Magnetoresistive RAM (MRAM) Market Report Scope and Overview:

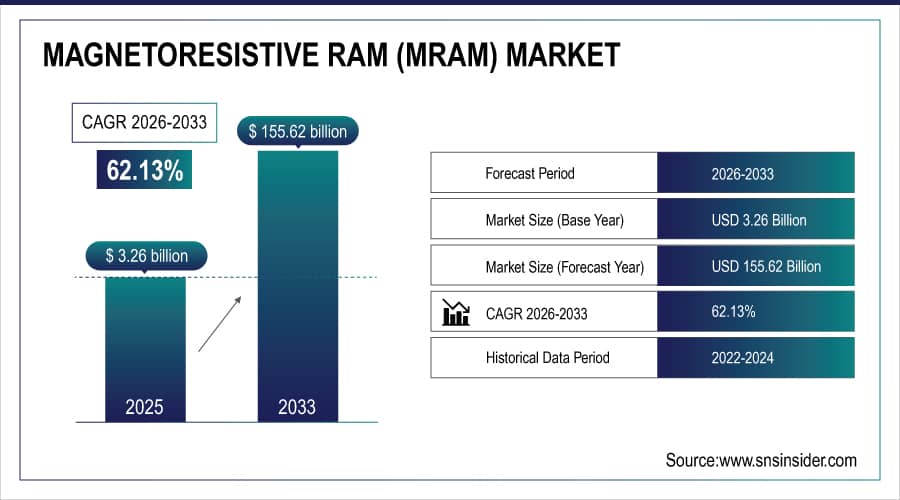

The Magnetoresistive RAM (MRAM) Market Size was valued at USD 3.26 billion in 2025E and is expected to reach USD 155.62 billion by 2033 and grow at a CAGR of 62.13% over the forecast period 2026-2033.

The Magnetoresistive (MRAM) market is evolving because of its superior performance capabilities and growing adoption across diverse sectors. MRAM technology stands out for its non-volatility, high durability, and quick data access capabilities, making it a compelling alternative to traditional memory choices like DRAM and NAND flash. MRAM's unique properties, such as its resistance to radiation and extreme temperatures, make it a good fit for demanding sectors such as aerospace, defense, and automotive. The significance of Magnetoresistive (MRAM)is increasing as industries embrace digital transformation and advanced computing technologies. Progress in Magnetoresistive (MRAM) technology, specifically in STT-MRAM and eMRAM, is pushing the boundaries of memory technology by offering faster writing speeds, lower energy consumption, and enhanced durability. These new developments are essential for activities requiring excellent performance and durable features, such as driver-assistance systems in cars and space missions. The growth of the market is driven by the growing prevalence of Internet of Things (IoT) and edge computing, necessitating robust, efficient memory solutions to handle large amounts of data rapidly.

The Magnetoresistive RAM (MRAM) market is poised for significant growth, driven by the rising demand for non-volatile memory that offers superior performance, energy efficiency, and longevity. Advances in embedded MRAM (eMRAM) are setting new standards in the industry, with near-completion of 8nm eMRAM development and ongoing process improvements. eMRAM, with its rapid write speeds and lack of data-refresh needs, is surpassing traditional DRAM, particularly in applications requiring high durability and speed. Large-scale production of eMRAM is planned across various process nodes, including 14nm by 2024 and 8nm by 2026. The automotive sector will benefit from eMRAM's ability to endure high temperatures and meet strict semiconductor requirements. The surge in big data and AI technologies is fueling demand for Magnetoresistive (MRAM), which combines DRAM speed with NAND non-volatility. As competition intensifies, Magnetoresistive (MRAM) is expected to expand rapidly to address the limitations of DRAM.

Due to its increasing use in hardware security, specifically the advancement of PUF circuits. The distinct characteristics of Magnetoresistive (MRAM), particularly the resistance of the magnetic tunnel junction (MTJ) cell, are being used to improve security measures, as shown by the creation of a PUF circuit that uses manufacturing differences to produce secure responses to specific tasks. This method represents a considerable advancement compared to conventional techniques like the Arbiter PUF, as it successfully meets the strict avalanche criterion (SAC) and provides better protection against machine learning-based modeling attacks. The circuit's grid-like layout boosts its defense against attacks, with simulations revealing a prediction accuracy of just 53.6% for a two-array circuit and 49.9% for a four-array circuit when targeted by multilayer perceptron (MLP), linear regression (LR), and support vector machine (SVM) attacks. Additionally, in complex deep learning modeling attacks conducted in high dimensions using networks such as convolutional neural network (CNN), recurrent neural network (RNN), MLP, and Larq, the circuit displayed strong performance, achieving accuracy levels close to 50.3%. The efficiency of the MRAM-based PUF circuit at the layout level is impressive, as simulated data shows a mean intra-hamming distance (HD) of 0.98% and a mean inter-hamming distance of 50.0%, as well as a mean diffuseness of 49.1%. These qualities highlight the increasing significance of MRAM in the market, especially in modern times where electronic devices are everywhere and safeguarding sensitive data is crucial. As the need for reliable, non-volatile storage options increases, the MRAM market is projected to experience rapid expansion due to advancements in PUF circuits and other security-oriented uses.

Magnetoresistive RAM (MRAM) Market Size and Forecast:

-

Market Size in 2025E: USD 3.26 Billion

-

Market Size by 2033: USD 155.62 Billion

-

CAGR: 62.13% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Magnetoresistive RAM (MRAM) Market - Request Free Sample Report

Magnetoresistive RAM (MRAM) Market Highlights:

-

Growing demand for advanced memory solutions in electric and autonomous vehicles is fueling MRAM adoption

-

MRAM offers fast read/write speeds (128Mb–1Gb), durability, and reliability under harsh automotive conditions

-

Essential for ADAS, V2X communication, and other safety-critical systems due to high endurance and data retention

-

Low power consumption aligns with EV battery efficiency goals and reduces overall vehicle energy usage

-

Compatible with existing memory systems like NOR Flash, easing adoption without major system redesigns

-

High production costs, complex manufacturing, and expensive materials limit widespread adoption despite technological advantages

Magnetoresistive RAM (MRAM) Market Drivers:

-

Advanced memory solutions are fueling innovation in the automotive industry.

The growing need for sophisticated memory solutions in the automotive sector is a major factor propelling the Magnetoresistive RAM (MRAM) market. As the automotive industry quickly changes, driven by the increasing number of electric vehicles (EVs), autonomous driving technologies, and the demand for secure, reliable, and high-performance memory solutions, MRAM is becoming a crucial element. Recent advancements in MRAM technology have brought about capabilities similar to flash memory, leading to significant enhancements in capacity, speed, and durability. This updated MRAM technology overcomes the drawbacks of older memory technologies like NOR does Flash, which have low endurance and sluggish write speed. The fast MRAM, available in sizes from 128Mb to 1Gb, enables quick data reading and writing, perfect for tasks needing fast data transfer speeds like in-car entertainment systems, driver-assistance systems, and firmware updates over the air. In contrast to conventional memory options, MRAM's ability to withstand high temperatures (up to 125 degrees Celsius for more than ten years) and retain data effectively, makes it ideal for challenging conditions in automotive use. Moreover, its resistance to radiation guarantees dependability in tough environments, an essential aspect as vehicles become increasingly interconnected and smart. MRAM's capability to work alongside current memory systems like NOR Flash makes it easier for manufacturers to switch to new memory technologies without major changes. The increasing focus on safety, performance, and efficiency in the automotive sector is anticipated to drive the growth of MRAM, positioning it as a crucial technology in fueling the future of automotive innovation. This pattern highlights how MRAM is playing a bigger role in addressing the changing demands of the automotive industry, where memory solutions need to be high-performance, long-lasting, and dependable.

-

Magnetoresistive (MRAM) is essential for the progression of autonomous driving and enhancing vehicle safety.

With the automotive sector quickly adopting autonomous driving and improved vehicle safety, the importance of dependable, high-performing memory solutions has never been greater. The shift from conventional memory technologies such as FRAM and NOR flash to more cutting-edge options is motivated by the restrictions of these outdated technologies in satisfying the requirements of modern vehicles. Magnetoresistive RAM (MRAM)is becoming a revolutionary technology in this field, with better durability, speed, and energy efficiency. In contrast to traditional non-volatile memory options, MRAM utilizes magnetic principles for data storage, offering various benefits, especially in the challenging conditions commonly found in automotive use. Due to the increase in autonomous vehicles, there has been significant growth in the amount of data produced and managed by in-car systems, leading to a need for memory with high write cycle durability. Magnetoresistive RAM MRAM's durability enables it to meet the challenging requirements of processing and storing real-time data, making it well-suited for uses like ADAS and V2X communication in vehicles. Furthermore, MRAM's capacity to hold onto data even when power is off guarantees that important information is safeguarded in case power is lost, an essential quality for automotive functions related to safety. Furthermore, MRAM's minimal energy usage is in line with the increasing focus on energy efficiency in the automotive industry, particularly with the rise of electric vehicles (EVs). This increase in energy efficiency not only lengthens the lifespan of batteries but also diminishes the total energy usage of vehicles, helping to achieve the sustainability objectives of the industry. As the automotive industry progresses, MRAM is set to play a crucial role in making vehicles smarter, safer, and more efficient, cementing its importance in driving innovation in the automotive memory market.

Magnetoresistive RAM (MRAM) Market Restraints:

-

The Magnetoresistive (MRAM) Market is being affected by the high manufacturing costs.

The Magnetoresistive RAM (MRAM) market is encountering considerable obstacles because of pricey production expenses, which are affecting its expansion and acceptance. The manufacturing of MRAM, specifically Spin-Transfer Torque MRAM (STT-MRAM) and embedded Magnetoresistive RAM (MRAM) (eMRAM), includes intricate and accurate production methods that demand cutting-edge materials and technology. Incorporating specialized materials like magnetic tunnel junctions (MTJs) and merging MRAM with current semiconductor manufacturing processes increases the cost. Furthermore, the advancement of smaller process nodes like 8nm and 5nm requires significant investment in state-of-the-art equipment and facilities, leading to increased expenses.These expensive prices may restrict the accessibility of Magnetoresistive (MRAM) technology, especially for use in consumer electronics and other markets that are sensitive to pricing. Even though MRAM chips offer benefits like non-volatility, speed, and energy efficiency, they are still priced higher than traditional memory technologies such as DRAM and NAND flash. Consequently, manufacturers and end-users need to consider the advantages of MRAM in comparison to its cost impacts. Advancements in production methods, like sophisticated lithography and material science, are focused on reducing costs and enhancing the competitiveness of MRAM. Nonetheless, as long as these cost-cutting methods are not fully implemented, the expensive manufacturing expenses will still hinder the widespread acceptance and market expansion of Magnetoresistive RAM (MRAM) technology.

Magnetoresistive RAM (MRAM) Market Segment Analysis:

By Type

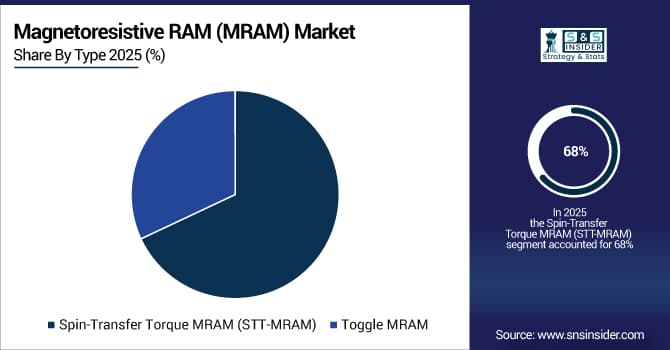

In 2025E, Spin-Transfer Torque MRAM (STT-MRAM) has become a leading contender in the Magnetoresistive RAM (MRAM) Market, holding a significant 68% portion of the revenue. This large portion of the market demonstrates STT-MRAM's better performance and flexibility in comparison to other MRAM technologies. STT-MRAM leverages the spin-transfer torque effect for switching magnetic states, improving its capability for fast write operations and increased durability. The growth of this technology is fueled by its capacity to surpass the constraints of conventional memory options like DRAM and NAND flash, especially in terms of speed, longevity, and energy efficiency. The need for STT-MRAM is especially high in industries that need high-performance memory, such as automotive, industrial, and consumer electronics. STT-MRAM is perfect for advanced driver-assistance systems (ADAS) and infotainment systems in automotive Offerings because of its durability and fast access speeds, which are vital for reliable data processing. Furthermore, the technology's lack of volatility and minimal power usage are in line with the growing focus on efficient and dependable memory options for electronic devices. With the increase in the Internet of Things (IoT) and edge computing Offerings, the demand for fast and reliable memory solutions such as STT-MRAM is rising. The growth of this sector is further propelled by continuous improvements in semiconductor fabrication techniques, including the implementation of smaller process nodes, leading to increased efficiency and decreased pricing of STT-MRAM devices.

By Application

In the year 2025, the aerospace and defense industry held the highest portion of revenue in the Magnetoresistive RAM (MRAM) market, with a share of 41%. The importance of MRAM in aerospace and defense Offerings is highlighted due to its ability to meet strict requirements for reliability, durability, and performance. The special qualities of MRAM, like its non-volatility, high endurance, and resistance to radiation, make it perfectly suitable for these rigorous environments. MRAM retains data even without power and can endure extreme temperatures and radiation, making it perfect for space missions and military electronics in harsh environments, unlike conventional memory technologies. Advancements in MRAM technology are increasingly improving its applicability for aerospace and defense. For example, the advancement of high-level Spin-Transfer Torque MRAM (STT-MRAM) is offering increased speed and durability, essential for immediate data processing in defense systems and satellite communications. Moreover, the incorporation of MRAM into advanced avionics systems is changing the way data integrity and system robustness are maintained. Recent advancements in MRAM technology, including enhanced magnetic tunnel junctions and improved manufacturing methods, are facilitating the development of smaller and more efficient memory units that adhere to the strict size and weight limitations of aviation uses. The progress of radiation-resistant MRAM reinforces its use in space exploration due to the necessity of withstanding cosmic radiation. As technology in the aerospace and defense industries advances, the importance of MRAM is rising, playing a key role in driving innovation and maintaining the functionality of critical systems in difficult conditions. This strong expansion and technological advancement underscore MRAM's crucial role in enhancing the capabilities of aerospace and defense Offerings.

Magnetoresistive RAM (MRAM) Market Regional Analysis:

North America Magnetoresistive RAM (MRAM) Market Trends:

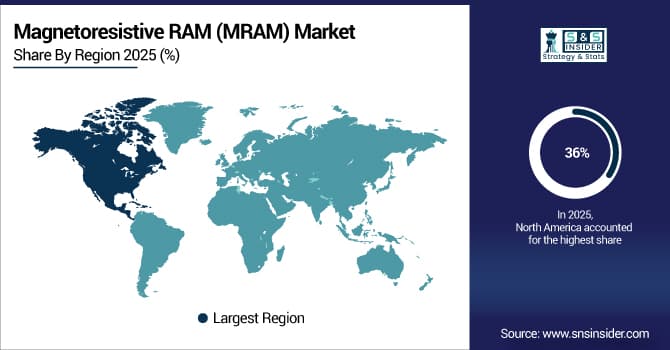

In 2025E, North America dominated the Magnetoresistive RAM (MRAM) market, accounting for 36% of the total global revenue. This strong status is a result of the area's cutting-edge technological foundation, substantial funding for semiconductor studies, and the prominent presence of top MRAM producers. In North America, innovative advancements and strategic initiatives are propelling the region's dominance in the MRAM market, leading the industry forward. Major technology companies and research institutions in the region are leading the way in advancing MRAM technology. For example, top semiconductor producers in the United States are making important progress in creating high-performance STT-MRAM and other Magnetoresistive (MRAM) variations. The focus of these advancements is on improving the speed, dependability, and scalability of MRAM products. For instance, businesses in North America are putting money into advanced fabrication methods and smaller process nodes to enhance MRAM performance and lower costs, thereby increasing its feasibility as a substitute for standard memory technologies. North America houses numerous state-of-the-art research facilities and educational institutes that are pushing forward the progress of MRAM technology. Industry and academia working together are driving advancements in-memory technology, such as developing new materials and innovative device structures to improve MRAM performance. Government programs like the CHIPS and Science Act are providing additional support for these innovations by encouraging semiconductor manufacturing and research within the country.IBM and Intel are leading the way in Magnetoresistive (MRAM) research in North America. IBM's creation of innovative MRAM technologies and Intel's dedication to incorporating MRAM into future computing systems demonstrate how the area is utilizing its technological knowledge to progress the industry. The significant presence of North America in the Magnetoresistive (MRAM) industry highlights its position as a center of technological progress and growth. Commitment to innovation has led to significant advancements in technology.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Magnetoresistive RAM (MRAM) Market Trends:

Asia-Pacific was the second most rapidly growing region in the Magnetoresistive (MRAM) market in 2025, securing a 26% market share. The area's rapid expansion is credited to its growing semiconductor sector, advancing technology, and sizable investments in research and development. The Magnetoresistive (MRAM) market in the region is experiencing rapid growth due to factors such as increasing electronics manufacturing, a strong supply chain, and government initiatives promoting technology innovation. Nations such as China, Japan, and South Korea lead the way in Magnetoresistive (MRAM )progress in the Asia Pacific region. China's increasing emphasis on semiconductor independence and innovation is driving the advancement of MRAM technologies. Chinese businesses are making significant investments in research and development to improve MRAM capabilities and incorporate it into a range of uses, such as consumer electronics and industrial machinery. Prominent companies like SMIC and Yangtze Memory Technologies Co. (YMTC) are crucial in driving the development of MRAM technology in the country. Japan, known for its expertise in semiconductor technology, is also making great progress in the MRAM market. Sony and Toshiba are using their skills to create advanced MRAM options, aiming to enhance data storage, speed, and energy efficiency. Japan's focus on innovation and high quality in the electronics industry helps solidify its role as a major player in the MRAM market. South Korea, where major semiconductor producers such as Samsung Electronics and SK Hynix are located, plays a crucial role in the growth of the MRAM market. Samsung's dedication to being at the forefront of MRAM innovations is evident in the company's advancement of Spin-Transfer Torque MRAM (STT-MRAM) technologies and efforts to increase production capacity. SK Hynix is dedicating resources to researching MRAM to improve the effectiveness and versatility of MRAM solutions in different industries.

Europe Magnetoresistive RAM (MRAM) Market Trends:

Europe accounted for a significant share, supported by strong semiconductor research and automotive and industrial electronics sectors. Investments in next-generation memory technologies such as MRAM, RRAM, and PCM are ongoing, with a focus on automotive, aerospace, and industrial IoT applications. Key players include Infineon Technologies, Crocus Nano Electronics, and Bosch, with industry-academia collaboration driving material and device innovation and an emphasis on low-power, high-speed, and reliable MRAM solutions.

Latin America Magnetoresistive RAM (MRAM) Market Trends:

Latin America accounted for a smaller but growing share, fueled by industrial and automotive electronics and government initiatives. The region is gradually adopting STT-MRAM and other MRAM variants, supported by multinational semiconductor investments, for applications in industrial automation, automotive MCUs, and consumer electronics.

Middle East & Africa Magnetoresistive RAM (MRAM) Market Trends:

MEA is an emerging MRAM market, driven by increasing electronics manufacturing and demand in aerospace, defense, and industrial automation. Growth is supported by partnerships with international semiconductor companies and government tech innovation programs, with a focus on high-end MRAM solutions for mission-critical environments.

Magnetoresistive RAM (MRAM) Market Competitive Landscape:

Everspin Technologies, Inc., established in 2008, is a public semiconductor company headquartered in Chandler, Arizona, that designs and manufactures Magnetoresistive RAM (MRAM) products for industrial, automotive, aerospace, defense, data center, and other mission‑critical markets. Its MRAM offers non‑volatile memory with high endurance, fast performance, and robust data retention, and the company leads commercially shipping discrete and embedded MRAM solutions globally.

-

In Feb 2025, Everspin Technologies’ PERSYST MRAM validated for all Lattice Semiconductor FPGA families, providing high-reliability memory for industrial, aerospace, automotive, and military applications. MRAM offers fast read/write, high endurance, and robust data retention, replacing traditional flash for mission-critical designs.

Renesas Electronics Corporation, established in 2003, is a Japanese semiconductor company headquartered in Tokyo, specializing in microcontrollers, system-on-chip solutions, and analog & power devices. The company serves automotive, industrial, and IoT markets, offering high-performance MCUs, embedded memory solutions, and AI-enabled processing technologies to enable scalable, energy-efficient, and secure electronic systems.

-

In October 2025, Renesas Electronics Launched RA8M2 and RA8D2 MCUs with embedded MRAM, delivering high-endurance, fast-write, low-power memory for industrial, IoT, and graphics applications.

Magnetoresistive RAM (MRAM) Market Key Players:

-

Toshiba Corporation

-

Everspin Technologies, Inc.

-

Samsung Electronics Co., Ltd.

-

NVE Corporation

-

Avalanche Technology, Inc.

-

Honeywell International, Inc.

-

Numem, Inc.

-

IBM Corporation

-

Infineon Technologies AG

-

Crocus Nano Electronics LLC

-

Intel Corporation

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Renesas Electronics Corporation

-

Spin Transfer Technologies

-

Applied Materials, Inc.

-

Canon ANELVA Corporation

-

IMEC Internationa

-

Qualcomm Technologies, Inc.

-

NXP Semiconductors

-

Cobham

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.26 Billion |

| Market Size by 2033 | USD 155.62 Billion |

| CAGR | CAGR of 62.13% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Spin-Transfer Torque MRAM (STT-MRAM), Toggle MRAM) • By Offering( Stand-Alone,Embedded) • By Application (Enterprise Storage, Automotive, Aerospace & Defense, Consumer Electronics, Robotics And Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Toshiba Corporation, Everspin Technologies, Inc., Samsung Electronics Co., Ltd., NVE Corporation, Avalanche Technology, Inc., Honeywell International, Inc., Numem, Inc., IBM Corporation, Infineon Technologies AG, Crocus Nano Electronics LLC, Intel Corporation, TSMC (Taiwan Semiconductor Manufacturing Company), Renesas Electronics Corporation, Spin Transfer Technologies, Applied Materials, Inc., Canon ANELVA Corporation, IMEC International, Qualcomm Technologies, Inc., NXP Semiconductors, Cobham |