Get more information on M-commerce Payment Market- Request Sample Report

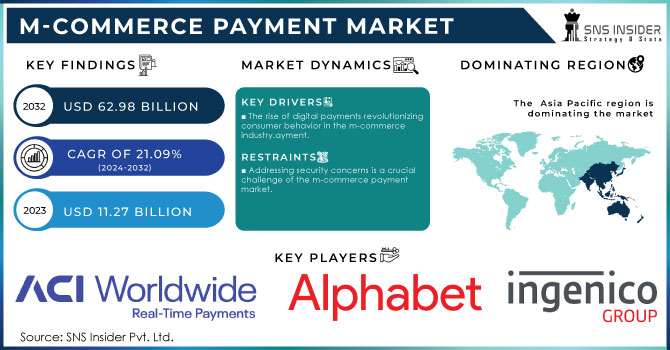

The M-Commerce Payment Market was valued at USD 11.27 Billion in 2023 and is expected to reach USD 62.98 Billion by 2032, growing at a CAGR of 21.09% over the forecast period 2024-2032.

The M-commerce payment market, a crucial segment of the broader mobile commerce ecosystem, has witnessed rapid growth over the past few years. This growth is driven by the proliferation of smartphones, advancements in mobile technology, and the increasing adoption of digital payment solutions. As a result, the mobile phone e-commerce industry has reached an impressive valuation of USD 2.2 trillion, reflecting a significant shift in consumer shopping behavior. This surge in the M-commerce payment market can be attributed to the convenience and accessibility that mobile devices offer, allowing users to shop anytime and anywhere. Over 56% of global consumers now prefer mobile devices for shopping, with mobile commerce apps expected to capture 78% of global e-commerce traffic, outpacing traditional desktops and tablets.

In 2024 i.e. 70% of purchases were made through mobile apps rather than websites. Additionally, 65% of mobile users have made purchases based on influencer recommendations, demonstrating the growing impact of social media on consumer decisions. The average transaction value for mobile shopping is USD 120, reflecting consumers' increasing trust in mobile platforms. Mobile apps have significantly higher engagement rates than traditional e-commerce avenues, with a conversion rate of 3.5% compared to 2% for mobile websites. Users engage more deeply with mobile shopping apps, viewing products 4.2 times more per session. The cart abandonment rate for mobile apps is also notably lower at 20%, indicating more effective sales processes.

Drivers

The increasing use of digital payment options is changing how consumers behave and playing a big role in the growth of the m-commerce payment industry. Digital payment solutions like mobile wallets, peer-to-peer systems, and contactless cards are gaining popularity as customers look for quicker and more secure payment options. Digital payment solutions provide a range of advantages, such as convenience, security, and quick transactions. Customers can make immediate payments without the need to have cash or physical cards, which improves the overall shopping experience. Incorporating biometric authentication techniques like fingerprints and facial recognition improves security even more, addressing worries regarding fraud and identity theft. This trust in online payments motivates customers to adopt mobile commerce platforms, resulting in higher transaction amounts. Moreover, the increase in online shopping platforms and mobile apps has led to a situation where electronic transactions are crucial. Retailers are more and more embracing digital payment solutions to meet evolving consumer demands. Numerous e-commerce platforms currently give importance to mobile-first approaches, making sure their websites and apps are tailored for mobile users. Consequently, mobile commerce payment options are becoming increasingly common.

The move towards contactless payments has transformed the payment environment in mobile commerce, leading to notable market expansion. Consumers are increasingly opting for easy and clean payment options like contactless payment methods, such as NFC technology, QR codes, and mobile wallets, due to their convenience and hygiene benefits. Furthermore, contactless payments improve the shopping experience by providing added convenience. Customers can swiftly finalize purchases, leading to decreased wait times and enhanced productivity. This rapid pace is especially advantageous in busy retail settings, where extended queues can dissuade potential shoppers. Therefore, retailers who adopt contactless payment options can improve customer satisfaction and boost sales. The inclusion of contactless payment technologies in different platforms continues to drive the expansion of the m-commerce payment industry. Numerous retailers currently provide mobile applications that enable customers to buy products directly from their devices, facilitating smooth transactions. Linking loyalty programs and promotions to contactless payments also boosts consumer engagement and spending.

Restraints

Even with improvements in security technologies, worries about security still hinder the growth of the m-commerce payment market. High-profile data breaches and fraud cases have increased consumer knowledge about the dangers of mobile payments. Consumers might be reluctant to disclose sensitive financial details on mobile apps due to concerns about unauthorized access and potential financial harm. The threat of identity theft is a major worry for customers participating in mobile commerce transactions. Cybercriminals frequently use advanced methods to steal personal and financial data, causing heightened worry among potential users. Moreover, the increasing occurrence of phishing attacks and malware directed at mobile devices intensifies these worries. Consumers might avoid using m-commerce payment options because they are afraid of being scammed or defrauded. Additionally, consumer ignorance about mobile payment security adds to these worries. Numerous consumers might not have a complete grasp of the functioning of mobile payment systems or the security protocols in place to safeguard their data. Being transparent about how data is handled and the security protocols in place can also contribute to building trust with consumers. Nevertheless, as long as these issues are not effectively resolved, they will still hinder the expansion of the m-commerce payment sector.

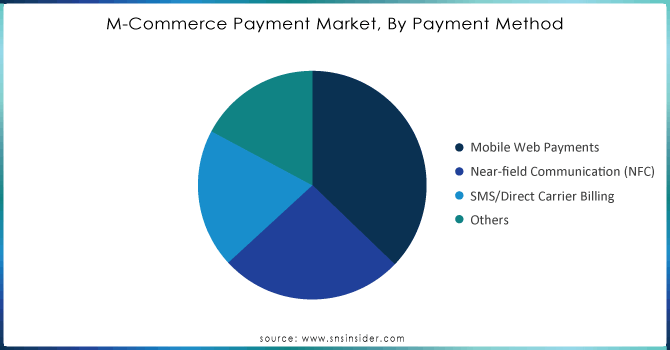

By Payment Method

Mobile web payments led the market segment in 2023 with a 37.00% market share, fueled by the growing use of smartphones and wide internet availability. This technique enables customers to conduct transactions via mobile browsers, making shopping more convenient. 2.71 billion people around the globe are making online purchases from dedicated eCommerce platforms or social media stores. Mobile web payments improve the buying process by offering one-click payments and storing payment details, which decreases the rates of abandoned carts. Key players, including PayPal and Stripe, have enhanced their platforms for mobile functionality, providing smooth payment integration for e-commerce merchants.

Near-field Communication (NFC) is quickly gaining growth rate and is to become the fastest-growing segment during 2024-2032. NFC allows for contactless payments by enabling devices to communicate with each other when nearby, ensuring fast and secure transactions. Apple and Google have created strong mobile wallet apps, including Apple Pay and Google Wallet, that use NFC technology for safe transactions. Companies such as Starbucks and McDonald's have also incorporated NFC payment systems to improve customer satisfaction and simplify the payment process.

Do you need any customization data on M-commerce Payment Market - Enquire Now

By Transaction Type

M-retailing dominated the market with a 44.00% market share in 2023. This section allows individuals to purchase products and services using mobile gadgets like smartphones and tablets, providing convenience and easy access. Retailers use mobile apps and websites to offer a smooth shopping experience, incorporating features such as personalized suggestions, mobile payment options, and loyalty programs. 20.1% of retail purchases are expected to take place online in 2024 and this share will further rise to 22.6% by 2027. For example, Amazon has strong mobile apps that make browsing, buying, and paying simple, increasing user interaction and boosting sales. Amazon Pay handled 72.4 million transactions, which is about 0.5% of all UPI transactions.

M-ticketing and booking are the most rapidly expanding segment in the m-commerce payment market over 2024-2032, fueled by the rising use of mobile devices and the increasing need for convenient travel and event services. This portion consists of mobile apps that let users buy tickets for transportation, concerts, movies, and other events using their smartphones. The rapid expansion of ticket accessibility anytime anywhere is driven by convenience. Companies such as Ticketmaster and Expedia showcase this pattern, offering easy-to-use platforms that assist in smooth booking and payment procedures.

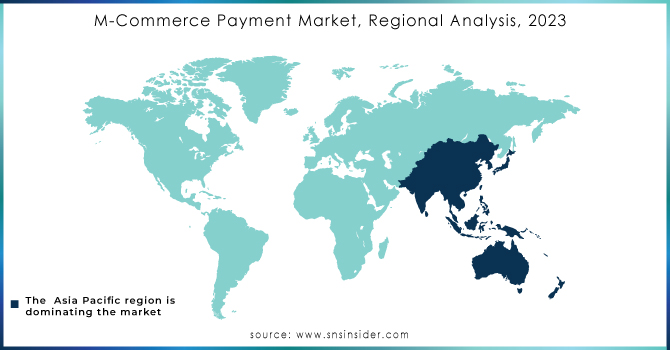

APAC held a 37.00% market share in 2023 and led the market, driven by a large population, fast urbanization, and extensive smartphone usage. Nations such as China and India are leading the way in incorporating mobile payment solutions into everyday transactions. Alipay and WeChat Pay in China showcase how effective m-commerce can be by allowing users to easily make transactions for shopping and utility payments. Furthermore, India has experienced a rise in mobile payment apps such as PhonePe and Google Pay, because of government efforts to encourage digital payments and financial inclusion.

North America is to show a significant growth rate during 2024-2032, due to quick technological advancements, widespread smartphone use, and the rising popularity of digital wallets. The area's strong infrastructure and emphasis on innovation enable the advancement of cutting-edge payment solutions, improving consumer experiences. For example, Venmo, a company owned by PayPal, has become extremely popular with younger age groups by offering fast and interactive payment choices. Moreover, major online retailers such as Amazon and Walmart are incorporating mobile commerce features, enabling consumers to easily make purchases using their mobile applications.

The major key players in the M-commerce Payment Market are:

ACI Worldwide, Inc. (ACI Secure EPN, ACI Universal Payments)

Alphabet Inc. (Google) (Google Pay, Google Wallet)

Apple Inc. (Apple Pay, Apple Card)

FIS (Worldpay, FIS Payment Gateway)

Fiserv, Inc. (Clover POS, Fiserv Payment Gateway)

Ingenico (Ingenico Move/5000, Ingenico Telium Tetra)

Mastercard (Mastercard Contactless, Mastercard Send)

PayPal Holdings, Inc. (PayPal Mobile App, Venmo)

Square, Inc. (Square Point of Sale, Square Online)

Visa, Inc. (Visa Direct, Visa Checkout)

Adyen (Adyen Payment Solutions, Adyen RevenueAccelerate)

Stripe (Stripe Payments, Stripe Terminal)

Samsung Electronics (Samsung Pay, Samsung Rewards)

Zelle (Zelle App, Zelle Integration with Banking Apps)

Braintree (Braintree Payments, Braintree Marketplace)

Alipay (Alipay Wallet, Alipay for Merchants)

WeChat Pay (WeChat Pay Mobile Wallet, WeChat Pay for Merchants)

Revolut (Revolut App, Revolut Business)

Klarna (Klarna App, Klarna Pay Later)

Skrill (Skrill Wallet, Skrill Prepaid Mastercard)

June 2024: Klarna introduced new features to its "Pay Later" service, allowing consumers to spread payments over a longer term. This enhancement caters to the increasing demand for flexible payment options in mobile commerce.

February 2024: Google Pay launched a new feature that allows users to store and manage loyalty cards, tickets, and passes alongside their payment methods. This integration simplifies the payment process for users, making it easier to access everything in one app.

October 2023: Mastercard introduced a biometric payment card that uses fingerprint verification for transactions. This innovation aims to enhance security and convenience for cardholders, allowing payments to be processed more quickly without the need for PINs.

August 2023: Amazon expanded its Amazon One palm recognition technology to additional retail locations, allowing customers to pay by scanning their palms. This development is part of Amazon's strategy to streamline the checkout experience in physical stores.

| Report Attributes | Details |

| Market Size in 2023 | $ 11.27 Billion |

| Market Size by 2032 | $ 62.98 Billion |

| CAGR | CAGR of 21.09 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Payment Method (Mobile Web Payments, Near-field Communication, SMS/Direct Carrier Billing, Others) • by Transaction Type (M-retailing, M-ticketing, M-billing, Others), by Application (Personal, 18 to 30 Year, 31 to 54 Year, 55 to 73 Year, Business) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ACI Worldwide, Inc., Alphabet Inc. (Google), Apple Inc., FIS, Fiserv, Inc., Ingenico, Mastercard, PayPal Holdings, Inc., Square, Inc., Visa, Inc. |

| Key Drivers | • M-commerce payments are becoming more popular for online buying and banking. Payment • Convenience and reduced transaction time |

| Market Opportunities | • The number of advances and activities relating to digitalized payments is rapidly increasing |

Ans: - The M-commerce Payment market size was valued at USD 11.27 Billion in 2023.

Ans: - Data breaches are becoming more common and Payment gateways are more expensive and tend to be used in certain locations.

Ans: - Asia Pacific held the greatest market share in the year 2022.

Ans: - The major key players are ACI Worldwide, Inc., Alphabet Inc. (Google), Apple Inc., FIS, Fiserv, Inc., Ingenico, Mastercard, PayPal Holdings, Inc., Square, Inc., Visa, Inc.

Ans. The study includes a comprehensive analysis of Speech-to-text API Market trends, as well as present and future market forecasts. DROC analysis, as well as impact analysis for the projected period. Porter's five forces analysis aids in the study of buyer and supplier potential as well as the competitive landscape etc.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Transaction Volume, (2023), by Region

5.3 Regulatory and Compliance Metrics, by Region (2020-2032)

5.4 Customer Retention Rates, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. M-commerce Payment Market Segmentation, by Payment Method

7.1 Chapter Overview

7.2 Mobile Web Payments

7.2.1 Mobile Web Payments Market Trends Analysis (2020-2032)

7.2.2 Mobile Web Payments Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Near-field Communication (NFC)

7.3.1 Near-field Communication (NFC) Market Trends Analysis (2020-2032)

7.3.2 Near-field Communication (NFC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 SMS/Direct Carrier Billing

7.4.1 SMS/Direct Carrier Billing Market Trends Analysis (2020-2032)

7.4.2 SMS/Direct Carrier Billing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. M-commerce Payment Market Segmentation, by Transaction Type

8.1 Chapter Overview

8.2 M-retailing

8.2.1 M-retailing Market Trends Analysis (2020-2032)

8.2.2 M-retailing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 M-ticketing/booking

8.3.1 M-ticketing/booking Market Trends Analysis (2020-2032)

8.3.2 M-ticketing/booking Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 M-billing

8.4.1 M-billing Market Trends Analysis (2020-2032)

8.4.2 M-billing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Other

8.5.1 Other Market Trends Analysis (2020-2032)

8.5.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America M-commerce Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.2.4 North America M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.2.5.2 USA M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.2.6.2 Canada M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.2.7.2 Mexico M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe M-commerce Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.1.5.2 Poland M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.1.6.2 Romania M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.1.7.2 Hungary M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.1.8.2 Turkey M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe M-commerce Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.4 Western Europe M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.5.2 Germany M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.6.2 France M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.7.2 UK M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.8.2 Italy M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.9.2 Spain M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.12.2 Austria M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific M-commerce Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.4.4 Asia Pacific M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.4.5.2 China M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.4.5.2 India M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.4.5.2 Japan M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.4.6.2 South Korea M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.2.7.2 Vietnam M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.4.8.2 Singapore M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.4.9.2 Australia M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East M-commerce Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.1.4 Middle East M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.1.5.2 UAE M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.1.6.2 Egypt M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.1.8.2 Qatar M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa M-commerce Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.2.4 Africa M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.2.5.2 South Africa M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America M-commerce Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.6.4 Latin America M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.6.5.2 Brazil M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.6.6.2 Argentina M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.6.7.2 Colombia M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America M-commerce Payment Market Estimates and Forecasts, by Payment Method (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America M-commerce Payment Market Estimates and Forecasts, by Transaction Type (2020-2032) (USD Billion)

10. Company Profiles

10.1 ACI Worldwide, Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Alphabet Inc. (Google)

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Apple Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 FIS

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Fiserv, Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Ingenico

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Mastercard

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 PayPal Holdings, Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Square, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Visa, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Payment Method

Mobile Web Payments

Near-field Communication (NFC)

SMS/Direct Carrier Billing

Others

By Transaction Type

M-retailing

M-ticketing/booking

M-billing

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Intelligent Network Market was valued at USD 4.7 billion in 2023 and is expected to reach USD 42.2 billion by 2032, growing at a CAGR of 27.49% by 2032.

The Telecom equipment market size was estimated at USD 718.30 Billion in 2023 and is expected to reach USD 1033.03 Billion by 2032 at a CAGR of 4.12% during the forecast period of 2024-2032.

The Cloud OSS BSS Market was valued at USD 22.0 billion in 2023 and is expected to reach USD 60.8 Billion by 2032, growing at a CAGR of 11.96% from 2024-2032.

Big Data Analytics Market was valued at USD 284.3 billion in 2023 and is expected to reach USD 842.6 billion by 2032, growing at a CAGR of 12.9% from 2024-2032.

The Metaverse Market size was USD 52.96 Billion in 2023 and is expected to reach USD 1599.72 Billion by 2032, growing at a CAGR of 46.0% over the forecast period of 2024-2032.

AI Voice Generators Market was valued at USD 3.20 billion in 2023 and is expected to reach USD 40.25 billion by 2032, growing at a CAGR of 32.51% by 2032.

Hi! Click one of our member below to chat on Phone