Get More Information on Luxury Car Rental Market - Request Sample Report

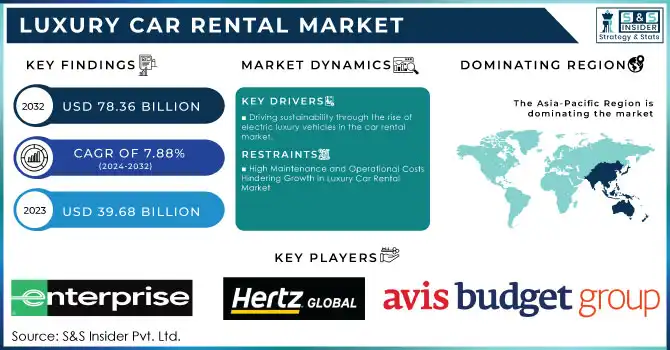

The Luxury Car Rental Market Size was valued at USD 39.68 Billion in 2023, and is expected to reach USD 78.36 Billion by 2032, and grow at a CAGR of 7.88% over the forecast period 2024-2032.

The luxury car rental market is experiencing significant growth, driven by the expansion of the tourism industry and rising demand for premium travel experiences. As global tourism continues to flourish, particularly in high-demand vacation destinations, there has been an increased inclination among tourists to opt for luxury vehicles to enhance their travel experience. The substantial rise in passenger traffic and the expansion of airports worldwide have further contributed to this trend, as they offer improved accessibility and convenience for travelers seeking upscale transportation options. Airports, as key hubs of international tourism, are becoming essential touchpoints for luxury car rental services, offering easy access to high-end vehicles directly at their locations.

The growing availability of luxury vehicles, such as high-end sedans, elegant SUVs, and multi-utility vehicles (MUVs), in car rental fleets is fueling this demand. These premium vehicles, priced approximately 30-35% higher than standard economy cars, offer superior comfort and brand prestige, appealing to both leisure and business travelers. However, despite the high rental costs, the demand for luxury car rentals remains robust, particularly due to the increasing number of business activities and international events that require luxurious transportation options.

Mobile applications and demand-responsive transport services are making it easier for customers to access luxury car rental options, compare prices, and book vehicles with features such as real-time feedback, vehicle tracking, and chauffeur services. For instance, the collaboration between GoAir and Eco Europcar to offer luxury car rentals at airports across India exemplifies the market’s expansion into diverse regions. As luxury car rental services become more accessible through these innovative platforms, the industry is expected to continue its growth trajectory over the forecast period, offering new opportunities for both luxury car rental businesses and travelers seeking premium mobility solutions.

Drivers

Driving sustainability through the rise of electric luxury vehicles in the car rental market

One of the key drivers of the luxury car rental market is the growing demand for electric luxury vehicles (EVs), driven by environmentally conscious consumers and the increasing adoption of sustainable transportation options. As electric mobility continues to gain traction, the luxury car rental market is witnessing a shift towards the integration of electric high-end cars like the Tesla Model S, Audi e-tron, and Jaguar I-PACE into rental fleets. This shift caters to consumers who prioritize eco-friendly travel while still seeking the prestige, comfort, and advanced technology that define luxury vehicles. The rapid growth and demand for electric luxury cars. This growth is supported by government incentives such as USD 7.51 billion for EV infrastructure in the US and cash rebates in New Zealand. The expansion of charging infrastructure, with 2.71 million public charging points globally as of 2022, further fuels the market by alleviating concerns over range and charging accessibility. The luxury EV market is being propelled by increased technological advancements, including ultra-modern features like autonomous driving capabilities and smartphone integration, and performance that matches traditional luxury vehicles. For example, the Audi e-tron GT can accelerate from 0-100 km/h in just 4 seconds, demonstrating the high-performance capabilities of these vehicles. This combination of sustainability, advanced technology, and performance is driving substantial growth in the luxury car rental market as consumers demand both luxury and eco-friendly options.

Restraints

High Maintenance and Operational Costs Hindering Growth in Luxury Car Rental Market

High maintenance and operational costs are significant restraints for the luxury car rental market, especially when it comes to luxury and electric vehicles (EVs). Luxury cars, such as the Tesla Model S, Audi e-tron, and Jaguar I-PACE, incur maintenance costs that are 20% to 30% higher than standard vehicles. This is primarily due to the specialized care required for high-end components, including advanced infotainment systems, premium tires, and high-performance engines. Additionally, the battery maintenance for electric luxury vehicles can be particularly expensive, adding a substantial financial burden to rental companies. Insurance premiums for luxury vehicles are also significantly higher, further contributing to the overall operational costs. Studies show that the operational expenses for maintaining luxury cars can be up to 30% higher than for economy vehicles, making them less profitable for rental businesses. Furthermore, the challenge of maintaining a reliable charging infrastructure for electric vehicles compounds the issue. A shortage of charging stations and the high cost of EV upkeep remain key barriers to the widespread adoption of electric luxury cars in rental fleets. Despite the growing demand for electric vehicles, the high upfront costs and the lack of suitable EV models for heavy-duty use continue to slow the market's expansion. As a result, this high maintenance, operational and insurance costs present significant challenges for rental agencies, limiting the profitability and scalability of the luxury car rental market.

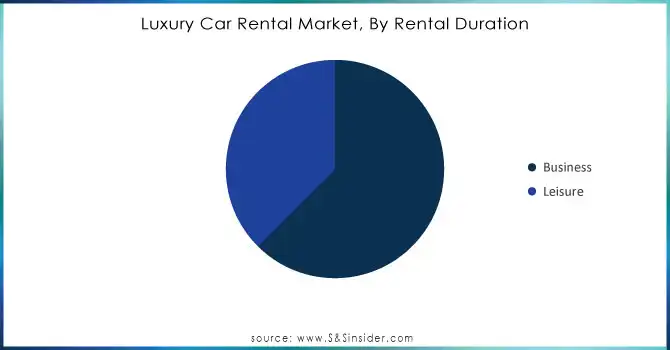

By Rental

In 2023, the business segment captured the largest revenue share of around 63% in the luxury car rental market. This is primarily driven by the increasing demand for high-end vehicles among corporate clients, business executives, and professionals who require premium transportation for meetings, conferences, and corporate events. Luxury car rentals offer businesses an opportunity to maintain a sophisticated image and provide their employees with comfortable, high-performance vehicles for work-related travel. Additionally, the growth in international business activities and the rise in executive travel have further fueled the demand. With top-tier models such as luxury sedans, SUVs, and electric vehicles becoming accessible for business rentals, this segment is expected to maintain its dominance in the coming years.

Need Any Customization Research On Luxury Car Rental Market - Inquiry Now

By Booking Type

In 2023, the online booking segment accounted for the largest revenue share of approximately 56% in the luxury car rental market. This growth is largely driven by the increasing preference for digital platforms among consumers who seek convenience, flexibility, and a seamless booking experience. Online booking offers customers the ability to compare prices, select vehicles, and secure reservations in real time, all from the comfort of their devices. The rise of mobile apps and online portals has made it easier for consumers to access luxury car rental services, even for last-minute bookings. Additionally, the integration of features like customer reviews, loyalty programs, and personalized recommendations has enhanced the overall user experience, further boosting online bookings. The ability to access a wide range of luxury vehicles, including electric models, via online platforms aligns with the growing trend of digital-first services in the travel and leisure industry, contributing to the dominance of this segment.

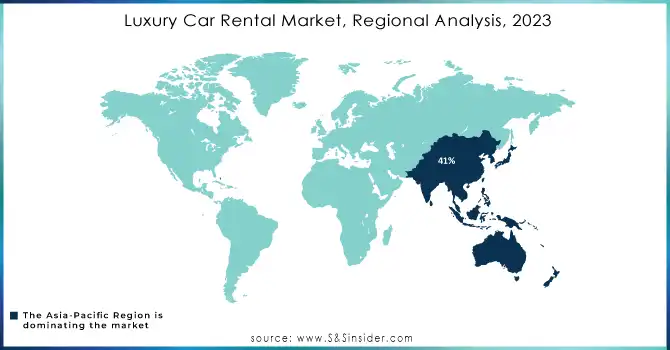

In 2023, the Asia-Pacific region led the luxury car rental market, accounting for around 41% of total revenue. This growth is driven by rapid economic development, rising disposable incomes, and increasing tourism in countries like China, Japan, South Korea, and India. The region is expanding middle class and growing demand for premium transportation, both for business and leisure, have fueled the demand for luxury car rentals. Major cities such as Tokyo, Shanghai, and Sydney have become key hubs for this demand. Additionally, the shift toward eco-friendly luxury vehicles, including electric and hybrid models, has boosted market growth. The increasing trend toward digitalization has made booking luxury cars more accessible, while urbanization and international events continue to drive demand. China’s expanding economy, along with India’s growing urban population and high-net-worth individuals, is making the region a key player in the global luxury car rental market.

North America is poised to be the fastest-growing region in the luxury car rental market from 2024 to 2032. The growth is primarily driven by strong demand from affluent consumers and the increasing number of business and leisure travelers seeking high-end transportation options. The United States, with its large number of high-net-worth individuals and thriving tourism industry, is expected to lead the region. Major cities such as New York, Los Angeles, Miami, and Las Vegas continue to experience strong demand for luxury rentals, driven by both local residents and international tourists. Additionally, the increasing popularity of electric luxury vehicles is contributing to the region's market growth, supported by incentives and investments in EV infrastructure. Canada also sees significant growth, with rising disposable incomes and a growing tourism sector boosting demand. The growing trend toward digital platforms for booking and the expanding presence of luxury rental services in urban and tourist destinations will further drive the market in North America.

Some of the major players in Luxury Car Rental Market with their product

Enterprise Rent-A-Car (BMW, Audi, Mercedes-Benz, Cadillac)

Hertz Global Holdings (Ferrari, Porsche, BMW, Mercedes-Benz - "Dream Collection")

Avis Budget Group (BMW, Audi, Lexus, Jaguar)

Sixt SE (Mercedes-Benz, BMW, Porsche, Audi)

Europcar (Mercedes-Benz, BMW, Audi)

Luxury Rentals (Ferrari, Lamborghini, Bentley)

Turo (Tesla, Porsche, Range Rover, Ferrari - Peer-to-peer rentals)

Green Motion (BMW, Mercedes-Benz - Eco-friendly luxury options)

National Car Rental (BMW, Audi, Lexus)

Rent A Ferrari (Ferrari models exclusively)

Riviera Luxury Rentals (Rolls-Royce, Lamborghini, Porsche)

Premier Car Rental (Mercedes-Benz, BMW, Range Rover)

Elite Rent-A-Car (Ferrari, Bentley, Lamborghini)

DriveNow (BMW Group) (BMW, Mini)

Exotic Car Collection by Enterprise (Porsche, Ferrari, Corvette)

Silvercar by Audi (Audi models exclusively)

Auto Europe (Mercedes-Benz, BMW, Jaguar)

CarTrawler (Audi, BMW, Mercedes-Benz)

Limos.com (Rolls-Royce, Bentley, Mercedes-Benz - Chauffeur services)

Auto Bavaria (BMW, Audi, MINI, and other luxury vehicles)

SKIL Cabs (Electric vehicles for eco-friendly transportation)

Enterprise Rent-A-Car – Offers a selection of luxury vehicles including BMW, Audi, Mercedes-Benz, and Cadillac.

Hertz Global Holdings – Provides high-end vehicles such as Ferrari, Porsche, BMW, and Mercedes-Benz through its "Dream Collection."

Avis Budget Group – Offers luxury cars including BMW, Audi, Lexus, and Jaguar.

Sixt SE – Provides luxury vehicles like Mercedes-Benz, BMW, Porsche, and Audi.

Europcar – Offers premium cars such as Mercedes-Benz, BMW, and Audi.

Luxury Rentals – Specializes in luxury car rentals with options like Ferrari, Lamborghini, and Bentley.

Turo – A peer-to-peer rental platform that offers luxury vehicles like Tesla, Porsche, Range Rover, and Ferrari.

LUXURY CAR RENTAL USA – Offers high-end cars like Ferrari, Rolls-Royce, and Aston Martin.

Green Motion – Provides eco-friendly luxury options, including BMW and Mercedes-Benz.

National Car Rental – Offers luxury cars from brands like BMW, Audi, and Lexus.

Rent A Ferrari – Specializes in renting Ferrari models exclusively.

Riviera Luxury Rentals – Offers vehicles like Rolls-Royce, Lamborghini, and Porsche.

Premier Car Rental – Provides luxury options such as Mercedes-Benz, BMW, and Range Rover.

Elite Rent-A-Car – Offers Ferrari, Bentley, and Lamborghini for luxury rentals.

DriveNow (BMW Group) – Provides luxury cars including BMW and Mini for rental.

Exotic Car Collection by Enterprise – Offers exotic cars like Porsche, Ferrari, and Corvette.

Silvercar by Audi – Exclusively offers Audi models for rental.

Auto Europe – Offers luxury rentals including Mercedes-Benz, BMW, and Jaguar.

CarTrawler – Provides access to luxury cars including Audi, BMW, and Mercedes-Benz.

Limos.com – Specializes in chauffeur services with luxury vehicles like Rolls-Royce, Bentley, and Mercedes-Benz.

February 6, 2024: Sime Darby Introduces EV Rental Partnership Sime Darby Auto Bavaria (SDAB) has partnered with Sime Darby Rent-A-Car (SDRAC) to offer electric vehicle (EV) rentals in Malaysia, starting with the BMW iX. This collaboration provides customers with the opportunity to experience high-tech, luxury EVs, with rental prices starting at RM550 per day and RM5,500 per month.

January 16, 2024: SIXT and Stellantis Form Strategic Agreement for Vehicle Purchase SIXT has reached a multi-billion euro agreement with Stellantis to purchase up to 250,000 vehicles by 2026, enhancing its rental fleet across Europe and North America. The deal includes a wide range of Stellantis brands and vehicle types, including electric models, aligning with both companies' decarbonization and customer-centric goals.

3rd January 2024: SKIL Cabs Launches Electric Car Rentals to Promote Sustainable TravelSKIL Cabs has introduced electric car rentals in India, marking a significant step towards sustainable transportation. This initiative reflects the company's commitment to reducing carbon footprints and promoting eco-friendly travel options in the country.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 39.68 Billion |

| Market Size by 2032 | USD 78.36 Billion |

| CAGR | CAGR of 7.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Model Style( Hatchback, Sedan, Sport Utility Vehicles, Multi-purpose Vehicles) • By Rental Duration(Business, Leisure) • By Booking Vehicle Model Style(Online Booking, Offline Booking) • By Drive Vehicle Model Style( Self-driven, Chauffeur-driven) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Key players in the luxury car rental market include Enterprise Rent-A-Car, Hertz Global Holdings, Avis Budget Group, Sixt SE, Europcar, Luxury Rentals, Turo, LUXURY CAR RENTAL USA, Green Motion, National Car Rental, Rent A Ferrari, Riviera Luxury Rentals, Premier Car Rental, Elite Rent-A-Car, DriveNow (BMW Group), Exotic Car Collection by Enterprise, Silvercar by Audi, Auto Europe, CarTrawler, and Limos.com.,Auto Bavaria ,SKIL Cabs. |

| Key Drivers | • Driving sustainability through the rise of electric luxury vehicles in the car rental market |

| Restraints | • High Maintenance and Operational Costs Hindering Growth in Luxury Car Rental Market |

Ans: Luxury Car Rental Market is anticipated to expand by 7.88% from 2024 to 2032.

Ans: The Luxury Car Rental Market Size was valued at USD 39.68 Billion in 2023, and is expected to reach USD 78.36 Billion by 2032

Ans: Increasing demand for premium travel experiences among high-net-worth individuals will drive the growth of the luxury car rental market.

Ans: Asia-Pacific is dominating in Luxury Car Rental Market

Ans: Business is the dominating segment in Luxury Car Rental market

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Rental Duration and Frequency

5.2 Rental Value by Car Model

5.3 Car Maintenance and Operational Costs

5.4 Fleet Utilization Rate

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Luxury Car Rental Market Segmentation, by Vehicle Model Style

7.1 Chapter Overview

7.2 Hatchback

7.2.1 Hatchback Market Trends Analysis (2020-2032)

7.2.2 Hatchback Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Sedan

7.3.1 Sedan Market Trends Analysis (2020-2032)

7.3.2 Sedan Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Sport Utility Vehicles

7.4.1 Sport Utility Vehicles Market Trends Analysis (2020-2032)

7.4.2 Sport Utility Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Multi-purpose Vehicles

7.5.1 Multi-purpose Vehicles Market Trends Analysis (2020-2032)

7.5.2 Multi-purpose Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Luxury Car Rental Market Segmentation, by Rental Duration

8.1 Chapter Overview

8.2 Business

8.2.1 Business Market Trends Analysis (2020-2032)

8.2.2 Business Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Leisure

8.3.1 Leisure Market Trends Analysis (2020-2032)

8.3.2 Leisure Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Luxury Car Rental Market Segmentation, by Booking Type

9.1 Chapter Overview

9.2 Online Booking

9.2.1 Online Booking Market Trends Analysis (2020-2032)

9.2.2 Online Booking Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Offline Booking

9.3.1 Offline Booking 2 Market Trends Analysis (2020-2032)

9.3.2 Offline Booking Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Luxury Car Rental Market Segmentation, by Drive Type

10.1 Chapter Overview

10.2 Self-driven

10.2.1 Self-driven Market Trends Analysis (2020-2032)

10.2.2 Self-driven Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Chauffeur-driven

10.3.1 Chauffeur-driven Market Trends Analysis (2020-2032)

10.3.2 Chauffeur-driven Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Luxury Car Rental Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.2.4 North America Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.2.5 North America Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.2.6 North America Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.2.7.2 USA Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.2.7.3 USA Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.2.7.4 USA Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.2.8.2 Canada Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.2.8.3 Canada Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.2.8.4 Canada Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.2.9.2 Mexico Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.2.9.3 Mexico Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.2.9.4 Mexico Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.1.7.2 Poland Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.1.7.3 Poland Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.1.7.4 Poland Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.1.8.2 Romania Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.1.8.3 Romania Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.1.8.4 Romania Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Luxury Car Rental Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.4 Western Europe Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.5 Western Europe Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.6 Western Europe Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.7.2 Germany Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.7.3 Germany Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.7.4 Germany Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.8.2 France Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.8.3 France Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.8.4 France Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.9.2 UK Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.9.3 UK Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.9.4 UK Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.10.2 Italy Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.10.3 Italy Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.10.4 Italy Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.11.2 Spain Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.11.3 Spain Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.11.4 Spain Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.14.2 Austria Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.14.3 Austria Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.14.4 Austria Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.4 Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.5 Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.6 Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.7.2 China Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.7.3 China Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.7.4 China Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.8.2 India Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.8.3 India Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.8.4 India Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.9.2 Japan Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.9.3 Japan Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.9.4 Japan Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.10.2 South Korea Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.10.3 South Korea Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.10.4 South Korea Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.11.2 Vietnam Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.11.3 Vietnam Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.11.4 Vietnam Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.12.2 Singapore Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.12.3 Singapore Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.12.4 Singapore Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.13.2 Australia Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.13.3 Australia Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.13.4 Australia Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Luxury Car Rental Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.1.4 Middle East Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.1.5 Middle East Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.1.6 Middle East Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.1.7.2 UAE Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.1.7.3 UAE Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.1.7.4 UAE Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Luxury Car Rental Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.2.4 Africa Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.2.5 Africa Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.2.6 Africa Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Luxury Car Rental Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.6.4 Latin America Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.6.5 Latin America Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.6.6 Latin America Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.6.7.2 Brazil Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.6.7.3 Brazil Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.6.7.4 Brazil Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.6.8.2 Argentina Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.6.8.3 Argentina Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.6.8.4 Argentina Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.6.9.2 Colombia Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.6.9.3 Colombia Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.6.9.4 Colombia Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Luxury Car Rental Market Estimates and Forecasts, by Vehicle Model Style (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Luxury Car Rental Market Estimates and Forecasts, by Rental Duration (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Luxury Car Rental Market Estimates and Forecasts, by Booking Type (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Luxury Car Rental Market Estimates and Forecasts, by Drive Type (2020-2032) (USD Billion)

12. Company Profiles

12.1 Enterprise Rent-A-Car

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Hertz Global Holdings

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Avis Budget Group

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Sixt SE

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Europcar

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Luxury Rentals

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Turo

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 LUXURY CAR RENTAL USA

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Green Motion

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 National Car Rental

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Vehicle Model Style

Hatchback

Sedan

Sport Utility Vehicles

Multi-purpose Vehicles

By Rental Duration

Business

Leisure

By Booking Type

Online Booking

Offline Booking

By Drive Type

Self-driven

Chauffeur-driven

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Rail Infrastructure Market Size was valued at USD 53.93 Billion in 2023 and is expected to reach USD 73.95 Billion by 2032 and grow at a CAGR of 3.61% over the forecast period 2024-2032.

The Emergency Ambulance Vehicle Market Size was $15 billion in 2023 and is expected to reach $21.33 billion by 2031 and grow at a CAGR of 4.5% by 2024-2031

The Torque Vectoring Market Size was USD 10.5 Billion in 2023. It is expected to grow to USD 28.5 Billion by 2032 and grow at a CAGR of 11.7% by 2024-2032.

The Off-highway Vehicle Lighting Market Size was valued at USD 1.18 billion in 2023 & will reach $2.22 billion by 2032 & grow at a CAGR of 7.3% by 2024-2032

The Automotive Stainless Steel Tube Market Size was USD 4.2 Billion in 2023 & is expected to reach $5.9 Bn by 2032, growing at a CAGR of 3.9% by 2024-2032.

The Electric Motorcycles Market size is expected to reach USD 144.69 Bn by 2031 and was valued at 35.5 Bn in 2023 and grow at a CAGR of 19.2% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone