Get More Information on LTE & 5G for Critical Communications Market - Request Sample Report

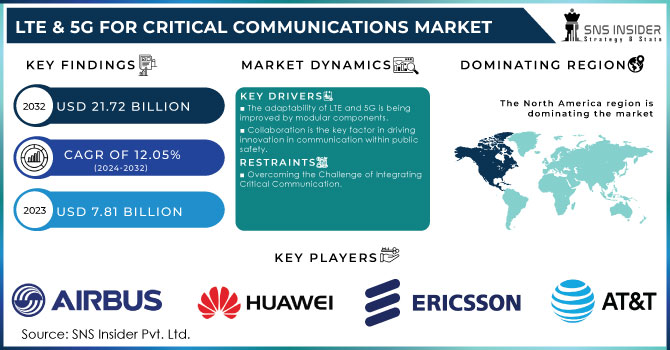

The LTE & 5G for Critical Communications Market size was USD 7.81 Billion in 2023 & expected a good growth by reaching USD 21.72 billion till end of 2032 at CAGR about 12.05% during forecast period 2024-2032.

Developments in technology such as upgraded connections and improved network architecture are enhancing essential communication, leading to increased costs for constructing these advanced networks. Ericsson, a major telecommunications company, recently launched resources to aid phone companies in providing enhanced 5G services, however, the implementation of these advanced functionalities demands a substantial initial financial commitment. It is estimated that phone companies will invest more than USD 1 trillion solely on constructing new 5G networks! Due to the significant expense, phone companies must proceed with caution when implementing 5G technology. Over time, LTE and 5G have the potential to reduce costs for businesses. Due to their speed and dependability, they can reduce operational expenses in the long run. This is highly appealing to companies with high communication needs, particularly those aiming for increased efficiency and dependability. Consequently, there is a rapid increase in the need for LTE and 5G as businesses strive to stay competitive in the modern digital landscape.

The growing demand for dependable and safe communication is spurring creativity in various sectors. Public safety, public transportation, utilities, and manufacturers in the "Industry 4.0" sector all need real-time data sharing and effective functioning. For example, firefighters must transmit high-quality video to central command, while train conductors need immediate track information. This is where a recent innovation from Black Box perfectly supports this increasing need. Black Box, a company that helps connect different communication systems, has teamed up with two other companies: Corning, which makes really good fiber optic cables, and Nokia, a big name in cell phones and phone networks. Their success reveals substantial opportunities for the growing private 4G/5G wireless networking market. Companies and organizations needed separate equipment to use regular cell phone signals (public carrier signals) and their own private wireless networks. Black Box's effective integration test proves that a single distributed antenna system (DAS) can now support both types of signals. This results in significant cost reductions and makes it easier to implement for the industries that require strong communication the most. By allowing for a more cost-effective method to set up private wireless networks in addition to current carrier signals, this development clears the path for greater use of these essential communication solutions. This will ultimately result in increased efficiency, quicker response times, and improved safety in various sectors.

Drivers

The adaptability of LTE and 5G is being improved by modular components.

Flexibility and customization will be crucial for the future of critical communication. This is where significant progress is being seen in modular and scalable design for LTE and 5G technologies. These advancements enable smoother incorporation with various systems and apps, developing custom solutions for particular requirements. This not only meets a broader range of market needs but also speeds up deployment times and lowers development expenses. For instance is FirstNet, a specialized network for American first responders, which upgraded to a complete 5G network in February 2024. This enhancement, enabled by the modular structure of 5G, enhanced network capabilities by providing quicker speeds, higher capacity, and better service quality for crucial emergency response activities. The utilization of 5G enhances communication within modern public safety by allowing for advanced features such as real-time data analysis, high-quality video transmission, and an increase in Internet of Things (IoT) devices. The modular strategy allows network operators to set up systems with increased flexibility. This implies that base stations, core networks, and user devices can be tailored to specific requirements, simplifying deployment procedures and cutting down on expenses. In the end, the move towards modularity and scalability is promoting innovation and effectiveness in the advancement and use of LTE and 5G technologies in various key communication sectors.

Collaboration is the key factor in driving innovation in communication within public safety.

The growing demand for safe and reliable communication in public safety is a major driver for the LTE and 5G critical communication market. This need is being fulfilled by industry cooperation, as shown by the collaboration between Icom and JRC.Icom, a top company in two-way radio devices, has partnered with JRC, an expert in private LTE network infrastructure, to create an advanced Private LTE Radio System. This partnership utilizes the advantages of each company, joining Icom's knowledge in easy-to-use gadgets with JRC's strong network system. The outcome is a unique solution created especially for the requirements of individuals in the public safety field. Transitioning from outdated communication systems to dedicated LTE and 5G networks is crucial in guaranteeing public safety. These cutting-edge technologies provide functions such as fast data transfer, enhanced network capability, and strong security, all crucial for efficient emergency reaction. The partnership between Icom and JRC showcases how collaborations among industries can speed up the development and acceptance of life-saving technologies in the market. The emphasis on public safety communication is just one instance of how the critical communication market is adapting to the changing demands of different sectors, ultimately leading to a safer and more secure future.

Restraints

Overcoming the Challenge of Integrating Critical Communication.

Having a critical communication network that is integrated with LTE and 5G doesn't always go smoothly. A significant hurdle is connecting the latest technologies with current outdated systems. Switching to a 5G network, which includes capabilities such as live video streaming and improved data analysis, would provide significant advantages. Nevertheless, carefully planning and technical expertise are necessary to integrate the new 5G system with the current dispatch network. Translating data formats, configuring interfaces, and resolving compatibility problems may be necessary. The adoption of LTE and 5G may be delayed for organizations with existing investments in old infrastructure due to the slow and expensive nature of the process. Coming up with creative solutions for smooth integration, like creating interfaces that are compatible or tools for converting data, is essential for overcoming this obstacle. By solving these integration issues, we can unleash the complete capabilities of LTE and 5G, enabling crucial communication systems to grow and adjust to future needs.

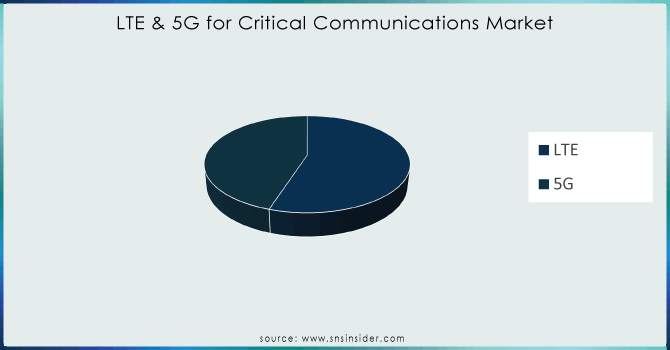

Based on technology, The LTE segment dominates the market in 2023 with 55% of market share. The LTE market segment is rapidly growing. LTE offers reliable, protected, and affordable communication essential for crucial applications. Its broad scope, ability to work with current systems, and backing for high-speed data and voice services make it the best selection. LTE has contributed to the development of a network of support, while its affordability has enhanced its prominence in 5G technology. In January 2024, as an illustration, Japan Radio Co., Ltd. (JRC) and Icom Incorporated have joined forces to create a private LTE radio system, with the goal of revolutionizing private communication networks, especially for public safety and industrial purposes.

Need any customization research on LTE & 5G for critical communications market - Enquiry Now

Based on Application, the public safety sector dominated the market with 48% share based on Application and is projected to experience substantial growth. This increase is due to the increasing demand for strong and reliable communication networks needed for effective emergency response. The increased bandwidth, minimal delay, and fast data speeds of LTE and 5G technologies are extremely advantageous for public safety organizations as they are crucial for situational awareness and immediate coordination. The creation of new applications for cutting-edge technologies such as AI-powered analytics and drones for monitoring has emphasized the importance of dependable communication infrastructure, provided by 5G and LTE.

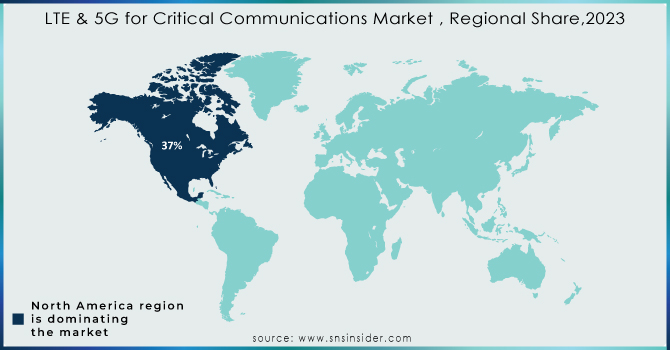

North America dominated the global LTE & 5G for critical communications market with a share of over 37% in 2023. Due to the significant investments in advanced communication infrastructure and key governmental initiatives. America's The FirstNet program showcases the region's commitment to building LTE and 5G networks tailored for public safety, enhancing communication for first responders and emergency services. North America's technological leadership drives the integration of unique applications like AI-driven analytics and unmanned aerial vehicles for surveillance, highlighting the need for 5G networks to maintain top-notch performance and reliability. The area's robust legal framework and supportive policies make it effortless to implement and grow these networks. Collaborations between major IT companies and public safety agencies in North America have accelerated the development and use of cutting-edge communication technologies, boosting the region's dominance in the market.

Asia Pacific region is rapidly growing LTE & 5G for critical communications market with 29% of market share in 2023. Due to the substantial investment of both public and private sectors in LTE and 5G infrastructure. Countries like China, Japan, and South Korea have implemented extensive networks tailored for the purpose of disaster response and ensuring public safety. For example, China is employing 5G slicing for real-time emergency response applications (The Critical Communications Review). The Asia Pacific market is being driven by partnerships within the region and advancements in technology, which are encouraging the development of new ideas and promoting the use of necessary communication solutions.

Some of the major players in LTE & 5G for Critical Communications Market are Airbus, AT&T, Ericsson, Huawei, Hytera, Motorola Solutions, Nokia, Samsung Electronics, Sapura, Verizon and others

In January 2023, Airbus and M1 launched the first 5G aerial standalone trial in Singapore, marking a significant advancement in technology. This collaboration aimed to explore the capabilities of 5G in applications such as Unmanned Aerial Vehicles (UAVs), aerial surveillance, and enhanced communications. The trial underscored Singapore's leadership in adopting innovative technological solutions.

In February 2022, Radisys released its 5G IoT Software Suite for organizations and telecommunications providers to facilitate the deployment and management of IoT applications across 5G networks. This suite takes advantage of 5G technology's high speed, low latency, and huge connectivity capabilities to cater to the demanding requirements of IoT use cases.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.81 billion |

| Market Size by 2032 | US$ 21.72 Billion |

| CAGR | CAGR of 12.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (LTE, 5G) • By Component (Hardware, Software, Services) • By Application (Public Safety, Transportation, Utilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DIGIRAD Corporation, Neusoft Corporation, CANON MEDICAL SYSTEMS CORPORATION, SurgicEye GmbH, CMR Naviscan., Absolute Imaging Inc., Bartec Technologies Ltd., BCL X-Ray Canada Inc., TTG Imaging Solutions, LLC., Lucerno Dynamics LLC.m, Berthold Technologies GmbH & Co.KG, Incom Inc., Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG |

| Key Drivers | • The adaptability of LTE and 5G is being improved by modular components. • Collaboration is the key factor in driving innovation in communication within public safety. |

| RESTRAINTS | • Overcoming the Challenge of Integrating Critical Communication. |

Ans. Increasing demand for secure, reliable, and high-speed communication across critical sectors like public safety, transportation, and utilities is driving the growth of the LTE & 5G for Critical Communications Market.

Ans. The LTE & 5G for Critical Communications Market size was USD 7.81 Billion in 2023 & expects a good growth by reaching USD 21.72 billion till end of 2032 at CAGR about 12.05% during forecast period 2024-2032.

Ans. Asia Pacific region is to record the Fastest Growing in the LTE & 5G for Critical Communications Market.

Ans .The LTE Segment is leading in the market revenue share in 2023.

Ans. North America is to hold the largest market share in the LTE & 5G for Critical Communications Market during the forecast period.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. LTE & 5G for Critical Communications Market Segmentation, By Technology

7.1 Introduction

7.2 LTE

7.3 5G

8. LTE & 5G for Critical Communications Market Segmentation, By Component

8.1 Introduction

8.2 Hardware

8.3 Software

8.4 Services

9. LTE & 5G for Critical Communications Market Segmentation, By Application

9.1 Introduction

9.2 Public Safety

9.3 Transportation

9.4 Utilities

9.5 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America LTE & 5G for Critical Communications Market by Country

10.2.3 North America LTE & 5G for Critical Communications Market By Technology

10.2.4 North America LTE & 5G for Critical Communications Market By Component

10.2.5 North America LTE & 5G for Critical Communications Market By Application

10.2.6 USA

10.2.6.1 USA LTE & 5G for Critical Communications Market By Technology

10.2.6.2 USA LTE & 5G for Critical Communications Market By Component

10.2.6.3 USA LTE & 5G for Critical Communications Market By Application

10.2.7 Canada

10.2.7.1 Canada LTE & 5G for Critical Communications Market By Technology

10.2.7.2 Canada LTE & 5G for Critical Communications Market By Component

10.2.7.3 Canada LTE & 5G for Critical Communications Market By Application

10.2.8 Mexico

10.2.8.1 Mexico LTE & 5G for Critical Communications Market By Technology

10.2.8.2 Mexico LTE & 5G for Critical Communications Market By Component

10.2.8.3 Mexico LTE & 5G for Critical Communications Market By Application

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe LTE & 5G for Critical Communications Market by Country

10.3.2.2 Eastern Europe LTE & 5G for Critical Communications Market By Technology

10.3.2.3 Eastern Europe LTE & 5G for Critical Communications Market By Component

10.3.2.4 Eastern Europe LTE & 5G for Critical Communications Market By Application

10.3.2.5 Poland

10.3.2.5.1 Poland LTE & 5G for Critical Communications Market By Technology

10.3.2.5.2 Poland LTE & 5G for Critical Communications Market By Component

10.3.2.5.3 Poland LTE & 5G for Critical Communications Market By Application

10.3.2.6 Romania

10.3.2.6.1 Romania LTE & 5G for Critical Communications Market By Technology

10.3.2.6.2 Romania LTE & 5G for Critical Communications Market By Component

10.3.2.6.4 Romania LTE & 5G for Critical Communications Market By Application

10.3.2.7 Hungary

10.3.2.7.1 Hungary LTE & 5G for Critical Communications Market By Technology

10.3.2.7.2 Hungary LTE & 5G for Critical Communications Market By Component

10.3.2.7.3 Hungary LTE & 5G for Critical Communications Market By Application

10.3.2.8 Turkey

10.3.2.8.1 Turkey LTE & 5G for Critical Communications Market By Technology

10.3.2.8.2 Turkey LTE & 5G for Critical Communications Market By Component

10.3.2.8.3 Turkey LTE & 5G for Critical Communications Market By Application

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe LTE & 5G for Critical Communications Market By Technology

10.3.2.9.2 Rest of Eastern Europe LTE & 5G for Critical Communications Market By Component

10.3.2.9.3 Rest of Eastern Europe LTE & 5G for Critical Communications Market By Application

10.3.3 Western Europe

10.3.3.1 Western Europe LTE & 5G for Critical Communications Market by Country

10.3.3.2 Western Europe LTE & 5G for Critical Communications Market By Technology

10.3.3.3 Western Europe LTE & 5G for Critical Communications Market By Component

10.3.3.4 Western Europe LTE & 5G for Critical Communications Market By Application

10.3.3.5 Germany

10.3.3.5.1 Germany LTE & 5G for Critical Communications Market By Technology

10.3.3.5.2 Germany LTE & 5G for Critical Communications Market By Component

10.3.3.5.3 Germany LTE & 5G for Critical Communications Market By Application

10.3.3.6 France

10.3.3.6.1 France LTE & 5G for Critical Communications Market By Technology

10.3.3.6.2 France LTE & 5G for Critical Communications Market By Component

10.3.3.6.3 France LTE & 5G for Critical Communications Market By Application

10.3.3.7 UK

10.3.3.7.1 UK LTE & 5G for Critical Communications Market By Technology

10.3.3.7.2 UK LTE & 5G for Critical Communications Market By Component

10.3.3.7.3 UK LTE & 5G for Critical Communications Market By Application

10.3.3.8 Italy

10.3.3.8.1 Italy LTE & 5G for Critical Communications Market By Technology

10.3.3.8.2 Italy LTE & 5G for Critical Communications Market By Component

10.3.3.8.3 Italy LTE & 5G for Critical Communications Market By Application

10.3.3.9 Spain

10.3.3.9.1 Spain LTE & 5G for Critical Communications Market By Technology

10.3.3.9.2 Spain LTE & 5G for Critical Communications Market By Component

10.3.3.9.3 Spain LTE & 5G for Critical Communications Market By Application

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands LTE & 5G for Critical Communications Market By Technology

10.3.3.10.2 Netherlands LTE & 5G for Critical Communications Market By Component

10.3.3.10.3 Netherlands LTE & 5G for Critical Communications Market By Application

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland LTE & 5G for Critical Communications Market By Technology

10.3.3.11.2 Switzerland LTE & 5G for Critical Communications Market By Component

10.3.3.11.3 Switzerland LTE & 5G for Critical Communications Market By Application

10.3.3.12 Austria

10.3.3.12.1 Austria LTE & 5G for Critical Communications Market By Technology

10.3.3.12.2 Austria LTE & 5G for Critical Communications Market By Component

10.3.3.12.3 Austria LTE & 5G for Critical Communications Market By Application

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe LTE & 5G for Critical Communications Market By Technology

10.3.3.13.2 Rest of Western Europe LTE & 5G for Critical Communications Market By Component

10.3.3.13.3 Rest of Western Europe LTE & 5G for Critical Communications Market By Application

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific LTE & 5G for Critical Communications Market by Country

10.4.3 Asia-Pacific LTE & 5G for Critical Communications Market By Technology

10.4.4 Asia-Pacific LTE & 5G for Critical Communications Market By Component

10.4.5 Asia-Pacific LTE & 5G for Critical Communications Market By Application

10.4.6 China

10.4.6.1 China LTE & 5G for Critical Communications Market By Technology

10.4.6.2 China LTE & 5G for Critical Communications Market By Component

10.4.6.3 China LTE & 5G for Critical Communications Market By Application

10.4.7 India

10.4.7.1 India LTE & 5G for Critical Communications Market By Technology

10.4.7.2 India LTE & 5G for Critical Communications Market By Component

10.4.7.3 India LTE & 5G for Critical Communications Market By Application

10.4.8 Japan

10.4.8.1 Japan LTE & 5G for Critical Communications Market By Technology

10.4.8.2 Japan LTE & 5G for Critical Communications Market By Component

10.4.8.3 Japan LTE & 5G for Critical Communications Market By Application

10.4.9 South Korea

10.4.9.1 South Korea LTE & 5G for Critical Communications Market By Technology

10.4.9.2 South Korea LTE & 5G for Critical Communications Market By Component

10.4.9.3 South Korea LTE & 5G for Critical Communications Market By Application

10.4.10 Vietnam

10.4.10.1 Vietnam LTE & 5G for Critical Communications Market By Technology

10.4.10.2 Vietnam LTE & 5G for Critical Communications Market By Component

10.4.10.3 Vietnam LTE & 5G for Critical Communications Market By Application

10.4.11 Singapore

10.4.11.1 Singapore LTE & 5G for Critical Communications Market By Technology

10.4.11.2 Singapore LTE & 5G for Critical Communications Market By Component

10.4.11.3 Singapore LTE & 5G for Critical Communications Market By Application

10.4.12 Australia

10.4.12.1 Australia LTE & 5G for Critical Communications Market By Technology

10.4.12.2 Australia LTE & 5G for Critical Communications Market By Component

10.4.12.3 Australia LTE & 5G for Critical Communications Market By Application

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific LTE & 5G for Critical Communications Market By Technology

10.4.13.2 Rest of Asia-Pacific LTE & 5G for Critical Communications Market By Component

10.4.13.3 Rest of Asia-Pacific LTE & 5G for Critical Communications Market By Application

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East LTE & 5G for Critical Communications Market by Country

10.5.2.2 Middle East LTE & 5G for Critical Communications Market By Technology

10.5.2.3 Middle East LTE & 5G for Critical Communications Market By Component

10.5.2.4 Middle East LTE & 5G for Critical Communications Market By Application

10.5.2.5 UAE

10.5.2.5.1 UAE LTE & 5G for Critical Communications Market By Technology

10.5.2.5.2 UAE LTE & 5G for Critical Communications Market By Component

10.5.2.5.3 UAE LTE & 5G for Critical Communications Market By Application

10.5.2.6 Egypt

10.5.2.6.1 Egypt LTE & 5G for Critical Communications Market By Technology

10.5.2.6.2 Egypt LTE & 5G for Critical Communications Market By Component

10.5.2.6.3 Egypt LTE & 5G for Critical Communications Market By Application

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia LTE & 5G for Critical Communications Market By Technology

10.5.2.7.2 Saudi Arabia LTE & 5G for Critical Communications Market By Component

10.5.2.7.3 Saudi Arabia LTE & 5G for Critical Communications Market By Application

10.5.2.8 Qatar

10.5.2.8.1 Qatar LTE & 5G for Critical Communications Market By Technology

10.5.2.8.2 Qatar LTE & 5G for Critical Communications Market By Component

10.5.2.8.3 Qatar LTE & 5G for Critical Communications Market By Application

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East LTE & 5G for Critical Communications Market By Technology

10.5.2.9.2 Rest of Middle East LTE & 5G for Critical Communications Market By Component

10.5.2.9.3 Rest of Middle East LTE & 5G for Critical Communications Market By Application

10.5.3 Africa

10.5.3.1 Africa LTE & 5G for Critical Communications Market by Country

10.5.3.2 Africa LTE & 5G for Critical Communications Market By Technology

10.5.3.3 Africa LTE & 5G for Critical Communications Market By Component

10.5.3.4 Africa LTE & 5G for Critical Communications Market By Application

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria LTE & 5G for Critical Communications Market By Technology

10.5.3.5.2 Nigeria LTE & 5G for Critical Communications Market By Component

10.5.3.5.3 Nigeria LTE & 5G for Critical Communications Market By Application

10.5.3.6 South Africa

10.5.3.6.1 South Africa LTE & 5G for Critical Communications Market By Technology

10.5.3.6.2 South Africa LTE & 5G for Critical Communications Market By Component

10.5.3.6.3 South Africa LTE & 5G for Critical Communications Market By Application

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa LTE & 5G for Critical Communications Market By Technology

10.5.3.7.2 Rest of Africa LTE & 5G for Critical Communications Market By Component

10.5.3.7.3 Rest of Africa LTE & 5G for Critical Communications Market By Application

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America LTE & 5G for Critical Communications Market by country

10.6.3 Latin America LTE & 5G for Critical Communications Market By Technology

10.6.4 Latin America LTE & 5G for Critical Communications Market By Component

10.6.5 Latin America LTE & 5G for Critical Communications Market By Application

10.6.6 Brazil

10.6.6.1 Brazil LTE & 5G for Critical Communications Market By Technology

10.6.6.2 Brazil LTE & 5G for Critical Communications Market By Component

10.6.6.3 Brazil LTE & 5G for Critical Communications Market By Application

10.6.7 Argentina

10.6.7.1 Argentina LTE & 5G for Critical Communications Market By Technology

10.6.7.2 Argentina LTE & 5G for Critical Communications Market By Component

10.6.7.3 Argentina LTE & 5G for Critical Communications Market By Application

10.6.8 Colombia

10.6.8.1 Colombia LTE & 5G for Critical Communications Market By Technology

10.6.8.2 Colombia LTE & 5G for Critical Communications Market By Component

10.6.8.3 Colombia LTE & 5G for Critical Communications Market By Application

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America LTE & 5G for Critical Communications Market By Technology

10.6.9.2 Rest of Latin America LTE & 5G for Critical Communications Market By Component

10.6.9.3 Rest of Latin America LTE & 5G for Critical Communications Market By Application

11. Company Profiles

11.1 Airbus

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 AT&T

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Ericsson

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Huawei

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Hytera

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Motorola Solutions

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Nokia

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Samsung Electronics

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Sapura

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Verizon

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Technology

LTE

5G

By Component

Hardware

Software

Services

By Application

Public Safety

Transportation

Utilities

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Wafer Process Control Equipment Market Size was valued at USD 7.93 billion in 2023 and is estimated to reach USD 14.06 billion by 2032 and grow at a CAGR of 6.52% over the forecast period 2024-2032.

The Smartphone Sensors Market Size was valued at USD 83.59 billion in 2023 and is expected to reach USD 367.94 billion at a CAGR of 17.9% by Forecast 2032

The Power Strip Market Size was valued at USD 12.65 Billion in 2023 and is expected to grow at a CAGR of 5.0% to reach USD 19.64 Billion by 2032.

The Leak Detection Market Size was valued at USD 4.58 billion in 2023 and is expected to grow at a CAGR of 5.31% to reach USD 7.26 billion by 2032.

The Microcontroller Unit (MCU) Market Size was valued at USD 32.82 Billion in 2023 and is expected to grow at 9.2% CAGR to reach USD 72.31 Billion by 2032.

The Smart Air Conditioning Market Size was valued at USD 17.65 billion in 2023 and is Projected to grow at 13.52% CAGR to reach USD 55.10 billion by 2032.

Hi! Click one of our member below to chat on Phone