Get More Information on m-Toulic Acid Market - Request Sample Report

The M-Toluic Acid Market Size was valued at USD 1.7 billion in 2023, and is expected to reach USD 4.2 billion by 2032, and grow at a CAGR of 10.8% over the forecast period 2024-2032.

Demand for the m-Toluic acid market is growing at a stable pace, driven by its diverse application in industries and also as an important chemical intermediate in organic synthesis. Also called 3-methylbenzoic acid, m-Toluic acid is a versatile compound with valuable properties that make it an indispensable compound in the manufacture of pharmaceuticals, agrochemicals, perfumes, and specialty chemicals. It can act as the building block for complex molecules, hence enabling a wider creation of products with specified functionalities and applications that drive its significance in the chemistry manufacturing process.

Another big segment that generates demand for m-Toluic acid market is the agrochemical sector. The Union Budget 2024 is likely to raise the agrochemical sector's import duties, according to The Economic Times, in a move to prevent the onslaught of chemicals coming from China. Experts in the industry want to see tariffs imposed to level the playing field for homegrown players and bring down trade deficits. Measures like a PLI scheme are also suggested for improving manufacturing capabilities. The Crop Care Federation of India has asked for import tariffs to be increased from the current about 7.5%, representing key players in the agrochemical sector.

Herbicides, insecticides, and fungicides are synthesized using this acid. With the rising global population and agricultural activities to meet food demand, agrochemical demand is also growing, consequently fuelling the demand for m-Toluic acid as the raw material used in the production of agrochemicals. Moreover, newer formulations of agrochemicals and the introduction of newer active ingredients also foster the growing requirement for m-Toluic acid in maintaining farm productivity and food security globally. In a nutshell, the m-Toluic acid market keeps its outlook bright, with its applications helping drive innovation in pharmaceuticals, agrochemicals, and specialty chemicals. Growing demand for high-performance chemical intermediaries, which would further develop high-end products with improved properties and functionalities, is also fuelling the market growth. With industries increasingly focusing on research and development and finding new ways to help combat the ever-changing issues, the role of m-Toluic acid is integral to the continued development of a range of industries into the future.

Market Dynamics:

Drivers:

Increased demand for insect repellents drives the demand for m-Toluic Acid market

The growing demand for insect repellents significantly affects the market growth of m-Toluic Acid, which is driven by enhanced global awareness about the quality of life and the need for controlling various insect-borne diseases. m-Toluic Acid is a raw material of great importance in the manufacture of various chemical intermediates for formulation into different compositions as used in insect repellents. It is used in the production of active ingredients such as DEET and N, N-Diethyl-meta-toluamide, one of the most effective and widely applied chemicals found in insect repellents. The number of users of insect repellents alone in the United States is expected to grow from 195.50 million in the three years ending 2020 to 201.53 million users by 2024, which portrays that the demand from the market, and hence the need for m-Toluic Acid in its production, is ever-increasing. Demand for robust repellents, whose formulation includes m-Toluic Acid, has increased with the ever-increasing cases of a lot of diseases, such as malaria and dengue fever. The worst outbreak is being seen in dengue fever in Latin America and other rest places of the world, where cases have been soaring, but a safe bug repellent can help protect from this and other diseases caused by pests. This is supported by increases globally in dengue fever. Cases recorded in Latin America during the first five months of 2024 are 238% higher than they were at this time last year. Insect-repellent demand has increased, given the increased trends of outdoor activities and growth in urban centres. Insect protection products are in high demand because most people spend their time outdoors. For example, repellent products are massively consumed in areas that get a large volume of tourists, like tropical regions. Increased volume consumption of meta-Toluic Acid has increased due to the rise in demand by manufacturers formulating repellents in various applications for consumers.

Developments towards Sustainable Production fuel the m-Toluic Acid market growth

Developments in sustainable production are strongly influencing the m-Toluic Acid market as the chemical industry increasingly focuses on environmental responsibility and efficiency. Conventional processes for the manufacture of m-Toluic Acid usually use harmful chemicals and often produce a lot of waste. To better respond to growing environmental concerns and stringent regulations, the industry is moving investment into greener technologies and processes. For example, the latest developments involve the invention of more efficient catalytic methods that reduce the use of toxic solvents and limit waste. Besides serving global sustainable objectives, such developments further enhance safety and efficiency in the production of m-Toluic Acid. Another development in this regard is the use of renewable feedstocks in m-Toluic Acid production. Among the ways through which researchers yearn to do this incorporate the application of bio-based raw materials originating from renewable sources, such as biomass, to supplant the conventional petroleum-based feedstock materials. Such a shift will reduce the carbon footprint of m-Toluic Acid manufacturing processes and support the establishment of a more circular economy. For instance, the use of bio-based chemicals in the synthesis of m-Toluic Acid has the huge potential to greatly reduce GHG emissions while minimizing dependency on fossil fuels, thereby solving both environmental and economic problems. Another key point is that companies are increasingly utilizing process optimization techniques to improve resource efficiency. Principally, companies are integrating green chemistry principles—designed to minimize chemical processes that cause environmental impacts—in the production of m-Toluic Acid. These involve the development of innovative technologies for areas like solvent-free reactions or less hazardous and less energy-demanding processes. A critically important example is the creation of new production routes that will be more resource-efficient and waste-reducing. Very specifically, innovations that help firms comply with regulations provide a competitive advantage to companies by appealing to environmentally-minded consumers and investors.

Restraints:

Awareness regarding vector-borne diseases hinders the growth of the market

Growth in regulatory awareness toward vector-borne diseases is a significant constraint in the m-Toluic Acid market since stimuli from increased public and government attention to vector-borne diseases continue to be positive drivers for increased regulation or scrutiny of chemical products used in repellents and other end-use applications. For example, increased awareness of diseases such as malaria and dengue fever has seen regulators increase safety and environmental standards about chemicals like m-Toluic Acid, used in the manufacture of insect repellents. This has led to increased regulation, and therefore increased production costs, sometimes throwing the companies into a race against time to ensure their products meet the escalated safety requirements. Also, a continuous rise in demand for products with m-Toluic, which are the main ingredients for the traditional ones, along with the natural and organic push driven by health-conscious consumers for alternative chemicals used as repellents, may further affect the demand.

Strict laws against harmful pharmaceutical chemicals hamper the growth of the market

By Product Type

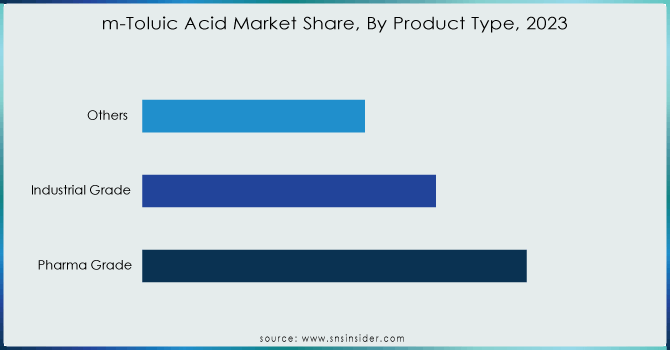

The Pharma Grade segment accounted for a 45% share of the m-Toluic Acid market in 2023. This might be because it occupies an extremely important place as an intermediate in API synthesis. For example, m-Toluic acid is intended for the synthesis of these compounds, which are included in pharmaceuticals to treat chronic diseases such as anti-inflammatory drugs and antibiotics. Because the rigid quality required by the pharmaceutical industry is coupled with high standards of purity in medicinal products, this sector drives demand for pharma-grade m-Toluic Acid. In this respect, pharmaceutical companies ensure that the effectiveness and safety of the products offered are aligned with the content of high-purity m-Toluic Acid and hence command a significant market share compared to other segments such as Industrial Grade or Others.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Application

In 2023, the pharmaceutical sector accounted for the largest share of the m-Toluic Acid market, roughly 50%. This is largely due to the requirement of m-Toluic Acid as a key intermediate for many active pharmaceutical ingredients. An example of its application includes synthesis in certain compounds that find an application in medicines used to treat diseases such as inflammatory conditions and infections like anti-inflammatory and antibiotic drugs. High-purity intermediates are required in Pharmaceuticals, and m-Toluic Acid gives way to the assurance of efficacy and safety of such drugs. The strong demand emanating from the pharmaceutical industry substantially outclasses that from other applications, including insect repellents and dyes & pigments, and hence easily seizes the leading position within this market.

By End-use Industry

The Pharmaceutical Companies segment was the largest shareholder in the m-Toluic Acid market in 2023 and is expected to cover roughly 52%. This is so because m-Toluic Acid acts as a key intermediate in active pharmaceutical ingredient production. For instance, the acid finds application in the manufacture of some APIs for treating different chronic diseases, such as anti-inflammatory drugs and antibiotics. This segment dominates, further driven by the complex purification processes for pharmaceutical-grade intermediates and high demand from pharmaceutical companies, hence driving high market share for m-Toluic Acid. The pharmaceuticals consumed a large quantity of m-Toluic Acid for drug manufacturing, significantly higher than that by chemical manufacturers and consumer goods companies combined.

By Distribution Channel

The Distributors segment dominated the m-Toluic Acid market with a volume share of approximately 55% in 2023. This can partly be attributed to the fact that m-Toluic Acid has extensive applications across various industries, thus dispersing back through large networks and the logistic capabilities of distributors. Through a clean supply chain, distributors bridge the gap between manufacturers and users, guaranteeing the availability of m-Toluic Acid to various industries and geographical regions. For instance, manufacturers of chemicals and pharmaceuticals need distributors for bulk sourcing of m-Toluic Acid to ensure that production demands are met with less hassle at cost-effective prices. Owing to its ability to process large volumes and offer product choices to many industries, the distributor network is also a preferred route over direct sales, retailers, and online sales, and has become particularly important in markets where reliability and bulk procurement are fundamental.

Regional Analysis

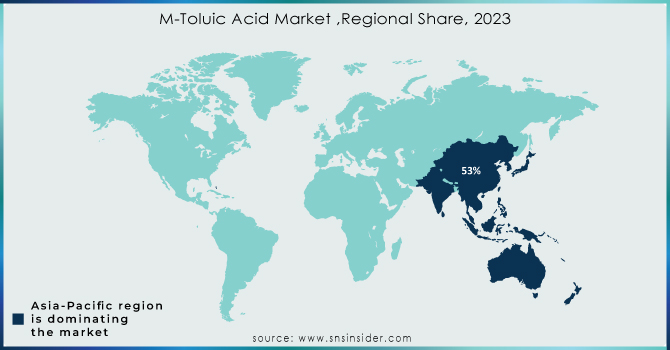

In 2023, the Asia-Pacific region dominated the m-Toluic Acid market, holding approximately 53% of the market. This is majorly based on the wide chemical manufacturing infrastructure and notable demand from both the pharmaceutical and industrial sectors. Countries like China and India are big producers and consumers of m-Toluic Acid since they have large-scale pharmaceutical and agrochemical industries. For instance, the robust pharmaceutical sector of China consumes the metabolite m-Toluic Acid for the production of active pharmaceutical ingredients, while the rising chemical manufacturing base of India also contributes to that of high demand. The region's leadership in the market is further precipitated by cost-effective production capabilities, favorable economic conditions, and increasing investments in the chemical industries.

Key Players:

Taixing Zhongran Chemical Co. Ltd., Yangzhou Gideon Biological Technology, Hebei Xingyu Chemical, Zibo Shibang Chemical, Shandong Yuexing Chemical, Dalian Richfortune Chemicals, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.7 Billion |

| Market Size by 2032 | US$ 4.2 Billion |

| CAGR | CAGR of 10.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Pharma Grade, Industrial Grade, Others) •By Application (Pharmaceutical, Insect Repellent, Dyes & Pigments, Others) •By End-use Industry (Pharmaceutical Companies, Chemical Manufacturers, Consumer Goods Companies, Others) •By Distribution Channel (Direct Sales, Distributors, Retailers, Online Sales, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Taixing Zhongran Chemical Co. Ltd., Yangzhou Gideon Biological Technology, Hebei Xingyu Chemical, Zibo Shibang Chemical, Shandong Yuexing Chemical, Dalian Richfortune Chemicals and other players |

| Key Drivers | •Increased demand for insect repellents •Developments towards Sustainable Production |

| Restraints | •Awareness regarding vector-borne diseases •Strict laws against harmful pharmaceutical chemicals |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Pharma Grade, Industrial Grade and Others are the sub-segments of by Product segment.

Ans: Taixing Zhongran Chemical Co. Ltd., Yangzhou Gideon Biological Technology, Hebei Xingyu Chemical, Zibo Shibang Chemical, Shandong Yuexing Chemical and Dalian Richfortune Chemicals are the major key players of m-Toluic Acid (MTA, CAS 99-04-7) Market.

Ans: M-Toluic Acid Market size was USD 1.7 billion in 2023 and is expected to reach USD 4.2 billion by 2032.

Ans: The M-Toluic Acid Market is expected to grow at a CAGR of 5.65%.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. m-Toluic Acid Market Segmentation, by Product Type

7.1 Introduction

7.2 Pharma Grade

7.3 Industrial Grade

7.4 Others

8. m-Toluic Acid Market Segmentation, by Application

8.1 Introduction

8.2 Pharmaceutical

8.3 Insect Repellent

8.4 Dyes & Pigments

8.5 Others

9. m-Toluic Acid Market Segmentation, by End-use Industry

9.1 Introduction

9.2 Pharmaceutical Companies

9.3 Chemical Manufacturers

9.4 Consumer Goods Companies

9.5 Others

10. m-Toluic Acid Market Segmentation, by Distribution Channel

10.1 Introduction

10.2 Direct Sales

10.3 Distributors

10.4 Retailers

10.5 Online Sales

10.6 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America m-Toluic Acid Market by Country

11.2.3 North America m-Toluic Acid Market by Product Type

11.2.4 North America m-Toluic Acid Market by Application

11.2.5 North America m-Toluic Acid Market by End-use Industry

11.2.6 North America m-Toluic Acid Market by Distribution Channel

11.2.7 USA

11.2.7.1 USA m-Toluic Acid Market by Product Type

11.2.7.2 USA m-Toluic Acid Market by Application

11.2.7.3 USA m-Toluic Acid Market by End-use Industry

11.2.7.4 USA m-Toluic Acid Market by Distribution Channel

11.2.8 Canada

11.2.8.1 Canada m-Toluic Acid Market by Product Type

11.2.8.2 Canada m-Toluic Acid Market by Application

11.2.8.3 Canada m-Toluic Acid Market by End-use Industry

11.2.8.4 Canada m-Toluic Acid Market by Distribution Channel

11.2.9 Mexico

11.2.9.1 Mexico m-Toluic Acid Market by Product Type

11.2.9.2 Mexico m-Toluic Acid Market by Application

11.2.9.3 Mexico m-Toluic Acid Market by End-use Industry

11.2.9.4 Mexico m-Toluic Acid Market by Distribution Channel

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe m-Toluic Acid Market by Country

11.3.2.2 Eastern Europe m-Toluic Acid Market by Product Type

11.3.2.3 Eastern Europe m-Toluic Acid Market by Application

11.3.2.4 Eastern Europe m-Toluic Acid Market by End-use Industry

11.3.2.5 Eastern Europe m-Toluic Acid Market by Distribution Channel

11.3.2.6 Poland

11.3.2.6.1 Poland m-Toluic Acid Market by Product Type

11.3.2.6.2 Poland m-Toluic Acid Market by Application

11.3.2.6.3 Poland m-Toluic Acid Market by End-use Industry

11.3.2.6.4 Poland m-Toluic Acid Market by Distribution Channel

11.3.2.7 Romania

11.3.2.7.1 Romania m-Toluic Acid Market by Product Type

11.3.2.7.2 Romania m-Toluic Acid Market by Application

11.3.2.7.3 Romania m-Toluic Acid Market by End-use Industry

11.3.2.7.4 Romania m-Toluic Acid Market by Distribution Channel

11.3.2.8 Hungary

11.3.2.8.1 Hungary m-Toluic Acid Market by Product Type

11.3.2.8.2 Hungary m-Toluic Acid Market by Application

11.3.2.8.3 Hungary m-Toluic Acid Market by End-use Industry

11.3.2.8.4 Hungary m-Toluic Acid Market by Distribution Channel

11.3.2.9 Turkey

11.3.2.9.1 Turkey m-Toluic Acid Market by Product Type

11.3.2.9.2 Turkey m-Toluic Acid Market by Application

11.3.2.9.3 Turkey m-Toluic Acid Market by End-use Industry

11.3.2.9.4 Turkey m-Toluic Acid Market by Distribution Channel

11.3.2.10 Rest of Eastern Europe

11.3.2.10.1 Rest of Eastern Europe m-Toluic Acid Market by Product Type

11.3.2.10.2 Rest of Eastern Europe m-Toluic Acid Market by Application

11.3.2.10.3 Rest of Eastern Europe m-Toluic Acid Market by End-use Industry

11.3.2.10.4 Rest of Eastern Europe m-Toluic Acid Market by Distribution Channel

11.3.3 Western Europe

11.3.3.1 Western Europe m-Toluic Acid Market by Country

11.3.3.2 Western Europe m-Toluic Acid Market by Product Type

11.3.3.3 Western Europe m-Toluic Acid Market by Application

11.3.3.4 Western Europe m-Toluic Acid Market by End-use Industry

11.3.3.5 Western Europe m-Toluic Acid Market by Distribution Channel

11.3.3.6 Germany

11.3.3.6.1 Germany m-Toluic Acid Market by Product Type

11.3.3.6.2 Germany m-Toluic Acid Market by Application

11.3.3.6.3 Germany m-Toluic Acid Market by End-use Industry

11.3.3.6.4 Germany m-Toluic Acid Market by Distribution Channel

11.3.3.7 France

11.3.3.7.1 France m-Toluic Acid Market by Product Type

11.3.3.7.2 France m-Toluic Acid Market by Application

11.3.3.7.3 France m-Toluic Acid Market by End-use Industry

11.3.3.7.4 France m-Toluic Acid Market by Distribution Channel

11.3.3.8 UK

11.3.3.8.1 UK m-Toluic Acid Market by Product Type

11.3.3.8.2 UK m-Toluic Acid Market by Application

11.3.3.8.3 UK m-Toluic Acid Market by End-use Industry

11.3.3.8.4 UK m-Toluic Acid Market by Distribution Channel

11.3.3.9 Italy

11.3.3.9.1 Italy m-Toluic Acid Market by Product Type

11.3.3.9.2 Italy m-Toluic Acid Market by Application

11.3.3.9.3 Italy m-Toluic Acid Market by End-use Industry

11.3.3.9.4 Italy m-Toluic Acid Market by Distribution Channel

11.3.3.10 Spain

11.3.3.10.1 Spain m-Toluic Acid Market by Product Type

11.3.3.10.2 Spain m-Toluic Acid Market by Application

11.3.3.10.3 Spain m-Toluic Acid Market by End-use Industry

11.3.3.10.4 Spain m-Toluic Acid Market by Distribution Channel

11.3.3.11 Netherlands

11.3.3.11.1 Netherlands m-Toluic Acid Market by Product Type

11.3.3.11.2 Netherlands m-Toluic Acid Market by Application

11.3.3.11.3 Netherlands m-Toluic Acid Market by End-use Industry

11.3.3.11.4 Netherlands m-Toluic Acid Market by Distribution Channel

11.3.3.12 Switzerland

11.3.3.12.1 Switzerland m-Toluic Acid Market by Product Type

11.3.3.12.2 Switzerland m-Toluic Acid Market by Application

11.3.3.12.3 Switzerland m-Toluic Acid Market by End-use Industry

11.3.3.12.4 Switzerland m-Toluic Acid Market by Distribution Channel

11.3.3.13 Austria

11.3.3.13.1 Austria m-Toluic Acid Market by Product Type

11.3.3.13.2 Austria m-Toluic Acid Market by Application

11.3.3.13.3 Austria m-Toluic Acid Market by End-use Industry

11.3.3.13.4 Austria m-Toluic Acid Market by Distribution Channel

11.3.3.14 Rest of Western Europe

11.3.3.14.1 Rest of Western Europe m-Toluic Acid Market by Product Type

11.3.3.14.2 Rest of Western Europe m-Toluic Acid Market by Application

11.3.3.14.3 Rest of Western Europe m-Toluic Acid Market by End-use Industry

11.3.3.14.4 Rest of Western Europe m-Toluic Acid Market by Distribution Channel

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific m-Toluic Acid Market by Country

11.4.3 Asia-Pacific m-Toluic Acid Market by Product Type

11.4.4 Asia-Pacific m-Toluic Acid Market by Application

11.4.5 Asia-Pacific m-Toluic Acid Market by End-use Industry

11.4.6 Asia-Pacific m-Toluic Acid Market by Distribution Channel

11.4.7 China

11.4.7.1 China m-Toluic Acid Market by Product Type

11.4.7.2 China m-Toluic Acid Market by Application

11.4.7.3 China m-Toluic Acid Market by End-use Industry

11.4.7.4 China m-Toluic Acid Market by Distribution Channel

11.4.8 India

11.4.8.1 India m-Toluic Acid Market by Product Type

11.4.8.2 India m-Toluic Acid Market by Application

11.4.8.3 India m-Toluic Acid Market by End-use Industry

11.4.8.4 India m-Toluic Acid Market by Distribution Channel

11.4.9 Japan

11.4.9.1 Japan m-Toluic Acid Market by Product Type

11.4.9.2 Japan m-Toluic Acid Market by Application

11.4.9.3 Japan m-Toluic Acid Market by End-use Industry

11.4.9.4 Japan m-Toluic Acid Market by Distribution Channel

11.4.10 South Korea

11.4.10.1 South Korea m-Toluic Acid Market by Product Type

11.4.10.2 South Korea m-Toluic Acid Market by Application

11.4.10.3 South Korea m-Toluic Acid Market by End-use Industry

11.4.10.4 South Korea m-Toluic Acid Market by Distribution Channel

11.4.11 Vietnam

11.4.11.1 Vietnam m-Toluic Acid Market by Product Type

11.4.11.2 Vietnam m-Toluic Acid Market by Application

11.4.11.3 Vietnam m-Toluic Acid Market by End-use Industry

11.4.11.4 Vietnam m-Toluic Acid Market by Distribution Channel

11.4.12 Singapore

11.4.12.1 Singapore m-Toluic Acid Market by Product Type

11.4.12.2 Singapore m-Toluic Acid Market by Application

11.4.12.3 Singapore m-Toluic Acid Market by End-use Industry

11.4.12.4 Singapore m-Toluic Acid Market by Distribution Channel

11.4.13 Australia

11.4.13.1 Australia m-Toluic Acid Market by Product Type

11.4.13.2 Australia m-Toluic Acid Market by Application

11.4.13.3 Australia m-Toluic Acid Market by End-use Industry

11.4.13.4 Australia m-Toluic Acid Market by Distribution Channel

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific m-Toluic Acid Market by Product Type

11.4.14.2 Rest of Asia-Pacific m-Toluic Acid Market by Application

11.4.14.3 Rest of Asia-Pacific m-Toluic Acid Market by End-use Industry

11.4.14.4 Rest of Asia-Pacific m-Toluic Acid Market by Distribution Channel

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East m-Toluic Acid Market by Country

11.5.2.2 Middle East m-Toluic Acid Market by Product Type

11.5.2.3 Middle East m-Toluic Acid Market by Application

11.5.2.4 Middle East m-Toluic Acid Market by End-use Industry

11.5.2.5 Middle East m-Toluic Acid Market by Distribution Channel

11.5.2.6 UAE

11.5.2.6.1 UAE m-Toluic Acid Market by Product Type

11.5.2.6.2 UAE m-Toluic Acid Market by Application

11.5.2.6.3 UAE m-Toluic Acid Market by End-use Industry

11.5.2.6.4 UAE m-Toluic Acid Market by Distribution Channel

11.5.2.7 Egypt

11.5.2.7.1 Egypt m-Toluic Acid Market by Product Type

11.5.2.7.2 Egypt m-Toluic Acid Market by Application

11.5.2.7.3 Egypt m-Toluic Acid Market by End-use Industry

11.5.2.7.4 Egypt m-Toluic Acid Market by Distribution Channel

11.5.2.8 Saudi Arabia

11.5.2.8.1 Saudi Arabia m-Toluic Acid Market by Product Type

11.5.2.8.2 Saudi Arabia m-Toluic Acid Market by Application

11.5.2.8.3 Saudi Arabia m-Toluic Acid Market by End-use Industry

11.5.2.8.4 Saudi Arabia m-Toluic Acid Market by Distribution Channel

11.5.2.9 Qatar

11.5.2.9.1 Qatar m-Toluic Acid Market by Product Type

11.5.2.9.2 Qatar m-Toluic Acid Market by Application

11.5.2.9.3 Qatar m-Toluic Acid Market by End-use Industry

11.5.2.9.4 Qatar m-Toluic Acid Market by Distribution Channel

11.5.2.10 Rest of Middle East

11.5.2.10.1 Rest of Middle East m-Toluic Acid Market by Product Type

11.5.2.10.2 Rest of Middle East m-Toluic Acid Market by Application

11.5.2.10.3 Rest of Middle East m-Toluic Acid Market by End-use Industry

11.5.2.10.4 Rest of Middle East m-Toluic Acid Market by Distribution Channel

11.5.3 Africa

11.5.3.1 Africa m-Toluic Acid Market by Country

11.5.3.2 Africa m-Toluic Acid Market by Product Type

11.5.3.3 Africa m-Toluic Acid Market by Application

11.5.3.4 Africa m-Toluic Acid Market by End-use Industry

11.5.3.5 Africa m-Toluic Acid Market by Distribution Channel

11.5.3.6 Nigeria

11.5.3.6.1 Nigeria m-Toluic Acid Market by Product Type

11.5.3.6.2 Nigeria m-Toluic Acid Market by Application

11.5.3.6.3 Nigeria m-Toluic Acid Market by End-use Industry

11.5.3.6.4 Nigeria m-Toluic Acid Market by Distribution Channel

11.5.3.7 South Africa

11.5.3.7.1 South Africa m-Toluic Acid Market by Product Type

11.5.3.7.2 South Africa m-Toluic Acid Market by Application

11.5.3.7.3 South Africa m-Toluic Acid Market by End-use Industry

11.5.3.7.4 South Africa m-Toluic Acid Market by Distribution Channel

11.5.3.8 Rest of Africa

11.5.3.8.1 Rest of Africa m-Toluic Acid Market by Product Type

11.5.3.8.2 Rest of Africa m-Toluic Acid Market by Application

11.5.3.8.3 Rest of Africa m-Toluic Acid Market by End-use Industry

11.5.3.8.4 Rest of Africa m-Toluic Acid Market by Distribution Channel

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America m-Toluic Acid Market by Country

11.6.3 Latin America m-Toluic Acid Market by Product Type

11.6.4 Latin America m-Toluic Acid Market by Application

11.6.5 Latin America m-Toluic Acid Market by End-use Industry

11.6.6 Latin America m-Toluic Acid Market by Distribution Channel

11.6.7 Brazil

11.6.7.1 Brazil m-Toluic Acid Market by Product Type

11.6.7.2 Brazil m-Toluic Acid Market by Application

11.6.7.3 Brazil m-Toluic Acid Market by End-use Industry

11.6.7.4 Brazil m-Toluic Acid Market by Distribution Channel

11.6.8 Argentina

11.6.8.1 Argentina m-Toluic Acid Market by Product Type

11.6.8.2 Argentina m-Toluic Acid Market by Application

11.6.8.3 Argentina m-Toluic Acid Market by End-use Industry

11.6.8.4 Argentina m-Toluic Acid Market by Distribution Channel

11.6.9 Colombia

11.6.9.1 Colombia m-Toluic Acid Market by Product Type

11.6.9.2 Colombia m-Toluic Acid Market by Application

11.6.9.3 Colombia m-Toluic Acid Market by End-use Industry

11.6.9.4 Colombia m-Toluic Acid Market by Distribution Channel

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America m-Toluic Acid Market by Product Type

11.6.10.2 Rest of Latin America m-Toluic Acid Market by Application

11.6.10.3 Rest of Latin America m-Toluic Acid Market by End-use Industry

11.6.10.4 Rest of Latin America m-Toluic Acid Market by Distribution Channel

12. Company Profiles

12.1 Taixing Zhongran Chemical Co. Ltd.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 The SNS View

12.2 Yangzhou Gideon Biological Technology

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 The SNS View

12.3 Hebei Xingyu Chemical

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 The SNS View

12.4 Zibo Shibang Chemical

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 The SNS View

12.5 Shandong Yuexing Chemical

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 The SNS View

12.6 Dalian Richfortune Chemicals

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 The SNS View

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Pharma Grade

Industrial Grade

Others

By Application

Pharmaceutical

Insect Repellent

Dyes & Pigments

Others

By End-use Industry

Pharmaceutical Companies

Chemical Manufacturers

Consumer Goods Companies

Others

By Distribution Channel

Direct Sales

Distributors

Retailers

Online Sales

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Latex Binders Market size was USD 7.6 billion in 2023 and is expected to reach USD 13.3 billion by 2032 and grow at a CAGR of 6.5% over the forecast period of 2024-2032.

Electric Vehicle Adhesives Market was valued at USD 1.93 billion in 2023 and is expected to reach USD 38.11 billion by 2032 at a CAGR of 39.30% by 2024-2032.

The Aerogel Insulation Market was valued at USD 897.28 million in 2023 and is expected to reach USD 5082.32 million by 2032, at a CAGR of 21.26% from 2024-2032.

Food Contact Paper Market size was USD 78.85 billion in 2023 and is expected to Reach USD 119.12 billion by 2032, growing at a CAGR of 4.69% from 2024-2032.

The Flame Retardants Market was valued at USD 8.3 Billion in 2023 and is expected to reach USD 14.20 Billion by 2032, growing at a CAGR of 6.17% over the forecast period 2024-2032.

The Antimicrobial Additives Market Size was valued at USD 3.24 billion in 2023 and is expected to reach USD 6.86 billion by 2032 and grow at a CAGR of 9.20% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone