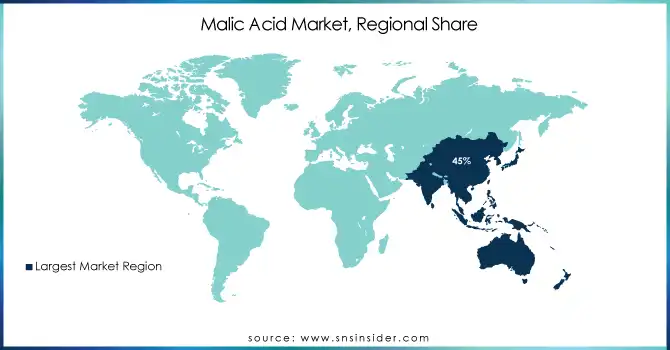

Asia Pacific region dominated the Malic Acid Market in 2023 with a market share of 45%. The dominance of Asia Pacific in the malic acid market can be attributed to the region’s large-scale production capacity, robust demand in key industries, and increasing consumer preference for natural ingredients. China, the largest producer and consumer of malic acid in the region, plays a pivotal role in the market's growth. China’s rapid industrialization, coupled with its extensive food and beverage sector, has driven the demand for malic acid in applications such as flavoring agents, acidulants, and preservatives. The country is home to several large malic acid manufacturers, ensuring the availability of the product in both domestic and international markets. India also contributes significantly to the dominance of the Asia Pacific region, as its growing food processing industry and the increasing demand for beverages and confectionery products further boost the need for malic acid. Additionally, the shift toward clean-label products in countries like Japan and South Korea has led to increased demand for naturally sourced malic acid. These factors collectively solidify Asia Pacific's leadership in the market. The region's low-cost manufacturing capabilities and growing urbanization continue to fuel the growth of malic acid production, positioning Asia Pacific as a key player in the global market.

On the other hand, North America emerged as the fastest growing region in the Malic Acid Market in 2023 with a CAGR of 7%. North America’s rapid growth in the malic acid market is attributed to the increasing demand for natural ingredients in food and beverages, coupled with the region's growing focus on health and wellness. The United States, in particular, is a major driver of this growth, with its robust food and beverage sector, which heavily relies on malic acid for flavor enhancement, acidulants, and preservatives in a wide range of products. Additionally, the demand for functional foods, dietary supplements, and clean-label products is fueling the need for natural malic acid. Companies in the U.S. are increasingly adopting malic acid for use in processed foods, beverages, and cosmetics, capitalizing on consumer trends toward more health-conscious and sustainable choices. Canada also contributes to the region’s growth, with a rising preference for organic and naturally sourced ingredients in both the food and cosmetic industries. Moreover, Mexico's growing food processing sector and increasing exports of processed foods have further contributed to the expansion of the malic acid market in North America. With its expanding health and wellness trend, North America is projected to experience strong growth in the coming years, driven by the demand for cleaner, more natural products.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Anhui Sealong Biotechnology Co., Ltd. (L-Malic Acid, DL-Malic Acid)

Bartek Ingredients Inc. (Food-Grade Malic Acid, Beverage-Grade Malic Acid)

Changmao Biochemical Engineering Co., Ltd. (L-Malic Acid, Fumaric Acid)

Fuso Chemical Co., Ltd. (High-Purity L-Malic Acid, DL-Malic Acid)

Guangzhou ZIO Chemical Co., Ltd. (Food-Grade Malic Acid, Industrial-Grade Malic Acid)

Isegen South Africa (Pty.), Ltd. (L-Malic Acid, DL-Malic Acid)

Jinhu Lile Biotechnology Co., Ltd. (L-Malic Acid, Fumaric Acid)

Lonza (Pharmaceutical-Grade Malic Acid, Food-Grade Malic Acid)

Nacalai Tesque, Inc. (L-Malic Acid, Research-Grade Malic Acid)

Polynt (Technical-Grade Malic Acid, Food-Grade Malic Acid)

Prinova Group LLC (Beverage-Grade Malic Acid, Food-Grade Malic Acid)

Shandong Ensign Industry Co., Ltd. (L-Malic Acid, DL-Malic Acid)

Thirumalai Chemicals Ltd. (L-Malic Acid, Fumaric Acid)

U.S. Chemicals, LLC (L-Malic Acid, DL-Malic Acid)

Weifang Ensign Industry Co., Ltd. (Food-Grade Malic Acid, Industrial-Grade Malic Acid)

Yongsan Chemicals (Food-Grade Malic Acid, Technical-Grade Malic Acid)

Yunnan Fuyan Biological Technology Co., Ltd. (L-Malic Acid, DL-Malic Acid)

Zhejiang Huadee Food Ingredients Co., Ltd. (L-Malic Acid, Food-Grade Malic Acid)

Zhejiang Sanhe Food Science and Technology Co., Ltd. (Food-Grade Malic Acid, Beverage-Grade Malic Acid)

Zhengzhou Ruipu Biological Engineering Co., Ltd. (L-Malic Acid, Industrial-Grade Malic Acid)

Recent Developments

July 2023: PH Plex launched a shampoo and conditioner featuring malic acid to improve hair health by balancing pH, exfoliating the scalp, and preventing damage. This aligns with the rising demand for natural, sustainable beauty products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 228.2 Million |

| Market Size by 2032 | US$ 364.8 Million |

| CAGR | CAGR of 7.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Natural, Synthetic) •By Type (L-Malic Acid, D-Malic Acid, DL-Malic Acid) •By Form (Powder, Liquid) •By Application (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Animal Feed, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bartek Ingredients Inc., Fuso Chemical Co., Ltd., Isegen South Africa (Pty.), Ltd., Anhui Sealong Biotechnology Co., Ltd., Thirumalai Chemicals Ltd., Yongsan Chemicals, Polynt, Lonza, Prinova Group LLC, Nacalai Tesque, Inc., Guangzhou ZIO Chemical Co., Ltd. and other key players |

| Key Drivers | •Rising Demand for Personal Care Products Leveraging Malic Acid’s Exfoliating and Skin-Brightening Properties •Growing Adoption of Malic Acid in Animal Feed to Enhance Livestock Health and Digestive Efficiency |

| Restraints | •High Production Costs and Price Volatility of Raw Materials for Malic Acid Pose Challenges to Market Growth |

Ans: The Malic Acid Market is expected to grow at a CAGR of 5.4%

Ans: The Malic Acid Market size was valued at USD 228.2 million in 2023 and is expected to reach USD 364.8 million by 2032.

Ans: Bio-based malic acid is emerging as a sustainable alternative, expanding its market potential in functional foods, dietary supplements, and industrial applications, driven by consumer demand for eco-friendly solutions.

Ans: The Malic Acid market is challenged by competition from cheaper petrochemical alternatives and fragmentation among numerous small players, which affects product quality and market penetration.

Ans: The malic acid market faces intense competition and fragmentation, with limited product differentiation, pricing pressure, and challenges for smaller players, requiring innovation for sustained growth.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Malic Acid Market Segmentation, by Source

7.1 Chapter Overview

7.2 Natural

7.2.1 Natural Market Trends Analysis (2020-2032)

7.2.2 Natural Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Synthetic

7.3.1 Synthetic Market Trends Analysis (2020-2032)

7.3.2 Synthetic Market Size Estimates and Forecasts to 2032 (USD Million)

8. Malic Acid Market Segmentation, by Type

8.1 Chapter Overview

8.2 L-Malic Acid

8.2.1 L-Malic Acid Market Trends Analysis (2020-2032)

8.2.2 L-Malic Acid Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 D-Malic Acid

8.3.1 D-Malic Acid Market Trends Analysis (2020-2032)

8.3.2 D-Malic Acid Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 DL-Malic Acid

8.4.1 DL-Malic Acid Market Trends Analysis (2020-2032)

8.4.2 DL-Malic Acid Market Size Estimates and Forecasts to 2032 (USD Million)

9. Malic Acid Market Segmentation, by Form

9.1 Chapter Overview

9.2 Powder

9.2.1 Powder Market Trends Analysis (2020-2032)

9.2.2 Powder Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Liquid

9.3.1 Liquid Market Trends Analysis (2020-2032)

9.3.2 Liquid Market Size Estimates and Forecasts to 2032 (USD Million)

10. Malic Acid Market Segmentation, by Application

10.1 Chapter Overview

10.2 Food & Beverages

10.2.1 Food & Beverages Market Trends Analysis (2020-2032)

10.2.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Pharmaceuticals

10.3.1 Pharmaceuticals Market Trends Analysis (2020-2032)

10.3.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Personal Care & Cosmetics

10.4.1 Personal Care & Cosmetics Market Trends Analysis (2020-2032)

10.4.2 Personal Care & Cosmetics Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 Animal Feed

10.5.1 Animal Feed Market Trends Analysis (2020-2032)

10.5.2 Animal Feed Market Size Estimates and Forecasts to 2032 (USD Million)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Malic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.2.4 North America Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.5 North America Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.2.6 North America Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.2.7.2 USA Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.7.3 USA Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.2.7.4 USA Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.2.8.2 Canada Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.8.3 Canada Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.2.8.4 Canada Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.2.9.2 Mexico Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.9.3 Mexico Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.2.9.4 Mexico Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Malic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.6 Eastern Europe Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.1.7.2 Poland Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.7.3 Poland Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.7.4 Poland Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.1.8.2 Romania Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.8.3 Romania Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.8.4 Romania Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.1.9.2 Hungary Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.9.3 Hungary Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.9.4 Hungary Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.1.10.2 Turkey Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.10.3 Turkey Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.10.4 Turkey Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Malic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.4 Western Europe Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.5 Western Europe Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.6 Western Europe Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.7.2 Germany Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.7.3 Germany Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.7.4 Germany Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.8.2 France Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.8.3 France Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.8.4 France Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.9.2 UK Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.9.3 UK Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.9.4 UK Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.10.2 Italy Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.10.3 Italy Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.10.4 Italy Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.11.2 Spain Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.11.3 Spain Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.11.4 Spain Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.12.2 Netherlands Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.12.3 Netherlands Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.12.4 Netherlands Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.13.2 Switzerland Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.13.3 Switzerland Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.13.4 Switzerland Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.14.2 Austria Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.14.3 Austria Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.14.4 Austria Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Malic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.4 Asia Pacific Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.5 Asia Pacific Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.6 Asia Pacific Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.7.2 China Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.7.3 China Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.7.4 China Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.8.2 India Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.8.3 India Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.8.4 India Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.9.2 Japan Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.9.3 Japan Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.9.4 Japan Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.10.2 South Korea Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.10.3 South Korea Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.10.4 South Korea Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.11.2 Vietnam Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.11.3 Vietnam Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.11.4 Vietnam Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.12.2 Singapore Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.12.3 Singapore Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.12.4 Singapore Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.13.2 Australia Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.13.3 Australia Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.13.4 Australia Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Malic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.1.4 Middle East Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.5 Middle East Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.6 Middle East Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.1.7.2 UAE Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.7.3 UAE Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.7.4 UAE Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.1.8.2 Egypt Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.8.3 Egypt Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.8.4 Egypt Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.1.10.2 Qatar Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.10.3 Qatar Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.10.4 Qatar Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Malic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.2.4 Africa Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.5 Africa Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.2.6 Africa Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.2.7.2 South Africa Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.7.3 South Africa Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.2.7.4 South Africa Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.2.8.2 Nigeria Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.2.8.4 Nigeria Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Malic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.6.4 Latin America Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.5 Latin America Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.6 Latin America Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.6.7.2 Brazil Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.7.3 Brazil Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.7.4 Brazil Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.6.8.2 Argentina Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.8.3 Argentina Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.8.4 Argentina Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.6.9.2 Colombia Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.9.3 Colombia Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.9.4 Colombia Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Malic Acid Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America Malic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America Malic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America Malic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

12. Company Profiles

12.1 Bartek Ingredients Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Fuso Chemical Co., Ltd.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Isegen South Africa (Pty.), Ltd.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Anhui Sealong Biotechnology Co., Ltd.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Thirumalai Chemicals Ltd.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Yongsan Chemicals

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Polynt

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Lonza

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Prinova Group LLC

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Nacalai Tesque, Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

12.11 Guangzhou ZIO Chemical Co., Ltd.

12.11.1 Company Overview

12.11.2 Financial

12.11.3 Products/ Services Offered

12.11.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Source

Natural

Synthetic

By Type

L-Malic Acid

D-Malic Acid

DL-Malic Acid

By Form

Powder

Liquid

By Application

Food & Beverages

Pharmaceuticals

Personal Care & Cosmetics

Animal Feed

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Emission Control Catalysts Market Size was USD 48.8 billion in 2023 and is expected to reach USD 88.2 Bn by 2032 & grow at a CAGR of 6.8% by 2024-2032.

The Toluene Market Size was valued at USD 28.6 Billion in 2023. It is expected to grow to USD 40.9 Billion by 2032, growing at a CAGR of 5.4% from 2024-2032.

The Sulfur Bentonite Market size was valued at USD 144.8 million in 2023. It is anticipated to reach USD 224.4 million by the year 2032 with a projected CAGR of 5.0% during the forecast period of 2024-2032.

Explore the Vegan Collagen Market, focusing on plant-based alternatives to animal collagen. Learn about key trends in skincare, supplements, and food industries, and how vegan collagen is gaining popularity among health-conscious consumers and the beauty

The Phase-transfer Catalyst Market size was valued at USD 1.1 Billion in 2023. It is expected to grow to USD 1.81 Billion by 2032 and grow at a CAGR of 5.7% over the forecast period of 2024-2032.

The Hybrid Sealants and Adhesives Market Size was valued at USD 8.10 billion in 2023 and is expected to reach USD 15.81 billion by 2032 and grow at a CAGR of 8.86% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone