To get more information on Machine Tools Market - Request Free Sample Report

Machine Tools Market Report Scope & Overview:

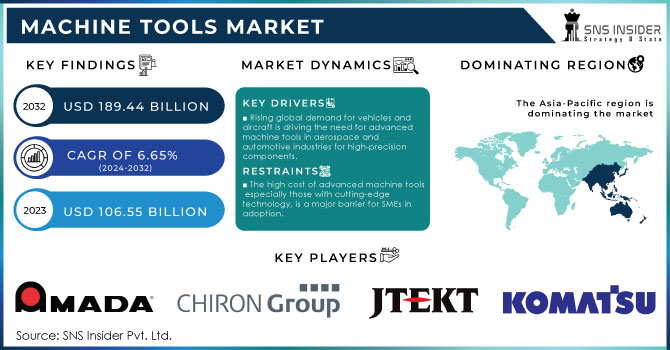

The Machine Tools Market Size was estimated at USD 106.55 billion in 2023 and is expected to reach USD 189.44 billion by 2032 at a CAGR of 6.65% during the forecast period of 2024-2032.

The machine tool market is experiencing significant transformation, primarily driven by technological advancements and an increasing focus on automation across diverse industries. Machine tools play a crucial role in manufacturing by facilitating precise material shaping and cutting through advanced equipment. Recent trends indicate a notable evolution in this sector, especially with the rise of automation, digitalization, and smart manufacturing practices. These innovations are reshaping traditional manufacturing approaches, leading to higher productivity, improved precision, and enhanced operational efficiency. A key development in the machine tool market is the emergence of Industry 4.0, which emphasizes the integration of machinery with data analytics and digital networks. This interconnected framework enables manufacturers to deploy smart machine tools capable of real-time communication, allowing for efficient performance monitoring and maintenance management. One significant advancement is the implementation of predictive maintenance technologies that help organizations foresee potential equipment failures, reducing unplanned downtime and maintenance costs while boosting overall productivity.

Sustainability is another critical driver in the machine tool market, with a notable shift toward electric and hybrid machines. These environmentally friendly solutions not only decrease energy consumption but also incorporate technologies focused on minimizing waste, aligning with global sustainability initiatives. Manufacturers are increasingly investing in machine tools that comply with strict environmental regulations, reflecting a broader commitment to eco-friendly manufacturing practices. Recent statistics underscore the robust growth of the machine tool market. The International Federation of Robotics reported that the global stock of operational industrial robots exceeded 3 million units in 2022, showcasing a strong reliance on automation in manufacturing. Additionally, a report from the American Machine Tool Distributors' Association (AMTDA) highlighted a significant 22% increase in machine tool shipments in 2022 compared to the previous year, indicating the sector's resilience and recovery from pandemic challenges. Moreover, additive manufacturing technologies, including 3D printing, are significantly influencing the machine tool landscape. These advancements enhance traditional machining capabilities, enabling the production of intricate designs while reducing material waste. As these technologies evolve, their integration with conventional machining processes is anticipated to yield hybrid machines, promoting greater customization and shorter lead times, allowing manufacturers to adapt quickly to market demands. Investment in advanced machine tools is also surging in emerging economies like China and India, driven by increasing demand for high-precision components in sectors such as aerospace, automotive, and healthcare.

Machine Tools Market Dynamics

DRIVERS

The escalating global demand for vehicles and aircraft significantly boosts the need for advanced machine tools in the aerospace and automotive industries, as these tools are essential for producing high-precision components.

The increasing demand from the automotive and aerospace industries is a key driver for the machine tools market. Both sectors rely heavily on advanced machine tools to manufacture high-precision components, which are essential for maintaining quality, safety, and performance standards. In the automotive industry, global vehicle production reached approximately 92 million units in 2022, with electric vehicle (EV) sales accounting for over 14%. As EV production continues to rise, so does the demand for specialized machine tools capable of handling components such as battery packs, electric drivetrains, and lightweight materials like aluminum. CNC machines are essential in ensuring the precision needed for these parts, with the automotive sector utilizing around 25% of machine tools globally.

Similarly, the aerospace industry relies on machine tools for manufacturing complex parts. In 2023, global air travel demand rose by over 30% compared to the previous year, driving a surge in aircraft production. This increase led to heightened demand for advanced machine tools to fabricate components from materials like titanium and carbon composites, which are essential for modern, fuel-efficient aircraft. The aerospace sector, known for its stringent quality requirements, demands ultra-precise machining capabilities, often pushing the technological boundaries of machine tools.

Technological advancements, including automation, CNC, and IoT integration, enhance machine tools' efficiency, precision, and productivity, driving market growth.

Technological advancements have significantly transformed the machine tools market by enhancing efficiency, precision, and productivity through the integration of automation, Computer Numerical Control (CNC), and the Internet of Things (IoT). Automation in machine tools allows for the seamless operation of machinery with minimal human intervention, leading to faster production cycles and reduced labor costs. CNC technology plays a crucial role in this evolution by enabling precise control of machining processes, allowing for the creation of complex geometries and intricate designs with high accuracy. This precision not only minimizes material wastage but also improves the overall quality of the end products.

Moreover, the incorporation of IoT in machine tools has revolutionized how industries monitor and manage production. IoT-enabled machines can collect and transmit real-time data regarding their performance, which helps in predictive maintenance and reducing downtime. This connectivity allows manufacturers to optimize production schedules and enhance workflow efficiency. The synergy of these technologies supports the trend towards smart manufacturing, where data-driven decisions lead to improved operational effectiveness. As a result, companies are increasingly investing in advanced machine tools that incorporate these technologies, driving market growth. This transition not only meets the rising demand for high-quality products but also aligns with the global push towards Industry 4.0, where automation and data exchange are key components of modern manufacturing processes. Thus, technological advancements in machine tools are pivotal in fostering innovation, meeting consumer expectations, and enhancing competitiveness in the manufacturing sector.

RESTRAIN

The high cost of advanced machine tools, particularly those with cutting-edge technology, poses a major obstacle for small and medium-sized enterprises (SMEs) in their adoption.

The high initial capital investment required for advanced machine tools serves as a notable barrier for small and medium-sized enterprises (SMEs) looking to modernize their manufacturing processes. Advanced machine tools, particularly those equipped with cutting-edge technologies such as CNC (Computer Numerical Control), automation, and IoT (Internet of Things) integration, often come with substantial price tags. For SMEs, which typically operate on tighter budgets compared to larger corporations, this upfront cost can be prohibitive.

Investing in these sophisticated machines not only requires significant financial resources for the tools themselves but also entails additional expenses related to installation, training, maintenance, and potential facility upgrades. These factors can stretch an SME's financial capabilities, leading to hesitation in adopting newer technologies. As a result, many SMEs may opt for older, less efficient machinery that does not offer the same level of precision or productivity, ultimately hindering their competitiveness in an increasingly automated market. Moreover, the inability to invest in advanced machinery can limit SMEs' capacity to innovate and respond to market demands, putting them at a disadvantage compared to larger firms that can easily absorb such costs. Consequently, the high initial capital investment in advanced machine tools not only affects the individual growth potential of SMEs but also stifles overall industry advancement, as innovation is often driven by the widespread adoption of state-of-the-art technology. This creates a cycle where the financial burden of upgrading remains a critical obstacle for SMEs in the machine tools market.

By Type

In 2023, the metal cutting type segment dominated the market over 77.4%. This segment is composed of various machines such as machining centers, turning machines, grinding machines, milling machines, and eroding machines. These machines are critical for removing excess material from workpieces, shaping them to meet precise specifications. Metal cutting machines, including drilling, gear cutting, lathe, and grinding machines, are essential tools in industries like automotive, aerospace, and manufacturing. They are widely used to enhance productivity, precision, and efficiency in metalworking processes. Technological advancements in machine tools, such as automation and computer numerical control (CNC) systems, have increased demand for these machines, driving innovation and improving output quality. Additionally, the rise of Industry 4.0 has fostered the integration of advanced systems into metal cutting, further enhancing operational efficiency and reducing downtime across industrial sectors.

By Technology

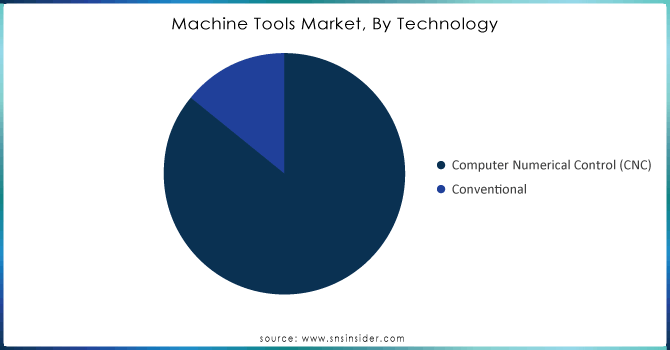

The Computer Numerical Control (CNC) segment dominated the market share over 86.2% in 2023, underscores its critical role in modern manufacturing. CNC machines, governed by precise computer programming, are essential for producing intricate and high-quality components. Their versatility spans multiple applications, including milling machines, lathes, and laser cutters. The increasing demand for automation and precision in industries such as automotive, aerospace, and electronics has fueled their adoption. CNC machines offer superior accuracy, reduced labor costs, and higher production speeds, making them indispensable for complex manufacturing tasks. This technological shift has led to enhanced efficiency in mass production, enabling industries to meet growing demands while maintaining consistency and minimizing errors. As industrial automation and Industry 4.0 trends evolve, the reliance on CNC technology continues to surge, transforming traditional manufacturing processes.

Need any customization research on Machine Tools Market - Enquiry Now

By End-use

The automotive segment dominated the market share over 41.9% in 2023. This is due to the growing demand for precision in producing automotive components. Machine tools are essential in the industry, especially for metal cutting and crafting small machine parts. These tools provide enhanced accuracy, reliability, and operational efficiency, making them indispensable for manufacturing processes. While various production methods are employed in the automotive sector, machine tools offer distinct advantages in high-volume production, contributing to cost-effectiveness and consistency. As vehicle designs evolve, the need for more advanced, precise components increases, driving the adoption of machine tools across automotive manufacturers. Additionally, the push towards electric vehicles and innovations in hybrid models has further emphasized the importance of precise machining technologies.

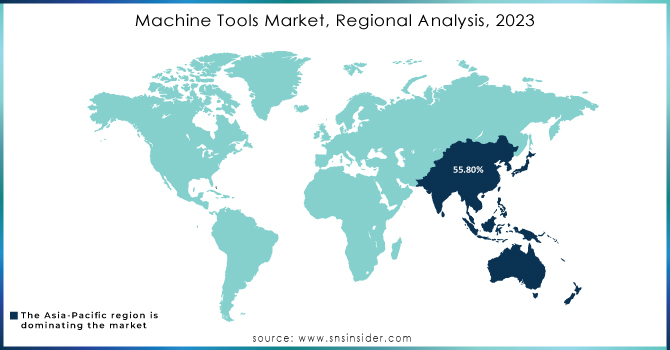

In 2023, the Asia Pacific region dominated the market share over 55.80% of the market. This dominance is largely driven by surging automotive production and increased budgets for defense and commercial aircraft manufacturing. Precision is critical for automotive components to meet stringent quality and safety standards, which, in turn, fuels demand for machine tools. China, a major player in the region, is expected to experience a robust 7.0% compound annual growth rate (CAGR) in its machine tools market. This growth is supported by advancements in manufacturing technologies like automation and smart manufacturing, alongside rising demand in industries such as automotive, aerospace, and electronics. In 2022, China's vehicle production increased by 3%, with over 26 million units manufactured, according to the China Association of Automobile Manufacturers (CAAM). This production boost, coupled with investments from both the government and major automotive companies, has amplified the use of machine tools in the manufacturing process. The automotive sector, particularly, employs machine tools for metal cutting and the production of precision parts. Globally, around 74% of machine tools are used in metal cutting, while 26% are used in forming operations, highlighting the sector's pivotal role in automotive production.

North America's machine tools market is poised for notable growth due to the expanding electric vehicle (EV) industry. Factors such as the presence of leading automakers like General Motors, Nissan, Tesla, and Ford, combined with the region's advanced infrastructure for EV production, create robust demand for machine tools used in vehicle manufacturing. High consumer disposable income also drives the shift towards EVs, boosting the need for precision tools required in automotive component production. Additionally, government incentives for sustainable transportation and the growing trend towards automation in manufacturing processes are further propelling the machine tools sector in the region.

Some of the major key players of Machine Tools Market

Amada Machine Tools Co., Ltd. (Laser Cutting Machines, Punching Machines)

CHIRON GROUP SE (Vertical Machining Centers, Horizontal Machining Centers)

DMG MORI CO., LTD. (CNC Lathes, CNC Milling Machines)

DN Solutions (Lathes, Machining Centers)

Georg Fischer Ltd. (Injection Molding Machines, CNC Machining Centers)

HYUNDAI WIA CORP (CNC Lathes, Machining Centers)

JTEKT Corporation (Ball Screws, Bearings)

Komatsu Ltd. (Excavators, CNC Machine Tools)

Makino (Vertical Machining Centers, Wire EDM Machines)

Okuma Corporation (CNC Lathes, CNC Machining Centers)

Hurco Companies, Inc. (CNC Machines, 5-Axis Machining Centers)

FANUC Corporation (Robots, CNC Control Systems)

Haas Automation, Inc. (CNC Lathes, CNC Vertical Machining Centers)

Mazak Corporation (Multi-Tasking Machines, Laser Cutting Machines)

Siemens AG (Drive Systems, CNC Controls)

Toshiba Machine Co., Ltd. (Injection Molding Machines, CNC Lathes)

Kia Motors Corporation (Automated Machining Systems, Robotic Solutions)

Mitsubishi Electric Corporation (CNC Controls, Laser Cutting Machines)

Yasda Precision Tools Co., Ltd. (High-Precision Machining Centers)

Biesse Group (Woodworking Machines, Stone Processing Machines)

DMG Mori

Mazak

Haas Automation

Okuma Corporation

Makino

Fanuc

Siemens

Hurco Companies, Inc.

Doosan Machine Tools

Emag GmbH & Co. KG

In April 2024: Lincoln Electric Holdings, Inc. acquired RedViking, a private automation system integrator located in Plymouth, Michigan, USA. RedViking specializes in developing and integrating advanced autonomous guided vehicles (AGVs), mobile robots, specialized assembly systems, dynamic test systems, and proprietary manufacturing execution system (MES) software.

In October 2023: AMADA MACHINERY CO., LTD. introduced a three-dimensional laser integrated system featuring both a blue laser and a fiber laser, designed for high-speed, high-quality cutting, welding, and layered manufacturing. This machine will be showcased at the “Amada Global Innovation Center” located within the AMADA Head Office in Isehara, Kanagawa, during November.

In 2024: Nidec Machine Tool Corporation announced the opening of its new factory in Pinghu, China, on October 11. The facility aims to meet the rising demand for machine tools in the automotive and robotics sectors. Covering approximately 66,000 square meters, the factory will produce various machine tools, with an anticipated output of 4 million units in its first year, scaling to 8 million by 2030.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 106.55 billion |

| Market Size by 2032 | USD 189.44 billion |

| CAGR | CAGR of 6.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Metal Cutting, Machining Centers, Turning Machines, Grinding Machines, Milling Machines, Eroding machines, Others) (Metal Forming, Bending Machines, Presses, Punching Machines, Others) • By Technology (Computer Numerical Control (CNC), Conventional) By End-use (Automotive, Mechanical Engineering, Metal Working, Aerospace, Electrical Industry, others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amada Machine Tools Co., Ltd., CHIRON GROUP SE, DMG MORI CO., LTD., DN Solutions, Georg Fischer Ltd., HYUNDAI WIA CORP, JTEKT Corporation, Komatsu Ltd., Makino, Okuma Corporation, Hurco Companies, Inc., FANUC Corporation, Haas Automation, Inc., Mazak Corporation, Siemens AG, Toshiba Machine Co., Ltd., Kia Motors Corporation, Mitsubishi Electric Corporation, Yasda Precision Tools Co., Ltd., Biesse Group. |

| Key Drivers | • The escalating global demand for vehicles and aircraft significantly boosts the need for advanced machine tools in the automotive and aerospace industries, as these tools are essential for producing high-precision components. • Technological advancements, including automation, CNC, and IoT integration, enhance machine tools' efficiency, precision, and productivity, driving market growth. |

| RESTRAINTS | • The high cost of advanced machine tools, particularly those with cutting-edge technology, poses a major obstacle for small and medium-sized enterprises (SMEs) in their adoption. |

Ans: The Machine Tools Market is expected to grow at a CAGR of 6.65% during 2024-2032.

Ans: The Machine Tools Market was USD 106.55 billion in 2023 and is expected to Reach USD 189.44 billion by 2032.

The development of machine tool technologies, such as multi-axis arms and robotics, and the expansion of the industrial sector are the main drivers of the machine tools market.

The leading participants in the Amada Machine Tools Co., Ltd., CHIRON GROUP SE, DMG MORI. CO., LTD., DN Solutions, Georg Fischer Ltd., HYUNDAI WIA CORP.

Yes, you may request customization based on your company's needs.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Manufacturing Output, by region, (2020-2023)

5.2 Utilization Rates, by region, (2020-2023)

5.3 Maintenance and Downtime Metrix

5.4 Technological Adoption Rates, by region

5.5 Export/Import Data, by region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Machine Tools Market Segmentation, by Type

7.1 Chapter Overview

7.2 Metal Cutting

7.2.1 Metal Cutting Market Trends Analysis (2020-2032)

7.2.2 Metal Cutting Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.3 Machining Centers

7.2.3.1 Machining Centers Market Trends Analysis (2020-2032)

7.2.3.2 Machining Centers Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.4 Turning Machines

7.2.4.1 Turning Machines Market Trends Analysis (2020-2032)

7.2.4.2 Turning Machines Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.5 Grinding Machines

7.2.5.1 Grinding Machines Market Trends Analysis (2020-2032)

7.2.5.2 Grinding Machines Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.6 Grinding Machines

7.2.6.1 Grinding Machines Market Trends Analysis (2020-2032)

7.2.6.2 Grinding Machines Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.7 Eroding machines

7.2.7.1 Eroding machines Market Trends Analysis (2020-2032)

7.2.7.2 Eroding machines Market Size Estimates and Forecasts to 2032 (USD Million)

7.2.8 Others

7.2.8.1 Others Market Trends Analysis (2020-2032)

7.2.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Metal Forming

7.3.1 Metal Forming Market Trends Analysis (2020-2032)

7.3.2 Metal Forming Market Size Estimates and Forecasts to 2032 (USD Million)

7.3.3 Bending Machines

7.3.3.1 Bending Machines Market Trends Analysis (2020-2032)

7.3.3.2 Bending Machines Market Size Estimates and Forecasts to 2032 (USD Million)

7.3.4 Presses

7.3.4.1 Presses Market Trends Analysis (2020-2032)

7.3.4.2 Presses Market Size Estimates and Forecasts to 2032 (USD Million)

7.3.5 Punching Machines

7.3.5.1 Punching Machines Market Trends Analysis (2020-2032)

7.3.5.2 Punching Machines Market Size Estimates and Forecasts to 2032 (USD Million)

7.3.6 Others

7.3.6.1 Others Market Trends Analysis (2020-2032)

7.3.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Machine Tools Market Segmentation, By Technology

8.1 Chapter Overview

8.2 Computer Numerical Control (CNC)

8.2.1 Computer Numerical Control (CNC) Market Trends Analysis (2020-2032)

8.2.2 Computer Numerical Control (CNC) Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Conventional

8.3.1 Conventional Market Trends Analysis (2020-2032)

8.3.2 Conventional Market Size Estimates and Forecasts to 2032 (USD Million)

9. Machine Tools Market Segmentation, By End-use

9.1 Chapter Overview

9.2 Automotive

9.2.1 Automotive Market Trends Analysis (2020-2032)

9.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Mechanical Engineering

9.3.1 Mechanical Engineering Market Trends Analysis (2020-2032)

9.3.2 Mechanical Engineering Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Metal Working

9.4.1 Metal Working Market Trends Analysis (2020-2032)

9.4.2 Metal Working Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Aerospace

9.5.1 Aerospace Market Trends Analysis (2020-2032)

9.5.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Electrical Industry

9.6.1 Electrical Industry Market Trends Analysis (2020-2032)

9.6.2 Electrical Industry Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Machine Tools Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.4 North America Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.5 North America Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.2 USA Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.6.3 USA Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.2 Canada Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.7.3 Canada Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.2 Mexico Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.8.3 Mexico Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Machine Tools Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.6.3 Poland Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.7.3 Romania Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.8.3 Hungary Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.9.3 Turkey Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Machine Tools Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.5 Western Europe Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.6.3 Germany Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.2 France Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.7.3 France Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.2 UK Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.8.3 UK Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.9.3 Italy Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.10.3 Spain Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.13.3 Austria Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Machine Tools Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.5 Asia Pacific Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.2 China Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.6.3 China Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.2 India Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.7.3 India Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.2 Japan Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.8.3 Japan Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.2 South Korea Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.9.3 South Korea Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.10.3 Vietnam Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.2 Singapore Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.11.3 Singapore Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.2 Australia Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.12.3 Australia Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Machine Tools Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.4 Middle East Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.5 Middle East Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.6.3 UAE Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.7.3 Egypt Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.9.3 Qatar Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Machine Tools Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.4 Africa Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.5 Africa Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.6.3 South Africa Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Machine Tools Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.4 Latin America Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.5 Latin America Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.2 Brazil Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.6.3 Brazil Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.2 Argentina Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.7.3 Argentina Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.2 Colombia Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.8.3 Colombia Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Machine Tools Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Machine Tools Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Machine Tools Market Estimates and Forecasts, by End Use (2020-2032) (USD Million)

11. Company Profiles

11.1 Amada Machine Tools Co., Ltd.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 CHIRON GROUP SE

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 DMG MORI CO., LTD.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 DN Solutions

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Georg Fischer Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 HYUNDAI WIA CORP

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 JTEKT Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Komatsu Ltd.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Makino

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Okuma Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Type

Metal Cutting

Machining Centers

Turning Machines

Grinding Machines

Milling Machines

Eroding machines

Others

Metal Forming

Bending Machines

Presses

Punching Machines

Others

By Technology

Computer Numerical Control (CNC)

Conventional

By End-use

Automotive

Mechanical Engineering

Metal Working

Aerospace

Electrical Industry

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Countertop Market size was valued at USD 131.2 Billion in 2023 and is now anticipated to grow to USD 233.2 Billion by 2032, displaying a compound annual growth rate of 6.6% during the forecast Period 2024-2032.

The Vibration Control System Market Size was esteemed at USD 5.21 billion in 2023 and is supposed to arrive at USD 8.87 billion by 2032 and develop at a CAGR of 6.1% over the forecast period 2024-2032.

The Industrial Dust Collector Market Size was estimated at USD 8.13 billion in 2023 and is expected to arrive at USD 13.12 billion by 2032 with a growing CAGR of 5.46% over the forecast period 2024-2032.

The Train Seat Market was valued at USD 2.66 billion in 2023 and is projected to reach USD 3.91 billion by 2032, growing at a CAGR of 4.37% from 2024 to 2032.

The Mass Flow Controller Market Size was valued at USD 1.32 Billion in 2023 and will Reach to $2.16 Billion by 2031, displaying a CAGR of 5.61% by 2024-2031.

The Condensing Unit Market Size was estimated at USD 40.30 billion in 2023 and is expected to arrive at USD 74.66 billion by 2032 with a growing CAGR of 7.09% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone